Our Marketing Team at PopaDex

How to Evaluate Investment Opportunities: A Practical Framework for Smarter Bets

Evaluating investment opportunities is part art, part science. If you’re relying purely on gut feelings, you’re not investing—you’re gambling. To move from speculation to a evidence-based strategy, you need a repeatable process.

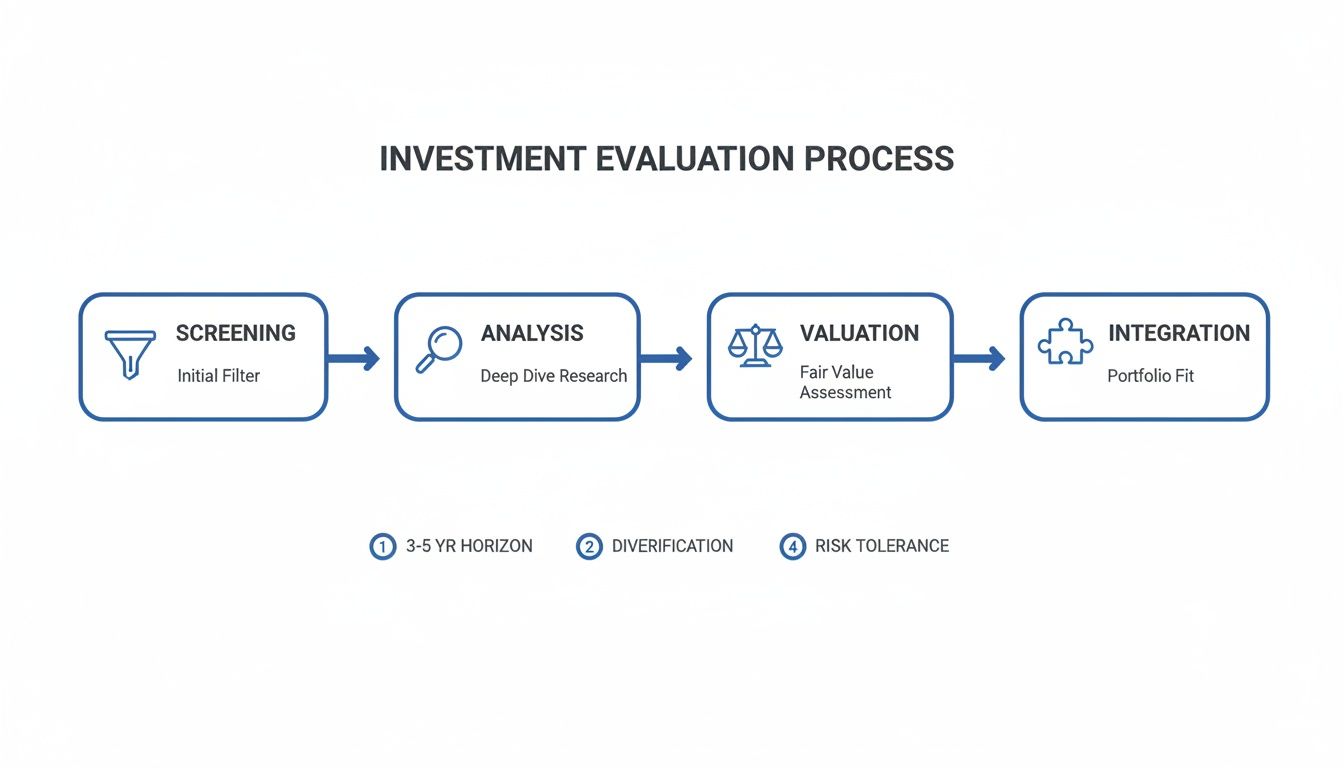

The core of this process breaks down into four key stages: screening out the noise, doing a deep dive on the financials and qualitative factors, figuring out a fair price, and finally, making sure the investment actually fits within your broader portfolio. Nailing this disciplined framework is what separates successful investors from the rest.

Building a Disciplined Investment Framework

Before you can confidently pull the trigger on an investment, you need a roadmap. Without one, it’s far too easy to get lost in financial jargon, fall for a slick story, or make emotional decisions driven by the latest market hype.

