Our Marketing Team at PopaDex

7 Essential Retirement Withdrawal Strategies for 2025

Retirement marks a significant shift from accumulating wealth to strategically drawing it down. The decisions you make now will define your financial security and lifestyle for decades. With market volatility, inflation, and increasing longevity, simply having a substantial nest egg isn’t enough; you need a robust, well-defined plan for how to spend it. A carefully chosen framework is what transforms your savings into a reliable income stream.

This guide cuts through the complexity to detail seven proven retirement withdrawal strategies. Each approach offers a different balance of simplicity, flexibility, and security, tailored for various financial situations and risk appetites. We will explore the precise mechanics behind each method, from the time-tested 4% Rule to more dynamic, market-responsive systems like the Guardrails Approach and the Bucket Strategy.

By understanding the pros, cons, and ideal scenarios for each of these blueprints, you will be equipped to select the strategy, or combination of strategies, that best aligns with your unique goals. Our focus is on providing actionable insights to help you build a durable plan, ensuring your hard-earned savings last a lifetime. Tracking your portfolio’s performance against your chosen strategy is critical, and specialized tools can offer a consolidated view to simplify this essential task.

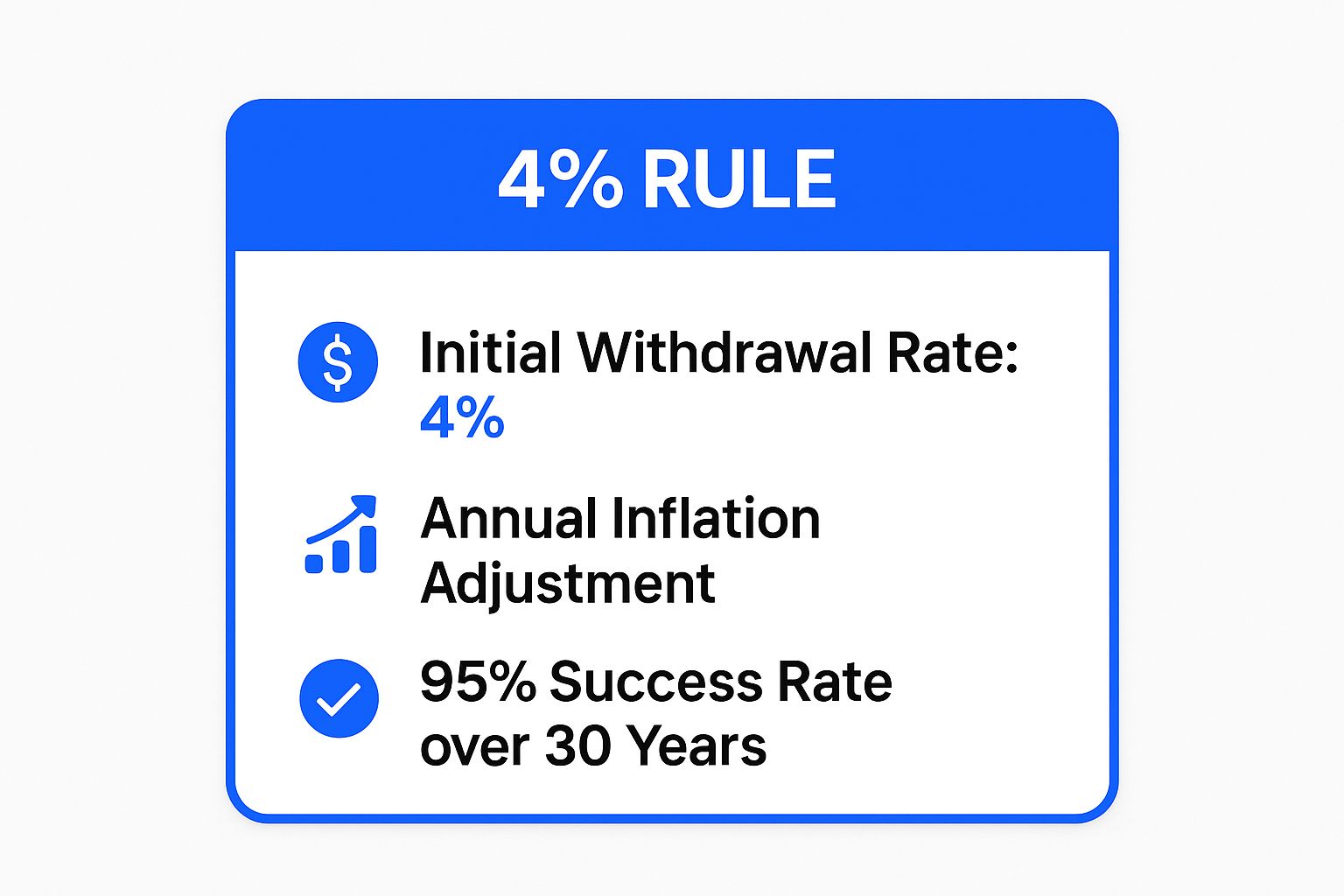

1. 4% Rule (Safe Withdrawal Rate)

The 4% Rule is one of the most well-known retirement withdrawal strategies, acting as a simple yet powerful benchmark for retirees. Popularized by financial planner William Bengen in 1994 and later supported by the famous “Trinity Study,” this guideline suggests a straightforward approach to spending your nest egg. The core principle is that you can withdraw 4% of your portfolio’s value in your first year of retirement.

In subsequent years, you adjust that initial dollar amount for inflation, not for your portfolio’s fluctuating value. This method aims to provide a stable, inflation-protected income stream that has historically been shown to last for at least 30 years.

How It Works in Practice

Let’s use a simple example: If you retire with a $1 million portfolio, your first-year withdrawal would be $40,000. If the inflation rate for that year is 3%, your second-year withdrawal would increase by that percentage to $41,200 ($40,000 x 1.03), regardless of whether your portfolio grew or shrank.

This systematic approach is designed to prevent retirees from overspending during market booms or underspending during downturns. The strategy’s success hinges on maintaining a diversified portfolio, typically a mix of at least 50% stocks and 50% bonds, to provide the growth necessary to sustain withdrawals.

