Our Marketing Team at PopaDex

12 Best Portfolio Analysis Tools for 2025

Beyond Spreadsheets: Finding Clarity in Financial Chaos

Your wealth is likely scattered across brokerage accounts, 401(k)s, international banks, real estate holdings, and crypto wallets. Trying to manage this complexity with a patchwork of spreadsheets is a losing battle. This approach often leads to a fragmented financial picture, missed opportunities, and a vague sense of your true net worth. For anyone serious about achieving long-term financial goals, this lack of clarity is a significant roadblock.

This is where dedicated portfolio analysis tools become indispensable. They are more than just trackers; they are your financial co-pilots, designed to aggregate disparate accounts, analyze performance against benchmarks, and uncover hidden fees. This need for streamlined financial management is especially acute for self-employed and gig-economy workers. Just as these tools bring clarity to a personal portfolio, automating business operations is equally vital. For those interested, here’s information on the Top Invoice Automation Software of 2025 to help streamline that side of your finances.

Forget surface-level reviews. This guide cuts through the marketing noise to offer a critical, in-depth look at the 12 leading platforms available today. We are not just listing features from a sales page; we are exploring practical use cases, assessing real-world performance, highlighting honest limitations, and defining who each tool is truly built for. Our goal is to empower you to select the platform that will bring genuine clarity and control to your financial journey.

1. PopaDex

PopaDex establishes itself as one of the most powerful and intuitive portfolio analysis tools for individuals with a global financial footprint. Its primary strength lies in its vast international support, connecting to over 15,000 banks in 30+ countries with full multi-currency and multilingual capabilities. This makes it an ideal solution for expats, digital nomads, or anyone managing assets across different regions, consolidating savings, investments, property, and liabilities into one streamlined dashboard.

Implementation is straightforward. Users can begin with a no-cost plan that relies on manual data entry, which is perfect for testing the interface. For automated convenience, the Premium plan is highly affordable at just €5/month, unlocking real-time bank syncs and advanced visual insights. While PopaDex excels at tracking conventional assets, users looking to broaden their financial literacy can explore concepts like unlisted company shares to understand different investment avenues. The platform’s additional resources, like a disposable income calculator and templates, further enhance its utility for budgeting and goal setting.

Pros:

- Unparalleled international support for multi-currency asset tracking.

- Flexible and affordable pricing with a robust free option.

- Risk-free with a free trial and 30-day money-back guarantee.

Cons:

- The free plan requires significant manual effort to maintain.

- Its promising AI co-pilot feature is not yet available.

Website: popadex.com

2. Empower (formerly Personal Capital)

Empower has long been a dominant force in the US market for free portfolio analysis tools, renowned for its ability to aggregate a user’s entire financial life. It excels at consolidating investment accounts, bank accounts, credit cards, and loans into a single, intuitive dashboard. This provides users with a real-time, 360-degree view of their net worth, cash flow, and investment performance, making it a go-to choice for those serious about tracking their progress toward major financial goals like retirement.

Getting started with Empower is simple and free; the core value comes from linking all your financial accounts. The platform leverages the power of financial data aggregation to provide deep insights, including a standout Retirement Planner that models various future scenarios and a Fee Analyzer that uncovers hidden costs in your investment funds. While the powerful dashboard and planning tools are free, users should be prepared for potential outreach from Empower’s advisors, as the platform’s business model is centered on converting free users to its paid wealth management service.

Pros:

- Completely free access to a robust suite of financial tools.

- Excellent retirement and investment fee analysis features.

- Provides a comprehensive and holistic view of your net worth.

Cons:

- Paid advisory services have a high entry barrier ($100,000 minimum).

- Users frequently report receiving calls to sign up for paid services.

Website: https://www.empower.com/

3. Stock Rover

Stock Rover carves out its niche as a premier research-first platform, positioning itself among the most data-rich portfolio analysis tools available to individual investors. It is meticulously designed for those who want to go beyond simple tracking and perform deep-dive analysis on stocks, ETFs, and funds. The platform’s core value lies in its extensive library of over 650 financial metrics, empowering users to build and test sophisticated investment theses with granular data and historical information.

