Our Marketing Team at PopaDex

Using a Car Loan Amortization Calculator to Save Money

A car loan amortization calculator is a digital tool that maps out your loan payments, showing you exactly how much of your money goes toward the actual car (the principal) and how much goes to the lender (the interest) over time. It gives you a detailed payment schedule, revealing how you can save money and own your vehicle faster.

What Is Car Loan Amortization Anyway?

Think of your car loan as a long road trip. You know the final destination—owning your car free and clear—but the journey can feel a bit foggy without a clear map. A car loan amortization calculator is that map. It gives you a turn-by-turn guide showing exactly where every dollar of your monthly payment is going.

At its core, amortization is just the process of paying off a debt over time with regular, fixed payments. It sounds complicated, but it’s a simple idea: each payment you make is split into two parts.

- Principal: This is the actual amount you borrowed to buy the car. Every dollar that goes toward the principal reduces your debt and builds your equity.

- Interest: This is the fee the lender charges for the privilege of borrowing their money. It’s the cost of the loan, and it doesn’t reduce what you owe on the car itself.

The Front-Loaded Nature of Interest

Here’s the part that catches most people by surprise: at the beginning of your loan, a bigger chunk of your payment goes straight to interest. As you keep making payments, that balance slowly shifts. More and more of your money starts hitting the principal, which helps you pay off the loan faster.

Understanding this front-loaded structure is the first step toward really taking control of your loan.

An amortization schedule does more than just show you numbers; it tells the story of your loan. It reveals how even a small extra payment can dramatically shorten your journey and cut down the total cost of your vehicle.

