Our Marketing Team at PopaDex

Retirement Planning Basics: Your Guide to Secure Savings

At its heart, retirement planning basics are all about translating your dreams for the future into a concrete plan for today. It’s about setting clear goals, building a consistent savings habit, and choosing the right accounts to make your money grow. Think of it as creating a financial blueprint for the life you want to live down the road.

Getting Started with Retirement Planning

Staring down the concept of retirement can feel like a huge, intimidating task, but it doesn’t have to be. Let’s reframe it. Instead of a complex financial puzzle, picture it as building your dream house—it all starts with a solid, well-laid foundation.

The most powerful tool you have isn’t some secret stock tip; it’s time. Thanks to the magic of compounding interest, even small amounts saved early can snowball into something massive decades from now. This whole journey is about turning an abstract idea (“I want to retire someday”) into a real, actionable strategy. Honestly, just getting started is often the hardest part.

The Four Pillars of a Solid Plan

To build a retirement plan that can weather any storm, you need to focus on four foundational pillars. Each one supports the others, creating a stable and reliable structure you can count on. Getting a handle on these fundamentals is your first real step toward feeling confident about your financial future.

Here’s a simple breakdown of what that looks like.

The Four Pillars of Retirement Planning Basics

A summary of the fundamental components of a solid retirement plan.

| Pillar | What It Means | First Action Step |

|---|---|---|

| Goal Setting | Defining what your ideal retirement looks like in terms of lifestyle, location, and activities. | Brainstorm your perfect retirement day and estimate its annual cost. |

| Savings Strategy | Creating a consistent plan to put money aside regularly. | Set up an automatic transfer from your checking to a savings account. |

| Account Selection | Choosing the right tax-advantaged accounts, like a 401(k) or IRA, to grow your money. | If your employer offers a 401(k) match, contribute enough to get the full amount. |

| Investment Growth | Making your savings work for you by investing it to outpace inflation. | Explore simple, diversified options like target-date funds within your retirement account. |

Getting these four pillars right is what separates a vague wish from a workable plan.

Overcoming the Initial Hurdle

Feeling totally lost about where to even begin? You’re not alone. That feeling of being overwhelmed is a common roadblock. In fact, a global survey from Fidelity found that many people find the whole process complicated and just aren’t sure how to start, leading to a massive retirement savings gap. This uncertainty often leads to procrastination, which is the single biggest threat to building a secure future.

The most important step in retirement planning is simply the first one. By breaking the process down into manageable actions, you can overcome inertia and start building momentum toward your goals.

The key is a simple mental shift. Stop thinking, “I need to save a million dollars!” and start thinking, “I’m going to save $50 this week.” That small, achievable action builds confidence and starts a positive feedback loop.

If you’re looking for a bird’s-eye view of how all these pieces fit together, our guide on financial planning for beginners is a fantastic place to start building these habits. Remember, the goal here is progress, not perfection.

Defining Your Personal Retirement Vision

Before you can map out a journey, you need to know where you’re going. It’s a simple truth, and it’s the absolute foundation of good retirement planning. Forget about intimidating spreadsheets and abstract dollar amounts for a moment. Let’s start with what actually matters—you.

Think of yourself less like a financial planner and more like an architect designing your ideal life. What does a perfect day look like in retirement? Are you traveling the globe, volunteering for a cause you love, or just enjoying your hobbies from the comfort of a cozy home? The more detail you can imagine, the more real and motivating your goal becomes.

This vision is the emotional fuel for your entire plan. It’s what turns a chore (“I have to save money”) into a genuine purpose (“I am building the future I truly want”).

From Dream to Data: How to Calculate Your Number

Once you have a vivid picture of that future lifestyle, it’s time to start putting some numbers to it. This isn’t about pulling a figure out of thin air; it’s about translating your vision into a practical financial target. The goal is to discover your personal “magic number”—the total amount you’ll need to fund the life you’ve just designed.

To get there, start by asking yourself some specific questions:

- Location: Where will you live? Will you stay put, downsize, or maybe even move to a new city or country with a completely different cost of living?

- Activities: What are your passions? Make sure to budget for travel, hobbies, dining out, or whatever else is central to your vision of a happy retirement.

