Our Marketing Team at PopaDex

12 Best Net Worth Tracking App Options for 2025

Understanding your net worth is the single most important metric for gauging your financial health. It’s the ultimate scoreboard, stripping away the complexity of income, expenses, and investments to give you one clear number: what you own minus what you owe. But manually calculating this across multiple accounts-from your 401(k) and brokerage to your mortgage and credit card debt-is tedious and often inaccurate. This is the exact problem the best net worth tracking app is designed to solve.

This comprehensive guide dives deep into the top platforms available today, moving beyond generic feature lists to provide a practical analysis. We’ll explore who each tool is best for, from individual investors managing multi-currency assets to young professionals just starting their wealth-building journey. You’ll find detailed reviews of leading options like Empower Personal Dashboard, Monarch Money, and Kubera, complete with screenshots, direct links, and an honest look at their strengths and limitations.

Our goal is to help you find the perfect tool to automate your financial overview, enabling you to make smarter decisions with a real-time, 360-degree view of your finances. While net worth trackers help visualize your financial standing, integrating strategies from the best money-saving apps can actively boost your progress towards financial goals. Let’s find the right app to put you in control.

1. PopaDex

Best For: Global users and those seeking a powerful, all-in-one financial dashboard.

PopaDex establishes itself as a leading contender for the best net worth tracking app by offering a uniquely powerful and user-friendly platform tailored for a global audience. Its core strength lies in its comprehensive integration capabilities, supporting over 15,000 banks in more than 30 countries. This makes it an exceptional choice for expats, international professionals, or anyone managing assets and liabilities across multiple currencies.

The platform provides a unified dashboard where you can consolidate everything from savings and investments to property and debt, offering a true 360-degree view of your financial health. Its interactive visualizations and multilingual interface make complex data easy to digest, empowering users to make smarter, data-driven decisions.

Key Features and Pricing

PopaDex utilizes a flexible freemium model that accommodates users at different stages of their financial journey.

- Free Standard Plan: Ideal for beginners, this plan allows for manual aggregation of all your accounts. It’s a great, no-cost way to get started with tracking your net worth.

- Premium Plan (€5/month): Unlocks the platform’s full potential with automated bank integrations, advanced analytics, and priority support. A 30-day money-back guarantee and a free trial (no credit card required) make it a risk-free upgrade.

- Additional Tools: Users gain access to practical resources like Google Sheets and Excel net worth trackers and a disposable income calculator, with an AI co-pilot for personalized guidance on the horizon.

| Feature | Details |

|---|---|

| Global Connectivity | Supports 15,000+ banks across 30+ countries with multi-currency and multilingual capabilities, making it ideal for expats and international users. |

| Flexible Pricing | A robust free plan for manual tracking and a highly affordable premium tier (€5/month) for full automation and advanced features. |

| User Experience | Intuitive dashboards and interactive visualizations simplify complex financial data, while upcoming AI assistance promises to further streamline planning. |

| Pros | Comprehensive global bank integration, affordable premium features, strong visualization tools, multilingual support, and valuable supplementary resources like spreadsheet templates. |

| Cons | Automated syncing and advanced insights are exclusive to the paid plan. The manual aggregation in the free version can be time-consuming for users with many accounts. |

| Website | https://popadex.com |

2. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard has long been a heavyweight contender for the title of best net worth tracking app, largely due to its powerful, free financial tools tailored for investors. It excels at aggregating your entire financial life, from checking and savings accounts to complex investment portfolios, loans, and mortgages, into a single, intuitive interface.

What sets Empower apart is its deep dive into investment analytics. While many apps simply list your assets, Empower analyzes your portfolio’s health, showing you your asset allocation across all accounts, highlighting hidden fees, and even running a retirement planning simulation. The Net Worth page provides a clear, time-series graph that visualizes your wealth-building journey, offering a powerful motivator. The dashboard is clean and user-friendly, making complex financial data easy to comprehend.

While the core net worth and investment tracking tools are completely free, users with significant assets should expect to receive calls from Empower’s advisory services. This is their primary business model. For those who can look past the occasional upsell, Empower offers an institutional-grade platform without a price tag, making it an indispensable tool for serious investors.

- Best For: Investors who want a holistic view of their wealth with a focus on portfolio analysis.

- Pricing: Free for the dashboard and tracking tools.

- Unique Feature: The Retirement Planner and Investment Fee Analyzer tools.

For a deeper dive into its capabilities, you can learn more about the Empower Personal Dashboard net worth tracker app.

