Our Marketing Team at PopaDex

Net Worth Calculator Tool

Understanding your net worth is key to grasping your financial health. Simply put, net worth is the value of what you own (assets) minus what you owe (liabilities). Whether you’re an individual, a company, or even a country, net worth provides a snapshot of financial stability. In personal finance, it’s what remains after settling all your debts. High-net-worth individuals, those with significant net assets, are often used as benchmarks. Conversely, a negative net worth means debts exceed assets, signaling a need for debt reduction. To improve net worth, increase your assets and decrease your liabilities. Important assets include cash, retirement savings, investments, your home, and other properties. Calculate net worth using online tools and guides, but always estimate conservatively based on current market prices.

Understanding Net Worth

Net worth is a financial metric that indicates the value of an individual’s or entity’s assets minus liabilities. It’s a measure of what you own versus what you owe. A positive net worth means that your assets exceed your liabilities, whereas a negative net worth indicates the opposite.

Assets are things of value that you own, like cash, investments, real estate, and personal property. Liabilities, on the other hand, are your financial obligations, such as mortgages, loans, and credit card debt. Understanding the distinction between assets and liabilities is crucial for calculating your net worth accurately.

Examples of net worth can be seen across various sectors. For instance, a homeowner’s net worth might include their home equity, savings, and personal belongings, minus any mortgage debt. A business’s net worth is assessed by calculating its total assets, like equipment and inventory, and subtracting its total liabilities, such as loans and accounts payable. In the tech industry, a company’s net worth might be influenced heavily by intellectual property and market valuation, contrasted by its operational debts.

Calculating Your Net Worth

To calculate your net worth, start by identifying your assets. These include cash, savings accounts, retirement accounts, real estate, valuable items like jewelry, and any other resources that can be converted into money. Make sure to list everything accurately to get a clear picture of what you own.

Next, list your liabilities. Liabilities are debts or obligations requiring future payment, such as mortgages, car loans, student loans, and credit card balances. Subtracting these liabilities from your assets will help you understand your financial standing.

Using a net worth calculator tool can simplify this process. Input your assets and liabilities, and the tool will do the math for you, providing a clear net worth figure. This figure is essential for assessing your financial health and making informed decisions about your future.

Improving Your Net Worth

To increase your net worth, start by boosting your assets. Consider investment opportunities like stocks, bonds, or real estate. Building a diversified portfolio is key to minimizing risk while maximizing returns. Regularly contributing to retirement accounts and exploring side hustles for additional income can also significantly grow your assets over time.

Reducing liabilities is equally important for net worth improvement. Begin by paying off high-interest debts, such as credit card balances. Refinancing loans to secure lower interest rates can save you a lot of money in the long run. Adopting a budget to control spending and avoid unnecessary expenses will help keep liabilities in check.

Regularly monitoring your net worth ensures you stay on track with your financial goals. Use a net worth calculator to assess your financial standing periodically. By tracking changes, you can make informed decisions to adjust your strategies and stay committed to improving your net worth.

Important Assets to Consider

Credits: stock.adobe.com

Cash and savings are among the most straightforward assets to consider when calculating your net worth. This includes the money you have in your checking and savings accounts, any cash you might have on hand, and even money saved in short-term deposit accounts. These are liquid assets, meaning they’re easily accessible and can be used quickly if needed.

Investments and retirement accounts are also key components. This can encompass stocks, bonds, mutual funds, and other market investments, as well as retirement funds like 401(k)s or IRAs. These accounts are crucial because they have the potential to significantly grow in value over time, though they also come with varying levels of risk.

Property and real estate often represent a substantial part of an individual’s net worth. This includes your primary residence, any vacation homes, and other real estate investments. Property values can fluctuate, but over the long term, they usually appreciate. It’s important to assess the current market value of these properties and subtract any remaining mortgage balances to get an accurate net worth calculation.

