Our Marketing Team at PopaDex

Master Multi Currency Accounting for Global Growth

At its core, multi-currency accounting is simply the way businesses record and manage financial transactions that happen in more than one currency. But for any company operating on the global stage, it’s far more than a simple feature—it’s the financial passport you need to succeed.

Why Multi Currency Accounting Is Essential for Global Business

Think of your business as a world traveler. To get by, you need to “speak” the local currency. That means paying suppliers in Japanese Yen, sending invoices to customers in Euros, and ultimately reporting your profits back home in US Dollars. This is the essence of multi-currency accounting, a non-negotiable financial language for any company with international ambitions.

Trying to run a global business without it is like navigating a complex foreign city without a map. It opens the door to costly mistakes, missed opportunities, and can bring your growth to a screeching halt. The moment you expand across borders, you’re dealing with different currencies. It’s just a fact.

The Scale of Global Transactions

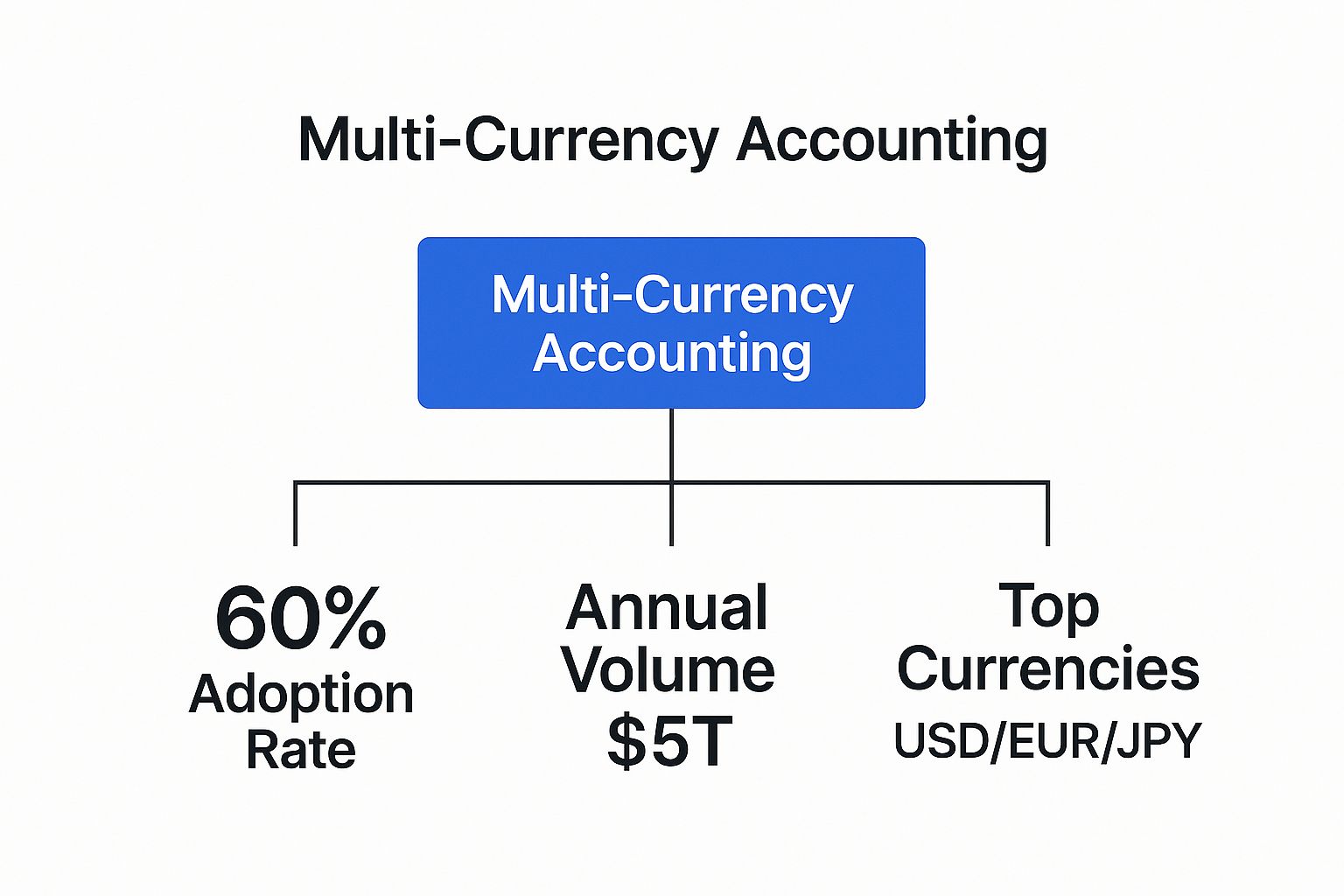

The sheer volume and complexity of international trade make robust financial systems an absolute necessity. The infographic below paints a clear picture of just how massive the global economy is and which currencies are driving it.

With trillions of dollars changing hands annually, it’s obvious that managing currencies like the USD, EUR, and JPY is a central part of modern commerce. This isn’t a niche problem; it’s a daily reality for a huge number of businesses.

As your international footprint grows, so does the challenge of translating all those foreign transactions back into your main reporting currency. Imagine a subsidiary based in Paris that sells its products in Euros. For the parent company’s consolidated reports in the US, those revenues have to be accurately converted to dollars. This process is absolutely critical for getting a true and fair view of the company’s overall health. You can get more details on how businesses tackle these conversions on netsuite.com.

At its heart, multi currency accounting transforms potential chaos into financial clarity. It provides a standardized view of your company’s health, regardless of where in the world you do business.

From Necessity to Strategic Advantage

While getting this right starts as a basic need, mastering it quickly becomes a powerful strategic tool. A solid approach to multi-currency accounting isn’t just about avoiding problems—it’s about building a resilient global enterprise.

Properly handling multiple currencies delivers several key benefits:

- Accurate Financial Reporting: It ensures your financial statements are correct, compliant, and give stakeholders a trustworthy picture of your company’s performance.