Website: https://www.empower.com/

3. Monarch Money

Monarch Money positions itself as a premium, all-in-one financial dashboard, earning its reputation as a powerful contender for the best net worth tracking app, especially for households and collaborative finances. It offers a modern and highly customizable interface that consolidates your complete financial picture, from bank accounts and credit cards to investments and loans. The platform seamlessly tracks your net worth over time with clean, intuitive charts.

What truly distinguishes Monarch is its focus on a collaborative, modern user experience. It allows you to invite a partner or financial advisor to share your dashboard at no extra cost, making it ideal for joint financial management. Its integrations go beyond standard financial institutions, pulling in data from Zillow for home valuations, Coinbase for cryptocurrency, and even vehicle value estimates. This holistic approach provides a more accurate and comprehensive snapshot of your total wealth.

While Monarch Money is a paid-only service with no free tier, its ad-free experience and robust feature set justify the cost for users seeking a powerful, user-centric tool. Minor user experience quirks, such as the net worth chart’s date range not always persisting, are small trade-offs for an otherwise polished and highly capable platform designed for the modern household.

- Best For: Households and partners wanting a collaborative, detailed view of their combined finances.

- Pricing: Paid subscription required after a free trial.

- Unique Feature: Unlimited collaborators and unique integrations with Zillow, Coinbase, and vehicle valuations.

Website: https://www.monarchmoney.com

4. Quicken Simplifi

Quicken Simplifi stands as a modern, all-in-one personal finance app from a trusted name, designed for users who want a comprehensive tool that goes beyond just net worth. It provides a dedicated Net Worth section that aggregates data from connected accounts, manual assets like collectibles, and real estate valuations via Zillow integration. This makes it an excellent choice for getting a complete picture of your financial health in one place.

What sets Simplifi apart is its powerful combination of net worth tracking with robust budgeting and goal-setting features. You can monitor your investments, including performance and holdings, while also managing a dynamic spending plan. The app’s strength lies in its extensive connectivity, leveraging Quicken’s ability to link to over 14,000 financial institutions, ensuring most of your accounts can be synced automatically.

While Simplifi offers a fantastic suite of tools, it is currently available only in the U.S. Some users have also noted occasional synchronization issues, which can require manually reconnecting accounts. However, for U.S.-based individuals seeking a single app to manage spending, savings goals, and track their complete net worth, Simplifi presents a compelling, user-friendly option.

- Best For: U.S. users who want a comprehensive money management tool that combines net worth tracking with detailed budgeting and spending plans.

- Pricing: Subscription-based, typically with a free trial available.

- Unique Feature: Integration of a dynamic spending plan alongside detailed net worth and investment tracking.

Website: https://www.quicken.com/simplifi/

5. YNAB (You Need A Budget)

While primarily famous for its life-changing zero-based budgeting methodology, YNAB (You Need A Budget) also serves as an excellent net worth tracking app for those who want to see the direct impact of their spending habits on their wealth. The platform forces you to be intentional with every dollar, and its reporting suite clearly visualizes how this discipline translates into a growing net worth over time. It aggregates all your linked accounts, from checking to credit cards and loans, into a single dashboard.

What makes YNAB stand out is its cause-and-effect clarity. The Net Worth report isn’t just a number; it’s a direct reflection of your budgeting success. The clean, simple graphs show your assets and liabilities, motivating you to pay down debt and increase savings. The platform’s emphasis on education and its active community provide unparalleled support for users committed to gaining financial control.

Although YNAB lacks the deep investment analysis tools of its competitors, its strength lies in building the foundational habits that fuel wealth creation. It’s less about portfolio management and more about managing the cash flow that allows you to invest in the first place. This makes it an indispensable tool for anyone starting their financial journey or needing to rein in their spending. You can discover more about using YNAB alongside other tools for net worth tracking.

- Best For: Individuals and families focused on disciplined budgeting to directly impact their net worth growth.

- Pricing: A free 34-day trial, then billed annually at $99/year or monthly at $14.99/month.

- Unique Feature: The “Four Rules” zero-based budgeting method that directly connects daily spending to long-term wealth.

Website: https://www.ynab.com/pricing

6. Tiller

For those who love the granular control of a spreadsheet but hate manual data entry, Tiller offers a unique and powerful solution. Instead of a standalone app, Tiller securely automates the flow of your financial data-including transactions and balances from banks, credit cards, and investment accounts-directly into your own Google Sheets or Microsoft Excel files. This makes it an exceptional net worth tracking app for spreadsheet enthusiasts who want ultimate customization.

