Our Marketing Team at PopaDex

A Guide to Your Best Financial Goal Tracker

Think of a financial goal tracker as a roadmap for your money. It’s what turns vague dreams like “saving more” into real, actionable targets. Instead of a dusty, static spreadsheet, it’s a living system that shows you exactly where you stand and what you need to do next to get where you want to go.

What Is a Financial Goal Tracker Anyway?

Ever tried to plan a cross-country road trip without a map or a GPS? You might know you want to get from New York to California, but you have no clue which roads to take, how much gas you’ll need, or how long it’ll even take. Managing your money without a dedicated system feels a lot like that—aimless, confusing, and pretty overwhelming.

A financial goal tracker cuts through that fog by giving you a clear, structured framework. It’s a system built to help you define, monitor, and actually manage your progress toward specific financial objectives. It’s all about turning abstract wishes into tangible milestones.

Instead of a fuzzy goal like “save for a down payment,” a tracker forces you to get specific: “Save $20,000 for a house down payment by contributing $834 per month for the next 24 months.” That simple shift from abstract to concrete is the first—and most powerful—step toward actually making it happen.

From Vague Hopes to Actionable Plans

At its core, a financial goal tracker is designed to break down intimidating objectives into small, manageable steps. It builds a bridge between your future ambitions and your daily financial habits, making the whole process feel much less like climbing a mountain. This is precisely why so many people are ditching guesswork for structured planning.

In fact, setting clear financial targets is becoming the norm. A recent survey revealed that 65% of Americans set a savings goal for the year. The most popular targets? Saving for a vacation (33%) and finally building that emergency fund (31%). A financial goal tracker is the engine that takes those good intentions and turns them into results. You can dive deeper into these trends in the NerdWallet midyear check-in report.

The Key Benefits of Using a Tracker

A dedicated tracking system gives you much more than just a bit of organization. It delivers some serious psychological and practical advantages that instill the discipline needed to stay on track, especially when progress feels slow.

Let’s break down exactly what a good tracker brings to the table.

Key Benefits of Using a Financial Goal Tracker

| Benefit | Description | Real-World Impact |

|---|---|---|

| Clarity and Focus | Forces you to define exactly what you want and by when, removing all ambiguity. | Your goal shifts from a vague “I want to retire someday” to a clear “I need to invest $500/month for 25 years.” |

| Enhanced Motivation | Visual progress—like a bar graph filling up or a debt balance shrinking—provides a powerful psychological boost. | Seeing your mortgage principal drop every month makes you excited to make the next payment, rather than dreading it. |

| Accountability | The tracker acts as a constant, objective reminder of your commitments, making it harder to stray from your plan. | You’re less likely to make an impulse purchase when you know it will push back your car savings goal by two months. |

Ultimately, a financial goal tracker isn’t just about the numbers; it’s about shaping your behavior. It’s the tool that provides the structure, insight, and encouragement you need to turn your financial dreams into your reality, one small, consistent step at a time.

The Building Blocks of a Great Tracker

What really separates a powerful financial goal tracker from a glorified to-do list? It’s not just about writing down your dreams. It’s about having a system with the right pieces, all designed to push you into action and keep you going.

Think of it like building a high-performance car. A chassis and four wheels aren’t enough. You need an engine for power, a dashboard for feedback, and a GPS to guide you. In the same way, an effective financial goal tracker needs its own set of essential components to get you across the finish line.

The Foundation: SMART Goal Definition

Every successful financial journey starts with crystal-clear direction. A vague goal like “save for a vacation” is almost impossible to track because you’ve never defined what “done” looks like. The best trackers force you to set SMART goals—that’s Specific, Measurable, Achievable, Relevant, and Time-bound.

This simple framework turns a fuzzy wish into a concrete plan. Instead of just wanting a trip, you create a real target: “I will save $3,000 for a trip to Italy by putting aside $250 every month for the next 12 months.” Suddenly, it’s not a dream; it’s a plan with clear steps and a deadline. The best trackers make this the non-negotiable first step for every goal.

Visualizing Your Progress

Let’s face it, humans are visual creatures. Seeing a debt balance shrink in a spreadsheet is okay, but watching a “Debt Freedom” bar fill up delivers a much more powerful psychological punch. This is where progress visualization becomes a game-changer.

