Our Marketing Team at PopaDex

Find the Best Free Net Worth Tracker for Your Finances

Think of a free net worth tracker as your financial command center. It pulls together everything you own (your assets) and everything you owe (your liabilities) into one, easy-to-read dashboard. The goal? To give you a real-time, accurate snapshot of your financial health so you can start making smarter moves with your money.

Why a Free Net Worth Tracker Is Your Financial GPS

Ever tried to drive to a new city without a map or GPS? You might know where you are and where you want to end up, but the journey between those two points is a total mystery. You’d probably make wrong turns, hit dead ends, and waste a ton of time and gas.

Managing your money without a clear picture of your net worth is exactly like that—it’s like flying blind.

A free net worth tracker is that personal financial GPS. It gives you a single, unified view of your entire financial world, solving a problem most of us don’t even realize we have: financial fragmentation.

Overcoming Financial Fragmentation

Let’s be honest, our financial lives are scattered all over the place. Sound familiar?

- A checking account with one bank.

- A 401(k) with whatever provider your employer picked.

- An old IRA or brokerage account you opened years ago.

- A mortgage, a car loan, and maybe some student loans.

- Credit card debt spread across a few different cards.

Trying to stitch that puzzle together in your head is next to impossible. A tracker does the heavy lifting for you, bringing all those scattered pieces into one place. Suddenly, you can see the complete picture. This clarity is the first, most crucial step toward taking real control of your finances.

Free net worth tracking apps have completely changed the game for personal finance in places like the US, UK, and Canada. Take Empower (which used to be Personal Capital) as an example. It’s a popular free tracker that bundles in tools for budgeting, investing, and retirement planning. By 2025, these apps are pulling in everything from bank accounts and investments to crypto and real estate, giving people a consolidated view that was once only available to the wealthy.

Here’s a glimpse of what a modern financial dashboard can look like.

This kind of visual layout tells you everything you need to know in seconds—from your total net worth to how your assets are allocated—without you ever having to sift through a single paper statement.

The Simple Formula for Clarity

At its core, a net worth tracker automates a simple but incredibly powerful formula. It adds up all your assets, subtracts all your liabilities, and gives you one number that matters more than almost any other.

To really understand what your tracker is doing, it helps to see the components broken down. This simple table shows you what goes into the calculation.

Your Net Worth Calculation at a Glance

| Component Type | Definition | Common Examples |

|---|---|---|

| Assets | Anything you own that has monetary value. | Cash, checking/savings accounts, investments (stocks, bonds), retirement accounts (401k, IRA), real estate, vehicles, valuable collectibles. |

| Liabilities | Any debt or financial obligation you owe to others. | Mortgages, car loans, student loans, credit card balances, personal loans. |

Seeing it laid out like this makes the core concept crystal clear. It’s all about what you own versus what you owe.

Your Net Worth Formula: Total Assets (What You Own) - Total Liabilities (What You Owe) = Your Net Worth

This isn’t just a number; it’s a progress report on your financial journey. When your assets are growing faster than your liabilities, your net worth climbs, which is a clear sign you’re building wealth. On the flip side, if your debts are growing faster than your assets, it’s a warning light telling you it’s time to adjust your strategy.

Watching this number change over time is empowering. It helps you make informed decisions, whether that means putting more money into investments, getting aggressive about paying down high-interest debt, or taking a hard look at your spending. It turns vague financial goals into a mission you can actually measure and track.

How Consistent Tracking Builds Real Wealth

Calculating your net worth just once is like weighing yourself on January 1st. It gives you a starting point, sure, but it does nothing to get you in shape. The real magic happens with consistency.

Regularly using a free net worth tracker is the financial equivalent of a fitness tracker. It pulls back the curtain, showing you the direct results of your financial habits over time. When you see how every extra debt payment or investment contribution moves the needle, “building wealth” stops being an abstract concept and becomes a tangible, measurable process.

You’re no longer guessing. You’re executing a data-driven strategy.

Fueling Your Motivation with Data

Watching your net worth trend upward—even by a little bit—is a powerful motivator. It’s hard proof that your discipline is paying off, which makes it a lot easier to stick to the plan when you’re tempted to splurge.

