Our Marketing Team at PopaDex

How to Track Expenses for Financial Clarity

Tracking your expenses is pretty simple: it’s the habit of logging every dollar you spend. You can use whatever method feels right—a notebook, a spreadsheet, or an app. The goal is to record every transaction, sort your spending into categories, and see how it stacks up against your income. This one habit is the bedrock for building a realistic budget and actually hitting your financial goals.

Your First Step to Financial Control

Before you get tangled up in complicated spreadsheets or download the trendiest new app, let’s reframe what tracking expenses is all about. This isn’t about punishment or restricting every little joy. It’s about gaining clarity and massively cutting down on that nagging, money-related anxiety. Think of it less like crunching numbers and more like uncovering the story of your financial life.

I know a freelance graphic designer who was constantly stressed about money. She just assumed she was terrible with her finances, but the real issue was much simpler: her spending was invisible. There wasn’t one giant leak in her financial boat; it was more like hundreds of tiny, untracked drips.

She committed to tracking every single expense for just one month, and what she found was surprising. Her spending wasn’t out of control at all. But those small, frequent purchases—coffees, forgotten subscriptions, and lunches out—were quietly adding up to over $500 a month. This discovery wasn’t a downer; it was empowering. It gave her the hard data she needed to make intentional changes, not drastic, miserable cuts.

This newfound clarity gave her the confidence to build a budget that actually worked with her fluctuating income. She started a savings fund for a down payment and, for the first time, felt like she was in the driver’s seat. That’s the real power of tracking your expenses. It turns vague financial anxiety into clear, actionable information.

“You can’t work toward spending wisely and saving more until you know exactly how much you earn and where that money is going. Understand your financial behavior so you can decide how you’d like to change it.”

Learning how to track your spending is the essential first move toward true financial wellness. It’s a foundational skill for anyone serious about building a better financial future. Once you have a crystal-clear picture of your cash flow, you can start looking into effective strategies to cut business expenses or trim personal costs. For a deeper look at getting your entire financial life in order, check out our complete guide on https://popadex.com/how-to-organize-finances/.

Finding Your Ideal Expense Tracking Method

Let’s be honest: the best way to track your expenses isn’t found on some top-ten list. It’s found by matching a method to your own personality and habits. A system that feels intuitive and satisfying is one you’ll actually use. Think of this less as choosing software and more as finding a financial groove that works for you.