Implementation involves connecting brokerage accounts or manually inputting holdings to leverage the platform’s powerful analytical engine. Users can deploy advanced features like customizable stock screeners to find new opportunities, dividend income projections for planning future cash flow, and even Monte Carlo simulations to model a range of future performance outcomes. While the free version provides a solid foundation for basic analysis, the affordable paid plans unlock the full suite of tools, making it ideal for identifying undervalued assets or closely tracking a dividend-focused portfolio.

Pros:

- Comprehensive research tools with hundreds of metrics.

- Highly customizable and user-friendly interface.

- Affordable pricing plans for advanced features.

Cons:

- The free version has limited access to real-time data.

- Its extensive features can present a learning curve for new users.

Website: stockrover.com

4. Portfolio Visualizer

Portfolio Visualizer carves out a niche as one of the most sophisticated portfolio analysis tools for investors focused on quantitative data and strategy validation. Its core strength is its suite of institutional-grade backtesting and simulation engines. This makes it the ideal platform for DIY investors who want to rigorously test asset allocation models, rebalancing strategies, or the impact of factor tilts before committing capital. The platform allows users to model historical performance with incredible detail.

Implementation is exceptionally accessible, with a powerful free version that covers most individual investor needs for backtesting and analysis. While Portfolio Visualizer excels at strategic modeling, it isn’t designed for day-to-day account aggregation; users seeking a holistic net worth tracker app would use it alongside a different platform. Advanced features like Monte Carlo simulations and detailed factor analysis empower users to understand risk and potential returns, helping to optimize their portfolio structure based on historical data and statistical probabilities.

Pros:

- Extensive suite of comprehensive analytical tools for deep backtesting.

- Surprisingly user-friendly interface given the complexity of the analytics.

- A robust and highly functional free version is available for all users.

Cons:

- The most advanced optimization features require a paid subscription.

- Its deep quantitative focus can be overwhelming for absolute beginners.

