Our Marketing Team at PopaDex

How to Build Wealth in Your 20s A Proven Guide

If there’s one piece of financial advice that actually matters, it’s this: start investing in your 20s. Even if it’s a small amount. Automate your savings, get aggressive with high-interest debt, and find ways to grow your income. Your biggest advantage right now isn’t how much money you make—it’s how much time you have. Don’t waste it.

Why Your 20s Are Your Wealth-Building Power Decade

Let’s get one thing straight: your 20s are a financial opportunity you will never get back. This isn’t about landing a six-figure job straight out of college. It’s about giving your money the longest possible runway to grow. The small, consistent moves you make now will have an outsized impact down the road, all thanks to the magic of compound interest.

Think of compounding as a tiny snowball rolling down a very, very long hill. When you invest, your money earns a return. The next year, you earn a return on your original cash and on the profit it just made. This cycle repeats, and your little snowball slowly but surely turns into an avalanche of wealth.

Your age is the single most powerful asset you have. Every year you put off investing is a year of compounding you can’t get back, and the cost of that delay is absolutely staggering.

A Tale of Two Investors

Let’s paint a picture with two friends, Alex and Ben.

- Alex starts investing at 25. He puts $300 a month into a simple, low-cost index fund. That’s it.

- Ben waits until he’s 35. He’s a bit more “settled,” but he invests the exact same amount, $300 a month, into the same fund.

They both invest faithfully until they hit 65. The only difference? Alex had a ten-year head start. The result isn’t just a small gap; it’s a Grand Canyon-sized difference in their final numbers.

By starting just ten years earlier, Alex ends up with hundreds of thousands of dollars more than Ben. The crazy part? He only invested $36,000 more out of his own pocket during that first decade. The rest is pure, unadulterated growth from time and compounding.

This isn’t just a hypothetical. Research from The Aspen Institute backs this up, showing that starting to save and invest earlier can lead to an extra $473,000 for retirement compared to waiting. You can dive into the findings on early wealth building yourself.

The Power of Compounding Starting at 25 vs 35

To really drive the point home, let’s look at the numbers. This table shows just how powerful a single decade can be, assuming a pretty standard 7% average annual return.

| Age | Started at 25 | Started at 35 |

|---|---|---|

| 35 | $62,755 | $0 |

| 45 | $210,500 | $62,755 |

| 55 | $510,750 | $210,500 |

| 65 | $1,085,000 | $510,750 |

Look at that difference. Ben does everything right from 35 onward, but he simply can never catch up. Alex’s portfolio cruises past the million-dollar mark, more than double what Ben ends up with.

This isn’t some get-rich-quick nonsense. It’s simple, proven math. Every single day you’re in your 20s is an opportunity to give your future self a financial gift that’s almost impossible to replicate later in life. Start now.

Create Your Personal Money Blueprint

Now that you see just how powerful time is, the next move is to get intentional with your money. For a lot of people, the word “budget” brings up painful images of spreadsheets and saying no to everything fun.

Let’s ditch that whole mindset.

Think of this as your personal Money Blueprint—a flexible, empowering plan that puts you squarely in the driver’s seat of your financial life.

The point isn’t to track every last penny or swear off lattes for good. It’s all about clarity. Once you know exactly where your cash is flowing, you can consciously decide if that spending lines up with your bigger goals, like saving up a down payment or finally maxing out your retirement accounts. This blueprint is the tool you’ll use to fund your future.

Applying the 50/30/20 Rule in Real Life

A fantastic framework to start with is the 50/30/20 rule. It’s simple, it’s effective, and it gives you clear guardrails without getting bogged down in tiny details. This isn’t about hitting the numbers perfectly; it’s about giving every single dollar a job.

Here’s how it breaks down:

- 50% for Needs: This bucket covers the absolute must-haves—rent, utilities, groceries, transportation, and minimum debt payments. These are the bills that keep the lights on.

- 30% for Wants: This is where the fun happens. Think dining out, your Netflix subscription, hobbies, travel, and shopping. This category is what keeps you from burning out on your financial journey.

