Our Marketing Team at PopaDex

A Modern Financial Planning Software Comparison for Investors

When you put financial planning software head-to-head, a big gap appears. On one side, you have spreadsheets—they give you total manual control but have zero automation. On the other, you have dedicated software that offers real-time data aggregation, multi-currency support, and actual goal-oriented planning. Your choice really boils down to this: do you want a simple ledger or a dynamic tool that can handle a complex, modern portfolio?

Why Your Old Spreadsheet Is No Longer Enough

For years, spreadsheets were the default for anyone trying to get a handle on their finances. They’re familiar, flexible, and seem like the cheapest option. But as your financial life gets more interesting, that trusty spreadsheet quickly starts feeling like a liability.

Free template

Want to follow along?

Grab the free net worth tracker spreadsheet and apply these steps immediately.

The moment you add international assets, crypto, or holdings in multiple currencies, that simple tracking task turns into a messy, error-prone headache. The hidden costs and risks that come with manually converting bank statements to Excel are a perfect example of why old methods just don’t work anymore. Manual data entry isn’t just boring; it’s a wide-open door for small mistakes that can quietly throw off your entire net worth calculation.

The Limits of Manual Tracking

Let’s be honest: spreadsheets can’t keep up with the speed of modern wealth. They completely lack the automated data aggregation you need for a real-time, bird’s-eye view of your finances. Every time you want an update, you’re back on the hamster wheel—logging into a dozen accounts, downloading statements, and messing with formulas.

This manual grind creates some serious problems:

- No Real-Time Insights: Your financial picture is only as current as your last update. That means you’re always making decisions based on old news.

- Increased Risk of Errors: One little typo in a formula or a misplaced decimal point can lead to huge miscalculations that you might not spot for months.

- Lack of Scalability: As you add new investment accounts, properties, or side hustles, your spreadsheet becomes a monster that’s almost impossible to manage. If you’re still curious about this route, our guide to the best net worth tracking spreadsheet options offers more context.

- Poor Security: Keeping all your sensitive financial data in a local file without bank-level encryption is just asking for trouble.

The biggest problem with spreadsheets is that they are reactive, not proactive. They tell you where your money was. Modern financial planning software shows you where it is right now and helps you map out where it’s going.

Evaluating Modern Financial Tools

To do a proper financial planning software comparison, we need to agree on what matters. This guide will size up the leading platforms based on the features that actually help you achieve financial clarity and control.

| Evaluation Criteria | Why It Matters for Modern Investors |

|---|---|

| Data Aggregation | Automatically pulls together all your financial accounts—from banks to brokerages—giving you a complete picture without lifting a finger. |

| Multi-Currency Support | A must-have for expats, global citizens, or anyone with assets in different currencies. It’s the only way to get a true, unified net worth. |

| Automation vs. Manual | This is all about how much time you save. Automated tools handle the data entry and updates, so you can focus on strategy instead of chores. |

| Security Protocols | Makes sure your sensitive financial data is locked down with things like 256-bit encryption and multi-factor authentication. |

