Our Marketing Team at PopaDex

Your 2026 Guide: 10 Critical Retirement Savings Milestones by Age

Navigating your financial journey without a map can feel like sailing in a storm. While everyone’s path to retirement is unique, there are well-established financial signposts that can tell you if you’re on the right track. This guide outlines 10 critical retirement savings milestones by age, providing clear, actionable benchmarks from your first job in your 20s to your legacy planning in your 60s and beyond.

Instead of generic advice, this listicle dives into specific, concrete goals to help you assess your financial health. You will learn about key targets, such as:

- Salary Multiples: Understand how much you should have saved relative to your annual income at ages 35, 40, 55, and beyond.

- Strategic Actions: Discover when to maximize employer 401(k) matches, activate catch-up contributions, and shift from accumulation to distribution.

- Savings Rates: Pinpoint the ideal percentage of your gross income to save during different phases of your career.

We’ll explore variations for couples, the self-employed, and expats, highlighting common pitfalls to avoid at each stage. Whether you’re just starting your career or nearing the finish line, use these milestones to gauge your progress, adjust your strategy, and build the financial confidence you deserve. To make this journey tangible, we will also show how a comprehensive tool like PopaDex can help you track every asset and liability, ensuring you know exactly where you stand at every step. This roadmap is designed to transform abstract retirement goals into a clear, manageable, and achievable plan.

1. Age 20s: Emergency Fund Foundation (3-6 Months of Expenses)

Before you start aggressively chasing retirement savings milestones by age, the first and most crucial step in your 20s is building a solid financial foundation. This foundation is your emergency fund: a liquid cash reserve equal to 3-6 months of your essential living expenses. This isn’t retirement savings; it’s a financial safety net designed to protect your long-term goals from unexpected life events like a job loss, medical emergency, or urgent car repair.

Having this buffer prevents you from derailing your progress by needing to cash out investments or take on high-interest debt when a crisis hits. For those with variable income, such as freelancers or gig-economy workers, aiming for the higher end (6 months or more) provides even greater security against income fluctuations. This principle, popularized by experts like Dave Ramsey and Suze Orman, emphasizes stability before wealth-building.

How to Implement and Track Your Emergency Fund

Building this fund requires a disciplined, automated approach. Start by calculating your non-negotiable monthly expenses (rent, utilities, food, insurance) to set a clear savings target.

- Automate Your Savings: Set up recurring automatic transfers from your checking account to a separate high-yield savings account (HYSA). This “pay yourself first” strategy ensures consistent progress without relying on willpower.

- Track Your Goal: Use a tool to monitor your progress. PopaDex’s dashboard allows you to create a specific goal for your emergency fund, visually tracking how close you are to your target and keeping you motivated.

- Real-World Example: A 25-year-old freelance graphic designer calculates their essential monthly expenses at $3,000. Their goal is a 6-month fund of $18,000. They set up a $400 automatic monthly transfer to an HYSA and direct 20% of any income above their baseline salary into the fund until the goal is met.

For a comprehensive guide on calculating your needs and accelerating your savings, you can learn more about how to build an emergency fund on popadex.com. Establishing this fund is the single most empowering financial move you can make in your 20s.