What truly sets Tiller apart is its flexibility combined with a strong privacy focus. You start with their customizable Foundation Template, which includes a net worth dashboard, and can then modify it endlessly or use templates created by the active Tiller Community. Because you own the spreadsheet, your data is yours to control, and Tiller’s business model is subscription-based, meaning no ads and no upselling of financial products. The trade-off is the lack of a dedicated mobile app and a steeper learning curve for those not comfortable with spreadsheets.

While it requires some initial setup, Tiller empowers users to build a net worth tracker that is perfectly tailored to their specific needs. It’s the ideal middle ground between a fully manual spreadsheet and a rigid, pre-built application, offering automation where it counts without sacrificing control.

- Best For: Spreadsheet power users and anyone who wants maximum control and privacy over their financial data.

- Pricing: Free 30-day trial, then $79/year.

- Unique Feature: Direct, automated bank feeds into personal Google Sheets or Microsoft Excel.

For a more detailed analysis, you can learn more about Tiller’s spreadsheet-based approach.

Website: https://www.tiller.com/

7. Kubera

Kubera positions itself as a modern, premium wealth tracker for the global citizen, built from the ground up to handle today’s complex asset classes. Where many traditional apps struggle, Kubera excels, seamlessly integrating everything from global bank accounts and brokerage holdings to cryptocurrency wallets, NFTs, DeFi assets, and even the estimated value of your domains or car. It is a true aggregator for a diversified, 21st-century portfolio.

What makes Kubera a standout in the best net worth tracking app category is its dedication to breadth and simplicity. It supports thousands of banks and brokerages worldwide and offers robust multi-currency tracking, automatically converting all assets into your preferred base currency. The interface is intentionally minimalist and spreadsheet-like, focusing purely on presenting your data cleanly without the clutter of ads, upsells, or budgeting advice. It’s designed for tracking, not managing, your finances.

While it comes with a subscription fee, Kubera’s privacy-focused model means it doesn’t sell your data or push advisory services. This makes it an ideal choice for high-net-worth individuals and tech-savvy users who need a powerful, private, and all-encompassing view of their assets, especially those with significant crypto or international holdings.

- Best For: Global citizens and crypto investors with diverse, hard-to-track assets across multiple currencies.

- Pricing: Subscription-based, typically around $150 per year.

- Unique Feature: Native support for a vast range of cryptocurrencies, DeFi platforms, NFTs, and global financial institutions.

Website: https://www.kubera.com/wealth-tracker

8. Rocket Money (formerly Truebill)

Rocket Money, formerly known as Truebill, carves out a unique niche by blending net worth tracking with powerful, automated savings tools. It’s an exceptionally user-friendly app that aggregates your bank accounts, credit cards, investments, and loans to provide a clear picture of your financial standing. The interface is clean and designed for quick, at-a-glance comprehension, making it an excellent entry point for those new to monitoring their wealth.

What distinguishes Rocket Money is its focus on the other side of the wealth equation: your expenses. The app actively works to lower your bills by identifying and canceling unwanted subscriptions and even negotiating recurring bills like cable or internet on your behalf. While its net worth tracking is more straightforward than investment-heavy platforms, its ability to directly increase your monthly cash flow provides a tangible boost to your savings potential, making it a very practical financial management tool.

The core net worth tracking features are available for free, but the app’s most powerful services, such as bill negotiation and advanced budgeting, are part of its premium subscription. This makes Rocket Money a strong contender for anyone looking for an all-in-one app that not only tracks their growth but actively helps them save.

- Best For: Beginners and anyone looking for a holistic app that combines net worth tracking with active subscription and bill management.

- Pricing: Free for basic tracking; Premium subscription offered on a sliding scale (typically $3-$12/month).

- Unique Feature: Automated bill negotiation and subscription cancellation services.

Website: https://www.rocketmoney.com/feature/net-worth

9. Lunch Money

Lunch Money carves out a unique niche in the financial tracking space as an indie-built platform with a strong focus on flexibility and multi-currency support. It is designed for users who need a more hands-on, customizable approach to their finances, moving beyond simple aggregation to offer powerful budgeting, transaction rules, and subscription tracking alongside a clear net worth dashboard. Its clean interface makes complex financial data accessible and manageable.

What truly distinguishes Lunch Money is its native support for multiple currencies, a critical feature for expats, digital nomads, or anyone with international assets. The app can automatically convert and display your total net worth in your primary currency, solving a major headache that many other platforms ignore. This makes it an exceptional net worth tracking app for those with a global financial footprint.