- 20% for Savings & Debt: This is your wealth-building engine. This slice of your income goes toward your emergency fund, attacking high-interest debt, and investing for the long haul.

Let’s run a quick example. Imagine Sarah, a recent grad who just landed her first job and brings home $3,500 a month after taxes. Using the 50/30/20 rule, her Money Blueprint takes shape instantly:

| Category | Percentage | Monthly Amount | Examples for Sarah |

|---|---|---|---|

| Needs | 50% | $1,750 | Rent, utilities, groceries, car payment, insurance |

| Wants | 30% | $1,050 | Restaurants, weekend trips, gym, Netflix subscription |

| Savings & Debt | 20% | $700 | Roth IRA, extra student loan payments, emergency fund |

Right away, Sarah has a clear path. She knows she has $1,050 for guilt-free spending each month while still putting a powerful $700 toward building her net worth. To get started on your own blueprint, dive into our guide on smart budgeting for young adults for more specific strategies.

Make Tracking Effortless with Modern Tools

A plan only works if you stick to it, and the secret to consistency is making it dead simple. Trying to manually track every coffee and grocery run in a notebook is a recipe for giving up. Thankfully, we have technology to make this almost automatic.

You don’t need some overly complex software. Just start with what feels right for you, whether that’s a basic spreadsheet or a dedicated app. Lots of banking apps now have built-in spending trackers that automatically categorize your purchases, so you can see at a glance if your “Wants” are getting a little out of hand or if you’re crushing your savings goals.

The most important habit you can build is awareness. You can’t control what you don’t track. Spending five minutes each week reviewing where your money went is one of the highest-return activities you can do for your financial future.

This isn’t just about discipline; it’s a smart response to today’s economy. A recent Bank of America study found that 72% of Gen Z took active steps last year to get their finances in order, mostly because of rising costs.

Their biggest financial pressures? Groceries (63%), rent (47%), and dining out (42%). This just goes to show how essential a clear Money Blueprint is for navigating the real world. By creating and actually following your blueprint, you turn your budget from a straitjacket into your single most powerful wealth-building asset.

Start Investing Without the Intimidation

This screenshot shows the annual contribution limits for a Roth IRA, a number you should know. Knowing the max you can put in helps you set a clear savings goal for one of the most powerful tax-advantaged accounts out there.

With your Money Blueprint sorted, you know exactly how much you can set aside to invest each month. For a lot of people in their 20s, the whole world of investing feels like an exclusive club with a secret handshake. The jargon is enough to make anyone’s eyes glaze over—stocks, bonds, ETFs, expense ratios.

But the core idea is shockingly simple.

Investing is just putting your money to work so it grows over time. Instead of letting your cash collect dust in a low-interest bank account, you’re buying assets that have the potential for much higher returns. And your biggest advantage isn’t some complicated trading strategy; it’s the decades you have ahead of you.

The best part? You don’t need to be a stock-picking genius. The most effective way to build wealth in your 20s is also the simplest: passive investing in low-cost index funds and ETFs.

Your First Two Investment Accounts

To get started, you’ll want to open two main types of accounts. Just think of them as different buckets for your investments, each with its own set of rules and perks. You don’t have to pick just one—in fact, using both is a smart and common strategy.

- A Roth IRA (Individual Retirement Arrangement): This is your secret weapon for building long-term, tax-free wealth. You put money in after you’ve paid taxes on it, but here’s the magic part: all of your investment gains and withdrawals in retirement are 100% tax-free. It’s an incredible deal, especially when you’re young and likely in a lower tax bracket than you’ll be later in your career.

- A Taxable Brokerage Account: This is your all-purpose investment account. It has no contribution limits or special retirement rules, offering total flexibility. You can pull your money out at any time without a penalty, which makes it perfect for medium-term goals like a down payment on a house or just building wealth outside of retirement. The only catch is you’ll pay capital gains taxes on your profits when you sell.

For a deeper dive, our guide on how to start investing money walks you through these initial steps in more detail.

An Investor’s Best Friends

So, your accounts are open. What do you actually buy? Forget trying to find the next Tesla. Your focus should be on two things: diversification and low costs.

