Our Marketing Team at PopaDex

Top 12 Investment Portfolio Tracker Tools for 2025

Beyond Spreadsheets: Why You Need a Modern Investment Portfolio Tracker

In today’s complex financial landscape, managing multiple accounts from stocks and crypto to real estate and retirement funds can feel overwhelming. A simple spreadsheet no longer provides the real-time insights, security, and comprehensive overview needed to make informed decisions and truly understand your net worth. This guide cuts through the noise to analyze the 12 best investment portfolio tracker platforms available today.

We’ll move beyond generic feature lists to provide deep, practical analysis based on real-world use cases, honest limitations, and specific implementation scenarios. These tools solve the critical problem of disconnected data by aggregating your assets into a single dashboard, offering powerful analytics that spreadsheets simply cannot match. While this article focuses specifically on portfolio tracking, those interested in a broader perspective on financial well-being can find information on general money management topics to complement these tools.

Whether you’re a beginner building your first portfolio, an expat managing multi-currency assets, or a seasoned investor tracking diverse holdings, you’ll find the right tool here. Our goal is to equip you with the detailed comparisons needed to gain clarity, optimize performance, and confidently navigate your financial journey. Let’s dive into the platforms that can help you achieve a true, unified view of your wealth.

1. PopaDex

PopaDex earns its top spot by offering a powerful, user-friendly net worth and investment portfolio tracker that excels in global asset management. Its standout feature is the extensive support for over 15,000 banks across 30+ countries, complete with multi-currency and multilingual interfaces. This makes it an indispensable tool for expatriates, digital nomads, or anyone managing assets and liabilities in different parts of the world. The platform consolidates everything from savings and stocks to property and loans into one clear dashboard, providing a holistic financial picture.

Key Features & Use Cases

- Best Use Case: Ideal for individuals with international financial exposure who need to track diverse, multi-currency assets and liabilities without complexity. It’s also great for self-employed workers who need to monitor fluctuating income against their total net worth.

- Implementation: Getting started is straightforward. The free tier allows for manual entry of all assets, which is a good way to test the interface. For automated updates, the premium plan (€5/month) enables direct connections to your financial institutions, significantly reducing manual effort.

- Limitations: The primary drawback is that the free version requires manual data entry, which can be tedious for users with numerous accounts. Additionally, the promising AI co-pilot for advanced insights is still a forthcoming feature, not yet available to all users.

Website: popadex.com

2. Empower (formerly Personal Capital)

Empower, widely known by its former name Personal Capital, offers one of the most robust free investment portfolio tracker and financial planning toolsets available. It excels at aggregating all your financial accounts, from banking and investments to loans and credit cards, into a single, intuitive dashboard. This comprehensive view allows users to get a true snapshot of their net worth. The platform is particularly strong in its retirement planning and portfolio analysis capabilities, making it a go-to for those focused on long-term wealth building and ensuring their investment strategy is on track.

Key Features & Use Cases

- Best Use Case: Perfect for U.S.-based investors who want a deep, analytical dive into their retirement readiness and portfolio allocation without paying for software. Its Fee Analyzer and Investment Checkup tools are invaluable for identifying costly hidden fees and rebalancing opportunities.

- Implementation: Setup involves linking your financial accounts, which is a secure and guided process. Once connected, the platform automatically pulls in your data, a core function of its powerful financial data aggregation. The free tools are fully functional after this initial setup, with no manual entry required for ongoing tracking.

- Limitations: While the tracking tools are free, users should expect to receive calls from Empower’s financial advisors, as the platform’s business model is to upsell its paid wealth management services. These advisory services require a high minimum investment of $100,000 and carry fees that may be higher than some robo-advisor competitors.

Website: https://www.empower.com/

3. Quicken Deluxe

Quicken Deluxe stands out as a comprehensive personal finance suite that integrates a capable investment portfolio tracker with robust budgeting tools. It’s designed for users who want to manage their entire financial life, not just their investments, in one place. The platform allows you to connect your brokerage accounts, 401(k)s, and IRAs to monitor performance, analyze asset allocation, and even see the “true” market value of your holdings after estimated capital gains taxes. This holistic approach helps you understand how your investment decisions impact your overall financial health, from monthly cash flow to long-term net worth.