The platform operates on a “pay-what-you-want” annual subscription model, reflecting its community-driven ethos. While it may lack the deep investment analysis tools of a competitor like Empower, its strength lies in detailed cash flow management and its unparalleled currency handling. For users who prioritize budgeting and international asset tracking over intricate portfolio analytics, Lunch Money offers a refreshing and powerful alternative.

- Best For: Expats, digital nomads, and anyone managing assets in multiple currencies.

- Pricing: Flexible “pay-what-you-want” annual subscription (suggested rates apply).

- Unique Feature: Robust, native multi-currency support for a truly global net worth view.

Website: https://lunchmoney.app/why-lunch-money

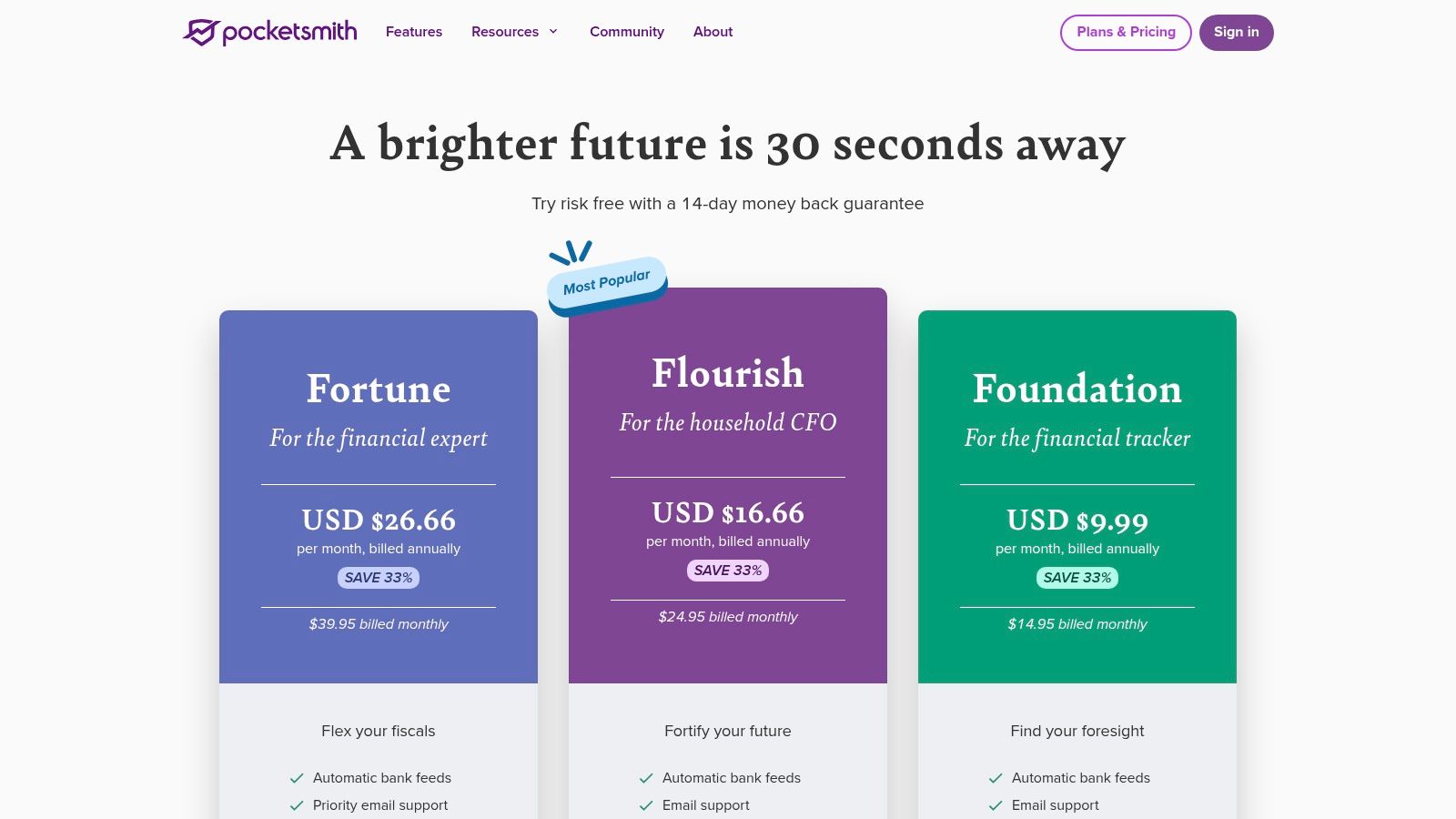

10. PocketSmith

PocketSmith approaches wealth management from a unique angle, positioning itself as a financial forecasting tool first and foremost. While it offers robust net worth tracking, its core strength lies in its ability to project your financial future based on current trends and “what-if” scenarios. This makes it a powerful platform for users who want to see not just where they are today, but where their decisions will take them over the next 10, 30, or even 60 years.

