Our Marketing Team at PopaDex

Money Management for Couples: Build Financial Harmony

Discovering Your True Money Personalities Together

Solid money management for couples doesn’t start with a spreadsheet or a joint bank account. It begins with understanding the person you share your life with—not just their daily habits, but the financial history that shaped them. You might think you know how your partner spends, but our deepest beliefs and anxieties about money often stay buried until a stressful situation brings them roaring to the surface. Uncovering these “money personalities” is the essential groundwork that prevents future arguments and builds a real financial partnership.

These hidden financial behaviors are frequently tied to our upbringing. How our parents handled money (or avoided the topic entirely), whether we grew up with a sense of scarcity or abundance, and the financial wins or losses we saw firsthand all create subconscious “money scripts” that guide us as adults. For one partner, carrying a credit card balance might feel like a temporary issue. For the other, it could trigger a deep-seated fear of debt learned from watching their parents struggle.

Exploring Your Money Stories

You don’t need to schedule a formal finance summit to have this conversation. It can start casually over dinner or on a long drive. The idea is to create a safe, judgment-free zone where you can both be honest about past mistakes and what you truly value.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

Try exploring these areas together:

- Childhood Money Memories: What’s your first memory of money? Was it a happy one or a stressful one? Talking about this can reveal core beliefs about whether money represents security or anxiety.

- Past Financial Mistakes: Share a money decision you wish you could do over. Opening up about these moments builds trust and shows you can support each other through rough patches instead of pointing fingers.

- “Fun Money” Philosophies: If an unexpected $1,000 landed in your lap, what’s the first thing you’d do with it? This simple question can reveal a lot about priorities—whether one person prefers experiences over physical items, or saving over splurging.

This chart shows the different parts of personal finance. It’s a great visual reminder that money is more than just budgeting; it involves income, saving, investing, and protecting your future—all areas where you and your partner might have different feelings and ideas.

This map drives home that personal finance is more than one thing. It’s a collection of interconnected topics, and you and your partner will likely have unique comfort levels and beliefs about each one.

Addressing Income Gaps and Financial Planning

A difference in income is one of the most common friction points for couples. It can create an unspoken power imbalance where one partner feels they have more say or the other feels their contribution isn’t valued. It’s vital to tackle this head-on. Shift the focus from pure dollar amounts to all the ways each person contributes to the household, including time, effort, and emotional support.

Making a financial plan together is one of the best things you can do for your relationship’s health. Research consistently shows a strong link between financial communication and relationship satisfaction. For instance, in the U.S., 92% of married couples merge their finances in some way. Of those who share a savings account, a whopping 94% report the highest levels of satisfaction. Even more telling, couples who made a formal financial plan before marriage also reported 94% satisfaction.

This proves that talking about money proactively builds a stronger foundation for your shared life. To dive deeper into how financial planning affects relationships, you can review the full study on pre-marriage money conversations.

Finding Your Perfect Account Setup (Without The Drama)

Deciding how to structure your bank accounts can feel like a huge commitment, but it’s less about a rigid, one-size-fits-all rule and more about finding what supports your unique partnership. The classic debate—joint, separate, or a hybrid—has no single correct answer. What works wonders for your friends might feel restrictive to you, and the best approach often changes as your relationship evolves. The goal is to build a system that fosters trust and transparency while still honoring individual freedom.

Joint vs. Separate vs. Hybrid: What’s Your Style?

The three main approaches each come with their own benefits and potential headaches. A fully joint account, where all income is pooled and all expenses are paid from one place, offers maximum simplicity and transparency. It’s a great fit for couples who truly see their finances as completely merged—one team, one pot of money.

On the other end of the spectrum are completely separate accounts. This setup provides the most financial independence, which can be comforting for partners who value autonomy or have experienced financial unease in the past. It’s not about hiding money; it’s about maintaining a sense of personal control over your own earnings and spending.

However, many modern couples land on a hybrid approach, which often provides the best of both worlds. This system usually involves:

- One joint checking account for shared household bills (rent/mortgage, utilities, groceries).

- Separate personal accounts for individual spending, hobbies, and personal savings.

- A joint savings account dedicated to shared long-term goals like a vacation or a house down payment.

This setup helps keep shared responsibilities organized while giving each partner the freedom to manage their own “fun money” without judgment.