The following infographic highlights the foundational principles of this retirement withdrawal strategy.

This visual summary underscores the rule’s simplicity: a fixed initial rate, annual inflation adjustments, and a high historical success rate over a typical 30-year retirement.

Is the 4% Rule Right for You?

While the 4% Rule provides an excellent starting point, it isn’t a one-size-fits-all solution. Its historical 95% success rate is based on past U.S. market data and may not reflect future returns. Consider these actionable tips:

- Adjust for Your Timeline: If you plan for a retirement longer than 30 years, consider a more conservative rate, such as 3.5%, to increase your portfolio’s longevity.

- Embrace Flexibility: Be prepared to reduce withdrawals during severe or prolonged market downturns. This flexibility can significantly increase your portfolio’s chances of survival.

- Review and Rebalance: Annually review your portfolio’s asset allocation to ensure it remains aligned with your risk tolerance and withdrawal needs.

Ultimately, the 4% Rule is a foundational element in any robust financial plan. Incorporating it into a broader framework is a key step, and you can explore more details by reviewing a complete retirement planning checklist on popadex.com.

2. Dynamic Withdrawal Strategy (Guardrails Approach)

The Dynamic Withdrawal Strategy, often called the “Guardrails Approach,” offers a flexible alternative to fixed-rate methods like the 4% Rule. Popularized by financial planners Jonathan Guyton and William Klinger, this strategy adjusts your withdrawal amounts based on your portfolio’s performance, aiming to maximize income during good years while protecting your nest egg during downturns. The core principle is to set upper and lower spending “guardrails” that trigger adjustments only when your portfolio experiences significant gains or losses.

This method allows retirees to spend more when markets are strong and systematically reduce spending when markets are weak, preventing catastrophic portfolio depletion. It strikes a balance between the rigidity of a fixed withdrawal and the unpredictability of a percentage-based approach, making it one of the most responsive retirement withdrawal strategies available.

How It Works in Practice

Imagine you retire with a $1 million portfolio and set an initial withdrawal rate of 4%, giving you a $40,000 income. You establish guardrails at 20% above and below this initial rate. Your annual withdrawal will increase with inflation each year, unless it crosses a guardrail.

