Our Marketing Team at PopaDex

7 Best Easy Expense Tracker Tools for 2025

Managing your money shouldn’t feel like a chore. In a world of complex financial products and fluctuating incomes, gaining a clear picture of where your money goes is the first, essential step toward financial freedom. Many people, however, are deterred by complicated software and tedious manual entry. This is precisely where an easy expense tracker becomes a game-changer. It’s not just about logging receipts; it’s about transforming raw data into actionable insights that empower you to save more, invest smarter, and eliminate financial stress.

A great tool simplifies this process, automating the heavy lifting so you can focus on making informed decisions. Whether you’re a freelancer tracking business costs, a young professional managing household budgets, or an investor monitoring portfolio growth, the right tracker provides an effortless, real-time overview of your financial health. This guide is designed to help you find that perfect tool.

We will explore seven of the best easy expense trackers available today, from comprehensive digital platforms like PopaDex and Monarch Money to straightforward analog solutions. For each option, we provide a detailed breakdown of features, pricing, and ideal use cases, complete with screenshots and direct links, so you can quickly identify the perfect fit for your specific financial goals.

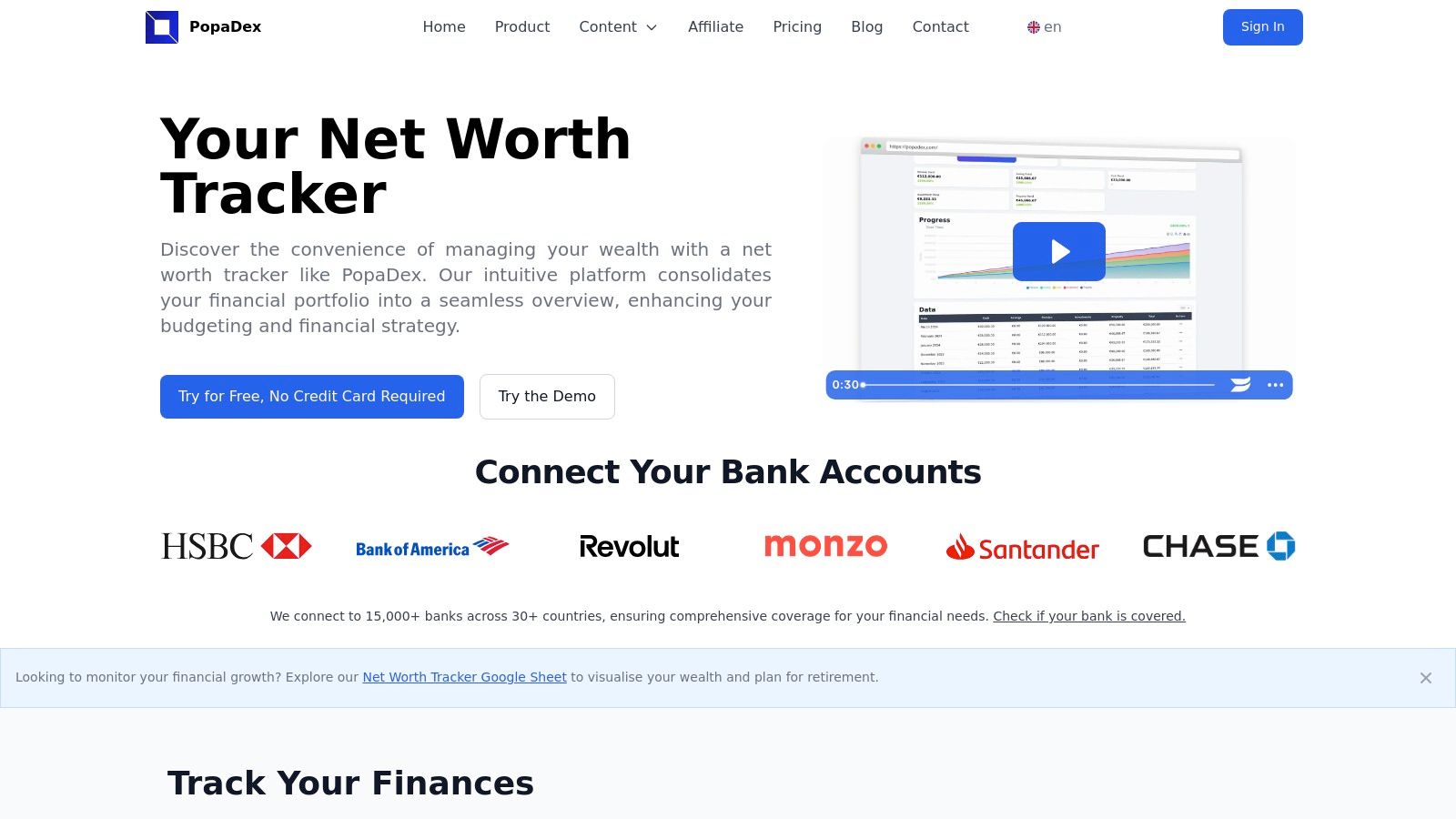

1. PopaDex: The All-in-One Net Worth and Easy Expense Tracker

PopaDex earns its top spot by fundamentally shifting the goal of financial tracking from simply monitoring expenses to actively building wealth. It positions itself as a holistic financial command center, providing a powerful, consolidated view of your entire financial landscape. Instead of just logging where your money goes, PopaDex helps you understand what your money is doing by integrating daily spending with long-term assets like investments, property, and savings. This comprehensive approach provides unparalleled clarity and makes it an exceptionally powerful, yet easy expense tracker for anyone serious about their financial future.

Key Features and Capabilities

PopaDex stands out with a feature set designed for a complete financial overview. Its interactive dashboards are the core of the user experience, visualizing net worth growth over time and allowing you to see the impact of your financial decisions in real time. This goes far beyond a simple list of transactions.

The platform’s most significant advantage is its global integration. With support for over 15,000 banks in more than 30 countries, it effortlessly handles multiple currencies, making it the ideal solution for expats, global citizens, or anyone with international assets. This removes the friction of managing finances across borders, consolidating everything into one clean interface.

