Our Marketing Team at PopaDex

The 12 Best Self Employed Expense Tracker Tools for 2025

For any self-employed professional, managing business expenses is non-negotiable. Juggling receipts, tracking mileage, and estimating quarterly taxes can feel like a second job, especially when your income fluctuates. The right self employed expense tracker transforms this chaotic process into a streamlined system, ensuring you capture every deductible expense and maximize your tax savings. But with so many options, from simple spreadsheets to sophisticated accounting software, how do you choose the one that fits your unique needs as a freelancer, consultant, or gig worker?

This guide cuts through the noise. We’ve meticulously reviewed the 12 best tools available, analyzing their core features, real-world usability, and pricing to help you find the perfect match for your business. Whether you’re a tech-savvy professional needing automated integrations or a gig worker tracking irregular income, this resource provides a direct comparison of the top solutions. Each review includes screenshots and direct links to help you make an informed decision quickly.

To fully appreciate how a smarter expense tracker fits into your overall financial picture and how it contributes to efficient financial management, explore the broader topic of understanding accounting and managing business expenses. Our detailed analysis will help you select a tool that not only simplifies tax preparation but also offers clear insights into your business’s financial health, empowering you to make smarter decisions throughout the year. Let’s find the tracker that works best for you.

1. Irregular Income Budget Template for Financial Stability

The Irregular Income Budget Template from PopaDex stands out as a powerful and practical solution for freelancers and gig workers who need more than just a standard expense tracker. Its core strength lies in its specialized design, which directly addresses the primary financial challenge of self-employment: managing fluctuating income. This downloadable template provides a robust framework to systematically organize unpredictable earnings and variable costs, making it a premier self employed expense tracker for those who require clarity and control.

Unlike generic apps that assume a consistent paycheck, this tool helps you proactively allocate funds for taxes, business expenses, and personal savings. Its comprehensive layout allows you to view your entire financial picture in one place, preventing common pitfalls like accidental overspending during a high-earning month or being unprepared for tax season. Beyond just tracking expenses, a comprehensive business plan is essential for any self-employed individual looking to achieve long-term financial stability. For those building a service-based business, this actionable business plan template offers a great starting point.

The template’s integration within the wider PopaDex ecosystem, known for its powerful net worth tracking, offers a seamless path toward holistic financial management. This thoughtful design encourages a disciplined approach to money, a critical skill detailed in PopaDex’s guide to budgeting for self employed individuals.

Key Highlights:

- Best For: Freelancers, gig economy workers, and self-employed professionals with variable income.

- Unique Feature: Specialized structure for managing irregular cash flow and systematizing tax savings.

- Accessibility: Downloadable spreadsheet, offering offline access and full user customization.

Pros & Cons:

| Pros | Cons |

|---|---|

| Designed specifically for fluctuating income | Requires manual data entry |

| Systematically helps set aside tax funds | Best suited for individuals, not complex businesses |

| Tracks business and personal finances together | |

| Integrates with PopaDex’s financial tool suite |

Learn more at PopaDex.com

2. Intuit QuickBooks (Solopreneur and Online plans)

Intuit QuickBooks is a dominant force in accounting software, and its Solopreneur and Online Simple Start plans provide a robust self employed expense tracker built into a comprehensive financial ecosystem. Unlike single-purpose apps, QuickBooks positions expense management as one part of your overall business health, connecting it directly to invoicing, payments, and financial reporting. This integrated approach is ideal for freelancers who plan to scale their operations or require an accountant-ready platform from day one.

The platform shines with its automated bank feed, which imports transactions for you to categorize. Its mobile app features excellent receipt capture technology that extracts key data, minimizing manual entry. For those who drive for business, the QuickBooks Online mobile app also includes mileage tracking, ensuring you maximize your vehicle-related deductions.

Key Features & Considerations

QuickBooks offers a clear upgrade path, but its product lineup can be initially confusing. The legacy “Self-Employed” plan is no longer available to new US users, who are now directed to the newer QuickBooks Solopreneur or the more traditional QuickBooks Online plans.