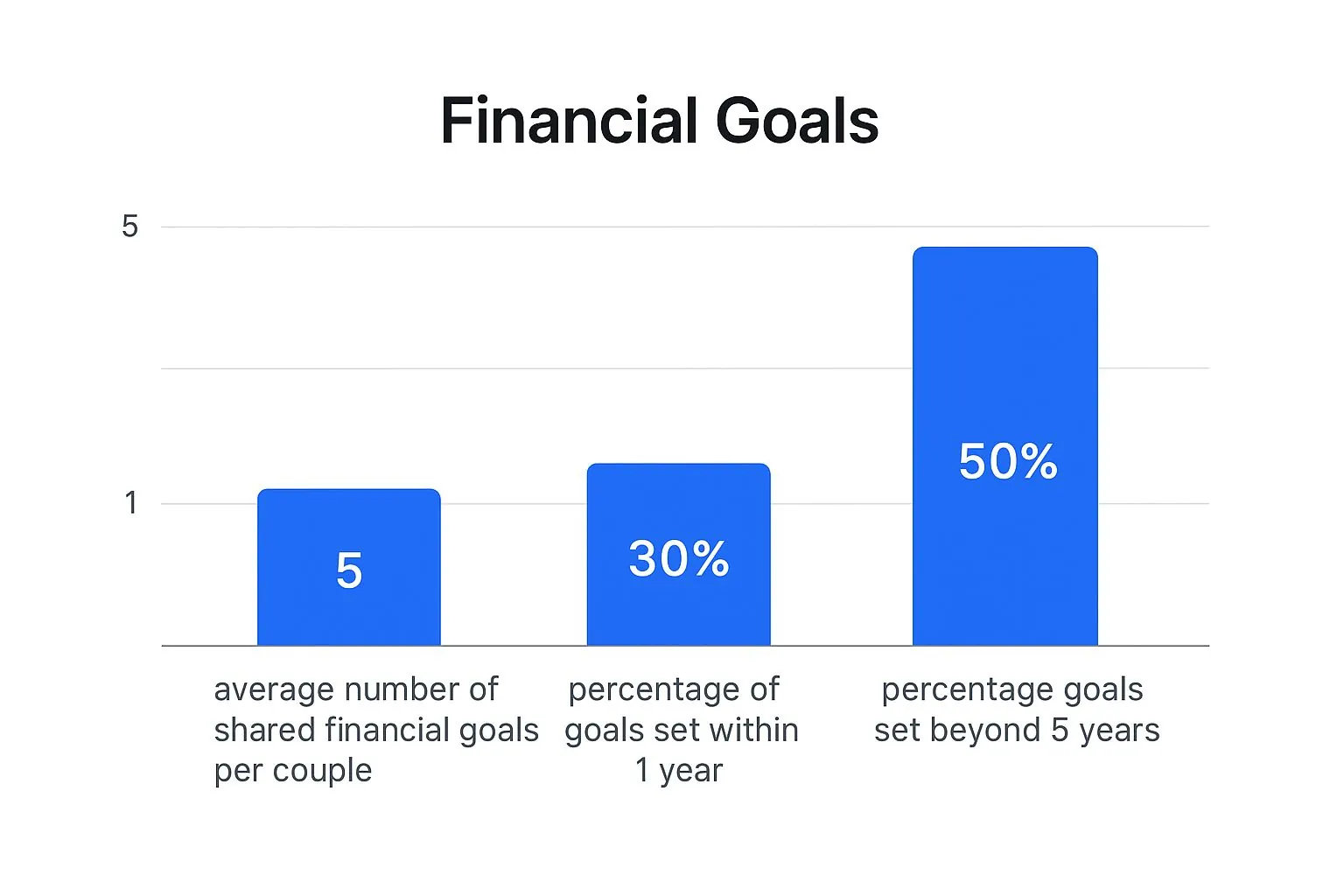

As the data shows, most couples are planning for the future together. This makes having the right account structure for saving and spending even more critical to turning those goals into reality.