2. Age 25: Employer 401(k) Match Maximization (Full Employer Contribution)

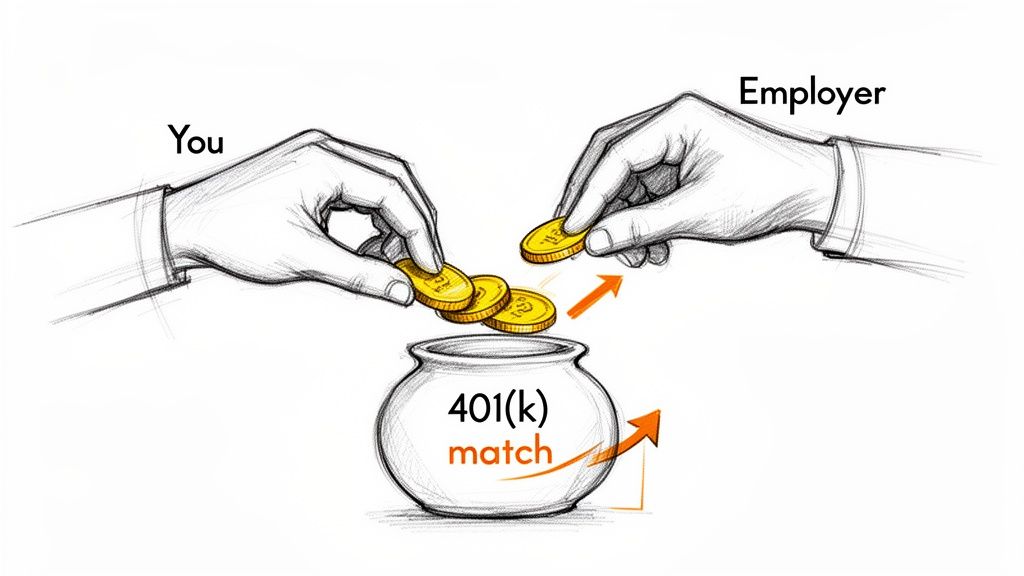

After establishing your emergency fund, the next critical retirement savings milestone is to capture every dollar of your employer’s 401(k) match. Think of this as an immediate, guaranteed return on your investment, often 50% or 100%, before your money even has a chance to grow in the market. Missing out on this is akin to turning down a portion of your salary. This “free money” is the most powerful accelerator for your retirement savings in your 20s.

This principle, championed by financial institutions like Vanguard and Fidelity, is simple: contribute enough from your paycheck to receive the maximum amount your employer will match. This contribution should be your top savings priority, even before paying down low-interest debt or opening other investment accounts. The compounding effect on these matched funds over 40-plus years is immense, making it a non-negotiable step for wealth building.

How to Implement and Track Your 401(k) Match

Maximizing your match requires understanding your benefits and automating your contributions to ensure you never miss the target.

- Review Your Plan: Log into your company’s benefits portal or review HR documents to find the exact matching formula (e.g., “50% match on the first 6% of your salary”). This tells you the minimum percentage you must contribute to get the full benefit.

- Automate Contributions: Set your contribution percentage through your payroll provider. This ensures the money is invested automatically with each paycheck, making the process effortless and consistent.

- Track Your Portfolio: Integrate your 401(k) account with a platform like PopaDex. This allows you to see your employer’s contributions alongside your own, tracking the total growth of your retirement assets in one unified dashboard.

- Real-World Example: A 25-year-old earning $60,000 has an employer that matches 100% of contributions up to 5% of her salary. She sets her contribution rate to 5% ($3,000 per year), and her employer adds another $3,000, for a total of $6,000 saved. If she only contributed 3%, she would miss out on $1,200 of free money annually.

3. Age 30: Retirement Savings Rate Achievement (10-15% of Gross Income)

By the time you turn 30, the primary focus should shift from foundational savings to establishing a powerful, consistent wealth-building habit. This key retirement savings milestone is achieving a savings rate of 10-15% of your gross income. This isn’t just about the dollar amount; it’s about creating a sustainable system that leverages the incredible power of compound interest over the next 30+ years. Hitting this target ensures your money has ample time to grow, setting a strong trajectory for a comfortable retirement.

This savings rate should encompass all contributions to your retirement vehicles, including your 401(k), Roth or Traditional IRA, and any taxable brokerage accounts earmarked for the long term. This principle is a cornerstone of financial planning, championed by major institutions like Fidelity and Vanguard, which emphasize that your savings rate is one of the most significant predictors of retirement success. It provides a scalable target that grows with your income, keeping your goals aligned with your career progression.

How to Implement and Track Your Savings Rate

Achieving and maintaining a 10-15% savings rate requires automation and strategic adjustments, especially as your income and expenses evolve. The goal is to make consistent saving an effortless, background activity.

- Automate and Escalate: Set up automatic contributions to your 401(k) and IRA. A powerful behavioral trick is to schedule an automatic 1-2% increase in your contribution rate each time you get a raise, so you feel the benefit of your higher income while painlessly boosting your savings.

- Track Across All Accounts: Your savings rate is a holistic number. Use PopaDex’s multi-account integration to link your 401(k), IRA, and investment accounts in one dashboard. This gives you a clear, real-time visualization of your combined savings rate against your gross income.