- Best For: Freelancers and solopreneurs who need a complete accounting solution, not just an expense tracker, and anticipate working with an accountant.

- Standout Feature: The deep integration with a vast ecosystem of third-party apps and its near-universal acceptance by accounting professionals make it a safe, scalable choice.

- Pricing: QuickBooks Solopreneur starts at $20/month. Plans often have introductory discounts for the first few months.

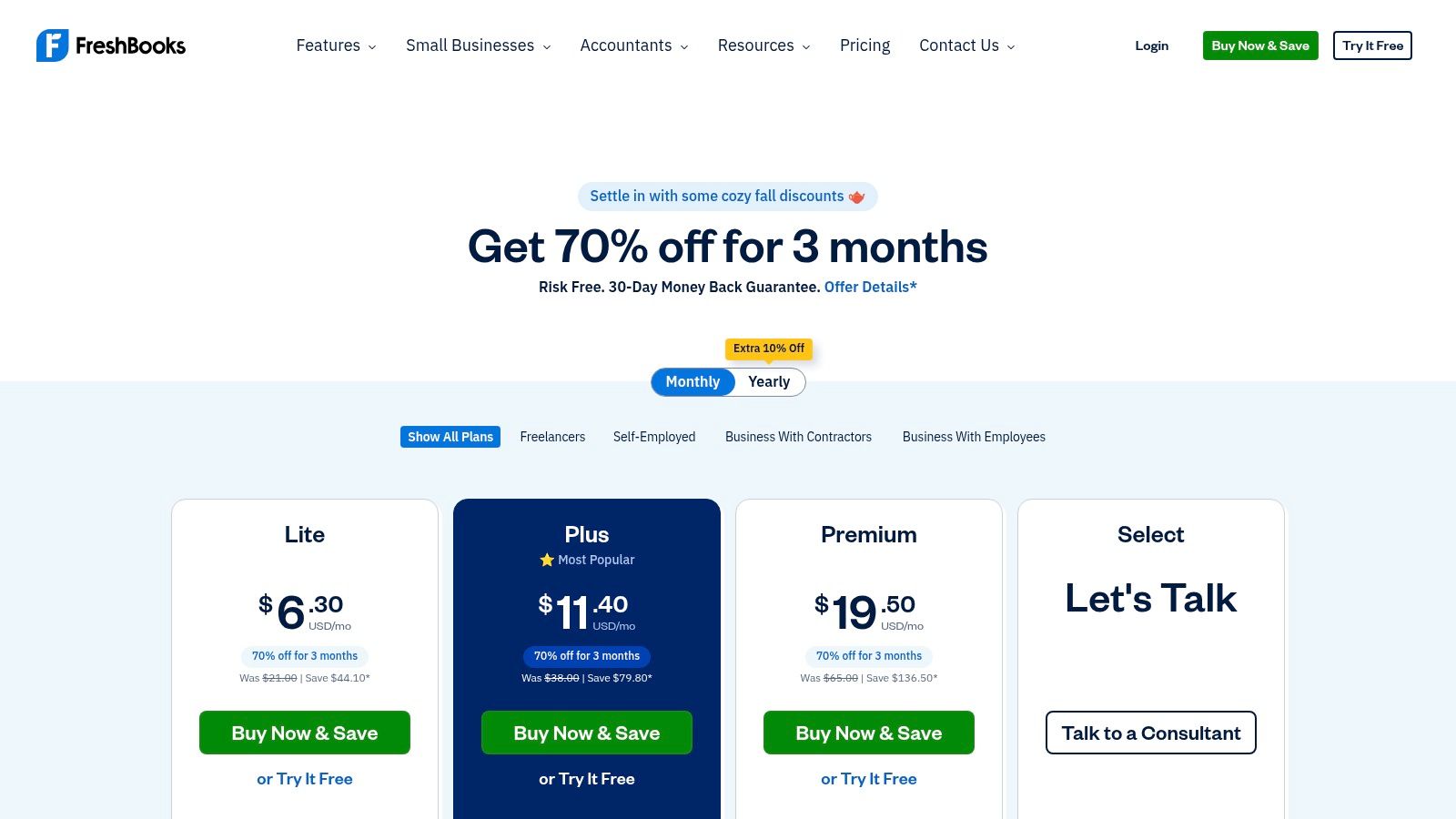

3. FreshBooks

FreshBooks has built its reputation on being an incredibly user-friendly accounting solution designed specifically for service-based small businesses and freelancers. Its platform offers a powerful self employed expense tracker that is elegantly integrated with its renowned invoicing, time tracking, and project management tools. This makes it a top choice for solopreneurs who bill by the hour or by the project and need a seamless way to connect their expenses directly to client work.

