Our Marketing Team at PopaDex

Master How to Calculate Disposable Income Like a Pro

Understanding What Disposable Income Really Means

Let’s cut through the financial jargon. At its core, your disposable income is the money you have left after the government takes its share. It’s not your total salary; it’s what remains after all mandatory deductions—like federal, state, and local taxes—are subtracted from your gross income. This number is the real starting point for every financial decision you make, from your daily coffee to your long-term savings goals.

Thinking of disposable income as your “real” income helps clarify its importance. Your gross pay might look impressive on a job offer, but it doesn’t pay the bills. Your disposable income does. It’s the most accurate measure of your financial flexibility and the foundation you need to calculate disposable income for budgeting, saving, or creating a debt repayment plan. This is the figure that truly dictates your lifestyle and spending power.

Disposable vs. Discretionary: Why the Difference Matters

A common point of confusion is the difference between disposable and discretionary income. They sound similar, but they represent two very different stages of your cash flow.

- Disposable Income: This is your take-home pay after all mandatory tax deductions are taken out.

- Discretionary Income: This is the money left over from your disposable income after you’ve paid for all your essential living expenses, like housing, food, transportation, and utilities.

Think of it this way: your disposable income is what you have to work with for both your needs and your wants. Your discretionary income is your “fun money”—what’s left for entertainment, hobbies, and non-essential savings after all necessities are covered. Understanding this distinction is vital for accurate financial planning.

This concept isn’t just personal; it’s a key economic indicator. For instance, recent data showed that real disposable income per capita in the United States grew by 0.7% in a single month after adjusting for inflation, with nominal income rising 4.47% year-over-year. This shows how purchasing power can change on a large scale. You can find more details in this recent analysis of personal income trends.

The Essential Formula and What Goes Into It

To figure out your disposable income, you need a simple but powerful formula. At its core, the equation looks like this:

Gross Income - All Mandatory Deductions = Disposable Income

But the real insight comes from understanding what makes up each piece of that puzzle. It’s about more than just glancing at your salary and guessing your taxes. It’s a full financial check-up.

Breaking Down Your Gross Income

Your gross income is every single dollar you earn before anything is taken out. This goes far beyond your regular paycheck. To get an accurate starting number, you have to account for all of it:

- Wages, salaries, and any tips you receive

- Performance bonuses and sales commissions

- Earnings from freelance projects or your side hustle

- Regular payments from pensions or retirement accounts

Getting a complete picture of your gross income is the first step toward true financial awareness. It’s a fundamental part of budgeting and is just as important as knowing how to calculate your net worth.

To help you organize this, here’s a detailed breakdown of common income sources and the deductions that typically apply to them.

| Income Category | Examples | Tax Deductions | Typical Percentage |

|---|---|---|---|

| Employment Income | Salary, Wages, Tips, Bonuses | Federal Income Tax, State/Local Tax, FICA (Social Security & Medicare) | 15-35% |

| Self-Employment | Freelance Work, Gig Economy | Self-Employment Tax (Social Security & Medicare), Estimated Income Tax | 25-40% |

| Investment Income | Dividends, Capital Gains | Capital Gains Tax, Income Tax on Dividends | 0-20% (Varies) |

| Retirement Income | Pension, 401(k)/IRA Withdrawals | Federal & State Income Tax (often at a lower rate) | 10-25% |

| Other Income | Royalties, Rental Income | Income Tax, potentially local property taxes | Varies by source |

This table shows that different types of income are treated differently by the tax system. The key insight is that your total tax burden isn’t a single flat rate but a blend of these various deductions.

Identifying All Mandatory Deductions

This is where the calculation gets serious. Mandatory deductions are the payments you are legally required to make. These are automatically subtracted from your gross income, and you have no say in the matter.

