Our Marketing Team at PopaDex

Portfolio Consolidation Simplified for Investors

Portfolio consolidation is a simple but powerful idea: bring all your scattered investments—like old 401(k)s, various IRAs, and different brokerage accounts—into one central place. Think of it like finally cleaning out a disorganized closet. Instead of rummaging through clutter, you create a streamlined wardrobe where you can see everything you own at once.

This same principle of unification gives you a clear, big-picture view of your assets, making your financial life so much easier to manage.

What Is Portfolio Consolidation and Why It Matters

Have you ever tried to captain a ship by running between three different steering wheels? That’s exactly what managing multiple, disconnected investment accounts feels like. You might have an old 401(k) from a previous job, a Roth IRA you started years ago, and a separate brokerage account for stock trading. Each one comes with its own statements, fees, and investment options, creating a confusing and fragmented picture of your wealth.

Portfolio consolidation fixes this by gathering these separate accounts under a single roof. This doesn’t always mean merging every single account into one—tax rules often require you to keep retirement and taxable accounts separate. Instead, it’s about choosing one primary institution to house your IRAs and another for your taxable investments. The goal is to slash the complexity and gain a clear, comprehensive overview.

The Immediate Benefits of a Unified View

Once you bring your assets together, the advantages become clear almost instantly. You move from a state of financial clutter to one of clarity and control. This isn’t just about convenience; it directly impacts your ability to build wealth effectively.

This strategy is gaining traction not just with individuals but with major firms, too. To manage risk and keep up with new financial tech, investment management firms are focusing more on strategic consolidation. While the number of deals for these firms dropped by 10% in 2023, the focus shifted to higher-value mergers. In fact, segments like direct indexing are expected to swell to $825 billion by 2026. This trend shows an industry-wide recognition that a consolidated approach is key for competitive performance.

By simplifying your financial life, you eliminate the mental drag of tracking multiple logins and statements. This frees up your energy to focus on what truly matters: your long-term investment strategy and goals.

If you want to dig deeper into the core ideas behind organizing your assets, you can explore various educational resources on investment management that cover these foundational principles.

To give you a quick snapshot, here’s a table summarizing the key benefits you can expect from consolidating your portfolio.

Portfolio Consolidation at a Glance

This table breaks down the core benefits of bringing your investment portfolio together, showing the real-world impact on your finances.

| Benefit | Impact on Your Finances |

|---|---|

| Simplified Management | Fewer statements, logins, and accounts to track. Saves time and mental energy. |

| Clearer Financial Picture | Get a true, holistic view of your asset allocation, risk exposure, and overall performance. |

| Reduced Fees | Lower account maintenance fees and potentially qualify for fee discounts based on higher total asset values. |

| Better Performance | Easier to rebalance your portfolio, avoid asset overlap, and align all investments with your long-term goals. |

| Streamlined Tax Reporting | Consolidated tax documents from fewer institutions simplify tax preparation and can help with tax-loss harvesting. |

| Easier Estate Planning | A simplified financial footprint makes it much easier for heirs to manage and distribute your assets. |

As you can see, the advantages go far beyond simple convenience, touching everything from your day-to-day management to your long-term financial legacy.

The True Benefits of a Unified Investment View

Bringing all your investments into a single view is like swapping a grainy, out-of-focus photo for a crystal-clear 4K display. Suddenly, the details that were once fuzzy or completely hidden snap into sharp relief, giving you the power to make smarter, more confident financial moves. This clarity is the real magic of portfolio consolidation—it completely changes how you see and manage your wealth.

The most immediate payoff is enhanced visibility and control. Let’s be honest: when your money is scattered across an old 401(k), a brokerage account, and a couple of different IRAs, getting a true read on your financial health is a headache. You’re constantly juggling multiple logins and trying to stitch together data from different statements, which makes it incredibly easy to miss the big picture.

Consolidation wipes that slate clean. With everything under one roof, you get a single, clean dashboard that shows your total assets, overall performance, and exact asset allocation at a glance. This complete picture is the bedrock of intelligent financial management. Having this kind of clarity and control is especially crucial when navigating investment challenges, as it lets you react faster and manage risk more effectively.