Pricing and Accessibility

PopaDex offers a uniquely accessible entry point with a robust Free Standard plan. This tier allows users to manually aggregate all their financial accounts, providing a complete net worth picture without any cost. It’s a perfect starting point for getting organized.

For just €5 per month, the Premium plan unlocks the platform’s full potential by automating the entire process. It syncs with all your linked accounts, providing a real-time, effortless financial overview. This plan also includes access to advanced financial insights and upcoming features like a personalized AI co-pilot.

Expert Tip: Start with the free manual plan to build your financial dashboard. This helps you understand your assets and liabilities on a deeper level. You can upgrade to Premium later to automate the updates once your framework is in place.

Practical Use and User Experience

The platform is designed for clarity and action. Users can leverage tools like the disposable income calculator to make informed budgeting decisions or use the provided Google Sheets and Excel templates to perform deeper, custom analysis. This blend of automated insights and manual flexibility caters to both hands-off users and detail-oriented planners.

The user interface is clean and intuitive, focusing on data visualization that simplifies complex financial data. With a strong commitment to privacy, responsive customer support, and a 30-day money-back guarantee, PopaDex provides a secure and risk-free environment to take control of your finances.

- Best For: Individuals aiming for a holistic view of their wealth, expats managing multi-currency assets, and tech-savvy users who want powerful automation.

- Website: PopaDex.com

2. Monarch Money

Monarch Money is a modern, all-in-one financial platform designed for clarity and ease of use, making it an excellent easy expense tracker for individuals, couples, and families. It positions itself as a premium alternative to services like Mint, focusing on a clean, ad-free user experience and robust features that simplify how you see your complete financial picture. The platform excels at automatically syncing and categorizing transactions from an unlimited number of accounts, including banks, credit cards, investments, and even assets like your home or car.

What truly sets Monarch apart is its collaborative approach. You can invite a partner, family member, or financial advisor to your dashboard, allowing everyone to stay on the same page with shared goals and spending habits. This cooperative feature is integrated seamlessly, making household financial management transparent and straightforward.

