Our Marketing Team at PopaDex

Build a Net Worth Tracker Spreadsheet That Works

A net worth tracker spreadsheet is a surprisingly simple but incredibly powerful tool. At its core, it just pulls all your assets (what you own) and liabilities (what you owe) into one place.

This lets you calculate your net worth with a basic formula: Total Assets - Total Liabilities. It’s a straightforward, manual way to get a clear snapshot of your financial health without plugging into automated apps.

Why Spreadsheets Are a Financial Game Changer

In a world overflowing with slick financial apps, the humble spreadsheet still holds its own for a reason. Taking a hands-on approach to your finances gives you a level of clarity that automated systems can sometimes hide.

When you manually punch in the numbers each month, you’re forced to look your financial reality straight in the eye. Abstract figures suddenly become tangible data that you truly own.

This process is so much more than data entry; it’s a monthly ritual that builds a real connection with your money. You aren’t just glancing at a dashboard—you’re actively engaging with your progress. This direct involvement has a huge psychological benefit, helping to dial down financial anxiety and build confidence in your decisions.

The Power of Control and Customization

One of the best things about using a spreadsheet is the absolute control it gives you. Unlike third-party apps with their rigid categories and layouts, a spreadsheet is a completely blank canvas.

You can tailor it to track exactly what matters to you, whether that’s a complex investment portfolio, your debt-paydown journey, or a detailed visualization of your path to retirement.

This isn’t just a niche preference, either. A lot of people choose spreadsheets specifically because they don’t want to link their bank accounts. Recent UK surveys show that about half of those who monitor their net worth use manual spreadsheets, prioritizing privacy and that hands-on control.

And don’t mistake simplicity for a lack of power. For those curious about how far you can push this tool, seeing how people are leveraging Google Sheets for advanced tracking really shows off its full potential.

Spreadsheet Trackers vs Automated Apps

So, what’s the real difference between a DIY spreadsheet and a hands-off app? It boils down to control versus convenience. Here’s a quick breakdown.

| Feature | Net Worth Spreadsheet (Manual) | Automated App (e.g., Empower) |

|---|---|---|

| Control | Total control over layout, formulas, and categories. | Limited customization within the app’s framework. |

| Privacy | 100% private. Your data never leaves your device. | Often requires linking bank accounts, sharing data with a third party. |

| Cost | Free. (e.g., Google Sheets) | Can be free (with ads) or require a paid subscription. |

| Setup & Maintenance | Requires initial setup and monthly manual updates. | Automated syncing after initial account linking. |

| Learning Curve | Basic spreadsheet skills needed. | Very user-friendly, designed for beginners. |

While automated apps are great for convenience, a spreadsheet puts you firmly in the driver’s seat of your financial journey.

Visualizing Your Financial Journey

A well-designed spreadsheet does more than just crunch numbers—it tells the story of your financial life. By creating simple charts and graphs, you can actually see your progress over time.

Watching that net worth line climb month after month is an incredible motivational boost. It keeps you focused on your goals in a way that a simple number just can’t.

“Tracking your net worth is the single most effective tool for understanding whether you are going backwards or forwards financially. It’s the equivalent of emptying your piggy bank and counting all your coins—it feels good to feel financially secure.”

This visual feedback loop turns abstract goals, like paying off student loans or building a seven-figure nest egg, into a tangible reality. The spreadsheet becomes your personal roadmap.

If you’re looking for a great starting point, our detailed guide on the https://popadex.com/excel-net-worth-tracker/ offers templates and tips to get you up and running fast. This hands-on method empowers you to build not just wealth, but lasting financial literacy.

Laying Your Financial Foundation

This is the goal: a clean, simple, two-column layout that’s easy to build and even easier to update. Let’s walk through how to create your own from scratch.

Whether you’re a Google Sheets fan or an old-school Microsoft Excel user, the process is exactly the same. The whole point is to build a tool that’s so straightforward you’ll actually want to use it. If you’re totally new to spreadsheets, don’t sweat it. A quick look at a simple guide to Excel will give you all the basic skills you need to get started.

First things first, we’re going to create two main sections: Assets and Liabilities. These are the twin pillars of your financial world. Think of it this way: assets are everything you own that has value, and liabilities are everything you owe.