Uncover Hidden Risks and Opportunities

With a bird’s-eye view, you can finally spot and fix imbalances that were previously invisible. It’s a classic trap for investors to be unknowingly overexposed to certain risks, and it happens all the time.

For example, you might have a tech-heavy mutual fund in your IRA and also own individual shares of the biggest tech giants in your brokerage account. Without a consolidated view, you’d never realize that 35% or more of your entire portfolio is dangerously concentrated in one highly volatile sector.

That’s a huge, unmanaged risk. Portfolio consolidation brings this kind of overlap to light instantly. It empowers you to rebalance your holdings and make sure your investments are truly diversified according to your actual risk tolerance—not just what you thought your allocation was.

A unified view turns you from a passive account holder into an active portfolio manager. You can spot asset overlap, identify underperforming funds, and ensure every dollar is aligned with your long-term goals.

Streamline Your Finances and Reduce Costs

Beyond the strategic wins, portfolio consolidation offers some very real, practical benefits that put money back in your pocket. Managing fewer accounts simply means less paperwork, fewer statements to track, and a much simpler tax season.

Instead of a flurry of different tax forms arriving from various institutions, you get one neat, consolidated package. That alone makes tax time significantly less of a chore and opens the door to smarter strategies like tax-loss harvesting.

Better yet, streamlining your accounts often leads to some serious cost savings. Many financial institutions offer perks like reduced fees for clients who bring more assets to their platform. By combining your accounts, you could unlock benefits such as:

- Lower Management Fees: Gaining access to lower-cost investment tiers that are typically reserved for higher-balance accounts.

- Reduced Trading Costs: Qualifying for commission-free trades or lower transaction fees.

- Waived Account Fees: Eliminating those pesky annual or quarterly maintenance charges that quietly eat away at your returns.

These little savings might not seem like much at first, but they compound dramatically over the years, potentially adding thousands of dollars to your nest egg. In the end, the initial effort to consolidate pays powerful, long-term dividends through better risk management, lower costs, and far greater peace of mind.

Proven Strategies For Effective Consolidation

Knowing you need to get your investments in one place is the easy part. Actually doing it? That’s a different story. The right way to consolidate your portfolio really comes down to your own situation—how complex your finances are, how much you know about investing, and frankly, how much time you want to spend on it.

There’s no magic bullet, but a few tried-and-true strategies can get you there. The trick is to pick the one that feels right for you, making sure the process fits your long-term goals and how you like to manage things.

The Hub And Spoke Model

One of the most intuitive ways to do this is the Hub and Spoke model. Think of it like a wheel: your main investment account is the central hub, and all your other investments are the spokes connecting to it. This primary account, usually with a big, full-service brokerage, becomes your one-stop shop for everything.

You’d simply transfer your assets from that old 401(k), those scattered IRAs, and any smaller brokerage accounts right into this central hub. This is perfect for investors who want to stay in the driver’s seat and see everything in a single, clean view. It makes tracking, rebalancing, and tax time so much simpler. To really make this work, a good investment portfolio tracker is your best friend, giving you the dashboard you need to monitor all your newly centralized assets.

Automated Consolidation With Robo-Advisors

If you’d rather set it and forget it, robo-advisors are a fantastic option. These platforms use smart algorithms to build and manage a diversified portfolio for you, all based on your risk tolerance and financial goals.

The process is incredibly straightforward. You answer some questions, the platform suggests a portfolio, and you fund the new account by transferring your money from all those other places. The robo-advisor then takes over, handling all the rebalancing and investment decisions. It’s a great choice for new investors or anyone who wants a low-effort way to consolidate and grow their wealth.

Partnering With A Financial Advisor

What if your financial life is a bit more… complicated? Maybe you own multiple properties, run a business, or have some tricky estate planning needs. In that case, teaming up with a financial advisor is probably your best bet. They bring a level of personalized guidance that you just can’t get from an algorithm.