- Reduced Financial Risk: It helps you manage your exposure to volatile exchange rate fluctuations, protecting your hard-earned profit margins from sudden currency swings.

- Improved Decision-Making: When you have a clear, consolidated view of your finances, you can make much smarter strategic calls on everything from pricing and budgeting to your next expansion move.

Ultimately, getting a solid multi-currency accounting strategy in place is about laying a strong financial foundation. It’s what supports sustainable international growth and gives you a real competitive edge.

Decoding the Language of Global Finance

If you want to get a real grip on multi-currency accounting, you first have to speak the language. These terms aren’t rocket science, but they are the absolute foundation for every single international transaction your business handles.

Let’s walk through them with a simple, real-world scenario.

Picture this: your US-based e-commerce store, “Global Goods Inc.,” just made a sale to a customer in the United Kingdom. Right away, the core concepts of multi-currency accounting kick in, each playing a distinct role.

Defining Your Financial “Home Base”

First things first, you need to understand two critical currency types. Think of them as your financial “home” language versus the “local” language you’re doing business in.

-

Functional Currency: This is the main currency a business or its subsidiary uses for its day-to-day operations. For your customer in the UK, their functional currency is the British Pound (GBP). For your US headquarters, it’s the US Dollar (USD). Simple enough.

-

Reporting Currency: This is the currency you use for your official, consolidated financial statements. Since Global Goods Inc. is a US company, its reporting currency is USD. Every transaction, no matter where it happens, must eventually be translated back into USD for the books.

Getting these two straight is the bedrock of accurate multi-currency accounting. They determine how every sale, expense, and asset gets recorded and, ultimately, reported.

The Story of a Single International Sale

Let’s follow a single sale to see how this plays out in the real world. On April 1st, you sell a product to your UK customer for £1,000. On that specific day, the exchange rate is $1.25 for every £1. So, you record the sale in your books as $1,250.

But here’s the catch: your customer has 30 days to pay. When the payment finally comes through on April 30th, the exchange rate has moved. The pound got a bit stronger, and the new rate is $1.28 to £1. When that £1,000 lands in your account, it’s now worth $1,280.

This constant wiggle in exchange rates is the central challenge—and opportunity—of multi-currency accounting. It creates gains and losses that have to be tracked perfectly.

This brings us to our last two essential concepts.

