Our Marketing Team at PopaDex

Your Guide to Financial Planning for Expats

When you’re building a life abroad, your finances get complicated—fast. Suddenly you’re dealing with multiple currencies, unfamiliar tax laws, and new banking systems. Having a clear financial framework isn’t just a nice-to-have; it’s the bedrock of a stable and successful expat experience.

This isn’t just about budgeting. It’s about creating a roadmap that guides your decisions on taxes, investments, and long-term goals like retirement. A proactive plan is what separates a stressful overseas experience from one where you feel secure and in control, no matter where your journey takes you.

Your Financial Framework For Life Abroad

Think of this framework as the blueprint for your financial life overseas. It’s what helps you stop reacting to financial surprises and start proactively managing your wealth. A solid system works for you, whether you’re an American in Germany grappling with citizenship-based taxation or a Canadian in London trying to manage a mortgage back home.

A good framework brings order to the chaos. It ensures you’ve covered all your bases, from day-to-day spending to preserving your wealth for the future.

The Core Pillars Of Your Financial Plan

Building a financial plan that can withstand the complexities of expat life means focusing on a few essential pillars. Each one tackles a specific challenge unique to those living and working across borders.

Here’s a breakdown of the core components every expat needs to address. Getting these right provides a strong foundation for everything else.

Core Pillars of Expat Financial Planning

| Pillar | Key Action | Why It Matters for Expats |

|---|---|---|

| Cross-Border Tax Plan | Understand residency vs. citizenship tax rules. | Prevents double taxation and ensures compliance with laws in both your home and host countries. |

| Multi-Currency Budget | Track income and expenses in all currencies. | Manages exchange rate risk and provides a true picture of your cash flow and spending habits. |

| International Banking | Open expat-friendly accounts. | Reduces transfer fees and simplifies moving money between countries for bills or investments. |

| Global Investment Strategy | Align assets with your risk and goals. | Ensures your portfolio grows effectively while accounting for currency and geopolitical risks. |

By addressing each of these pillars, you create a system that not only supports your current lifestyle but also builds a secure financial future.

Navigating The Global Financial Landscape

Financial planning is a dynamic process, especially for expats. The global financial health score held steady at 55 in Q1 2025, showing that while people are learning more, there’s still work to do. Even in strong labor markets like the US and Canada, many people still face significant debt—a challenge that becomes even more complex when you move abroad.

Your financial framework must be adaptable. Economic conditions in your host country can change, exchange rates fluctuate, and tax laws get updated. A plan that can evolve with your circumstances is non-negotiable.

Developing a robust plan means getting comfortable with concepts like risk management frameworks to protect your assets. When you systematically tackle these core financial areas, you build the confidence and peace of mind needed to truly enjoy your adventure.

Building a Realistic Expat Budget

First things first: mastering your cash flow is the foundation of financial stability when you live abroad. A regular budget you might have used back home often doesn’t cut it. Why? It’s just not built for the unique curveballs of expat life, like constant currency fluctuations and wildly different living costs. Your financial plan needs a complete overhaul, starting with a budget built for this new reality.

For example, if you move to Singapore, housing will likely gobble up a huge chunk of your income. But if you relocate to Mexico, you might find yourself spending more on travel and fun. A smart expat budget gets this. It adapts to your new local environment instead of trying to cram your new life into an old, ill-fitting financial box.