Key Features & Use Cases

- Best Use Case: Perfect for individuals and households who need a single application to manage day-to-day budgeting, bill payments, debt reduction, and long-term investment tracking. It excels at providing a complete financial picture.

- Implementation: The initial setup can be time-consuming as it requires linking all your financial accounts, from checking and credit cards to brokerage and retirement plans. Once connected, Quicken automatically downloads transactions, making ongoing management much smoother.

- Limitations: The software’s strength is also a potential drawback; it can feel overly complex if you only need a simple investment portfolio tracker. The subscription-based model ($4.99/month for Deluxe) may also be a deterrent for users accustomed to free or one-time purchase software.

Website: quicken.com

4. Mint

Mint has long been a household name in personal finance, and for good reason. It offers a completely free, ad-supported service that aggregates your entire financial life, from bank accounts and credit cards to loans and investments. While its primary strength lies in budgeting and expense tracking, its capabilities as an investment portfolio tracker are solid for beginners who want a holistic financial overview without paying a subscription fee. The platform automatically syncs with your institutions to provide a consolidated view of your assets and liabilities, making it an excellent starting point for anyone new to managing their money.

Key Features & Use Cases

- Best Use Case: Ideal for young professionals and individuals who need a comprehensive, all-in-one financial dashboard. It excels at combining day-to-day budgeting and expense management with a basic overview of investment performance and credit score monitoring.

- Implementation: Setup is simple. You create a free account and connect your financial institutions. Mint automatically pulls and categorizes transaction data, though you may need to manually adjust some categories initially to fine-tune its accuracy. Unlike other options, Mint is a fully featured net worth tracker app from the start.

- Limitations: The platform is supported by ads, which can be intrusive. Its investment analysis tools are also quite basic, lacking the in-depth analytics, asset allocation breakdowns, and rebalancing suggestions found in more specialized portfolio trackers. It’s more of a financial aggregator than a dedicated investment tool.

Website: mint.com

5. Kubera

Kubera distinguishes itself as a premium, all-in-one net worth and investment portfolio tracker designed for the modern investor with a diverse range of assets. It moves beyond just stocks and bonds to offer a truly holistic financial overview. The platform excels at consolidating everything from traditional bank accounts and brokerage holdings to cryptocurrency, DeFi assets, real estate, vehicles, and even website domain values. This comprehensive approach makes it a powerful tool for anyone who wants a single, accurate number for their total net worth.

Key Features & Use Cases

- Best Use Case: Ideal for high-net-worth individuals or tech-savvy investors with a complex mix of assets, especially those heavily invested in cryptocurrency, DeFi, and alternative assets like real estate or collectibles. Its “dead man’s switch” feature also makes it excellent for estate planning.

- Implementation: Setup involves a 14-day free trial, after which a subscription is required ($15/month or $150/year). You connect accounts via Plaid and Zabo integrations for automated updates. Manually adding unique assets is straightforward, allowing for complete customization of your portfolio dashboard.

- Limitations: The primary drawback is its price point; there is no free-forever plan, which may deter casual users or those just starting their investment journey. While its crypto tracking is robust, some niche DeFi protocols may still require manual entry.

Website: www.kubera.com

6. Stock Rover

Stock Rover is a powerhouse investment portfolio tracker designed for serious, data-driven investors who require deep analytical capabilities. It moves beyond simple tracking to offer a comprehensive research platform for over 8,500 North American stocks and ETFs. Its strength lies in its robust screening tools, which allow users to filter potential investments using more than 650 financial metrics. This makes it an exceptional tool for investors who base their decisions on fundamental analysis and want to uncover opportunities that meet very specific criteria.

Key Features & Use Cases

- Best Use Case: Perfect for fundamental and dividend investors who want to perform in-depth research, screen for undervalued stocks, and analyze their portfolio’s health against benchmarks. It’s also ideal for those wanting to project future dividend income.

- Implementation: You can start by connecting your brokerage accounts to automatically import holdings. The free plan offers basic portfolio tracking, but to unlock the powerful research and screening tools, a subscription is necessary, starting with the Essentials plan at $7.99/month.

- Limitations: The sheer volume of data and features can present a steep learning curve, potentially overwhelming novice investors. Furthermore, its focus is primarily on North American equities and ETFs, making it less suitable for those with globally diversified portfolios.