-

Unrealized Gain/Loss: This is what we call a “paper” gain or loss. Between April 1st and April 29th, the value of that £1,000 you were owed went up by $30. It was an unrealized gain because you hadn’t actually received the cash yet. It only existed on your balance sheet.

-

Realized Gain/Loss: This is the real deal—a tangible gain or loss. When you received the payment on April 30th and converted it to USD, that extra $30 became a realized gain. It’s now actual cash that hits your bottom line.

The sheer scale of foreign exchange markets underscores just how vital precise financial tracking is. The Bank for International Settlements’ upcoming 2025 survey will offer the most detailed data yet on these global markets, reinforcing why dependable multi-currency systems are non-negotiable.

As global finance keeps evolving, new ideas emerge, like the recent discussions around gold-backed currency plans and global economic policy, which could introduce even more variables into currency dynamics.

Navigating Common Multi-Currency Challenges

Taking your business global is thrilling. New markets, new customers—it’s a huge step forward. But it also throws a whole new set of financial curveballs your way. These aren’t just minor speed bumps; they’re serious threats that can sink your profitability and stability if you’re not prepared.

Think about a small e-commerce shop dipping its toes into the European market. They set their prices in Euros, calculating a nice profit margin based on today’s exchange rate. But by the time the customer’s payment actually lands in their account, the market has shifted. Just like that, their hard-earned profit shrinks. This is the daily reality of exchange rate volatility, and it’s one of the biggest headaches in multi-currency accounting.

This constant up-and-down isn’t just an annoyance—it directly eats into your bottom line. A sale that looks great on Monday could be a loss by Friday, which makes trying to forecast your finances feel like guesswork.

The Hidden Costs and Admin Headaches

Beyond the shifting markets, you’re also walking into an administrative maze. It’s way more complicated than just swapping one currency for another. You’ve got to reconcile foreign bank accounts, navigate completely different tax laws, and untangle complex payment systems.

Suddenly, your team is buried in administrative tasks, pulling them away from what they should be doing: growing the business. The financial bleed from all this is real, and for many small and medium-sized enterprises (SMEs), it’s a massive barrier to growth.

In fact, a staggering 49% of SMEs say international payments are a major obstacle to their expansion. Hidden fees from currency conversions, bank charges, and unpredictable rates cost these businesses nearly $800 million in 2023 alone.

This isn’t just a theoretical problem. It has a real, measurable cost that demands a smart, proactive strategy. For a closer look at these hurdles, check out the findings from satchel.eu.

Common Multi-Currency Hurdles

To protect your business, you need to know exactly what you’re up against. Here are the most common challenges you’ll likely face:

- Profit Margin Erosion: A bad swing in the exchange rate can turn a profitable sale into a loss before the money even hits your bank.

- Complex Reconciliation: Trying to match invoices, payments, and bank statements across different currencies and systems is a tedious, error-prone nightmare.

- High Transaction Fees: Banks and payment processors often tack on hefty fees for converting currencies and sending money internationally, slicing away at your revenue.

- Cash Flow Uncertainty: When international payments are delayed and currency values are all over the place, it’s incredibly tough to manage your cash flow with any confidence.

Getting a handle on these issues is fundamental to running a successful international business. It requires a solid framework that takes all these factors into account—a key part of any good cross-border financial planning. Without a clear plan, these “small” problems can quickly snowball into major financial disasters.

Proven Best Practices For Managing Global Finances

Knowing the challenges of global finance is one thing; actually navigating them successfully is another beast entirely. It calls for a solid framework of best practices. Creating a dependable multi-currency accounting system isn’t about finding one silver bullet solution. Instead, it’s about weaving together a series of smart, connected habits that build a resilient and accurate financial backbone for your business.

Think of it like building a house in a place with unpredictable weather. You wouldn’t just use standard materials. You’d reinforce the foundation, install storm-proof windows, and make sure the roof is sealed tight. The same logic applies here. Your financial “house” must be built to withstand the turbulence of global markets.

Establish Your Core Financial Policies

Before you can even think about automating or optimizing, you have to define the rules of the game. A clear, documented policy is your single source of truth, ensuring everyone across your organization is on the same page, no matter where they are.

This policy needs to be explicit about how you handle the nuts and bolts of multi-currency accounting. This means defining a set functional currency for each distinct business entity or subsidiary. For instance, your German office will run on Euros (EUR), while your US headquarters uses Dollars (USD). This simple, foundational step stops confusion in its tracks and standardizes reporting from the very beginning.