If a strong market grows your portfolio to $1.3 million, your initial 4% withdrawal rate has now fallen to just 3.07% ($40,000 / $1.3M). This drop of over 20% from the initial rate triggers the “upper guardrail,” allowing you to increase your spending. Conversely, if a market crash reduces your portfolio to $750,000, your withdrawal rate jumps to 5.33% ($40,000 / $750K). This breach of the “lower guardrail” signals the need to reduce your withdrawal to protect your principal.

Is the Guardrails Approach Right for You?

This strategy is ideal for retirees who are comfortable with some income fluctuation and want to benefit from market upswings without taking on excessive risk. Consider these actionable tips to implement it effectively:

- Define Your Guardrails: Determine your guardrails based on your lifestyle’s flexibility. A common approach is to set them at 20% above and below your initial target withdrawal rate.

- Plan for Flexibility: Identify discretionary expenses like travel or hobbies that can be easily reduced if you hit your lower guardrail. This makes spending cuts less painful.

- Conduct Annual Reviews: Each year, calculate your current withdrawal rate based on your portfolio’s new balance. Adjust your spending only if the rate has moved outside your pre-defined guardrails.

Ultimately, the Guardrails Approach provides a structured yet adaptable framework. By building in rules for when to adjust spending, it helps remove emotion from financial decisions during volatile market periods.

3. Bond Ladder Strategy

The Bond Ladder Strategy is a time-tested approach to generating predictable retirement income while managing interest rate risk. Instead of investing a lump sum into a single bond or bond fund, this strategy involves purchasing multiple individual bonds that mature at staggered intervals. As each bond “rung” on the ladder matures, you can use the principal for income or reinvest it into a new, longer-term bond to extend the ladder.

This method provides a steady and reliable cash flow, making it one of the most dependable retirement withdrawal strategies for conservative investors. It helps mitigate the risk of being forced to reinvest all your capital at a time when interest rates are low.

How It Works in Practice

Imagine you have $250,000 to invest. You could build a five-year bond ladder by purchasing five separate $50,000 bonds or Certificates of Deposit (CDs). The first would mature in one year, the second in two years, the third in three years, and so on, up to five years. Each year, as one bond matures, it provides you with $50,000 (plus interest) for living expenses.

This structure ensures you have access to a portion of your principal annually without having to sell assets, potentially at a loss, in a down market. If you don’t need the principal for income, you can reinvest it in a new five-year bond, maintaining your ladder and income stream for another year.

The infographic below illustrates how a bond ladder creates a consistent cycle of maturing assets and reinvestment opportunities.

This visual shows the core benefit: a predictable, rotating source of liquidity that smooths out the effects of interest rate volatility on your retirement income.

Is the Bond Ladder Strategy Right for You?

The Bond Ladder Strategy is ideal for retirees who prioritize capital preservation and predictable income over high growth potential. It is particularly effective for covering essential, non-discretionary expenses in retirement. Consider these actionable tips:

- Plan Ahead: Start building your bond ladder three to five years before you plan to retire. This allows you to lock in yields and stagger maturities before you need the income.

- Diversify Your Bonds: Mix different types of bonds, such as U.S. Treasuries, investment-grade corporate bonds, and municipal bonds, to balance risk and return.

- Consider Inflation: Incorporate Treasury Inflation-Protected Securities (TIPS) into your ladder. The principal value of TIPS adjusts with inflation, protecting your purchasing power.

- Match Ladder Length to Goals: Align the length of your ladder with your income needs. A shorter ladder (1-5 years) can cover near-term expenses, while a longer one (10+ years) can secure income further into the future.

Ultimately, a bond ladder provides a structured framework for generating income, giving you clarity and control over a key portion of your retirement portfolio.

4. Total Return Approach

The Total Return Approach is one of the more flexible retirement withdrawal strategies, focusing on the portfolio’s overall growth rather than just the income it generates. Popularized by Modern Portfolio Theory advocates like John Bogle, this method treats capital appreciation, dividends, and interest as a single pool of resources. Retirees can sell any asset to generate cash, providing greater freedom and tax management opportunities.

Instead of living off only the “natural yield” from dividends and interest, this strategy allows you to tap into the growth of your entire portfolio. This approach avoids the trap of chasing high-yield, potentially riskier investments and instead encourages maintaining a well-diversified portfolio aligned with your long-term goals.