The platform aggregates all your accounts to build a comprehensive net worth statement, which can be visualized on a highly configurable dashboard. Its standout feature is the calendar-based cash flow projection, allowing you to simulate the long-term impact of major life events, like buying a house or changing careers, on your net worth. The interface is data-rich and may present a steeper learning curve than simpler apps, but its forecasting power is unparalleled for proactive financial planners.

PocketSmith’s extensive bank connections, including multi-currency support, make it an excellent choice for international users. While some of the most advanced forecasting features are locked behind premium tiers, its detailed reporting and customization offer a level of control that few other apps can match, making it a top-tier net worth tracking app for forward-thinkers.

- Best For: Planners who want to forecast their future net worth and cash flow based on different scenarios.

- Pricing: Tiered plans from Free (manual entry only) to Premium ($9.95/mo) and Super ($19.95/mo).

- Unique Feature: Long-range cash flow and net worth forecasting up to 60 years into the future.

For more details on its forecasting tools, you can explore the PocketSmith planning features.

Website: https://my.pocketsmith.com/plans

11. NerdWallet App

NerdWallet is a well-known name in personal finance education, and its app extends this reputation by offering a simple yet effective net worth tracking tool. It’s an excellent entry point for individuals who are just beginning to take control of their finances and want more than just a number. The app combines your net worth, credit score, and cash flow into one dashboard, providing a holistic financial check-up at a glance.

The platform’s strength lies in its integration with NerdWallet’s broader ecosystem of educational content and financial product comparisons. While tracking your assets and liabilities, the app provides contextual insights and suggests relevant articles or tools to help you improve your financial health. It supports connections to most major financial institutions and allows manual entry for assets like property. Although it lacks the deep investment analytics of specialized platforms, its user-friendly interface makes it a fantastic starting point for building good financial habits.

NerdWallet is ideal for those who want a guided introduction to wealth tracking. The focus is less on granular portfolio management and more on foundational financial literacy, making it a valuable tool for beginners who want to understand the “why” behind their numbers.

- Best For: Beginners seeking a simple net worth tracker combined with financial education and credit score monitoring.

- Pricing: Free.

- Unique Feature: Integration of net worth, cash flow, and credit score tracking with personalized financial guidance.

Website: https://www.nerdwallet.com/l/nerdwallet-app-track-your-wealth-and-build-your-future

12. Copilot Money

Copilot Money has carved out a niche as the best net worth tracking app for users deeply embedded in the Apple ecosystem. Designed exclusively for iPhone, iPad, and Mac, it offers a polished, native experience that feels both modern and intuitive. The app excels at providing a comprehensive financial picture, aggregating everything from bank accounts and credit cards to investments and loans into one clean interface. Its net worth tracker presents a clear graph with customizable timeframes, allowing you to see wealth progression at a glance.

What makes Copilot stand out is its intelligent design and machine-learning-powered transaction categorization, which reduces manual effort and provides smarter insights into spending habits. The investment dashboard is seamlessly integrated, offering clean views of your portfolio’s performance. For those with tangible assets, Copilot even provides guidance on how to manually track items like vehicles to ensure your net worth calculation is complete. It’s a premium product with a subscription fee, aimed at users who value a superior user experience and aesthetic.

The commitment to the Apple platform is both its greatest strength and a significant limitation, as Android and web users are left out. Furthermore, its account aggregation is currently limited to U.S. financial institutions. Despite this, for its target audience, Copilot delivers a best-in-class, design-forward financial tracking experience that justifies its subscription price.

- Best For: Apple users seeking a premium, design-focused app for tracking net worth and budgets.

- Pricing: Subscription-based, typically around $95 per year (pricing may vary).

- Unique Feature: A highly polished, native Apple UI with smart, AI-driven transaction categorization.