Key Features and User Experience

Monarch’s interface is intentionally minimalist and intuitive, which significantly lowers the learning curve for new users. Instead of overwhelming you with complex charts, it presents your financial data in a way that’s immediately understandable.

- Comprehensive Connections: It syncs with a vast array of institutions, including tricky ones like Apple Card, and pulls in values from Zillow for real estate and other sources for vehicle valuations.

- Flexible Budgeting: You can budget using traditional categories or create custom groups, like “Monthly Bills” or “Kid’s Expenses,” for a more personalized overview.

- Forward-Looking Tools: The platform includes features to track recurring bills and subscriptions, along with cash flow projections to help you plan for the future.

Pricing and Access

Monarch Money operates on a subscription model, reinforcing its commitment to privacy and an ad-free experience.

| Plan | Price (Billed Annually) | Trial Period | Key Benefit |

|---|---|---|---|

| Premium | $14.99/month or $99.99/year | 7-day free trial | Full access to all features, including unlimited connections and collaboration. |

While there’s no permanent free tier, the free trial offers ample time to connect your accounts and determine if it’s the right fit. This subscription-based model ensures your data is not sold to third parties. For those looking to build a comprehensive financial overview, exploring a personal finance dashboard can provide deeper insights. Learn more about creating a personal finance dashboard.

Website: https://www.monarchmoney.com

3. Simplifi by Quicken

From the creators of the long-standing financial software Quicken, Simplifi is a modern and streamlined tool designed to be a “powerfully easy” expense tracker. It’s built for the user who wants a clear, automated overview of their daily financial life without the complexity of traditional accounting software. Simplifi excels at aggregating all your financial accounts, including checking, savings, credit cards, loans, and investments, into a single, intuitive dashboard, making it an ideal choice for those migrating from services like Mint or anyone seeking simplicity.

What makes Simplifi stand out is its focus on a personalized spending plan rather than a rigid, category-based budget. It automatically projects your income and bills to show you what’s left to spend, offering a more flexible and realistic approach to managing money. This forward-looking perspective helps you make informed spending decisions on the fly.

Key Features and User Experience

Simplifi is praised for its approachable setup and clean interface, which makes daily check-ins quick and painless. It presents your financial data with clarity, focusing on what matters most: your current cash flow and progress toward your goals. The app is designed to provide actionable insights with minimal effort.

- Personalized Spending Plan: Instead of strict budgets, Simplifi calculates your available spending money after accounting for income, bills, and savings goals.

- Watchlists & Projections: You can create custom watchlists to monitor specific spending categories and use the projected cash flow feature to see the future impact of your financial decisions.

- All-in-One Tracking: Beyond spending, it helps you track savings goals, manage recurring subscriptions, and monitor your credit score, all within one platform.

Pricing and Access

Simplifi operates on a subscription model, ensuring an ad-free experience and a strong commitment to user privacy. Its pricing is competitive, though it’s important to be aware of potential renewal rate changes.

| Plan | Price (Billed Annually) | Trial Period | Key Benefit |

|---|---|---|---|

| Simplifi | Varies, typically around $3.99/month | 30-day free trial | Full access to all features, including account aggregation and spending plan. |

The generous trial period provides ample time to connect accounts and test its features thoroughly. While Simplifi itself is a paid service, many of the best free budgeting apps offer similar foundational features that might be sufficient for some users. Find a comprehensive list of the best free budgeting apps.

Website: https://www.quicken.com/simplifi

4. Rocket Money (formerly Truebill)

Rocket Money, formerly known as Truebill, is a powerful and easy expense tracker designed to put your finances on autopilot, with a unique strength in managing and eliminating unwanted recurring expenses. It excels at providing a clear overview of where your money is going by automatically importing and categorizing transactions from your connected financial accounts. The platform is particularly effective for users who suspect they are overpaying for subscriptions or have forgotten about services they no longer use.

