Our Marketing Team at PopaDex

Personal Financial Management Essentials: Master Your Money with Smart Budgeting

Let’s be honest, “personal financial management” sounds a bit stuffy. Like something you’d hear in a dusty old bank. But all it really means is taking charge of your money—budgeting, saving, investing, and spending—to build the life you actually want.

It’s not about restriction or penny-pinching. Think of it as the blueprint for your dreams, whether that’s buying a house, traveling the world, or just retiring without a single worry.

Charting Your Course to Financial Freedom

Imagine your financial goals are a treasure-filled island somewhere on the horizon. If you just set sail without a map or compass, you’d be at the mercy of the currents—drifting along with daily expenses and getting knocked off course by unexpected storms.

Personal financial management is your map and compass, all in one. It’s the simple act of telling your money where to go, instead of wondering where it went.

This isn’t about sacrificing every latte today for some abstract future. It’s about being intentional. It’s about aligning your spending with what you truly value, giving you the confidence to navigate life’s financial waters knowing exactly where you’re headed.

The Four Pillars of the Journey

Your financial journey is built on four core activities. Get these right, and you’re well on your way.

Here’s a quick breakdown of the four pillars that form the foundation of solid financial management. Each one plays a unique and critical role in steering you toward your goals.

| Pillar | What It Is | Why It’s Important |

|---|---|---|

| Budgeting | Your ship’s rudder. | It lets you steer your income toward your goals instead of letting it drift away on impulse buys. |

| Saving | Your life raft and anchor. | An emergency fund keeps you afloat in a storm, while saving for big goals anchors your progress. |

| Investing | The wind in your sails. | Investing puts your money to work, using compound growth to get you to your destination faster. |

| Spending | The enjoyable part of the voyage. | Smart management means you can spend on things you love without throwing yourself off course. |

Mastering these four elements creates a powerful system for building wealth and achieving the financial freedom you’re after.

The core idea is simple: To increase your wealth, your money must grow faster than inflation. Your financial plan is the strategy that ensures your investments consistently outpace the rising cost of living over time.

This proactive approach is catching on. People everywhere are looking for more control over their financial lives, and technology is making it easier than ever.

In fact, by 2025, a massive 72% of consumers worldwide are expected to be using personal finance or budgeting apps to manage their money. This shift shows just how powerful these tools have become. You can check out more on this trend in these personal finance marketing statistics.

Ultimately, your financial journey is your own. Your destination—whether it’s early retirement, debt freedom, or a life of travel—is completely up to you. With the right map and a few good tools, anyone can take the helm and chart a course to a more secure future. This guide is here to give you the essentials to get started.