Your policy also needs to dictate the exact timing and methods for recognizing foreign exchange gains and losses. Will you use a daily average rate for income statement items and a period-end spot rate for the balance sheet? Deciding this upfront and enforcing it everywhere is non-negotiable for compliance and for getting a true read on performance.

The goal is to eliminate ambiguity. When everyone follows the same playbook, you slash the risk of errors and create financial data that is consistent, comparable, and trustworthy across all your global operations.

Select The Right Tools For The Job

Trying to manage multiple currencies with manual spreadsheets is just asking for trouble. The risk of human error is massive, and the time wasted on manual entry is a huge drain on your team. Modern accounting software isn’t a luxury; it’s an absolute necessity.

When you’re shopping for a platform, make sure it has these essential features:

- Real-Time Rate Updates: The system has to pull current exchange rates automatically. Looking them up by hand is slow and opens the door to tiny inaccuracies that can snowball into big problems.

- Automated Revaluation: Your software should automatically revalue foreign currency assets and liabilities at the end of each reporting period. It needs to calculate unrealized gains or losses without anyone having to lift a finger.

- Consolidated Reporting: The power to generate a single, consolidated financial statement in your main reporting currency with one click is a must-have.

For a broader look at financial management and best practices, exploring comprehensive all3credit financial solutions can offer some great insights. These resources often provide valuable perspectives on building a solid financial strategy. The right tech doesn’t just save you time; it enforces your policies and delivers the clarity you need to make sharp decisions. And for individuals juggling assets across borders, our guide on financial planning for expats can be a huge help for personal finance strategies.

Here’s a quick checklist to help you stay on track with these best practices.

Multi Currency Accounting Best Practices Checklist

This checklist breaks down the key actions you need to take to build and maintain a strong multi-currency accounting system. Use it as a quick reference to ensure you’ve covered all your bases, from policy-making to technology and reporting.

| Practice Area | Key Action | Why It’s Important |

|---|---|---|

| Policy & Governance | Define a clear, written policy for currency handling. | Ensures consistency and reduces ambiguity across all teams and locations. |

| Functional Currency | Assign a specific functional currency for each legal entity. | Simplifies local operations and standardizes the foundation for reporting. |

| FX Rate Source | Choose a single, reliable source for all exchange rates. | Guarantees all calculations are based on the same data, preventing discrepancies. |

| Technology | Implement accounting software with automated multi-currency features. | Reduces manual errors, saves time, and provides real-time financial visibility. |

| Gains & Losses | Standardize the timing and method for recognizing FX gains/losses. | Critical for accurate financial statements and compliance with accounting standards. |

| Reporting | Ensure your system can produce consolidated reports in your primary currency. | Provides a clear, unified view of the entire company’s performance for stakeholders. |

| Regular Audits | Periodically review and audit your multi-currency processes. | Helps identify inefficiencies or compliance gaps before they become major issues. |

By systematically working through these areas, you’re not just managing currencies—you’re building a robust financial framework that can support your business as it grows across the globe.

How PopaDex Tames Your Global Operations

Knowing the theory is one thing, but seeing a real solution handle the chaos is something else entirely. This is exactly where a dedicated tool like PopaDex stops being a “nice-to-have” and becomes a non-negotiable part of your financial toolkit. PopaDex was built from the ground up to solve the exact multi-currency headaches that individuals and businesses run into when managing assets across different countries.

Forget about wrestling with clunky spreadsheets or hopping between a dozen different banking apps. PopaDex gives you a single, clean command center for your entire global portfolio. It puts the tedious, error-prone tasks on autopilot, freeing you from the risk and wasted time of manual work. The result? A clear, accurate, and real-time picture of your financial world, so you can spend less time on admin and more time making confident decisions.

Automated Currency Management

Let’s be honest: one of the biggest nightmares in multi-currency accounting is the never-ending rollercoaster of exchange rates. Manually updating these values isn’t just a chore; it’s a disaster waiting to happen. One tiny mistake in a single conversion can send ripples through your entire financial statement, completely warping your view of your net worth or profitability.

PopaDex tackles this problem head-on by automating the whole process.