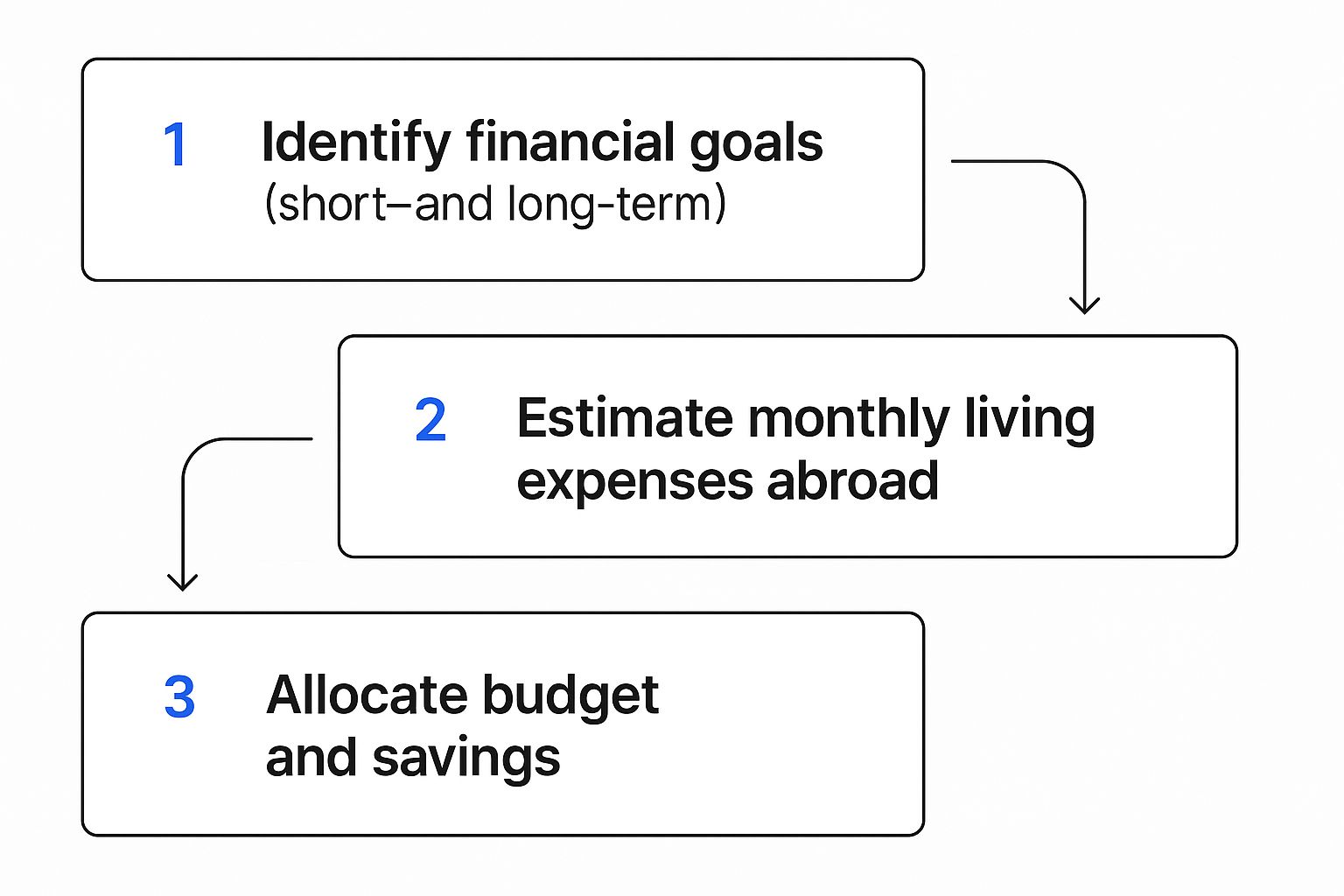

This breakdown shows the essential flow for putting together an expat budget that actually works.

As you can see, a solid budget isn’t just about tracking receipts. It starts with defining what you want to achieve, then moves to a real-world assessment of your new expenses before you start assigning your money to different categories.

Tracking Your Cross-Currency Spending

One of the biggest headaches for any expat is keeping track of spending in two (or more!) currencies. It’s incredibly easy to lose sight of where your money is going when you’re constantly doing mental math. The simplest solution is to pick one primary currency—usually the one you’re paid in or use for daily life—and convert every major expense back to that standard.

This trick gives you a single, clear picture of your financial health. It helps you dodge the common trap of thinking those “small” purchases in a foreign currency don’t add up. They do, and quickly. This method also helps you spot spending patterns and potential savings that would otherwise get lost in the noise of changing exchange rates. For a deeper dive, check out our guide on mastering budgeting for financial freedom.