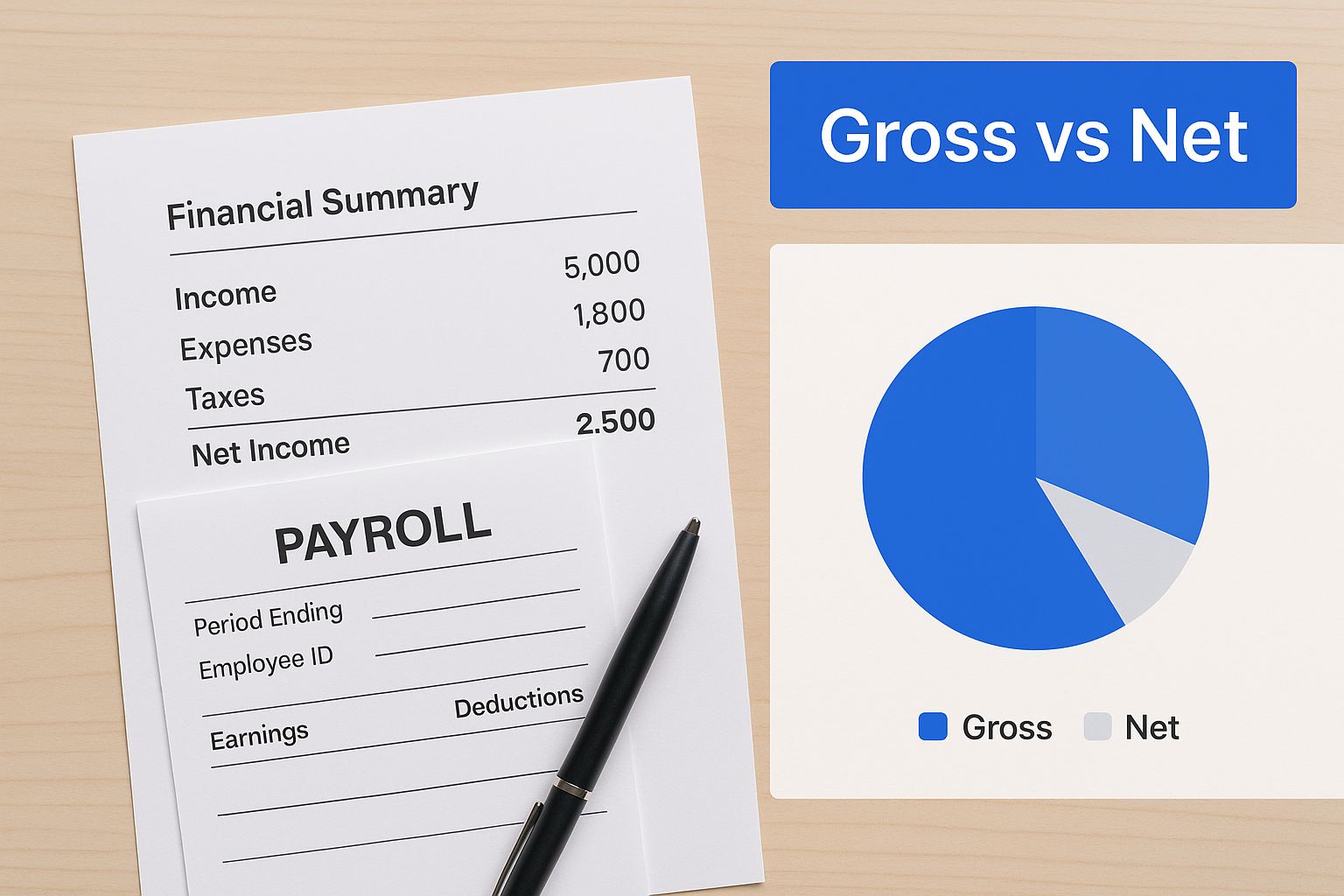

The infographic below shows how your gross pay is reduced to get to your net pay, which is another term for disposable income.

As you can see, a big chunk of your earnings is gone before you can even touch it. These legally required deductions almost always include:

- Federal, state, and local income taxes

- Social Security and Medicare taxes (often called FICA)

- State-required payments like unemployment or disability insurance

- Court-ordered wage garnishments, such as for child support or unpaid tax levies

It’s important to separate these from voluntary deductions. Things like your health insurance premiums, 401(k) contributions, or life insurance payments also reduce your take-home pay, but they aren’t part of the official disposable income formula because they are choices you make, not legal obligations.

Gathering Your Financial Information Like a Pro

Before you can get an accurate disposable income figure, you need to play detective with your own finances. Guessing what you earn or what comes out of your paycheck just won’t work. The quality of your calculation depends entirely on using real numbers from your actual financial documents. Think of this as getting to know the story your money tells.

Your Primary Data Sources

Let’s start by rounding up the core documents that outline your earnings and deductions. These are the sources of truth you can’t do without.

- Recent Pay Stubs: Grab your last two or three pay stubs. They offer a current snapshot of your gross pay, tax withholdings, and any other pre-tax deductions.

- Most Recent Tax Return: Your Form W-2 (if you’re an employee) or various Form 1099s (if you’re a freelancer) are critical. Your completed tax return, like a Form 1040, ties all your annual income and tax information together.