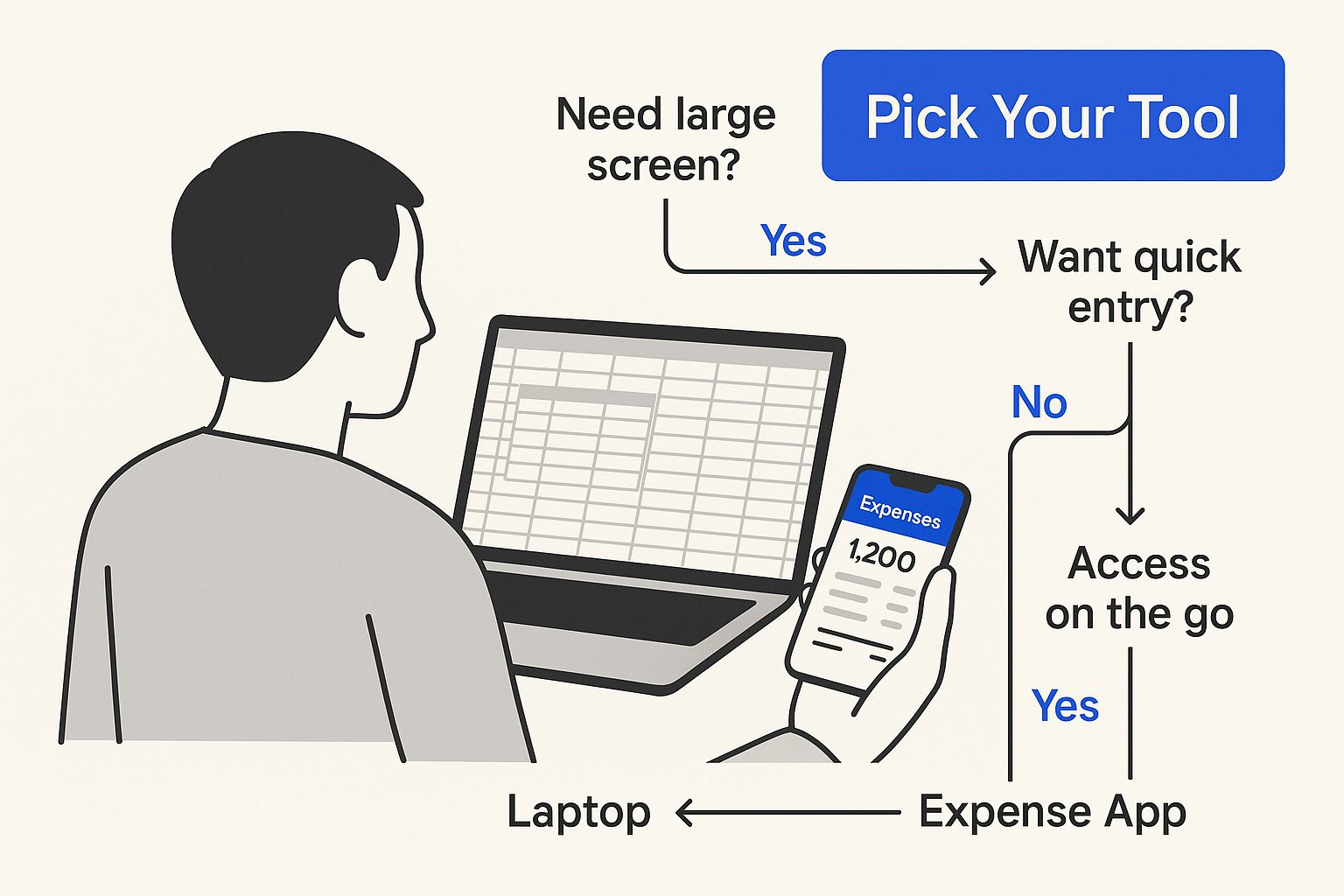

This is all about picking a tool that fits your life, whether you’re a spreadsheet wizard or an app minimalist.

Here’s the bottom line: your personality—whether you crave hands-on detail or prefer set-it-and-forget-it automation—is the single biggest predictor of which tracking method will stick.

Aligning Tools With Your Personality

Are you a tactile person who loves the physical act of writing things down? If that’s you, a dedicated notebook or a structured journal might be your perfect match. This approach forces a moment of mindfulness with every purchase you log, creating a powerful connection to your spending habits. It’s simple, direct, and blissfully free of digital distractions.

On the flip side, maybe you’re someone who thrives on data and loves seeing patterns emerge from the numbers. In that case, a customized spreadsheet is your playground. You can build out charts, create your own spending categories, and design formulas that give you a precise, granular view of your financial world. This route offers unlimited flexibility and control, perfect for anyone who loves the details.

Then there are those of us who just want efficiency. If your goal is a system that works quietly in the background with minimal fuss, an automated app is the clear winner. These tools sync directly with your bank accounts, categorize your transactions for you, and deliver insights with almost zero daily effort.

Choosing the right method is less about features and more about feel. The goal is to find a system that reduces friction, not one that adds another tedious task to your to-do list.

Making a Sustainable Choice

The number one reason people give up on tracking expenses? They pick a method that goes against their natural tendencies. A creative, big-picture thinker will feel suffocated by the meticulous detail of a spreadsheet. And a data analyst will find a simple notebook far too unstructured to be useful.

