Our Marketing Team at PopaDex

12 Best Personal Finance Apps Free for 2025

In a world of subscriptions and hidden fees, finding powerful financial tools that don’t cost a dime can feel like a major win. The right app can transform how you see and manage your money, shifting you from financial stress to confident control. But with hundreds of options available, how do you choose the one that truly fits your life? This guide cuts through the noise and gets straight to the point.

We’ve analyzed the best personal finance apps free for the current year, focusing on real-world usability, critical features, and honest limitations. This isn’t just a list; it’s a detailed resource designed to match your specific needs with the right tool. Forget generic marketing copy and surface-level reviews. Our analysis dives deep into what makes each app stand out and where it might fall short, so you can make an informed decision without wasting time on trial and error.

Inside, you will find a curated selection of top-tier applications, from comprehensive budget planners like EveryDollar to powerful net worth and investment trackers like Empower Personal Dashboard. Whether you are a gig worker managing fluctuating income, a couple merging finances with Honeydue, or a long-term investor monitoring your portfolio, a practical solution awaits. Each entry includes detailed overviews, direct links, and screenshots to give you a clear picture before you even download. Our goal is to help you find the perfect free app to build financial clarity and achieve your goals without adding another monthly bill to your budget.

1. PopaDex

PopaDex establishes itself as a premier net worth tracker by offering a sophisticated, yet intuitive platform designed for a comprehensive financial overview. It excels at consolidating diverse financial elements, including savings, investments, property, and liabilities, into a single, cohesive dashboard. This makes it a powerful choice among personal finance apps free for users seeking clarity and control over their entire portfolio.

The platform is particularly adept at handling financial complexity. For instance, an expat managing accounts in multiple currencies or a seasoned investor with a diverse portfolio will find its multi-currency and multilingual support invaluable. The free standard plan provides a solid foundation, allowing users to manually aggregate their accounts and access essential planning tools.

Why It’s a Top Free Choice

PopaDex stands out due to its powerful free tier and an exceptionally affordable upgrade path. While many free apps limit features significantly, PopaDex provides robust manual tracking and useful resources like a disposable income calculator and spreadsheet templates without any cost. This commitment to accessibility allows users to build a detailed financial picture from day one.

The platform’s real strength lies in its scalability. As your financial needs grow, the premium plan (€5/month) unlocks automated bank integrations, advanced analytics, and interactive data visualizations. This structure ensures the app can support your journey from basic budgeting to complex portfolio optimization.

Key Advantage: PopaDex provides a global-ready solution with extensive bank connectivity, supporting over 15,000 institutions in 30+ countries, making it ideal for international users and those with widespread assets.

Use Case: The Global Professional

Consider a young professional working abroad. They have a checking account in their home country, a savings account in their current country of residence, a brokerage account with international stocks, and a small real estate investment. PopaDex allows them to:

- Consolidate: Manually input and track all these multi-currency assets in the free version.

- Visualize: See their total net worth calculated in their preferred currency.

- Plan: Use the budgeting tools and calculators to plan for future goals, like purchasing another property or saving for retirement.

Feature Breakdown

| Feature | Free Plan | Premium Plan (€5/mo) |

|---|---|---|

| Account Aggregation | Manual Entry | Automated Bank Sync |

| Bank Connectivity | N/A | 15,000+ banks in 30+ countries |

| Currency Support | Multi-Currency | Multi-Currency |

| Financial Insights | Basic Overview | Advanced Analytics & Visualizations |

| Additional Tools | Calculators & Templates | All tools included |

| Customer Support | Standard | Dedicated Support |

Pros:

- Extensive international bank and multi-currency support.

- Generous free tier with valuable manual tracking tools.

- Highly affordable premium plan unlocks powerful automation.

- Clean, user-friendly interface simplifies complex financial data.

- Risk-free trial without requiring credit card information.

Cons:

- The free plan requires manual data entry, which can be time-consuming.

- The anticipated AI co-pilot for advanced decision-making is not yet available.