- Benefit Summaries: Don’t overlook documents from your employer’s HR department. These summaries detail costs for things like health insurance premiums or mandatory pension contributions that are deducted from your pay.

Handling Irregular and Complex Income

Not everyone has a straightforward, predictable salary, and that’s okay. If your income comes from freelancing, tips, or occasional bonuses, tracking it carefully is key. A simple spreadsheet or a budgeting app can be your best friend here. For less frequent income, like stock options or a large annual commission, it’s wise to average the amount over 12 months to get a more stable monthly figure for your calculations.

Going through the motions of collecting these documents is one thing, but truly appreciating what they represent is another. Understanding the deeper meaning of accounting and financial records can shift your perspective entirely. These papers aren’t just a chore; they’re telling the story of your financial life. Viewing them this way turns a tedious task into a powerful step toward building a more secure future.

Working Through Real-World Calculation Examples

Theory is helpful, but seeing how the numbers shake out in real life is where it all starts to make sense. To really calculate disposable income, we need to go beyond the basic formula and see how different life situations affect the final number. Let’s walk through a couple of common scenarios to see how this plays out.

The Single Professional in a High-Tax State

Meet Alex, a single marketing manager who lives in California and earns a gross annual salary of $90,000. After running the numbers through a state tax calculator, Alex realizes the mandatory deductions are pretty substantial:

- Federal Income Tax: Approximately $12,500

- FICA (Social Security & Medicare): $6,885

- California State Income Tax: Roughly $5,100

- State Disability Insurance (SDI): About $990

When you add these up, Alex’s total mandatory deductions amount to $25,475.

Here’s the calculation: $90,000 (Gross Income) - $25,475 (Total Deductions) = $64,525 (Disposable Income)

This leaves Alex with $5,377 per month to cover rent, utilities, savings, and everything else. It’s a great example of how much state taxes matter. If Alex lived in a state with no income tax, their disposable income would jump by over $5,000 a year.

The Freelancer Juggling Irregular Income

Now, let’s look at Maria, a freelance graphic designer who brought in $72,000 last year. Her calculation is a bit different because she’s in charge of handling her own taxes.

First, she needs to figure out her self-employment tax, which covers both the employer and employee portions of FICA. This is 15.3% of 92.35% of her net earnings, which comes out to about $10,180. She also sets aside an estimated $7,500 for her federal and state income taxes.

Here’s the calculation: $72,000 (Gross Income) - $17,680 (Total Estimated Taxes) = $54,320 (Disposable Income)

Maria’s monthly disposable income is around $4,526, but she has to be disciplined about making quarterly estimated tax payments to avoid penalties. A common pitfall for freelancers is spending their gross income without remembering that a big piece of it belongs to the government.

These American examples show a high earning potential. In fact, on a global scale, the United States leads with an average net disposable income of approximately $51,147 per capita. You can explore how different countries stack up with this disposable income ranking data.

Using PopaDex’s Calculator for Quick and Accurate Results

While you can certainly calculate your disposable income by hand, using a dedicated tool saves you time and helps avoid costly mistakes. Why wrestle with confusing tax tables when an automated solution can calculate disposable income for you in seconds? The PopaDex tool is built for precision, automatically factoring in regional tax differences and various income streams that are a headache to track on your own.

How to Get Your Calculation

Getting your number is straightforward. Just enter your gross income, specify your tax jurisdiction, and the calculator does all the heavy lifting. It instantly applies the correct federal and state tax rates, so the final figure is as accurate as possible. This is especially helpful for anyone with a more complex financial life, like freelancers or people juggling multiple jobs.

Here is a look at the simple interface you’ll use.

The clean layout lets you input your gross income and state to receive an immediate, easy-to-understand breakdown of your disposable income.

Beyond the Bottom Line

The real advantage of our calculator is its ability to model different financial situations. Are you considering a new job offer in another state? You can see right away how the change in income and taxes will affect your finances. For instance, a $5,000 raise in a high-tax state like California might give you less disposable income than the same raise in a state with no income tax.

This feature lets you test-drive major financial decisions before you commit. It gives you the confidence to plan for a big purchase, like a house, or to find ways to optimize your tax strategy. The calculator transforms a simple math problem into a powerful financial planning exercise.

Maximizing Your Disposable Income Through Smart Planning

Now that you have a clear picture of your finances, you can shift from simply calculating to actively growing your disposable income. The real goal isn’t just about earning more; it’s about keeping more of what you earn. This involves a dual strategy: boosting your gross income while finding smart, legal ways to lower your tax obligations.