- Index Funds: Think of these as a big basket holding tons of different stocks. They’re designed to mirror a major market index, like the S&P 500 (which tracks the 500 biggest U.S. companies). You get instant diversification without having to buy hundreds of individual stocks.

- ETFs (Exchange-Traded Funds): ETFs are very similar to index funds—they’re also collections of assets—but they trade on an exchange just like a single stock. They’re famous for their rock-bottom fees (called expense ratios) and are super easy to buy and sell.

Honestly, for most people in their 20s, buying a simple, low-cost S&P 500 ETF inside a Roth IRA is one of the most powerful wealth-building moves you can make. It’s a “set it and forget it” strategy that has a long history of delivering solid returns. If you’re curious and want to learn more about specific investment vehicles, you can always explore a trading academy.

Embrace the Market Roller Coaster

The number one thing that paralyzes new investors is the fear of a market crash. What happens if you invest $5,000 and the market tanks, turning it into $3,000 overnight? It’s a gut-wrenching feeling, but you have to make a crucial mindset shift.

As a young investor, market downturns are not a risk; they are an opportunity. Your time horizon is measured in decades, not days. A crash simply means that your favorite investments are now on sale.

When the market drops, every dollar you continue to invest buys you more shares than it did before. When things inevitably recover (and historically, the market always has), you’ll own more shares that will ride the wave back up, turbo-charging your growth. This is called dollar-cost averaging, and it happens automatically when you invest a fixed amount of money consistently, month after month, through thick and thin.

This generation is already catching on. A JPMorgan Chase Institute analysis found that 37% of 25-year-olds added money to investment accounts, a huge leap from just 6% in 2015. As traditional assets like housing become less attainable, young adults are smartly turning to the financial markets to build their wealth.

Your job isn’t to time the market. It’s to stay in the market. Automate your contributions, stick with your plan, and let compounding do its thing.

Supercharge Your Wealth by Growing Your Income

Consistent saving and smart investing are the bedrock of any solid financial plan. But if you want to put your wealth-building on the fast track, there’s one lever that trumps all others: earning more money.

Think about it. You can only cut your budget so much before you’re living on ramen and regret. Your earning potential, on the other hand, is theoretically limitless. Every extra dollar you bring in can be poured directly into your wealth engine—crushing debt, maxing out your Roth IRA, and fueling your investment portfolio.

This isn’t about grinding 80-hour weeks. It’s about being strategic. Your 20s are the perfect time to make bold moves, when you have the energy and flexibility to really amplify your earning power. Let’s dig into a few practical ways to do exactly that.

Maximize Your Primary Paycheck

Before you even think about a side hustle, your first stop should be optimizing the job you already have. So many young professionals leave thousands of dollars on the table just because they’re afraid to ask. Don’t be one of them.

If you’ve taken on new responsibilities, knocked a major project out of the park, or earned a valuable certification, you’ve built a strong case for a raise.

- Do Your Homework: Jump on sites like Glassdoor and Payscale. Research what people with your skills and experience are making in your city. You need to walk into that conversation armed with hard data.

- Track Your Wins: Keep a running “brag sheet” of your accomplishments. Did you save the company money? Make a process more efficient? Exceed your targets? Put numbers to your impact whenever you can.

- Practice Your Pitch: Seriously, role-play the conversation with a friend. It helps you get the nerves out and allows you to frame your request around the value you deliver, not just why you need more money.

Asking for a raise feels intimidating, but a 5% increase on a $50,000 salary is an extra $2,500 a year. If you invest that with an average 7% return, it could grow to over $26,000 in just a decade. Never underestimate the massive long-term power of a single conversation.

Develop High-Value Skills

The modern job market pays for specialized knowledge. Investing in skills that are in high demand is one of the most reliable ways to boost your income, whether that’s at your current company or by making a strategic career pivot. The trick is to pick skills with a clear return on investment.

Look at fields that are exploding right now:

- Digital Marketing: SEO, content creation, and paid advertising are skills nearly every single business is desperate for.

