Our Marketing Team at PopaDex

Paying Off Student Loans Fast: paying off student loans fast with proven tactics

To get a handle on your student loans and pay them off fast, you have to start with one non-negotiable step: knowing exactly what you owe. Before you can build a smart repayment strategy, you need to pull together every detail—balances, interest rates, and loan servicers—to see the whole picture. This is how you identify your real financial enemies.

Build Your Debt Payoff Command Center

Before you can attack your loans, you need a clear map of the battlefield. It’s tempting to avoid looking at the details when that total balance feels so overwhelming, but trust me, gaining clarity is the most empowering first step you can possibly take. This isn’t just about listing a bunch of numbers; it’s about creating a strategic headquarters for your debt-free mission.

Think of it like a general getting ready for a big campaign. You wouldn’t just send troops into the field without knowing the terrain, the enemy’s strength, or what resources you have on hand. It’s the same with debt. You can’t pay it down effectively without a complete inventory of every single loan.

Assemble Your Loan Inventory

Your first mission is to hunt down every last piece of information about your student loans. No guessing, no estimating. Log into each of your servicer portals and get the exact numbers.

Here’s what you’re looking for on each loan:

- Loan Servicer: Who are you sending money to each month? (e.g., Nelnet, MOHELA, SoFi)

- Current Principal Balance: The precise amount you still owe on the loan itself, not counting future interest.

- Interest Rate: This is your most critical piece of intel. It determines how fast your debt is actually growing.

- Loan Type: Is it a Federal Direct Subsidized, Unsubsidized, PLUS, or a private loan? This matters for repayment options down the road.

For all your federal loans, the National Student Loan Data System (NSLDS) on the StudentAid.gov website is your ultimate source of truth. It lists every federal loan you’ve ever taken out. For private loans, you’ll have to dig through your own records or pull a credit report to make sure you’ve found them all.

Why This Clarity is a Game-Changer

Once you have all this info laid out, the fog of uncertainty just lifts. Suddenly, you can see which loans are costing you the most money because of sky-high interest rates. A loan with a 7.5% interest rate is a five-alarm fire, while one sitting at 3.5% is much more manageable. That distinction is everything when it comes to creating a plan that actually works.

Trying to pay off your student loans without knowing the details is like navigating a maze blindfolded. Creating a detailed inventory turns on the lights and reveals the fastest path to the exit.

Organizing this data is the next critical move. You can use a simple spreadsheet or a financial dashboard like PopaDex to create your “debt command center.” This central hub lets you see your entire debt landscape at a glance, track your progress, and stay motivated as you watch those balances start to shrink.

Having a clear, organized view transforms a single, terrifying number into a series of smaller, conquerable targets. For those who like a hands-on approach, you can learn more about building your own powerful debt payoff calculator spreadsheet to manage the journey. By the end of this process, you’ll have a crystal-clear picture of your total debt and know exactly where to aim your financial firepower first.

Choosing Your Debt Repayment Strategy

Now that you have a full inventory of your student loans laid out, it’s time to decide on your plan of attack. Choosing the right repayment method isn’t about finding some magical “best” strategy—it’s about matching your financial plan to your personality.

The two most effective and widely used methods are the Debt Avalanche and the Debt Snowball. Each one offers a different path to becoming debt-free, and your choice comes down to a simple question: are you motivated by math or momentum?

The Debt Avalanche Method

The Debt Avalanche is for the number-crunchers who want to pay the absolute minimum in interest over time. The logic is simple but powerful: you hammer away at the loan with the highest interest rate first, while just making minimum payments on everything else.

Once that high-interest loan is gone, you “avalanche” its entire payment (the minimum plus all the extra you were sending) onto the loan with the next-highest rate. This process continues, creating a bigger and bigger payment that systematically wipes out your most expensive debts first.

The Debt Avalanche guarantees you will pay the least amount of interest and get out of debt in the shortest possible time, assuming you make consistent extra payments. It’s the most mathematically efficient method.

This strategy is perfect if you’re driven by logic and long-term savings. Watching the total interest you’re avoiding can be an incredible incentive to stay the course.

The Debt Snowball Method

On the other hand, the Debt Snowball method is all about behavioral psychology. With this strategy, you temporarily ignore the interest rates and focus on paying off your loans with the smallest balances first.

You’ll still make minimum payments on all your loans, but you throw every extra dollar you can find at the one with the tiniest balance. After you knock it out, you get a quick, tangible win. You then take that entire payment and “snowball” it onto the next smallest loan, creating a wave of momentum that knocks out loans one by one.