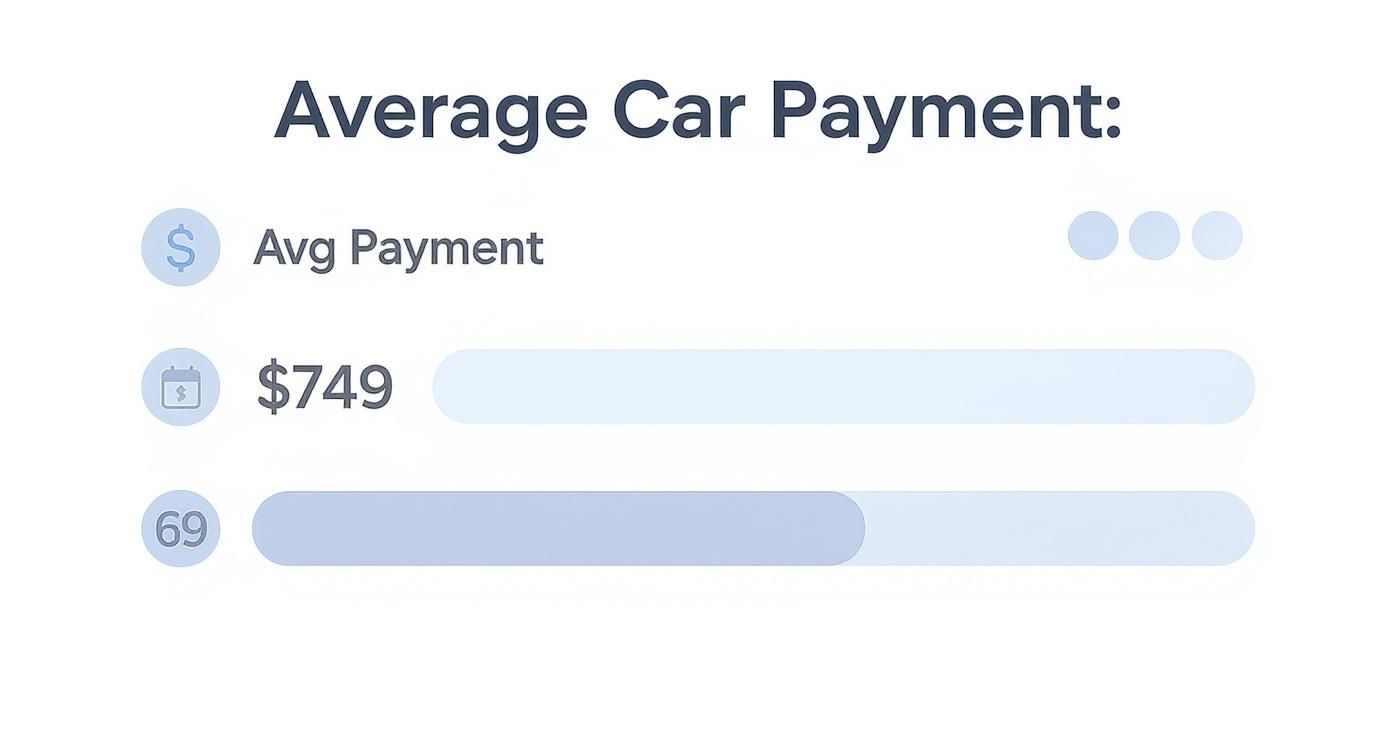

This knowledge is more critical than ever as loan dynamics change. The average monthly payment for new cars recently climbed to $749, with loan terms stretching to nearly 69 months. A clear amortization schedule helps you manage these rising costs and sidestep paying more interest than you absolutely have to. You can explore more data on current auto debt trends to see the bigger picture.

Ultimately, a car loan amortization calculator transforms you from a passive payer into an empowered car owner. It pulls back the curtain on the loan process, letting you see the financial impact of every single payment and make strategic moves to save money and reach your goal sooner.

How to Use a Car Loan Amortization Calculator

Think of a car loan amortization calculator as a cheat sheet for your auto financing. It cuts through the confusing numbers and tells a clear story about your payments, taking all the guesswork out of the equation. Best of all, you only need three simple pieces of info to get started.

First things first, you’ll need to gather the basic details of your loan. Don’t worry, you won’t need to dig through complex financial documents—these are just the simple figures from any loan offer. Consider them the coordinates for your financial GPS.

The Three Essential Inputs for Your Calculator

To get a clear picture of your loan, any good car loan amortization calculator will ask for these three core details:

- Total Loan Amount: This is the price of the car after your down payment and any trade-in value have been subtracted. It’s the exact amount of money you’re borrowing from the lender.

- Annual Interest Rate (APR): This is the percentage the lender charges you for borrowing the money, and it includes any associated fees. Your credit score plays a huge role in determining this number.

- Loan Term: This is simply how long you have to repay the loan. It’s usually shown in months, like 36, 48, 60, or 72 months.

Once you plug in these three numbers, the calculator does the heavy lifting and instantly spits out a full amortization schedule.

The chart below gives you a sense of the national average for car payments and loan terms, which can be a helpful baseline to see how your own loan stacks up.

This data makes one thing clear: a lot of people are financing large amounts over long periods. That makes it even more critical to understand exactly where every single one of your payments is going.

Running a Sample Loan Calculation

Let’s walk through a real-world example to see this tool in action. Imagine you’re taking out a $30,000 loan for a new car. The lender offers you a 6% interest rate on a 60-month (5-year) term.

You would simply pop these numbers into the calculator’s fields. A typical online tool like Calculator.net’s auto loan calculator makes this incredibly straightforward.

The calculator will immediately process this and tell you your estimated monthly payment, which in this case would be around $580 per month. But the real magic isn’t just that monthly number—it’s the detailed schedule that comes with it.

How to Read Your Amortization Schedule

The output you get is called an amortization schedule, which is just a fancy term for a month-by-month breakdown of your entire loan. It’s a table showing every single payment from day one until the car is officially yours. This isn’t just a list of dates; it’s a financial roadmap revealing how your loan actually works.

Understanding your amortization schedule is the key to moving from being a passive borrower to an active manager of your debt. It shows you the precise impact of every dollar you pay.

Let’s break down the first few months of our $30,000 loan example to see how to read the table.

Sample Amortization Schedule Breakdown (First 6 Months)

Here’s a look at the first six payments for our sample $30,000 car loan at 6% interest over 60 months. Notice how each $580 payment gets split between paying down the loan (principal) and paying the lender (interest).

| Payment # | Monthly Payment | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $580.00 | $430.00 | $150.00 | $29,570.00 |

| 2 | $580.00 | $432.15 | $147.85 | $29,137.85 |

| 3 | $580.00 | $434.31 | $145.69 | $28,703.54 |

| 4 | $580.00 | $436.48 | $143.52 | $28,267.06 |

| 5 | $580.00 | $438.67 | $141.33 | $27,828.39 |

| 6 | $580.00 | $440.86 | $139.14 | $27,387.53 |

See the pattern? With your very first payment, a whopping $150 goes straight to interest. But by the sixth payment, that amount has already dropped to $139.14. At the same time, the portion paying down your actual debt—the principal—steadily climbs each month.

