Our Marketing Team at PopaDex

Retirement for Independent Contractors Simplified

When you’re an independent contractor, planning for retirement just feels different. That’s because it is. You’re not just the employee; you’re also the CEO and the entire HR department. That traditional safety net of an employer-sponsored plan? It simply isn’t there for you.

The New Reality of Self-Employed Retirement

When you work for yourself, the buck stops with you—and that includes building a secure financial future. There are no automatic 401(k) deductions pulled from a steady paycheck or company matching funds to give your savings a boost. This level of control can feel liberating, but let’s be honest, it can also be intimidating, especially when you’re juggling the natural highs and lows of freelance income.

This isn’t just a feeling; the data backs it up. The lack of employer-sponsored plans creates a real retirement gap. One survey found that gig workers, on average, expect to retire three years later than their traditionally employed peers. This delay often comes down to one thing: the absence of the automatic, “set it and forget it” savings systems that have long been the bedrock of retirement planning. If you want to dig deeper, the MacroMonitor survey offers some fascinating insights into this trend.

But here’s the flip side: this independence is also a massive opportunity. Instead of being shoehorned into a generic corporate plan, you have the power to build a retirement strategy that’s perfectly tailored to your life, your business, and your goals.

Reframing the Retirement Challenge

The first step is a mental shift. Stop seeing this as a burden and start viewing it as a strategic advantage. You have access to incredibly powerful and flexible retirement accounts that most W-2 employees can only dream of.

Think of it this way: a traditional employee is handed the keys to a standard-issue sedan for their retirement journey. It’s reliable, but it’s basic. You, on the other hand, get to walk into a custom garage and build your own vehicle from the ground up—choosing the engine, the features, and the destination.

You’re not just saving for retirement; you’re designing it. This control opens the door to greater potential returns, more aggressive savings strategies, and a plan that can pivot as your business and income evolve.

This guide is your roadmap. We’re going to walk through the specific tools you have at your disposal, from specialized retirement accounts to clever tax-saving strategies, to help you construct a plan that’s built to last. For independent contractors, proactive planning isn’t just a good idea—it’s the absolute foundation of achieving financial freedom on your own terms.

Before we dive into the specific accounts, it helps to get a clear picture of the landscape. Here’s a quick look at the main challenges you’ll face and the core strategies needed to conquer them.

Key Retirement Hurdles for Independent Contractors

The journey to a secure retirement for freelancers and contractors has its own unique set of obstacles. Recognizing them is the first step toward building a plan to overcome them.

| Challenge | Impact on Retirement | Core Strategy |

|---|---|---|

| No Employer Match | You miss out on “free money” that can significantly accelerate savings growth. | Maximize your own contributions and choose accounts with high contribution limits to compensate. |

| Irregular Income | Unpredictable cash flow makes consistent, fixed contributions difficult to maintain. | Automate a percentage-based savings plan and build a cash reserve to cover contributions during lean months. |

| Increased Tax Burden | You are responsible for both the employee and employer portions of FICA taxes (15.3%). | Use tax-deductible contributions to retirement accounts (like a SEP IRA or Solo 401k) to lower your taxable income. |

| Benefit Administration | You must research, select, and manage your own retirement accounts without an HR department. | Educate yourself on the best options for the self-employed (SEP IRA, Solo 401k, SIMPLE IRA) and seek professional advice if needed. |

Each of these hurdles might seem daunting on its own, but with the right knowledge and a solid plan, they are all completely manageable. Now, let’s get into the specific tools that will form the engine of your retirement vehicle.

Choosing Your Best Retirement Account

Picking the right retirement account is easily one of the most important financial decisions you’ll make as an independent contractor. Think of your options like different kinds of vehicles, each one built for a specific purpose. Some are designed for pure, simple power, while others come loaded with features and flexibility. The trick is to find the perfect match for your business, your income, and where you want to go in the long run.

So, let’s cut through the jargon and look at the main contenders on the lot. The three most common and powerful retirement plans for people like us are the SEP IRA, the Solo 401(k), and the SIMPLE IRA. Each one has a very specific job to do in the world of retirement for independent contractors.

The Heavy-Duty Truck: The SEP IRA

The Simplified Employee Pension (SEP) IRA is the go-to choice for a ton of freelancers and sole proprietors. Why? It’s a straightforward, low-maintenance plan with a seriously high contribution limit. It’s like a trusty, heavy-duty pickup truck—super easy to operate and capable of hauling a massive financial load.