- Data Analytics: The ability to look at a mess of data and pull out clear, actionable insights is pure gold to employers.

- Skilled Trades: Don’t sleep on careers like electricians, plumbers, or welders. They often command excellent pay and have huge demand, all without a four-year degree.

Learning doesn’t have to mean going back to school for another degree. You can gain incredibly valuable skills through online courses, certifications, and even free tutorials on YouTube.

Launch a Smart Side Hustle

A side hustle is about more than just a little extra cash. It’s a way to diversify your income streams so you’re not completely reliant on a single employer. The best ones are built on skills you already have or are genuinely passionate about. To truly supercharge your wealth, consider exploring diverse strategies to earn money online, which can perfectly complement your primary income.

Start by brainstorming a few ideas that actually fit your life:

- Freelancing: If you’re a good writer, designer, or programmer, offer your skills on platforms like Upwork or Fiverr.

- E-commerce: Find a niche product you’re excited about and launch a small online store. You can start small with platforms like Shopify or Etsy.

- Local Services: Think about what your community needs. Could you offer pet-sitting, tutoring, or basic handyman services?

The key is to start small. Test your idea to see if people will actually pay for it before you sink a ton of time or money into it. The goal here is to build something sustainable that boosts your bottom line without burning you out.

By combining these income-boosting strategies, you can dramatically accelerate your ability to increase your net worth and hit your biggest financial goals years ahead of schedule.

Handle Debt Without Halting Your Progress

Debt in your 20s can feel like trying to run a marathon with an anchor chained to your ankle. Whether it’s student loans or the ghost of credit cards past, it’s a heavy drag that makes getting ahead feel impossible.

But here’s the good news: you don’t have to choose between paying off debt and building your future. In fact, the smartest move is to do both at the same time. The trick is having a clear strategy to attack that debt without sacrificing your single greatest asset—time.

This approach isn’t just about digging yourself out of a hole. It’s about building the ladder you’ll need to climb toward financial freedom while you do it.

Good Debt vs. Bad Debt

First things first, not all debt is created equal. Understanding the difference is your first step to prioritizing where your money goes. Some debt is an investment in yourself, while other debt just slowly drains your bank account.

- Good Debt: This is money you borrowed for something that can boost your net worth or future income. Think of a sensible mortgage on a home that’s appreciating in value or a student loan that unlocked a higher-paying career. These debts usually come with lower, sometimes tax-deductible, interest rates.

- Bad Debt: This is the nasty, high-interest stuff. Credit card balances are the number one culprit here, with interest rates of 20% or higher trapping you in a cycle of minimum payments that barely make a dent. Car loans for rapidly depreciating vehicles also fit this description.

Your mission, should you choose to accept it, is to obliterate bad debt as aggressively as you can while managing your good debt responsibly.

Choosing Your Debt Payoff Strategy: Snowball vs. Avalanche

When it’s time to go to war with bad debt, two popular strategies lead the charge: the debt snowball and the debt avalanche. Neither one is inherently “better”—the right one for you depends entirely on your personality and what keeps you motivated.

The most effective plan is the one you’ll actually stick with. Let’s break them down.

Choosing Your Debt Payoff Strategy Snowball vs Avalanche

This table compares the two most popular debt repayment methods to help you decide which is right for your financial goals and personal motivation style.

| Feature | Debt Snowball Method | Debt Avalanche Method |

|---|---|---|

| How it Works | You pay off debts from the smallest balance to the largest, regardless of interest rates. | You pay off debts from the highest interest rate to the lowest, regardless of the balance. |

| Primary Benefit | Psychological Wins. Knocking out small debts quickly creates momentum and keeps you motivated. | Mathematical Efficiency. You’ll pay less total interest over the life of your loans, saving money. |

| Best For | People who need quick, tangible wins to stay engaged and build positive financial habits. | Individuals who are disciplined and motivated primarily by saving the most money possible in the long run. |

So, which one fits you? Let’s say you have a $500 credit card nagging you at 22% interest and a $10,000 student loan at a more reasonable 6%. The snowball method tells you to crush that $500 balance first for the quick win. The avalanche method, however, directs every spare dollar at the 22% card because it’s costing you a fortune in interest.