- Real-Time Rate Conversions: The platform automatically syncs with up-to-date exchange rates, instantly converting all your foreign currency holdings into your chosen home currency. This means the numbers you’re looking at are always current and correct.

- Elimination of Manual Entry: You can finally stop Googling exchange rates and punching numbers into a calculator. This automation not only saves you hours of mind-numbing work but also wipes out the risk of human error.

- Instant Financial Clarity: See your total net worth in one currency, with one glance. No more mental gymnastics trying to add up euros, pounds, and dollars in your head.

Here’s a quick look at the PopaDex dashboard. It’s designed to give you an intuitive, consolidated view of all your accounts, no matter where they are or what currency they’re in.

As you can see, balances from different accounts—like those in EUR, GBP, and USD—are all neatly converted and tallied up into a single reporting currency. It’s an immediate, precise financial overview without any of the usual hassle.

Unified Reporting And Strategic Insights

Smart financial management isn’t just about having accurate numbers; it’s about having data you can actually use. Pulling together consolidated reports by hand is a notoriously complex and time-consuming mess. PopaDex fixes this by integrating all your financial data into one place, unlocking powerful, one-click reporting and analysis. This unified approach is the very heart of effective financial data aggregation.

By putting currency conversions and data centralization on autopilot, PopaDex cuts down administrative costs by an average of 15-20% for our users who manage multiple foreign accounts. That’s time they get back to focus on strategy and growth.

This single, unified view empowers you to make much smarter financial moves. You can easily track performance, spot trends, and tweak your strategy based on a complete and truthful picture of your finances. Instead of getting buried in data entry, you’re armed with the insights you need to confidently steer your financial ship—whether you’re saving for retirement, managing your life as an expat, or scaling a global business. PopaDex transforms multi-currency accounting from a painful chore into a simple, automated, and powerful tool for financial control.

Your Top Questions Answered

When you start managing money across different countries, a few common questions always pop up. It’s completely normal. Let’s clear up any confusion with some straight-to-the-point answers, so you can handle your global finances with total confidence.

What’s the Difference Between a Functional and a Reporting Currency?

Think of it like your everyday language versus the official language of your company’s headquarters.

A functional currency is the “local language” a specific branch of your business uses for daily operations. If you have an office in France, it will pay its rent, bill local clients, and handle payroll in Euros (EUR). That’s its functional currency.

The reporting currency is the “headquarters language.” It’s the single currency the parent company uses to roll up all its financial statements into one big picture. For a US-based company, this is almost always the US Dollar (USD). The French office’s numbers, originally in EUR, have to be translated into USD for the main company reports.

How Often Should I Update My Exchange Rates?

For the most accurate books, you need a system that pulls in new exchange rates daily, or even in real-time. This is non-negotiable for recording individual sales or purchases as they happen.

When it’s time to close the books for the month or quarter, it’s mandatory to use the official closing rate for that exact day on all your balance sheet items. You can often use an average rate for things like income and expenses over the period, but relying on old rates is a huge mistake.

Using stale exchange rates is like navigating with an old map. The small mistakes add up, and before you know it, you’re miles off course and your financial reports are a mess.

Can I Just Use Spreadsheets for Multi-Currency Accounting?

You can, but it’s like choosing to dig a foundation with a spoon. It’s technically possible, but it’s incredibly inefficient and dangerously risky. This manual approach is just asking for problems that modern software was built to solve.

- It’s a magnet for human error. Manually hunting for exchange rates and plugging them into complex formulas is a recipe for typos and calculation mistakes that are a nightmare to track down.

- It doesn’t scale. As your international business grows, that “simple” spreadsheet will quickly become a tangled, unmanageable mess that eats up all your time.

- There’s no real audit trail. Spreadsheets don’t have the secure, unchangeable audit trails you absolutely need for compliance and transparent financial reporting.

Dedicated software like PopaDex automates all of this. It guarantees accuracy, gives you the audit trails you need, and frees up countless hours so you can focus on growing your business, not on tedious data entry.

Ready to take control of your global finances with a tool that makes multi-currency management simple? PopaDex consolidates your entire portfolio into one clear view, automating conversions and eliminating manual errors. Start tracking your net worth accurately and effortlessly today at https://popadex.com.