Our Marketing Team at PopaDex

Asset Protection Planning: Shield Your Wealth

Think of asset protection planning as building a financial fortress around your life’s work. It’s not about hiding money in some shady offshore account. It’s about using smart, completely legal structures to put a barrier between your hard-earned assets and future risks—things like lawsuits, creditor claims, and other unexpected crises.

Why Asset Protection Planning Is Non-Negotiable

In a world full of financial tripwires and legal rabbit holes, just “hoping for the best” isn’t a strategy. It’s a gamble. Asset protection used to be seen as something only for the mega-rich, but now it’s a core part of responsible financial management for anyone with something to lose.

Whether you’re a small business owner, a doctor, or just someone diligently building a nest egg, you need a proactive defense. Why? Because threats can pop up from anywhere. A fender bender, a business deal gone sour, or a professional liability claim can quickly escalate into a legal battle targeting your personal assets—your home, your savings, your investments.

Without the right structure in place, everything you’ve built is sitting out in the open, completely exposed.

The Modern Imperative for Protection

These days, the need for a solid plan is only growing. As regulations tighten globally, high-net-worth individuals and families are rightly putting a much bigger premium on asset security. This isn’t just a feeling; the numbers back it up. A recent Global Insurance Survey from Goldman Sachs Asset Management found that 78% of executives—representing over $14 trillion in assets—have beefed up their protection structures in just the last five years.

A good asset protection plan makes sure your financial future can’t be torpedoed by one bad day. It’s all about creating legal firewalls that separate your personal wealth from professional or other liabilities, giving you genuine peace of mind.

The goal is simple: to control everything you own but officially own nothing that a creditor can take. This legal distinction is the cornerstone of a successful asset protection plan.

From Theory to Practical Application

Getting your head around the concepts is step one, but putting them into practice is what really counts. The strategies you use have to be fitted to your specific situation, taking into account both what you own and what your unique risks are.

For a deeper dive into the importance and real-world application of these concepts, you might want to look into safeguarding your wealth with asset protection strategies. Ultimately, this whole discipline is about being prepared—ensuring the wealth you’re building today is still there for your family tomorrow.

