Our Marketing Team at PopaDex

Master Your Money with the 50 30 20 Budget

Let’s be real—most budgeting methods are a chore. They’re often too complicated, too restrictive, or just plain unrealistic. If you’ve been searching for a simpler way to get a handle on your money, the 50/30/20 budget might be exactly what you need. It’s less of a strict rule and more of a flexible guide for your after-tax income.

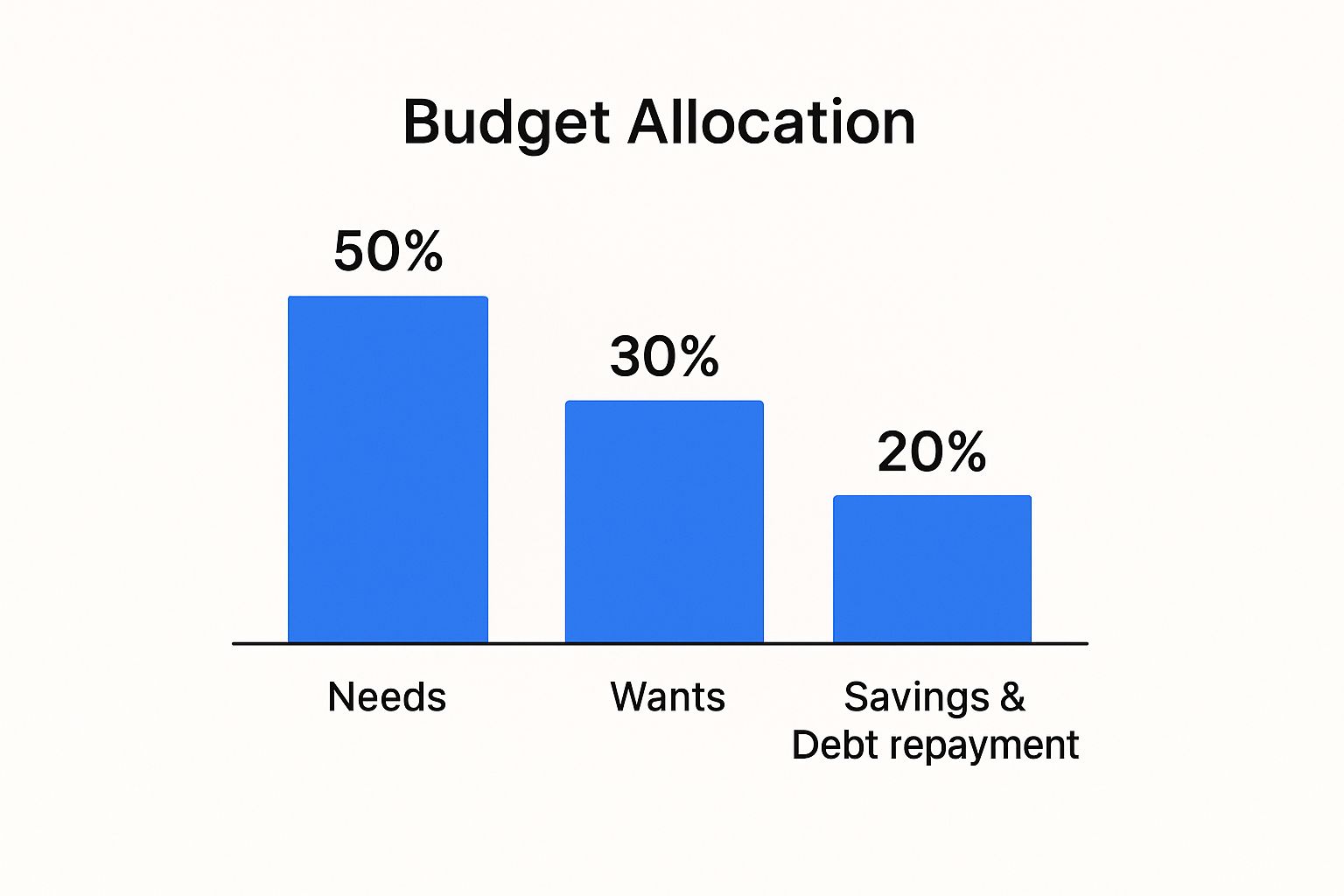

The whole idea is to divide your take-home pay into just three buckets: 50% for Needs, 30% for Wants, and 20% for Savings and Debt Repayment. It’s a balanced approach that helps you live comfortably now while still planning for a secure future.