Making the Choice That Fits Your Relationship

To help you decide, let’s compare these popular account structures. This table breaks down the pros, cons, and ideal situations for each approach, so you can see which one aligns best with your financial personalities and goals.

| Account Type | Best For | Advantages | Potential Challenges | Setup Complexity |

|---|---|---|---|---|

| Fully Joint | Couples who view their finances as completely intertwined and prioritize simplicity. | - Simplifies bill pay - Total transparency - Easy to track shared goals |

- Loss of individual autonomy - Potential for disagreements over spending - Can be messy in a breakup |

Low |

| Fully Separate | Couples who value financial independence, have different spending styles, or are combining finances later in life. | - Full personal control - Protects individuals from partner’s debt - Clear ownership of funds |

- Can feel less like a “team” - Requires more coordination for shared bills - Less transparency |

Low |

| Hybrid | Most couples, especially those who want both shared responsibility and personal freedom. | - Balances teamwork and autonomy - Reduces arguments over personal spending - Flexible for different income levels |

- Requires managing multiple accounts - Needs clear rules on what is a “shared” expense |

Medium |

| Joint Account with Allowances | Couples who want a unified approach but with designated personal spending money for each partner. | - All income is pooled for shared goals - “No-questions-asked” personal spending - Fosters a team mindset |

- Requires discipline to stick to allowance amounts - Can feel controlling if not agreed upon mutually |

Medium |

Ultimately, your choice is a personal one. The hybrid approach offers a great middle ground, but what matters most is that you and your partner feel comfortable and empowered by the system you create together.

Your ideal setup also depends heavily on your comfort levels with transparency and control. Interestingly, there’s a clear generational divide here: nearly half (49%) of Gen Z adults keep their finances completely separate, compared to only 27% of baby boomers. Boomers are far more likely to prefer joint accounts, with 65% opting to merge everything. You can explore more about these generational differences in shared finances and how they shape modern relationships.

The key takeaway is that your bank accounts are tools for collaboration, helping you work together on your biggest financial objectives. The best system is one you both agree on and feel good about. It should reduce financial stress, not add to it.

Creating Budgets That Actually Stick

The biggest myth about budgeting is that it’s just a math problem. For couples, it’s a communication challenge with some numbers sprinkled in. Most budgeting advice is written for one person, but effective money management for couples requires a plan that respects two different personalities, spending habits, and financial priorities. A budget that feels like a straitjacket to one partner is doomed from the start. The secret is building a flexible spending plan that works for your relationship, not against it.

This flexibility is especially important when dealing with different money mindsets. What happens when a natural saver marries a spontaneous spender? Forcing the spender into a rigid, restrictive budget will only breed resentment, while the saver will feel constant anxiety. The solution is often a hybrid approach where you create specific “no-questions-asked” spending pots for each person. This gives both partners the freedom to enjoy their money without guilt or micromanagement, while still covering all shared responsibilities.

Choosing a Budgeting Method for Your Partnership

Not all budgeting methods are created equal, and what works best depends entirely on your dynamic as a couple. Finding the right fit is about aligning your system with your personalities and lifestyle. To help you choose, here’s a look at some popular methods and who they suit best.

Budgeting Methods for Different Couple Types

Comparison of popular budgeting approaches showing which methods work best for different relationship dynamics and financial situations

| Method | Best For | Complexity Level | Flexibility | Time Required |

|---|---|---|---|---|

| Zero-Based Budget | Couples who want maximum control and to assign every dollar a job. | High | Low | High |

| 50/30/20 Rule | Couples looking for a simple framework (50% needs, 30% wants, 20% savings). | Low | Medium | Low |

| “Pay Yourself First” | Disciplined couples focused on aggressive saving and investing goals. | Medium | High | Low |

| Cash Envelope System | Couples who struggle with overspending on credit cards and need tangible limits. | Medium | Low | Medium |

These methods aren’t mutually exclusive, and you can always blend them. The key takeaway is to pick a system that feels empowering, not punishing, for both of you.

For many, the 50/30/20 rule is a fantastic starting point. It’s less about tracking every single penny and more about ensuring your spending aligns with broader priorities. For example, if you jointly bring in $6,000 per month after taxes, you’d aim to spend no more than $3,000 on needs (housing, utilities, groceries), set aside $1,200 for savings and debt, and have $1,800 left for wants—which you can split for individual and joint fun.

Making Budget Meetings Productive, Not Painful

The dreaded budget meeting can easily turn into a session of blame and frustration. To avoid this, frame these check-ins as “financial date nights.” Make it a positive, collaborative ritual. Grab a favorite beverage, put on some music, and focus on celebrating wins first. Did you stick to your grocery budget? Did you hit a savings goal? Acknowledge the progress you’ve made together.