Detailing Your Assets

Under an “Assets” heading, it’s time to start listing everything of value you own. The trick here is to be thorough without getting bogged down in tiny details. Don’t worry about getting every number perfect to the penny on your first pass; just focus on creating a complete list.

Here are the most common categories people start with:

- Cash and Equivalents: This is your liquid money—checking accounts, savings accounts, and any actual cash you have stashed away.

- Investments: Pull in the balances from your retirement accounts (like a 401(k) or IRA), brokerage accounts with stocks or ETFs, and any other investment funds.

- Real Estate: If you own a home or any rental properties, jot down their current estimated market value here.

- Vehicles: Look up the private-party value of your car, truck, or motorcycle. Kelley Blue Book or similar sites are great for this.

- Valuable Personal Property: This one is for significant items like jewelry, art, or valuable collectibles. The key is to only include things you could realistically sell for a decent amount of cash.

Give each of these its own row. In the column right next to it, plug in its current value. This list forms the first half of your complete financial picture.

Listing Your Liabilities

Alright, now for the other side of the coin: your liabilities. I know, this part isn’t as fun, but getting an honest look at your debts is just as critical for understanding your true financial health.

Create a new “Liabilities” heading and start listing out everything you owe.

Common liabilities usually include:

- Mortgage: The outstanding balance on your home loan.

- Student Loans: The total amount you still have left to pay on your education.

- Auto Loans: What’s the remaining balance on your car loan?

- Credit Card Debt: Add up the current balance on each of your credit cards.

- Personal Loans: Don’t forget any other personal or family loans you might have.

Just like you did with assets, enter the current balance for each liability in the adjacent column. Being brutally honest here is non-negotiable. A useful net worth tracker spreadsheet is built on accurate data—both the good and the bad.

Bringing It All Together with Simple Formulas

With your lists complete, you’re ready for a little spreadsheet magic. This is where your numbers turn into real information.

First, you need to total each section. Go to an empty cell at the bottom of your asset values and type in the formula =SUM(B2:B6). You’ll need to adjust the cell range (the B2:B6 part) to make sure it includes all of your asset values. Do the exact same thing for your liabilities. Now you have a Total Assets and a Total Liabilities figure.

The final calculation is the simplest, but it’s also the most powerful. Find a prominent spot—maybe right at the top of your sheet—and type in a formula to subtract your total liabilities from your total assets. It might look something like this:

=B7-B14(if B7 is your Total Assets cell and B14 is your Total Liabilities).

That one number is your net worth. It’s the core metric you’ll watch month after month to see how you’re progressing. By doing this manually, you build a deep sense of financial awareness that no automated app can truly replicate. You’re not just crunching numbers; you’re building a crystal-clear view of your financial life.

Transform Your Tracker Into a Personal Dashboard

With your core numbers locked in, it’s time for the fun part: turning that simple tracker into your personal finance command center. A static list of numbers is fine, but a visual dashboard brings your financial story to life. This isn’t about fancy coding; it’s about adding a few smart features that turn raw data into motivating, actionable insights.

The goal is to see your progress at a glance, making your monthly check-in something you actually look forward to. And it’s not just us—surveys show that 60–70% of people prefer charts and automated calculations for their finances. It’s a clear signal that we’re moving past simple spreadsheets and toward integrated, visual tools that just make sense. You can dig deeper into this trend and its impact on modern net worth tracking tools on popadex.com.

Create a Historical Log for Your Net Worth

To see where you’re going, you need to know where you’ve been. That starts with a historical log. It sounds technical, but I promise it’s dead simple.

Just open a new tab in your spreadsheet and name it something like “Historical Data” or “Monthly Log.” Set up three basic columns: Date, Total Assets, and Net Worth. Now, at the end of each month, just copy and paste those key figures from your main sheet into a new row on this log.

- Date: The last day of the month works great (e.g., “1/31/2024”).

- Total Assets: Grab the total from your main sheet.

- Net Worth: Copy your final net worth calculation.

This tiny habit is the single most important step for meaningful analysis. After just a few months, you’ll have a powerful dataset telling the story of your financial journey, one month at a time.