Access PopaDex: https://popadex.com

2. Rocket Money

Rocket Money has rapidly become a favorite among users seeking a powerful, automated financial dashboard, making it one of the best personal finance apps free of charge. Originally known as Truebill, it excels at providing a holistic view of your finances by aggregating all your accounts, from checking and savings to investments and loans, into one clean interface.

What truly sets Rocket Money apart is its powerful subscription management tool. The app automatically identifies all your recurring payments, making it easy to spot and cancel unwanted subscriptions directly within the app, a feature that can lead to immediate savings. The free version provides a comprehensive suite of tools, including budget creation, spending categorization, net worth tracking, and credit score monitoring.

Key Features & User Experience

The user interface is modern and intuitive, particularly appealing to tech-savvy users who appreciate automation. While the core features are free, more advanced capabilities like bill negotiation, where the Rocket Money team negotiates bills like cable or internet on your behalf, are part of the Premium plan.

- Pricing: Robust free tier. Premium is available on a “pay-what-you-want” model, from $6 to $12 per month.

- Best For: Users who want to regain control over recurring subscriptions and get a clear, automated overview of their spending habits.

- Limitations: The most powerful automation and concierge services are locked behind the paid tier. Some users report occasional synchronization issues with smaller financial institutions.

For those transitioning from now-defunct apps like Mint, Rocket Money’s free offering is a compelling and feature-rich alternative that focuses on actionable savings.

Website: https://www.rocketmoney.com

3. EveryDollar

For those who prefer a hands-on, disciplined approach to budgeting, EveryDollar from Ramsey Solutions stands out as one of the most effective personal finance apps free for implementing a zero-based budget. This method involves giving every dollar a job, ensuring your income minus your expenses, savings, and debt payments equals zero. The philosophy is to create an intentional plan for your money each month, eliminating mindless spending.

The free version of EveryDollar is designed for this manual approach. It allows you to create a detailed monthly budget, set up customizable spending categories, and track savings goals through its “Funds” feature. By requiring you to manually input every transaction, it forces a level of mindfulness and accountability that automated apps can sometimes obscure, making you acutely aware of where your money is going.

Key Features & User Experience

EveryDollar offers a clean, straightforward user interface that is exceptionally beginner-friendly. It guides you through the process of creating your first budget without overwhelming you with complex features. The core strength of the free version is its simplicity and focus. For users who want automation, the Premium plan unlocks bank connections for auto-transaction imports and detailed reporting.

- Pricing: Free version for manual budgeting. Premium starts at $79.99 per year.

- Best For: Individuals and families committed to the zero-based budgeting method who want a simple, no-frills tool to build financial discipline.

- Limitations: The free version has no bank syncing, requiring completely manual transaction entry. Advanced reporting and financial tracking are exclusive to the paid tier.

For anyone looking to take direct, active control over their budget and build strong financial habits from the ground up, EveryDollar’s free, manual-first system is a powerful and purposeful choice.

Website: https://www.everydollar.com

4. Goodbudget

Goodbudget brings the time-tested envelope budgeting method into the digital age, making it an excellent choice among personal finance apps free for those who prefer a hands-on, proactive approach to managing their money. Instead of just tracking past spending, Goodbudget helps you allocate your income into digital “envelopes” for different categories like groceries, rent, and entertainment before you spend. This method is particularly effective for couples and families who need to coordinate their spending from a shared budget.

What makes Goodbudget stand out is its commitment to the envelope philosophy and its generous free plan. The “Free Forever” version allows for one account, two devices, 10 regular envelopes, and 10 annual envelopes. This is often sufficient for individuals or couples to get a firm grasp on their financial habits. It focuses on intentional spending rather than automated tracking, forcing users to be more mindful of where their money is going. As you can learn more about in this guide to the best free budgeting apps, this method can be a game-changer for breaking bad spending cycles.