When you do discuss challenges, approach them with curiosity, not accusation. Instead of, “Why did you spend so much on eating out?” try, “I noticed our restaurant spending was higher than planned. Should we adjust the budget for next month, or find some new recipes to try at home?” This shifts the conversation from blame to problem-solving. Using a visual tool can also help keep the conversation centered on data rather than feelings.

For instance, this dashboard from a popular budgeting app like Mint provides a clear, at-a-glance overview of spending categories.

Having a visual like this removes the guesswork and emotion, allowing you both to see exactly where your money is going and make informed decisions together. The key is to create a system where you both feel heard, respected, and empowered. Your budget is more than a document; it’s a living agreement that reflects your shared vision for the future.

Having a visual like this removes the guesswork and emotion, allowing you both to see exactly where your money is going and make informed decisions together. The key is to create a system where you both feel heard, respected, and empowered. Your budget is more than a document; it’s a living agreement that reflects your shared vision for the future.

Turning Dreams Into Achievable Financial Goals

Saying you want to buy a house is a great start, but let’s be real—a dream without a plan is just a wish. The real magic in money management for couples happens when you work together to turn those big, fuzzy aspirations into concrete, actionable steps. This goes beyond spreadsheets; it’s about building a shared future and getting stronger as a team by tackling major milestones together.

Couples who actually pull off their big goals, whether it’s saving for a down payment or planning a year-long sabbatical, do one thing exceptionally well: they break down intimidating goals into bite-sized pieces. Staring at a goal like “save $60,000 for a down payment” can feel totally overwhelming. But reframing it as “save $1,000 a month for the next five years” suddenly feels tangible and, more importantly, doable.

From Vague Wishes to Concrete Plans

The first move is to get specific. Vague goals like “save more” or “get out of debt” don’t give you a clear direction. This is where the SMART goal framework comes in handy. It pushes you to make your goals Specific, Measurable, Achievable, Relevant, and Time-bound.

| Vague Goal | SMART Goal |

|---|---|

| “Buy a house someday.” | “Save $70,000 for a down payment on a three-bedroom house in our target neighborhood within the next four years.” |

| “Pay off our credit cards.” | “Pay off our combined $8,500 credit card debt in 18 months by contributing an extra $475 per month.” |

| “Go on a nice vacation.” | “Save $6,000 for a two-week trip to Italy for our fifth anniversary, which is 24 months away.” |

This level of detail turns a fuzzy dream into a clear target. It gives you a finish line to run toward and makes it much easier to see if you’re on track. Without this clarity, it’s easy to feel like you’re just running in place.

Handling Competing Priorities and Staying Motivated

It’s pretty rare for both partners to have the exact same financial priorities. One of you might be obsessed with maxing out retirement accounts, while the other is desperate to renovate the kitchen. Neither goal is wrong, but with limited funds, you have to find a balance. This is where open and honest communication is a must.

Instead of an all-or-nothing fight, try sorting your goals into tiers:

- Must-Haves: These are your non-negotiables, like building a three-month emergency fund or tackling high-interest debt.

- Important-But-Flexibles: These are the big goals you both want, like saving for a new car or a house down payment. You can fund these at the same time, maybe by splitting your extra savings between them.

- Wishes: These are the “nice-to-haves” that come after the essentials, like a dream vacation or a major home upgrade.

This approach helps you put your money where it matters most without making anyone feel like their dreams are being ignored. It’s also incredibly helpful to see your progress visually. Many budgeting apps have features built just for this.

For example, a tool like Mint lets you create specific financial goals and watch them grow, showing you just how close you are.

Seeing a progress bar fill up gives you a powerful psychological boost that keeps you both going. It transforms saving from a chore into an exciting journey you’re on together.

Seeing a progress bar fill up gives you a powerful psychological boost that keeps you both going. It transforms saving from a chore into an exciting journey you’re on together.

Finally, don’t forget to celebrate your wins, no matter how small. Did you hit your savings target for three months straight? Treat yourselves to a nice dinner out. Paid off a credit card completely? Pop a bottle of something bubbly. Acknowledging your progress reinforces that you’re a successful team, which makes it much easier to stay committed when progress feels slow or life throws you a curveball.