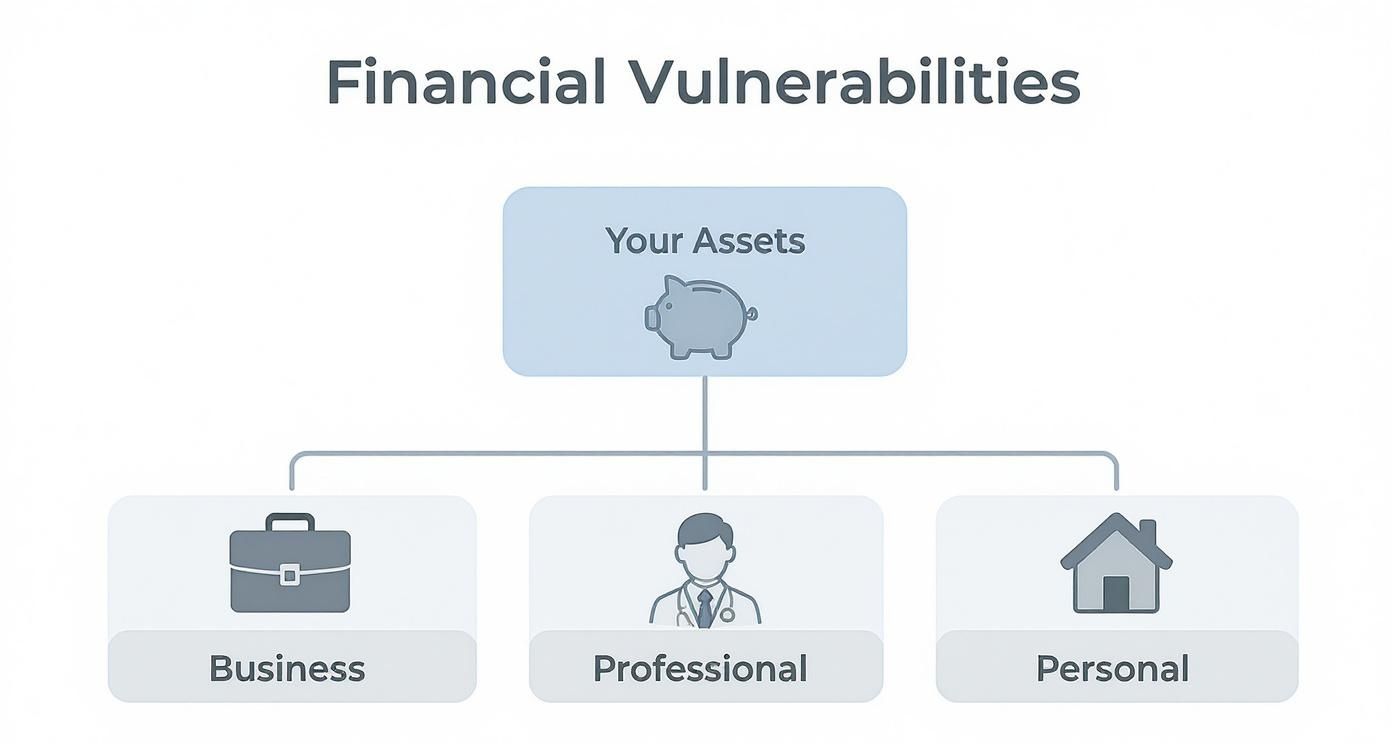

Identifying Your Financial Vulnerabilities

Effective asset protection isn’t about building a fortress blindfolded. It starts with a simple, yet critical, question: where are you most exposed? Before you can construct any meaningful defense, you have to map the territory and pinpoint the potential points of attack. This isn’t about abstract legal theory; it’s about looking at the tangible, real-world risks you face every day.

Think of this as your personal “risk audit.” It’s an honest inventory of your professional life, your business ventures, and your personal assets to see where a lawsuit or liability could spring from. For most people, the biggest threats are hiding in plain sight.

Professional and Business Risks

For many, the greatest financial vulnerability comes directly from their job. High-stakes careers carry inherent risks that can easily bleed into your personal finances if you haven’t built a firewall between them.

Take a surgeon, for example. A single malpractice lawsuit—justified or not—can lead to a judgment that blows past their insurance coverage. Without the right protective structure, their family home, savings, and investments are suddenly on the table to satisfy the claim.

Entrepreneurs face a similar, constant stream of liability. If their business racks up debt and ultimately fails, creditors might try to go after the owner’s personal assets. This is a legal maneuver known as “piercing the corporate veil,” and it happens when a business isn’t structured or maintained correctly. This is where the line between a business problem and personal financial ruin gets dangerously thin.

A business liability should remain a business problem. Asset protection ensures that a professional setback doesn’t become a personal catastrophe by creating a legal firewall between the two.

Common professional and business weak points include:

- Professional Malpractice: A huge concern for doctors, lawyers, architects, and consultants.

- Business Debts and Guarantees: Personally guaranteeing a business loan directly ties your personal wealth to your company’s fate.

- Employee-Related Lawsuits: Claims of wrongful termination or harassment can result in massive legal bills and judgments against the business—and potentially its owners.

Personal Liability and Property Risks

Your financial weak spots aren’t just confined to your 9-to-5. Everyday life and the things you own come with their own unique set of risks that demand just as much attention in your asset protection plan.

A rental property owner is a classic example. If a tenant or guest gets injured on the property due to what a court deems negligence, the owner can be held personally liable. That liability isn’t limited to the value of that one rental; it can extend to all their other assets.

Even something as mundane as your teenager driving the family car creates exposure. A serious auto accident could spark a lawsuit that targets your entire net worth, going far beyond the limits of a standard auto insurance policy. Grasping the full scope of these threats is a core part of effective financial risk management and the foundation of any secure plan.