But what about when it drops? A dip in your net worth from a market downturn or a big expense isn’t a failure. It’s a crucial data point. It’s a signal to analyze what happened, tweak your strategy, and plan your recovery. It’s information, not judgment.

By making your financial progress visible, a net worth tracker gamifies the process of wealth building. Each positive month feels like leveling up, providing the psychological boost needed to stay engaged for the long haul.

This isn’t just theory. The financial blog Budgets Are Sexy documented over a decade of monthly tracking, showing exactly how net worth moves with the market. For instance, in 2018, the blogger’s net worth fell from over $900,000 to around $791,150 during a market meltdown—only to bounce back. This long-term view proves that tracking helps you weather the storm with a clear head instead of panicking.

Exposing Hidden Financial Leaks

One of the best things about consistent tracking is how it shines a spotlight on problems you might not even know you have. Are your credit card balances slowly creeping up? Is that car loan eating away at your progress more than you realized?

These subtle but destructive patterns are impossible to ignore when they’re staring back at you in your net worth report. A free net worth tracker acts as your financial early warning system, helping you spot and fix small leaks before they turn into major floods.

Clarifying Your Path to Major Goals

Consistent tracking gives you the clarity to chase your biggest goals with actual confidence. It helps you answer the big, fuzzy questions with real numbers:

- Buying a Home: How fast is my down payment fund really growing? Am I knocking down other debts quickly enough to get a great mortgage rate?

- Retirement: Is my portfolio growing at the pace I need to retire on my timeline? How are my retirement accounts impacting my overall wealth?

- Financial Independence: Where am I now, and what number do I need to hit to live off my investments?

This clarity replaces anxiety with a sense of control. You aren’t just hoping to reach your goals anymore; you have a roadmap and can see every step you take along the way. Ultimately, tracking connects your daily financial choices to the future you want to create and helps you implement smart strategies for building generational wealth.

Key Features Every Great Tracker Should Have

Not all free net worth trackers are created equal. Some are little more than glorified spreadsheets, while others act as powerful, dynamic dashboards for your entire financial life. Knowing the difference is critical because the right features can turn a simple number into a tool for building real wealth.

Think of it like choosing a car. A basic model gets you from A to B, sure. But a model with GPS, live traffic data, and advanced safety sensors makes the journey smarter, safer, and far more efficient. Your financial journey deserves the best navigation you can get. Let’s break down the non-negotiable features every great tracker needs.

Secure and Seamless Account Aggregation

At its core, any automated free net worth tracker worth its salt must have account aggregation. This is the magic that securely links to all your different financial accounts—banks, investment brokerages, loan providers, you name it—and pulls all that data into one clean, unified dashboard. Without it, you’re back to punching in numbers manually, which completely defeats the purpose.

A great tracker should connect to thousands of institutions, making sure everything from your primary checking account to that old 401(k) you nearly forgot about is included. This is what provides a truly holistic view of your finances without the hours of grunt work. The goal is automation that saves you time and sidesteps the inevitable human error.