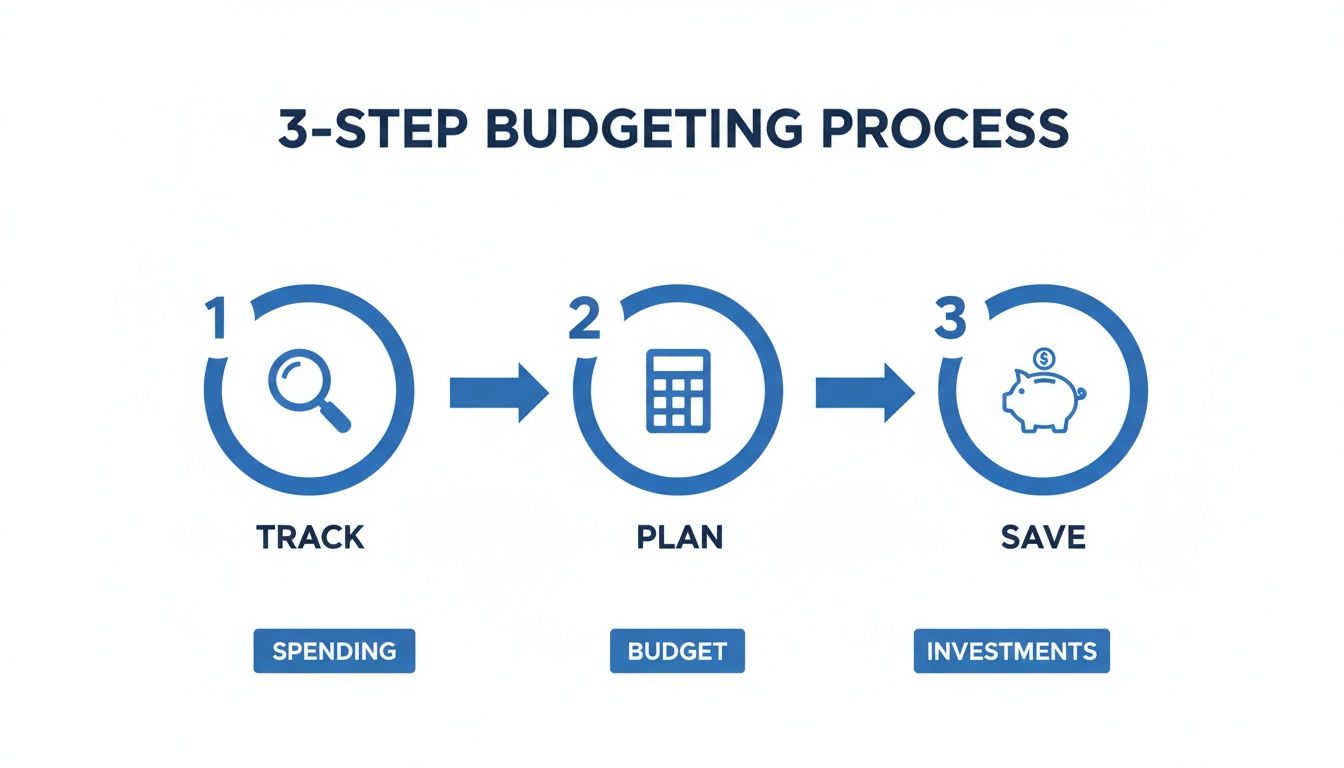

Build Your Financial Foundation with Smart Budgeting

If your financial plan is the blueprint, then your budget is the foundation you build everything else on. Let’s get one thing straight: budgeting isn’t about saying “no” to everything fun. Far from it. Think of it as a plan for intentional spending—a tool that puts you in the driver’s seat, directing your money toward what you actually care about.

At its core, a budget is just a plan for your cash flow. It gives every single dollar a job, whether that job is paying the rent, saving up for a trip to Italy, or quietly building your future wealth. When you create this plan, you transform money from a source of stress into a predictable system that works for you.

That shift in mindset is everything. You stop just tracking where your money went and start designing a life that fits your income and your biggest goals. The endgame? To spend, save, and invest with total confidence.

Choosing Your Budgeting Method

There’s no one-size-fits-all “best” way to budget. The right method is simply the one you’ll actually stick with. Your personality, lifestyle, and how complex your finances are will all point you toward the approach that feels the most natural.

Here are three popular methods that have stood the test of time:

- The 50/30/20 Rule: This is a fantastic starting point if you want simplicity. You just divide your after-tax income into three buckets: 50% for Needs (housing, groceries, utilities), 30% for Wants (restaurants, hobbies, streaming services), and 20% for Savings & Debt Repayment. It’s flexible and gives you a high-level guide without getting bogged down in tiny details.

- The Zero-Based Budget: This one is for the detail-oriented folks who want maximum control. The formula is simple: income minus expenses equals zero. Every dollar gets a specific assignment, whether it’s for spending, saving, investing, or crushing debt. It’s a hands-on approach that forces you to see exactly where every penny is going.

- The Envelope System: A classic for a reason. This tangible, cash-based method is a game-changer for visual learners or anyone who struggles with credit card overspending. You physically put cash into labeled envelopes for your spending categories (“Groceries,” “Gas,” “Entertainment”). When an envelope is empty, you’re done spending in that category for the month. Simple and brutally effective.

A budget is telling your money where to go instead of wondering where it went. It’s the single most powerful tool for taking control of your financial life and accelerating your progress toward your goals.

Choosing the right strategy is your first big win. To really dig into these methods and find your perfect match, check out our in-depth guide on how to budget money effectively. It’s packed with step-by-step instructions to get you up and running.