- Health: How will you cover healthcare? It’s critical to factor in potential costs for insurance, medications, and the possibility of long-term care down the road.

This simple exercise helps transform a vague dream into a concrete annual income target. A recent Northwestern Mutual study found that Americans, on average, believe they need $1.26 million to retire comfortably. Interestingly, this number actually dropped from $1.46 million the year before, which suggests people are actively rethinking their needs in the current economy. You can learn about the study’s retirement findings on news.northwesternmutual.com to see how expectations are shifting.

Breaking It Down Into Achievable Milestones

That big retirement number might feel overwhelming at first glance. But here’s the thing: you don’t have to save it all at once. The key is to break that massive goal into a series of smaller, more manageable milestones. This is where an intimidating journey becomes a sequence of confident, achievable steps.

Think of it like a marathon. No one sprints the full 26.2 miles. Instead, they focus on running one mile at a time, hitting specific checkpoints along the way. Your retirement plan should work the same way.

Set targets for where you want your savings to be in five years, ten years, and so on. Celebrating these smaller wins keeps you motivated and confirms you’re on the right track. This approach makes the entire process feel less like an impossible climb and more like a steady, confident walk toward the future you’ve designed for yourself.

Choosing Your Best Retirement Savings Accounts

Once you have a clear vision for your retirement, the next step is picking the right tools to build it. Think of retirement accounts less like simple savings accounts and more like special buckets with powerful tax advantages, all designed to help your money grow faster. Getting a handle on these accounts is a fundamental part of solid retirement planning basics.

These accounts generally fall into two main camps: those sponsored by your employer and those you open on your own. An employer-sponsored plan, like the familiar 401(k), is tied directly to your job. An Individual Retirement Account (IRA), on the other hand, is all yours—you open it, you fund it, and you manage it. Each has its own set of rules and perks, and knowing which one to focus on first can make a huge difference in how quickly your nest egg gets growing.

The Power of the Employer Match

If your company offers a 401(k) plan, the very first thing you need to check for is an employer match. People call it “free money,” and honestly, that’s exactly what it is. A common example is a company matching your contributions dollar-for-dollar up to 3% of your salary.

By not contributing enough to get the full match, you are effectively leaving a portion of your compensation on the table. It is one of the single best returns on investment you will ever receive.

This employer contribution instantly doubles your savings rate on those initial dollars, supercharging your growth right from the start. This should always be your top savings priority. No exceptions.