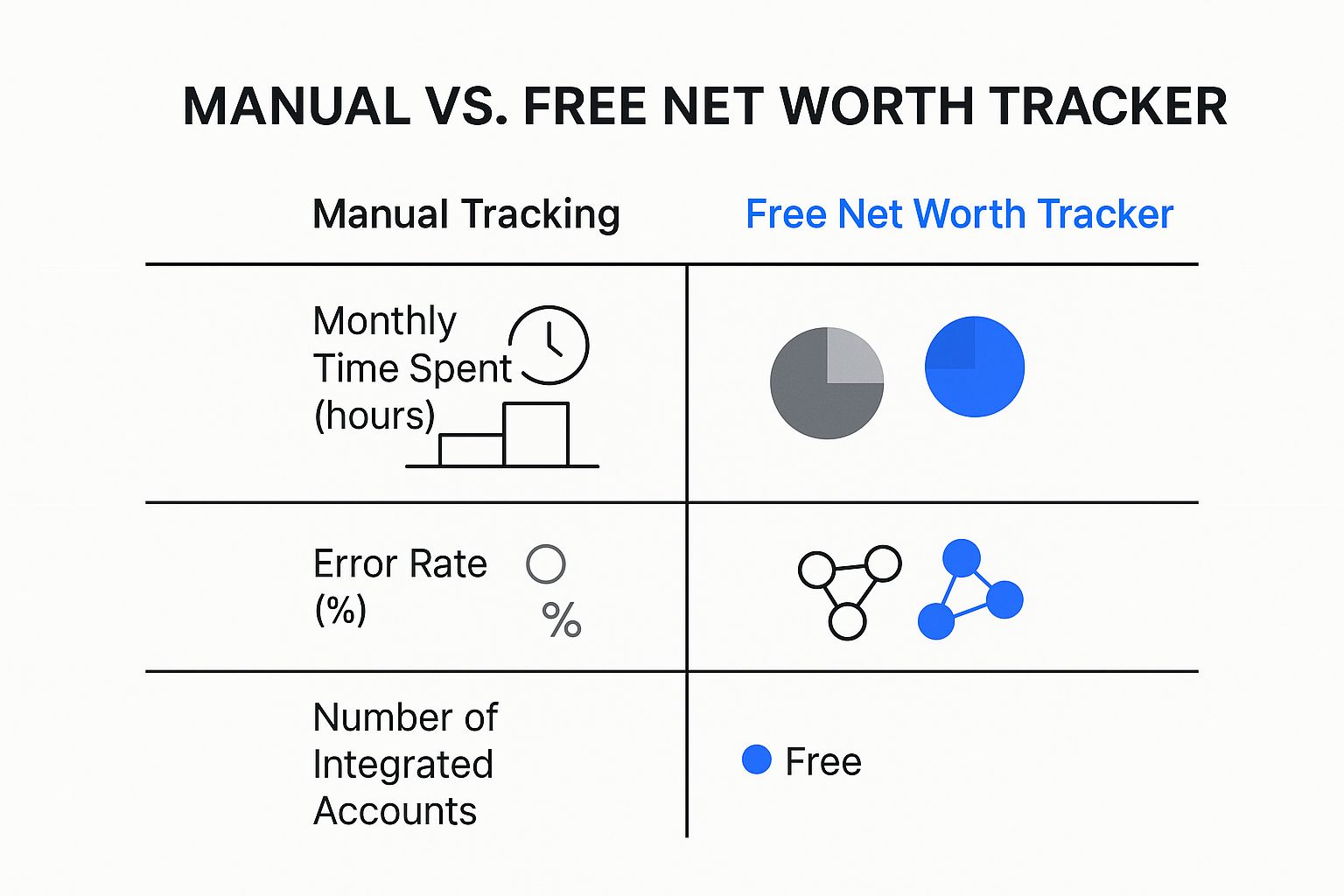

Just look at the difference between doing it by hand versus using a dedicated tool.

The data speaks for itself. Automated trackers slash the time you spend managing your money while dramatically improving accuracy. It’s a no-brainer.

Now, let’s explore the different kinds of trackers out there and what they offer.

Comparing Different Types of Free Net Worth Trackers

Choosing the right tracker depends on your comfort with technology and how much hands-on work you’re willing to do. From simple spreadsheets to fully automated platforms, each has its place. This table breaks down the main options to help you find the perfect fit.

| Tracker Type | Key Features | Best For | Example |

|---|---|---|---|

| Spreadsheets | Fully manual entry, 100% customizable, total data privacy. | DIY enthusiasts who want complete control and don’t mind the manual updates. | Google Sheets, Microsoft Excel |

| Manual-Entry Apps | Structured templates, manual input for assets/liabilities, enhanced privacy. | Individuals who want more structure than a spreadsheet but prefer not to link accounts. | PopaDex (Free Plan) |

| Automated Aggregators | Automatic data syncing, real-time updates, connects to thousands of institutions. | People seeking a comprehensive, hands-off overview of their finances with minimal effort. | Empower, Mint |

Ultimately, the best tool is the one you’ll actually use. For many, a hybrid approach like PopaDex offers the best of both worlds—start manually for free, then upgrade for automation when you’re ready.

Real-Time Data and Clear Categorization

Your financial life doesn’t stand still, and your tracker shouldn’t either. A great tool provides real-time or near-real-time updates, not data from last week. When the stock market dips, your portfolio’s value should reflect it. When you make a huge payment on your car loan, that liability should drop instantly.

This immediacy is what turns a tracker from a historical archive into a dynamic tool for making decisions now. It’s the difference between looking at an old photo of your finances and watching a live video feed.