Creating Your Financial Safety Net

Before you start dreaming big about investing or retiring early, you need to build a financial safety net. This is your emergency fund—a stash of cash, ready and waiting for life’s curveballs, like a sudden job loss, an unexpected medical bill, or a busted water heater.

Having an emergency fund is what keeps a minor setback from becoming a full-blown financial disaster. Without it, one surprise expense could force you into high-interest debt, erasing months or even years of hard work.

Most experts agree you should aim to save three to six months’ worth of essential living expenses. First, figure out your bare-bones monthly survival number (rent/mortgage, food, utilities, insurance). Then, multiply that by at least three. Keep this money in a high-yield savings account—it needs to be accessible but separate from your daily checking account so you aren’t tempted to dip into it. Building this fund should be your number one savings priority. Once it’s solid, you can move on to your other goals with confidence.

How to Effectively Manage and Reduce Debt

Debt can feel like a heavy anchor, holding you back from where you want to go financially. But a huge part of smart financial management is recognizing that not all debt is the same. The first step to getting it under control is learning to tell the difference.

Think of it this way: good debt is an investment in something that will likely grow in value. A mortgage is the classic example—it helps you build equity and own a valuable asset. On the other hand, bad debt usually pays for things that get consumed quickly and comes with punishing interest rates that just drain your money. High-interest credit card debt is the number one offender here.

Understanding the Forces Working Against You

Before you can really start tackling your debt, you need to get a grip on two powerful concepts that determine how fast it can spiral: APR and compounding interest.

The Annual Percentage Rate (APR) is the yearly cost of borrowing money, including interest and fees. But the real monster in the closet is compounding interest. Picture a snowball rolling downhill—it starts small but picks up speed and grows exponentially. When you carry a balance on a credit card, the interest you’re charged gets added to the principal. The next month, you’re paying interest on that new, bigger total.

This compounding effect is exactly why a small credit card balance can balloon into a huge, overwhelming problem. It’s a powerful force, but the good news is you can turn it in your favor once you start knocking down the principal instead of just treading water with interest payments.

Choosing Your Debt Repayment Strategy

When it comes to paying off debt, two tried-and-true strategies stand out: the Debt Snowball and the Debt Avalanche. The “best” one really just depends on your personality and what keeps you motivated.

The most effective debt repayment plan is the one you can actually stick with. Both the Snowball and Avalanche methods work because they give you a clear, structured path to becoming debt-free.

Let’s break down how each one works.

The Debt Snowball Method

The Debt Snowball method is all about building momentum through quick, psychological wins. It’s perfect for anyone who needs to see progress early on to stay in the fight.

Here’s the game plan:

- List Your Debts: Write down every single debt from the smallest balance to the largest, ignoring the interest rates for now.

- Pay Minimums on All: Make the minimum payment on all your debts except for the smallest one.

- Attack the Smallest Debt: Throw every extra dollar you have at that smallest debt until it’s gone. Obliterated.

- Roll It Over: Once it’s paid off, take the entire amount you were paying on it (the minimum plus all the extra) and “roll” it onto the payment for the next-smallest debt.

- Repeat and Build Momentum: Keep doing this, knocking out debts one by one. Your payment “snowball” gets bigger and bigger, helping you crush your remaining debts faster and faster.

The Debt Avalanche Method

The Debt Avalanche is the undisputed champ if we’re just talking math. It will save you the most money on interest over time, making it ideal for disciplined, numbers-driven people.

The process is similar but flips the priority to interest rates:

- List Your Debts: This time, you’ll list your debts from the highest interest rate (APR) down to the lowest.

- Pay Minimums on All: Just like before, cover the minimums on every debt except for the one with the highest APR.

- Attack the Highest-Interest Debt: Funnel every spare cent you can find toward that expensive, high-interest debt.

- Roll It Over: As soon as that debt is paid off, apply its full payment toward the debt with the next-highest APR.

- Repeat and Save: Continue this cycle until you’re completely debt-free, saving yourself a bundle in interest along the way.

Figuring out which of these powerful methods is right for you is a huge step forward. For a deeper look at building your own plan, check out our guide on how to pay off debt for good. It’s packed with more tips and tools to accelerate your journey to financial freedom.