Allocating Your Income Effectively

How you spend your money as an expat depends almost entirely on where you live. Data shows that essentials like housing and utilities can eat up 30–40% of an expat’s income, with healthcare taking another 8–12%. These numbers really drive home why your location is the biggest factor in your financial plan. Someone living in a lower-cost country like Thailand might save up to 25% of their income, but that figure plummets in expensive hubs like London or New York.

A successful expat budget isn’t just about tracking expenses. It’s about building dedicated funds for the unique costs of living abroad—things like visa renewals, surprise trips home, and unexpected tax bills.

Think of it as creating a financial safety net designed specifically for your international lifestyle. A great way to start is by sorting your spending into these buckets:

- Fixed Costs: The non-negotiables like rent, utilities, insurance, and loan payments.

- Variable Costs: Things that change month to month, like groceries, dining out, and transport.

- Expat-Specific Costs: The extras you wouldn’t have back home, like visa fees, international travel, and currency transfer fees.

- Long-Term Goals: The big picture stuff, including retirement savings, investments, and a down payment on a future property.

When you break your spending down this way, you get a clear, actionable budget that not only supports your life abroad but also keeps you moving toward your long-term financial goals.

How to Approach International Investing

When you move abroad, your financial life gets an upgrade—whether you’re ready for it or not. The simple banking and investment strategies that served you well back home can suddenly become clunky, expensive, or completely off-limits. It’s a common roadblock for expats, but one you can definitely navigate. With the right approach, you can keep your wealth growing no matter where you are.

The first, most practical step is to get a bank account built for a global life. Look for banks that specialize in multi-currency accounts, offer fair exchange rates, and don’t sting you with outrageous fees for international transfers. This single move will simplify managing money between your new country and your old one, saving you a surprising amount in conversion costs over the years.

Navigating Onshore and Offshore Investing

With your day-to-day banking sorted, your next big challenge is investing. Many U.S. brokerage firms, for example, will show you the door once they find out you live overseas. This isn’t because they don’t like you; it’s due to complex regulations like the Foreign Account Tax Compliance Act (FATCA) that make servicing American expats a massive headache for them.

This regulatory maze leaves you with two main paths for investing:

- Onshore Investing: This means using a brokerage based in the country where you currently live. The upside is that it can make your local tax reporting much simpler. The downside? You might lose access to familiar investment products, like the U.S.-based ETFs you’re used to.

- Offshore Investing: This involves using an international brokerage, often based in a third, financially-savvy jurisdiction like Singapore or the Channel Islands. These platforms are designed for a global audience and typically offer a much broader menu of investment options.

For many American expats, a smart solution is finding a U.S.-based financial advisor who specializes in working with people abroad. They often have relationships with expat-friendly custodians, letting you keep your access to U.S. markets while staying on the right side of the rules.

A word of warning for U.S. citizens: avoid buying foreign-domiciled mutual funds or ETFs. The IRS often classifies these as Passive Foreign Investment Companies (PFICs), triggering a nightmarish tax situation that can decimate your returns. It’s a costly mistake.

Building a Resilient Global Portfolio

A truly robust investment strategy needs to be diversified across more than just asset classes—it needs to be diversified across currencies, too. If all your investments are in U.S. dollars but you’re living in Spain, a strengthening euro could quietly shrink the purchasing power of your entire portfolio. You’re getting poorer without even realizing it.

As you build out your global portfolio, it’s wise to get comfortable with the tools of the trade. Learning how to understand stock analyst ratings, for instance, can help you sift through the noise and make sharper decisions.

Continuing Retirement Contributions

What about saving for the long haul? The great news is that you can usually keep contributing to your retirement accounts back home. An American abroad can often still fund an IRA, and a Brit can continue to build up their SIPP.

But—and this is a big but—you have to play by the rules. For U.S. expats, your ability to contribute to an IRA hinges on having “earned income” after you’ve applied tax breaks like the Foreign Earned Income Exclusion (FEIE). For 2025, the FEIE is projected to be around $130,000. If you use the exclusion to wipe out all of your reported income, the IRS says you have $0 of earned income. No earned income means no IRA contribution.

This is where careful tax planning becomes absolutely critical. You have to balance your tax-saving strategies with your retirement goals to make sure you can keep building that nest egg from afar.

