Our Marketing Team at PopaDex

How to Build Wealth in Your 30s for Lasting Growth

Building wealth in your 30s really comes down to three things: disciplined saving, strategic investing, and actively growing your income. If you can get these three pillars working together, you’ll build a powerful financial engine that moves you beyond living paycheck to paycheck and toward real, lasting financial security.

The Reality of Building Wealth in Your Thirties

Your thirties are a game-changer. You’re likely hitting your stride at work, meaning your earning potential is higher than it was in your twenties. But this decade also brings a whole new level of financial complexity—maybe a mortgage, a growing family, and the last stubborn remnants of student loans.

It’s easy to glance at headlines and feel like you’re already behind. Don’t fall for it.

Why Average Net Worth Is Misleading

You’ve probably seen the stats. Recent data shows the average net worth for Americans in their 30s is $317,171, but the median is just $35,649. That massive gap tells a story: a handful of super-high earners pull the average way, way up. The median is a much more grounded look at where most people actually are.

And frankly, everyone’s path is different. Some people are laser-focused on crushing debt, while others are pouring everything into a new business. Comparing yourself to a skewed national average is a surefire way to get discouraged. If you want to dive deeper into these numbers, Datalign Advisory has some great insights.

The only metric that truly matters isn’t how you stack up against others—it’s how consistently you stick to winning financial habits. Your savings rate and investment strategy will do more for you than any national average ever could.

Focus on What You Can Control

Instead of getting bogged down in comparisons, zero in on the actions that build real, sustainable wealth. The habits you lock in now will have a massive impact down the road, thanks to the magic of compounding. This isn’t about getting rich overnight; it’s about building a rock-solid foundation that will support you for decades.

To get a clearer picture of the core strategies, think of your financial plan as having three essential pillars.

Three Pillars of Wealth Building in Your 30s

| Pillar | Core Action | Why It’s Critical in Your 30s |

|---|---|---|

| Master Your Cash Flow | Automate savings and investments before you can spend the money. | Your income is likely rising, but so are expenses. Automation ensures your future self gets paid first, creating a non-negotiable habit. |

| Invest Consistently | Prioritize tax-advantaged retirement accounts and low-cost index funds. | This is your prime decade to harness compounding. Every dollar invested now has 30+ years to grow, making it incredibly powerful. |

| Accelerate Your Income | Actively seek raises, promotions, and side income streams. | A higher income directly fuels a higher savings rate, dramatically shortening the time it takes to reach your financial goals. |

Success in this decade boils down to executing on these three pillars. Master your cash flow, invest consistently, and find ways to accelerate your income. It’s a simple formula, but it works.

Master Your Cash Flow With a Modern Budget

Building wealth in your 30s isn’t about pinching every penny until it screams. It’s about building a smart system that puts your money to work for you—ideally, on autopilot. Forget the fussy spreadsheets and rigid rules you’ve tried before. The real goal is to get a handle on your cash flow with a simple, modern approach that actually fits your life.

The cornerstone of this whole system is the pay yourself first principle. It’s a game-changer.

This just means you treat your savings and investment contributions like your most important bill. Before rent, before groceries, before that new subscription, a chunk of your income gets automatically whisked away into your wealth-building accounts. This tiny mindset shift makes growing your wealth a non-negotiable, not an afterthought you get to when you’re too tired to care.