What makes Rocket Money stand out is its aggressive focus on cutting costs. The app actively identifies all your recurring bills and subscriptions, from streaming services to gym memberships, and presents them in a single, easy-to-manage list. This focus on “financial hygiene” helps users quickly spot and cancel services that are draining their budgets, making it more than just a passive tracker.

Key Features and User Experience

Rocket Money’s interface is designed for action, guiding you from identifying spending patterns to taking steps to improve them. Its dashboard provides a quick snapshot of your cash flow, recent spending, and upcoming bills, which is perfect for a daily financial check-in.

- Subscription Cancellation Service: For a fee, the Premium plan offers a concierge service that will cancel unwanted subscriptions on your behalf, saving you the time and hassle of dealing with customer service.

- Automated Budgeting: The app helps you create a simple budget based on your spending history and tracks your progress in real-time, sending alerts if you are nearing your category limits.

- Bill Negotiation: Rocket Money can also negotiate with service providers like cable, internet, and cell phone companies to try and lower your monthly bills, taking a percentage of the savings as its fee.

Pricing and Access

Rocket Money offers a robust free version and a unique pricing model for its Premium features, allowing users to choose what they pay.

| Plan | Price (Billed Annually) | Trial Period | Key Benefit |

|---|---|---|---|

| Free | $0 | N/A | Core expense tracking, manual cancellations, and budget creation. |

| Premium | $4-12/month (user-selected) | 7-day free trial | Automated cancellations, bill negotiation, smart savings accounts, and full data export. |

The free plan is sufficient for basic expense tracking and identifying subscriptions you can cancel yourself. The “pay-what-you-think-is-fair” sliding scale for the Premium plan is an interesting approach, though the lowest available price can vary. This model makes advanced features accessible while empowering users to find hidden savings.

Website: https://www.rocketmoney.com

5. Tiller (for Google Sheets and Microsoft Excel)

Tiller bridges the gap between manual spreadsheets and fully automated apps, creating a powerful easy expense tracker for those who love the control of a spreadsheet but hate manual data entry. It’s a unique service that securely feeds all your daily transactions and balances from banks, credit cards, and investment accounts directly into Google Sheets or Microsoft Excel. This approach is ideal for spreadsheet enthusiasts and former Mint users who want total command over their financial data without sacrificing automation.

What makes Tiller stand out is its commitment to privacy and customization. Unlike app-based trackers, your financial data lives in your own private spreadsheets, which you own and control completely. You can use Tiller’s library of pre-built templates for budgeting, debt tracking, and net worth analysis, or build a completely custom dashboard from scratch to see your finances exactly how you want.

Key Features and User Experience

Tiller is built around the familiar interface of a spreadsheet, which can have a slight learning curve but offers unmatched flexibility once you’re comfortable. The platform’s core strength is its reliable, automated bank feeds.

- Automated Daily Feeds: Tiller automatically imports your daily transactions and balances into your chosen spreadsheet, eliminating the tedious task of manual entry.

- Template Library: Access a wide range of ready-to-use templates for everything from a simple monthly budget to complex yearly financial planners.

- Full Customization: Because it’s in a spreadsheet, you can customize every single category, chart, and report. If you can do it in Excel or Google Sheets, you can do it with your Tiller data.

Pricing and Access

Tiller’s model is straightforward and privacy-focused, with a single subscription plan that ensures an ad-free experience where your data is never sold.

| Plan | Price (Billed Annually) | Trial Period | Key Benefit |

|---|---|---|---|

| Annual Plan | $79/year | 30-day free trial | Full access to automated bank feeds for both Google Sheets and Excel, plus all templates. |

The generous 30-day trial provides plenty of time to connect your accounts, explore the templates, and decide if the spreadsheet-based workflow fits your style. For those looking to dive deeper into spreadsheet-based financial tracking, you can explore Tiller’s capabilities further. Learn more about maximizing your financial vision with Tiller.