How It Works in Practice

Imagine your portfolio consists of a mix of growth stocks, bonds, and low-dividend index funds. If you need $50,000 for annual expenses, you would generate this by systematically selling appreciated assets across your portfolio, regardless of their individual yields. For example, you might sell some growth stock shares that have seen significant gains while leaving your income-producing assets untouched.

This strategy decouples your income needs from the specific performance of dividend stocks or bonds. During a year when your growth funds perform exceptionally well, you can sell shares from those funds. Conversely, if interest rates rise and your bond funds appreciate, you can sell those. This flexibility is key to its effectiveness.

Is the Total Return Approach Right for You?

The Total Return Approach offers significant control but requires more hands-on management than fixed-rate methods. It is best suited for retirees comfortable with actively managing their portfolio and optimizing for tax efficiency. Consider these actionable tips:

- Rebalance Strategically: Use your withdrawal needs as an opportunity to rebalance your portfolio back to its target asset allocation. If stocks have outperformed, sell some to generate cash.

- Prioritize Tax Efficiency: Harvest tax losses to offset capital gains and hold high-income assets in tax-advantaged accounts (like an IRA) to minimize your tax burden.

- Maintain a Cash Buffer: Keep one to two years’ worth of living expenses in a cash or near-cash equivalent. This allows you to avoid selling assets during a significant market downturn.

Ultimately, this approach gives you the power to adapt to changing market conditions. To see how this strategy could impact your own timeline, you can model different scenarios with a detailed retirement income calculator on popadex.com.

5. Bucket Strategy

The Bucket Strategy is a popular retirement withdrawal strategy that aims to balance short-term income needs with long-term growth potential. This approach segments your portfolio into different “buckets,” each designed for a specific time horizon and risk level. The goal is to provide psychological comfort by ensuring immediate cash needs are met with safe assets, allowing the rest of your portfolio to grow.

This method, popularized by financial planners like Harold Evensky and Morningstar’s Christine Benz, helps retirees navigate market volatility with greater confidence. By separating funds, you avoid selling growth assets during a downturn to cover living expenses, giving those investments time to recover and compound.

This visual shows how assets are allocated across different timeframes, from immediate cash needs to long-term growth investments, creating a structured and less stressful withdrawal plan.

How It Works in Practice

Imagine you retire with a $1 million portfolio and need $40,000 per year. You could structure your buckets like this:

- Bucket 1 (Short-Term): Holds 1-2 years of living expenses in cash or cash equivalents. You would place $80,000 in a high-yield savings or money market account.

- Bucket 2 (Mid-Term): Designed to refill Bucket 1, this holds 3-8 years of expenses in lower-risk investments like bonds and conservative balanced funds. This bucket might contain $320,000.

- Bucket 3 (Long-Term): Contains the remaining funds ($600,000) and is invested for growth in a diversified mix of stocks and equity funds.

During strong market years, you sell appreciated assets from Bucket 3 to refill Bucket 2, which in turn refills Bucket 1. In down markets, you can draw from Bucket 1 and 2 without touching your growth assets.

Is the Bucket Strategy Right for You?

The Bucket Strategy provides a clear framework for managing assets, but it requires active management. It is ideal for retirees who want a systematic way to manage risk while still participating in market growth. Consider these actionable tips:

- Size Buckets Appropriately: Determine the right size for your short-term bucket based on your risk tolerance. A more conservative retiree might want three years of cash, while others may be comfortable with one.

- Plan Your Refills: Establish clear rules for when and how you will replenish the buckets. A common approach is to do so annually or whenever long-term assets have performed particularly well.

- Maintain Diversification: While assets are segmented, ensure your overall portfolio remains well-diversified across various asset classes to manage risk effectively.

Ultimately, the Bucket Strategy is one of the most intuitive retirement withdrawal strategies for visualizing and managing portfolio risk. It creates a buffer that can help you stick to your long-term plan, even when markets are turbulent. For a deeper dive into asset allocation, consider exploring insights on diversifying your investment portfolio with Morningstar.

6. Flexible Withdrawal Strategy (Floor-and-Ceiling)

The Flexible Withdrawal Strategy, often called the “Floor-and-Ceiling” method, offers a dynamic approach to retirement income that adapts to market performance. This strategy is designed to provide stability for essential needs while allowing for increased spending when your portfolio performs well. The core principle is to set a “floor” for your minimum required income and a “ceiling” for your maximum possible withdrawal.