The 50/30/20 Rule as a Guideline

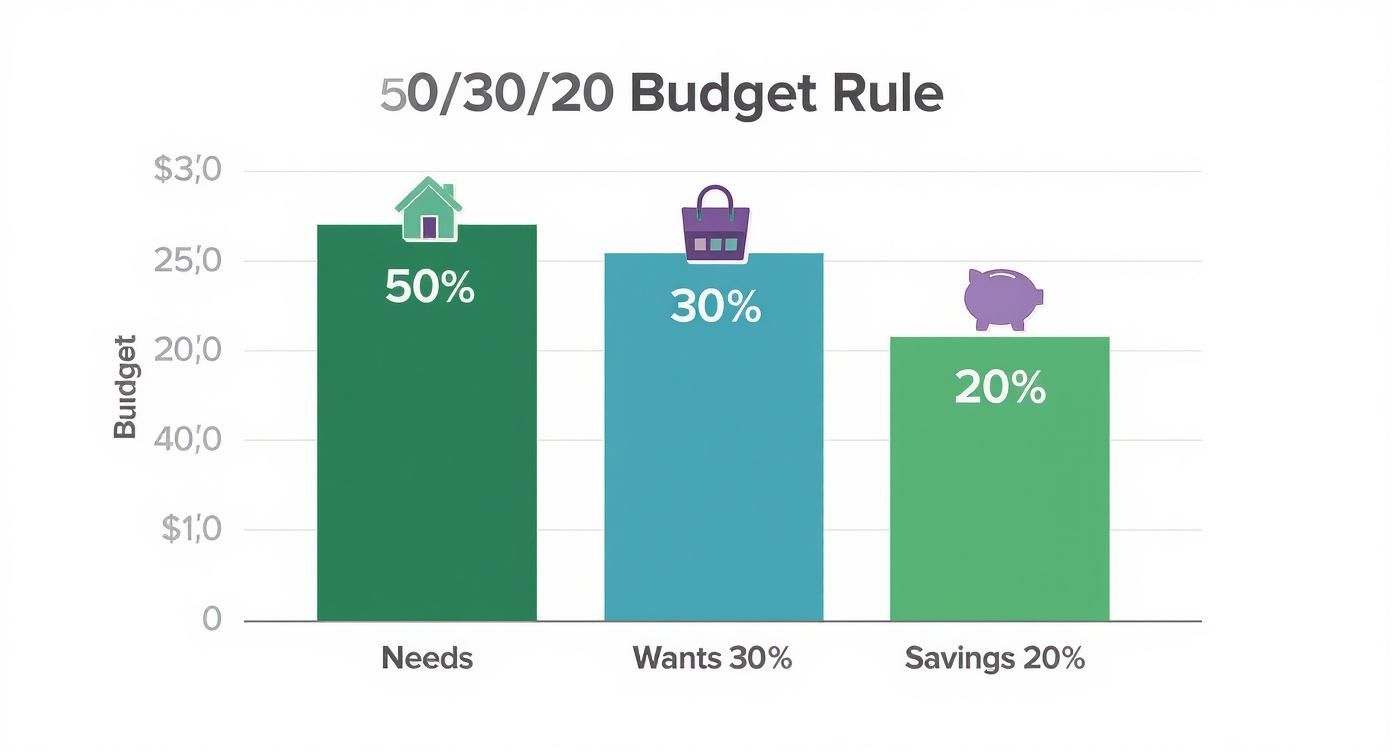

If you’re wondering where to start, the 50/30/20 rule is a fantastic framework. Think of it less as a strict law and more as a flexible guideline to see where your money is really going.

- 50% for Needs: This bucket covers the absolute must-haves: housing, utilities, transportation, and groceries. These are the bills that keep the lights on and a roof over your head.

- 30% for Wants: Here’s the fun stuff. Dining out, hobbies, travel, entertainment—everything that makes life enjoyable. This is your lifestyle spending.

- 20% for Savings and Debt Repayment: This is the crucial slice dedicated to your future self. It covers retirement contributions, investments, and knocking out high-interest debt.

Let’s break this down with a real-world example. Imagine a single person earning $70,000 a year, which comes out to roughly $4,500 a month after taxes.

- Needs (50%): That’s $2,250 for rent, utilities, and other essentials.

- Wants (30%): This leaves $1,350 for their social life, travel, and personal spending.

- Savings (20%): A solid $900 gets automatically funneled into a 401(k), Roth IRA, and a brokerage account.

This simple setup ensures $10,800 is saved and invested every single year, all without feeling like you’re on a financial diet. To dive deeper into making this work for you, check out our complete guide on mastering budgeting for financial freedom.

Identify and Eliminate Wealth Destroyers

Even the most perfect budget can be completely derailed by two common traps in your 30s: high-interest debt and lifestyle inflation. These are the silent killers of your wealth-building momentum.

High-interest debt, particularly from credit cards, is like trying to swim upstream. It’s reverse compounding—the debt grows against you. A nasty 19% APR on a credit card balance will undo any investment gains you make, and then some. Making it a top priority to wipe out this debt is one of the highest-return “investments” you can possibly make.

Lifestyle inflation is that sneaky habit of increasing your spending every time your income goes up. A raise or a bonus feels like free money, but if it all disappears into a pricier car or a bigger apartment, your savings rate stays flat. You’re making more, but you’re not actually getting ahead.