Good trackers don’t just show you numbers; they tell a story of your success with compelling visuals. These features tap directly into your brain’s reward system, making the whole process feel less like a chore and more like a motivating game.

Key visualization tools usually include:

- Progress Bars: Give you an instant snapshot of how close you are, offering a quick hit of motivation.

- Donut or Pie Charts: Perfect for savings goals, they show how your contributions are piling up over time.

- Burn-down Charts: Visually reinforce your hard work by showing a debt balance consistently dropping.

These visual aids make your progress tangible, keeping you hooked and focused on the end goal.

A study on goal achievement found that vivid visualization can significantly increase the likelihood of success. By seeing your goal progress, you activate the brain’s reticular activating system (RAS), which helps filter information and subconsciously directs your focus toward actions that align with your objective.

Automation and Timely Notifications

Life is busy. Manually updating your progress is one of those tasks that can easily get pushed to the bottom of the list. A top-tier financial goal tracker eliminates this friction with automation. Many apps can link directly to your bank accounts, automatically pulling in transactions and updating your goal progress without you having to do a thing.

This automation ensures your tracker is always giving you an accurate, real-time picture of where you stand. But it’s not just about syncing. Smart notifications are what keep you in the game.

A great system will ping you when:

- A milestone is reached: Celebrating small wins, like saving your first $1,000, builds incredible momentum.

- A contribution is due: A gentle nudge is all it takes to stay on schedule.

- You’re falling behind: An early warning gives you time to adjust your strategy before you get too far off track.

Together, these features create a support system. They handle the boring stuff, cheer you on, and offer a little course correction when you need it, making it far easier to stay consistent and hit your financial targets.

Finding the Right Financial Goal Tracker for You

The most important feature of any financial tool isn’t its bells and whistles—it’s whether you’ll actually use it. A fancy app with a dozen features is worthless if it’s too complicated, and a simple spreadsheet won’t do much good if you find it too boring to update. The “best” financial goal tracker is the one that clicks with your personality, your daily habits, and the current complexity of your financial life.

Choosing the right system means being honest about your own style. Do you want technology to handle all the heavy lifting, or do you prefer to get your hands dirty with every single detail? Your answer is the key to finding the right kind of tracker.