- Real-World Example: A 30-year-old earning $120,000 aims for a 12% savings rate, or $14,400 per year. They contribute 8% ($9,600) to their 401(k) to maximize their employer match and contribute the remaining $4,800 to a Roth IRA, automating the entire process.

To accurately determine your current performance, you can get a detailed breakdown of how to calculate your savings rate on popadex.com. Mastering this milestone by 30 puts you on an excellent path toward financial independence.

4. Age 35: One Year Gross Income Saved (Retirement + Taxable Accounts)

By your mid-30s, the goal shifts from building a foundation to accumulating significant assets. The age 35 milestone, a key benchmark in many retirement savings guidelines, is to have saved an amount equal to one full year of your gross income. This total includes all your investment assets, from your 401(k) and IRAs to any taxable brokerage accounts. Reaching this target demonstrates that your savings habits are strong and your investments are beginning to benefit from serious compounding growth.

This milestone is a powerful indicator of your financial trajectory. Achieving it means you’ve successfully navigated the early career years of lower income and competing financial priorities, establishing a robust base for future wealth creation. This principle, widely promoted by financial institutions like Fidelity, validates that your long-term strategy is on track and provides the momentum needed to reach more ambitious future goals.

How to Implement and Track Your Progress

Consolidating your financial picture is the first step to accurately measuring your progress toward this crucial milestone. Many people have assets spread across old 401(k)s, current employer plans, and separate brokerage accounts, making it difficult to see the full picture.

- Consolidate Your View: Use a tool that aggregates all your accounts in one place. PopaDex supports over 15,000 banks and financial institutions, allowing you to link everything and calculate your total accumulated wealth instantly. For expats or those with multi-currency accounts, its conversion features ensure you get an accurate, unified total.

- Set Milestone Alerts: Create a specific goal within your PopaDex dashboard to track your “One Year Gross Income” target. You can set up alerts to notify you as you approach this important retirement savings milestone, keeping you motivated and focused.

- Real-World Example: A 35-year-old marketing manager earns $120,000 annually. She uses PopaDex to link her current 401(k) ($65,000), a rollover IRA from a previous job ($30,000), and a taxable brokerage account ($28,000). The dashboard shows her total invested assets are $123,000, confirming she has successfully hit her 1x salary goal.

For a deeper dive into consolidating your accounts and understanding your financial position, you can learn more about how to track your net worth on popadex.com. Hitting this target is a clear sign that your financial discipline is paying off.

5. Age 40: Three Times Annual Income Accumulated (Career Midpoint Checkpoint)

Entering your 40s marks a significant career midpoint and a crucial checkpoint for your retirement savings milestones by age. The widely accepted benchmark is to have accumulated three times your annual gross income. This target signifies that your compounding growth is taking hold, putting you on a solid trajectory for a comfortable retirement. Reaching this milestone provides a substantial buffer and flexibility to navigate future financial demands, like college tuition or higher lifestyle costs, without derailing your long-term goals.

This rule of thumb, popularized by financial institutions like Fidelity and T. Rowe Price, is a powerful indicator of your saving and investing discipline over the past two decades. With approximately 25 years left until traditional retirement age, hitting this 3x salary goal ensures your portfolio has the necessary mass to generate significant growth through the power of compounding in the years ahead. It confirms your strategy is working and allows for a comprehensive review and potential course corrections.

How to Implement and Track Your Midpoint Goal

At this stage, your financial life may be more complex, involving multiple accounts and possibly international assets. A holistic and detailed approach is essential for accurate tracking.

- Consolidate Your Financial View: Bring all your accounts, including 401(k)s, IRAs, brokerage accounts, and even international assets, into a single view. PopaDex’s dashboard provides a comprehensive overview, allowing you to see your true net worth and progress toward the 3x milestone without toggling between platforms.

- Model Future Scenarios: Use advanced analytics to project your retirement outcome based on your current trajectory. PopaDex’s tools can help you model different scenarios, showing how increased contributions or adjusted asset allocation could impact your final nest egg.