Website: www.portfoliovisualizer.com

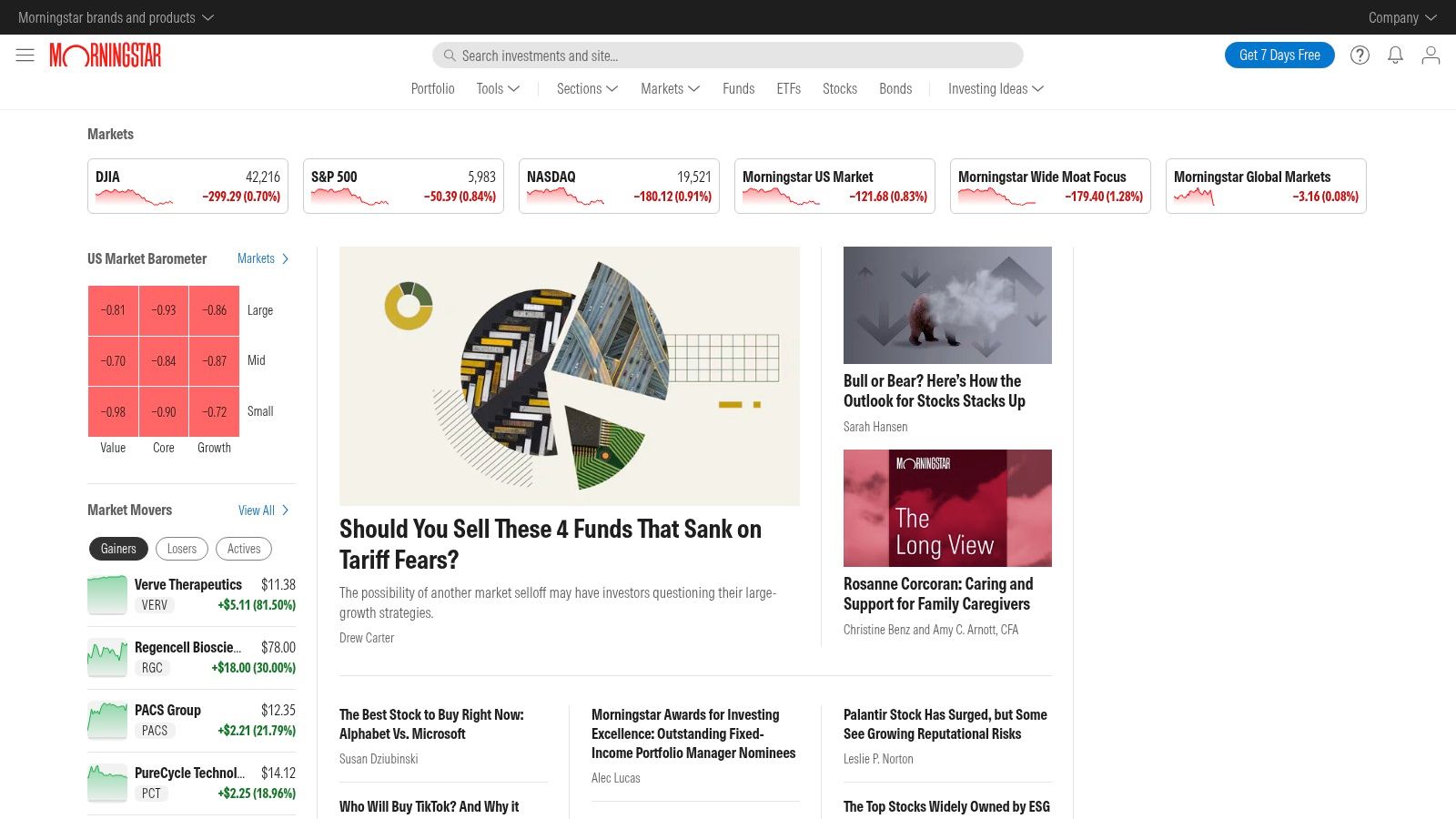

5. Morningstar Portfolio Manager

Morningstar is a titan in investment research, and its Portfolio Manager leverages that expertise to offer deep analytical insights. It stands out among portfolio analysis tools for its focus on fund-level transparency, making it invaluable for investors holding mutual funds or ETFs. Rather than simply tracking market value, Morningstar helps you dissect your holdings to understand true asset allocation, style diversification, and underlying sector exposure. This provides a professional-grade view of what you truly own across your entire portfolio.

Implementation requires manual entry of your holdings, as the platform does not sync directly with brokerage accounts. The real value comes from its signature X-Ray tool, which uncovers hidden risks like asset overlap between different funds or concentrated exposure to a single stock you might not have realized you held. While the basic portfolio tracker is free, unlocking the full suite of analytical features and premium research reports requires a Morningstar Investor subscription. This tool is ideal for diligent investors who want to go beyond surface-level performance and adopt a research-driven strategy.

Pros:

- Exceptional in-depth fund analysis with the signature X-Ray tool.

- Clean, user-friendly interface for tracking and complex analysis.

- Access to Morningstar’s extensive, highly-regarded research reports.

Cons:

- Requires manual data entry for all portfolio holdings, which can be time-consuming.

- The most powerful analytical features are locked behind a subscription paywall.

Website: morningstar.com

6. Ziggma

Ziggma carves out a niche as an AI-powered platform for investors who prioritize data-driven decisions and ethical considerations. It distinguishes itself among portfolio analysis tools by combining robust stock research with in-depth ESG (Environmental, Social, and Governance) and Climate Score data. This makes it particularly valuable for those looking to build a portfolio that aligns with their personal values without sacrificing performance metrics, offering quantitative scorecards for quick company evaluation.

Getting started is simple, with portfolio tracking and a stock market simulator that allows users to test strategies risk-free. The platform’s Smart Alerts help investors stay on top of portfolio changes and market movements automatically. While Ziggma provides granular detail on individual holdings, users can contextualize this information by tracking their overall financial health with a complete net worth dashboard. The platform is built for active investors who want deep insights rather than passive tracking.

Pros:

- Comprehensive analysis with quantitative stock scorecards.

- Strong emphasis on ESG and Climate Score metrics for ethical investing.

- Affordable pricing model makes advanced tools accessible.

Cons:

- Lacks integrated trading capabilities, requiring a separate brokerage account.

- Some advanced features may present a learning curve for novice users.