When you’re looking at proven strategies for effective consolidation, an advisor can help you consider all your options, including looking into top global property investment opportunities to round out your holdings. They’ll help you sidestep tax traps, pick the right place to consolidate everything, and build a sophisticated strategy that goes beyond what a typical robo-advisor can handle. This high-touch approach is ideal for anyone with a high net worth or a complex financial picture who wants an expert in their corner.

The most effective consolidation strategy is one that reduces complexity without sacrificing control, aligning your management style with your financial goals.

Comparing Consolidation Strategies

To help you decide which path is right for you, here’s a quick comparison of the most common methods. Each has its own strengths and weaknesses, so consider what matters most for your financial journey.

| Strategy | Best For | Key Advantage | Potential Drawback |

|---|---|---|---|

| Hub and Spoke | DIY investors who want direct control and a unified view of their assets. | Total Control. You manage everything from one central account. | Requires more hands-on management and investment knowledge. |

| Robo-Advisor | New investors or those seeking a simple, low-effort, automated solution. | Simplicity. Set-it-and-forget-it investing with low fees. | Less personalization; may not suit complex financial situations. |

| Financial Advisor | High-net-worth individuals or those with complex finances (e.g., business, real estate). | Expert Guidance. Personalized strategy and holistic financial planning. | Higher costs and fees compared to other methods. |

Ultimately, the best strategy is the one that simplifies your life and empowers you to meet your financial objectives, whether you’re a hands-on investor or prefer to let an expert take the lead.