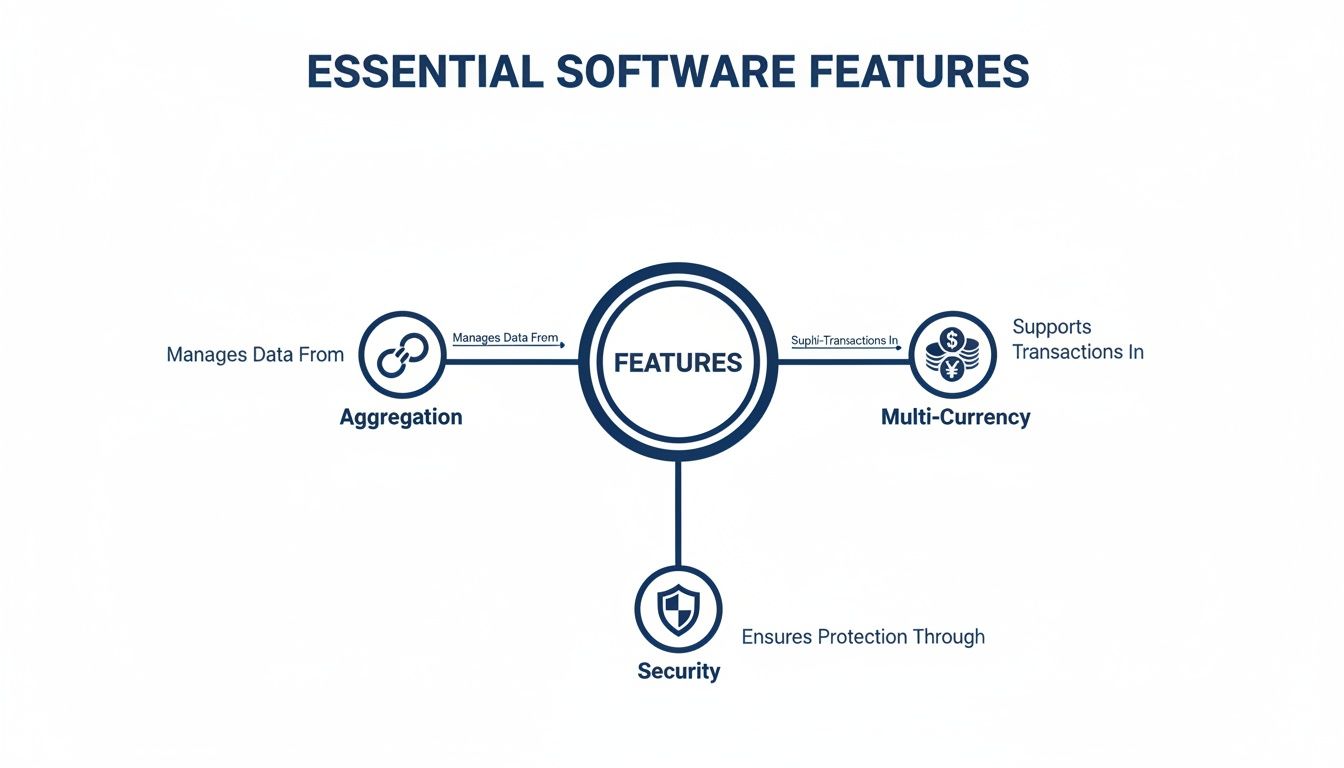

What to Look for in Financial Planning Software

When you’re comparing financial planning tools, it’s easy to get distracted by flashy charts and endless feature lists. But the real value isn’t in the bells and whistles—it’s in a handful of core functions that actually solve problems instead of creating new ones. Let’s cut through the noise and focus on the non-negotiables.

The absolute foundation of any modern platform is seamless account aggregation. This isn’t just about linking a bank account or two. It’s about creating a single, unified dashboard of your entire financial life: checking, savings, brokerage accounts, credit cards, mortgages, and even international assets, all updated automatically.

Without it, you’re stuck with the digital version of a shoebox full of receipts, manually logging into a dozen websites to piece together your own financial puzzle. For a self-employed professional with income scattered across multiple accounts, automated aggregation isn’t a perk; it’s a critical time-saver. You can learn more about how this works in our detailed guide to financial data aggregation.

True Multi-Currency Support

For anyone living, working, or investing across borders, this is the one feature that separates the genuinely useful tools from the completely useless ones. Plenty of US-centric platforms claim to handle multiple currencies, but what they often do is just show a converted value based on a single, daily exchange rate. This lazy approach completely misses the nuances of currency fluctuations and can paint a dangerously misleading picture of your net worth.

True multi-currency functionality delivers much more:

- Accurate Conversions: It should use real-time or near-real-time exchange rates for an up-to-the-minute valuation of your global assets.

- Historical Tracking: It must let you track an asset’s performance in its native currency, not just your home currency.

- A Holistic Net Worth: It has to consolidate assets held in USD, EUR, GBP, and others into one cohesive net worth figure.

Imagine an expat with a 401(k) in the US, a savings account in Germany, and property in the UK. This feature is the only way for them to get an unfiltered, accurate view of their financial health. Without it, they’re just guessing.

A financial planning tool that can’t handle multiple currencies properly is like a world map that only shows one country. You’re missing the bigger picture, and that’s a dangerous blind spot when managing global wealth.

Uncompromising Security

Let’s be clear: handing over access to your financial data requires an immense amount of trust. Top-tier security isn’t just a feature; it’s the absolute minimum requirement. The software you choose must protect your information with the same rigor as a major bank.