Website: https://www.ziggma.com/

7. Kubera

Kubera distinguishes itself as a premium, privacy-first tracker for the modern investor’s complete net worth. While many portfolio analysis tools concentrate on traditional stocks, Kubera excels at aggregating an incredibly diverse range of assets, from global bank and brokerage accounts to cryptocurrency wallets, DeFi protocols, and even physical collectibles. This makes it the ideal dashboard for individuals who demand a single, uncluttered view of their entire financial picture, including alternative investments and international holdings.

Implementation is centered around connecting accounts via its vast integration library, with flexible manual entry for unique assets like real estate or art. The platform operates on a single subscription-only model, guaranteeing a completely ad-free and private experience where user data is never sold. Its standout features include a secure file vault for storing important documents alongside relevant assets and an innovative beneficiary function. This allows you to securely designate someone to receive your financial information in an emergency, adding a crucial layer of estate planning.

Pros:

- Extensive account integrations across traditional and digital assets.

- Strong focus on user privacy with no ads or data selling.

- Modern, customizable interface for a clean user experience.

Cons:

- No dedicated mobile app, limiting on-the-go access.

- Subscription-only model may be a barrier for some users.

Website: kubera.com

8. Sharesight

Sharesight solidifies its position as one of the most powerful portfolio analysis tools for investors who demand a true performance picture, not just a market value snapshot. Its primary distinction is its ability to automatically track all dividends, stock splits, and currency impacts to calculate total annualized returns. Supporting over 40 global stock exchanges, it is an essential platform for anyone managing an international portfolio and looking to benchmark their performance against major indices accurately.

Implementation begins with a free plan that allows users to track up to 10 holdings, which is ideal for testing the interface or managing a small portfolio. For serious investors, the paid tiers are necessary, unlocking unlimited holdings, automated trade imports from hundreds of global brokers, and powerful tax reporting features. Its ability to generate country-specific reports, such as for Capital Gains Tax, simplifies year-end accounting significantly. The dividend projection feature is particularly useful for those building an income-focused portfolio for retirement.

Pros:

- Comprehensive and automated tracking of dividends and corporate actions.

- Extensive support for over 40 global stock exchanges and multiple currencies.

- Generates detailed, country-specific tax reports to simplify accounting.

Cons:

- The free version is very restrictive, limited to only 10 holdings.

- Advanced reporting and full broker integration require a paid subscription.

Website: sharesight.com

9. Investment Account Manager

Investment Account Manager carves out a niche as a powerful desktop-based solution for serious, long-term investors. Unlike cloud-based platforms, this Windows-native software is designed for users who prioritize offline data security and comprehensive management capabilities. It stands out as one of the most thorough portfolio analysis tools for individuals or families juggling multiple accounts, such as IRAs, 401(k)s, and brokerage portfolios, all from a single, centralized application. Its strength lies in providing detailed control and in-depth reporting without relying on a web connection.

Implementation involves a direct software download and installation, offering a 90-day free trial for the full version. The tool excels with features like target asset allocation modeling, which helps users rebalance their holdings according to predefined goals. Its performance and tax reporting tools are particularly robust, providing the detailed documentation needed for tax season or annual reviews. This makes it ideal for investors who actively manage their portfolios and require granular insights into capital gains, losses, and dividend income, a level of detail often simplified in more modern apps.

Pros:

- Comprehensive portfolio management features for detailed analysis.

- Excellent for managing and reporting on multiple, diverse accounts.

- Detailed performance and tax reporting simplifies financial planning.

Cons:

- Strictly desktop-based with no mobile or web version available.

- Only compatible with the Windows operating system.

Website: investmentaccountmanager.com

10. Danelfin

Danelfin carves a unique niche among portfolio analysis tools by focusing on AI-driven stock selection rather than simple asset tracking. Its core feature is a proprietary AI Score that rates stocks on a scale of 1 to 10, predicting their probability of outperforming the market over the next three months. The system processes thousands of fundamental, technical, and sentiment data points daily for US and European equities. This offers a predictive layer that goes beyond traditional performance metrics for growth-oriented investors.

Implementation is direct: users search for stocks to view their AI Score and a breakdown of contributing factors like Value, Quality, and Momentum. This transparency helps investors understand the “why” behind the rating. The platform is best used for idea generation and validating investment theses, with daily alerts to track score changes for stocks in a watchlist. While there is no free-forever plan, the subscription tiers provide access to sophisticated analytics without the high technical barrier of creating custom AI models.