The trick is to split the difference. When you get a raise, absolutely celebrate. Allocate some of it to your “wants” and enjoy it. But—and this is key—commit at least half of that new income directly to your savings and investments. That way, you get to enjoy the fruits of your labor while seriously speeding up your path to wealth.

Your Investment Blueprint for Long-Term Growth

Investing in your 30s is where the real magic happens. This isn’t about chasing risky stocks or trying to time the market; it’s about putting your single greatest asset—time—to work. With decades of growth ahead of you, even modest, consistent contributions can snowball into a serious nest egg, all thanks to the power of compound interest.

The name of the game is creating a simple, effective, and mostly automated system. This is your decade to go all-in on tax-advantaged retirement accounts, which offer incredible tax breaks that seriously accelerate your growth.

- Your 401(k) or Workplace Plan: If your employer offers a match, contribute enough to get 100% of it. No excuses. This is free money and an instant, guaranteed return on your investment.

- A Roth IRA: This account is a powerhouse for long-term growth. You contribute with after-tax dollars, which means every qualified dollar you withdraw in retirement is completely tax-free.

So, what should you actually invest in? Keep it simple. Low-cost index funds or ETFs (Exchange-Traded Funds) are your best friends. They give you a slice of the entire market without the high fees that quietly eat away at your returns. This “set it and forget it” approach is a proven strategy for building real, lasting wealth.

The infographic below breaks down the 50/30/20 budget rule. It’s a straightforward framework that carves out a dedicated slice of your income specifically for investing.

As you can see, a significant 20% of your income should be systematically funneled into savings and investments. That’s how you build a secure financial future.

The Real Impact of Starting Now

Let’s look at what this actually means with real numbers. Scenario modeling shows a typical 30-year-old with a $40,000 investment balance and a median income of $60,000 could see their portfolio grow to $1.7 million by age 65, assuming an 8% annual return.

But here’s the catch: waiting just until 40 to start drastically slashes that potential. You miss out on a critical decade of compounding that you can never get back. Many experts even recommend a more aggressive approach, aiming to invest 25% of your gross income.

The cost of waiting is the single biggest threat to your financial future. Every year you delay investing is a year you forfeit your most powerful wealth-building tool—time.

Diversify Beyond the Basics

Once your retirement accounts are humming along on autopilot, it’s time to expand your investment blueprint. A taxable brokerage account offers more flexibility, and exploring other asset classes can further diversify your holdings. You can dive deeper into these strategies in our guide on how to start investing your money.

As you build out your plan, looking into specific market opportunities can be a smart move. For example, real estate can be a powerful wealth-builder, and a good place to start is this practical guide to investing in Dubai real estate.

The key is to build a portfolio that reflects your long-term goals and risk tolerance, ensuring your money is always working as hard for you as you do for it.

Accelerate Your Wealth by Growing Your Income

While mastering your budget and investing consistently are the bedrock of building wealth, they can only take you so far. After all, there’s a hard limit to how much you can cut back.

To truly hit the accelerator, you need to play offense. That means focusing on the other side of the equation: growing the amount of money you bring in each month.

Increasing your income is the single most powerful lever you can pull. It lets you invest more aggressively, crush debt faster, and ultimately reach your financial goals years ahead of schedule. There are really two ways to tackle this: maximizing your main career and building new income streams.

Level Up Your Primary Career

Your 9-to-5 is almost certainly your biggest income source, so making it work harder for you is the smartest first move. This isn’t about passively waiting for a tiny annual raise. It’s about taking control of your career trajectory.

The goal is to become invaluable. That means deliberately acquiring skills that directly boost your company’s bottom line.

- Become a Lifelong Learner: Are there specific certifications, software skills, or management techniques that would make you a bigger asset? Go learn them.

- Negotiate Your Worth: Don’t go in blind. Arm yourself with hard data on industry salary benchmarks for your role and experience. Build a clear business case connecting your accomplishments to tangible results.

- Make Strategic Moves: Don’t be afraid to jump ship. Often, the biggest salary bumps come from moving to a new company that sees the immediate value you bring to the table.

The Power of Multiple Income Streams

Beyond your main job, creating additional sources of income has shifted from a “nice-to-have” to a financial necessity. This mindset is especially true for millennials, who are now squarely in their prime wealth-building years.

This generation has seen their collective wealth quadruple since 2019. That boom isn’t just from market returns; it’s from a fundamental change in financial behavior—embracing side hustles, real estate, and diverse investments far more than previous generations.