The expense tracking functionality is robust, allowing you to connect your bank account for automatic transaction imports, capture receipts on the go with its mobile app, and automatically categorize recurring expenses. A key advantage is the ability to assign expenses to specific clients or projects, making it simple to rebill costs and understand the profitability of each job. The mobile app also includes mileage tracking to ensure you capture every deductible mile.

Key Features & Considerations

FreshBooks emphasizes simplicity and a low learning curve, making it accessible for those who are intimidated by more complex accounting software. For a more detailed look, you can explore this overview of an easy expense tracker and see how its features align with your needs.

- Best For: Service-based freelancers, consultants, and small agencies who prioritize easy invoicing and time tracking alongside expense management.

- Standout Feature: The seamless connection between tracking time, logging expenses, and pulling both directly onto a client invoice is exceptionally smooth and saves significant administrative time.

- Pricing: The Lite plan starts at $19/month. Plans often feature significant introductory discounts for new users.

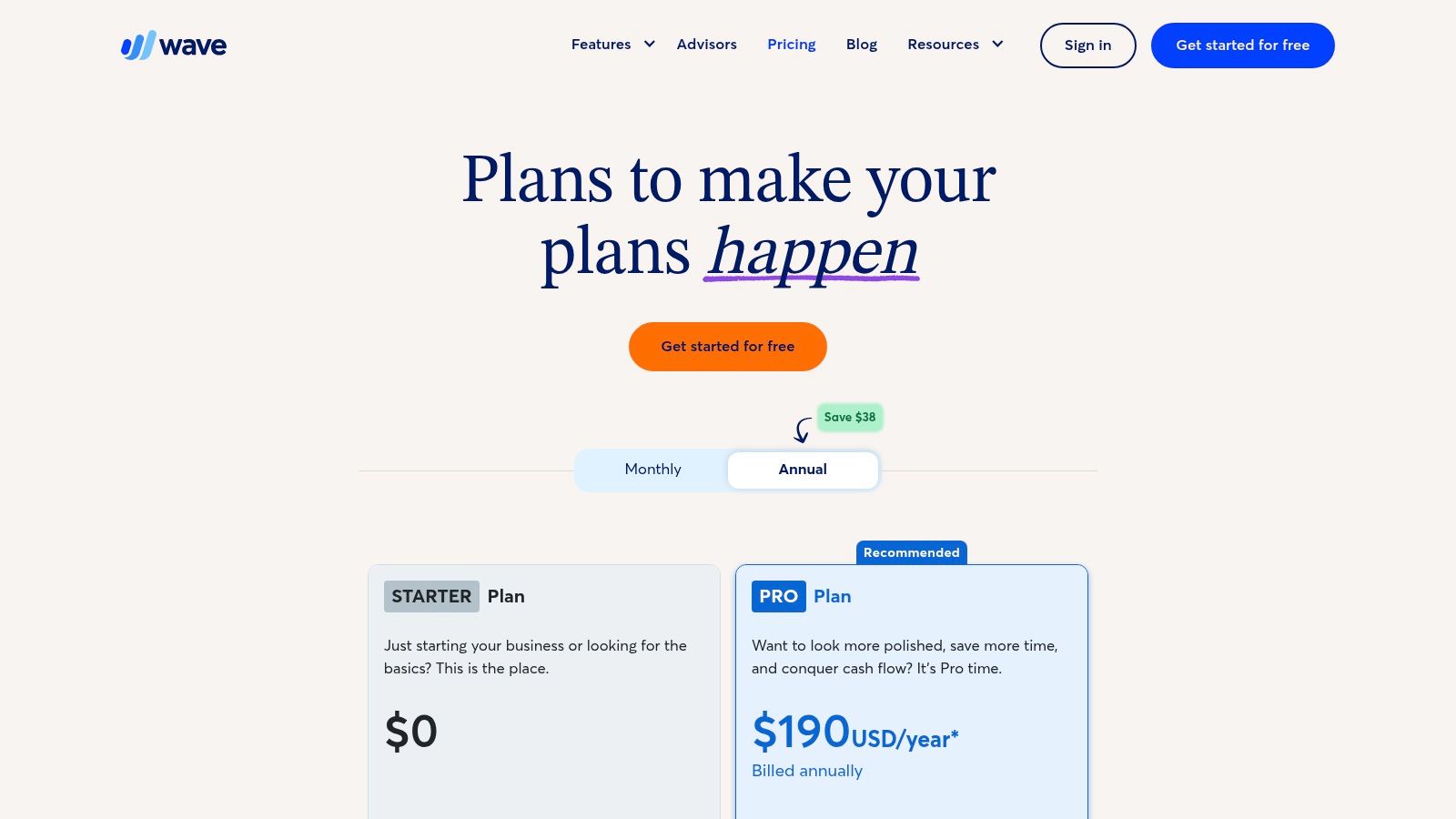

4. Wave