You contribute as the “employer,” socking away up to 25% of your net adjusted self-employment income, with a very generous annual cap. That simplicity is a huge plus, especially when you’re just starting out. The trade-off is that it lacks some of the bells and whistles you’ll find in other plans, like the option to take a loan against your savings.

A SEP IRA is ideal for the contractor who prioritizes ease of setup and wants to maximize tax-deductible contributions without complex administration.

The High-Performance SUV: The Solo 401(k)

If the SEP IRA is a pickup truck, the Solo 401(k) is the high-performance SUV of retirement accounts. It’s a bit more complex to get running, but it offers a whole lot more power and flexibility. This plan is built exclusively for self-employed folks with no employees (though your spouse can participate).

So, what makes it so powerful? A Solo 401(k) gives you two ways to contribute:

- As the “employee,” you can contribute up to 100% of your compensation, right up to the annual IRS limit.

- As the “employer,” you can also contribute up to 25% of your net adjusted self-employment income on top of that.

This dual-contribution structure lets you stash away a truly significant amount of money each year. Many Solo 401(k) plans also offer a Roth option for tax-free growth and even permit plan loans, giving you a financial safety net. A well-designed plan is a cornerstone of solid financial planning for freelancers, helping you build wealth with incredible efficiency.

The Team-Friendly Van: The SIMPLE IRA

What if you see yourself hiring employees down the road? That’s where the Savings Incentive Match Plan for Employees (SIMPLE) IRA comes in. Just like the name says, it’s relatively easy to set up and manage, which makes it a great fit for small businesses that are starting to grow.

The catch, however, is that its contribution limits are much lower than what you’d get with a SEP IRA or Solo 401(k). This makes it less than ideal for high-earning contractors who are focused on maxing out their own savings. But if growing a team is part of your five-year plan, it’s definitely one to keep on your radar.

Comparing Self-Employed Retirement Plans

This side-by-side comparison of the most popular retirement plans for independent contractors can help you choose the best fit.

| Feature | SEP IRA | Solo 401(k) | SIMPLE IRA |

|---|---|---|---|

| Best For | Sole proprietors seeking high contributions and simplicity. | High-earning sole proprietors wanting to maximize savings and get advanced features. | Small business owners who plan to hire employees. |

| Contribution Limit | High (25% of net income) | Highest (Employee + Employer contributions) | Lower |

| Setup & Admin | Very easy | More complex, requires more paperwork. | Relatively easy |

| Roth Option? | No | Yes, if the plan provider offers it. | No |

| Can You Take Loans? | No | Yes, if the plan provider offers it. | No |

| Employee Eligibility | Can cover employees, but contributions can be costly. | Only for the business owner and their spouse. | Designed for small businesses with employees. |

As you can see, the SEP IRA and Solo 401(k) are typically the heavy hitters for solo entrepreneurs. The SIMPLE IRA serves a different, but equally important, purpose for those with a growing team.