This is exactly why pinpointing your specific vulnerabilities is the essential first step. By conducting a thorough risk audit, you can see precisely where the threats are, allowing you to build a defense that is truly tailored to your life and gives you genuine peace of mind.

Exploring Your Asset Protection Toolkit

Once you’ve mapped out your financial weak spots, it’s time to choose the right tools to build your defenses. Think of effective asset protection as assembling a specialized toolkit, where each instrument has a very specific job.

Some tools are like fortified containers, designed to keep certain assets separate and safe from trouble. Others function more like sophisticated vaults, protecting wealth while laying out exactly who can access it and under what conditions. The real key is understanding how each one works so you can pick the right combination for your unique situation.

This diagram shows how different parts of your life—business, professional, and personal—can all put your core assets at risk.

As you can see, without creating deliberate separation, a problem in one area can easily spill over and threaten everything else you own. Let’s break down the most common tools you’ll find in this toolkit.

The Limited Liability Company (LLC): The Fortified Container

One of the most fundamental and versatile tools in asset protection is the Limited Liability Company (LLC). It’s a true workhorse.

Imagine you own a rental property. If you hold that property in your own name, any liability—like a tenant’s slip-and-fall lawsuit—directly exposes your personal bank accounts, your home, and every other investment you have.

Now, picture putting that same rental property inside a metaphorical steel box. That’s your LLC. The LLC legally owns the property. If a lawsuit comes up, the claim is against the LLC, and the liability is generally limited to the assets held inside that specific box. Your personal assets sitting outside the box remain untouched.

This is the power of limited liability. It creates a crucial wall that contains business or investment risks, preventing them from contaminating your personal financial life. For small business owners and real estate investors, forming an LLC is often the first and most important step in building a solid plan.

Trusts: The Secure Vault with Instructions

While an LLC acts as a simple container, a trust is more like a secure vault that comes with a highly detailed instruction manual. When you create a trust, you transfer ownership of your assets to a trustee, who then manages them for the benefit of your chosen beneficiaries. The “instruction manual” is the trust document itself, which spells out exactly how those assets are to be handled.

There are many kinds of trusts, but when it comes to pure asset protection, irrevocable trusts are the gold standard. Once you place assets into an irrevocable trust, you legally no longer own them—the trust does. That simple action can place those assets completely beyond the reach of your future personal creditors.

By giving up direct control and ownership, you gain a powerful shield. A properly structured irrevocable trust ensures that a lawsuit against you personally cannot touch the assets held within it, because they technically belong to the trust, not you.

This makes irrevocable trusts an incredible tool for protecting significant liquid assets, family heirlooms, or even a primary residence in some states.

To help clarify the differences between these common tools, here’s a quick comparison of the most popular options.

Comparison of Key Asset Protection Tools

| Tool | Primary Purpose | Level of Protection | Ideal for Whom |

|---|---|---|---|

| LLC | To separate business/investment assets from personal assets and limit liability. | Strong | Business owners, real estate investors, anyone with active income-producing assets. |

| Irrevocable Trust | To move assets out of your personal ownership to protect them from future creditors. | Very Strong | Individuals with significant assets (cash, stocks, heirlooms) seeking long-term protection. |

| Umbrella Insurance | To provide an extra layer of liability coverage on top of existing policies. | Foundational | Virtually everyone, especially homeowners and drivers. |

| DAPT/FLP | To create advanced, layered protection for complex or high-value estates. | Maximum | High-net-worth individuals, families with complex assets, or those in high-risk professions. |

This table gives you a starting point for thinking about which structure might be the best fit, but the real power often comes from combining them.

Advanced Tools for Enhanced Protection

For those with more complex situations or a higher net worth, the toolkit expands to include more specialized instruments. These tools offer extra layers of security designed for specific goals.