A structured framework forces you to ask the right questions at every single stage. It’s about systematically vetting each potential investment against a consistent set of criteria you’ve already defined. This isn’t about memorizing complex formulas; it’s about building a mental checklist that protects your capital and aligns every single decision with your long-term goals.

The Four Pillars of Evaluation

I like to think of the entire process as four distinct but interconnected pillars. Each one builds on the last, creating a funnel that narrows a massive universe of options down to the handful that are truly right for you. It’s like moving from a wide-angle lens to a microscope.

This flow chart gives you a bird’s-eye view of the journey: starting with a broad screen to filter your options, then digging deep into the fundamentals, assessing the price, and finally, checking if it makes sense for your portfolio.

This systematic approach stops you from wasting time analyzing weak candidates or, even worse, overpaying for an asset that doesn’t actually align with your strategy.

To make this super practical, let’s map out what each stage actually involves. This table gives a quick summary of the key questions and tools for each pillar, which we’ll explore in much more detail throughout this guide.

The Four Pillars of Investment Evaluation

This table breaks down the core stages of the evaluation process. For each pillar, we’ll identify the central question you’re trying to answer and the common tools or metrics you’ll use to get there.

| Evaluation Pillar | Key Question to Answer | Primary Tools & Metrics |

|---|---|---|

| Initial Screening | Does this opportunity meet my basic criteria? | Financial screeners, P/E ratio, dividend yield, market cap filters, industry reports |

| Deep Analysis | Is this a high-quality, sustainable business? | Financial statements, ROIC, debt-to-equity, competitive moat analysis |

| Valuation | What is this investment’s intrinsic worth? | Discounted Cash Flow (DCF), comparative analysis, scenario modeling |

| Portfolio Integration | Does this investment improve my overall portfolio? | Diversification analysis, risk-adjusted return metrics, correlation checks |

Think of this table as your cheat sheet. As you move through the process, you can refer back to it to ensure you’re not skipping any critical steps.

This structured approach is really the foundation for making smarter, more confident investment decisions. It turns the often-chaotic process of finding good investments into a manageable workflow. Of course, having a well-defined framework is just one piece of your overall financial strategy. For more on that, our guide on creating a financial plan provides some essential context.

The purpose of an evaluation framework is not to eliminate risk but to understand it. By systematically assessing an opportunity, you can distinguish between calculated risks worth taking and uncompensated gambles that threaten your capital.

Finding Quality Investments with Smart Screening

The world of investing can feel like drinking from a firehose. Thousands of companies, endless data, and constant noise. Where do you even begin? Your first job isn’t to find the perfect investment right away. It’s to build a filter—a smart screening process—that cuts through the chaos.

This initial step is all about efficiently saying “no.” By tossing out the obvious misfits early, you can dedicate your precious time and energy to the opportunities that actually have a shot at making you money. This screen should be a direct reflection of your own goals. A retiree hunting for dividend income will use a completely different set of rules than a young professional chasing high-growth tech stocks. The key is to create a repeatable system that removes emotion from the equation.

Combining Numbers with Narrative

A truly effective screening process is part science, part art. You have to blend the cold, hard numbers with a gut check on the company’s story.

Relying only on metrics like a low Price-to-Earnings (P/E) ratio is a classic rookie mistake that leads straight to “value traps”—companies that look cheap on paper because their business is fundamentally broken. On the flip side, falling for a great story without checking the financials is just gambling.

The real magic happens when you combine them. Start with quantitative data to create a manageable pool, then apply qualitative judgment to see what’s really going on.

For instance, your first pass with numbers might look for companies that meet a few non-negotiable criteria:

- Market Capitalization: You might filter for companies above $2 billion to make sure they have some stability and you can actually buy and sell their stock without trouble.

- Debt-to-Equity Ratio: Capping this at 0.5 helps you weed out businesses that are buried in debt and might crumble in a downturn.

- Return on Equity (ROE): Demanding a consistent ROE over 15% for the past five years is a great shorthand for finding profitable, well-managed companies.

This simple quantitative filter can take an investment universe of thousands of stocks and shrink it down to a few hundred. That’s a much more manageable list to work with.

A Real-World Screening Example

Let’s walk through a practical scenario. Imagine you’re hunting for undervalued tech stocks that have a real competitive edge.