This approach is tailor-made for anyone who needs to see progress early and often to stay engaged. Celebrating the milestone of eliminating an entire loan account provides the psychological fuel to keep going. If you’re looking for more ways to structure your attack, our complete guide on how to pay off debt offers even more insights.

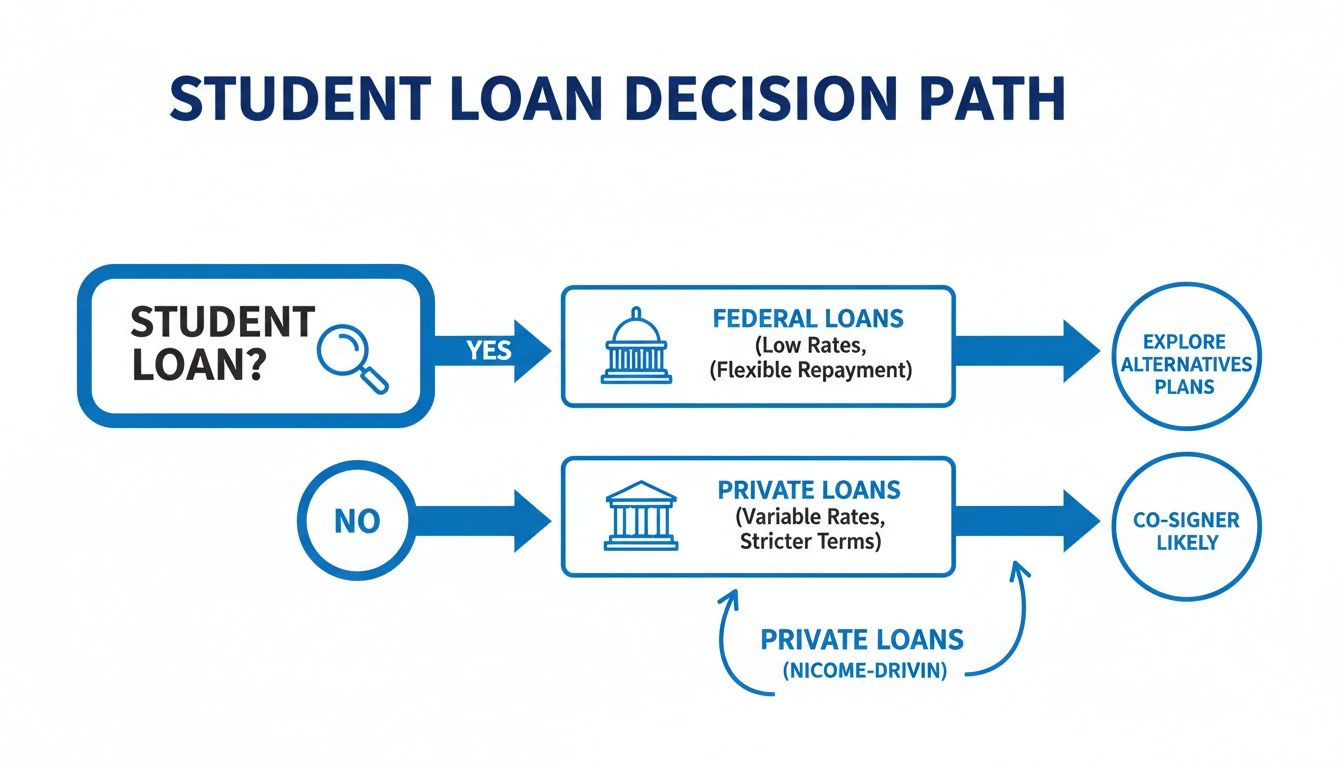

This flowchart can help you visualize how federal and private student loans create different decision paths.

As the chart shows, your loan type is a critical first step in determining which repayment and refinancing options are even on the table.

Making the Right Choice for You

The decision between Avalanche and Snowball isn’t just about spreadsheets; it’s about what will keep you in the fight month after month. The total U.S. student debt has ballooned to $1.6 trillion, but there’s a strategy for every situation.

For instance, 32% of borrowers owe less than $10,000, making them perfect candidates for the quick, motivating wins of the Debt Snowball. On the other hand, a mid-career borrower with an average balance of $44,240 might use their higher income to aggressively pursue the Debt Avalanche, saving thousands in interest.