Look for platforms that are transparent about these security layers:

- Bank-Level Encryption: This means 256-bit AES encryption, the same standard used by global financial institutions to secure data both in transit and at rest.

- Multi-Factor Authentication (MFA): This is a critical barrier that requires you to verify your identity with a second method (like a code sent to your phone), stopping unauthorized access even if someone steals your password.

- Read-Only Access: The software should only ever have permission to view your account data, never to initiate transactions, move money, or make any changes.

Choosing a platform that skimps on these safeguards is a risk you just don’t need to take. The peace of mind that comes from knowing your sensitive data is locked down is priceless. These three pillars—aggregation, true multi-currency support, and hardcore security—are what separate a decent tool from one that can genuinely deliver clarity and control over your finances.

Comparing the Top Financial Planning Platforms

Picking the right financial planning software is a big decision, and honestly, the “best” one really depends on what you need. A great tool for a US-based investor might be totally useless for someone juggling assets in a few different countries. This is a head-to-head look at how PopaDex, Empower Personal Dashboard, and Monarch Money stack up against each other.

We’re going to dig deeper than just a simple feature list. We’ll look at how each platform actually works for real people by focusing on who they’re built for, how good their automation is, if they can handle multiple currencies, and what the true cost is. The idea is to give you a clear, practical way to make the right choice for your financial life.

This diagram breaks down the three pillars that any solid financial tool needs to have.

As you can see, it all comes down to reliable data aggregation, genuine multi-currency support, and rock-solid security. These aren’t just features; they’re the foundation of a platform you can actually trust with your finances.

Target Audience and Core Use Case

Before you look at any features, you have to ask: who was this tool actually built for? A platform designed for a US retiree has a completely different set of priorities than one made for a globetrotting professional.

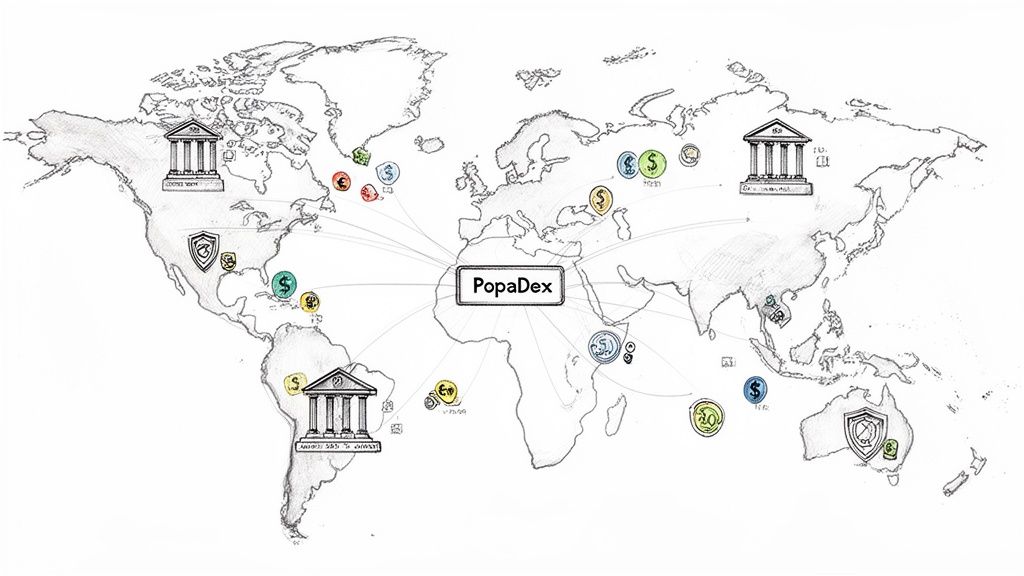

PopaDex was built from the ground up for expats, international investors, and anyone with a messy, multi-country financial life. The whole point is to solve the headache of tracking wealth across different currencies. Its core job is to give you one, accurate net worth number when you have assets, investments, and debts scattered around the world.

Empower Personal Dashboard (what used to be Personal Capital) is aimed squarely at the US-based investor, especially those with a decent-sized portfolio. Its sweet spot is retirement planning and investment analysis. It’s fantastic at hooking into US investment accounts, showing you your asset allocation, and running retirement scenarios—making it a powerhouse if your finances are centered in the States.