Key Features & User Experience

The user interface is straightforward and functional, prioritizing clarity over flashy design. It’s designed to be simple to use across its web and mobile platforms, ensuring you can check your envelope balances and log transactions from anywhere. The lack of bank syncing in the free tier means all transactions must be entered manually, which can be seen as either a pro (encouraging mindfulness) or a con (time-consuming).

- Pricing: Free Forever plan with clear limitations. Premium is $8/month or $70/year for unlimited envelopes, more devices, and bank syncing.

- Best For: Individuals, couples, or families who want to proactively plan their spending using the envelope method and are willing to manually track transactions.

- Limitations: The free version requires manual transaction entry as it does not sync with bank accounts. The Android app has occasionally faced temporary availability issues on the Google Play Store.

For users seeking to build disciplined spending habits, Goodbudget’s deliberate, manual approach is a powerful feature, not a bug, and offers a refreshing alternative to fully automated apps.

Website: https://goodbudget.com

5. Empower Personal Dashboard (formerly Personal Capital)

Empower Personal Dashboard stands out as one of the most powerful personal finance apps free for those who prioritize wealth management and investment tracking. Formerly known as Personal Capital, its free dashboard provides an institutional-grade overview of your entire financial picture. It excels at aggregating all your accounts, including complex investment portfolios, 401(k)s, and IRAs, to deliver a precise, real-time calculation of your net worth.

What makes Empower truly unique in the free space is its sophisticated set of analytical tools. Users gain access to a Retirement Planner, an investment checkup tool that analyzes your portfolio’s risk, and a Fee Analyzer that uncovers hidden fees in your retirement accounts that could be eroding your wealth. While it offers budgeting and cash flow tracking, its core strength lies in providing a long-term, investment-focused perspective on your finances.

Key Features & User Experience

The platform offers a mature, data-rich user experience through both its website and mobile apps, appealing to investors who want deep insights. While the powerful financial dashboard is completely free, be aware that the company uses this platform to offer its paid wealth management services, so you may receive occasional outreach from financial advisors.

- Pricing: The financial dashboard and all its analytical tools are completely free. Paid wealth management services are optional.

- Best For: Investors and long-term planners who want to track net worth and optimize their investment portfolios for retirement.

- Limitations: Its budgeting features are less granular and robust than dedicated budgeting apps. Some users report occasional synchronization quirks with certain financial institutions.

For individuals focused on building wealth and planning for retirement, Empower’s free dashboard offers a level of investment analysis that is unparalleled among its peers.

Website: https://www.personalcapital.com

6. Credit Karma

While many know it as a credit monitoring service, Credit Karma has evolved into a robust contender among personal finance apps free of charge, especially for users who prioritize credit health. It provides a comprehensive financial overview by allowing you to link various accounts, including checking, savings, and loans, giving you a snapshot of your spending patterns and overall net worth.

What makes Credit Karma stand out is its truly free model, supported by targeted financial product recommendations. The platform offers free credit scores and reports from both TransUnion and Equifax, along with a credit simulator to see how potential financial decisions might impact your score. While it offers spending insights and categorization, its core strength lies in credit management rather than granular budgeting, making it a powerful tool for monitoring your financial reputation and tracking your assets in one place. Explore different options with this overview of a net worth tracker.

Key Features & User Experience

The recently redesigned app offers a clean, user-friendly interface that makes complex credit information easy to understand. It provides educational content and clear insights into factors affecting your credit. The platform is monetized through offers for credit cards and loans, so users should be mindful of the heavy advertising. However, all core features for monitoring your credit and finances remain completely free.

- Pricing: Entirely free; monetized through financial product recommendations.

- Best For: Individuals focused on monitoring, understanding, and improving their credit score while also getting a high-level view of their net worth and spending.

- Limitations: It is not a true budgeting app, as it lacks features for setting and enforcing category-specific spending limits. The heavy emphasis on product offers can be distracting for some users.

For those whose primary goal is credit health management with the added benefit of financial aggregation, Credit Karma offers an invaluable and completely free service.