To help you decide, here’s a quick comparison of the two leading strategies.

| Debt Avalanche vs Debt Snowball: A Comparison | ||

|---|---|---|

| Feature | Debt Avalanche | Debt Snowball |

| Primary Focus | Highest interest rate | Smallest balance |

| Best For | People motivated by math and saving money | People motivated by quick wins and momentum |

| Key Benefit | Pay the least amount of interest | Get early wins to stay motivated |

| Payoff Speed | Fastest, mathematically speaking | Can be slightly slower, but higher success rate |

| Psychological Impact | Delayed gratification, but bigger final reward | Immediate positive reinforcement |

So, which path is yours? The best strategy is always the one you’ll actually stick with. Whether it’s the cold, hard math of the Avalanche or the emotional rush of the Snowball, committing to a plan is the single most important step toward paying off student loans fast and reclaiming your financial freedom.

Unlocking Extra Cash to Accelerate Repayment

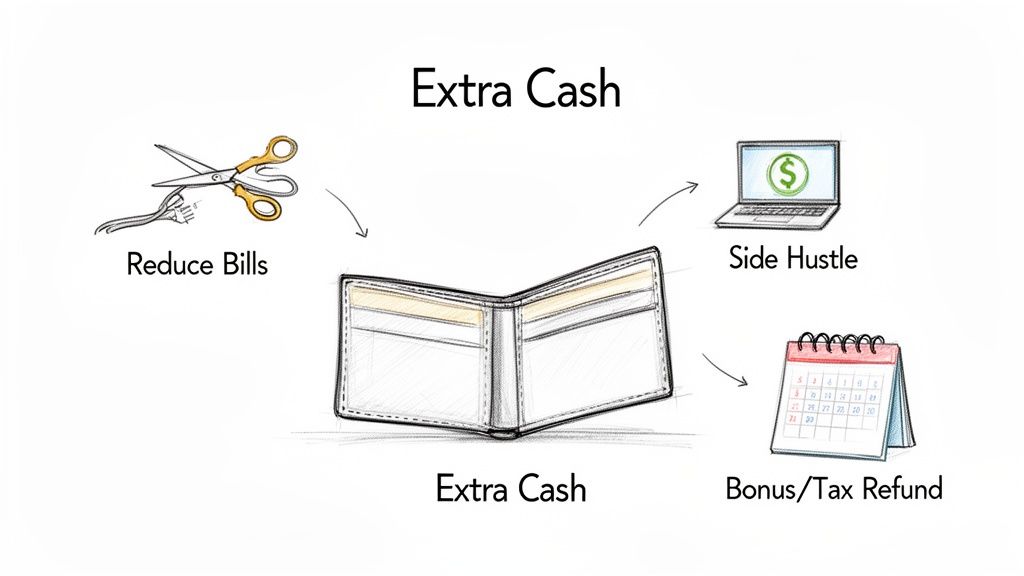

The secret to paying off student loans fast isn’t really a secret. You just have to pay more than the minimum each month. Simple, right? But with a tight budget, the real question is, “Where on earth does that extra cash come from?”

This isn’t about living on ramen noodles for the next decade. It’s about being strategic—making a series of smart moves to optimize your cash flow and then finding ways to boost your income. It starts with a hard look at where your money is actually going, because it’s often the small, recurring expenses that bleed us dry without us even noticing.

Fine-Tuning Your Budget to Free Up Funds

Before you make any drastic lifestyle changes, hunt for the quick wins hiding in your current budget. You’d be surprised how many of your “fixed” monthly bills aren’t so fixed after all. A few phone calls and a quick audit can free up a surprising amount of cash.

Start by targeting these high-impact areas:

- Negotiate Recurring Bills: Your cable, internet, cell phone, and even car insurance providers almost always have better rates available, but they won’t offer them unless you ask. Call their retention department, tell them you’re shopping around, and ask what they can do for a loyal customer.

- Audit Your Subscriptions: Remember that free trial you signed up for six months ago? Or the streaming service you haven’t logged into since last season? These “subscription leaks” can easily siphon $50-$100 per month. Comb through your bank statements and be ruthless.

- Adopt Smarter Spending Habits: This doesn’t mean you can’t have fun; it just means being more intentional. Plan your meals to cut down on pricey takeout, look for free community events instead of expensive nights out, and grab a library card instead of buying every new bestseller.

The goal isn’t just to cut spending, but to redirect it. Every dollar saved on an unused subscription is another dollar you can use to buy back your financial freedom from student debt.

Understanding exactly where your money goes is the first step to telling it where to go instead. For a deeper dive, using a tool to get a clear picture can be an eye-opener; learn more in our guide to calculate disposable income. That clarity shows you exactly how much extra you can realistically throw at your loans.