Diving Into the 50/30/20 Budget Rule

Forget about tracking every single penny. The beauty of the 50/30/20 framework is its simplicity. Popularized by Senator Elizabeth Warren back in 2005, it was designed to give everyday people a clear, manageable way to handle their finances without getting bogged down in the details.

The goal here isn’t to make you feel guilty about spending. Instead, it’s about making intentional choices that align with your life and financial goals. It’s all about finding that sweet spot between your responsibilities, your lifestyle, and your future self.

To help you get started, here’s a quick overview of how each category works.

50/30/20 Budget Breakdown at a Glance

This table breaks down what goes into each category, giving you a clear picture of how to classify your spending.

| Category | Percentage | Description | Examples |

|---|---|---|---|

| Needs | 50% | Your absolute essentials. These are the bills you have to pay to live and work. | Rent/mortgage, groceries, utilities, insurance, transportation, minimum debt payments |

| Wants | 30% | Everything that adds fun and enjoyment to your life but isn’t strictly necessary for survival. | Dining out, hobbies, streaming services, vacations, new clothes, concerts |

| Savings & Debt Repayment | 20% | The money you put toward building a better financial future. This is where real wealth-building happens. | Emergency fund, retirement accounts, investments, extra debt payments (above minimums) |

Seeing it laid out like this makes it much easier to start thinking about where your own money is going each month.

For instance, if your monthly take-home pay is $4,000, your budget would break down like this: $2,000 for Needs, $1,200 for Wants, and $800 for Savings.

It’s a straightforward formula that gives you permission to enjoy your money while also hitting your financial targets.

If you’re ready to put this into practice, we’ve made it even easier. You can grab our 50 30 20 budget spreadsheet to automate the math and see exactly where you stand. It’s a great way to stay organized and motivated on your journey.

Finding Your True Starting Number

Before you can even think about splitting your money into the 50/30/20 buckets, you need to nail down the most important number in your budget: your true starting figure. This isn’t your gross salary—the big number you see on your offer letter. It’s your actual, after-tax, take-home pay.

Getting this number right is everything. It’s the foundation of your entire budget, and if you get it wrong, you’re setting yourself up for failure before you even begin.

Grab your most recent pay stub. The top-line number is your gross pay, but we need to dig deeper to find out what you actually have to work with. You’ll want to subtract all the deductions that come out before the money hits your bank account.

These usually include things like:

- Federal and state income taxes

- Social Security and Medicare (FICA)

- Pre-tax 401(k) or other retirement contributions

- Health insurance premiums

The number left over is your net income—the real amount you can spend, save, and invest. This is the figure you’ll use to calculate your 50%, 30%, and 20% targets. Of course, knowing your income is only half the battle; getting a clear picture of where your money currently goes is just as vital. Effective tracking your spending is the only way to build a solid financial foundation.

What If Your Income Isn’t Consistent?

So, what happens if your income changes from month to month? This is a common reality for freelancers, salespeople, or anyone who earns commissions and bonuses. The trick is to find a reliable average.

Just add up your take-home pay from the last three to six months and divide by the number of months you used. This gives you a much more stable monthly average to build your budget around. It smooths out the peaks and valleys.

The key is to avoid using a one-time bonus or an unusually high-earning month as your baseline. Consistency is more important than optimism when setting up a budget that you can actually stick to.

This pay stub example really drives home the difference between your gross pay and what you actually take home.

See how much those deductions eat into the total? That’s precisely why focusing on your net income is the only way to create a budget that’s accurate, realistic, and ultimately, successful.

Sorting Your Spending Into Needs, Wants, and Savings

Alright, this is where the rubber meets the road with your 50/30/20 budget. The single biggest hurdle I see people face is figuring out what’s a true ‘Need’ versus a sneaky ‘Want.’ It’s where the best intentions can completely unravel, so let’s get this sorted out with a solid framework you can actually use.

Your 50% Needs category is for the absolute essentials—the stuff you must pay for to live and work. Think of them as your non-negotiables. This bucket covers things like your rent or mortgage, utility bills, basic groceries, and the cost of getting to work.

Aiming for about half of your after-tax income here is a healthy target. For a little perspective, data from the U.S. Bureau of Labor Statistics shows that in 2023, housing alone took up about 33% of the average household’s income. That’s a huge chunk, and it really underscores why it’s the biggest ‘Need’ for most of us. You can even see how your spending compares to national averages to get a better sense of where you stand.