To help you decide, let’s look at a few common scenarios:

- The Mindful Spender: You want to feel every dollar you spend. The physical act of writing it down makes it real. Your best bet is a pen-and-paper method, like the Japanese Kakeibo system.

- The Data Optimizer: You live for digging into trends and want total control over how your information is organized. A custom spreadsheet (think Google Sheets or Excel) is your go-to.

- The Busy Professional: You’re short on time and want technology to do the heavy lifting. An automated app that syncs with your accounts will deliver the most value with the least manual work.

Ultimately, consistency is king. A “perfect” system is useless if you ditch it after a week. If you’re leaning toward a digital tool that balances ease of use with powerful insights, exploring an easy expense tracker can give you a great head start. The right tool makes tracking feel less like a chore and more like an empowering part of your routine.

Manual vs Automated Tracking Which Is Right for You?

Choosing between a hands-on manual approach and a high-tech automated one can be tough. Both have their merits, but they cater to very different needs and personalities. This table breaks down the key differences to help you see which style aligns better with your goals and lifestyle.

| Feature | Manual Tracking (Notebooks/Spreadsheets) | Automated Tracking (Apps/Software) |

|---|---|---|

| Effort Required | High; requires daily discipline and manual data entry. | Low; syncs with bank accounts and categorizes transactions for you. |

| Setup Time | Low to moderate, depending on spreadsheet complexity. | Quick; requires linking bank accounts and setting initial preferences. |

| Customization | Unlimited. You control every category, formula, and report. | Limited to the app’s built-in features and categories. |

| Real-Time Data | No; data is only as current as your last entry. | Yes; provides an up-to-the-minute view of your finances. |

| Cost | Typically free (notebook, Google Sheets) or a one-time purchase. | Often subscription-based, though many offer free versions. |

| Best For | Detail-oriented individuals, data lovers, and mindful spenders. | Busy professionals, tech-savvy users, and those seeking convenience. |

After looking at the comparison, you should have a clearer idea of which path to take. If you value control and awareness above all else, manual tracking is a powerful tool. But if your main goal is efficiency and getting a quick, accurate overview, automation is likely your best bet.

Getting Hands-On with Manual Tracking

If you’ve decided to track your expenses by hand, you’ve picked a path that builds some serious financial muscle. Manual tracking is way more than just scribbling down numbers; it’s about creating a real, conscious connection with where your money is going. When you get it right, what feels like a chore can quickly become an empowering daily habit.

This hands-on method forces you to stop and really think about every dollar you spend. Whether you’re using a simple notebook or a tricked-out spreadsheet, the physical act of logging a purchase makes it feel real. You’ll find this naturally helps you cut back on impulse buys and shines a light on spending patterns that automated apps sometimes miss.

Find a System That Clicks

To keep from drowning in a chaotic pile of receipts, you need a system. One of the best I’ve come across is Kakeibo, the Japanese art of mindful money management. It’s a simple, journal-based method that’s less about rigid rules and more about reflecting on your spending habits.

Before you make a non-essential purchase, Kakeibo has you ask four simple but powerful questions:

- Can I live without this?

- Can I actually afford it right now?

- Will I really use it?

- Do I even have a place to put it?

This simple pause shifts your thinking from what you want to what you genuinely need. Another great, practical approach is the modern envelope system. It’s perfect if you still use cash. You just put a set amount of cash into different envelopes labeled for things like “Groceries” or “Fun Money.” When an envelope is empty, that’s it—no more spending in that category until next month.

Make Your Spreadsheet Your Ally

For those of us who love the precision of digital tools but aren’t sold on full automation, a well-built spreadsheet is a game-changer. Don’t just make a boring list of numbers; you can turn that spreadsheet into a dynamic financial dashboard that works for you.

The real power of a manual spreadsheet isn’t just logging what you’ve spent—it’s creating visual cues that guide your future spending decisions.