- Real-World Example: A 40-year-old marketing director earns $150,000 annually. Their goal is $450,000 in retirement savings. They use PopaDex to consolidate a 401(k) from a previous employer, their current 401(k), a Roth IRA, and a taxable brokerage account, confirming they have reached $455,000. They then run a retirement simulation to ensure they are on track for their target retirement age of 65.

For a deeper dive into managing a diverse portfolio as you approach this crucial age, you can learn more about holistic wealth tracking on popadex.com. This midpoint review is less about the exact number and more about validating your long-term strategy.

6. Age 45: Six Times Annual Income Saved (Pre-Peak Earning Years)

By your mid-40s, your focus should shift from foundational saving to aggressive wealth accumulation. The key retirement savings milestone by age 45 is having six times your annual gross income saved. This benchmark, advocated by financial institutions like Fidelity, is critical because it positions you to take full advantage of your upcoming peak earning years, which typically occur in the late 40s and early 50s.

Hitting this milestone ensures that the substantial salary increases you’re likely to experience can be channeled directly into supercharging your retirement accounts, rather than playing catch-up. This period is less about starting and more about optimizing and amplifying the growth of the wealth you have already built. Your investment strategy should be well-established, focusing on growth while managing risk as you approach the final decade before retirement.

How to Implement and Track Your 6x Income Goal

Achieving this ambitious target requires a comprehensive view of your entire financial picture, especially for those with complex assets. You need a system that can consolidate diverse holdings to give you a clear, accurate net worth calculation.

- Consolidate Your Financial View: Aggregate all your accounts, including 401(k)s, IRAs, brokerage accounts, real estate equity, and even international assets, into one unified dashboard. This gives you a precise snapshot of your progress toward the 6x milestone.

- Model Future Scenarios: Use financial planning tools to model the impact of increased contributions during your peak earning years. This helps you visualize how aggressive saving now will translate into a larger nest egg later and prepare for catch-up contributions after age 50.

- Real-World Example: A 45-year-old global executive earns an annual salary of $200,000. Their goal is a net worth of $1.2 million. Using PopaDex, they link their U.S. 401(k), a brokerage account in Singapore, and real estate holdings in London. The platform automatically converts currencies and provides a real-time net worth calculation, confirming they have reached their 6x income target and can now focus on maximizing their final pre-retirement contributions.

7. Age 50: Catch-Up Contributions Activation (401(k) and IRA Acceleration)

Turning 50 is a significant retirement savings milestone because it unlocks a powerful tool: catch-up contributions. The IRS allows individuals age 50 and over to contribute an additional amount to their retirement accounts beyond the standard annual limits. This is a critical opportunity to accelerate savings during what are often peak earning years, helping to close any savings gaps before retirement. For 2024, this means an extra $7,500 for 401(k)s and $1,000 for IRAs.

This provision recognizes that many people hit their highest income levels in their late 40s and 50s, making it the ideal time to supercharge their nest egg. It’s a strategic shift from steady accumulation to an aggressive final push. Financial institutions like Fidelity and Vanguard heavily promote this strategy, as it’s one of the most effective ways to make substantial progress in the final decade before retirement.

How to Implement and Track Your Catch-Up Contributions

Leveraging catch-up contributions requires a proactive adjustment to your savings plan. You must manually increase your contribution rates with your employer or IRA provider to take advantage of these higher limits.

- Adjust Your Contributions: Contact your HR department or log into your 401(k) provider’s portal to increase your deferral percentage. For your IRA, set up larger automated transfers to meet the new, higher limit.

- Track Your New Limits: Update your retirement goals in PopaDex to reflect the increased contribution maximums. The dashboard will help you monitor your progress toward hitting the new target and visualize the impact on your long-term retirement forecast.

- Real-World Example: A 50-year-old manager earning $150,000 was already maxing out their 401(k) at $23,000. Upon turning 50, they increase their contributions to hit the new maximum of $30,500 ($23,000 + $7,500 catch-up). This extra $7,500 per year, if invested for 15 years with an 8% average return, could add over $200,000 to their retirement balance.

By activating these catch-up provisions, you are seizing one of the most important retirement savings milestones by age, ensuring you are doing everything possible to secure your financial future.