Beyond fresh data, the tracker absolutely must offer clean, clear categorization for your assets and liabilities. You should be able to see at a glance how much you have in:

- Cash: Checking, savings, and money market accounts.

- Investments: Stocks, bonds, ETFs, and retirement funds.

- Real Estate: Your home and any other properties.

- Debt: Mortgages, student loans, credit cards, and auto loans.

This clean separation helps you instantly spot where your wealth is concentrated and where your biggest debts are hiding—essential information for any strategic financial planning.

Robust Security Protocols Are Non-Negotiable

Handing over any kind of access to your financial accounts requires a huge amount of trust. That’s why top-tier security isn’t just a nice-to-have feature; it’s an absolute prerequisite. Any free net worth tracker you consider must use bank-level security to protect your sensitive information. End of story.

Here are the critical security features you should demand:

- Read-Only Access: The platform should only be able to view your account data. It should have absolutely no ability to initiate transfers, make withdrawals, or perform any other transactions.

- 256-bit AES Encryption: This is the gold standard, the same level of encryption used by major banks and militaries to scramble data and make it unreadable to anyone without authorization.

- Two-Factor Authentication (2FA): This adds a vital second layer of security. Even if someone gets your password, they can’t log in without a code from your phone.

If a platform isn’t loud and proud about these security measures, walk away. The convenience is never worth the risk.

How Automated Trackers Work Their Magic

Ever wonder how a free net worth tracker can instantly pull together your bank balance, investment portfolio, and credit card debt? It feels like magic, but it’s actually just really smart—and secure—technology doing the heavy lifting. This tech acts like a digital courier, fetching all your financial data without ever getting its hands on your actual accounts.

Picture your financial life as a series of separate islands. Your bank is one, your 401(k) is another, and your mortgage lender is a third. An automated tracker doesn’t build a permanent bridge to these islands. Instead, it sends a secure, armored boat to grab a snapshot of the current balances and brings that information back to your dashboard.

The engine behind this is something called an Application Programming Interface (API). Think of an API as a tightly controlled, secure language that lets different software programs talk to each other. Your bank has one, your brokerage has one, and your net worth tracker uses them to request data in a completely standardized and protected way.

The Role of Financial Data Aggregators

Now, most trackers don’t build direct connections to thousands of individual banks themselves. That would be a massive undertaking. Instead, they partner with trusted third-party services called financial data aggregators. You’ve probably heard of the big names like Plaid or Yodlee; they are the specialists who handle this secure communication.

Here’s a simple breakdown of how it works:

- You Grant Permission: Inside your tracker app, you pick your bank and type in your login details through a secure portal that’s actually hosted by the aggregator (like Plaid).

- A Secure Handshake: The aggregator then uses your credentials just once to create a secure, encrypted token—a sort of digital key—that establishes a link with your bank’s API. Your login info is never stored by the tracker itself.

- Data Is Pulled: Using that secure token, the aggregator pulls “read-only” data like account balances and transactions and feeds it into your tracker.

This system is designed so your tracker can see your financial data but can never move money, make transactions, or change anything in your accounts. We dive deeper into this technology in our complete guide to financial data aggregation. It’s the very reason modern financial tools can be both incredibly powerful and safe.

Valuing Your Assets in Real Time

Just seeing a list of your accounts isn’t enough. The real power of a great free net worth tracker is its ability to value everything you own dynamically. This is where multiple data feeds come into play.

For publicly traded investments like stocks and ETFs, it’s pretty straightforward. Trackers hook into financial market data feeds to pull the latest prices for whatever you hold, updating your portfolio’s value throughout the day. You get a live look at how the market is impacting your wealth.

Even simple tools have found clever ways to do this. A big leap forward came with the use of the =GOOGLEFINANCE() function in Google Sheets. This simple function, which saw a surge in popularity between 2023-2025, allowed people to fetch real-time stock prices right in their spreadsheet. It slashed the time spent on manual updates to less than 15 minutes a month and gave users live visibility without a fee. You can discover more insights about these innovative tracking methods on ofdollarsanddata.com.

By combining secure account linking with live data feeds, a tracker transforms a scattered collection of financial accounts into a single, living, and accurate picture of your net worth.