Wave offers a compelling proposition for freelancers and solo business owners with its free-forever accounting, invoicing, and receipt management tools. Unlike competitors that lock core features behind a paywall, Wave provides a powerful self employed expense tracker at no cost, making it an exceptional entry point for those just starting out or operating on a tight budget. Its platform is designed for simplicity, allowing users to connect bank accounts manually, track income, and categorize expenses without a steep learning curve.

The platform is a genuine accounting tool, not just a simple ledger. You can generate essential financial reports like a Profit & Loss statement and Balance Sheet, which are crucial for tax time and understanding your business’s financial health. For those wanting more automation, the paid Pro plan adds features like automatic bank feeds and unlimited receipt scanning via its mobile app, but the free version remains highly functional.

Key Features & Considerations

Wave’s business model relies on its optional paid services like payment processing and payroll, allowing it to offer robust core accounting software for free. The user interface is clean and modern, prioritizing ease of use over overwhelming feature depth, which is perfect for individuals managing their own finances.

- Best For: New freelancers, small service-based businesses, and solopreneurs who need a complete, no-cost accounting system to get started.

- Standout Feature: Its truly free Starter plan provides unlimited invoicing, expense tracking, and financial reporting, offering incredible value for solo operators.

- Pricing: The Starter plan is free. The Pro plan, which adds automated features, is $16/month.