Pros:

- Transparent AI-driven insights with clear scoring factors.

- Comprehensive analysis across fundamental, technical, and sentiment data.

- Flexible pricing plans with actionable daily alerts.

Cons:

- Less suitable for day traders due to its 3-month outlook.

- AI predictions are probabilistic and require user judgment and validation.

Website: danelfin.com

11. PEvaluator

PEvaluator carves out a niche for itself among portfolio analysis tools by focusing specifically on fundamental value investing. Its core function is to help users determine the intrinsic value of stocks by building custom market models. The platform provides fair price estimates for thousands of equities, moving beyond simple tracking to offer deep, analytical insights based on P/E analysis and proprietary moat ratings, which assess a company’s competitive advantage. This makes it ideal for investors who prioritize data-driven valuation over market trends.

Implementation is straightforward, with a free tier available for users to test the platform’s core interface. However, this access is limited to mega-cap stocks, making a paid subscription necessary for serious investors looking to analyze a broader market. Once subscribed, users can leverage powerful stock comparison features, track their portfolio’s valuation, and set price alerts based on their models. The interface is designed to be highly user-friendly, making complex financial modeling accessible to individual investors without a steep learning curve or extensive financial background.

Pros:

- User-friendly interface simplifies complex financial analysis.

- Highly customizable tools for building personal market models.

- Affordable pricing for access to advanced valuation features.

Cons:

- The free tier is heavily restricted, only covering mega-cap stocks.

- Full functionality and advanced analysis require a paid subscription.