This is proof of how your payments gain momentum over time, chipping away more of the loan balance with every check you write.

This kind of step-by-step clarity builds confidence and shows that a car loan amortization calculator is a powerful, approachable tool for anyone. When you see the numbers laid out this clearly, you can start spotting opportunities to save money and pay off your car much faster.

Why Your Credit Score Shapes Your Car Loan

When you’re looking at a car loan, one number rules them all: the interest rate. It’s the price you pay to borrow money, and the key that unlocks a low rate is your credit score. Think of it as your financial report card—and lenders are paying close attention.

A great score tells lenders you’re a reliable borrower, and they’ll reward you with their best offers. It’s like getting a VIP discount. On the flip side, a lower score signals more risk, and that risk comes with a higher price tag. We’re not talking about a few bucks here and there; the difference can easily run into thousands of dollars over the life of the loan.

Seeing the Difference with the Calculator

This is where playing with a car loan amortization calculator becomes so powerful. Instead of just hearing that a good score matters, you can plug in different interest rates and see exactly how it impacts your wallet. It makes the abstract concept of “interest” painfully concrete.

Let’s run a quick side-by-side comparison to see what this looks like in the real world. We’ll imagine two different people buying the exact same car with a $30,000 loan over a 60-month (5-year) term.

- Borrower A: Has an excellent credit score and locks in a great 5% interest rate.

- Borrower B: Has a fair-to-poor credit score and gets stuck with a 15% interest rate.

The results from the calculator are stunning. The monthly payment difference alone is a major wake-up call.

Your credit score isn’t just a gatekeeper for loan approval—it actively determines the total cost of your car. A few points can be the difference between a comfortable payment and a serious financial strain.

Borrower A is looking at a monthly payment of about $566. Borrower B, for the same car, now has a payment of $714. That’s an extra $148 every single month.

The True Cost of a Weaker Score

That monthly difference is just the beginning. The real shock comes when you look at the total interest paid over the five years. This is where the true cost of that higher rate becomes clear.

| Borrower Profile | Interest Rate | Monthly Payment | Total Interest Paid |

|---|---|---|---|

| Borrower A | 5% | ~$566 | ~$3,968 |

| Borrower B | 15% | ~$714 | ~$12,839 |

Just look at that. Borrower B will pay nearly $9,000 extra in interest over the loan term. That’s a huge chunk of money that could have gone into savings, investments, or paying down other debt—all gone, just because of a lower credit score. This is precisely why checking and boosting your score before you even set foot in a dealership is one of the smartest money moves you can make.

How Lenders See It: Credit Tiers and Rates

This isn’t just a hypothetical exercise. Lenders literally group applicants into tiers based on their credit scores, with each tier getting a different range of interest rates. The data doesn’t lie.

For example, Experian’s auto finance market report shows that borrowers with “super prime” scores (781-850) were recently getting new car loans with average rates of just 5.18%. Meanwhile, those in the “deep subprime” category (300-500) were facing average rates of a staggering 15.81%.

Of course, your score isn’t the only thing lenders look at. They also care about your debt-to-income (DTI) ratio. A low DTI shows them you can comfortably handle another monthly payment, making you an even more attractive borrower. It’s a good idea to learn how to calculate your debt-to-income ratio to see where you stand.

By using an amortization calculator to model these scenarios, you’re no longer in the dark. You can see exactly what’s on the line, giving you a powerful reason to get your credit in shape and shop around for the best loan you can find.

Ready to Pay Off Your Car Loan Faster? Here’s How.

Knowing how your car loan works is one thing, but now it’s time to take action. Just making the minimum payment will eventually get you there, but if you’re proactive, you can cross the finish line faster and with more money in your pocket. Think of it as having a playbook to conquer your debt, not just carry it.