For your other assets, the valuation process is a bit different:

- Real Estate: The value of your home is usually estimated by pulling data from third-party real estate services that analyze recent sales of similar homes in your area.

- Vehicles: The value of your car is often pulled from automotive pricing guides based on its make, model, year, and overall condition.

- Manual Assets: For unique items like art, collectibles, or private investments, you can simply input the value yourself and update it whenever you see fit.

Your First Steps to Tracking Your Net Worth

Jumping into your finances can feel like a huge undertaking, but setting up your first free net worth tracker is actually much simpler than it seems. The whole point is to bring you clarity, not confusion. This guide breaks it all down into a few manageable steps.

Think of it like putting together a puzzle. Each bank account you connect and every asset you add is another piece falling into place. By the end, you’ll see the complete picture of your financial health for the very first time. This is your starting line.

Step 1: Gather Your Financial Information

Before you even click “sign up,” the best thing you can do is get all your financial details in one place. A little prep work here saves a ton of time and stops you from having to hunt for login info midway through the process.

Just make a simple list of every financial institution you use. Don’t stress about the exact numbers yet, just the names.

- Bank Accounts: All your checking, savings, and money market accounts.

- Investment Accounts: Think brokerages, 401(k)s, IRAs, and any other retirement plans.

- Loan Accounts: Your mortgage, car loans, student loans, and personal loans.

- Credit Cards: Every card with a balance.

Having this list ready makes everything that follows much, much smoother.

Step 2: Link Your Accounts Securely

With your list ready, it’s time to connect everything to your tracker, like the PopaDex free plan. This is where the magic of automation kicks in. You’ll link each account one by one, using your login details through a secure portal.

Keep in mind that reputable trackers use read-only access. This means they can see your balances but have zero ability to make transactions. If a connection doesn’t work on the first try, don’t sweat it. It’s usually just a typo in a password or a two-factor code that needs to be entered.

While a net worth tracker gives you the 10,000-foot view, managing day-to-day costs is just as important. For that, it can be helpful to look into shared expense tracker apps to handle the daily spending that affects your bottom line.

Step 3: Manually Add Your Offline Assets

Not everything you own has an online login. A lot of your most valuable assets exist in the real world, and adding them manually is what makes your net worth calculation truly accurate.

You’ll need to add estimated values for things like:

- Your Home: Use a recent appraisal or a trusted online estimator (like Zillow or Redfin) for its current market value.

- Your Vehicles: Look up the current private-party value for your car’s make, model, year, and condition.

- Valuable Collectibles: This could be anything from art and jewelry to rare sneakers. Use recent sales of similar items to get a good benchmark.

Pro-Tip: For anything you add manually, set a reminder in your calendar to update the values every 6 to 12 months. This prevents your net worth figure from getting stale and ensures it reflects today’s market.

Step 4: Review and Verify Your First Snapshot

Once all your accounts are connected and manual assets are plugged in, your tracker will show you your very first net worth number. This is a big moment! Take a minute to look it over.

Does it all seem right? Click through your assets and liabilities and spot-check the numbers against what you see when you log into your bank or brokerage directly. Syncing errors are rare, but it’s smart to catch any little hiccups early to make sure your starting point is rock-solid. If you’re the type who likes to see how the sausage is made, you could even build a net worth tracking spreadsheet to understand the calculations from the ground up.

And that’s it! You’ve just built a powerful, single view of your entire financial world. This number is your baseline. From now on, every financial move you make can be guided by this clear, comprehensive picture.

Turning Your Financial Data Into Action

Okay, you’ve done the hard part. Your free net worth tracker is set up, your accounts are synced, and the numbers are rolling in. This is where the magic happens—the point where a simple report becomes a powerful tool for building real wealth.

Your data tells a story about your financial habits, and learning to read that story is how you start making smarter choices. Think of your net worth dashboard less like a final grade and more like your personal financial playbook. It’s built to show you what’s working, what isn’t, and where your biggest opportunities are hiding.

Analyze Your Asset Allocation

One of the first things your tracker will reveal is your asset allocation. That’s just a fancy way of saying how your money is spread out across different types of investments. A quick glance can tell you if you’re well-diversified or if you’ve accidentally put all your eggs in one basket.