Website: pevaluator.com

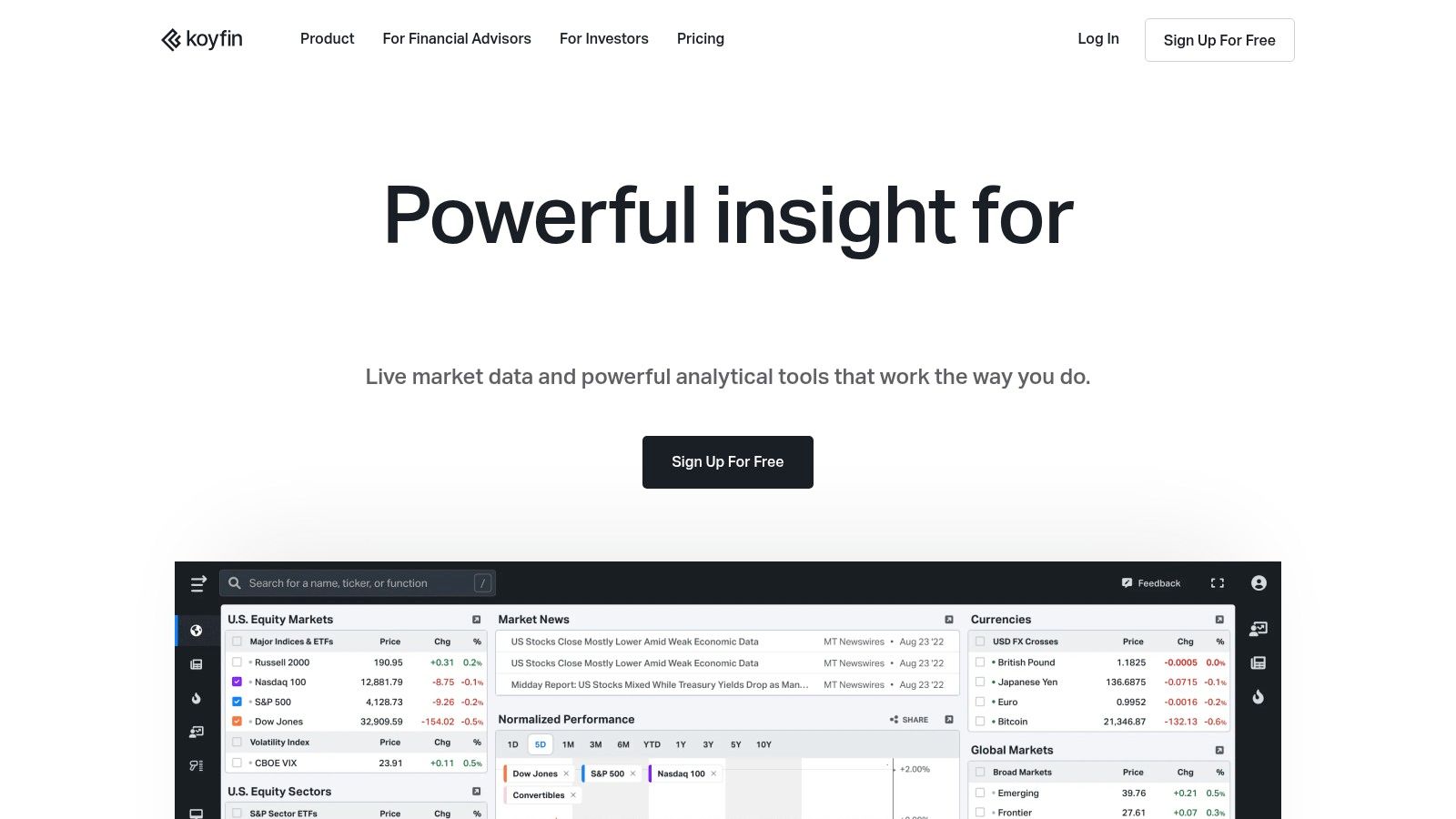

12. Koyfin

Koyfin positions itself as a professional-grade financial data terminal, offering capabilities often reserved for more expensive platforms. It stands out among portfolio analysis tools for investors who demand deep market insights and granular data visualization. Its core strength is providing comprehensive global market data, advanced charting, and powerful analytical functions, making it ideal for users who actively research individual stocks, ETFs, and macroeconomic trends to inform their investment strategy.

Implementation is accessible thanks to a remarkably generous free plan that provides significant functionality. Users can immediately build custom dashboards and leverage the advanced stock screener, which includes over 500 different metrics for detailed filtering. While the sheer volume of data presents a learning curve, the interface is surprisingly intuitive. For those performing deep dives, the platform supports sophisticated financial analysis and allows for data downloads, a key feature for offline modeling. Paid tiers unlock even more advanced capabilities, including portfolio-specific analytics.

Pros:

- Extensive data and analysis tools rivaling premium platforms.

- A generous and highly functional free version.

- User-friendly interface considering its data depth.

Cons:

- Steeper learning curve for users new to financial analytics.

- The most powerful features require a paid subscription.

Website: koyfin.com

Portfolio Analysis Tools Comparison Overview

| Product | Core Features/Capabilities | User Experience & Quality | Value & Pricing | Target Audience | Unique Selling Points |

|---|---|---|---|---|---|

| 🏆 PopaDex | Multi-currency, 15,000+ banks, multilingual ✨ | Interactive dashboards ★★★★ | Free manual 💰 / Premium €5/mo 💰 | Expats, investors, freelancers 👥 | AI co-pilot upcoming, templates ✨ |

| Empower (formerly Personal Capital) | Unified dashboard, retirement tools, fee analyzer | User-friendly ★★★★ | Free 💰 | General investors & planners 👥 | Fee analysis, investment advice |

| Stock Rover | 650+ metrics, stock screening, dividend projections | Customizable UI ★★★ | Affordable plans 💰 | Active investors & analysts 👥 | Monte Carlo simulations ✨ |

| Portfolio Visualizer | Backtesting, Monte Carlo, portfolio optimization | User-friendly ★★★ | Free/basic; paid advanced 💰 | Advanced investors 👥 | Advanced portfolio analytics |

| Morningstar Portfolio Manager | Asset allocation, X-Ray fund tool, research reports | User-friendly ★★★ | Free/basic; paid advanced 💰 | Fund investors & analysts 👥 | In-depth fund analysis |

| Ziggma | Portfolio tracking, ESG analysis, smart alerts | Affordable, user-friendly ★★★ | Affordable 💰 | ESG-focused investors 👥 | ESG data & market simulator ✨ |