Grow Your Wealth Through Smart Investing

Once your budget is nailed down and your high-interest debts are handled, you can flip the script from just managing money to making money work for you. This is where the real fun of personal financial management begins—the part where you start building serious long-term wealth. Investing is the engine that will drive you toward financial freedom.

Think of it this way: saving is like stashing cash in a safe. It’s secure, but it’s not growing. Investing, on the other hand, is like planting a money tree. It starts small, but with a bit of time and patience, that tiny seed can grow into something substantial.

This isn’t about risky day trading or trying to time the market. It’s about a patient, sustainable strategy that harnesses the power of growth over the long haul. Let’s break down the building blocks.

Understanding Your Investment Options

For anyone new to this, the world of investing can feel a bit overwhelming, but the core ideas are actually pretty simple. You’re basically buying a piece of something that you believe will be more valuable in the future.

Here are the three main asset types you’ll come across:

- Stocks: Buying a stock means you own a tiny slice of a company. If the company thrives, the value of your slice can grow right along with it.

- Bonds: When you buy a bond, you’re lending money to a government or a corporation. In return, they agree to pay you back with interest over a set period. They’re generally considered less risky than stocks.

- Mutual Funds & ETFs: Think of these as baskets holding a mix of many different stocks and bonds. Buying a share in a mutual fund or an Exchange-Traded Fund (ETF) is an easy way to instantly diversify, spreading your risk across many companies instead of betting it all on one.

For most beginners, starting with low-cost index funds or ETFs is a fantastic move. These funds simply track a major market index, like the S&P 500, giving you broad exposure without the headache of picking individual stocks.

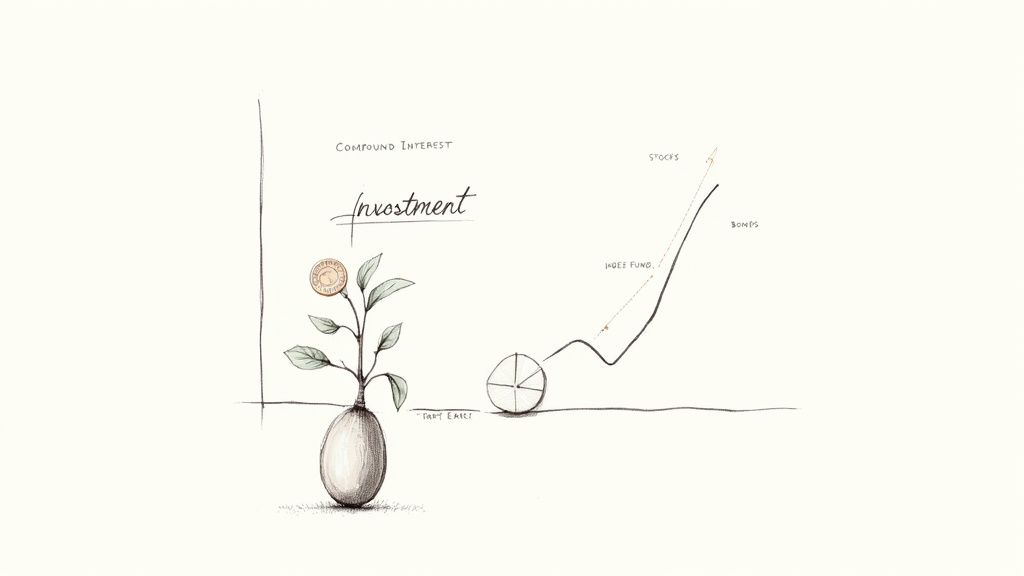

The Magic of Compound Interest

The single most powerful force on your investing journey is compound interest. It’s the phenomenon Albert Einstein supposedly called the “eighth wonder of the world.” It’s what happens when your investments earn returns, and then those returns start earning their own returns.

Imagine rolling a small snowball down a very long, snowy hill. As it rolls, it picks up more snow, getting bigger and faster. The longer it rolls, the more powerful its growth becomes. This is why starting early is your greatest advantage.

A small amount invested consistently over a long period can often outperform a much larger sum invested later in life. Time is the most critical ingredient for building wealth through investing.

To grow your wealth effectively, you need to weigh the potential returns and risks of different opportunities. For a practical breakdown, you might explore articles comparing different investment avenues like Airbnb rentals and the stock market.