Understanding Cross-Border Tax Compliance

Taxes are easily the biggest headache in financial planning for expats. I get it. But they don’t have to be a nightmare. The secret is getting a handle on a few core ideas that completely change how you approach reporting your income. Once you know the rules of the game, you can tackle your tax obligations with confidence and sidestep those costly mistakes.

The first major concept to grasp is the difference between tax systems. Most countries operate on residency-based taxation, which is simple: they only tax your worldwide income if you actually live there. The United States, however, is a huge exception. It uses citizenship-based taxation. This means that if you’re a U.S. citizen, you have to file a U.S. tax return and report your global income, no matter where you call home.

This dual obligation sounds scary, I know. But it almost never means paying taxes twice on the same dollar. That’s where tax treaties and foreign tax credits come in.

Avoiding Double Taxation

Thankfully, the U.S. has tax treaties with dozens of countries specifically designed to prevent double taxation. These agreements clarify which country gets the first crack at taxing different types of income. To properly manage this, you need a solid understanding of the regulatory and tax landscape in both your home and host countries.

American expats have two powerful tools to help manage this:

- Foreign Earned Income Exclusion (FEIE): This lets you exclude a large chunk of your foreign-earned income from U.S. taxes. For 2025, this figure is projected to be around $130,000. The catch? It only works for earned income like your salary, not passive income from investments or rent.

- Foreign Tax Credit (FTC): This is a fantastic tool. It gives you a dollar-for-dollar credit for taxes you’ve already paid to a foreign government. If you paid $15,000 in taxes in your new country, you can often claim a $15,000 credit to wipe out or reduce your U.S. tax bill.

Which one is better? It completely depends on your situation, especially the tax rate where you live. Choosing correctly between the FEIE and FTC is a cornerstone of smart cross-border financial planning.

Critical Reporting Requirements

Beyond your annual tax return, U.S. expats have other critical reporting duties. Let me be clear: ignoring these can lead to penalties that are far, far worse than any unpaid tax.

One of the most important is the Foreign Bank Account Report (FBAR), officially known as FinCEN Form 114. You are required to file this form if the combined value of all your foreign financial accounts tops $10,000 at any point during the year. A non-willful failure to file can start with a $10,000 penalty per violation. Ouch.

The FBAR threshold isn’t your average balance or what’s there on December 31st. It’s triggered if the total value of your accounts crosses $10,000 for even one day. This is a tiny detail that trips up a lot of expats.

On top of that, the Foreign Account Tax Compliance Act (FATCA) might require you to file Form 8938 if your foreign assets exceed certain higher thresholds. While it sounds similar to the FBAR, they are two separate filings with their own rules. Getting these compliance pieces right is absolutely non-negotiable for staying financially healthy while living abroad.

Finding a Trusted Expat Financial Advisor

While you can definitely manage your own finances as an expat, you might hit a wall where the complexity just gets to be too much. It happens. The unique challenges of a cross-border life—from baffling tax treaties to building a truly global investment portfolio—can quickly become overwhelming. This is where an advisor who lives and breathes expat finance becomes a game-changer.

They aren’t just dishing out generic advice. They’re providing specific solutions to problems you might not even know you have. Think of them as a specialist who understands the rulebooks for multiple countries at once.

When to Seek Professional Help

Knowing when you need help is the first, and most important, step. If any of these scenarios sound familiar, it’s probably time to start looking for a professional to guide your expat financial planning journey.

- You’re a U.S. citizen struggling to invest without tripping over regulations like FATCA or PFIC rules.

- You own property in more than one country and have no idea how to handle the tax implications.

- Your income lands in one currency, but your biggest expenses and savings goals are in another.

- You’re trying to figure out how to save for retirement with pension plans scattered across multiple countries.

A good advisor helps translate your goals—like buying a home or retiring comfortably—into a concrete strategy that actually works across borders.

The right advisor does more than manage investments; they bring clarity and confidence to your entire financial life abroad. They act as your long-term strategic partner, ensuring your financial decisions are coordinated and effective.