I once worked with a freelance designer who had a wildly unpredictable income. She built a custom spreadsheet to track her project earnings against specific business expenses. It was a simple system, but it showed her exactly how much profit each client project brought in after accounting for things like software subscriptions and contractor fees. That’s a level of custom detail you just can’t get with most standard apps.

To make your own data more useful, try these simple tricks:

- Use Conditional Formatting: Set up a rule to turn cells red the moment you go over budget in a category. It’s an instant visual gut-check that helps you correct course.

- Create Simple Pivot Tables: With just a few clicks, a pivot table can instantly summarize your spending by category or even by store. This gives you a bird’s-eye view at the end of the month, so you can see where your money really went without wrestling with complicated formulas.

- Add a Few Charts: A basic pie or bar chart is all you need to see your top spending categories at a glance, making it much easier to spot where you can make cuts.

These little tweaks prove that “manual” doesn’t have to mean basic. You can manage even the most complex financial life with incredible clarity and control.

Using Technology to Track Expenses Smarter

Let’s be honest, manual expense tracking is a drag. It’s the kind of chore that starts with good intentions but often ends with a shoebox full of faded receipts. But what if tracking your expenses wasn’t a chore at all? What if it was an automatic, proactive strategy that gave you back your time and provided genuine insights into where your money goes?

That’s where modern financial tech comes in. It’s like having a personal finance assistant working for you 24/7.

Imagine your spending getting categorized the second a transaction clears. Picture getting bill reminders before they’re due, or real-time alerts that stop you from overspending. This is the new reality. By syncing directly with your bank and credit card accounts, today’s apps create a seamless, real-time picture of your financial life.

Automation and Real-Time Insights

The single biggest advantage of using tech is that it kills manual data entry—the very thing that trips most of us up. Instead of spending your weekend poring over a spreadsheet, an app can capture every single transaction without you lifting a finger.

This isn’t just a personal finance trend; the business world caught on years ago. A recent survey showed that mobile apps accounted for 54% of expense report submissions globally. Why? Because businesses need accuracy and efficiency. You can apply that same logic to your own finances and get the same benefits. If you’re curious, you can learn more about the evolution of expense management technology.

A Central Hub for Your Finances

Tools like PopaDex go a step further. Instead of bouncing between your banking app, credit card portal, and investment accounts, you get your entire financial picture consolidated into one place. It’s a game-changer.

This is what a modern personal finance dashboard should look like—a clean, visual summary of your financial health.

Having this unified view makes it incredibly easy to connect the dots between your daily spending and your big-picture goals, whether that’s saving for a down payment or beefing up your retirement fund.

By automating the small stuff—like categorizing your morning coffee—you free up mental energy to focus on the big decisions that truly build wealth. The goal is to spend less time tracking and more time acting on the insights you gain.

When everything is in one place, you start spotting trends you’d otherwise miss completely. Maybe you’ll notice that your “miscellaneous” spending has quietly crept up by 20% over the last three months. Armed with that data, you can dig in and adjust your budget.

This proactive approach is what makes technology so powerful. For a closer look at how this works, you might be interested in our guide on creating a personal finance dashboard.

Ultimately, using tech to track expenses isn’t about giving up control; it’s about gaining a smarter, more efficient form of it.

Common Expense Tracking Mistakes to Avoid

So you’ve decided to start tracking your expenses. That’s a huge first step, but even the best of us can get tripped up by a few common hurdles. Think of these not as failures, but as normal bumps in the road. Knowing what they are ahead of time makes it so much easier to build a habit that actually sticks.

The Inconsistency Trap

One of the biggest killers of a new tracking habit is inconsistency. You might start off strong, logging every single coffee and subscription fee, but then a busy week hits. Before you know it, you’re staring at a month’s worth of crumpled receipts, and the whole task feels so massive that you just throw in the towel.

This doesn’t just make your data useless; it reinforces that nagging feeling that you’re “bad with money.” The key isn’t perfection, it’s persistence.