Website: stockrover.com

7. Sharesight

Sharesight carves out a niche as a premier investment portfolio tracker, particularly for investors who prioritize detailed performance and tax reporting. It excels at automatically tracking trades, dividends, and corporate actions for over 240,000 global stocks, ETFs, and funds. The platform’s true strength lies in its ability to calculate investment performance by considering capital gains, dividends, and currency fluctuations, providing a comprehensive picture of your true returns. This makes it an invaluable asset for serious investors managing diverse holdings across international markets.

Key Features & Use Cases

- Best Use Case: Perfect for detail-oriented investors who need to generate accurate tax reports, like the Capital Gains Tax report, without manual spreadsheet work. It’s also ideal for those wanting to benchmark their portfolio’s performance against various global indices. For those interested in a deeper dive, you can explore more portfolio analysis tools available.

- Implementation: You can start with the free plan to track one portfolio of up to 10 holdings, which is great for beginners. For automation, connect your broker to automatically import trade data. Paid plans unlock multi-portfolio tracking and advanced reporting features, essential for more complex investment strategies.

- Limitations: The free version is quite restrictive, limiting users to just 10 holdings in a single portfolio. The premium plans, while powerful, can become expensive for investors who need to manage multiple distinct portfolios, making it less cost-effective for households with several individual investors.

Website: sharesight.com

8. Ziggma

Ziggma carves out its niche as a powerful investment portfolio tracker for the active, data-driven investor. While many trackers focus on passive net worth monitoring, Ziggma provides tools for actively optimizing a portfolio. It excels at delivering deep, actionable insights through its dashboard, which scores portfolio quality, risk, and dividend yield. The platform is designed to move beyond simple tracking and empower users to make informed decisions with institutional-grade data and analytics.

Key Features & Use Cases

- Best Use Case: Perfect for hands-on investors who want to actively manage and stress-test their portfolios. Its stock screener and portfolio simulator are invaluable for those who enjoy researching new opportunities and modeling potential outcomes before committing capital.

- Implementation: You can start by linking your brokerage accounts or creating a manual portfolio. The free version offers a solid foundation with key metrics and a limited screener. To unlock advanced features like the portfolio simulator and comprehensive quality scores, the premium plan ($9.90/month) is necessary.

- Limitations: The platform is heavily focused on stock and ETF analysis, making it less suitable for users who need to track other asset classes like real estate or crypto. Additionally, its mobile app experience is not as robust as its desktop counterpart, limiting on-the-go management.

Website: www.ziggma.com

9. Delta Investment Tracker

Delta secures its spot with a mobile-first approach that excels in tracking a diverse mix of traditional and modern assets. It is particularly well-regarded among cryptocurrency enthusiasts for its extensive support of digital assets alongside stocks, ETFs, and mutual funds. The app provides a sleek, unified dashboard that presents a clear overview of your entire portfolio, making it an excellent investment portfolio tracker for the modern investor who values on-the-go access and real-time data for both their crypto and stock market holdings.

Key Features & Use Cases

- Best Use Case: Perfect for investors heavily involved in the cryptocurrency market who also hold traditional stocks and want a single, mobile-centric view of their combined wealth. Its real-time alerts are crucial for reacting to volatile market movements.

- Implementation: Setup is quick, with options to manually add transactions or connect to a wide range of crypto exchanges and brokerage accounts for automatic syncing. The free version offers robust tracking capabilities, making it easy to start without a financial commitment.

- Limitations: While the mobile app is outstanding, its desktop functionality is more limited and less refined in comparison. Accessing advanced analytics, unlimited connections, and other powerful features requires upgrading to the Pro version, which comes at a subscription cost.

Website: delta.app

10. SigFig Portfolio Tracker

SigFig offers a highly accessible and free investment portfolio tracker designed to give users a clear, consolidated view of their investments. It excels at aggregating data from various brokerage accounts, presenting a unified dashboard that highlights performance, asset allocation, and, crucially, hidden fees. By focusing on fee analysis and providing actionable recommendations, SigFig helps investors understand and optimize their costs, which can significantly impact long-term returns. Its support for a wide range of U.S. brokerages makes it a practical choice for investors with accounts spread across multiple platforms.