This shift toward investing isn’t just a personal strategy; it’s a global trend. Global assets managed by wealth managers hit a staggering US$139 trillion in 2024 and are projected to reach $200 trillion by 2030. This shows just how many people are channeling their savings into investments to build a better financial future.

Planning for a Secure Retirement

One of the biggest reasons to invest is to set yourself up for a comfortable retirement. To help you get there, governments offer powerful, tax-advantaged accounts designed specifically for this goal.

Two of the most common retirement accounts are:

- 401(k) or 403(b): These are plans sponsored by your employer. You contribute a piece of your pre-tax paycheck, which lowers your taxable income for the year. The best part? Many employers offer a “match”—they’ll contribute money to your account if you do. It’s essentially free money and one of the best deals in finance.

- IRA (Individual Retirement Arrangement): This is an account you open on your own. The two main flavors are the Traditional IRA, where your contributions might be tax-deductible, and the Roth IRA, where you contribute after-tax money, but your qualified withdrawals in retirement are completely tax-free.

Using these accounts is a cornerstone of smart financial management. They give your investments a tax-sheltered environment to grow in, which can dramatically speed up your wealth-building and put you on the fast track to a secure future.

Choosing the Right Tools for Your Financial Journey

Think of your financial plan as the map to where you want to go. The right tools? They’re the vehicle that gets you there, saving you a ton of time and effort along the way. In a world where tech makes everything easier, managing your money is no different.

A good digital tool handles the tedious stuff—like tracking every last coffee purchase or sorting your bills—so you can focus on the big picture. It’s like having a financial co-pilot, giving you a clean dashboard of your progress and helping you make smarter, more confident decisions.

This isn’t just a passing trend. It’s a fundamental shift in how we manage our money. The global market for Personal Finance Management (PFM) tools was already valued at USD 8.2 billion in 2024 and is on track to hit USD 16 billion by 2031.

What to Look For in a Financial Tool

Not all financial apps are built the same. When you’re shopping around, the goal isn’t to find the most complicated tool with a million features. It’s to find the one that feels intuitive and actually makes your life easier.

Here are a few non-negotiables to look for:

- Automatic Bank Syncing: A modern tool has to do this. It should securely connect to all your accounts—checking, savings, credit cards, loans—to give you a real-time, hands-off view of your money.

- Smart Expense Categorization: The app should be smart enough to automatically sort your spending into buckets like “Groceries,” “Utilities,” or “Entertainment.” This saves hours and shows you exactly where your cash is going.

- Goal Tracking and Visualization: A great tool helps you set goals, whether it’s saving for a down payment or beefing up your retirement fund. Seeing your progress with charts and graphs is a huge motivator.

The best financial tool is one that reduces friction and provides clarity. If it makes you feel more in control and less overwhelmed, you’ve found a winner.

To get your financial house in order and stay on track, picking the best financial planning software for individuals is a game-changing first step.

Comparison of Popular Personal Finance Tools

The market is full of great options, but they all have slightly different personalities. Some are built for detailed, hands-on budgeting, while others are all about giving you a bird’s-eye view of your entire net worth.

To help you find the right fit, here’s a quick look at how some of the leading personal finance management tools stack up.

| Tool Name | Best For | Key Feature | Pricing Model |

|---|---|---|---|

| YNAB (You Need A Budget) | Hands-on, zero-based budgeting and changing spending habits. | Giving every dollar a specific “job” before you spend it. | Subscription-based |

| Empower Personal Dashboard | A holistic view of your net worth, including investments. | A powerful investment checkup tool and retirement planner. | Free dashboard |

| PopaDex | Tracking your complete net worth across multiple currencies. | Seamlessly integrating assets and liabilities into one clear view. | Freemium model |

Tools like PopaDex are designed for the way we live and work today—globally and dynamically. They offer clean, intuitive dashboards that pull everything together, from your bank accounts to your property values.

If you want to dig deeper, you can explore more options in our guide to the top financial management tools available today.

What you’re seeing in the PopaDex dashboard is the power of consolidation. When your entire financial picture is in one place, you can spot trends, make connections, and move forward with total confidence.

Got Questions About Managing Your Money? We’ve Got Answers.