Getting Lost in the Weeds

It’s so easy to get bogged down in tracking every last penny. While diligence is great, obsessing over a missing receipt for a $2 coffee can lead to serious burnout. This is classic “perfection is the enemy of progress.”

The real gold is in the big picture—the major trends and spending patterns—not in accounting for every single cent.

A simple fix? Try a five-minute daily money check-in. At the end of each day, just take a few moments to log your spending. This small, manageable habit keeps you on track without the overwhelm and prevents that dreaded receipt pile-up.

Another common trap is getting your spending categories all wrong. Lumping everything into a giant “Miscellaneous” bucket tells you absolutely nothing useful. On the flip side, creating fifty hyper-specific categories like “Artisanal Coffee” vs. “Workday Coffee” is a recipe for exhaustion. You’re aiming for clarity, not a full-time accounting job.

Overcoming the Guilt Trip

Here’s a surprising reason people quit: the guilt they feel when they see where their money actually goes. That moment you realize you spent $300 on takeout can be a real shock, and it’s tempting to just stop looking altogether.

But tracking isn’t about judging your past. It’s about informing your future.

Approach your spending data with curiosity, not judgment. You’re not a bad person for buying lattes; you’re a detective uncovering clues about your habits. This mindset shift turns a stressful task into an empowering act of self-discovery.

When you treat your financial data as neutral information, you can make changes from a place of awareness, not shame. This is also where manual methods can hit their limits, especially for businesses. In fact, 71% of finance leaders report major headaches with expense compliance and fraud when they don’t use automated systems.

The rising complexity of modern expenses simply demands better tools than a spreadsheet. You can find more insights on business expense management trends on ExpenseOut.com. By sidestepping these common mistakes, you’re setting yourself up for real, long-term success.

Frequently Asked Questions About Tracking Expenses

Even with the perfect system in place, a few questions always seem to come up once you get started with expense tracking. I’ve been there. Let’s tackle some of the most common hurdles you’ll likely face on your financial journey.

How Long Until I See Real Patterns?

This is where a little patience goes a long way. You need to stick with it for at least 90 days to get a truly reliable picture of your spending habits. Anything less is just a snapshot.

- Your first month is all about building the habit. Don’t stress about catching every single penny. Just focus on logging what you can, when you can. Consistency over perfection.

- The second month is when the magic starts. You’ll begin to see where your money actually goes, which is often a surprise compared to where you thought it was going.

- By the third month, you have a solid baseline. Now you can confidently make meaningful adjustments to your budget and start hitting your savings goals.

What About Small Cash Purchases?

Ah, the silent budget killers. That morning coffee, the vending machine snack—they add up fast and are incredibly easy to forget. The best defense is a simple daily log.

Seriously, just take two minutes at the end of each day. Open a notes app or a small notebook and jot down any cash you spent. Trying to recall a week’s worth of these tiny transactions is a recipe for failure. Make it a quick, daily ritual.

The goal here isn’t to become a certified accountant. It’s about building an honest picture of your cash flow, and you can’t do that if you ignore all the small leaks.

Should I Budget First or Track First?

This is the classic chicken-or-the-egg dilemma, but in finance, the answer is crystal clear: track your expenses before you even think about setting a strict budget.

Building a budget without real data is just financial fantasy. It almost always leads to unrealistic goals, which breeds frustration and makes you want to quit.

Use your first month or two of tracking to inform your first evidence-based budget. This simple shift sets you up for success because your plan is grounded in reality, not wishful thinking. It’s also the direction the entire industry is headed. By 2025, market research suggests that around 75% of businesses will rely on mobile apps for this very reason, with the global market for these tools projected to hit $13.15 billion by 2030. You can read more about these expense management technology trends on Softjourn.com.

Ready to stop guessing and start knowing? PopaDex gives you a clear, consolidated view of your entire financial life. Take control of your money today by visiting https://popadex.com to get started for free.