Why You Must Invest While Paying Off Debt

This is probably the single most important concept to grasp when you’re figuring out how to build wealth in your 20s. It’s so tempting to think you need to be completely debt-free before you even think about investing. That mindset is a massive, costly mistake.

Every year you aren’t invested is a year of compound growth you can never get back.

If your debt has a relatively low interest rate (say, below 7-8%), the historical average return of the stock market (around 10%) is likely to outpace it. By paying only the minimum on that lower-interest debt and investing the rest, your money is working harder for you in the market than it’s costing you in interest.

Here’s a simple, actionable game plan:

- Grab Your 401(k) Match: If your job offers a 401(k) match, contribute enough to get the full amount. This is literally free money—an instant 100% return you won’t find anywhere else. It’s non-negotiable.

- Destroy High-Interest Debt: Pick your weapon—snowball or avalanche—and aggressively attack any debt with an interest rate above 8%. Think credit cards, personal loans, and the like.

- Invest for the Future: Once the bad debt is gone, keep making the standard payments on your “good” debt (like student loans or a mortgage) and start funneling that extra cash into a Roth IRA or another investment account.

This balanced attack allows you to systematically crush your liabilities while your assets are busy growing. It’s the ultimate two-pronged strategy for building a rock-solid financial foundation.

Common Questions About Building Wealth in Your 20s

Navigating personal finance in your 20s can feel like trying to solve a puzzle with half the pieces missing. You’ve got the basics down—saving, investing, managing debt—but the real-world questions are what trip you up.

Let’s tackle the most common ones head-on with some clear, practical answers to solidify your strategy and keep you moving forward.

How Much Money Should I Actually Invest Each Month?

There’s no magic number here, but a great target to aim for is 15% of your pre-tax income. Hitting this puts you on a fantastic track for building serious long-term wealth.

But look, if that number makes you want to run for the hills, don’t get paralyzed. The most important thing is to just start.

Even investing $50 or $100 a month is a huge win. The trick is to automate it so it becomes a non-negotiable part of your financial routine. Build the habit first. You can always dial up the amount later as your income grows. Consistency is what creates momentum.

Is It Better to Pay Off Student Loans or Invest?

This is the classic dilemma, but it’s not an either/or decision. The smartest move is a balancing act, letting you do both at the same time so you don’t miss out on precious years of market growth.

Think of it as financial multitasking. You can chip away at your liabilities while simultaneously building your assets.

A smart, balanced strategy is to first contribute enough to your 401(k) to get the full employer match—it’s an instant, guaranteed return. Then, aggressively pay down any high-interest debt (typically anything over 7%). For lower-interest debt, making standard payments while prioritizing investing often makes more sense, as your potential market returns can outpace the loan interest.

This hybrid approach ensures you’re not leaving free money on the table or letting high-interest debt wreck your progress. It’s all about making every dollar work as hard as possible for you.

What Is the Single Best First Step I Can Take Today?

If you’re feeling overwhelmed and just want one simple, high-impact thing you can do right now, here it is: Open a Roth IRA.

This is hands-down the most powerful retirement account for a young person. Your contributions go in after-tax, which means your investments grow completely tax-free, and all your qualified withdrawals in retirement are also 100% tax-free. It’s a massive advantage.

You can open an account with a major online brokerage in about 15 minutes. Once it’s set up, just automate a small monthly contribution—even $25 is a great start—into a low-cost, diversified fund like an S&P 500 ETF. This one move puts the incredible power of compounding on your side immediately and builds a rock-solid foundation for your financial future.