| Kubera | Net worth, crypto, insurance, file vault | Modern interface ★★★ | Premium pricing 💰 | Privacy-conscious, diverse assets 👥 | Crypto & insurance tracking |

| Sharesight | Global tracking, dividends, tax reporting | User-friendly ★★★ | Limited free; paid advanced 💰 | Global investors 👥 | Tax tools & multi-currency |

| Investment Account Manager | Multi-portfolio, asset allocation, tax reports | Detailed but Windows only ★★ | Desktop licensed 💰 | Multi-account investors 👥 | Target asset allocation |

| Danelfin | AI-driven stock scoring, sentiment analysis | Transparent AI ★★★ | Flexible plans 💰 | Data-driven stock investors 👥 | AI Score ranking system ✨ |

| PEvaluator | Custom models, intrinsic value, P/E & moat ratings | User-friendly ★★★ | Free limited; paid advanced 💰 | Fundamental analysts 👥 | Custom market models ✨ |

| Koyfin | Advanced charts, 500+ metrics, global data | Generous free, detailed UI ★★★ | Free/basic; paid advanced 💰 | Data-driven investors 👥 | Extensive analytics & downloads |

From Data to Decisions: Choosing Your Financial Co-Pilot

Navigating the landscape of modern finance requires more than just intuition; it demands clarity. We’ve journeyed through a comprehensive list of twelve distinct portfolio analysis tools, from the powerful backtesting engine of Portfolio Visualizer to the sleek, global aggregation of Kubera and the specialized AI insights of Danelfin. The single most important takeaway is that the perfect tool is not a one-size-fits-all solution. Instead, it is a direct reflection of your personal investment philosophy, financial complexity, and long-term goals.

The “best” platform for a day trader analyzing market momentum will be vastly different from the one for an expat managing multi-currency assets. The right choice hinges on honest self-assessment. What began as a search for software should end with a clearer understanding of yourself as an investor.

Matching the Tool to Your Investor Profile

Your ideal platform directly corresponds to your primary financial objective. Consider which of these profiles resonates most with you:

- The Global Citizen: If you manage assets across different countries and currencies, your priority is seamless international support. Platforms like PopaDex, Sharesight, and Kubera are built for this reality, handling currency conversions and foreign brokerage connections with ease.

- The Data Scientist: For those who thrive on deep analytics, backtesting custom strategies, and running complex “what-if” scenarios, a powerful engine is non-negotiable. Portfolio Visualizer, Koyfin, and Stock Rover offer the granular control and robust modeling capabilities you crave.

- The Hands-Off Accumulator: If your goal is a simplified, holistic view of your net worth with automated tracking and straightforward retirement planning, user-friendliness is key. Empower excels here, providing a high-level dashboard that makes tracking progress effortless.

Your Actionable Roadmap to Selection

To move from analysis to action, follow this structured approach to find your perfect financial co-pilot.

- Define Your Core Need: Start by articulating the single biggest problem you want to solve. Is it tracking true performance across all accounts? Is it understanding your real asset allocation? Or is it finding new investment opportunities? Your answer will immediately filter out irrelevant options.

- Shortlist and Test: Based on your core need and investor profile, select two or three tools from our list for a head-to-head comparison. Take full advantage of free trials or freemium tiers. Connect a test account or use dummy data to evaluate the features that matter most to you.

- Evaluate the Implementation: Assess the setup process. Does the tool offer robust, secure integrations with your banks and brokerages? Or does it require significant manual data entry? Be realistic about the time and effort you are willing to commit, both initially and for ongoing maintenance.

- Weigh Cost Against Value: Finally, consider the price. A free tool is great, but a premium subscription to one of these portfolio analysis tools can easily pay for itself by saving you time, uncovering costly portfolio imbalances, or revealing new opportunities.

Ultimately, these platforms are enablers. They transform raw data into organized insights, empowering you to make smarter, more confident financial decisions. Your journey toward financial clarity doesn’t end with choosing a tool; it begins with one.

For those managing diverse assets, especially across international accounts, finding a tool that simplifies complexity is paramount. PopaDex is designed to provide a clear, unified view of your entire financial world, connecting everything from global equities to crypto. Start simplifying your portfolio management by exploring what a truly comprehensive dashboard can do for you at PopaDex.