Let’s dive into two of the most effective ways to speed things up. Both of these strategies lean on the power of a car loan amortization calculator to give you a clear advantage, helping you save cash and own your car outright much sooner.

Make Extra Principal Payments

One of the smartest moves you can make is to pay more than the minimum each month. It might not seem like much, but even a small extra payment has a massive impact because it goes straight to the principal—the actual amount you borrowed.

Here’s why that matters: interest is calculated on your remaining balance. When you knock down the principal faster, you shrink the balance that interest gets charged on for every single future payment. This creates a snowball effect, shortening your loan term and slashing the total interest you end up paying.

Just be sure to tell your lender to apply the extra cash directly to the principal. If you don’t, some lenders might just hold it and apply it to your next month’s payment, which completely cancels out the benefit.

Think of your loan principal like a big block of ice, and the interest is the sun beating down on it. Every extra payment you make is like moving that block into the shade—it slows down the melting (interest) and saves more of the original block (your money).

Let’s go back to our earlier example: a $30,000 loan at a 6% interest rate for 60 months. Your standard payment is right around $580. But what if you decided to round up and toss an extra $50 at it every month?

The difference might surprise you.

The Impact of an Extra $50 a Month

Here’s a side-by-side look at what that small, consistent change can do.

| Metric | Standard Payment ($580/month) | With Extra $50 ($630/month) | Your Savings |

|---|---|---|---|

| Loan Payoff Time | 60 Months | 55 Months | 5 Months |

| Total Interest Paid | ~$4,799 | ~$4,360 | ~$439 |

Just by adding $50 a month, you’d own your car five months sooner and keep over $400 in interest from ever leaving your bank account. A car loan amortization calculator is your best friend here. You can play around with different amounts—$25, $75, even $100—to see what fits your budget and how much you could save. The goal is to find a sweet spot that accelerates your payoff without squeezing your finances too tight.

Consider Refinancing Your Loan

Refinancing is another killer strategy. It’s simple: you take out a new loan, hopefully with a better interest rate, to pay off your current one. You’re essentially trading in your old, more expensive loan for a new, cheaper model.

This isn’t the right move for everyone, but in the right situation, it’s a total game-changer. Refinancing makes the most sense if:

- Your Credit Score Has Improved: If you’ve been on top of your payments, your score has probably climbed since you first got the loan. A higher score often unlocks a much lower interest rate.

- Market Interest Rates Have Dropped: Sometimes the market does the work for you. If rates have fallen across the board, you might qualify for a better loan even if your credit score hasn’t changed.

A lower interest rate means more of each payment hits the principal, speeding up your payoff and cutting your total costs. Before you pull the trigger, use a car loan amortization calculator to compare your current loan schedule with the potential new one. This will give you a clear, numbers-based look at how much you stand to save. Just be sure to factor in any fees for the new loan to make sure the savings are real.

If you’re juggling multiple debts, it’s smart to see how these strategies fit into your overall financial picture. A debt payoff calculator spreadsheet can help you visualize how paying down your car loan faster impacts your entire portfolio, giving you the clarity to make the best decisions for your money.

Fitting Your Car Loan Into Your Financial Goals

Your car loan isn’t just another monthly bill to check off the list—it’s an active piece of your larger financial puzzle. If you only see it as a payment going out, you’re missing the bigger picture. In reality, every single payment you make is a small but meaningful step toward building your wealth.

As you chip away at your loan, the portion of your payment that hits the principal directly increases your ownership stake in the vehicle. This slow, steady process of turning debt into an asset is one of the most fundamental ways you build your net worth over time. It’s a quiet climb, but a crucial one.

Tools that give you a complete financial overview, like PopaDex, are designed to show you this progress in real-time. By integrating your auto loan alongside your savings, investments, and other assets, you can actually see how paying down your car contributes to your overall financial health.

Connecting Your Loan to Long-Term Goals

Understanding your car loan’s trajectory is the key to smarter long-term planning. When you use a car loan amortization calculator, you’re not just crunching numbers; you’re gaining the clarity you need to set and hit bigger financial milestones.

This insight helps you answer the important questions about your future, like:

- When can I start saving for a down payment? Knowing your loan’s exact payoff date gives you a clear timeline for when that monthly payment can be redirected toward a home.