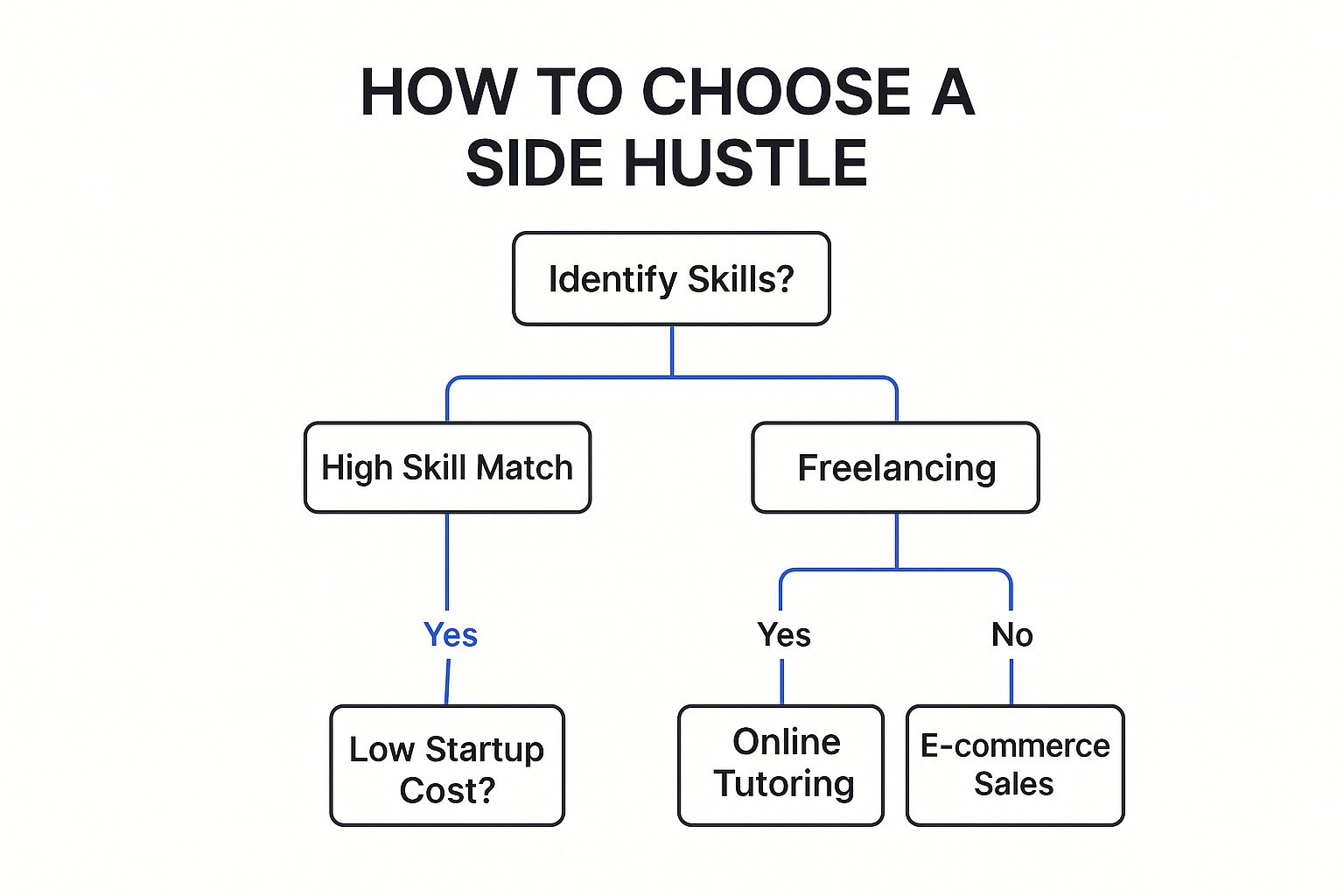

Where Should I Start with a Side Hustle?

Boosting your income is a total game-changer, but figuring out where to start can be tricky. The best side hustles usually tap into skills or interests you already have, which makes them much more enjoyable and sustainable.

This decision tree breaks down a simple way to think about it.

As you can see, turning your current expertise into freelance work is often the most direct path. Other options like e-commerce or tutoring become great choices when you factor in things like startup costs and how much time you can commit.

Ready to stop guessing and start tracking your financial journey with clarity? PopaDex is the all-in-one net worth tracker that brings your accounts together, giving you a real-time view of your progress. Sign up for free and take control of your wealth-building journey today at https://popadex.com.