Strategic Tax Reduction

Lowering your taxable income is one of the most direct ways to increase the money in your pocket at the end of the month. This often means taking full advantage of tax-advantaged accounts and deductions that many people overlook.

A few key strategies include:

- Maximizing retirement contributions: Funneling money into a 401(k) or traditional IRA lowers your taxable income for the year, giving you an immediate win and a future one.

- Using Health Savings Accounts (HSAs): If you’re eligible, HSAs are a triple tax threat. Contributions are tax-deductible, the money grows tax-free, and withdrawals for qualified medical expenses are also tax-free.

- Reviewing all possible deductions: Don’t leave money on the table. Be sure to claim deductions you’re entitled to, like those for student loan interest or certain self-employment expenses.

For those with diverse income streams, such as from real estate, understanding specific tax rules is crucial. For instance, if you have rental properties, getting familiar with the details of the Netherlands Rental Income Tax can be a critical part of your financial planning.

The table below outlines some common strategies tailored to different income levels, showing how you can be tactical regardless of how much you earn.

| Income Level | Tax Strategies | Income Optimization | Expected Impact |

|---|---|---|---|

| Low-to-Mid Income | Maximize tax credits (EITC, Child Tax Credit), contribute to a Roth IRA, utilize HSAs if available. | Focus on high-impact skills, negotiate for small but regular raises, explore side gigs with low startup costs. | Moderate: Small, consistent gains can free up hundreds of dollars per month for savings or debt reduction. |

| Mid-to-High Income | Maximize 401(k)/403(b) contributions, explore tax-loss harvesting in investment accounts, itemize deductions. | Negotiate for stock options or bonuses, invest in income-generating assets (e.g., dividend stocks), start a small business. | Significant: Strategic tax and income moves can increase disposable income by 10-20% annually. |

| High Income | Use donor-advised funds for charitable giving, invest in municipal bonds, consider advanced retirement plans (e.g., solo 401k). | Diversify income sources (real estate, angel investing), optimize business structures for tax efficiency. | High: Advanced strategies can preserve a substantial portion of earnings from taxes, leading to major increases in after-tax income. |

As you can see, the methods change, but the principle of smart planning remains the same across all income brackets. The key is to be proactive about both what you earn and what you keep.

Boosting Your Income Intelligently

Beyond specific tax tactics, it’s wise to look at your financial situation within the broader economic context. For example, disposable personal income in the U.S. recently climbed to $22,361.7 billion in early 2025, signaling a trend of steady growth. You can discover more about U.S. income dynamics to see how your personal progress compares to national trends.

This bigger picture can inform your career moves. Consider negotiating your salary based on estimated take-home pay, not just the gross number. Exploring ways to automate your finances can also create more breathing room by ensuring bills are paid on time and savings goals are met without constant effort, leaving you with more discretionary cash.

Putting Your Disposable Income Knowledge to Work

Now that you have an accurate number, you can go beyond theory and use your disposable income to build the life you want. This figure is the foundation of any solid financial plan, turning abstract goals into concrete, achievable targets. It’s the difference between wishing you could save more and creating a realistic savings plan that actually sticks.

From Calculation to Action

Think of your disposable income as the real starting point for your monthly budget. This isn’t about restriction; it’s about directing your money with purpose. For instance, financial planners often use this number as a first step to figure out how much house you can genuinely afford without feeling stretched thin. It helps answer critical questions like:

- Can I realistically increase my retirement contributions by $200 a month?

- Will taking that vacation derail my goal of paying off my car loan ahead of schedule?

- How much can I safely invest each month without feeling the pinch?

By grounding your financial choices in this real-world figure, you shift from guesswork to strategic planning. For more tips on getting your financial life in order, check out our guide on how to organize your finances.

Tracking Your Progress Over Time

Your financial life isn’t static, and neither is your disposable income. A raise, a new job, or paying off a big debt will all change your numbers. That’s why it’s a good idea to periodically calculate disposable income—maybe quarterly or after any major life event. This lets you adjust your strategy as your circumstances change, keeping your financial plan relevant and effective. Tracking these shifts gives you clear benchmarks to measure your progress and build genuine, long-term financial security.

Ready to see your entire financial picture in one place? PopaDex helps you consolidate all your accounts into a simple dashboard, so you can track your net worth and make smarter decisions with confidence. Start your free trial today!