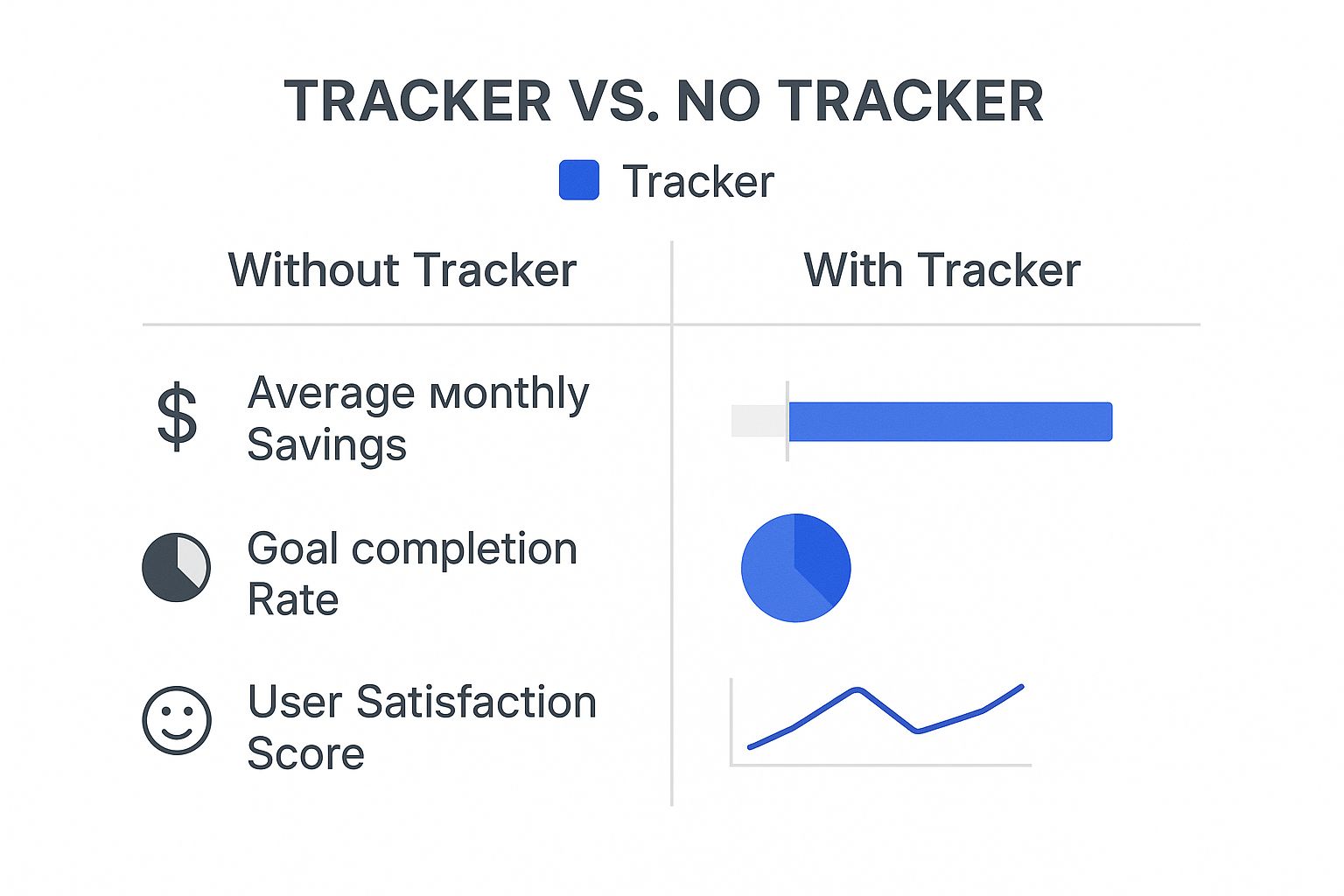

The image below shows just how powerful finding and using a tracker can be.

As you can see, people who actively use a tracker tend to save more each month and hit their goals more often. That translates into feeling much better about your financial progress.

Identify Your User Style

When it comes to managing money, most of us fall into one of three camps. Figure out which one sounds most like you, and you’ll be on the right track to finding a tool you’ll stick with.

-

The Hands-Off Automator: You’re all about convenience and efficiency. The thought of manually typing in every coffee purchase is your worst nightmare. You need a “set it and forget it” system that hooks up to your bank accounts, sorts your spending automatically, and updates your goals while you sleep.

-

The DIY Controller: You’re meticulous, detail-oriented, and you trust your own system above all else. You want total control and the ability to customize exactly how your finances are organized. Giving an app your bank login makes you nervous, and you love the idea of building your own perfect tracker in a spreadsheet.

-

The All-in-One Investor: For you, saving and investing are two sides of the same coin. Your financial life is closely tied to your investment portfolio, so you want your goal tracking built right into your brokerage platform. You need to see how your market gains are directly impacting your progress toward that next big goal.

Comparing Your Tracker Options

Once you know your style, you can start looking at the tools that fit. Each type has its own set of pros and cons related to cost, security, and what it can do. It’s often helpful to see how similar systems work in other areas—for example, the principles behind the best job search tracker tools are all about organization and progress monitoring, just like with finances.

The goal is to match the tool to the user, not the other way around. Forcing a DIY Controller into an automated app is a recipe for disaster, just like handing a Hands-Off Automator a blank spreadsheet is asking for it to be abandoned.

To make it easier, I’ve broken down the most common types of trackers.

Comparison of Financial Goal Tracker Types

This table gives you a quick look at the main options out there, helping you weigh the trade-offs and find what works for you.

| Tracker Type | Best For | Pros | Cons | Example Tools |

|---|---|---|---|---|

| Budgeting Apps | The Hands-Off Automator | Automatic bank syncing, real-time updates, cool visual charts, easy mobile access. | Often have monthly fees, less room for customization, and potential privacy concerns. | Mint, YNAB, Empower Personal Dashboard |

| Spreadsheets | The DIY Controller | 100% customizable, completely private, totally free, and great for super-detailed analysis. | Needs manual data entry, easy to make mistakes, and can take a while to set up just right. | Google Sheets, Microsoft Excel |

| Brokerage Platforms | The All-in-One Investor | Connects seamlessly with your investments and gives you a single view of your financial world. | Usually limited to that specific brokerage and might not have detailed budgeting features. | Fidelity, Vanguard, Charles Schwab |

Ultimately, picking a financial goal tracker is a personal call. Think about your comfort level with tech, how much time you’re willing to spend on it, and where you want your financial data to live. The aim is to find a system that feels easy and makes you feel in control.