8. Age 55: Eight to Ten Times Annual Income (Retirement Readiness Assessment)

Reaching your mid-50s marks a critical inflection point where retirement shifts from an abstract concept to an approaching reality. The milestone here is accumulating eight to ten times your annual gross income. This isn’t just a savings target; it’s the financial fuel required for a comprehensive retirement readiness assessment, allowing you to model your future lifestyle with a high degree of accuracy and make final strategic adjustments.

Having this substantial nest egg enables you to move beyond simple accumulation and into detailed distribution planning. At this stage, you can realistically project income streams, finalize healthcare strategies, and decide on Social Security claiming options. This level of savings, recommended by financial institutions like Fidelity and Vanguard, signifies that you have likely built sufficient capital to support your desired retirement lifestyle, triggering final-phase planning like considering bridge employment or a phased retirement.

How to Implement and Track Your Retirement Readiness

With a significant portfolio accumulated, the focus shifts to consolidation, detailed analysis, and scenario modeling to ensure your assets can sustain your long-term needs.

- Consolidate Your Financial Picture: Aggregate all your accounts (401(k)s, IRAs, brokerage, international assets) into a single view. PopaDex’s dashboard provides a holistic overview, which is essential for accurate projections and identifying any gaps in your plan.

- Model Retirement Scenarios: Use your consolidated data to run multiple simulations. Explore different outcomes: retiring fully at 62, working part-time until 65, or delaying Social Security until 70. This helps you understand the financial impact of each choice.

- Real-World Example: A 55-year-old marketing executive earns $200,000 and has saved $1.8 million (9x salary). They use a financial planning tool to model a phased retirement, working three days a week from age 60 to 65. The projection shows this strategy allows their portfolio to grow for five extra years while covering living expenses, significantly increasing their income security after age 65. For an expat, this would involve modeling income in both their home and host country currencies.

9. Age 60: Twelve Times Annual Income (Final Accumulation Verification)

By age 60, you’ve reached the final major accumulation checkpoint before retirement officially begins. The target here is to have twelve times your annual gross income saved, a crucial benchmark that confirms your readiness for the transition from earning to spending down your assets. This milestone signifies that the primary phase of wealth building is complete; your focus now shifts decisively toward wealth preservation and crafting a strategic, tax-efficient distribution plan for the decades ahead.

This goal, supported by benchmarks from institutions like Fidelity, provides a strong financial base for entering retirement. Hitting this target means you are well-positioned to create a sustainable income stream that can support your lifestyle, cover healthcare costs, and withstand market volatility. At this stage, your portfolio should be de-risked, with a greater allocation to fixed income and dividend-paying assets to generate predictable cash flow.

How to Implement and Track Your Pre-Retirement Strategy

Achieving this milestone requires a comprehensive review of your entire financial picture and modeling various future scenarios to ensure your plan is resilient.

- Conduct a Comprehensive Net Worth Analysis: Use PopaDex to aggregate all your accounts, from 401(k)s and IRAs to taxable brokerage and international assets. This holistic view is essential for accurate withdrawal modeling and understanding your complete financial position.

- Model Withdrawal Scenarios: Don’t rely on a single rule. Test the classic 4% rule, dynamic withdrawal strategies that adjust to market performance, and longevity-based models. This helps you understand the trade-offs between income level and portfolio sustainability.

- Plan for Healthcare and Taxes: Develop a detailed plan for Medicare, supplemental insurance, and potential long-term care costs. Simultaneously, map out a tax-efficient withdrawal sequence, deciding which accounts (traditional, Roth, taxable) to draw from first to minimize your tax burden in retirement.

- Real-World Example: A 60-year-old executive earning $200,000 has accumulated $2.4M. They use a financial planner to model a phased retirement, gradually reducing their work hours while beginning to draw from their taxable brokerage account. This allows their tax-advantaged accounts to continue growing for a few more years, optimizing their long-term income potential.

10. Age 65+: Retirement Income Sufficiency & Distribution Strategy (Legacy & Longevity Planning)

Entering your mid-60s marks the pivotal transition from accumulating wealth to strategically distributing it. This retirement savings milestone is less about a target number and more about creating a sustainable income stream designed to last for a 30-plus-year retirement. The focus shifts to longevity planning, managing healthcare costs, and ensuring your assets can support your lifestyle while also considering any legacy you wish to leave.