Navigating the Gray Areas

Next up is the 30% Wants category. This is all about your lifestyle choices—the things that make life more fun but aren’t critical to your survival. We’re talking about dinners out, streaming services, hobbies, and that weekend getaway you’ve been dreaming about.

But some expenses are tricky; they live in a gray area. How you categorize them really comes down to your personal situation and, frankly, how honest you are with yourself.

Is that daily coffee a ‘Need’ to get your brain working, or a ‘Want’ you could swap for a home-brewed cup? What about a gym membership? If it’s your main outlet for physical and mental health, you could argue it’s a need. But if you barely go, it’s definitely a want.

The real test is to ask yourself: “Could I still live and do my job without this?” If the answer is yes, it’s almost certainly a want. A high-end phone plan is a want; a basic phone line is a need.

Prioritizing Your 20% Savings

Finally, we get to the 20% Savings category. This is your path to financial freedom. This bucket isn’t just about stashing cash in a savings account; it’s also for knocking down debt faster than the minimum payments. For a truly robust financial plan, your first mission here is building an emergency fund.

Here’s a smart way to approach it:

- Build your emergency fund first: Your initial goal should be to save 3-6 months of essential living expenses. This is your buffer against a surprise job loss or a big medical bill.

- Attack high-interest debt: Once that safety net is in place, go after expensive debt like credit card balances.

- Invest for your future: With your emergency fund ready and costly debt under control, you can start funneling more of this 20% toward long-term goals like retirement accounts.

Following this order ensures you have a cushion, which makes your entire budget much more resilient when life inevitably throws a curveball your way.

Putting Your 50/30/20 Budget Into Action

A budget on paper is a great start, but the real magic happens when you bring it to life. The trick isn’t to get bogged down in manual data entry; it’s about making financial tracking a seamless, almost invisible, part of your routine. This is where a modern budgeting tool like PopaDex really shines.

First things first, you’ll want to set up your three main spending buckets inside the app: Needs, Wants, and Savings. Once that’s done, you can link your bank accounts and credit cards. This automation is a total game-changer because it pulls in all your transactions for you. No more tedious logging of every coffee and grocery run.

From there, your main job is to simply review and categorize your spending as it flows in. That weekly trip to the grocery store? Tag it as a ‘Need.’ Your Netflix subscription? That’s a clear ‘Want.’ And that extra payment you threw at your student loan? That goes straight into your ‘Savings & Debt Repayment’ bucket.

Gaining Deeper Spending Insights

As you begin tracking, you’ll quickly get a real, honest look at where your money is going—and it’s often an eye-opener. To get even more granular, you can use custom tags within your main categories. Instead of just lumping everything into a generic ‘Wants’ category, try creating specific tags like #DiningOut, #Shopping, or #Hobbies.

This micro-level detail helps you make smarter choices without feeling overwhelmed. You might discover your dining out expenses are way higher than you realized, which could inspire you to look into more affordable habits, like finding strategies for eating organic on a budget.

The whole point is to turn raw data into smart decisions. Seeing that 20% of your ‘Wants’ budget is eaten up by subscription services you barely use gives you an immediate, actionable way to free up some cash.

By making tracking an automated and simple review process, you shift your focus from actively “budgeting” to passively monitoring your financial health. This turns a chore into a powerful, wealth-building habit.

For anyone ready to take things a step further, our guide on mastering budgeting offers a path to financial freedom and builds on these fundamental tracking skills. The consistency you build here is exactly what makes the 50/30/20 framework so successful over the long haul.

Adapting Your Budget When Life Happens

Life rarely fits into neat little boxes, and your budget shouldn’t be forced into one either. The 50/30/20 budget is an incredible starting point, but its real magic is in its flexibility. You have to think of it as a guide, not a set of rigid, unbreakable rules. For a financial plan to actually work, it needs to breathe and bend with your real-life circumstances.

A classic example I see all the time is trying to stick to the rules in a high-cost-of-living city. When your rent or mortgage alone eats up more than 50% of your take-home pay, trying to force the numbers to fit the standard model is just setting yourself up for failure. The goal is to make smart adjustments, not to feel defeated before you even begin.

This graphic gives you a great visual of the ideal 50/30/20 split.

While these are the target percentages, your personal situation is what will ultimately dictate how you need to adjust them to make them work for you.