Increasing Your Income for Maximum Impact

While cutting costs is a great start, there’s a ceiling on how much you can save. Increasing your income, on the other hand, is practically limitless. This is easily the most powerful lever you can pull to shrink your repayment timeline.

Your first stop should be your primary job. Do your research, document your wins, and build a solid case for a raise. Even a modest 5% raise can translate into thousands of extra dollars a year—money you can aim directly at your highest-interest loan.

Beyond your 9-to-5, a side hustle can be a complete game-changer. The trick is to find something that plays to your strengths without burning you out.

Consider options like:

- Freelancing: Offer skills you already have, like writing, graphic design, or web development.

- Tutoring: If you’re an expert in a specific subject, you can help students online or locally.

- Gig Economy Work: Services like delivery or ridesharing offer flexible hours to earn extra cash when you have the time.

Don’t just stop there; it’s crucial to actively explore various ways to make money online if you’re serious about turbocharging your repayment efforts.

Weaponizing Your Financial Windfalls

Finally, you need a plan for any unexpected money that comes your way. Treat these financial windfalls—like a tax refund, an annual bonus, or even a cash gift—not as a bonus for spending, but as a strategic weapon against your loan principal.

Instead of letting this extra cash get absorbed into your daily budget, decide its fate before it even hits your bank account. The moment it arrives, apply the full amount as an extra, principal-only payment to your target loan. This single move can shave months or even years off your repayment schedule and save you a fortune in interest, getting you that much closer to being debt-free.

Get Smart with Your Financial Tools

Optimizing your budget and boosting your income are huge wins, but to really put your debt payoff into overdrive, you need to make your money work smarter. This is where financial tools like refinancing, consolidation, and employer benefits come into play. These aren’t just minor tweaks; these strategies can slash the interest you pay and potentially shave years off your repayment schedule.

Making the right moves here is a big deal. The American student debt crisis is staggering—a total of $1.81 trillion spread across 43 million people, a number second only to mortgages. But don’t let that statistic intimidate you. The data shows that paying off student loans quickly is absolutely possible. While the average timeline can drag on for two decades, aggressive tactics help more than half of undergraduates with debt finish in under 10 years. These tools are your ticket into that group. For more context, check out these insights on average student loan debt on Credible.com.

Should You Refinance Your Student Loans?

Refinancing simply means taking out a new private loan to pay off your old ones. The goal is straightforward: lock in a lower interest rate. If you’ve built up a good credit score and have a steady income, you could qualify for a rate that’s way better than what you’re paying now, especially if you have older federal or private loans.

Think about it: a lower interest rate means more of your payment hits the principal balance instead of just feeding the interest beast. Over the life of your loan, that can translate into thousands of dollars in savings and get you to the debt-free finish line much faster.

But—and this is a big one—there’s a crucial trade-off if you’re dealing with federal loans.

When you refinance federal loans, you’re swapping them for a private loan. That means you permanently give up access to all federal protections and benefits. Things like income-driven repayment plans, Public Service Loan Forgiveness (PSLF), and generous deferment or forbearance options are gone for good.

Before you even think about refinancing, you need to be rock-solid in your financial stability and absolutely sure you won’t need those federal safety nets down the road.

Refinancing vs. Consolidation: What’s the Difference?

People mix these two up all the time, but they’re completely different tools for different jobs. Knowing which is which is key to making the right call for your situation.

| Feature | Federal Consolidation | Private Refinancing |

|---|---|---|

| Primary Goal | Simplify payments into a single monthly bill. | Lower your overall interest rate to save money. |

| Interest Rate | A weighted average of your original rates, rounded up. | A brand-new rate based on your credit score and finances. |

| Loan Type | Combines only federal loans into a new federal loan. | Can combine both federal and private loans into a new private loan. |

| Key Benefit | Convenience and keeping your access to federal programs. | Huge potential for interest savings over time. |

| Main Drawback | Your interest rate won’t go down; it might even go up slightly. | You forfeit all federal loan protections and benefits. |

So, federal consolidation is for someone who craves the simplicity of one payment but needs to keep their federal benefits. Refinancing is the power move for someone whose main focus is paying off student loans fast by crushing their interest costs.

Don’t Sleep on Employer-Sponsored Help

One of the most overlooked resources for tackling debt is sitting right there in your employee benefits package. As companies fight to attract and keep good people, more and more are offering student loan repayment assistance. Think of this as a financial windfall—free money aimed directly at your loan principal.