Visualize Your Journey with Charts

Alright, now let’s make that data sing. With your historical log ready to go, you can build charts that turn those numbers into a powerful visual narrative. My favorite for this is a simple line chart.

In your “Historical Data” tab, highlight the ‘Date’ and ‘Net Worth’ columns. Head over to your spreadsheet’s “Insert” menu and select “Chart.” Choose a line chart, and boom—you’ll instantly see your net worth growth plotted over time. That upward-trending line is one of the best motivators out there. It’s tangible proof that your hard work and discipline are actually paying off.

A visual dashboard does more than just show you numbers; it makes your financial goals feel real and attainable. Watching that chart climb month after month reinforces good habits and helps you stay the course, even when the market gets rocky or an unexpected expense pops up.

Add Deeper Financial Health Metrics

To really level up your net worth tracker spreadsheet, let’s add a few key financial ratios directly to your main dashboard. These metrics give you a much deeper look into your financial health beyond the big top-line number.

A great place to start is with your asset allocation. Create a small pie chart showing the percentage of your assets in stocks, real estate, cash, or whatever categories you use. This will immediately show you if you’re well-diversified or maybe a bit too heavy in one area.

Another fantastic metric to track is your debt-to-income ratio, which is perfect for monitoring your progress as you chip away at debt. For a more detailed walkthrough on building out these kinds of visuals, check out our guide on creating a complete net worth dashboard. Adding these elements transforms your sheet from a simple calculator into a true diagnostic tool for your financial life.

Manual Spreadsheets Versus Automated Tools

So, you’re at a crossroads: should you build your own net worth tracker spreadsheet or sign up for a slick, automated financial app? There’s no single right answer here. The best choice really boils down to what you value more—total, hands-on control or set-it-and-forget-it convenience.

At its heart, this is a debate between manual effort and automated syncing. A spreadsheet demands your full attention. You’re the one plugging in the numbers every month, which creates this really deep, tangible connection with your finances. Automated services, on the other hand, do all the heavy lifting for you once you link up your accounts.

You can see this split in how people manage their money. While automated platforms can save users an estimated 8–10 hours per year compared to manual entry, the humble spreadsheet is far from dead. Free Google Sheets and Excel templates are downloaded thousands of times a month, proving that manual tracking has a fiercely loyal following. In fact, it’s estimated that 30% of net worth tracking still happens on spreadsheets, a huge group that clearly isn’t willing to give up control. For more on this, you can find some great trends in net worth calculators on robberger.com.