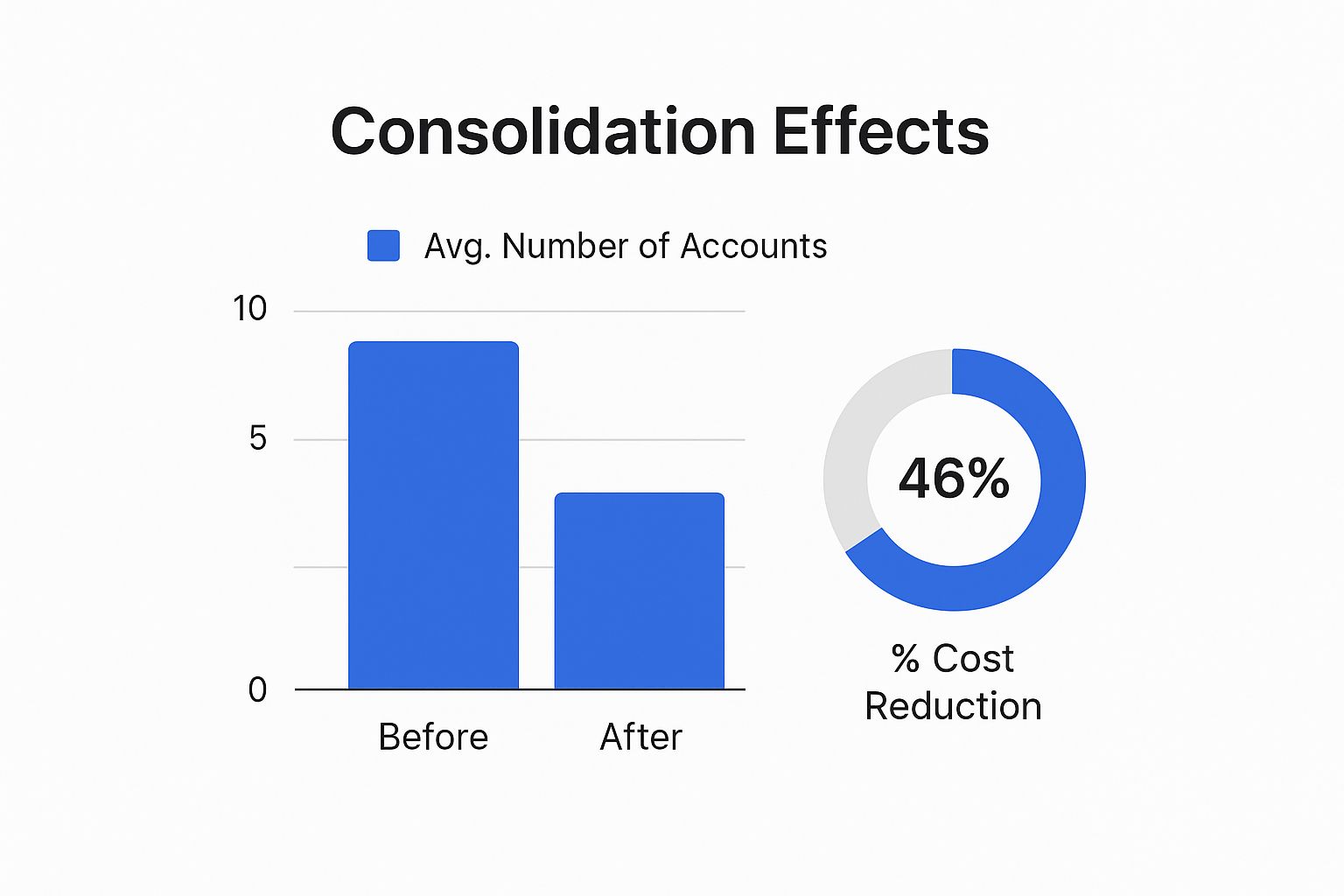

The infographic below shows just how powerful consolidation can be, illustrating the typical drop in the number of accounts and fees.

As you can see, it’s not uncommon for investors to cut the number of accounts they manage by more than half, all while saving a significant amount on fees. Picking the right path—whether it’s a self-managed hub, an automated platform, or expert guidance—is your first step toward getting these kinds of results.

Your Step-by-Step Consolidation Action Plan

Moving from financial clutter to clarity is an empowering feeling, but let’s be honest—the process itself can look pretty intimidating. This action plan breaks down portfolio consolidation into five simple, manageable steps. Just follow this roadmap to bring your assets together, sidestep the common pitfalls, and finally take firm control of your financial future.

This is about more than just shuffling money around; it’s a strategic realignment of your assets. It requires the same kind of discipline as tidying up other parts of your financial life. In fact, many people find it helpful to first learn how to consolidate bank accounts, since the core ideas of simplification and efficiency are almost identical.

Step 1: Create A Complete Account Inventory

Before you can chart a new course, you need a map of exactly where you are right now. Your first task is to create a complete inventory of every single investment account you own. Think of this as the foundation for your entire consolidation strategy.

It’s time to gather all your recent statements—both digital and paper—for every account:

- Old 401(k)s and 403(b)s just sitting there from previous jobs.

- Traditional and Roth IRAs scattered across different institutions.

- Taxable brokerage accounts you might have opened over the years and forgotten about.

- Any other investment vehicles you have, like SEP IRAs or employee stock purchase plans.

For each account, jot down its current value, the institution holding it, what’s inside it, and any fees you’re paying. This complete picture will quickly show you where you have overlaps and where you can save money.

Step 2: Define Your Unified Investment Strategy

With your full inventory in hand, it’s time to decide on your new, unified investment strategy. What’s the main goal here? Are you aiming for aggressive growth, steady income for retirement, or something in between? Your answers will dictate the perfect asset allocation for your newly combined portfolio.

A clear strategy acts as your North Star. It ensures that once your assets are combined, they are all working together toward the same objective, rather than pulling in different directions.

This is your chance to fix any imbalances you spotted back in Step 1. For example, if you realized you were accidentally way too invested in tech stocks across three different accounts, your new strategy should correct that by setting a more diversified target.

Step 3: Select The Right Platform Or Advisor

Now you get to choose the new home for your consolidated portfolio. Your choice really depends on how comfortable you are with managing your own investments and how complex your finances have become. Your main options are a full-service brokerage, a robo-advisor, or a human financial advisor.