| Asset Type | Examples | Value |

|---|---|---|

| Cash and Savings | Bank accounts, Cash on hand | $10,000 |

| Investments and Retirement Accounts | Stocks, Bonds, 401(k) | $50,000 |

| Property and Real Estate | Primary residence, Rental property | $200,000 |

Challenges and Risks

Credits: aspeninstitute.org

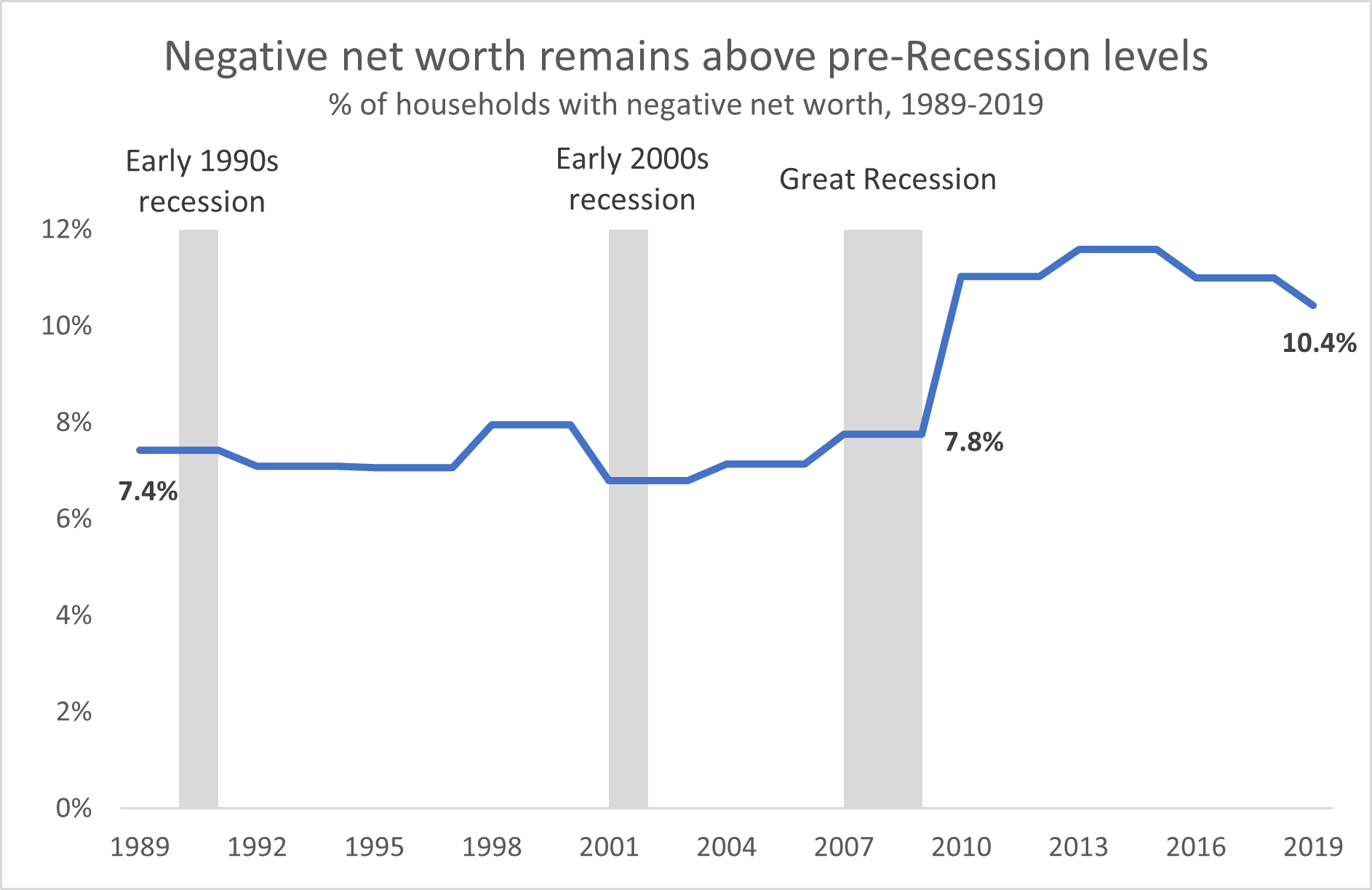

Understanding a negative net worth is crucial when using a net worth calculator. A negative net worth means that your liabilities exceed your assets. This situation can arise from excessive borrowing, declining asset values, or a combination of both. Knowing this can help you take corrective measures, such as budgeting better or paying down debt, to turn your financial condition around.

Market fluctuations can significantly impact your net worth. Investments in stocks, real estate, and other assets can vary greatly in value due to market conditions. These fluctuations can cause your net worth to rise or fall, sometimes unpredictably. It’s essential to consider these risks and avoid making decisions based on short-term market movements.

Using conservative estimates in your net worth calculation is vital. Overestimating the value of your assets or underestimating your liabilities can give a false sense of financial security. By using cautious and realistic figures, you can get a more accurate picture of your financial health, make better decisions, and plan more effectively for the future.

Tools and Resources

Online net worth calculators are excellent tools for getting a quick estimate of your financial standing. These calculators require you to input information about your assets and liabilities. Once you enter the details, the tool calculates the difference between your assets and liabilities to give you a snapshot of your net worth. Many of these tools are free and user-friendly, making them accessible for anyone wanting to keep track of their financial health.

Specialty financial guides can provide deeper insights into understanding and improving your net worth. These guides often include strategies for managing debts, investing wisely, and growing your assets. By following the advice in these guides, you can make informed decisions that have long-term positive impacts on your financial situation.

Consulting a financial advisor can offer personalized advice that considers your unique financial circumstances. A financial advisor can help you develop a comprehensive plan to achieve your financial goals. They can offer tailored recommendations for saving, investing, and reducing debt, ensuring you are on the right path to improving your net worth.

Frequently Asked Questions

1. What is a net worth calculator tool?

A net worth calculator tool helps you figure out how much money you have after subtracting what you owe from what you own.

2. How does a net worth calculator work?

You input details about your assets (things you own) and liabilities (debts you owe), and the tool calculates your net worth by subtracting the liabilities from the assets.

3. Why should I use a net worth calculator?

Using a net worth calculator gives you a clear picture of your financial health and helps you plan for the future.

4. What information do I need to use a net worth calculator?

You’ll need details about your assets like savings, investments, and property, as well as your liabilities like loans, mortgages, and credit card debt.

5. Can a net worth calculator help me with financial planning?

Yes, it can help you see where you stand financially and make informed decisions about saving, investing, and managing debt.

TL;DR: Learn the basics of net worth, how to calculate it, and ways to improve it. Understand the difference between assets and liabilities, and identify them accurately. Use a net worth calculator tool for precision. Enhance your financial position by increasing assets and reducing liabilities. Regularly monitor changes. Pay attention to significant assets like cash, investments, and property. Be mindful of challenges such as negative net worth and market fluctuations. Employ conservative estimates and utilize online calculators, specialty guides, and financial advisors for better financial planning.