The global demand for this kind of expertise is definitely on the rise. In 2025, there are around 230,000 certified financial planners worldwide, a 3.1% jump from the previous year. This growth, especially in markets like the U.S. and U.K., shows just how many people need skilled pros who can handle the multi-currency, multi-jurisdictional puzzle of an increasingly mobile workforce. You can explore more global financial advisor statistics to see the trends for yourself.

What to Look For in an Expat Advisor

Finding the right person takes some real diligence. Not all financial advisors are equipped to handle the very specific needs of expatriates. To make sure they have the right experience, you need to ask the right questions.

Here are the key things I’d be asking any potential advisor:

Key Questions for a Potential Advisor

- Do you specialize in working with expats from my home country? An advisor who’s deeply familiar with your home country’s tax and investment laws is non-negotiable.

- How are you compensated? Always look for fee-only advisors. This means you pay them directly, not through commissions they get for selling you certain financial products. It keeps conflicts of interest out of the picture.

- What are your credentials? Look for key certifications like Certified Financial Planner (CFP) or other qualifications that are specific to cross-border planning.

- Can you provide references from other expat clients? Nothing beats hearing from current clients. It gives you a real-world feel for their expertise and how they operate.

Taking the time to properly vet advisors will pay off massively in the long run. You’ll end up with a trusted partner who can protect and grow your wealth, no matter where in the world you decide to call home.

Here are some of the most common money questions that trip up expats. Let’s get them sorted.

How Should I Handle My Retirement Savings?

Juggling retirement funds from different countries can feel like a mess. The first step is to get a handle on the rules for each pension or retirement plan you’ve paid into. Some countries have “totalization agreements,” which can be a huge help—they let you combine work periods from multiple countries to meet the minimum requirements for benefits.

For your personal investments, think about setting up an international or offshore account. These are built to accept your contributions no matter where you are on the map. If you’re a US citizen, for example, you can often keep putting money into your IRA, but there’s a catch: you need to have enough foreign earned income after taking deductions like the Foreign Earned Income Exclusion (FEIE).

Honestly, this is where a financial advisor who specializes in expat retirement is worth their weight in gold. They’ll help you build a smart withdrawal strategy that makes all your different pots of money work together, not against each other, when you eventually retire.

What’s the Best Way to Send Money Internationally?

The “best” way to move money between your home and host countries really boils down to how much you’re sending and how often.

For big, one-time transfers—like putting down a deposit on a new apartment—specialist currency exchange services are almost always the winner. Companies like Wise, Revolut, or OFX give you much better exchange rates and lower fees than your average high-street bank.

These services are great for smaller, regular transfers, too. Another option is to see if your international bank offers free or cheap transfers between its global accounts. If you bank with the same institution in both countries, this can be incredibly convenient. Always check both the exchange rate and the transfer fee before you hit send.

Should I Keep My Bank Accounts Back Home?

Yes. In almost every case, you should absolutely keep at least one bank account and a credit card in your home country. It’s your financial lifeline for any loose ends—paying leftover bills, receiving rental income, and, critically, keeping your credit history alive and well.

A credit card from your home country with no foreign transaction fees can be a lifesaver for travel or online shopping. It’s also a financial safety net that makes moving back home (or on to your next country) a whole lot smoother.

How Does Expat Health Insurance Work?

Health insurance is a non-negotiable for expats, but it’s also a minefield of confusing options. Generally, you’re looking at one of three paths:

- The Local System: You might be eligible to join the public health service in your host country.

- Local Private Insurance: This is a private plan based specifically in your new country.

- International Private Medical Insurance (IPMI): Often the most flexible and comprehensive choice. IPMI plans provide coverage across multiple countries, usually including short trips back to your home country.

IPMI plans typically come with higher coverage limits and give you access to a broader network of private hospitals and specialists. Many employers offer this as a standard part of their relocation packages. Whatever you choose, the most important thing is to ensure you have continuous, adequate coverage. Getting caught without it can lead to devastating medical bills.

Ready to stop guessing and finally see the complete picture of your global financial life?

With PopaDex, you can bring all your accounts—from banks in different countries to investments and property—into one clear, simple dashboard. Track your net worth in real-time and start making smarter decisions for your future.

Get started for free and take control of your financial planning.