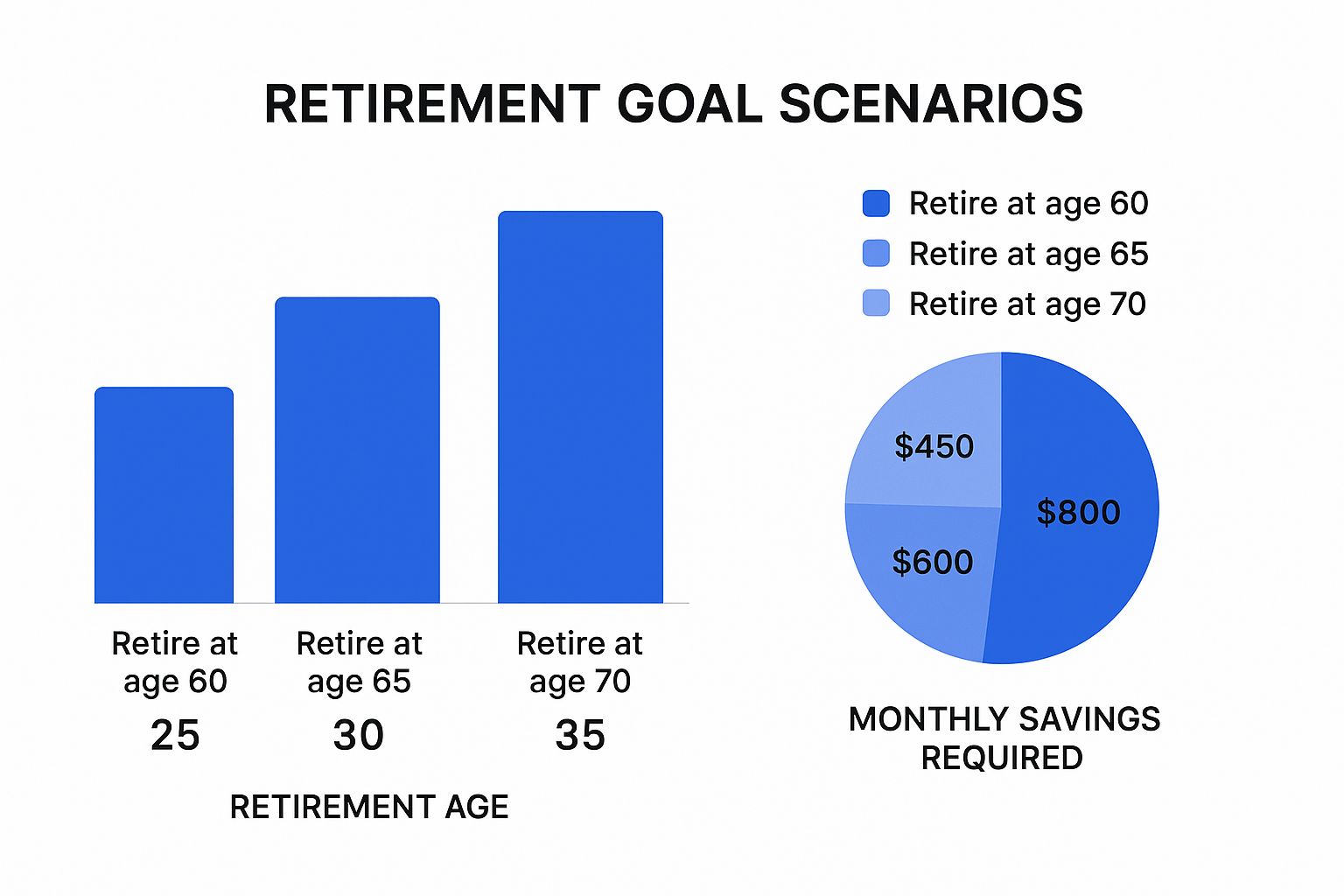

This chart really drives home how starting early, even with smaller amounts, can dramatically change your retirement outcome.

As you can see, just waiting five years to get started could mean you have to save hundreds more every single month just to catch up to the same goal. Time is your most valuable asset here.

Comparing Key Retirement Accounts

Okay, so you’ve secured your full employer match. What’s next? This is where you can start exploring other powerful accounts like a Roth or Traditional IRA. The biggest difference between them really just boils down to a simple question: Do you want to pay taxes now or later?

To help you decide, here’s a straightforward comparison of the most common retirement accounts available to you. Think about your current financial situation and where you expect to be in the future as you review your options.

Comparing Common Retirement Accounts: 401(k) vs. Roth IRA vs. Traditional IRA

A side-by-side comparison to help you choose the best retirement savings account for your needs.

| Feature | 401(k) | Roth IRA | Traditional IRA |

|---|---|---|---|

| Contribution Source | Comes directly from your paycheck. | Funded with your own post-tax money. | Funded with your own money (may be tax-deductible). |

| Tax on Contributions | Pre-tax, lowers your current taxable income. | After-tax, no immediate tax break. | Often pre-tax, potentially lowering current taxable income. |

| Tax on Withdrawals | Taxed as regular income in retirement. | 100% tax-free qualified withdrawals. | Taxed as regular income in retirement. |

| Employer Match? | Yes, if offered. This is a huge benefit! | No. | No. |

| Best For… | Anyone with an employer match. Great for automated, disciplined saving. | People who expect to be in a higher tax bracket in retirement. | People who expect to be in a lower tax bracket in retirement. |

Choosing between a Roth and Traditional account really hinges on your best guess about your future income and tax rates. If you think you’ll be earning more (and thus be in a higher tax bracket) in retirement, paying taxes now with a Roth makes a ton of sense. If you think you’ll be in a lower bracket, a Traditional account’s upfront tax break might be more appealing.

These aren’t niche products; they are the bedrock of American retirement. In fact, total U.S. retirement assets have ballooned to $44.1 trillion, with IRAs holding the largest piece of that pie. You can explore more of the data behind this trend to understand just how vital these accounts are.