At this stage, your primary goal is to turn your nest egg into a reliable “paycheck” that maintains your purchasing power against inflation. This involves implementing Social Security claiming strategies, activating pensions, and executing a tax-efficient withdrawal sequence from your various accounts (e.g., 401(k), IRA, brokerage). This approach, rooted in research from figures like William Bengen (the “4% Rule”) and frameworks from institutions like Vanguard, is about creating a durable, lifelong income plan.

How to Implement and Track Your Distribution Strategy

A successful distribution phase requires careful planning, modeling, and ongoing monitoring to adapt to market conditions and personal spending needs.

- Model Withdrawal Scenarios: Before drawing any funds, use a financial tool to model different withdrawal rates (e.g., 3.5% vs. 4.5%) and see how they impact your portfolio’s longevity. PopaDex’s retirement planner can simulate these scenarios, helping you find a sustainable rate that aligns with your risk tolerance and life expectancy. For those at or nearing retirement, a critical aspect of your distribution strategy is understanding non-probate assets like retirement accounts and how they are handled.

- Coordinate Income Streams: Integrate all sources of income, including Social Security, pensions, and investment withdrawals, into a cohesive plan. For expats, this involves coordinating international pensions and navigating multi-currency finances.

- Real-World Example: A 66-year-old retired teacher with a $1.2 million portfolio decides on a 3.8% initial withdrawal rate, providing $45,600 in annual income. They supplement this with their Social Security benefits. They use PopaDex to track their portfolio’s performance quarterly and plan to adjust the withdrawal amount annually based on inflation and market returns, ensuring their plan remains on track.

Retirement Savings Milestones: 10-Age Comparison

| Milestone | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 ⭐ | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Age 20s: Emergency Fund (3–6 months) | Low — set up liquid account & auto-transfers 🔄 | Moderate liquidity in high-yield savings (3–6 months expenses) ⚡ | Reduces forced asset sales; stabilizes cash flow 📊 ⭐ | New grads, gig workers, expats with variable income 💡 | Protects investments; improves financial resilience ⭐ |

| Age 25: 401(k) Match Maximization | Low — enroll and contribute to match 🔄 | Contribute enough salary % to capture full employer match ⚡ | Immediate guaranteed return via employer match; long-term compounding 📊 ⭐ | Employees with employer match; self-employed using Solo 401(k) 💡 | “Free money” boost to retirement savings; tax-advantaged growth ⭐ |

| Age 30: Save 10–15% of Income | Moderate — coordinate multiple accounts and automate 🔄 | Steady annual contributions across 401(k), IRA, taxable accounts ⚡ | On-track retirement funding with 30 years of compounding 📊 ⭐ | Middle-income earners balancing present spending & retirement 💡 | Sustainable long-term savings rate; flexibility across accounts ⭐ |

| Age 35: One Year Gross Income Saved | Moderate — consolidate accounts & maintain discipline 🔄 | Cumulative assets ≈ 1× annual salary across accounts ⚡ | Strong net-worth milestone; foundation for accelerated growth 📊 ⭐ | Consistent savers, mid-career professionals, expats 💡 | Psychological milestone; buffer for career/mkt shocks ⭐ |

| Age 40: 3× Annual Income Accumulated | Moderate–High — active portfolio growth & tracking 🔄 | Significant invested assets (3× salary) across vehicles ⚡ | Mid-career checkpoint indicating retirement trajectory 📊 ⭐ | Established professionals seeking flexibility or pivots 💡 | Provides options (mortgage paydown, business investment) ⭐ |

| Age 45: 6× Annual Income Saved | High — disciplined long-term contributions & allocation 🔄 | Large diversified portfolio (6× salary) and habit persistence ⚡ | Near-peak funding for final wealth-accumulation decade 📊 ⭐ | Peak-earning professionals preparing for catch-up phase 💡 | Substantial retirement security; catch-up ready ⭐ |

| Age 50: Catch-Up Contributions Activated | Moderate — implement higher contribution limits 🔄 | Additional annual catch-up limits (401(k) + IRA) ⚡ | Accelerated accumulation in final pre-retirement decade 📊 ⭐ | High earners, late savers, self-employed using Solo 401(k) 💡 | Large tax-advantaged boost to retirement balances ⭐ |