Website: https://www.creditkarma.com

7. Honeydue

Honeydue is designed from the ground up to solve one of the biggest challenges in personal finance: managing money with a partner. As one of the most specialized personal finance apps free for couples, it facilitates financial transparency and collaboration. The app allows you and your partner to link individual and joint accounts, giving you a shared view of your balances, bills, and spending habits without forcing you to merge finances completely.

What makes Honeydue unique is its focus on communication. Each transaction has a comment field, allowing couples to ask questions or add notes directly within the app, clearing up confusion before it starts. You can set joint category limits, get reminders for upcoming bills, and easily split expenses, all within a simple, shared interface. For partners looking to get on the same financial page, effective money management for couples is crucial, and this app provides the perfect framework.

Key Features & User Experience

The user experience is built for simplicity and teamwork, stripping away complex charts in favor of clear, actionable information. The setup is straightforward, letting each partner decide which of their accounts to share and which to keep private. This balance of transparency and privacy makes it an ideal tool for couples at any stage of their relationship, from moving in together to managing a household.

- Pricing: Completely free. The platform is supported by optional tips from users.

- Best For: Couples who want a simple, collaborative way to track shared expenses, bills, and savings goals without a combined bank account.

- Limitations: It lacks the advanced investment tracking and long-term financial planning tools found in more comprehensive apps. The platform is also heavily mobile-focused, with limited desktop functionality.

For partners seeking to build financial harmony, Honeydue offers a purpose-built, free solution that prioritizes communication and shared visibility over complex analytics.

Website: https://www.honeydue.com

8. WalletHub

WalletHub positions itself as a comprehensive financial hub, making a strong case as one of the best personal finance apps free for users who prioritize credit health alongside budgeting. It offers an impressive, all-in-one toolkit designed to give users a 360-degree view of their financial life. The platform’s standout feature is its free daily credit score and report updates from TransUnion, a frequency that is rare in the free market.

Beyond just credit monitoring, WalletHub integrates essential budgeting tools, a spending analyzer, a net worth tracker, and a debt payoff planner. This combination allows users to not only see where their money is going but also understand how their spending habits directly impact their creditworthiness. The platform also includes a subscription manager and provides personalized recommendations for financial products like credit cards and loans based on your profile.

Key Features & User Experience

The user experience is data-rich, providing detailed insights and alerts. While this is a major strength, the interface can sometimes feel busy or overwhelming for individuals who only need basic budgeting features. The platform is available across iOS, Android, and the web, ensuring seamless access. While the core offering is robustly free, there are frequent upsells to its premium service for more advanced analytics and features.

- Pricing: Completely free core model. Premium upgrades are available for enhanced credit monitoring and identity theft protection.

- Best For: Users who are actively working to improve their credit score and want an integrated platform to monitor credit, track spending, and plan debt repayment.

- Limitations: The interface can feel cluttered with product recommendations and advertisements. It also requires significant personal and usage data to provide its full suite of services.

For those who want daily credit insights without a paywall, WalletHub provides an exceptionally powerful free toolkit that rivals many paid services.

Website: https://wallethub.com

9. NerdWallet app

The NerdWallet app extends the company’s well-known financial advice platform into a practical tool for monitoring your financial health, solidifying its place among the best personal finance apps free for those who value education alongside tracking. It offers a high-level dashboard that links your accounts to provide a clear, consolidated view of your cash flow, spending patterns, and overall net worth. This makes it an excellent starting point for anyone beginning their financial journey.

What distinguishes NerdWallet is its seamless integration of financial management tools with its vast library of expert content. As you track your finances, the app provides relevant articles and guides to help you understand complex topics. Recently, it has also added a subscription management feature, allowing users to identify and potentially cut recurring costs. While it isn’t a dedicated budgeting app with granular control, it excels at providing a comprehensive financial snapshot and empowering users with knowledge.