For those with a higher risk tolerance or a desire for more control, other options exist. For instance, getting familiar with managing your Self Managed Super Fund (SMSF) tax is a critical step for those considering more hands-on, advanced strategies. The key is to remember that each account is a tool with a specific job, and the best strategy often involves using a mix of them to create a balanced, tax-efficient plan for your future.

Making Your Money Work for You Through Investing

Simply tucking money away in a savings account isn’t going to cut it for the future you want. Over time, inflation acts like a slow, silent thief, chipping away at the buying power of your cash. Think of investing as the engine that actually powers your retirement savings, helping your money grow faster than the rising cost of living.

It’s a foundational piece of the puzzle. A dollar saved today is just a dollar. But a dollar invested has the potential to become many more dollars down the road. This section will pull back the curtain on investing, making it feel a lot less intimidating, even if you’re starting from scratch.

The Building Blocks of Your Portfolio

When you step into the world of investing, you’ll hear about a few key asset types. Getting a handle on what they are is your first real step toward building a strong portfolio. Let’s break down the main players with some simple analogies.

- Stocks: Buying a stock is like owning a tiny piece of a company, whether it’s Apple or a local business. If the company thrives and its value grows, the value of your slice—your stock—grows right along with it. You’re becoming a part-owner.

- Bonds: Think of a bond as a loan you give to a government or a large corporation. In exchange for your cash, they promise to pay you back in full on a specific date, with regular interest payments along the way. They’re generally seen as a steadier, less risky option than stocks.

- Mutual Funds: A mutual fund pools money from many investors to buy a wide variety of stocks, bonds, or other assets. It’s like buying a chef-curated meal instead of hunting down every single ingredient yourself. This approach instantly gives you diversification.

There’s a timeless piece of advice you’ve probably heard before: “Don’t put all your eggs in one basket.” In the investing world, we call this diversification. By spreading your money across different investments, you lower the risk that one poor performer will torpedo your entire portfolio.

This strategy is absolutely vital for long-term success. If you’re eager to get started on the right foot, diving into some resources on investment basics for beginners is an excellent way to firm up your understanding of these core ideas.

Asset Allocation: A Strategy for Balance

Once you know the building blocks, the next question is how to mix them. That strategy is called asset allocation, and it’s all about finding the right balance between risk and reward based on your personal situation—especially your age and how you feel about market swings.

For example, a younger investor with decades ahead of them can generally afford to take on more risk by holding more stocks, knowing they have time to bounce back from any downturns. Someone nearing retirement, however, will likely want to safeguard the wealth they’ve built by shifting more of their money into stable assets like bonds.

A Simple Path for Beginners: Target-Date Funds

Feeling a bit overwhelmed by all the choices? You’re definitely not alone. For many people just starting out, a target-date fund is the perfect “set-it-and-forget-it” solution.

These funds are brilliantly simple. You just pick a fund with a year closest to when you plan to retire (like a “Target 2055 Fund”). The fund manager does the rest, starting with an aggressive mix (more stocks) when you’re young and automatically shifting to a more conservative one (more bonds) as your retirement date gets closer.

This handles all the rebalancing for you, making it an incredibly straightforward and effective way to invest. While this works for almost anyone, independent contractors might want to explore guides tailored to their unique situation, like this one on retirement for independent contractors, for more specific advice.

How to Protect Your Retirement Nest Egg

Building a sizable retirement fund is a monumental achievement, but the work doesn’t stop there. Protecting that hard-earned nest egg from real-world risks is just as important as growing it.

Think of it this way: you’ve spent years constructing a beautiful house. Now you need to build a strong fence around it to guard against threats like market downturns, inflation, and those curveballs life loves to throw. These aren’t just abstract ideas; they’re real forces that can chip away at your financial security if you’re not prepared.

Your First Line of Defense: An Emergency Fund

Before we even get into market risk or insurance, we have to talk about your emergency fund. This isn’t part of your retirement plan. It’s a completely separate, liquid savings account holding three to six months’ worth of essential living expenses. Its only job is to be your financial firewall.

When an unexpected crisis hits—a sudden job loss, a furnace that dies in January, or a surprise medical bill—this fund lets you handle it without raiding your retirement accounts. Tapping into your 401(k) or IRA early almost always triggers steep taxes and penalties, a move that can set your long-term goals back by years. An emergency fund is the buffer that keeps a short-term problem from spiraling into a long-term disaster.