Here’s how to tap into this perk:

- Talk to HR: Your first stop is the human resources department. Just ask if the company has any kind of student loan assistance program.

- Get the Details: Find out how much they contribute monthly or annually, what the eligibility rules are, and if there’s a lifetime cap on the benefit.

- Max It Out: If your employer offers a match, make sure you contribute enough to get the full amount. It’s the closest you’ll get to free money for your debt.

Even a modest $100 per month from your employer can cut significant time and money off your repayment journey, all without you having to lift an extra finger.

Automate Your Progress and Watch Your Wealth Grow

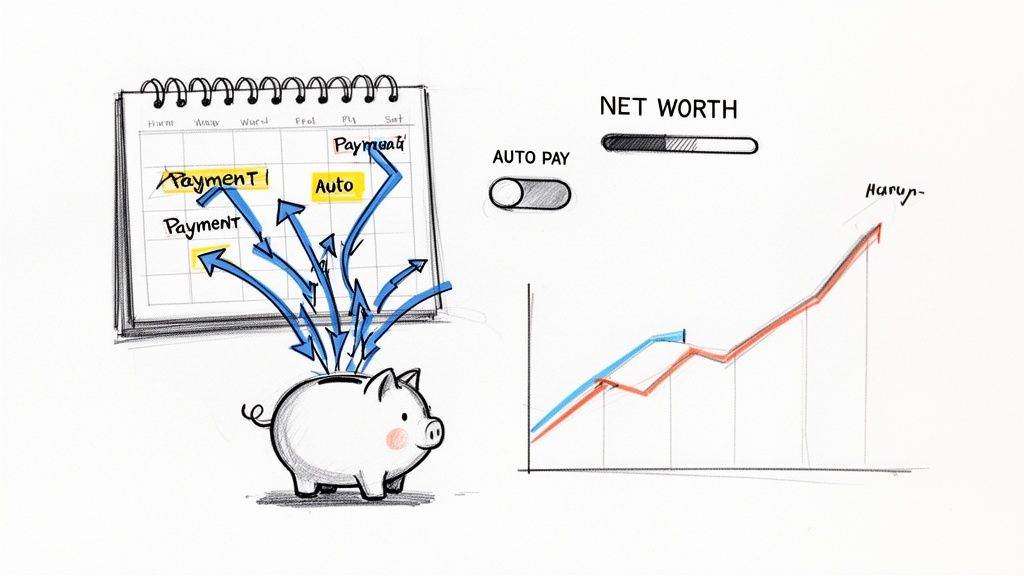

In the fight against student debt, consistency is your superpower. And the single best way to stay consistent? Automation. Setting up automatic payments isn’t just a convenient way to avoid late fees—it’s about putting your entire debt payoff plan on autopilot.

When you automate your payments, especially the extra ones, you’re making a single decision that benefits you month after month. It’s like telling your money exactly where to go before you even have a chance to miss it. This simple move keeps you on the offensive, methodically crushing your loan principal without requiring a daily dose of willpower.

Set It and Forget It: The Power of Automatic Payments

Most loan servicers make it easy to set up recurring payments straight from your bank account. The trick is to schedule not just your minimum payment, but the full extra amount you’ve committed to your target loan, whether you’re using the Avalanche or Snowball method.

This “set it and forget it” strategy is a game-changer for two big reasons:

- It builds discipline: Automation turns your debt payoff into a non-negotiable priority, not just another bill you’ll get to eventually.

- It removes friction: You eliminate the chance of forgetting a payment or, more importantly, talking yourself out of making that extra contribution “just this once.”

Get in touch with your loan servicer and set up an automatic debit for an amount higher than your minimum. Make sure you specify that all extra funds go directly toward the principal of your target loan. This little detail ensures your money is working as hard as possible to shrink that balance.

Shift Your Focus from Debt to Net Worth

While automation takes care of the mechanics, staying motivated for the long haul requires a psychological shift. Let’s be honest: watching a giant debt balance slowly shrink can feel like a grind. The real victory, the number that truly matters, is watching your personal net worth grow with every payment.

Your net worth—the total value of your assets (savings, investments) minus your liabilities (loans, credit card debt)—is the ultimate scoreboard of your financial health. Each student loan payment doesn’t just reduce a negative number; it directly increases your positive net worth.

Framing your journey this way transforms the entire experience. You’re not just escaping debt; you are actively building wealth. This perspective shift is incredibly powerful for maintaining momentum when you feel like you’re running a marathon.