- How much can I really afford to invest? Seeing the total interest you’ll pay helps you make informed choices about where your money will work hardest for you.

- Can I take on another financial commitment? A clear view of your debt-payoff schedule gives you the confidence to plan for other major life events without guessing.

You can take this a step further by using a dedicated financial goal setting worksheet to map out these milestones with real precision. This turns your loan data from a simple liability into an actionable roadmap for your future.

Why a Clear Payoff Plan Is Crucial Today

Having a responsible borrowing strategy is more important now than ever. The latest market trends show a growing number of borrowers are feeling the financial strain. Currently, 5.0% of all outstanding auto debt is at least 90 days delinquent, which is a significant 12.6% jump from the previous year.

These figures aren’t just statistics; they’re a clear signal that building a realistic budget and having a solid plan is essential for long-term stability. A car loan amortization calculator is your best friend here, helping you create a payment plan that works with your entire budget and gives you peace of mind.

Your auto loan shouldn’t be a source of stress. By treating it as a strategic component of your net worth, you transform a simple liability into a tool for building wealth and achieving your most important financial goals.

When you’re planning a car purchase, it’s also vital to compare electric vehicle costs—from the upfront price to charging and long-term ownership—to accurately fit the loan into your financial strategy. This complete view ensures your car payment supports, rather than hinders, your progress. By connecting these dots, you can confidently steer your finances in the right direction.

Common Questions About Car Loan Amortization

Once you’ve driven off the lot and started making payments, a few questions always seem to pop up. A car loan is a multi-year commitment, so it’s completely normal to think about the details as your own financial picture changes. Let’s tackle some of the most common questions people have.

Think of this as your practical guide to managing your auto loan like a pro, clearing up any confusion so you can steer your finances with confidence.

Can I Get an Amortization Schedule from My Lender?

Yes, and you absolutely should. While a car loan amortization calculator gives you a fantastic roadmap from day one, the official schedule from your lender is the definitive document.

Most lenders make this available right inside your online account portal. If you don’t see it there, a quick call or a message to customer service will usually do the trick. Having their official schedule is perfect for double-checking that your numbers match theirs, ensuring there are no surprises down the road. It’s the single source of truth for your loan.

What Happens If I Make a Large Lump-Sum Payment?

Dropping a lump sum on your loan—say, from a bonus or tax refund—is one of the smartest financial moves you can make. When you do this, the entire payment should go straight to your principal balance, which is like hitting the fast-forward button on your loan.

By knocking down the principal, you immediately shrink the balance that your lender uses to calculate interest. The result? Every future payment will chip away more principal and less interest, saving you a ton of money over time.

A lump-sum payment doesn’t just lower what you owe; it fundamentally rewrites the rest of your loan’s story. It’s a shortcut that can save you a significant amount in future interest payments and get you debt-free months or even years sooner.

But here’s the critical step: you have to tell your lender exactly how to apply the money. Be explicit that the entire amount is a principal-only payment. If you don’t, some lenders might just apply it to your next few monthly payments, which completely wipes out the interest-saving benefit. Always get confirmation that it was applied correctly.

Will Paying Off My Car Loan Early Hurt My Credit Score?

This is probably one of the biggest myths in the world of auto loans, but the answer is mostly reassuring. Paying off your car loan early is a great financial decision and will not meaningfully hurt your credit score in the long run.

However, you might see a tiny, temporary dip in your score right after the loan is closed. This happens for a couple of technical reasons:

- Credit Mix: Lenders like to see that you can handle different kinds of credit (like installment loans and credit cards). Closing the car loan removes one of those active accounts from your “mix.”

- Average Age of Accounts: Closing an older account can slightly lower the average age of your credit history, which is a small factor in your score.

Honestly, this small dip is nothing to worry about. The overwhelming positive of being debt-free—like freeing up hundreds of dollars in your budget and saving all that future interest—is far more valuable than a few temporary credit score points. Ultimately, paying off debt is always a win for your overall financial health.

Ready to see your car loan as part of your complete financial picture? PopaDex helps you track your auto debt alongside all your other assets and liabilities, giving you a clear view of your growing net worth. Start tracking your financial progress with PopaDex today.