And remember, as your finances grow, you might want to see an even bigger picture. A great next step is to see how a net worth tracker can work alongside your goal tracker to give you a complete view of your wealth.

Setting Up Your Tracker for Success

This is where the rubber meets the road. Knowing what a tracker is is one thing, but actually building a system that works for you is how you turn wishes into reality. The good news? This isn’t some complex, weekend-long project. You can get a powerful financial goal tracker up and running in under an hour.

This is where the rubber meets the road. Knowing what a tracker is is one thing, but actually building a system that works for you is how you turn wishes into reality. The good news? This isn’t some complex, weekend-long project. You can get a powerful financial goal tracker up and running in under an hour.

To show you how it’s done, let’s follow a simple example. We’ll walk through the exact steps someone—let’s call him Alex—would take to save for a new car. By following along, you’ll have a clear blueprint to build your own system from the ground up.

Step 1: Prioritize Your Top Goals

First things first: focus. Juggling ten different goals at once is a surefire way to get overwhelmed and burn out. Instead, start by picking your top one to three financial priorities. This forces you to get honest about what really matters to you right now.

For Alex, the goal is crystal clear: save $5,000 for a down payment on a reliable used car within the next 18 months. That single-minded focus makes the whole process feel much more achievable. He’s not thinking about retirement or a vacation yet—he’s zeroed in on his most pressing need.

This idea of honing in on specific targets is the bedrock of any solid financial plan. If you’re struggling to nail down your own objectives, our guide to financial goal setting offers a great framework.

Step 2: Gather Your Key Financial Data

Next, you need to know your starting point. Don’t worry, you don’t need a decade’s worth of bank statements. You just need a few key numbers to get a realistic snapshot of where you are today. Think of it as establishing a baseline, not conducting a full-blown financial audit.

Pull together these essential figures:

- Monthly Take-Home Pay: Your income after all taxes and deductions.

- Fixed Monthly Expenses: Things like rent/mortgage, utilities, and car payments.

- Variable Monthly Spending: Your best guess for groceries, gas, dining out, etc.

- Current Savings: How much have you already put toward this specific goal?

Alex crunches the numbers and finds his take-home pay, lists his non-negotiable bills, and has a small “aha” moment when he sees how much he’s spending on food delivery. He already has $500 tucked away for the car. This quick snapshot gives him the context he needs for the next step.

Step 3: Configure Your Tracker and Schedule

With your goal defined and your numbers in hand, it’s time to plug everything into your chosen tool. Whether you’re using an app, a spreadsheet, or a dedicated notebook, this is where your plan takes shape. Enter your target amount ($5,000), your starting point ($500), and your deadline (18 months).

Your financial goal tracker will do the math. For Alex, it’s simple: he needs to save another $4,500 over 18 months. That breaks down to $250 per month. Suddenly, it’s not a vague dream; it’s a concrete, actionable target. The final move? He sets up an automatic transfer of $250 from his checking to a separate savings account, scheduled for the first of every month.

A critical part of this setup is grounding your goals in reality. Experts emphasize that successful tracking relies on targets that are not only measurable but also adjustable. A solid foundation includes having an emergency fund covering 6 to 9 months of expenses and prioritizing high-interest debt reduction to free up more resources for your goals.

Step 4: Establish a Simple Review Cadence

Finally, decide how often you’ll check in. The goal here is to strike a balance between staying engaged and becoming obsessive. Staring at your tracker every day can be counterproductive, but ignoring it completely defeats the purpose.

A simple but highly effective rhythm is:

- A Weekly Check-in: A quick, 5-minute glance to make sure your contribution went through and to watch that progress bar inch forward. It’s a great little motivational hit.

- A Monthly Review: A 15-minute session to look over your spending, confirm you’re on track, and make any small adjustments for the month ahead.