Your process might look something like this:

-

The Quantitative Sieve: You fire up a stock screener and plug in your criteria. You’re looking for tech companies with a P/E ratio below the industry average of 25, positive Free Cash Flow (FCF) for the last three years, and a size between $5 billion and $50 billion. Boom. Your list of thousands is now down to maybe 50 companies.

-

The Qualitative Gut Check: Now, the real work begins. You spend 10-15 minutes on each of those 50 names. You’re asking questions the numbers can’t answer. Does this company have a “moat”—something that protects it from competitors? Is it the top dog in a specific niche? Is the management team straightforward and honest with shareholders, or do their reports sound like a used car salesman’s pitch?

-

The Hunt for Red Flags: As you do this quick review, you’re actively looking for reasons to say “no.” Things like messy financial reports, a revolving door of executives, or overly hyped-up language in the annual report are all huge red flags. They often hint at bigger problems hiding under the surface.

A great screening process is less about finding reasons to invest and more about finding clear reasons to pass. Eliminating weak candidates early is the single most effective way to improve your investment returns and save your most valuable asset: time.

After running through these steps, your list of 50 companies might be whittled down to just five or six truly promising candidates. These are the businesses that have earned the right to a much deeper analysis. This funnel approach keeps you from chasing hot tips or getting distracted by headlines, forcing you to systematically find quality businesses that match exactly what you’re looking for.

Going Beyond the Numbers with Deep Analysis

So, you’ve screened a few investment ideas and have a shortlist. Now the real fun begins. This is where we roll up our sleeves and move from a quick scan to a deep, focused examination of a business. The goal is simple: to build a complete, 360-degree view that blends the hard numbers with the story they tell.

Ultimately, we’re trying to answer one crucial question: Is this a high-quality business that can generate sustainable returns for years to come? To figure that out, you have to put on your detective hat and piece together clues from financial reports, management calls, and the competitive landscape.

Unpacking the Financial Story

Financial statements aren’t just tables of numbers; they’re the biography of a company, written in the language of accounting. Your job is to translate that language into a clear story about the company’s health and efficiency.

Sure, top-line numbers like revenue growth are important, but they don’t tell you much on their own. To really get a feel for a business, you need to dig into how effectively it turns that revenue into actual profit and, more importantly, cash.

Here are a few key areas I always focus on:

- Profitability Ratios: Look past the simple net income. Dive into metrics like Return on Invested Capital (ROIC), which shows how well a company uses its money—both debt and equity—to generate profits. A consistently high ROIC is often the hallmark of a fantastic business with a real edge.

- Cash Flow Health: Profit can be an illusion, but cash is king. The Statement of Cash Flows is arguably the most important document you’ll read. Is the company generating positive Free Cash Flow (FCF)—the cash left over after all expenses and investments? A business that consistently spits out cash has the freedom to pay down debt, grow, or reward shareholders without begging for outside capital.

- Balance Sheet Strength: The balance sheet gives you a snapshot of a company’s financial stability at a single point in time. I always zoom in on the Debt-to-Equity ratio. A little debt can be smart, but a heavily leveraged company can become incredibly fragile when the economy sours.

Assessing Qualitative Strength

Numbers will only get you so far. Some of the most critical factors driving an investment’s success can’t be quantified on a spreadsheet. These qualitative elements are what separate the truly great companies from the merely good ones.

A business might have stellar financials today, but if it doesn’t have a protective barrier, competitors will eventually swarm in and eat away at its profits. We call this barrier a competitive moat.

A strong competitive moat is the single most important qualitative factor. It’s what allows a company to fend off rivals and maintain high profitability for years, even decades. This is the source of long-term value creation.

Evaluating these “softer” factors requires critical thinking and digging around well beyond the annual report.

Elements of a Strong Moat

- Brand Recognition: Think of companies like Coca-Cola or Apple. Their brands command pricing power and create fierce customer loyalty that is almost impossible for rivals to replicate.

- Network Effects: Platforms like Facebook or Visa become more valuable as more people use them. This creates a powerful, self-reinforcing advantage that’s incredibly tough to break.