Key Features & User Experience

The app’s interface is clean, straightforward, and designed for quick check-ins rather than deep-dive budgeting sessions. It’s perfect for users who want to see the big picture, monitor their credit, and get trusted financial advice without feeling overwhelmed. The integration with partner offers for credit cards or loans is a core part of its business model but is generally presented as an optional resource.

- Pricing: Completely free. The platform is supported by partnerships with financial institutions.

- Best For: Beginners seeking a simple financial overview, credit score monitoring, and access to reliable financial education all in one place.

- Limitations: Lacks the in-depth budgeting, goal-setting, and alert features found in more specialized budgeting apps. Some product recommendations are linked to partner offers.

For users who want a simple, trustworthy hub to monitor their financial standing and improve their financial literacy, the NerdWallet app offers a powerful, no-cost solution.

Website: https://www.nerdwallet.com

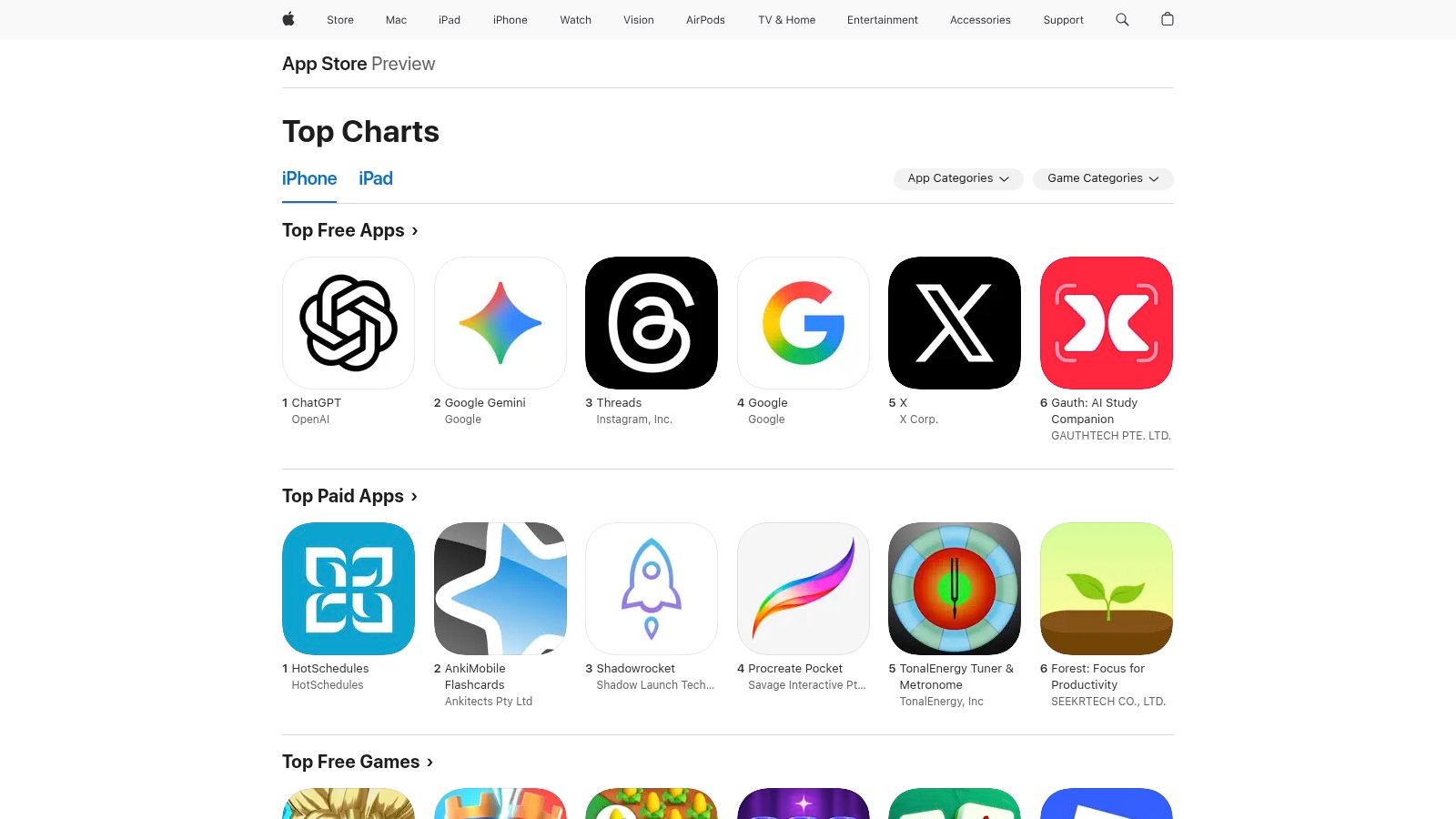

10. Apple App Store

For iPhone and iPad users, the Apple App Store is not just a marketplace but a curated and trusted ecosystem for discovering the best personal finance apps free of charge. It serves as the primary gateway to a vast library of tools, each vetted for security and quality. Apple’s stringent review process and transparent privacy labels give users confidence that the apps they download handle their sensitive financial data responsibly.

What makes the App Store an essential resource is its powerful discovery engine. Users can browse editorial picks, check out curated lists like “Apps for Budgeting,” and rely on authentic user reviews and ratings to find the perfect tool for their needs. Centralized management of app updates, subscriptions, and even refund requests simplifies the entire experience, making it an indispensable starting point for any iOS user looking to improve their financial health without an initial investment.

Key Features & User Experience

The App Store offers a seamless and integrated experience, with parental controls and family sharing making it easy to manage finance apps across multiple devices. While the platform itself is free, it’s important to read app descriptions carefully, as many developers use a freemium model where core features are free but advanced automation or tools require an in-app purchase or subscription.

- Pricing: Free to access. Individual app pricing varies from completely free to freemium models with in-app purchases.