Website: https://www.tillerhq.com

6. Microsoft Create – Free Budget and Expense Tracker Templates

For those who prefer a more hands-on and traditional approach, Microsoft Create offers an excellent easy expense tracker solution through its vast library of free templates. Instead of a dedicated app, it provides professionally designed Excel and Microsoft Word files for tracking everything from personal monthly budgets to small business expenses. This method is ideal for users who are already comfortable with the Microsoft Office suite and want full control over their data without subscriptions or cloud-based platforms.

What makes this resource stand out is its simplicity and familiarity. There’s no need to learn a new interface or link sensitive bank accounts. You simply download a template, customize it to your liking, and start entering your financial data. It’s a powerful way to manage your finances offline, ensuring complete privacy and giving you the flexibility to adapt the tracker to your specific needs, whether that’s adding new categories or creating custom charts.

Key Features and User Experience

The primary benefit of using Microsoft’s templates is leveraging the powerful features of Excel, a tool many already know how to use. This significantly flattens the learning curve and provides a sense of ownership over your financial data.

- Diverse Template Library: Find dozens of free templates, including simple monthly budgets, detailed family budgets, expense calculators, and even wedding budget planners.

- Complete Customization: Every template is fully editable. You can change categories, colors, formulas, and layouts to create a tracker that perfectly matches your financial life.

- Offline Access and Privacy: Since your data is stored locally on your computer, you maintain full control and privacy. It’s a great option for those wary of connecting financial accounts to online apps.

Pricing and Access

The key advantage of Microsoft Create’s templates is that they are completely free. This model makes financial tracking accessible to everyone with access to Microsoft Office.

| Plan | Price | Key Benefit |

|---|---|---|

| Template Downloads | Completely Free | Unlimited access to a wide variety of customizable Excel and Word templates. |

This no-cost approach is perfect for beginners who want to learn the fundamentals of budgeting without a financial commitment. Beyond dedicated apps, many also find value in readily available simple financial statement templates, which can be a great starting point for manual tracking or integrating with tools like Excel.

Website: https://create.microsoft.com/en-us/templates/budgets

7. Amazon – Expense Tracker Notebooks and Ledgers

For those who find digital tools distracting or overly complex, the ultimate easy expense tracker might be a classic pen-and-paper notebook. Amazon offers a vast marketplace for these tools, from simple account books to detailed budget planners. This analog method provides a tangible, focused way to record income and expenses without the need for software installation, account syncing, or even an internet connection, making it incredibly straightforward for anyone to start immediately.

What makes Amazon a standout source is the sheer variety and accessibility. You can find ledgers specifically designed for small businesses, undated monthly planners for flexible budgeting, and notebooks with pockets for receipts. With extensive user reviews and fast Prime shipping, you can have a dedicated expense tracker in your hands within a day or two, offering a refreshing, screen-free approach to managing your finances.

Key Features and User Experience

The primary benefit of a physical ledger is its simplicity. There is no learning curve; you simply open the book and start writing. This method is particularly effective for tracking cash spending or managing finances for a specific side-hustle where you want to keep records separate.

- Tactile and Focused: The physical act of writing down each expense can make you more mindful of your spending habits compared to automated digital entries.

- Highly Customizable: You are not limited by an app’s pre-set categories. You can structure your ledger exactly how you see fit, creating a system that is perfectly tailored to your life.

- Portable and Private: A notebook requires no battery and keeps your sensitive financial data completely offline and under your direct control.

Pricing and Access

Physical expense trackers are one of the most cost-effective financial tools available. The main cost is the one-time purchase of the notebook itself.

| Item Type | Average Price Range | Shipping | Key Benefit |

|---|---|---|---|

| Expense Tracker Notebook | $7 - $20 | Often Prime eligible | A low-cost, distraction-free way to manually log and review every transaction. |

The biggest drawback is the entirely manual process. You must calculate totals and analyze trends by hand, which can be time-consuming. However, for those seeking a simple, direct method to build financial awareness, a physical notebook is an excellent and incredibly easy expense tracker.