It’s not just a feeling; the numbers back it up. A staggering 83% of Americans now view multiple income streams as essential for financial security. It builds a powerful safety net and dramatically speeds up your ability to build wealth in your 30s. You can read more about how this generation is getting richer.

Realistic Side Hustles for a Busy Schedule

The key is finding something that fits your life and skills without causing burnout. You don’t need to launch the next unicorn startup. You just need a consistent, extra stream of cash.

- Freelance Your Expertise: Are you a writer, graphic designer, or project manager? Platforms like Upwork and Fiverr are great for connecting with clients who need your skills.

- Consult in Your Field: Offer your professional knowledge on an hourly basis. Even one solid consulting gig a month can add a significant chunk to your income.

- Create a Small Digital Product: Think about what you know. Could you write a short ebook, create a simple online course, or sell templates related to your profession? This builds an asset that can earn money while you sleep.

By combining a focused push to grow your primary salary with one or two smart side hustles, you pour rocket fuel on your investment engine.

Protect Your Wealth With Smart Financial Moves

Building wealth is an exciting game of offense—growing your income, investing smartly, and watching your net worth climb. But a winning strategy needs a strong defense. Without one, a single curveball from life, like a sudden illness or accident, could wipe out years of hard work.

Protecting your assets is just as crucial as growing them. Think of it as building a financial fortress around everything you’re working so hard to accumulate. It’s not the most glamorous part of the plan, but it’s what makes sure your progress is secure and lasting.

Your Non-Negotiable Insurance Shield

Insurance is the bedrock of any solid financial defense. As your income and responsibilities grow in your 30s, having the right coverage becomes non-negotiable. It’s a small price to pay to transfer catastrophic financial risk away from your family.

Here are the key policies you need to have in place:

- Disability Insurance: This is arguably the most important coverage for a professional in their prime earning years. It protects your single greatest asset—your ability to earn an income. If an injury or illness keeps you from working, disability insurance replaces a chunk of your paycheck, keeping your entire financial plan from derailing.

- Life Insurance: If anyone depends on your income—a spouse, kids, or even aging parents—life insurance is a must. A straightforward term life insurance policy is often surprisingly affordable in your 30s and provides a critical safety net for your loved ones.

- Liability (Umbrella) Insurance: This policy provides an extra layer of protection on top of your existing auto and homeowners policies. If you were found at fault in a serious accident, this coverage kicks in when your standard limits are maxed out, shielding your investments and savings from being seized in a lawsuit.

Create a Basic Estate Plan Now

The term “estate plan” can sound intimidating, like something reserved for the ultra-wealthy. The reality? Every adult needs one, especially once you start accumulating assets or have dependents. You don’t need a complex web of trusts right now; a simple, foundational plan is all it takes to protect your family from chaos during an already difficult time.

A basic will isn’t about planning for your death; it’s about protecting your loved ones’ future. It’s the ultimate act of financial responsibility, ensuring your assets go exactly where you intend without unnecessary legal battles or delays.

At a minimum, your plan should include these three things:

- A Simple Will: This legal document outlines who should inherit your assets. Even more importantly, it names a guardian for any minor children. If you don’t have a will, the state makes these critical decisions for you.

- Beneficiary Designations: This is a big one. Go check every single one of your financial accounts—401(k), IRA, brokerage accounts, and life insurance policies. Make sure your named beneficiaries are up-to-date. These designations often override what’s in your will, making them incredibly powerful.

- Durable Power of Attorney: This document lets you designate someone you trust to make financial decisions on your behalf if you become incapacitated and can’t manage your own affairs.

Putting these defensive measures in place creates the stable foundation your wealth needs to grow securely for decades to come.

Track Your Progress and Stay Motivated

Let’s be real: all the saving, investing, and side-hustling in the world won’t mean much if you’re just flying blind. You wouldn’t drive across the country without a map, so why navigate your financial future without one? This is where tracking your progress becomes your secret weapon.

What gets measured gets managed. It’s an old saying because it’s true. The simple act of checking in on your net worth transforms wealth building from some fuzzy, far-off goal into a tangible, engaging game. Seeing that number tick upward, even just a little, is the fuel you need to stick with it when things get tough.

Get a Real Sense of Financial Control

Building wealth in your 30s can feel like juggling chainsaws. You’ve got a mortgage, student loans, retirement goals, and maybe even kids pulling you in a dozen different directions. Tracking your net worth cuts right through that noise. It gives you one single, powerful number that tells the story of all your financial decisions.