Key Differences at a Glance

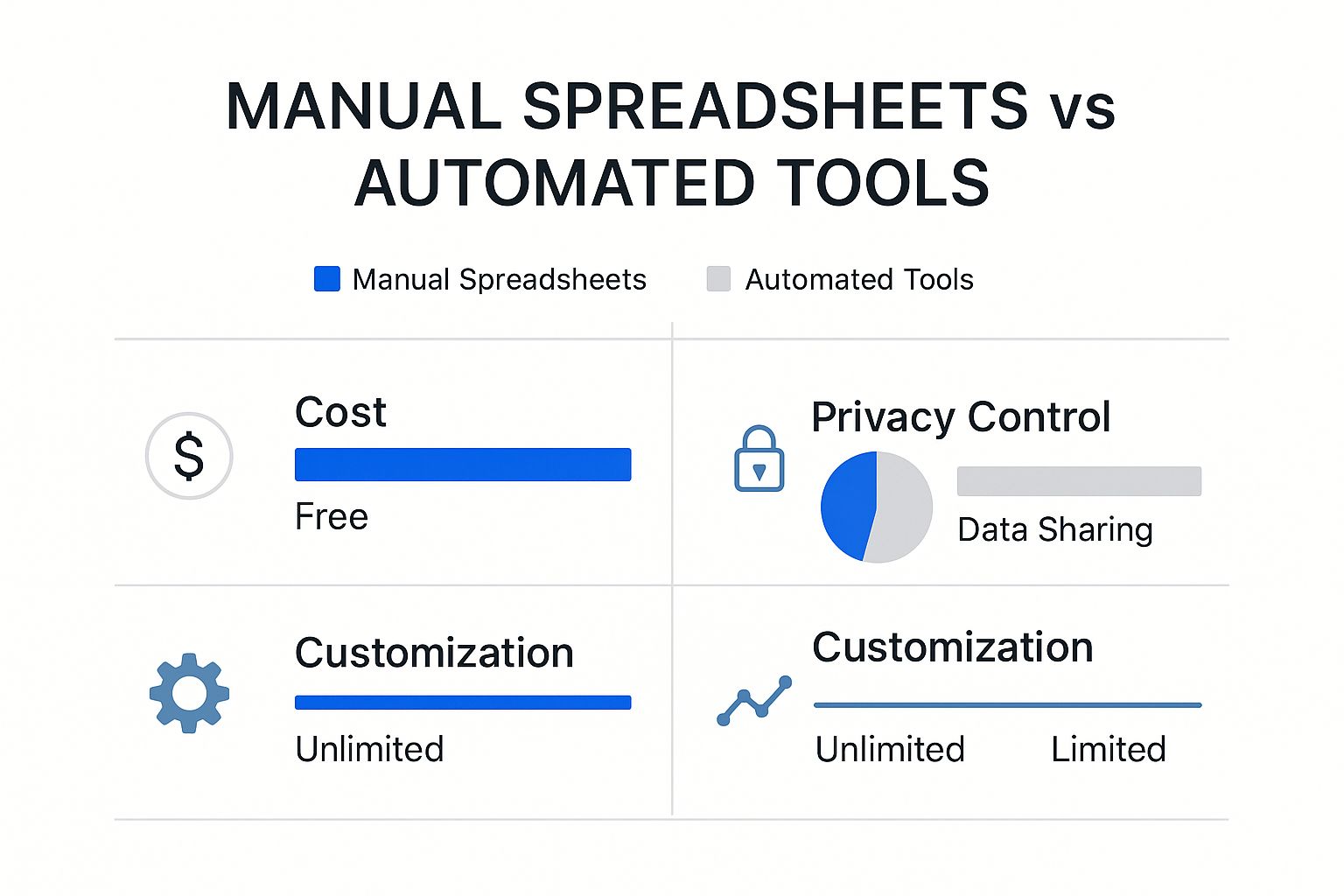

So, how do these two paths really compare day-to-day? This infographic cuts right to the chase, breaking down the core differences in cost, privacy, and how much you can tweak things.

The trade-off is pretty clear. Spreadsheets give you unmatched customization and privacy for free, but you pay for it with your time. Automated tools offer convenience, but it might come at a cost to your wallet and your data privacy.

Weighing Your Priorities

Your choice really hinges on your personality and what you want to achieve with your money. A manual spreadsheet is probably your best bet if you are:

- Privacy-conscious: You’re not comfortable linking your bank and investment accounts to a third-party app. Your data stays on your device, period.

- A customization fanatic: You want to build your tracker from scratch, adding weird and wonderful categories or custom formulas that no standard app would ever offer.

- On a tight budget: You want a powerful tool without another monthly subscription fee. Google Sheets and Excel are completely free.

On the flip side, an automated tool is likely a much better fit if you:

- Value time over control: You’d rather spend your energy analyzing the numbers than manually typing them in.

- Want an all-in-one solution: Many apps bundle budgeting, investment analysis, and retirement planning right alongside your net worth.

- Prefer a clean, simple interface: Automated tools are built to be intuitive. Just link your accounts and you’re good to go.

There’s no shame in either camp. The most effective tool is the one you will consistently use. An abandoned automated account is just as useless as a spreadsheet that hasn’t been updated in six months.

Think about your personal style. Are you a hands-on person who learns by doing, finding value in the ritual of manual entry? Or do you get energized when technology handles the boring stuff for you? Answering that question will point you straight to the right tool for your financial journey. For those who like the idea of automation but still want powerful tracking features, it’s worth exploring how a comprehensive net worth tracker can offer the best of both worlds.

Keeping Your Tracker Accurate (and Actually Useful)

Let’s be honest: a powerful tool you don’t use is just digital clutter. Even the most perfectly designed net worth tracker spreadsheet is useless if it’s not kept up to date. The secret to making this a sustainable habit isn’t about becoming a financial guru overnight—it’s about building a simple, repeatable routine that sticks.