Alex decides to check his tracker every Sunday morning with his coffee. It’s a simple ritual that keeps him connected to his goal without adding any stress to his week. By following these four steps, he’s built a fully functional system that’s ready to guide him from day one.

Using Advanced Strategies to Accelerate Your Goals

Alright, once your financial goal tracker is set up and humming along, you’ve officially graduated from the basics. It’s time to put your foot on the gas. Now we can unlock its true power by bringing in some advanced strategies to seriously speed up your progress.

This is about more than just chipping away at a single savings goal. We’re talking about orchestrating a complete financial strategy—one that lets you chase multiple dreams at once, roll with life’s inevitable punches, and shield your money from forces like inflation. Let’s dive into how you can take your tracking game to the next level.

Juggling Multiple Competing Goals

Most of us are balancing more than one financial priority. You might be aggressively paying down student loans while also saving for a wedding and trying to max out your retirement funds. A basic tracker shows these as separate, competing goals, which can easily make you feel stretched thin and like you aren’t making real headway on anything.

An advanced approach is all about strategic prioritization right inside your tracker. Instead of giving each goal an equal slice of your savings, you rank them. For example, you could decide to funnel 60% of your available savings toward high-interest debt, send 30% to your wedding fund, and put the remaining 10% toward long-term retirement. Your tracker then shows you exactly how this focused allocation changes your timelines, helping you make conscious trade-offs instead of feeling stuck.

Master the Art of Goal Stacking

One of the most powerful techniques for seasoned tracker users is goal stacking. The strategy is simple: you line up your financial goals one after another and use the cash flow from a completed goal to supercharge the next one in line. Think of it like a snowball rolling downhill—it just keeps picking up more mass and speed.

Here’s how it works in the real world:

- Focus on Goal #1: You throw all your extra funds at demolishing your highest-interest credit card debt.

- Complete and Redirect: Once that debt is gone, you don’t just let that freed-up monthly payment get absorbed back into your budget.

- Accelerate Goal #2: You immediately point that entire payment amount (plus anything else you can spare) toward your next priority, like building your emergency fund.

This method creates an incredible sense of momentum. Your financial goal tracker becomes a visual testament to this power, showing how each win fuels the next, shrinking your timelines and making those bigger goals feel much more achievable.

The core idea behind goal stacking is turning past achievements into future fuel. By systematically redirecting freed-up cash flow, you create a compounding effect on your savings rate, allowing you to tackle larger financial hurdles with increasing speed and confidence.

Building a Resilient Financial Plan

A financial plan is only as good as its ability to handle change. Life happens. You might get a promotion, get hit with an unexpected medical bill, or need to help out a family member. Your tracker has to be agile enough to adapt. To really get ahead, you can incorporate smart strategies like optimizing your Health Savings Accounts directly into your tracking and planning.

This proactive mindset also applies to bigger economic forces. Global trends have a direct line to our personal finances. With moderate global economic growth and lingering inflation risks, it’s clear we need robust savings strategies. An effective goal tracker helps you build resilience against these kinds of economic shocks. By regularly adjusting your contributions to stay ahead of inflation, you make sure your money keeps its purchasing power, keeping your long-term goals firmly on track.

Staying Motivated When Progress Feels Slow

Let’s get real for a moment. The hardest part of any financial plan isn’t crunching the numbers—it’s staying in the game when your goal feels like it’s a million miles away. It’s a marathon, not a sprint.

It’s easy to feel pumped up when you first start. But after a few months of diligent saving, you check your tracker, and that progress bar has barely budged. That’s when the enthusiasm drains away, and what was once exciting starts to feel like a chore. This is the exact point where most people give up.

But the secret to pushing through isn’t some superhuman level of willpower. It’s about building a smarter system that keeps you going, even when you feel like quitting. Your financial goal tracker is a huge part of that system, but only if you use it with the right mindset.

Reframe Your Mindset From Perfection to Consistency

One of the fastest ways to kill your motivation is trying to be perfect. You set an aggressive savings goal, miss it by a little one month, and suddenly feel like a failure. It’s so tempting to just throw your hands up and say, “What’s the point?”

Don’t fall into that trap. Shift your focus to consistency over perfection.