- Switching Costs: If it’s a massive headache for customers to switch to a competitor (think about your bank or your company’s core software), the business has a sticky customer base and highly predictable revenue.

- Cost Advantages: Giants like Walmart or Amazon use their immense scale to offer lower prices than anyone else, effectively locking out smaller players.

Beyond the moat, you have to size up the leadership team. Are they trustworthy? Read shareholder letters, listen to earnings calls, and see if management is transparent, makes smart capital allocation decisions, and focuses on long-term value instead of just pumping the stock price for the next quarter. A bad management team can easily sink a great business. This deep dive into a company’s vulnerabilities is a core part of effective financial risk management. You can learn more about this by checking out our guide on https://popadex.com/what-is-financial-risk-management/.

Connecting the Dots to Historical Performance

Finally, it’s time to tie these qualitative factors back to the numbers. Does the company’s powerful brand actually allow it to command higher margins than its peers? Does its network effect show up as accelerating revenue growth? This is where your investment thesis really starts to take shape. For more advanced methods, it’s worth exploring how you can leverage AI for financial analysis to process huge datasets and spot subtle patterns.

It’s also crucial to ground your expectations in reality by looking at long-term market performance. History shows that patience pays off. The S&P 500, for example, has delivered an average annual return of 8.55% since 1928 when adjusted for inflation with dividends reinvested.

Over time, positive returns become far more likely: 75% of one-year periods were positive, which climbs to 95% over 10-year periods and 100% over 20-year horizons. This really highlights the power of thinking long-term. This deep analysis phase is demanding, but it’s what transforms you from a market spectator into a truly informed investor.

Determining an Investment’s True Value

So you’ve found a high-quality business. That’s a great start, but it’s only half the battle. Now comes the most important question: What is it actually worth?

A fantastic company can turn into a terrible investment if you overpay. This is where we separate the business from its stock price to figure out its intrinsic value. Think of it less as finding a single, perfect number and more like establishing a reasonable price range. It’s a process that gives you the confidence to act when others are panicking and stay disciplined when the market gets a little too excited.

Practical Valuation Methods You Can Actually Use

Forget about building complex financial models that would make a Wall Street analyst’s head spin. For most of us, a couple of straightforward methods are more than enough to get a solid handle on an investment’s potential value. The real key is understanding the assumptions you’re making along the way.

Two of the most effective approaches I’ve found are comparative analysis and a simplified Discounted Cash Flow (DCF).

-

Comparative Analysis (Comps): This is the quickest way to get a feel for value. You compare the investment’s valuation metrics—like the Price-to-Earnings (P/E) or Price-to-Sales (P/S) ratio—to its direct competitors or even its own historical average. If a solid company is trading at a P/E of 15 while its peers are all sitting around 25, it might be a signal that it’s undervalued.

-

Discounted Cash Flow (DCF): This one sounds more intimidating than it is. The core idea is simple: a business is worth the sum of all the cash it will generate in the future, just discounted back to today’s dollars. You estimate future cash flows for a certain period (say, 10 years), make an educated guess on its value at the end of that period, and then use a discount rate to find its present value.

Using both methods gives you a much more robust picture. If your comps suggest a company is cheap and your DCF model points to a similar conclusion, your confidence in the investment thesis grows dramatically. A core part of this analysis is projecting what your returns might look like. If you need a refresher, it’s worth understanding how to calculate your rate of return to set realistic expectations.

Stress-Testing Your Assumptions with Scenario Analysis

Any valuation is only as good as the assumptions you bake into it. What if your growth estimates are way too optimistic? What happens if a recession hits next year? This is where scenario analysis becomes your best friend for managing risk.

Instead of creating one valuation, you create three different versions:

- Base Case: This is your most realistic and probable set of assumptions for revenue growth, profit margins, and other key drivers.

- Optimistic Case: This is the “everything goes right” scenario. The company executes flawlessly, and the market conditions are perfect.

- Pessimistic Case: And this is the “everything goes wrong” scenario. A key product flops, a new competitor disrupts the market, or the economy tanks.

By building out these three scenarios, you’re not trying to predict the future. You’re trying to understand the range of possible outcomes and see just how sensitive your valuation is to different variables.