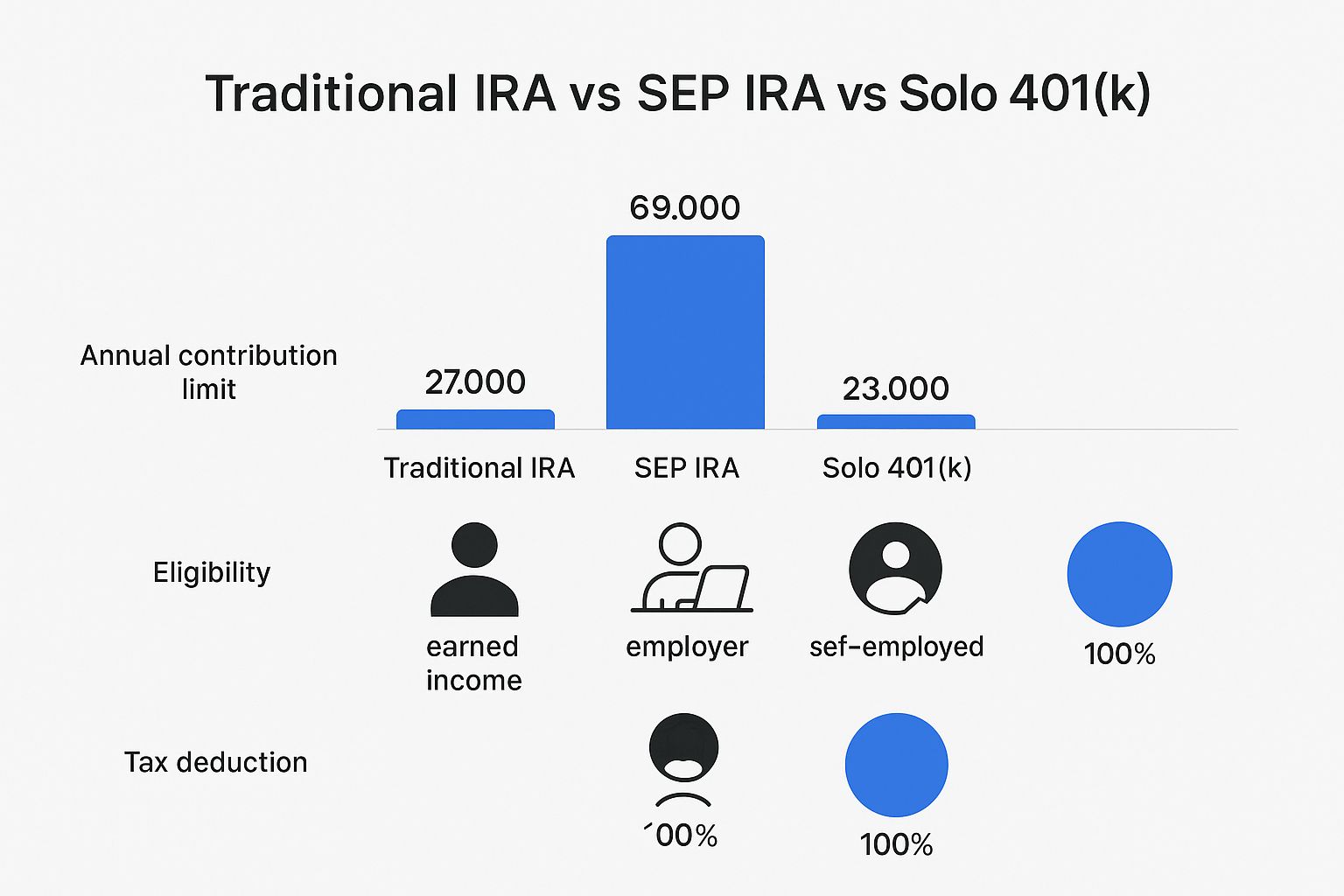

This visual really drives home how much more contribution potential the Solo 401(k) and SEP IRA offer compared to a Traditional IRA, making them far better options for the self-employed. Beyond these popular plans, you can also explore advanced strategies like a Self-Directed IRA, which can give you greater control over your investments, including things like real estate.

Ultimately, choosing the right plan comes down to your income, your savings goals, and whether you see yourself hiring anyone in the future.

Unlocking Advanced Solo 401k Strategies

For the driven independent contractor, the Solo 401(k) isn’t just another account—it’s a high-powered engine for building wealth. While a SEP IRA is great for its simplicity, the Solo 401(k) kicks things up a notch with flexibility and contribution power that’s hard to beat. Its real strength is buried in features that go way beyond basic retirement saving.

The secret sauce is its dual-contribution structure. Since you’re self-employed, you get to wear two hats: you contribute as both the “employee” and the “employer” of your own business. This is an absolute game-changer for supercharging your retirement strategy.

The Power of Two Contributions

Think of it this way: your employee contribution is your personal savings commitment. The employer contribution is your business investing back into its most important asset—you.

-

As the Employee: You can contribute up to 100% of your compensation, right up to the annual limit set by the IRS. This is your direct, personal contribution.

-

As the Employer: Your business can also kick in a profit-sharing contribution of up to 25% of your net adjusted self-employment income.

When you add these two together, you can sock away significantly more than with most other plans. It’s a seriously powerful tool for high-earning contractors who want to build their nest egg fast.

Adding the Roth Solo 401k Option

Another huge advantage is the option for a Roth Solo 401(k). Not every provider offers this, but finding one that does can fundamentally change your retirement outlook. With a Roth component, you make your employee contributions with post-tax dollars.

That means you pay taxes on the money today. In exchange, every single dollar of growth and every withdrawal you make in retirement is completely tax-free. For contractors who expect to be in a similar or higher tax bracket down the road, this is an incredible move. It gives you certainty in a world of unknown future tax rates.