-

Domestic Asset Protection Trusts (DAPTs): These are a special kind of irrevocable trust available in over a dozen states. What makes a DAPT unique is that you can be both the creator of the trust and one of its beneficiaries, all while still getting creditor protection. This lets you benefit from the trust’s assets under certain rules without directly owning them.

-

Family Limited Partnerships (FLPs): An FLP is a legal entity you can create to hold family assets, like a business or a real estate portfolio. You typically act as the general partner (maintaining control), while your family members are limited partners. This structure makes it extremely difficult for a creditor of one partner to seize the underlying assets, often forcing them to settle for a far less attractive “charging order” instead.

The Essential Role of Insurance

Finally, no asset protection plan is complete without a solid foundation of insurance. Your legal structures are there to protect you from claims that exceed your insurance coverage. Insurance is, and always will be, your first line of defense.

Think of it this way: if a fire breaks out, your insurance policy is the fire extinguisher that puts out the immediate blaze. Your LLC or trust is the fireproof wall that stops the flames from spreading to the rest of your house.

A critical piece of this puzzle is an umbrella liability policy. This affordable policy provides an extra layer of liability coverage—typically $1 million or more—that only kicks in after your standard auto or homeowner’s insurance is maxed out. It’s an incredibly cost-effective way to handle large, unexpected claims without ever having to test your more complex legal structures.

Diving Into Advanced and Offshore Strategies

When you’re dealing with substantial assets or have international business interests, the standard domestic tools might not be enough. They’re good, but they have their limits. This is where advanced and offshore strategies come into play, offering a much higher level of privacy and legal reinforcement.

It’s important to get one thing straight from the start: legitimate offshore asset protection is about smart, legal risk management. It has nothing to do with illegal tax evasion or hiding money from rightful obligations.

Think of it like this: your domestic plan is a top-of-the-line security system for your house. An offshore strategy is like moving your most priceless valuables to a specialized vault in a different country—a country with laws specifically designed to fend off the kind of legal attacks that might break through your defenses back home. You’re adding a powerful layer of jurisdictional diversity.

These strategies create serious roadblocks for potential creditors. The goal is to make litigation so expensive, complicated, and time-consuming that it discourages them from even trying. It’s not about being secretive; it’s about building a legally sound fortress.

Why Some Places Are Better Than Others

The heart of offshore planning lies in picking a jurisdiction with strong, debtor-friendly laws. Some countries have deliberately structured their legal and financial systems to attract legitimate international capital by offering incredible protection for trusts and other entities. These aren’t random choices; they’re strategic selections based on specific legal advantages.

Take the Cook Islands and Anguilla, for example. They are world-famous for their asset protection trust laws. A key feature is that their courts generally don’t recognize or enforce foreign judgments. So, if a creditor wins a lawsuit against you in the U.S., they can’t just take that court order to the Cook Islands and demand the trust’s assets. They have to start the fight all over again, from scratch, in a foreign court system with rules stacked heavily against them.

An offshore asset protection trust essentially forces a creditor to play a new game, on a new field, with a new set of rules that are intentionally difficult for them to win. This legal and geographical separation is the key to its strength.

It’s no surprise the use of these jurisdictions has taken off. Recent industry analysis shows Anguilla, the Cook Islands, and Nevis have become top-tier destinations. Anguilla alone captured over 15% of all new international trust formations last year. The Cook Islands saw a 22% jump in trust registrations over just four years.

This Isn’t a DIY Project—Experts Are Non-Negotiable

While the benefits are massive, setting up offshore structures is incredibly complex. There’s zero room for error. This is absolutely not a do-it-yourself project. The process involves navigating a maze of international laws, ensuring strict compliance with U.S. reporting rules (like FBAR and FATCA), and structuring everything perfectly to be bulletproof under legal attack. As you get into these advanced plans, researching the best countries to open an offshore bank account is a fundamental first step.