So what if you only saved half of what you planned? That’s still progress! Getting that smaller amount into your savings and logging it in your tracker is infinitely better than saving nothing because you felt defeated. This small change in perspective turns your tracker from a rigid report card into a tool that celebrates forward motion, which is how real wealth gets built.

A neat trick for staying motivated involves your brain’s reticular activating system (RAS). When you consistently focus on your goals—even with small, imperfect actions—you’re basically training your subconscious to spot and prioritize opportunities that will help you succeed.

Celebrate Small Wins to Build Momentum

Big goals, like saving for a house down payment, can feel so abstract and far off that they lose their motivational power. The solution is to create smaller, more frequent wins for yourself along the way. Your financial goal tracker is the perfect tool for this.

Break down your massive goal into bite-sized milestones. For example, instead of just staring at the final $20,000 down payment number, make a point to celebrate:

- Saving your very first $1,000.

- Hitting the 10% completion mark.

- Making six monthly contributions in a row without fail.

Every time you hit one of these mini-goals, actually stop and acknowledge it. This creates a powerful positive feedback loop that makes the whole process feel more rewarding and less like a grind. The ultimate reward is watching these efforts compound, not just in your savings account, but in your overall financial picture. If you’re curious, you can learn more about how to increase net worth and see how these small steps contribute to a much bigger win.

Use Automation to Overcome Decision Fatigue

You make hundreds of little decisions every single day. Adding “Should I move money to savings today?” to that list creates what psychologists call decision fatigue. It’s a tiny bit of friction that, over time, makes you less likely to follow through.

The fix is beautifully simple: put it on autopilot.

Set up automatic transfers from your checking to your savings account right after you get paid. This one move takes willpower and emotion completely out of the equation. Your savings just grow quietly in the background, your tracker updates itself, and you can focus your mental energy on the bigger picture.

Common Questions About Using a Financial Tracker

Even the slickest financial system will spark a few questions once you start using it day-to-day. As you get into the rhythm of tracking your goals, some practical uncertainties are bound to pop up. Here are our answers to the most common ones, so you can move forward with confidence.

How Often Should I Check My Tracker?

Finding the right cadence for checking your progress is all about balance. You want to stay engaged without becoming obsessive. While there’s no single magic number, most people find success with a simple two-tiered approach.

We suggest a quick, five-minute weekly check-in. This is just enough time to confirm you’ve made your contributions, glance at your progress, and get that little hit of motivation. Then, schedule a more in-depth monthly review. Block out 15-20 minutes to look at the bigger picture, see how your spending aligns with your goals, and make any tweaks for the month ahead.

What Happens If I Miss a Savings Contribution?

First off, take a deep breath. One missed contribution won’t sink your financial ship. The real danger is falling into an all-or-nothing mindset and abandoning your plan entirely. Remember, consistency over perfection is the name of the game.

The best response to a setback is curiosity, not criticism. Figure out why you missed the payment—was it an unexpected car repair or just a bit of overspending? This isn’t about blame; it’s about gathering data to make your plan even more resilient.

When a contribution gets missed, try this no-shame game plan:

- Analyze the “Why”: Get to the root cause. If it was a one-time emergency, just focus on getting back on track next month.

- Adjust if Needed: Are you consistently coming up short? That might be a signal that your contribution goal is a bit too ambitious for your current budget. It’s far better to lower the amount to something you can hit every single time.

- Focus Forward: What’s done is done. Concentrate on nailing your next contribution and building momentum from here.

Can I Use a Tracker for Debt Repayment?

Absolutely. In fact, a financial goal tracker is a powerhouse tool for demolishing debt. There’s a huge psychological and visual payoff that comes from watching a debt balance shrink, which is incredibly motivating when the finish line feels far away.

You can set up each of your debts—like a credit card, student loan, or car payment—as its own “goal” inside your tracker. This gives you a crystal-clear way to manage popular debt-reduction strategies. For instance, you can visually track your progress using the debt snowball (paying off the smallest balances first) or the debt avalanche (targeting the highest-interest debts). Watching those balances hit zero one by one turns a daunting challenge into a series of satisfying wins.

Ready to see all your financial goals—and your complete net worth—in one clear dashboard? PopaDex gives you the tools to track your progress with confidence. Start your free trial today at PopaDex.com.