Monarch Money styles itself as a modern, collaborative tool for US couples and families. It does a great job of mixing detailed budgeting and expense tracking with investment monitoring. Its real strength lies in helping you manage the day-to-day cash flow and set joint financial goals with a partner.

The most crucial difference here is the global perspective. PopaDex is built for a worldwide audience from day one. Empower and Monarch are fundamentally US-centric, and their support for anything outside the American financial system is an afterthought at best.

Automation and Data Aggregation Capabilities

The dream of these tools is to kill the spreadsheet. But how well they actually connect to your accounts and pull in data automatically varies—a lot.

PopaDex shines with its global reach, supporting over 15,000 banks and institutions across more than 30 countries. This is its secret sauce. For users in Europe, Asia, or North America, it means your accounts can sync automatically, giving you a real-time net worth without lifting a finger. It’s a game-changer if you’re tired of manually converting balances from your overseas accounts.

Empower has fantastic aggregation for US-based institutions. It’s been around for a while, and its connections to American banks, brokerages, and 401(k) providers are solid. The problem? Try connecting it to a major European or Asian bank, and you’ll likely hit a wall. Its international support is extremely limited.

Monarch Money also offers reliable connections for US institutions and has a slick, modern interface for linking everything up. But just like Empower, its focus is firmly on the US market. If you have accounts abroad, you’ll probably find yourself back to entering data manually.

Multi-Currency Support: The Real Deal-Breaker

This is where the differences become stark. For anyone with assets outside the United States, this is probably the most critical part of the comparison.

- PopaDex: This is true, native multi-currency support. It doesn’t just convert your foreign assets into a base currency; it uses real-time exchange rates and lets you see how those assets are performing in their original currency. This gives you a far more accurate and insightful view of your global wealth.

- Empower Personal Dashboard: It has no meaningful multi-currency support. Period. It might show you a foreign stock ticker, but it can’t connect to foreign banks or properly track assets held in other currencies. Any manual entries have to be in USD, which makes it pretty much useless for tracking a global portfolio.

- Monarch Money: It offers some basic multi-currency functions, letting you manually log assets in different currencies. But—and this is a big but—it doesn’t automatically connect to international banks. That means every foreign account has to be updated by hand, defeating much of the purpose of an automated tool.

Feature Breakdown of Leading Financial Planning Tools

So, how does it all come together? This table cuts through the marketing noise to show you exactly what each platform offers and how their philosophies differ, especially when it comes to pricing.

| Feature | PopaDex | Empower Personal Dashboard | Monarch Money |

|---|---|---|---|

| Primary Focus | Global Net Worth Tracking | US Investment & Retirement | US Budgeting & Households |

| Automation | 15,000+ global institutions | Strong for US institutions | Strong for US institutions |

| Multi-Currency | Native, real-time support | None | Manual entry only |

| Analytics | Portfolio & net worth trends | Deep investment analysis | Budgeting & cash flow trends |

| Pricing | Free (manual) & Premium (€5/mo) | Free (with wealth management ads) | Premium Only ($14.99/mo) |

PopaDex runs on a freemium model. The free version is surprisingly powerful, giving you unlimited manual tracking—perfect if you value privacy or have assets that can’t be linked. The Premium plan unlocks all the automatic syncing for a very reasonable price. You can get a better feel for its advanced features in our overview of the available portfolio analysis tools.

Empower’s dashboard is free, but you have to understand their business model. The “free” tool is designed to get you to sign up for their paid wealth management services. You’ll see frequent prompts to talk to an advisor, whose services come with management fees starting at 0.89% of your assets.

Monarch Money is a premium-only service with no free option, though you can get a free trial. Its higher subscription fee reflects its focus on a polished, ad-free experience built for collaborative household finance. At the end of the day, “free” often has a hidden cost, whether it’s dealing with sales pitches or missing out on essential features.

Matching the Right Software to Your Financial Goals

When you’re comparing financial planning tools, the one with the longest feature list isn’t always the winner. The best choice is the one that actually fits your life—your specific financial picture, your goals, and how you manage your money. A tool built for a US-based family focused on budgeting is going to fall flat for an expat juggling investments across three different currencies.