Think about what matters most to you: investment options, account fees, research tools, or customer support. A DIY investor might lean toward a low-cost brokerage with powerful tools, while someone who wants a completely hands-off approach might find a robo-advisor is the perfect fit.

Step 4: Initiate The Account Transfer Process

Once you’ve picked your new “hub” account, you can kick off the transfer process. For most accounts, this happens through the Automated Customer Account Transfer Service (ACATS), which makes moving assets between brokerages surprisingly smooth.

You’ll start the process from your new institution by giving them the details of your old accounts. Here’s a critical tip: always request an “in-kind” transfer if you can. This moves your stocks and funds as they are, without selling them first. Why does that matter? It helps you avoid accidentally creating a tax bill from capital gains in your taxable accounts.

Step 5: Monitor And Rebalance Your Portfolio

Consolidation isn’t just a one-and-done task; it’s the start of a much simpler way to manage your money. Once all your assets have safely arrived in their new home, your final step is to set up a regular schedule for monitoring and rebalancing.

Set a reminder on your calendar to review your portfolio quarterly or twice a year. You’re just checking to see if your asset allocation has strayed from your target and making small adjustments if needed. This ongoing tune-up ensures your portfolio stays aligned with your strategy and on track to hit your long-term goals.

How Top Firms Use Consolidation to Win

The idea of portfolio consolidation isn’t just some abstract concept for personal finance nerds. It’s a fundamental strategy that the world’s most successful corporations and private equity (PE) firms use to dominate markets and create massive efficiencies. By seeing how these giants operate, you can steal their playbook and apply the same core logic to your own finances.

Think about a huge corporation making a strategic acquisition. They aren’t just buying another company for the fun of it. They’re consolidating market share, knocking out a competitor, and absorbing new technology or customer lists into their existing empire. This is portfolio consolidation on a grand scale, all aimed at building a stronger, more resilient, and more profitable machine.

The Private Equity Playbook

Private equity firms are the undisputed masters of this game, often using a method called a “bolt-on” acquisition. It’s a brilliant strategy. They start by buying a solid “platform” company in a specific industry. Then, they hunt for smaller companies to “bolt on” to this main platform.

Each bolt-on isn’t random; it’s a calculated move to create synergies, making the whole enterprise worth far more than the sum of its parts. This could mean:

- Expanding Services: Adding a new service they can immediately cross-sell to the platform’s existing customers.

- Entering New Markets: Acquiring a company in a different city or country to gain an instant foothold.

- Boosting Efficiency: Merging back-office operations like HR and accounting to slash redundant costs.

This targeted approach to consolidation is how they build industry-leading companies from a collection of smaller players.

And this isn’t a niche activity; the scale is staggering. The private equity world has seen a huge rebound, with buyout values soaring 37% year-over-year in 2024 to a massive $602 billion. With the average deal size climbing to a near-record $849 million, it’s crystal clear that large-scale, strategic consolidation is a winning move. You can dive deeper into the latest findings on the 2025 global private equity outlook.

The Big Picture: Whether it’s a PE firm buying a competitor or you rolling over an old 401(k), the goal is identical—to create a stronger, more efficient, and more focused portfolio that’s easier to manage and poised for growth.

Ultimately, these corporate-level strategies offer a powerful lesson for the rest of us. The underlying principles—strategic focus, operational efficiency, and building resilience—are universal. You might be consolidating old IRAs instead of entire companies, but the end goal is the same: creating a financial future that’s simpler, stronger, and more secure. Keeping tabs on that unified financial picture is far easier with the right tools, and an effective net worth tracker can give you that clear, high-level view.

Global Trends Driving Portfolio Consolidation

The push to consolidate your investments isn’t just some personal finance hack—it’s a powerful strategy playing out on the world’s biggest economic stages. Major corporations and investment firms are aggressively doing the exact same thing for the exact same reasons: to build resilience, drive efficiency, and sharpen their competitive edge.

When you see what’s happening at a global level, you’ll realize your own move toward consolidation is part of a much larger, sophisticated playbook.