Making Big Money Decisions Without Breaking Up

Daily budgeting is one thing, but it’s the major life decisions—buying a home, switching careers, or dealing with a sudden medical bill—that truly test your financial partnership. These high-stakes moments can reveal different priorities and comfort levels with risk you never knew you had. Successful money management for couples isn’t about sidestepping these challenges; it’s about creating a game plan to tackle them together, even when emotions are running high and you don’t see eye-to-eye at first.

Daily budgeting is one thing, but it’s the major life decisions—buying a home, switching careers, or dealing with a sudden medical bill—that truly test your financial partnership. These high-stakes moments can reveal different priorities and comfort levels with risk you never knew you had. Successful money management for couples isn’t about sidestepping these challenges; it’s about creating a game plan to tackle them together, even when emotions are running high and you don’t see eye-to-eye at first.

The secret is to build your decision-making process before a crisis hits. While you’re both calm, decide what counts as a “big” purchase. Is it any expense over $500? A new car? Agreeing on a specific dollar amount that requires a joint conversation prevents one person from feeling shocked or left out of a major choice. This simple pact builds a foundation of trust for when the stakes get higher.

A Framework for Tough Financial Choices

When a massive decision is on the horizon, it’s easy to get overwhelmed by all the options or, even worse, make a snap judgment you’ll regret. To avoid this, you need a structured approach. Let’s imagine you’re thinking about buying your first home. It’s a huge step toward achieving financial independence, but the process can be incredibly stressful. Instead of letting it devolve into arguments, try this framework:

- Schedule a “Research Night”: Set aside dedicated time to gather facts together. Maybe one of you researches mortgage rates while the other looks into comparable home prices in different neighborhoods.

- Write Separate Pro/Con Lists: Before discussing, each of you should independently list the pros and cons from your own point of view. This lets you both organize your thoughts without interruption before coming together to compare notes.

- Define Your “Must-Haves” vs. “Nice-to-Haves”: You might both agree that a three-bedroom house is a non-negotiable, but a finished basement is a “nice-to-have” that you’re willing to compromise on.

- Set a “Decision Deadline”: Give yourselves a target date to make the final call. This keeps the conversation from dragging on for months and adding unnecessary stress to your lives.

Using objective tools can also ground these emotional talks in hard data. For instance, if you’re looking at mortgages, an online learning center can offer neutral, factual information to help guide your discussion.

A resource like this one from Zillow provides clear explanations of different loan types and includes calculators, helping you both understand the financial weight of your options without emotional bias getting in the way.

A resource like this one from Zillow provides clear explanations of different loan types and includes calculators, helping you both understand the financial weight of your options without emotional bias getting in the way.

Navigating External Pressures and Emergencies

Sometimes, the biggest financial challenges come from outside your relationship. Pressure from family or unexpected events like a job loss can completely upend your plans. This is when your communication skills become your most important financial asset. Many couples feel this pressure right from the start of their life together. Recent reports show the average wedding now costs between $30,000 and $45,000, with a staggering two-thirds of couples taking on debt to cover it. For 41% of those couples, it will take over a year to pay off, starting their marriage with a significant financial strain. You can read more about current wedding cost trends to get a better sense of these external pressures.

When faced with these kinds of challenges, the main goal is to stay united. Remind yourselves that you are a team solving a problem together, not two people fighting each other. Adopting this unified mindset is what turns a potential crisis into a chance to make your partnership even stronger.

Building Long-Term Wealth As A Team

Once you’ve mastered the art of budgeting for groceries and splitting the rent, it’s time to level up. Creating a secure financial future together is about more than just managing monthly bills; it’s about building a long-term wealth strategy that grows with you. This is where money management for couples moves from day-to-day spending to creating systems that protect and expand your net worth for decades. We’re talking about looking beyond your checking accounts and into the world of investing, insurance, and estate planning.

A big part of building wealth together is getting on the same page about risk. It’s perfectly normal for one partner to be the cautious one, preferring stable, slow-and-steady investments, while the other is ready to chase higher rewards with higher-risk options. A successful plan doesn’t mean one person has to give in. It’s about finding a middle ground. For example, you might decide to put a certain percentage of your investment portfolio into aggressive growth stocks for one partner’s peace of mind, and another portion into safer index funds to satisfy the other.

Protecting Your Partnership and Your Assets

A solid financial plan also prepares you for life’s curveballs. Your first line of defense is a joint emergency fund. The classic advice is to save three to six months of living expenses, but as a couple, you should think about your specific situation. If one of you is a freelancer with an unpredictable income or works in a volatile industry, aiming for a larger cushion of nine to twelve months of expenses can provide invaluable security.