Insurance: The Essential Safety Net

Too many people see insurance as just another monthly bill. It’s time to reframe that thinking. The right insurance coverage isn’t an expense; it’s a critical safety net for your entire financial foundation, protecting your ability to keep saving for the future.

This is a bigger deal than you might think. Recent studies show a majority of Americans are anxious about outliving their savings. Yet at the same time, about 60% of younger people like Gen Z and Millennials admit to focusing heavily on investing while neglecting insurance. You can discover more insights about these planning priorities on news.northwesternmutual.com.

Key insurance products are not costs; they are investments in your financial security. They shield your retirement plan from being dismantled by life’s unexpected turns.

Here are the non-negotiables:

- Disability Insurance: This replaces a chunk of your income if an illness or injury keeps you from working. It’s what keeps your savings plan chugging along even when your paycheck stops.

- Life Insurance: If you have people who depend on your income, this provides a financial backstop for them. It protects their future and keeps your hard-won assets from being liquidated to cover debts.

- Long-Term Care Insurance: This is the one many people put off, but it’s crucial. It helps cover the staggering costs of assisted living or in-home care later in life, an expense that can drain a retirement fund in a hurry.

Of course, protecting your portfolio from market volatility is a huge piece of the puzzle. That’s where smart strategies for effective investment risk management come into play. Regular financial check-ups are vital to make sure your plan stays on track. For a step-by-step guide to covering all your bases, our retirement planning checklist can help you stay organized and plug any holes in your defense.

Common Retirement Planning Questions

As you start putting these retirement planning basics into action, questions are bound to surface. It’s a long journey, after all. Having clear answers to the most common sticking points can build your confidence and make sure your plan stays solid.

Let’s dive into some of the most frequent questions we hear. Think of this as your quick-reference guide to bust through any uncertainty and keep moving forward.

How Much Money Do I Actually Need to Retire?

This is the big one, isn’t it? The truth is, there’s no single “magic number” that fits everyone. Your target depends entirely on the kind of life you want to live in retirement. But there’s a fantastic rule of thumb to get a surprisingly solid estimate: the 4% Rule.

The idea is that you can safely withdraw 4% of your total invested savings each year without running out of money. To figure out your target number, just flip the math around: multiply your desired annual retirement income by 25.

Example: If you want to live comfortably on $60,000 a year, your goal would be: $60,000 (Your Annual Income Goal) x 25 = $1,500,000 (Your Target Nest Egg)

Suddenly, a vague, intimidating question has a concrete, actionable answer. That’s your number to aim for.

Is It Too Late to Start Saving in My 40s or 50s?

Absolutely not. Let’s get that out of the way right now. While starting early is ideal because of compounding, the best time to start saving for retirement is always right now. You haven’t missed the boat; you just have a shorter runway.

This just means you need to be more intentional—and likely more aggressive—with your savings. Your focus should be on maximizing every contribution you can make. If you’re over 50, the IRS offers a great tool called “catch-up contributions,” which lets you put extra money into your 401(k) and IRA each year. Make that your top priority. Don’t waste energy dwelling on the past; focus on building a powerful plan today.

What’s the Biggest Mistake People Make?

If I had to point to one thing, it’s this: underestimating the future impact of inflation and healthcare costs. So many people build a retirement plan based on today’s prices, and that’s a massive oversight.

The reality is, the cost of pretty much everything will be higher in 20 or 30 years. A plan that looks perfectly fine today could leave you struggling down the road as your savings buy less and less each year.

A truly durable retirement plan has to account for these creeping costs. This means:

- Factoring in Inflation: Assume an average inflation rate—historically, it’s around 3%—and build that extra cost into your future income needs.

- Budgeting for Healthcare: You have to plan for rising insurance premiums, out-of-pocket medical bills, and the potential need for long-term care. These costs rarely go down.

By planning for tomorrow’s expenses, not just today’s, you build a nest egg that can actually support you for your entire retirement.

Ready to get a crystal-clear view of your entire financial picture? Track your progress toward these retirement goals with PopaDex. You can bring all your accounts—from savings and investments to property—into one simple, intuitive dashboard. Take control of your financial future and visit PopaDex to start your free trial today.