Hiring a team of experienced legal and financial professionals who live and breathe this stuff is non-negotiable. They are the ones who make sure your structure is legally sound, fully compliant, and perfectly suited to your specific situation and goals. This kind of high-level work is also deeply intertwined with your entire financial life, which is why a firm grasp of cross-border financial planning is crucial for anyone managing wealth across different countries.

Ultimately, advanced offshore strategies are the pinnacle of asset protection. They offer a formidable shield for those who need it most, but their strength comes directly from the expertise and precision used to build them.

Avoiding Costly Asset Protection Mistakes

Here’s a hard truth: a poorly constructed asset protection plan is worse than having no plan at all. It gives you a dangerous false sense of security, making you believe your wealth is safe when it’s actually completely exposed.

The line between an impenetrable financial fortress and a house of cards often comes down to dodging a few critical, yet common, mistakes. Understanding these pitfalls is the only way to ensure your hard work actually pays off when you need it most.

The Peril of Fraudulent Conveyance

The single biggest mistake in asset protection? Waiting too long. You have to build your fortress before you see an enemy on the horizon. Trying to move assets to shield them from an existing or imminent creditor is known as fraudulent conveyance—and it’s illegal.

Imagine a business owner gets a letter from a lawyer and learns they’re about to be sued. In a panic, they quickly sign their house over to their brother for $1. A court will see right through that, reverse the transfer, and probably hit them with penalties. The law simply doesn’t let you dodge legitimate debts.

Proactive planning is the only legal and effective path. Asset protection is about shielding your wealth from future, unknown threats, not hiding it from current, known ones. Any strategy implemented under duress is likely to fail.

This is why asset protection can’t be an afterthought; it has to be integrated into your financial management from the start.

Forgetting to Fund and Maintain Your Structures

Another classic blunder is treating asset protection like a “set it and forget it” task. Creating a trust or LLC is just the first step. If you don’t follow through with the necessary administrative work, these legal entities can be rendered useless.

-

Failing to Fund a Trust: You can have the most brilliantly drafted trust in the world, but if you never actually transfer assets into it, it’s just an empty legal shell. The trust must be formally funded by retitling assets—like real estate deeds or investment accounts—into its name.

-

Ignoring Corporate Formalities: An LLC provides a liability shield only if you treat it as a separate legal entity. That means keeping separate bank accounts, holding regular meetings, and never commingling personal and business funds. If you pay your personal mortgage from the LLC’s account, a court could decide to “pierce the corporate veil,” making your personal assets fair game.

Failing to properly manage these structures is like building a strong gate but leaving it wide open for anyone to walk through.

Relying on Outdated or Inadequate Strategies

The legal and regulatory landscape is always shifting. A strategy that was rock-solid a decade ago might be full of holes today. In fact, recent legislative changes have exposed major gaps in many traditional asset protection plans.

An analysis from 1291 Group revealed that over 60% of high-net-worth families still use outdated structures like nominee arrangements, which are highly vulnerable under new rules like the Corporate Transparency Act (CTA). Last year alone, global penalties for non-compliance with these types of regulations topped $1.2 billion. Keeping your plan effective requires regular review and updates.

On top of that, you have to stay current with all your compliance duties. For example, our guide on foreign asset reporting requirements helps clarify some of the complex rules that apply to international assets. Meticulous execution and ongoing maintenance are what keep your financial defenses impenetrable over time.

How to Build Your Personal Protection Plan

Knowing the theory is one thing, but putting it into practice is where real protection begins. Building your own plan isn’t something you knock out in an afternoon. It’s a methodical process: you catalog what you own, pinpoint where you’re vulnerable, and get crystal clear on what you need to shield. This framework becomes the blueprint for your entire strategy.

The first step is a full-blown inventory of your assets. I mean everything—your house, investment properties, brokerage accounts, retirement funds, even valuable personal property. Don’t gloss over digital assets like crypto or any intellectual property you might own. The goal is an honest, complete picture of your net worth, because you can’t protect what you haven’t accounted for.