Key Features & Use Cases

- Best Use Case: Excellent for cost-conscious investors who hold accounts at multiple U.S. brokerages and want to identify and reduce unnecessary investment fees. It is also great for those seeking straightforward performance and diversification analysis without the complexity of premium tools.

- Implementation: Setup is simple. Users create a free account and link their brokerage accounts through a secure connection. The platform then automatically imports and syncs holdings to provide a holistic analysis. The process is entirely web-based.

- Limitations: The primary drawback is its lack of a dedicated mobile app for the tracker, limiting on-the-go access. While its analysis is robust for a free tool, it lacks the deeper, more advanced analytical features and custom reporting found in paid competitors.

Website: sigfig.com

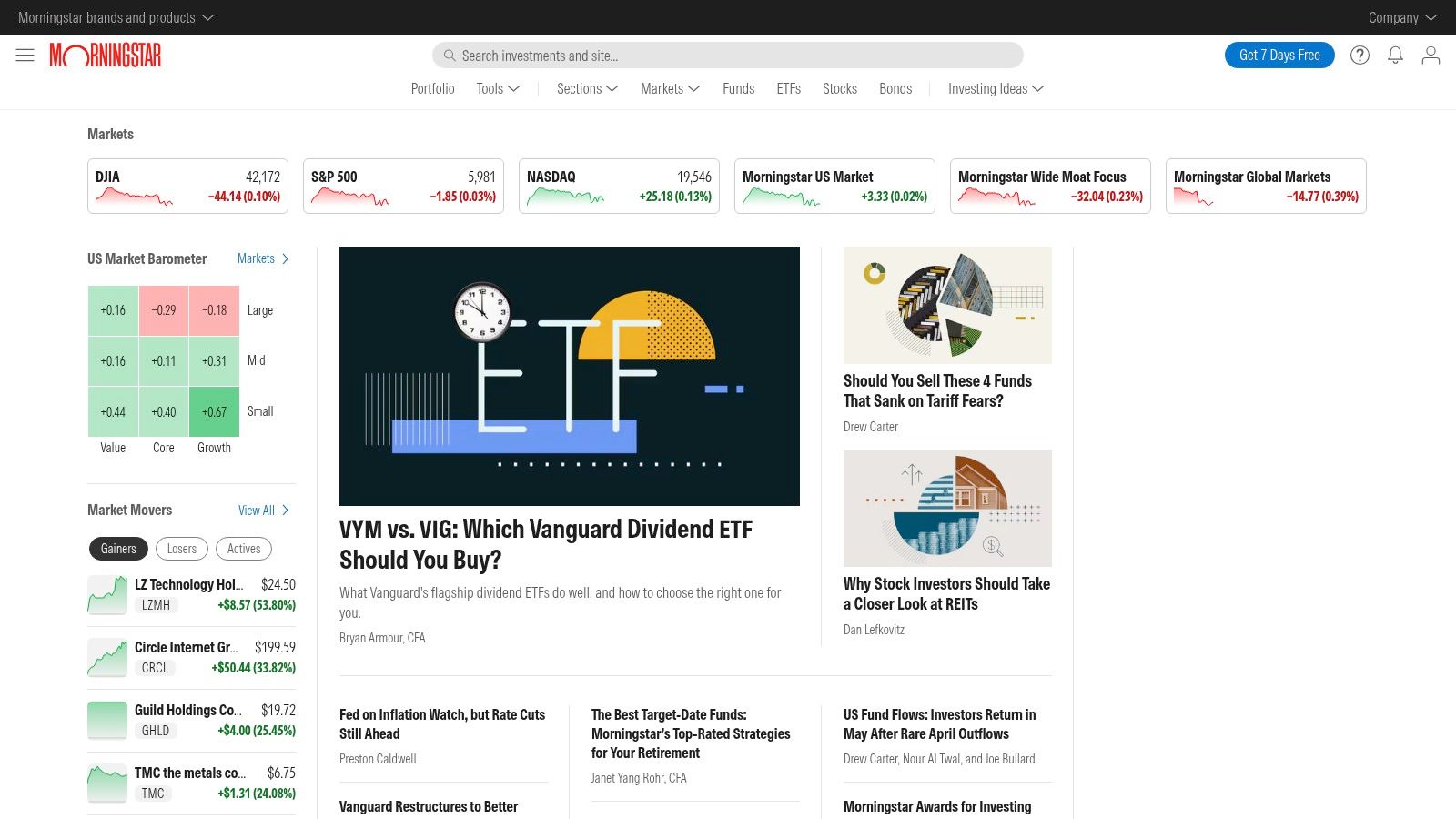

11. Morningstar Portfolio Manager

Morningstar is a heavyweight in the investment research world, and its Portfolio Manager tool extends this expertise directly to individual investors. It’s less of a simple net worth aggregator and more of a powerful analytical engine. This investment portfolio tracker shines for users who want to go beyond basic balance tracking and dive deep into the fundamental quality of their holdings. Leveraging Morningstar’s proprietary ratings and extensive research, it allows you to scrutinize your portfolio’s asset allocation, sector exposure, and overall health with professional-grade insights.

Key Features & Use Cases

- Best Use Case: Perfect for the research-driven investor who actively manages their portfolio and wants to benchmark performance against specific indexes. It is also invaluable for those looking to “X-Ray” their mutual funds and ETFs to understand underlying holdings and avoid concentration risk.

- Implementation: You can start with the free version by manually inputting your holdings (tickers and number of shares). To unlock the full suite of analytical tools, ratings, and in-depth reports, a Morningstar Investor subscription is required ($34.95/month or $249/year).

- Limitations: The user interface can feel dated and may present a steep learning curve for beginners accustomed to more modern, streamlined designs. The reliance on manual entry in the free version makes it cumbersome for frequent traders, and the real power of the tool is locked behind a relatively expensive subscription.

Website: morningstar.com

12. AssetDash