Website: https://www.amazon.com/Best-Sellers-Account-Books/zgbs/office-products/705338011

Easy Expense Tracker Comparison of Top 7 Tools

| Product | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| PopaDex | Moderate: Setup manual or automated (Premium) | Low to moderate: Free tier + affordable Premium | Clear net worth tracking and multi-asset overview | Individuals across wealth stages; multi-currency | Extensive bank integrations, interactive dashboards |

| Monarch Money | Low: User-friendly, minimal setup | Moderate: Subscription only, no free tier | Simple spending tracking and household collaboration | Beginners and families seeking clarity | Clean interface, strong collaboration, privacy |

| Simplifi by Quicken | Low: Quick setup, automated aggregation | Moderate: Paid plans, price varies | Daily spending overview and basic financial insights | Users migrating from Mint or needing simple dashboard | Approachable, strong brand trust, no ads |

| Rocket Money (formerly Truebill) | Low to moderate: Easy start, subscription for Premium | Low: Free tier + Premium subscription | Subscription and expense tracking, cost savings | Users focused on managing recurring subscriptions | Free plan, subscription cancellation concierge |

| Tiller (Google Sheets & Excel) | High: Spreadsheet setup with automation | Moderate to high: Subscription, spreadsheet skills | Automated spreadsheet expense tracking | Spreadsheet enthusiasts wanting automation | Highly customizable, no ads, strong user community |

| Microsoft Create – Excel Templates | Low: Manual or semi-automated with templates | Very low: Free downloadable files | Basic budgeting and expense tracking | Users preferring offline manual or semi-automated tracking | Free, familiar Excel environment, good tutorials |

| Amazon – Expense Tracker Notebooks | Very low: No tech, purely manual | Very low: Cost of notebook only | Manual recording without automation | Users preferring analog tracking or cash-based systems | Very low cost, distraction free, portable |

From Tracking Expenses to Building Your Future

We’ve explored a diverse landscape of tools, each offering a unique path to financial clarity. From the powerful, automated dashboards of dedicated apps to the tactile satisfaction of a physical ledger, the central message is clear: the best easy expense tracker is the one you will consistently use. The journey from financial ambiguity to confident control begins not with choosing the perfect tool, but with the simple commitment to start tracking.

This list was designed to cater to a wide array of financial personalities and goals. Whether you are a gig worker managing fluctuating income, a young professional building your first serious budget, or an investor optimizing your portfolio, there is a solution here for you. The key is to recognize that these tools are not just about recording transactions; they are about revealing the story your money tells.

Finding Your Perfect Match

Selecting the right tool is a personal decision that hinges on your specific needs and preferences. To guide your choice, consider these questions:

- What is your primary goal? Are you trying to eliminate debt, maximize savings, or simply understand where your money goes each month? A goal-oriented app like Monarch Money might be ideal, while a simple notebook could suffice for basic awareness.

- How much automation do you want? If you value a hands-off approach, platforms like PopaDex, Simplifi, and Rocket Money that sync with your bank accounts are powerful allies. If you prefer manual control and customization, a Tiller spreadsheet or a physical notebook offers unparalleled flexibility.

- What is your budget for the tool itself? We’ve covered everything from premium subscriptions to completely free options like Microsoft’s templates. Your budget for the tool should align with the value you expect to receive from it.

Your Next Actionable Steps

Choosing a tool is just the beginning. The real transformation happens when you integrate it into your daily or weekly routine. Start small to build momentum. Commit to spending just five minutes each day or fifteen minutes each week reviewing your expenses. Set a recurring calendar reminder to hold yourself accountable.

Remember, the goal is not perfection, but progress. You might miss a day or forget to categorize a purchase, and that’s okay. The power of using an easy expense tracker comes from the cumulative insights you gain over time. Consistent tracking illuminates spending patterns you never knew you had, identifies opportunities for significant savings, and empowers you to make intentional decisions that align your spending with your most important life goals. This simple habit is the foundation upon which financial freedom is built, turning abstract dreams of the future into a tangible, achievable plan.

Ready to turn your financial data into a clear action plan? PopaDex was built to be the ultimate easy expense tracker and portfolio management tool, connecting all your accounts in one secure place. Go beyond simple tracking and start building your future with powerful insights and automated clarity. Try PopaDex today to take the first step towards mastering your money.