This exercise is incredibly revealing. It shows you what truly drives value and helps you see how much downside risk you’re really taking on. If the pessimistic case still results in a valuation that’s close to the current price, you’ve likely found a resilient investment with a strong margin of safety.

The Importance of a Margin of Safety

The margin of safety is the bedrock principle of value investing, plain and simple. It’s the gap between the estimated intrinsic value of an asset and the price you actually pay for it. The bigger that margin, the more room you have for error.

If your analysis suggests a stock is worth $100 per share, you don’t jump in at $98. You wait until you can buy it at $70, or maybe even $60. That discount provides a crucial cushion against bad luck, mistakes in your forecast, or any other negative event that you didn’t see coming.

It’s also smart to consider broader market cycles. A great way to assess value is by looking at the cycles of outperformance between US and international markets. Historically, these cycles have averaged over eight years each since 1975. Right now, the US outperformance cycle is at an unusually long 14.6 years, which suggests a potential reversion to the mean is on the horizon. Keeping this in mind can stop you from chasing recent winners and overpaying at the peak of a cycle.

Conducting a Final Risk and Portfolio Fit Check

You’ve done the deep dive. You’ve analyzed the financials, run the valuation models, and now you’re staring at the “buy” button. It’s tempting to click it and celebrate, but this is the moment that separates disciplined investors from impulsive ones.

Hold on for one last check. This final step isn’t about the company itself anymore. It’s about how this potential investment fits into your financial life. An asset that looks amazing in a vacuum can be a terrible addition if it throws your entire strategy out of whack. This is your pre-flight check before committing capital.

Assessing the Full Spectrum of Risk

Risk isn’t just about watching a stock price wiggle up and down. To do this right, you have to think about risk in layers, each of which could derail your returns.

We can break it down into three main buckets:

-

Market Risk: This is the big stuff you can’t control—recessions, sudden interest rate hikes, or geopolitical turmoil. It’s the tide that lifts or sinks all boats. You can’t avoid it, but good diversification can help you ride out the storm.

-

Business-Specific Risk: These are the risks tied directly to the company. Think a key product launch that flops, a brilliant CEO who suddenly quits, or a new competitor who completely changes the game. Your due diligence should have already put these on your radar.

-

Liquidity Risk: Can you get your money out when you need it? For a blue-chip stock, that’s easy. But for an investment in a private company, a small-cap stock, or even a piece of real estate, you might find yourself stuck, unable to sell without taking a massive haircut on the price.

Using the Sharpe Ratio for a Fair Comparison

Raw returns can be dangerously misleading. An investment that screams 20% growth looks way better than one that delivered 12%, right? Not if it took on three times the volatility to get there. That’s why we look at risk-adjusted returns.

The Sharpe ratio is my go-to tool for this. It’s a simple way to measure how much return you’re getting for each unit of risk you take on. A higher ratio is better—it means you’re getting more bang for your risk buck.

For context, the MSCI World index, a solid benchmark for global markets, posted a 10.49% compound annual growth rate over 46 years. But with a standard deviation of 14.77%, its Sharpe ratio was 0.68. As you evaluate a new opportunity, anything with a Sharpe ratio below 0.5 should give you serious pause. It suggests you’re simply not being paid enough for the risk you’re taking. For a deeper dive on this, check out this in-depth analysis of investment performance.

Does It Actually Fit Your Portfolio?

This is it—the final, most personal question. We’re no longer asking, “Is this a good investment?” We’re asking, “Is this a good investment for me?” That hot tech stock everyone is talking about might be a fantastic company, but if your portfolio is already 60% tech, adding more is just asking for trouble.

An investment’s true value is determined not just by its individual merit but by its contribution to the strength and resilience of your entire portfolio. A new position should either reduce overall risk or offer a unique source of return.

Here’s a quick checklist to run through:

-

Check for Diversification: How does this asset behave compared to what you already own? Adding something with a low correlation—like international bonds to a portfolio heavy on US tech stocks—is a classic move to reduce overall volatility without killing your returns.

-

Assess Concentration: Is this new position going to make one stock, industry, or asset class a dangerously large slice of your pie? As a general rule of thumb, I try to avoid letting any single stock grow to more than 5-10% of my total portfolio.