This approach balances the need for consistent income to cover non-negotiable expenses with the desire to enjoy the fruits of a strong market. It prevents overspending during bull markets and protects your portfolio from being depleted during downturns by ensuring you never withdraw less than your essential floor amount.

How It Works in Practice

Imagine your essential living expenses (housing, food, healthcare) total $40,000 per year. This becomes your income floor. You might fund this with guaranteed sources like Social Security, pensions, and a bond ladder. Separately, you establish a spending ceiling, say $60,000, which represents your ideal lifestyle including travel and hobbies.

The amount you withdraw between the floor and ceiling depends on your portfolio’s performance. For example, you might use a rule that if your portfolio returns more than 7% in a year, you can withdraw up to the $60,000 ceiling. If returns are flat or negative, you stick to the $40,000 floor, drawing only from your most stable assets and allowing your growth investments to recover. This is one of the more adaptable retirement withdrawal strategies available.

Is the Floor-and-Ceiling Strategy Right for You?

This strategy is ideal for retirees who want a structured way to participate in market upside while protecting their basic needs. It requires more active management than a fixed rule but offers greater peace of mind. Consider these actionable tips:

- Define Expenses Clearly: Carefully distinguish between essential (floor) and discretionary (ceiling) expenses. This clarity is the foundation of the strategy.

- Secure Your Floor: Whenever possible, match your floor income needs with guaranteed or very low-risk income sources to minimize volatility.

- Set Realistic Guardrails: Establish clear, simple rules for when and how much you can withdraw above your floor based on specific portfolio performance triggers.

- Review Annually: Reassess your floor and ceiling amounts each year to account for inflation, changes in your lifestyle, and unexpected costs like healthcare.

7. Annuity-Based Strategy

An annuity-based strategy shifts retirement income from relying solely on market performance to receiving a guaranteed, pension-like payment stream. This approach involves purchasing an annuity from an insurance company, which in return provides a predictable income for a set period or for life. It is one of the few retirement withdrawal strategies that can eliminate longevity risk, the fear of outliving your money.

By converting a portion of your retirement savings into an annuity, you create a reliable income floor to cover essential expenses like housing, healthcare, and food. This security allows you to invest the remainder of your portfolio more aggressively for growth, knowing your basic needs are met.

How It Works in Practice

Imagine you have a $1 million retirement portfolio and want to guarantee $30,000 per year for essential expenses. You might use $500,000 to purchase an immediate fixed annuity, which could provide approximately $2,500 per month for the rest of your life. The remaining $500,000 in your portfolio can then be managed using a different withdrawal strategy to cover discretionary spending and combat inflation.

Another approach is to purchase a deferred annuity years before retirement. For example, a 55-year-old could buy a deferred income annuity that begins paying out when they turn 70, ensuring a higher income stream later in life when other assets may be depleted.

Is an Annuity-Based Strategy Right for You?

Annuities offer peace of mind but come with trade-offs like fees, limited liquidity, and complexity. They are best suited for risk-averse retirees who prioritize income security over market growth potential. Consider these actionable tips before committing:

- Shop Around: Rates and terms vary significantly between insurance companies. Obtain quotes from multiple highly-rated insurers to find the best value.

- Don’t Go All-In: Avoid placing all your retirement savings into a single annuity. Diversifying your income sources provides crucial flexibility.

- Consider Inflation: A fixed payment will lose purchasing power over time. Look for annuities with a cost-of-living adjustment (COLA) rider, though it will reduce your initial payout.

- Understand the Terms: Be crystal clear on all fees, surrender charges, and payout options before signing.

This strategy can be particularly valuable for those without a traditional pension, a common scenario for self-employed individuals. You can explore more financial planning options by reviewing a guide to retirement for independent contractors on popadex.com.