Assess Your Unique Risk Profile

Once you have your asset list, it’s time for a personal risk assessment. This is where you take a hard look at your profession, your business dealings, and your personal life to see where the threats are hiding.

A surgeon, for example, is rightly consumed with malpractice risk. A real estate investor, on the other hand, is probably more worried about tenant lawsuits or someone slipping on their property.

Ask yourself some tough questions:

- Have I personally guaranteed any business loans?

- Do my kids drive the family car? (Hello, teenage drivers.)

- Do I own rental properties that could open me up to liability claims?

- Is my profession a magnet for lawsuits?

Answering these questions tells you where the biggest dangers are coming from, so you can build your defenses in the right places.

Assemble Your Team of Experts

Solid asset protection planning is a team sport, not a DIY project. You need a crew of qualified pros who can give you specialized guidance and make sure your plan is both legally sound and financially smart.

This “dream team” usually includes:

- An Asset Protection Attorney: This is the specialist who will draft the legal structures—like trusts and LLCs—that form the backbone of your defense.

- A Certified Public Accountant (CPA): Your CPA is there to keep everything tax-compliant and help maintain the clean financial separation your legal entities need to work properly.

- A Financial Advisor: They make sure your protection strategy works hand-in-glove with your bigger investment and wealth-building goals.

Think of your team as the architects, engineers, and general contractors building your financial fortress. Each one has a critical role in designing, building, and maintaining a structure that can actually withstand an attack. Without their combined expertise, you risk building a plan with fatal flaws.

A Few Common Questions About Asset Protection Planning

Diving into asset protection planning for the first time usually kicks up a few practical, but totally critical, questions. Getting straight answers is often what gives people the confidence to go from just thinking about it to actually doing something—and doing it the right way.

“When’s the Right Time to Start?”

This is, without a doubt, the question I hear most often. My answer is always the same: yesterday. But since we can’t do that, the next best time is right now.

Think of it this way: you install a security system in your house to prevent a future problem, not while a burglar is already halfway through the window. Effective asset protection works the exact same way. It has to be proactive.

If you wait until you’ve been threatened with a lawsuit to start moving your assets around, you’re walking into a legal minefield. This is often classified as fraudulent conveyance, an action that can get your entire strategy thrown out by a judge and land you in even hotter water. The only legitimate way forward is to build your financial fortress during peacetime, long before any specific threat appears on the horizon.

“Isn’t This Just for the Super Rich?”

This is another huge misconception. It’s the idea that asset protection is some exclusive club for multimillionaires. That’s just flat-out wrong.

Sure, the complexity of a plan will scale with your net worth, but the fundamental need to protect what you’ve built applies to anyone with something to lose.

A landlord with a single rental property, for example, can get massive protection from a simple LLC. A doctor just hanging their shingle needs to think about professional liability from day one. And a good umbrella insurance policy? That’s a cost-effective and powerful shield for almost everyone.

At its heart, asset protection planning is about matching the right tool to your specific level of risk and wealth. It’s not about how much you have—it’s about securing what you’ve worked so hard to build.

Asset Protection vs. Estate Planning: What’s the Difference?

Finally, a lot of people mix up asset protection and estate planning. They’re definitely related and a good financial plan needs both, but they serve two very different primary purposes.

- Asset Protection Planning: This is all about shielding your wealth from creditors, lawsuits, and other threats during your lifetime. The goal is to keep what you own safe while you’re still here to enjoy it.

- Estate Planning: This is focused on the orderly management and transfer of your assets after you die. It’s the world of wills, trusts, probate, and making sure your legacy goes to the people and causes you care about.

A truly bulletproof financial strategy weaves both together. One protects your assets while you’re alive, and the other ensures they’re passed on exactly as you wish. Together, they create a complete shield for your wealth, securing it for today and for the generations that follow.

You can’t protect what you can’t see. A clear view of your assets is the first step, and with PopaDex, you can see your entire financial picture in one place. This makes building a smart and effective asset protection plan so much easier. Take control of your net worth today at https://popadex.com.