When you first start getting serious about your finances, a few big questions always seem to pop up. They’re the practical, “what-if” scenarios that can feel like major hurdles if you don’t have a clear path forward. Let’s tackle them head-on.

Think of this as the FAQ for your financial journey. Getting these answers straight will give you the confidence to handle real-world decisions, juggle competing goals, and finally bust some of those stubborn money myths holding you back.

How Much Money Do I Actually Need to Start Investing?

One of the most persistent—and damaging—myths in finance is that you need a pile of cash to even think about investing. The truth? You can get started with less than the cost of a fancy coffee.

Thanks to modern investment platforms, you can now buy fractional shares. This just means you can buy a small slice of a company’s stock for as little as $1 or $5. You don’t need to fork over hundreds of dollars for a single share of a big-name company to get in the game and benefit from its growth.

What truly matters isn’t the amount you start with; it’s the habit of consistency.

The magic of investing comes from consistency and time, not from a single large initial investment. Starting small and staying consistent will almost always outperform waiting for the “perfect” amount of money.

Even a modest $50 a month can snowball into a surprisingly large sum over the years, all thanks to the power of compound interest. The most important move you can make is just to begin. Pick a low-cost option like an index fund and set up automatic investments.

What’s the Best Budgeting Method If I Hate Tracking Every Penny?

If the thought of logging every single coffee purchase makes you want to abandon budgeting altogether, you’re not alone. Meticulous tracking can feel like a full-time job. Luckily, there’s a brilliantly simple alternative: the “Pay Yourself First” method.

Some people call it the “anti-budget” because it completely flips the script. Instead of painstakingly tracking where your money went, you proactively decide where it will go—before you get a chance to spend it. It’s simple, powerful, and takes almost zero daily effort.

Here’s the game plan:

- Automate Your Savings: Set up automatic transfers from your checking account straight into your savings and investment accounts.

- Time It Right: Schedule these transfers to happen the day your paycheck hits. Don’t even let the money get comfortable in your checking account.

- Spend What’s Left, Guilt-Free: Once your future self is taken care of, the remaining money is yours to spend on bills and fun. No tracking required.

This strategy ensures you’re always hitting your most important financial goals first. It shifts the focus from the tedious process of tracking to the exciting outcome of building wealth.

Should I Pay Off Debt or Invest My Extra Money?

This is the classic financial tug-of-war. The answer comes down to a simple math problem: compare the interest rate on your debt (your guaranteed “loss”) with your potential investment return (your potential “gain”).

High-interest debt—think credit card balances with a 20% APR or higher—is a five-alarm financial fire. Wiping out that debt is like earning a guaranteed 20% return on your money, because that’s how much you’re saving in interest. You won’t find a risk-free investment that delivers that kind of return, ever. Make paying it down your absolute top priority.

But for low-interest debt, like a mortgage at 4%, the calculation flips. The stock market has historically returned much more than that over the long term, so you could come out ahead by investing your extra cash instead of aggressively prepaying your home loan.

A balanced approach is usually the smartest play:

- First, contribute enough to your 401(k) to get the full employer match. It’s free money and an instant 100% return. Don’t leave it on the table.

- Next, aggressively attack any debt with an interest rate above 7-8%.

- Finally, invest the rest in a diversified portfolio for long-term growth.

How Often Should I Review My Financial Plan?

A financial plan isn’t something you carve in stone and forget about. It’s a living, breathing guide that should adapt as your life changes. That said, you don’t need to obsess over it daily.

For your day-to-day spending, a quick monthly check-in with your budget is perfect. It helps you catch any overspending early and make small course corrections before they become big issues.

For the big picture—your investments, retirement savings, and overall net worth—a thorough review once a year is plenty. This is your chance to check your progress, rebalance your portfolio, and make sure your strategy still fits your long-term vision.

The big exception? Revisit your plan immediately after any major life event. Getting a new job, a big raise, getting married, having a baby, or receiving an inheritance can completely change your financial picture. Your plan needs to change with it.

Ready to see your entire financial world in one clear, simple view? With PopaDex, you can consolidate all your accounts, track your net worth in real-time, and make confident decisions on your journey to financial freedom. Take control of your finances today by visiting https://popadex.com to get started for free.