Retirement Withdrawal Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| 4% Rule (Safe Withdrawal Rate) | Low - simple fixed formula | Low - basic portfolio and inflation data | Predictable income, ~95% success over 30 years | Retirees seeking simplicity and stability | Predictability, ease of use, historically tested |

| Dynamic Withdrawal Strategy (Guardrails Approach) | Medium - requires monitoring and adjustment | Medium - frequent portfolio evaluation | Flexible income adapting to market, better longevity | Those comfortable with variable income | Adaptability, better portfolio preservation |

| Bond Ladder Strategy | Medium - involves managing multiple bonds | Medium - access to diverse bonds/CDs | Stable income stream, principal protection | Conservative investors focused on income | Predictability, principal safety, liquidity |

| Total Return Approach | High - active portfolio management required | High - broad portfolio with diverse assets | Potential for higher returns, tax-efficient withdrawals | Investors seeking growth and flexibility | Flexibility, tax efficiency, broad investment access |

| Bucket Strategy | Medium - multiple time-based buckets to manage | Medium - diversified across time horizons | Emotional comfort, sequence risk protection | Retirees wanting structured withdrawals | Psychological comfort, risk mitigation |

| Flexible Withdrawal Strategy (Floor-and-Ceiling) | High - requires detailed budgeting and adjustments | Medium to High - tracking essential/discretionary spending | Ensured essential expenses, spending flexibility | Those prioritizing essentials plus discretionary spending | Guaranteed essential income, adaptability |

| Annuity-Based Strategy | Low to Medium - purchase process; complex terms | Medium - financial commitment to annuities | Guaranteed lifelong income, reduces longevity risk | Risk-averse retirees seeking guaranteed income | Guaranteed income, longevity risk elimination |

Crafting Your Personalized Retirement Income Plan

Navigating the world of retirement withdrawal strategies can feel like learning a new language. From the simplicity of the 4% Rule to the structured security of a Bond Ladder or the adaptive nature of the Guardrails Approach, the options are as diverse as retirees themselves. The journey through these methods reveals a fundamental truth: there is no single “best” strategy, only the one that is best for you.

The goal is not to pick one strategy off the shelf and follow it blindly for thirty years. Instead, the most resilient and effective retirement income plans are often hybrids, artfully combining elements from several different approaches to create a personalized financial engine. This is where you transition from a passive saver to the active architect of your retirement.

Synthesizing Your Strategy: The Hybrid Approach

Think of the strategies we’ve covered as individual tools in a comprehensive toolkit. A master craftsperson doesn’t use just a hammer; they use a hammer, a saw, and a level, each for its specific purpose. Similarly, you can construct a more robust plan by blending different concepts.

Consider these powerful combinations:

- Bucket Strategy + Bond Ladder: Use a dedicated bond ladder to fund your “cash” and “short-term” buckets. This creates a predictable, reliable income stream for your non-negotiable expenses for the next 3-5 years, insulating you from market volatility while the rest of your portfolio remains invested for long-term growth.

- Annuity + Total Return: Secure a baseline of essential income by purchasing a single premium immediate annuity (SPIA). This covers your “floor” needs like housing, utilities, and healthcare. You can then apply a more aggressive total return approach to the remainder of your portfolio, giving you the freedom to pursue growth for discretionary spending, travel, and legacy goals.

- 4% Rule + Dynamic Guardrails: Start with the 4% Rule as your baseline withdrawal rate. Then, layer the Guardrails Approach on top of it. If the market performs exceptionally well, you give yourself a 10% “raise.” If the market experiences a significant downturn, you implement a 10% “pay cut.” This adds a crucial layer of flexibility that the original static rule lacks.

The Importance of Adaptability and Regular Review

Your retirement isn’t a static event; it’s a dynamic, evolving phase of life. Your health, spending habits, family needs, and even your location may change. When crafting your personalized retirement income plan, consider all aspects of your lifestyle, including potential international moves. For instance, you might explore a comprehensive guide to retiring in Japan to understand how location-specific costs and regulations could impact your withdrawal needs.

Because life is unpredictable, your strategy must be adaptable. A plan that looks perfect on paper at age 65 might need significant adjustments by age 75. Commit to an annual review of your retirement withdrawal strategies, preferably with a financial advisor, to ensure your plan remains aligned with your portfolio’s performance and your life’s trajectory. This proactive approach is the key to transforming a good plan into a great one that provides lasting financial security and peace of mind.

Ready to take control of your financial future? A successful retirement withdrawal strategy begins with a crystal-clear understanding of your complete financial picture. PopaDex provides a powerful, intuitive platform to track all your assets, monitor your portfolio’s performance, and model your withdrawal scenarios, empowering you to make informed decisions with confidence. Sign up for PopaDex today and build the foundation for the retirement you deserve.