-

Review Your Goals and Timeline: A high-risk biotech startup might have incredible upside, but it’s a terrible fit for someone a few years from retirement who needs to preserve capital and generate income. Does this investment actually help you get where you’re trying to go?

This last check is what keeps your strategy coherent and disciplined. By making sure every new piece fits the puzzle, you’re not just buying assets; you’re building a truly resilient financial future.

Common Questions About Investment Evaluation

Even with a solid framework, some questions always come up when you try to put theory into practice. These are the common sticking points, and getting them sorted out is the difference between making a confident call and getting stuck in analysis paralysis. Let’s dig into some of the most frequent questions investors grapple with.

How Do I Evaluate a Private Company or Startup?

Trying to evaluate a private company is a whole different ballgame. You don’t have a public stock price or quarterly filings to lean on, so the focus shifts away from public metrics and zeroes in on qualitative strengths and what the future might hold. This is where you really have to put on your detective hat.

The first place to look is the management team. Do they have a real track record in this space? Is their vision both compelling and grounded in reality? A brilliant idea with a mediocre team is almost always a losing bet. Next, you have to get ruthless about assessing the total addressable market (TAM). Is this market actually big enough to deliver the kind of explosive growth you’re looking for? And does the company have something genuinely unique to offer that will let them grab a meaningful piece of it?

Since hard data is thin on the ground, you’ll be relying heavily on the financial projections the company gives you. But you can’t just take them at face value.

- Stress-Test Everything: Run your own scenarios. What happens if their customer acquisition costs are 50% higher than they think? What if the sales cycle is double what they’re projecting?

- Focus on Unit Economics: Get a crystal-clear picture of how much they make from a single customer. The lifetime value (LTV) has to be significantly higher than the customer acquisition cost (CAC). A healthy LTV:CAC ratio—ideally 3:1 or better—is non-negotiable.

- Legal Diligence is a Must: You absolutely have to review the capitalization table (the “cap table”) to understand who owns what. Pore over shareholder agreements and the company’s legal structure with a fine-tooth comb.

When you invest in a private company, you’re not just buying a piece of a business. You’re betting on a specific team’s ability to execute a specific vision in a specific market. More often than not, your assessment of that team is more important than any financial model you can build.

What Are the Biggest Mistakes to Avoid?

Knowing what not to do is just as critical as knowing what to look for. Interestingly, most investment blunders aren’t about getting the numbers wrong; they’re psychological traps. Just being aware of them is your first line of defense.

The most common trap by far is confirmation bias. This is our natural tendency to seek out information that supports what we already believe about an investment. You fall in love with the story and then subconsciously ignore any data that pokes holes in it. Another classic mistake is getting swept up in a great narrative and overpaying for it without a solid valuation to back you up. A good story doesn’t automatically mean good returns.

Finally, a lot of investors get so fixated on the potential upside that they completely forget to assess the risks or consider how the investment fits into their overall portfolio. Sure, an investment might have huge potential, but if it goes to zero, will it wreck your entire financial plan? Failing to think about how a new position concentrates your risk can wipe out years of patient work. For a more detailed look at the entire process, you can find a comprehensive guide on how to evaluate investment opportunities.

How Much Time Should I Spend on Evaluation?

There’s no magic number here. The best rule of thumb is that the time you spend should be directly proportional to the investment’s complexity and how much of an impact it could have on your portfolio.

For a small stake in a well-known, large-cap stock you already follow, a few hours might be all you need. You’d just review the latest earnings report and make sure your original thesis still holds up. On the other hand, a major investment in an obscure small-cap company or a private real estate deal could easily demand dozens of hours of deep-dive research. That means reading years of financial reports, digging into competitors, and really understanding the industry dynamics.

The goal isn’t to clock a certain number of hours. It’s to get to a point where you can explain your investment thesis—the key drivers for success and the biggest risks—to someone else in simple, clear terms. If you can’t do that, you’re not done yet.

A disciplined evaluation process means tracking countless data points across all your assets. PopaDex cuts through the complexity by giving you a unified dashboard to see how every investment fits into your total financial picture. Consolidate your portfolio, monitor your net worth, and make smarter decisions with a clear, complete view of your finances. Visit https://popadex.com to start your free trial.