This is where a net worth tracker becomes your most valuable tool. Instead of logging into five different accounts to piece together the puzzle, a single dashboard gives you a real-time, consolidated view. You see your loan balance drop and, in the same glance, watch your net worth chart tick upward. That visual feedback is the fuel that keeps you going.

The Advantage of a Holistic Financial View

For the average Millennial borrower, the reality of student loans is a starting balance of $40,438, which is nearly 7% higher than the national average. But those who get aggressive can completely rewrite that story. By making extra payments or refinancing, borrowers can slash a typical 20-year payoff period down to just 5-7 years, saving thousands in interest. You can find more details in these student loan debt statistics by generation.

Pulling this off requires a clear view of your entire financial world. Tools like PopaDex make this simple by tracking your net worth in real-time, pulling together your loans alongside your savings and investments from over 30 countries. This is especially critical for anyone managing finances across different currencies. You get a complete, accurate picture of how every single extra payment accelerates your journey.

This big-picture view helps you make smarter decisions. You can see how throwing a work bonus at your loans immediately boosts your net worth, reinforcing the value of your sacrifice. It turns the abstract goal of paying off student loans fast into a tangible, measurable, and deeply rewarding process of building your financial future, one automated payment at a time.

Got Questions About Paying Off Student Loans? We’ve Got Answers.

As you start getting serious about tackling your student loans, you’ll inevitably hit some tricky “what-if” scenarios. The path to debt freedom isn’t always a straight line, and it’s normal to have questions that don’t have a simple, universal answer. Let’s dig into some of the most common ones.

Should I Pay Off Student Loans or Invest My Extra Money?

Ah, the classic financial crossroads. The right move here really boils down to your loan interest rates and your own comfort level with risk. A good rule of thumb is to weigh your loan’s interest rate against the after-tax return you could realistically expect from investing.

If your loans are saddled with high interest rates—think anything over 6-7%—then paying them down aggressively is almost always the smarter play. Why? Because every extra dollar you pay is a guaranteed, risk-free return equal to that interest rate. You’d be hard-pressed to find a guaranteed 7% return in the market without taking on a ton of risk.

But what if your loans have super-low interest rates, say under 4%? In that case, the math might tip in favor of investing, since the stock market has historically returned more than that over the long haul. A popular hybrid approach works wonders here: make extra payments on your loans, but also contribute enough to your retirement accounts to snag any employer match. Never, ever leave that free money on the table.

Does Paying Off Student Loans Fast Hurt My Credit Score?

This is a huge fear for a lot of people, but it shouldn’t hold you back. It’s true that when you pay off that final student loan, you might see a small, temporary dip in your credit score. This happens for a couple of wonky, technical reasons.

- Closing an old account: Wiping out an established loan can slightly lower the average age of your credit history, which is a factor in your score.

- Shrinking your credit mix: Lenders like seeing that you can handle different kinds of credit (like installment loans and credit cards). Closing your last installment loan can narrow this mix.

But here’s the key: the dip is almost always minor and bounces back quickly. The massive, long-term win of being debt-free crushes this tiny, temporary blip. Don’t let a small score fluctuation stop you from the huge financial victory of being done with student loans for good.

In the long run, ditching debt is phenomenal for your financial health. It massively improves your debt-to-income ratio—a critical number for future borrowing—and frees up your cash flow, making you a much stronger borrower in the eyes of lenders.

What if an Emergency Happens While I’m Paying Aggressively?

This is precisely why having a fully funded emergency fund isn’t just a suggestion—it’s a non-negotiable prerequisite before you go all-in on debt payoff. Think of your emergency fund as a firewall protecting your financial life and your repayment plan from getting torched by unexpected events.

Your goal should be to have 3 to 6 months of essential living expenses stashed in a separate, high-yield savings account. This money is sacred; it’s only for true emergencies like a sudden job loss, a surprise medical bill, or a critical home repair.

If a crisis hits, you simply pause your extra loan payments. You use your emergency fund to handle the problem without sliding back into debt. Once you’re back on your feet and have replenished your fund, you can confidently fire up your aggressive repayment strategy again. That cash cushion ensures one bad month doesn’t undo years of hard work.

Ready to stop guessing and start seeing the real-time impact of your efforts? PopaDex gives you a single, clear view of your entire financial world. Watch your loans shrink and your net worth grow in one simple dashboard, keeping you motivated and helping you make smarter decisions on your journey to financial freedom. Start tracking your progress today at PopaDex.com.