By choosing a Roth Solo 401(k), you are essentially pre-paying your tax bill on your retirement savings, allowing your future self to enjoy the full value of your investment growth without owing the IRS a dime.

Using Plan Loans as a Financial Backstop

Here’s something you can’t do with any IRA: many Solo 401(k) plans let you take out a loan against your savings. Now, borrowing from your retirement should never be your first move, but it provides a valuable financial safety net for emergencies or unique opportunities.

You can typically borrow up to 50% of your vested account balance, with a cap of $50,000. The best part? The interest you pay on the loan goes right back into your own account, not to a bank. This feature offers a layer of liquidity that provides serious peace of mind—something every independent contractor can appreciate.

How to Save Consistently with Fluctuating Income

For most freelancers and independent contractors, the biggest hurdle to retirement planning isn’t picking the right account—it’s actually funding it. How do you build a steady savings habit when your income is more like a rollercoaster than a predictable paycheck? The secret is to throw out the old, rigid rules and build a system that bends with your cash flow instead of breaking under the pressure.

You’ve probably heard the classic advice to “pay yourself first.” As a freelancer, this means paying your future self first, before any other bill. The simplest way to make this happen is to automate your savings based on a percentage, not a fixed dollar amount. This strategy works with your income rhythm, not against it.

Whenever a client payment lands in your bank account, a pre-set rule automatically diverts a percentage—let’s say 15%—straight into your retirement account. This way, you’re saving more in the boom months and a bit less during the lean ones. The key is that you are always saving.

Create a Flexible Savings System

A solid system for a fluctuating income really has two parts. First, you set up those automated, percentage-based contributions. Second, you design a flexible budget that anticipates and adapts to the natural ups and downs of your earnings.

This approach acknowledges a tough reality for many freelancers. Income instability is a major roadblock to consistent saving. In fact, as of mid-2025, about 40% of primary gig workers report that their monthly income fluctuates. This volatility helps explain why only 43% have enough savings to cover three months of expenses, a sharp contrast to the 57% of traditional workers who do. These numbers underscore why a proactive, flexible retirement strategy isn’t just nice to have—it’s essential.

Master the Catch-Up Contribution

A flexible system also opens the door for strategic “catch-up” contributions. When you land a huge project or have a surprisingly profitable quarter, you can seize the opportunity to make a larger, one-time deposit into your retirement plan.

This isn’t about punishing yourself for a slow month. It’s about being smart during the prosperous ones. By topping up your savings when cash flow is strong, you smooth out the average over the course of the year, keeping you firmly on track to hit your long-term goals.

Forget feeling guilty about a lean month. Instead, focus on building a resilient system that can handle inconsistency. Your goal is progress over perfection, making sure your retirement fund grows no matter what your monthly invoices add up to.

This dynamic approach demands a clear, real-time view of your finances. Having a solid framework is crucial for managing this kind of variability. Our guide on budgeting for freelancers gives you actionable steps to create a budget that perfectly supports this savings method. By combining automated percentage-based savings with smart catch-up contributions, you build a powerful and sustainable engine for your retirement.

Of course. Here is the rewritten section, crafted to sound completely human-written and natural, following all the specified requirements.

Using Retirement Savings to Lower Your Tax Bill

When you’re self-employed, every single dollar you can save on taxes is a dollar that goes straight into your pocket—or even better, toward building your future. Your retirement plan isn’t just a piggy bank for your golden years; it’s one of the most powerful tax-slashing tools you have.

Think about it this way: every contribution you make to a traditional SEP IRA or Solo 401(k) is tax-deductible. This directly shaves down your taxable income for the year, giving you an immediate financial win. It’s a brilliant one-two punch—you’re building long-term wealth while simultaneously cutting the check you have to write to the IRS right now. This simple move transforms a retirement contribution from just another line item into a savvy financial strategy.

Let’s See It In Action

Okay, let’s get real and put some numbers to this. Imagine you’re a freelance graphic designer who netted $80,000 this year. You decide to put $10,000 of that into your SEP IRA.

- Without that contribution, your taxable business income is $80,000.

- After you contribute, your taxable income drops to $70,000.

Just like that, you don’t owe income tax on the $10,000 you socked away. If you’re in the 22% federal tax bracket, that single move could save you $2,200 in federal taxes alone, not to mention any potential state tax savings. This isn’t some complex loophole; it’s a straightforward benefit baked into the tax code to reward independent workers for saving.