The goal isn’t to get bogged down by daily market swings. For most of us, a monthly check-in is the sweet spot. It’s frequent enough to track real progress and make adjustments, but not so often that it feels like a chore. My advice? Set a recurring calendar reminder for the first or last day of every month. Make it official.

Your 15-Minute Monthly Update Routine

To make your updates quick and painless, a checklist is your best friend. A consistent process means you won’t forget a key account, which can throw off your numbers and kill your motivation.

Your monthly rhythm should look something like this:

- Log into your banks: Pull up the month-end statements for checking, savings, and credit card accounts.

- Check investment balances: Jot down the closing values for your 401(k), IRA, and any other brokerage accounts.

- Update loan balances: Record the remaining principal on your mortgage, car loans, and student loans.

- Log the history: Once your main dashboard is updated, copy the key totals—like Total Assets and your final Net Worth—over to your historical data tab.

Once you get the hang of it, this entire process shouldn’t take more than 15 minutes. It’s a tiny time investment that pays massive dividends in financial clarity.

How to Value Your Tricky Assets

Not everything you own comes with a neat monthly statement. What about your house, your car, or that collection of vintage baseball cards? The key here isn’t getting a perfect, to-the-penny valuation every time. It’s all about consistency in how you measure.

For your home, you could use an online estimator like Zillow and update the value quarterly instead of monthly. For your car, a quick check on a site like Kelley Blue Book once a year is plenty.

For the really unique stuff—like a stake in a private company or a piece of art—your spreadsheet’s ‘Notes’ column becomes invaluable. Use it to document how you arrived at a value (e.g., “Based on last funding round valuation” or “Appraised value from 2023”). This creates a clear, defensible record for your future self.

Troubleshooting Common Spreadsheet Problems

Even the best-laid spreadsheets can break. Seeing a dreaded #REF! or #VALUE! error is frustrating, but it’s usually an easy fix.

Most often, these errors pop up when you accidentally delete a row or column that a formula was referencing. The first thing to do is double-check your SUM ranges to make sure they still cover all your assets and liabilities. Another common culprit is inconsistent data entry, like typing text into a cell that’s supposed to be a number.

By keeping your routine simple and your formatting clean, you’ll make sure your spreadsheet remains a trustworthy financial copilot for years to come.

Common Questions About Net Worth Tracking

As you start building out your own personal finance system, it’s totally normal for a few questions to pop up. Nailing down the answers early on is the key to building a tracking habit that actually lasts.

One of the first things people ask is how often they should be updating their net worth tracker spreadsheet. The sweet spot for most people is a monthly check-in. It’s frequent enough to see real progress and stay motivated, but not so often that you get stressed out by the daily ups and downs of the market.

How Should I Value My Home or Car?

Figuring out the value of assets that don’t have a daily price tag, like your house or car, can feel a bit like guesswork. But here’s the secret: consistency matters more than pinpoint accuracy.

For your home, which is likely your biggest asset, a reputable online estimator like Zillow works great. You really only need to plug in a new number once a quarter, or even every six months.

Your car is a bit different since it depreciates more predictably. A quick check on Kelley Blue Book (KBB) once a year is plenty to keep your spreadsheet in the right ballpark.

The goal isn’t perfection. It’s about picking a reasonable valuation method and sticking with it. I like to keep a ‘Notes’ column in my spreadsheet to jot down the source (e.g., “Zillow estimate 1/1/25”). This helps me remember my process and keeps the data reliable over the long haul.

Can I Automate Investment Tracking?

Yes, you absolutely can—and you should! This is where a spreadsheet really starts to shine. If you’re using Google Sheets, the GOOGLEFINANCE formula is your best friend for pulling live data on stocks, ETFs, and mutual funds.

For example, popping =GOOGLEFINANCE("NASDAQ:GOOG") into a cell will instantly fetch the current stock price for Alphabet Inc. Just multiply that by the number of shares you own, and a huge chunk of your tracking becomes completely hands-off. It’s the perfect blend of automation and control.

Ready to skip the formulas and get a complete, automated picture of your finances? PopaDex connects to over 15,000 banks to give you a real-time view of your entire portfolio in one simple dashboard. Start your free trial today at https://popadex.com and take control of your financial journey.