Making Realistic Adjustments

Let’s get practical. When one of your budget categories swells, that money has to come from somewhere else—it’s a zero-sum game. Say your ‘Needs’ creep up to 60% because of a rent hike. You have a choice. You could tighten your belt on ‘Wants’ and slash them to 20% to protect your savings rate. Or, you could split the difference, trimming a little from both ‘Wants’ and ‘Savings’.

The key is to be intentional with your changes. Consciously deciding to reduce your ‘Wants’ budget to cover higher rent is a strategic move. Letting it happen without a plan is how budgets fall apart.

Major life events are another reason you’ll need to pivot. When things change, your budget has to change, too. Maybe you’re staring down a mountain of high-interest credit card debt. In that case, you might temporarily shift to a 50/20/30 split, funneling that extra 10% from ‘Wants’ directly to your ‘Savings & Debt’ category to pay it off faster.

The same logic applies if you’re saving for a down payment on a house. That goal might require a period of intense focus where you prioritize savings above almost everything else.

Common Scenarios and Budget Adjustments

Here’s a look at how different life situations might lead you to adjust the standard 50/30/20 framework. This table shows a few common scenarios and the strategies you could use to adapt.

| Scenario | Suggested Needs % | Suggested Wants % | Suggested Savings % | Strategy |

|---|---|---|---|---|

| High-Cost-of-Living Area | 60% | 20% | 20% | Reduce discretionary spending to cover essential housing costs while protecting your savings rate. |

| Aggressive Debt Payoff | 50% | 20% | 30% | Temporarily cut back on ‘Wants’ to accelerate payments on high-interest debt and save on interest. |

| Saving for a Big Goal | 50% | 15% | 35% | Make significant, short-term cuts to ‘Wants’ to reach a major savings goal (like a down payment) faster. |

| Sudden Income Boost | 50% | 30% | 20%+ | Keep ‘Needs’ and ‘Wants’ percentages stable and direct the majority of the new income straight to savings/investments. |

| Low-Income or Starting Out | 65% | 25% | 10% | Focus on covering essentials. The goal is to build a savings habit, even if the percentage is small to start. |

Remember, these are just examples. The most important thing is that you’re in control and making decisions that align with your priorities.

And what about good news? Getting a new job with a higher salary is the perfect time to re-evaluate your budget. Before “lifestyle creep” has a chance to absorb all that extra cash, make a conscious plan. A great strategy is to commit to sending most, if not all, of that new income directly into your 20% savings and investments bucket.

Your financial journey is yours alone. The people who are most successful with budgeting are the ones who treat it like a living document. They review it, tweak it, and adjust their 50/30/20 plan to match their current reality and future goals. That’s how you make sure your budget is always working for you, not against you.

Common Questions About The 50 30 20 Budget

Even with a budget as straightforward as the 50/30/20 rule, it’s normal for questions to come up. Life is messy, and trying to fit your unique financial situation into a neat framework can feel tricky.

A common challenge I see is dealing with an irregular income. If you’re a freelancer or your pay is commission-based, your take-home cash can swing dramatically from one month to the next. The best approach here is to look at your average monthly income over the past six months. This gives you a much more stable baseline to work with.

Another question that comes up a lot is what to do when your debt feels like it’s crushing you. Is it even worth trying to save? The answer is a huge “yes.” Your first move should be to focus that 20% savings bucket on building a small emergency fund—even just $500 to $1,000 can make a world of difference. That small cushion is what keeps a surprise car repair from becoming more credit card debt.

What If I Can’t Hit The Percentages Perfectly?

Look, it’s completely fine if your numbers don’t line up perfectly with the 50 30 20 budget rule from day one. This is especially true if you’re in a high-cost-of-living area or just getting started in your career. The goal is progress, not instant perfection.

The real power of this budget isn’t in hitting the exact numbers on day one. It’s about the awareness it creates, which is the first step toward lasting financial change.

And the data shows this approach genuinely works. Recent studies found that between 40-50% of people who stick with this method feel more in control of their finances in just six months. Many even see a 15-20% bump in their savings rate, which speaks volumes about its effectiveness.

If you’re having a tough time making the percentages fit, start by combing through your ‘Wants’ category. That’s usually the first place to find some wiggle room. If that’s not enough, it might be time for bigger strategies. For more advanced tips, you can check out our comprehensive guide on budgeting best practices.