Website: https://apps.apple.com/us/app/copilot-track-budget-money/id1447330651

Top 12 Net Worth Tracking Apps Comparison

| Product | Core Features / Highlights | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| PopaDex 🏆 | 15,000+ banks, multi-currency, multilingual | ★★★★☆ | Free manual + €5/mo Premium automation | Global users, expats, wealth builders | AI co-pilot coming; Google Sheets/Excel tools; 30-day guarantee |

| Empower Personal Dashboard | Net Worth + investment analytics | ★★★★ | Free core dashboard | Investors, retirement planners | Strong portfolio insights |

| Monarch Money | Net worth, investments, unlimited collaborators | ★★★★ | Paid only | Couples, power users | Zillow, Coinbase, vehicle values integration |

| Quicken Simplifi | Connected accounts, Zillow valuations | ★★★★ | Paid, US only | US users, comprehensive money managers | Broad financial reports |

| YNAB (You Need A Budget) | Zero-based budgeting + net worth trends | ★★★★½ | Paid, higher price | Budget-focused users | Best budgeting methodology |

| Tiller | Bank feeds into Google Sheets/Excel | ★★★★ | Paid subscription | Spreadsheet-savvy, privacy-focused | Customizable spreadsheets, no ads |

| Kubera | Complex portfolios, crypto, multi-currency | ★★★★ | Higher priced | High-net-worth, global asset managers | Deep crypto and cross-border tracking |

| Rocket Money | Net worth + bill negotiation | ★★★ | Free + variable premium fees | Casual users, savings seekers | Bill negotiation and subscriptions management |

| Lunch Money | Multi-currency, budgets, pay-what-you-want | ★★★★ | Flexible pricing | International, multi-currency users | Indie-built, community-driven pricing |

| PocketSmith | Forecasting + detailed net worth reports | ★★★★ | Paid | Users wanting projections, planners | Long-term cash flow forecasting |

| NerdWallet App | Net worth, credit score, financial insights | ★★★ | Free | Beginners, financial education seekers | Simple onboarding with education |

| Copilot Money | Apple ecosystem, ML categorization | ★★★★½ | Paid | Apple device users | Seamless iPhone/Mac integration, polished UI |

From Tracking to Thriving: Making Your Net Worth Work for You

Navigating the landscape of personal finance tools can feel overwhelming, but selecting the right net worth tracking app is a critical first step toward achieving financial clarity and freedom. We’ve explored a dozen powerful platforms, from the comprehensive investment analysis of Empower Personal Dashboard to the meticulous budgeting philosophy of YNAB and the spreadsheet-driven flexibility of Tiller. Each tool offers a unique approach to the same fundamental goal: providing you with an accurate, real-time snapshot of your financial health.

The key takeaway is that the best net worth tracking app is not a one-size-fits-all solution. Your ideal tool depends entirely on your specific financial situation, goals, and personal preferences.

How to Choose Your Perfect Financial Co-Pilot

To make the right choice, reflect on what you truly need from a platform. Are you a hands-on investor who needs sophisticated portfolio analysis and retirement planning? Empower or Monarch Money might be your best fit. Are you struggling to break the paycheck-to-paycheck cycle and need a structured system for intentional spending? The proactive budgeting methods of YNAB or Quicken Simplifi are designed for you.

For those managing diverse or unconventional assets, the choice becomes even more specific. If your portfolio includes significant cryptocurrency holdings, international accounts, or even physical collectibles, a platform like Kubera or PopaDex offers the specialized tracking capabilities you require. Similarly, if your primary goal is to cut down on subscription bloat and recurring expenses, Rocket Money’s automation is unparalleled.

From Data Points to Deliberate Action

Remember, a net worth tracker is more than just a dashboard of numbers; it’s a catalyst for action. Seeing your complete financial picture empowers you to make smarter decisions, identify opportunities, and mitigate risks. It transforms abstract goals like “saving for retirement” into tangible, measurable progress. Use the data to ask critical questions: Is my asset allocation aligned with my risk tolerance? Am I paying too much in investment fees? Where can I redirect funds to accelerate my wealth-building journey?

Once you have a clear understanding of your assets and liabilities, you can begin to optimize your portfolio for growth. To truly make your net worth work for you and move from tracking to thriving, consider exploring avenues like crypto passive income strategies to grow your digital assets. This shift from passive monitoring to active strategy is where true financial transformation occurs. Ultimately, the best net worth tracking app is the one you will use consistently to guide these crucial financial decisions.

Ready to gain unparalleled clarity on your complete financial portfolio, including crypto, DeFi, and traditional assets? PopaDex offers a powerful, privacy-first platform designed to give you a true 360-degree view of your wealth. Start tracking your progress and making informed decisions today with PopaDex.