There’s simply no one-size-fits-all solution here. The first step is to get clear on what you actually need. Are you just starting to build wealth, managing a complex global portfolio, or trying to get a handle on unpredictable freelance income? Your answer will lead you straight to the platform that can solve your real-world problems.

For the Global Citizen or Expat

If you live, work, or invest across borders, you know the biggest challenge is complexity. You’re dealing with multiple currencies, different banking systems, and assets scattered around the globe that are a nightmare to track in one place. For this kind of financial life, a generic, US-centric platform just won’t cut it. You need a tool built from the ground up with a global mindset.

This is where PopaDex’s powerful multi-currency engine truly shines. It doesn’t just do a simple currency conversion; it gives you a real-time, accurate valuation of your entire net worth by syncing with over 15,000 international banks. Your London investments, Singapore savings, and Toronto property all show up on one clear, consolidated dashboard.

For anyone with assets in multiple countries, true multi-currency support is non-negotiable for an accurate net worth picture. Anything less is just guesswork, and you can’t build a serious financial plan on guesswork.

For the Early-Stage Wealth Builder

When you’re at the beginning of your financial journey, you need a tool that can grow alongside you. Right now, your needs are probably straightforward—basic budgeting and keeping an eye on a couple of investment accounts. But in five years, you might be dealing with property, a bigger portfolio, and more complex loans. You need software that’s simple enough for today but powerful enough for tomorrow.

PopaDex was designed for this exact scenario with its flexible free and premium tiers. You can start with the completely free manual tracking plan to get a solid grasp of your finances without spending a dime. Later, as your portfolio expands and you want the convenience of automated data aggregation, upgrading is straightforward and affordable. The intuitive dashboards make it easy to see your progress, which is a huge motivator when you’re building from the ground up.

The market for these tools is exploding. The global financial planning software market was valued at USD 5.63 billion in 2024 and is projected to hit USD 25.16 billion by 2034, growing at a 16.2% CAGR. This isn’t just a trend; it shows a real demand for tools that support every stage of the wealth-building journey. You can find more data on this market growth at sphericalinsights.com.

For the Freelancer or Solopreneur

Freelancers and solopreneurs have a unique financial headache: irregular income. Money comes in from different clients at different times, often landing in multiple bank accounts. This makes getting a clear view of your monthly cash flow and overall financial health incredibly difficult. A basic budgeting app just can’t keep up with that kind of variability.

This is where comprehensive account aggregation becomes a lifesaver. By linking all your business and personal accounts—checking, savings, credit cards, and investment platforms—PopaDex creates a single source of truth. You can see exactly where you stand at a glance, making it much easier to handle taxes, plan for lean months, and make smart business decisions. Part of this planning also means understanding how big-picture economic factors, like the current mortgage rates in America, might impact your long-term goals and ensuring your software can help you model those possibilities.

How PopaDex Delivers Unmatched Global Wealth Tracking

While many tools you’ll find in a financial planning software comparison are built with a US-based user in mind, PopaDex was created from the ground up to solve the real-world headaches of global citizens, expats, and international investors. Its entire purpose is to bring clarity to a financial life that doesn’t stop at the border, tackling the frustrating blind spots that other platforms ignore.

The biggest game-changer is its international connectivity. With direct support for financial institutions in over 30 countries, PopaDex offers an automated aggregation that’s simply not on the table with many mainstream tools. This means your accounts in Europe, Asia, and North America can all sync up, giving you a truly complete, real-time picture of your entire net worth.

A Focus on True Global Usability

But just linking accounts isn’t enough. PopaDex is designed for genuine international use. The platform features a multi-lingual interface, so language is never a barrier to understanding your money. That thoughtful approach carries over to how it manages all your accounts.

For anyone who values privacy or has assets that can’t be linked automatically—think physical real estate, art, or collectibles—PopaDex provides a powerful free plan with unlimited manual tracking. This dual approach covers every type of asset you own, whether it’s digital or physical, so you always have a complete picture of your wealth.

PopaDex’s real value isn’t just in its tech; it’s in its global philosophy. It gets that modern wealth is scattered across countries and currencies, and it gives you the specific tools needed to actually manage that reality.