This trend is easiest to spot in the world of mergers and acquisitions (M&A). The modern M&A landscape has shifted to a “fewer, but bigger” philosophy. Companies aren’t just buying up assets randomly; they’re making highly calculated moves to consolidate market power, absorb crucial technology, and turn sprawling corporate structures into lean, focused machines. It’s a clear signal that in a complex global market, a tightly integrated portfolio is a winning one.

The Big Picture of Strategic Consolidation

Recent M&A data tells a compelling story. In the first half of 2025, even as the total number of deals dropped by 9% compared to last year, the total value of those deals jumped by 15% to a staggering $1.49 trillion. This points to a clear pivot toward larger, more impactful transactions aimed squarely at strategic consolidation.

The Americas led this charge, accounting for $908 billion of that deal value. Even more telling, 91% of the capital from Americas-based buyers was spent right in their own backyard, showing a deliberate move to consolidate assets locally for tighter operational control. You can dig deeper into these M&A deal trends from PwC to see the full picture.

This corporate-level thinking provides a powerful blueprint for individual investors. When you roll over those scattered 401(k)s and IRAs into a single, cohesive account, you’re mirroring the exact logic used by the world’s top economic players.

You’re trading complexity for clarity, fragmentation for focus, and inefficiency for strength. This isn’t just organizing your finances; it’s aligning your personal strategy with the same principles that drive success at the highest levels of global business.

By choosing portfolio consolidation, you’re doing more than just tidying up your accounts. You’re adopting a proven, forward-thinking approach to building wealth. You’re setting up your finances to not just survive but thrive in an increasingly complex world, ensuring every dollar is working in concert to hit your most important goals.

Common Questions About Portfolio Consolidation

Even after seeing the upside, it’s completely normal to have questions about the nuts and bolts of portfolio consolidation. Getting straight answers is the best way to move forward confidently and sidestep those little snags that can mess with your financial plans. Let’s tackle some of the most common questions head-on.

Will Consolidating My Portfolio Trigger Taxes?

This is the big one, and the short answer is: it depends entirely on how you do it.

If you do a direct “in-kind” transfer—meaning you move your assets from one account to a similar one without actually selling them—it’s usually not a taxable event. A classic example is rolling over an old 401(k) into a new IRA. The investments just change hands, they don’t get cashed out.

On the other hand, if you sell investments within a taxable brokerage account to free up cash for the move, that’s a different story. That sale can trigger capital gains taxes. It’s always a good idea to chat with a tax professional before pulling the trigger to understand exactly what it means for your specific situation.

Key Takeaway: The transfer method is everything. “In-kind” transfers between like accounts (IRA to IRA) are typically tax-free. Selling assets in a taxable account to move the cash can create a tax bill.

How Long Does The Consolidation Process Take?

The timeline for portfolio consolidation can vary, but there’s good news. For most standard accounts, the process is surprisingly quick. An automated transfer through the ACATS system usually wraps up in just 3 to 6 business days.

Of course, a few things can slow it down. If you’re dealing with more complex or less common assets, or moving from a smaller firm that isn’t as tech-savvy, it might take a few weeks. Staying in touch with your new brokerage is the best way to keep things moving smoothly.

Can I Merge Retirement and Taxable Accounts?

No, you can’t directly mix your tax-advantaged retirement accounts (like a 401(k) or an IRA) with your regular taxable brokerage accounts. The government has very strict rules that keep these two worlds separate to preserve their unique tax benefits.

But what you can do is consolidate similar account types, which still massively simplifies your financial life. For instance:

- You could roll multiple old 401(k)s and various IRAs into a single, new IRA.

- Separately, you could combine all of your taxable brokerage accounts into one primary taxable account.

This way, you get the streamlined view you’re after while playing by all the tax rules.

Ready to stop juggling multiple accounts and see your complete financial picture in one place? PopaDex is an intuitive net worth tracker that empowers you to consolidate and monitor your entire portfolio with ease. Get the clarity you need to make smarter financial decisions. Start your free trial today at PopaDex.com.