This clarity is empowering. It shows you exactly how your assets (investments, savings, property) are stacking up against your liabilities (loans, credit card debt). When you see your 401(k) contribution directly bump up your net worth, suddenly that extra dinner out you skipped feels like a win.

Tracking your financial journey provides a profound psychological benefit—it shifts your mindset from being a passive participant in your financial life to being the active driver. You’re no longer just hoping for the best; you are making deliberate choices and seeing the direct results.

The Power of a Quarterly Check-In

You don’t need to obsess over your numbers daily. Honestly, that’s a recipe for anxiety, especially with the market’s normal ups and downs. A quarterly check-in hits the sweet spot. It’s frequent enough to keep you engaged but spaced out enough to see meaningful progress.

Just set aside an hour every three months. That’s all it takes. Here’s a simple game plan for your financial review:

- Update Your Numbers: Tally up all your assets and subtract your liabilities. Your net worth is the result. A good tool can make this the easiest part.

- Review Your Progress: How does this quarter’s number compare to the last? Celebrate the wins, big or small. A $1,000 increase is still $1,000 in the right direction.

- Analyze Your Cash Flow: Glance back at your budget. Did you hit your savings goals? Any sneaky spending habits creeping in that need to be addressed?

- Set a Goal for Next Quarter: Based on your review, set a realistic target for your next check-in. It keeps you focused and gives you something to aim for.

This little ritual reinforces your commitment and helps you catch small problems before they become big ones. For a more detailed walkthrough, our guide explains how to track your net worth using some simple, effective methods. Keeping a consistent pulse on your financial health is a cornerstone of building wealth in your 30s.

Your Top Questions About Building Wealth in Your 30s

Let’s be real: navigating your money in your 30s can feel like juggling flaming torches. Your income is finally starting to look good, but so are the responsibilities—and the questions. Let’s cut through the noise and tackle some of the biggest concerns that pop up when you’re building wealth at this stage.

How Much Should I Have Saved by 30?

Ah, the million-dollar question. You’ve probably heard the popular rule of thumb: have one times your annual salary saved by the time you hit 30. So, if you’re making $70,000 a year, the benchmark is to have $70,000 tucked away in retirement and investment accounts.

But before you panic, take a breath. That’s just a guideline.

Most of us spend our 20s digging out from student debt or just finding our footing professionally. The number you start with is far less important than the savings rate you lock in right now. A 32-year-old socking away 20% of their income is in a much better financial position than a 30-year-old who’s only saving 5%.

The best time to start was yesterday. The next best time is today. It’s your habits from this point forward, not your starting balance, that will truly shape your financial future.

Should I Pay Off Student Loans or Invest?

This is the classic fork in the road. The best path forward usually comes down to a simple math problem: pit the interest rate on your debt against the returns you expect from investing.

Here’s how to think about it:

- High-interest debt (above 7-8%)? It almost always makes sense to attack this debt aggressively. Wiping out a 7% loan is like earning a guaranteed 7% return on your money. No investment on earth can promise you that.

- Low-interest debt (below 5%)? You’ll likely come out ahead by investing your extra cash. The stock market’s long-term average return hovers around 10% historically, giving your money a much better shot at serious growth compared to the interest you’re paying on the loan.

For most people, a balanced approach is the sweet spot. Make sure you’re contributing enough to your 401(k) to get the full employer match—that’s free money you can’t leave on the table. After that, throw any extra cash at your highest-interest debt. Once it’s gone, you can crank up your investment contributions.

How Long Until I See Real Growth?

Compounding is a funny thing. At first, it’s a slow burn. Then, all at once, it feels like an inferno.

In the beginning, your progress is almost entirely driven by what you put in. It can feel like you’re pushing a giant boulder up a very steep hill, and frankly, it can be a little discouraging.

But stick with it. After about 5-7 years of consistent investing, you’ll start to hit an inflection point. That’s when your investment earnings start making their own earnings, and the growth curve starts to bend upward, fast. By year 10, it can feel exponential. Patience is your superpower here. Automate your contributions, trust the process, and let time do the heavy lifting.

Keeping an eye on your progress through all these milestones is what keeps you motivated. PopaDex gives you a single, clear dashboard of your entire financial world, so you can see exactly how every decision moves the needle on your wealth-building journey. Start tracking your net worth for free today at https://popadex.com.