After your emergency fund, insurance is the next critical layer of protection. This includes:

- Life Insurance: This is especially important if one partner’s income is the primary source of support for the household, or if you have children or a shared mortgage.

- Disability Insurance: This protects your shared goals if one of you can’t work due to an injury or illness. It replaces a portion of your income, ensuring your financial plans don’t get derailed.

- Estate Planning: This goes beyond the ultra-rich. Creating wills and naming each other as beneficiaries on retirement accounts and insurance policies ensures your assets go where you want them to, protecting your partner from legal complexities during an already difficult time.

Investing for a Shared Future

Investing as a team is one of the most effective ways to build wealth, but it demands a unified strategy. It all starts with defining what you’re working toward. For most couples, retirement is the big one. Take some time to actually visualize what that future looks like—it’s a surprisingly powerful motivator.

This overview of retirement planning shows the different stages involved, which can help make the process feel more concrete.

As the visual from Fidelity shows, retirement is a journey, not a destination. Seeing it broken down into phases, from early saving to managing income later in life, highlights why a long-term plan is so essential.

Once you have a shared vision, you can work backward. For instance, if you decide you’ll need $2 million for a comfortable retirement in 30 years, you can calculate the monthly investment needed to hit that target. Suddenly, a huge, abstract goal becomes a clear, manageable action item for your budget.

Smart couples make a habit of revisiting their long-term plans annually or after any major life event, like a promotion or the birth of a child. This keeps your strategy relevant and ensures you’re both still on board and motivated. By taking this proactive approach, you shift your financial partnership from simply reacting to life’s expenses to intentionally building a future you both want.

Your Next Steps To Financial Partnership Success

Turning your separate financial lives into a successful partnership can feel like a massive undertaking, but it really just comes down to taking small, intentional steps together. This isn’t about one grand gesture; it’s about building good habits that make money talks a source of strength, not stress. The goal is to create a practical plan you can actually start on today, focusing on steady progress instead of trying to get everything perfect overnight.

A Practical Checklist for Your Financial Journey

To keep moving forward without getting bogged down, it helps to break the process into smaller, more manageable pieces. This way, you can celebrate the small victories, which is key to staying motivated for the long haul.

Immediate Actions (This Month):

- Schedule Your First “Financial Date Night”: Get it on the calendar now. The objective isn’t to solve every single financial problem in one sitting. It’s simply to open the door to a real conversation about your histories and feelings around money.

- Map Out All Your Accounts: Make a complete list of every checking, savings, investment, and debt account you both have. You can’t manage what you can’t see, and this gives you the full picture of your combined financial world.

- Define a “Big Purchase” Threshold: Agree on a specific dollar amount—maybe $250 or $500—that requires a quick chat before either of you spends it. This simple rule is a great way to prevent future arguments and stay aligned.

Next Steps (1-3 Months):

- Choose and Set Up Your Account Structure: Talk through whether a joint account, separate accounts, or a hybrid system feels right for your relationship. Once you decide, take the practical step of opening or reorganizing your accounts.

- Draft Your First Joint Budget: Don’t aim for perfection. Use a straightforward framework like the 50/30/20 rule to create a basic spending plan. It’s a starting point you can refine over time.

- Identify Your Top 1-2 Shared Goals: What’s most important to you both right now? Maybe it’s building a small emergency fund or tackling one high-interest credit card. Focusing on a couple of key priorities makes your efforts more impactful.

Maintaining Momentum and Seeking Help

Effective money management for couples is a long-term project, not a quick fix. Life gets hectic, and your financial system will need tweaks along the way. It’s also important to know when to ask for help. A major red flag is having the same unresolved financial argument over and over. If you feel stuck in a loop, talking to a financial counselor can provide a much-needed objective point of view.

Regular check-ins are your best defense against drifting apart financially. A quick, 15-minute weekly huddle to go over upcoming bills, paired with a deeper monthly “date night” to review your goals, will keep you on the same page.

Ready to see your entire financial world in one place? PopaDex consolidates all your accounts—from savings and investments to property and debts—into a single, intuitive dashboard. Stop guessing and start seeing your real progress. Take control of your financial journey together and sign up for PopaDex today!