The market for these tools is definitely heating up. A recent analysis for 2025 showed eMoney leading the market for advisory firms with a 28% share, followed by MoneyGuidePro at 22.79%. But those platforms are built for financial advisors. PopaDex is for a different person entirely: the individual investor who needs direct control, multi-currency support, and net worth tracking above all else. You can find more data on the financial planning software market here.

Future-Proofing Your Financial Journey

PopaDex is always evolving, with new features on the horizon to make managing your wealth even simpler. One of the most anticipated updates is an AI co-pilot designed to surface smarter insights and automate routine financial analysis, helping you make better decisions without the grunt work.

This commitment is backed by a simple, user-friendly pricing model. The goal is to deliver powerful financial clarity for a minimal cost, making sophisticated wealth tracking something anyone can access. To make sure it’s the right fit, PopaDex offers a 30-day money-back guarantee on its premium plan.

It’s a risk-free way to see for yourself how the platform handles the unique challenges of a global portfolio. By focusing squarely on the needs of an international user, PopaDex provides a specialized solution that truly stands out.

Common Questions About Financial Planning Software

Diving into the world of financial planning tools can definitely bring up some practical questions. As you get closer to picking one, it’s completely normal to have a few last-minute thoughts about security, what the tool actually does, and how painful it will be to get started.

Let’s clear up the most common questions we hear. The goal here is to tackle any lingering uncertainties so you can feel confident in your choice.

How Secure Is My Data on These Platforms?

This is usually the first question people ask, and for a good reason. You’re connecting your most sensitive financial information, and you need to know it’s safe.

Top-tier financial planning platforms treat security as their absolute highest priority, using the same kinds of safeguards your bank does. Here’s what that typically looks like:

- 256-bit AES Encryption: This is the gold standard for data protection. It’s used by major financial institutions globally to scramble your data, both when it’s stored and when it’s moving between servers.

- Multi-Factor Authentication (MFA): A non-negotiable security feature. MFA requires you to provide a second piece of proof (like a code from your phone) to log in. This makes it incredibly difficult for someone to get into your account, even if they manage to steal your password.

- Read-Only Access: This is a critical point. Reputable platforms are built with “read-only” permissions. This means the software can see your balances and transactions to give you the big picture, but it cannot move money, make withdrawals, or perform any other transactions.

Before you sign up for any service, it’s always a good idea to check their dedicated security page or terms of service to confirm their specific protocols.

What Is the Difference Between a Net Worth Tracker and a Budgeting App?

While people sometimes use these terms interchangeably, they’re designed for fundamentally different jobs. Getting this distinction right is key to picking a tool that actually helps you.

A net worth tracker is all about the big picture. It gives you a high-level snapshot of your overall financial health by adding up all your assets (investments, property, cash) and subtracting your liabilities (mortgages, loans, credit card debt). The result is one simple number: your net worth. It’s built for tracking long-term wealth accumulation.

A budgeting app, on the other hand, lives in the details of your day-to-day cash flow. It’s there to help you track every dollar coming in and going out, categorize your spending, and make sure you stick to a monthly plan. Its main job is to manage your daily finances so you don’t spend more than you earn. Some tools try to do both, but they usually lean heavily one way or the other.

How Difficult Is It to Switch Financial Tools?

The thought of moving years of financial data from one platform to another can feel like a huge headache, but modern tools have made this process far less painful than it once was.

The switch itself is pretty straightforward, but it does take a bit of upfront effort. The most time-consuming step is linking all your financial accounts to the new platform, which is typically a one-time setup. Once connected, the software automatically pulls in your data. You may still need to manually re-categorize some older transactions or tweak your dashboard to get it just right.

A great way to handle the transition is to run your old and new tools side-by-side for a month. This gives you time to make sure the new software is pulling data correctly and allows you to get comfortable with it before you cut the cord on the old one.

The demand for better ways to manage money is skyrocketing. The financial planning software market is expected to jump from USD 4.1 billion in 2023 to a massive USD 17.5 billion by 2033, mostly driven by the need for smarter analytics and cloud-based platforms. You can dig deeper into these financial planning software market trends to see where the industry is headed.

Ready to gain clarity over your global finances? PopaDex provides the intuitive net worth tracking and true multi-currency support you need to see your entire financial picture in one place. Start for free and see the difference it makes.