- Best For: iOS users who want a secure, centralized, and reliable source to discover, compare, and manage a wide variety of vetted personal finance apps.

- Limitations: Exclusively for Apple devices, so Android users are excluded. The sheer volume of apps can be overwhelming, and some of the best features are often locked behind paywalls.

For those embedded in the Apple ecosystem, the App Store is the most logical and secure starting point for finding high-quality financial management tools.

Website: https://apps.apple.com/us/genre/ios-finance/id6015

11. Google Play Store

While not a finance app itself, the Google Play Store is the essential gateway for Android users to discover the vast universe of personal finance apps free for download. It serves as the primary marketplace where you can find, compare, and install nearly every major budgeting, investing, and financial tracking tool, including many of the others mentioned on this list. Its inclusion is critical because it empowers users to make informed decisions before committing to an app.

What makes the Play Store an indispensable resource is its user-generated content. You can read thousands of reviews, check app ratings, and view screenshots to get a real-world sense of an app’s user experience and reliability. This community feedback is invaluable for sorting through the noise and finding high-quality applications that meet your specific financial needs, from simple expense trackers to comprehensive wealth management platforms.

Key Features & User Experience

The platform offers a centralized hub for managing app updates, subscriptions, and even sharing eligible app purchases with family members through the Family Library. While the sheer volume of apps is a major benefit, it also means users should be cautious and look for established apps with strong, positive reviews to avoid low-quality clones or apps with privacy concerns.

- Pricing: Free to access and browse. Most finance apps offer a free tier or a free trial.

- Best For: Android users looking for the widest possible selection of finance apps and the ability to compare them using authentic user reviews and ratings.

- Limitations: The quality of apps can vary dramatically. Users must be diligent in vetting apps for security and functionality, as some low-effort or misleading “guide” apps are present.

For anyone on an Android device, the Play Store is the first and most important stop in the journey to find the perfect tool to manage their money effectively.