Think of it like this: The government is basically offering you a huge discount on your tax bill as a thank you for taking care of your own retirement. Frankly, it’s one of the smartest financial plays a self-employed person can make.

How This Affects Your Self-Employment Tax

Now, there’s one crucial detail to understand. Your retirement contributions are fantastic for lowering your income tax, but they don’t touch your self-employment tax bill (the part that covers Social Security and Medicare).

The self-employment tax is calculated first, based on 92.35% of your net business profit. Your SEP IRA or Solo 401(k) contributions are deducted after that calculation. So, you’ll still pay the full 15.3% self-employment tax on your earnings before the retirement deduction. But the big break on your income tax liability is where you really come out ahead, freeing up more cash to reinvest in your business or pile back into your savings.

Your Step-by-Step Retirement Action Plan

Alright, you’ve absorbed a lot of information. But knowledge is just trivia until you put it to work. This is where we move from theory to action, turning everything you’ve just learned about retirement for independent contractors into concrete steps. It’s time to build your future.

Let’s be honest: flying solo means you have to be your own HR department. Pew Research found that while 48.1% of contract workers were technically eligible for workplace retirement plans, only a tiny 12.7% actually participated. Why? Volatile income and a lack of clear guidance are often the culprits. That’s exactly why having a personal action plan isn’t just a good idea—it’s essential.

So, where do you start? It’s simpler than you think.

- Calculate Your Goal: First, figure out what your target retirement number actually is. A fuzzy goal is hard to hit.

- Choose Your Account: Use the comparisons we’ve covered to pick the right account for your business, whether that’s a SEP IRA, Solo 401(k), or another option.

- Open the Account: Find a reputable provider and get the paperwork done. This is the official starting line.

- Automate Your Contributions: Don’t rely on willpower. Set up automatic, percentage-based transfers from your business income to keep your savings consistent.

A crucial part of any robust retirement action plan for independent contractors is streamlining collaboration with financial professionals, such as accountants, to ensure proper financial management and tax compliance.

For a detailed walkthrough that holds your hand through this process, grab our complete retirement planning checklist. We designed it to give you the clarity and confidence to execute these steps and start building a secure financial future, one decision at a time.

Have Questions? We Have Answers

When you’re self-employed, navigating the retirement landscape can feel like you’re piecing together a puzzle. Let’s tackle some of the most common questions that pop up for freelancers and independent contractors.

Can I Have a Solo 401(k) and a Roth IRA at the Same Time?

Yes, and you absolutely should if you can swing it. Think of them as two separate buckets you can fill up simultaneously. The contribution limits for a Solo 401(k) and a Roth IRA are completely independent of each other.

By maxing out both, you can seriously accelerate your savings and build a much larger nest egg than you could with just one account. It’s a powerful strategy for supercharging your retirement goals.

What Happens to My Solo 401(k) if I Hire an Employee?

This is a big one, so pay close attention. A Solo 401(k) is exactly what it sounds like: a plan for a solo operator. The only exception is your spouse. The moment you hire your first full-time, non-spouse employee, the “solo” part no longer applies, and you can’t contribute to the plan anymore.

When that happens, you’ve got two main choices:

- Freeze the plan: You simply stop putting money in. Your existing funds stay put and continue to grow (or shrink) with the market.

- Roll it over: You can move the money into a new retirement plan, like a SEP IRA or a traditional 401(k) that’s designed for small businesses with employees.

The “Solo” in Solo 401(k) is a hard-and-fast rule. Hiring that first employee is a major business milestone, and it’s critical to have a plan for your retirement account when you get there.

Is It Better to Make Pre-Tax or Roth Contributions?

This is the classic “pay taxes now or pay taxes later” dilemma. There’s no single right answer—it all boils down to an educated guess about your future income.

If you think you’ll be in a higher tax bracket during retirement than you are now, making Roth contributions is a smart move. You pay the taxes today, but all your withdrawals in retirement will be 100% tax-free.

On the flip side, if you’re in a high tax bracket today and expect your income (and tax bracket) to be lower in retirement, then making pre-tax contributions could be your best bet. You get a nice tax deduction now, which lowers your current bill.

Many freelancers hedge their bets by doing a little of both.

Ready to take control and see all your retirement accounts in one place? PopaDex provides a single, clear dashboard to track your entire financial picture, helping you stay on course toward your goals. Start your free trial at https://popadex.com today.