AssetDash carves out its niche by catering to the modern investor whose portfolio extends beyond traditional stocks and into the realm of digital assets. It shines by consolidating a vast array of investments, including stocks, cryptocurrencies, and even NFTs, into a single, cohesive dashboard. This makes it an exceptional investment portfolio tracker for those deeply involved in the Web3 space, offering a holistic view of both conventional and emerging asset classes. Its focus on real-time tracking across diverse digital wallets and exchanges provides a unified financial snapshot that many competitors lack.

Key Features & Use Cases

- Best Use Case: Perfect for crypto enthusiasts and NFT collectors who need to track their digital collectibles alongside traditional investments like stocks and ETFs. It bridges the gap between decentralized finance and legacy systems.

- Implementation: Setup involves connecting your various exchange accounts and crypto wallets. The process is intuitive, and since the core platform is free, users can immediately start consolidating their holdings without a financial commitment. The mobile app is essential for on-the-go monitoring.

- Limitations: As a relatively new platform, it lacks the deep, sophisticated analytical tools found in more established trackers. Users seeking advanced performance attribution or complex tax-loss harvesting reports may find its capabilities limited for now.

Website: assetdash.com

Investment Portfolio Tracker Features Comparison

| Product | Core Features / Integration ✨ | User Experience / Quality ★★★★☆ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆✨ | Price Points 💰 |

|---|---|---|---|---|---|---|

| 🏆 PopaDex | Supports 15,000+ banks, multi-currency, multilingual | Interactive dashboards, manual & automated aggregation | Free manual plan; Premium €5/month | Beginners to seasoned investors | AI co-pilot (coming), extensive financial tools | Free; €5/month premium |

| Empower | Aggregates 401(k), IRAs, investments; fee analysis | Intuitive dashboards, strong security | Free investment tools; Wealth mgmt min. | Investors with $100k+ portfolios | Retirement planner, investment checkup | Free tools; fees on wealth mgmt |

| Quicken Deluxe | Budgeting, bill pay, investment tracking | Robust features, regular updates | Subscription-based | Personal finance managers | Debt planning, customizable reports | Subscription (varies) |

| Mint | Automatic transaction categorization, credit score | Intuitive, beginner-friendly | Free | Beginners, casual users | Credit score monitoring, ads supported | Free |

| Kubera | Global banks, crypto, real estate, vehicles | User-friendly, customizable dashboards | Subscription-based | Global, diverse-asset investors | Crypto & asset tracking beyond typical portfolios | Subscription (varies) |

| Stock Rover | 650+ metrics, dividend tracking, correlation analysis | Customizable dashboards | Subscription-based | Advanced investors | In-depth stock/ETF analysis | Subscription (varies) |