Website: https://play.google.com/store/apps/category/FINANCE

12. GnuCash

For users who prioritize data privacy and robust, traditional accounting methods, GnuCash stands out as a powerful and truly personal finance app free of charge. This open-source desktop software is not a flashy cloud-based service; instead, it offers a comprehensive double-entry bookkeeping system that runs locally on your Windows, macOS, or Linux computer. It’s designed for meticulous users who want complete control over their financial data without ads or monthly fees.

GnuCash provides a level of detail that many modern apps lack, including powerful budgeting, multi-currency support, and sophisticated investment and portfolio tracking. It operates more like professional accounting software, making it ideal for managing complex personal finances, a side business, or even a small non-profit. The trade-off for this power is the lack of automatic bank synchronization; users typically import their transaction data manually using standard file formats like QIF, OFX, or CSV.

Key Features & User Experience

The user interface is functional and data-dense rather than sleek and modern, reflecting its accounting software roots. This desktop-centric approach comes with a steeper learning curve compared to mobile-first apps, but its flexibility and extensive reporting capabilities are unmatched in the free software space. The active community and detailed documentation provide excellent support for new users willing to learn the system.

- Pricing: Completely free and open-source with no ads, subscriptions, or premium tiers.

- Best For: Detail-oriented individuals, freelancers, and small business owners who want a powerful, local-first accounting system and complete data ownership.

- Limitations: No automatic bank syncing, which requires manual transaction imports. The desktop interface can feel dated and has a significant learning curve for beginners accustomed to modern fintech apps.

GnuCash is the ultimate choice for anyone who values control, privacy, and the proven reliability of double-entry accounting over the convenience of automated, cloud-based platforms.

Website: https://www.gnucash.org

Top 12 Free Personal Finance Apps Comparison

| Product | Core Features/Characteristics | User Experience/Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| PopaDex 🏆 | Bank sync (15,000+ banks), multi-currency, multilingual | Intuitive UI, customizable dashboards ★★★★☆ | Free plan + €5/month Premium 💰 | Wealth builders, expats, investors 👥 | AI co-pilot (coming), disposable income calc ✨ |

| Rocket Money | Auto aggregation, subscription finder, spend tracking | Strong free tier ★★★★☆ | Free + $6–12/mo Premium 💰 | Budget conscious, subscription managers 👥 | Subscription cancel, bill negotiation ✨ |

| EveryDollar | Zero-based budgeting, manual (free), bank sync (Premium) | Clean, beginner-friendly ★★★☆☆ | Free + Premium available 💰 | Beginners, strict budgeters 👥 | Simple zero-based budgeting ✨ |

| Goodbudget | Envelope budgeting, debt tracking, cross-device sync | Transparent, steady ★★★☆☆ | Free plan + Premium for bank sync 💰 | Couples, families 👥 | Envelope method, budgeting courses ✨ |

| Empower Personal Dashboard | Investment-grade dashboard, fee analyzer, retirement tools | Mature, comprehensive ★★★★☆ | Free tool 💰 | Investors needing wealth overview 👥 | Strong investment analytics ✨ |

| Credit Karma | Free credit scores, spending insights, net-worth tracker | Reliable, frequent updates ★★★☆☆ | Free, ad-supported 💰 | Credit-focused users 👥 | Free TransUnion scores, credit simulations ✨ |

| Honeydue | Joint account linking, expense splitting, chat | Simple, couples-focused ★★★☆☆ | Fully free 💰 | Couples, collaborative users 👥 | In-app chat, free with tips ✨ |

| WalletHub | Daily credit scores, subscription management, debt planner | Feature rich but busy ★★★☆☆ | Free + upsells 💰 | Users wanting all-in-one finance 👥 | Daily credit updates, product comparisons ✨ |

| NerdWallet app | Net worth, credit scores, financial education | User-friendly, well-guided ★★★☆☆ | Free with partners 💰 | High-level financial overview seekers 👥 | Subscription integrations, editorial content ✨ |

| Apple App Store | Vetted iOS finance apps, privacy labels, editorial picks | Trusted, quality control ★★★★☆ | Free platform 💰 | iPhone/iPad users 👥 | Curated apps, privacy transparency ✨ |

| Google Play Store | Large catalog, ratings/reviews, family sharing | Wide variety, variable quality ★★★☆☆ | Free platform 💰 | Android users 👥 | Massive app selection, frequent deals ✨ |

| GnuCash | Double-entry bookkeeping, local data, multi-currency | Powerful but steep ★★★☆☆ | 100% free, open-source 💰 | Desktop users wanting control 👥 | Open-source, no ads, desktop focused ✨ |