| Age 55: 8–10× Annual Income (Readiness) | High — detailed projections & healthcare planning 🔄 | Very large asset base; modeling for longevity & taxes ⚡ | Enables retirement scenario testing and phased retirement 📊 ⭐ | Pre-retirees, those assessing Social Security/healthcare 💡 | Provides flexibility for retirement timing and income strategies ⭐ |

| Age 60: 12× Annual Income (Final Accumulation) | High — shift to preservation & distribution planning 🔄 | Substantial portfolio; focus on risk reduction and tax planning ⚡ | Transition to income generation and withdrawal strategies 📊 ⭐ | Pre-retirees finalizing withdrawal plans and protections 💡 | Strong legacy & inflation buffer; optional flexible retirement timing ⭐ |

| Age 65+: Retirement Income & Distribution Strategy | High — complex withdrawal, tax, and healthcare coordination 🔄 | Multi-source income (Social Security, pensions, investments) ⚡ | Sustained retirement income over long horizon; legacy planning 📊 ⭐ | Retirees, legacy planners, healthcare-focused savers, expats 💡 | Tax-efficient distributions, diversified income streams, longevity focus ⭐ |

From Milestones to Mastery: Your Next Financial Move

Navigating the path to a secure retirement can feel like a complex journey, but the milestones we’ve explored provide a clear, age-by-age roadmap. From establishing your emergency fund in your 20s to optimizing your distribution strategy in your 60s, each benchmark serves as a powerful checkpoint, not a rigid ultimatum. These targets are designed to keep you engaged, motivated, and on track as your life and financial situation evolve.

The true value of these retirement savings milestones by age isn’t about hitting every single number with perfect precision. Instead, it’s about fostering a habit of consistent, intentional financial planning. Your personal journey will inevitably have its own unique twists and turns, influenced by career changes, family growth, market fluctuations, and personal goals. The key is to adapt, adjust, and always have a clear understanding of your current financial standing.

Key Takeaways for Your Financial Journey

To truly move from simply acknowledging these milestones to mastering your financial future, focus on these core principles:

- Consistency Over Intensity: Saving a manageable 10-15% of your income consistently over decades is far more powerful than making sporadic, large contributions. The magic of compounding needs time to work, and your best ally is an early and steady start.

- Automation as Your Ally: Set up automatic transfers to your 401(k), IRA, and other investment accounts. Automating your savings removes the friction of making a decision each month, ensuring you pay yourself first without fail.

- Periodic Reassessment is Non-Negotiable: Life happens. A promotion, a new job, or a change in family structure should trigger a review of your savings rate and investment allocation. At a minimum, schedule an annual financial check-up to ensure your strategy still aligns with your goals.

- Embrace a Holistic View: Retirement savings are just one piece of a larger financial puzzle. Your plan must also account for debt management, insurance coverage, and long-term legacy planning. As you consider your later years, understanding and preparing essential estate planning documents is crucial for protecting your assets and ensuring your family’s future.

Your Actionable Next Step: Gain Absolute Clarity

The most significant barrier to achieving these milestones is often a lack of clarity. Juggling multiple accounts, currencies, and asset types can make it nearly impossible to know your true net worth or track your progress accurately. This is where planning falters and guesswork takes over.

Your financial plan is only as strong as the data it’s built on. Without a real-time, consolidated view of your finances, you’re navigating your most important financial journey with an outdated map.

To make confident, informed decisions at every stage, you need a single source of truth. This means moving beyond spreadsheets and fragmented bank apps to a dynamic, comprehensive dashboard that brings your entire financial world into focus. By seeing exactly where you stand today, you can chart a precise course toward where you want to be tomorrow. This clarity transforms abstract goals like “saving three times your income” into tangible, achievable steps. Don’t let financial complexity be the reason you fall behind on your retirement savings goals. The power to master your financial future is within reach, and it starts with a clear, complete picture.

Ready to stop guessing and start knowing? PopaDex provides a seamless, real-time dashboard of your entire financial life by integrating over 15,000 banks and institutions worldwide. Track your progress against these retirement savings milestones by age with unparalleled clarity and take control of your financial destiny today. Start your free trial at PopaDex and turn your financial plan into reality.