| Sharesight | Auto-tracks 240,000+ global assets, tax reporting | Detailed analytics, user-friendly | Free limited portfolios; premium costly | International investors | Tax tools, dividend & capital gains tracking | Free & premium plans |

| Ziggma | Portfolio risk/yield metrics, smart alerts | Custom alerts, free essentials | Free version; premium subscription | Active investors | Portfolio simulator, alerts | Free & subscription |

| Delta Investment Tracker | Real-time alerts, broad asset class support | Mobile-first, easy interface | Free essentials; Pro advanced | Mobile users, crypto/investors | Crypto & real-time data alerts | Free & Pro |

| SigFig Portfolio Tracker | Auto-sync brokerage, fee optimization | Clear visuals, easy to use | Free | Brokerage account holders | Fee analysis, diversification advice | Free |

| Morningstar Portfolio Manager | Deep research, benchmarking, asset allocation | Trusted, customizable but complex | Subscription-based | Experienced investors | Proprietary ratings, extensive research | Subscription (varies) |

| AssetDash | Stocks, crypto, NFTs; exchange & wallet integration | Real-time updates, mobile app | Free | Digital asset collectors | NFT and collectibles tracking | Free |

Choosing the Right Tracker to Master Your Financial Future

Navigating the diverse landscape of investment portfolio trackers can feel overwhelming, but making an informed choice is the first definitive step toward gaining command over your financial destiny. Throughout this guide, we’ve dissected twelve leading platforms, moving beyond surface-level features to uncover their true strengths, limitations, and ideal use cases. From the comprehensive net worth aggregation of Empower to the deep-dive stock analysis offered by Stock Rover, the perfect tool isn’t a one-size-fits-all solution; it’s the one that aligns precisely with your individual investment philosophy and operational needs.

The key takeaway is that an investment portfolio tracker is more than just a digital ledger. It is a strategic command center. It transforms abstract numbers into actionable intelligence, empowering you to identify underperforming assets, pinpoint hidden fees, and ensure your portfolio allocation remains aligned with your long-term goals, whether that’s early retirement, wealth generation, or funding a major life event.

How to Select Your Ideal Tracker

Making the right choice requires a moment of self-assessment. Before committing to a platform, consider these critical factors:

- Investment Complexity: Do you hold a simple mix of stocks and ETFs, or is your portfolio a complex blend of international equities, cryptocurrencies, real estate, and alternative assets? A tool like PopaDex or Kubera excels with diverse, multi-currency assets, whereas a beginner might find Mint’s streamlined approach sufficient.

- Analysis vs. Aggregation: Is your primary goal to see your entire net worth in one place (aggregation), or do you need sophisticated tools for performance analytics, tax-loss harvesting, and dividend tracking (analysis)? Platforms like Sharesight and Ziggma are built for the analytical investor, while others prioritize a holistic, big-picture view.

- Manual vs. Automated: How much time are you willing to spend on data entry? Most users, especially tech-savvy professionals and those with many accounts, will benefit immensely from platforms offering robust, secure API integrations. Manual entry, while providing granular control, can become tedious and prone to error.

- Cost vs. Value: Free tools like Mint are excellent starting points, but they often come with limitations and advertisements. Paid platforms typically offer superior security, deeper features, and dedicated customer support. Evaluate whether the clarity and control a premium investment portfolio tracker provides is worth the subscription fee.

Implementing Your New Tool for Maximum Impact

Once you’ve chosen your tracker, implementation is key. Don’t just link your accounts and forget about it. To truly master your financial future, it’s essential not just to track, but also to understand the strategies involved in building a successful crypto portfolio, ensuring your tracker reflects your investment goals. Set a regular schedule, perhaps weekly or monthly, to review your dashboard, analyze performance against benchmarks, and rebalance as needed. Use the tool to actively manage, not just passively observe.

Your financial journey is unique, and the right technology can serve as your most trusted copilot. By investing the time to select and implement the right investment portfolio tracker, you are not just organizing your finances; you are building a foundation for sustained, strategic wealth creation.

Ready to gain unparalleled clarity over your entire financial world? If you manage diverse assets across multiple currencies and demand a seamless, powerful, and user-friendly experience, PopaDex was built for you. Sign up for PopaDex today and transform how you see and manage your wealth.