Choosing Your Financial Co-Pilot

Navigating the world of personal finance can feel like charting a course through a vast, complex ocean. Throughout this guide, we’ve explored a diverse fleet of personal finance apps free to download and use, each serving as a potential co-pilot for your financial journey. From the meticulous, hands-on approach of GnuCash to the high-level investment tracking of Empower Personal Dashboard, the right tool is rarely a one-size-fits-all solution. It’s the one that aligns with your specific goals, habits, and financial personality.

The journey to financial mastery begins with a single, clear objective. Before committing to any platform, ask yourself: What is my most pressing financial need right now? Your answer is the compass that will point you to the most effective app.

Matching the App to Your Mission

To crystallize your decision, let’s revisit the core strengths of the apps we’ve covered, framing them as solutions to specific financial challenges:

- For Aggressive Debt Reduction and Zero-Based Budgeting: If your primary mission is to annihilate debt and account for every single dollar, EveryDollar and Goodbudget are your champions. Their structured, proactive methodologies force you to plan your spending, making them ideal for individuals or families needing disciplined financial frameworks.

- For Automated Subscription Management and Bill Negotiation: For those battling the slow drain of forgotten subscriptions and recurring charges, Rocket Money excels. Its powerful automation identifies and helps you cancel unwanted services, effectively plugging leaks in your financial ship.

- For Comprehensive Net Worth and Investment Tracking: If your focus is on wealth accumulation and a holistic view of your assets, Empower Personal Dashboard is unparalleled in the free category. It’s the perfect tool for tech-savvy investors who want a detailed, 30,000-foot view of their financial health and retirement readiness.

- For Building and Monitoring Your Credit Score: Your credit is a cornerstone of your financial life. Apps like Credit Karma, WalletHub, and the NerdWallet app provide invaluable, free access to your credit scores and reports, offering insights and alerts that help you protect and improve this critical asset.

- For Shared Finances and Collaborative Budgeting: Couples looking to streamline their joint financial management will find a dedicated ally in Honeydue. Its design is built from the ground up to foster transparency and teamwork in managing shared expenses.

Implementation and Long-Term Success

Choosing an app is only the first step; consistent use is what transforms data into progress. When you’ve selected your tool, dedicate time to setting it up properly. Connect your accounts, categorize your initial transactions, and establish your budget or financial goals within the first week. Treat this setup process as a foundational investment in your financial future.

Remember that these tools are part of a larger financial ecosystem. A budgeting app helps manage cash flow, but a comprehensive plan also includes savings, investments, and insurance. As you organize your daily finances, it becomes easier to see where you need broader protection. For instance, creating a budget highlights what you need to protect, making it a good time to improve your knowledge of different safety nets by understanding different types of financial protection to secure your family’s future.

Ultimately, the best of the many personal finance apps free to use is the one that becomes a seamless, encouraging part of your routine. Don’t be afraid to experiment. Try one for a month, and if its interface or workflow doesn’t click with you, move on to another from this list. Your financial co-pilot should reduce stress, not add to it. By taking this proactive step, you are seizing control, transforming abstract financial goals into a concrete, achievable reality, one transaction at a time.

Ready to move from planning to action with a tool designed for clarity and control? PopaDex offers a streamlined, user-friendly platform that makes mastering your money feel intuitive, not intimidating. Start with our robust free version to build your financial foundation, and discover why users trust PopaDex to guide them toward their financial goals.