For example, you might realize that 90% of your investments are stuck in a single type of stock. That’s a huge red flag. A solid portfolio spreads risk across different assets to cushion you from the market’s inevitable ups and downs.

- Cash and Equivalents: Is your emergency fund where it needs to be and easy to get to?

- Stocks and Equities: Are you spread across different industries and company sizes?

- Real Estate: How much of your net worth is tied up in property? Is that too much, or not enough?

- Alternative Assets: Do you have a small slice in things like crypto or collectibles?

Seeing this laid out visually makes it incredibly easy to spot imbalances and shift your funds to build a more resilient financial base.

Identify and Attack High-Interest Debt

Your tracker also lines up all your liabilities side-by-side, which is an absolute game-changer for tackling debt. It shines a harsh—but necessary—spotlight on the debts that are actively working against you.

Scan the list for liabilities with the highest interest rates; these are your primary targets. A credit card with a 22% APR is a financial emergency, while a 4% mortgage is a manageable, long-term tool. Having them all in one place helps you build a focused payoff plan, whether you prefer the avalanche or snowball method, to knock out the most destructive debts first.

Your net worth tracker gives you the clarity to stop playing defense against debt and start playing offense. It turns a vague sense of being in debt into a concrete list of targets to conquer one by one.

Track Progress Toward Your Biggest Goals

Every big financial goal you have, from buying a house to retiring early, is directly connected to your net worth. Your tracker becomes the ultimate accountability partner, showing you in black and white how close you are to making those dreams a reality. This is why effective financial goal setting is so important—it gives all this tracking a purpose.

If you notice your liabilities are growing faster than your assets, that’s a clear signal to rethink your strategy. This data pushes you to ask the tough questions and take action. Is it a spending problem? An income issue? Or are your investments just not pulling their weight?

By checking in on your progress monthly, you can make small, steady adjustments that compound into huge results over time. You’re no longer just watching your finances happen; you’re actively shaping the future you want.

Have Questions About Net Worth Trackers? We’ve Got Answers.

Diving into the world of financial tracking naturally brings up a few questions. It’s smart to be curious, especially when your money is involved. We’ve tackled some of the most common queries about using a free net worth tracker to help you get started with total confidence.

Are Free Net Worth Trackers Actually Safe?

Yes, but only if you choose a reputable one. The best services are built with security as their absolute foundation. They use “read-only” access, which means the app can see your balances but has zero ability to move money or authorize transactions.

Think of it like this: you’re handing over a copy of your bank statement, not your debit card and PIN. To make sure your data is locked down, only use platforms that offer these non-negotiables:

- Bank-level 256-bit AES encryption to scramble your data into unreadable code.

- Two-factor authentication (2FA) to block anyone from logging in, even if they somehow get your password.

How Often Should I Actually Check My Net Worth?

It’s tempting to check daily, especially when your tracker updates in real-time. But honestly, that can do more harm than good. Watching the daily rollercoaster of the stock market can create a ton of unnecessary stress and lead to emotional, knee-jerk decisions.

A monthly check-in is the sweet spot. It’s frequent enough to keep you plugged in and motivated, but it smooths out all the noise from short-term market jitters. A monthly review gives you a much clearer, more accurate picture of how your savings, investments, and debt payments are actually moving the needle.

What if a Tracker Can’t Connect to One of My Accounts?

This happens sometimes, especially with smaller local banks or credit unions. Don’t worry—every quality free net worth tracker has a simple fix: manual entry. You can add the asset or liability yourself and just update its value whenever you check in.

This is also how you’ll track any “offline” assets that don’t have an online portal, like your home, car, or that vintage comic book collection. A quick update quarterly or annually is all it takes to keep your total net worth figure on point.

Will Using a Free Tracker Ding My Credit Score?

Absolutely not. Using a net worth tracker has zero impact on your credit score. The connection process uses “soft inquiries” or direct data feeds, which are totally different from the “hard inquiries” used for loan applications.

These soft pulls are invisible to lenders and aren’t reported to credit bureaus like Experian or TransUnion. These tools are for your eyes only—designed for personal financial insight, not for credit assessment.

Ready to finally get a clear, complete picture of your financial life? The free plan from PopaDex gives you all the tools you need to bring your assets and liabilities together into one simple, powerful dashboard. Start tracking your net worth for free today!