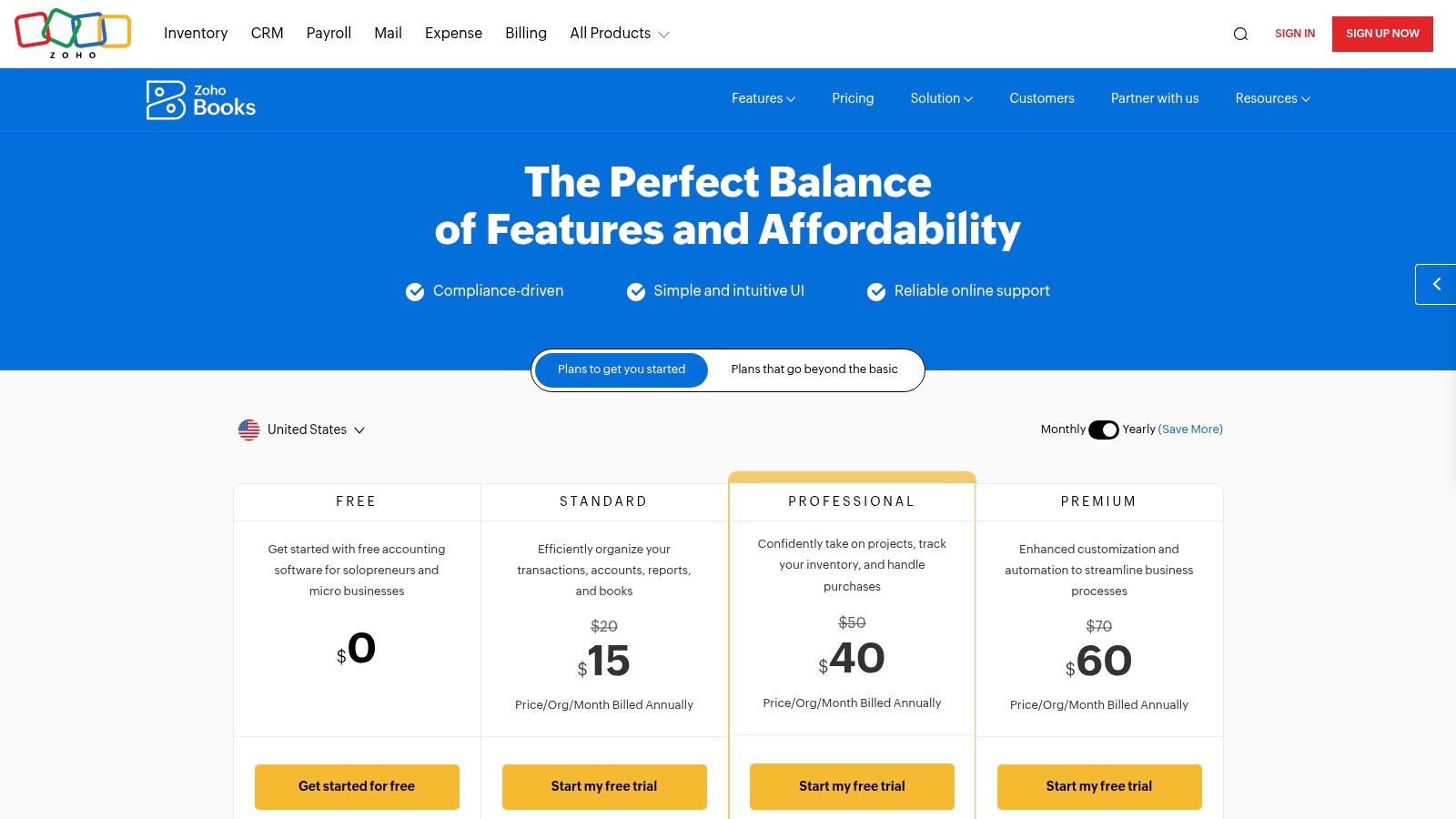

5. Zoho Books

Zoho Books is a comprehensive accounting suite that provides a powerful self employed expense tracker within a much broader ecosystem of business tools. It stands out for its exceptionally generous free plan, making it a compelling entry point for freelancers and solopreneurs who need robust features without an initial investment. The platform integrates expense management with invoicing, client portals, and bank reconciliation, offering a scalable solution that can grow with a business. It’s ideal for users who may eventually need more than just expense tracking.

The platform streamlines expense recording with features like automated bank feeds and receipt scanning via its mobile app. While some advanced features like document autoscans are paid add-ons, the core functionality is more than sufficient for tracking income and expenses. Its strength lies in being part of the larger Zoho ecosystem, allowing for seamless integration with CRM, inventory, and other business management applications as needs evolve.

Key Features & Considerations

Zoho’s tiered pricing means users only pay for the features they need, but it’s important to be aware of the limits, especially on the free plan which caps at 1,000 expenses annually. The interface is clean and professional, though the sheer number of features may feel overwhelming for those seeking a simple tracker.

- Best For: Solopreneurs and small business owners who want a free, full-featured accounting platform with the option to scale into an entire suite of integrated business apps.

- Standout Feature: The free plan is one of the most capable in the industry for businesses under a certain revenue threshold, offering features many competitors charge for.

- Pricing: A robust free plan is available for businesses with annual revenue under $50K USD. Paid plans start from $15/month (billed annually).

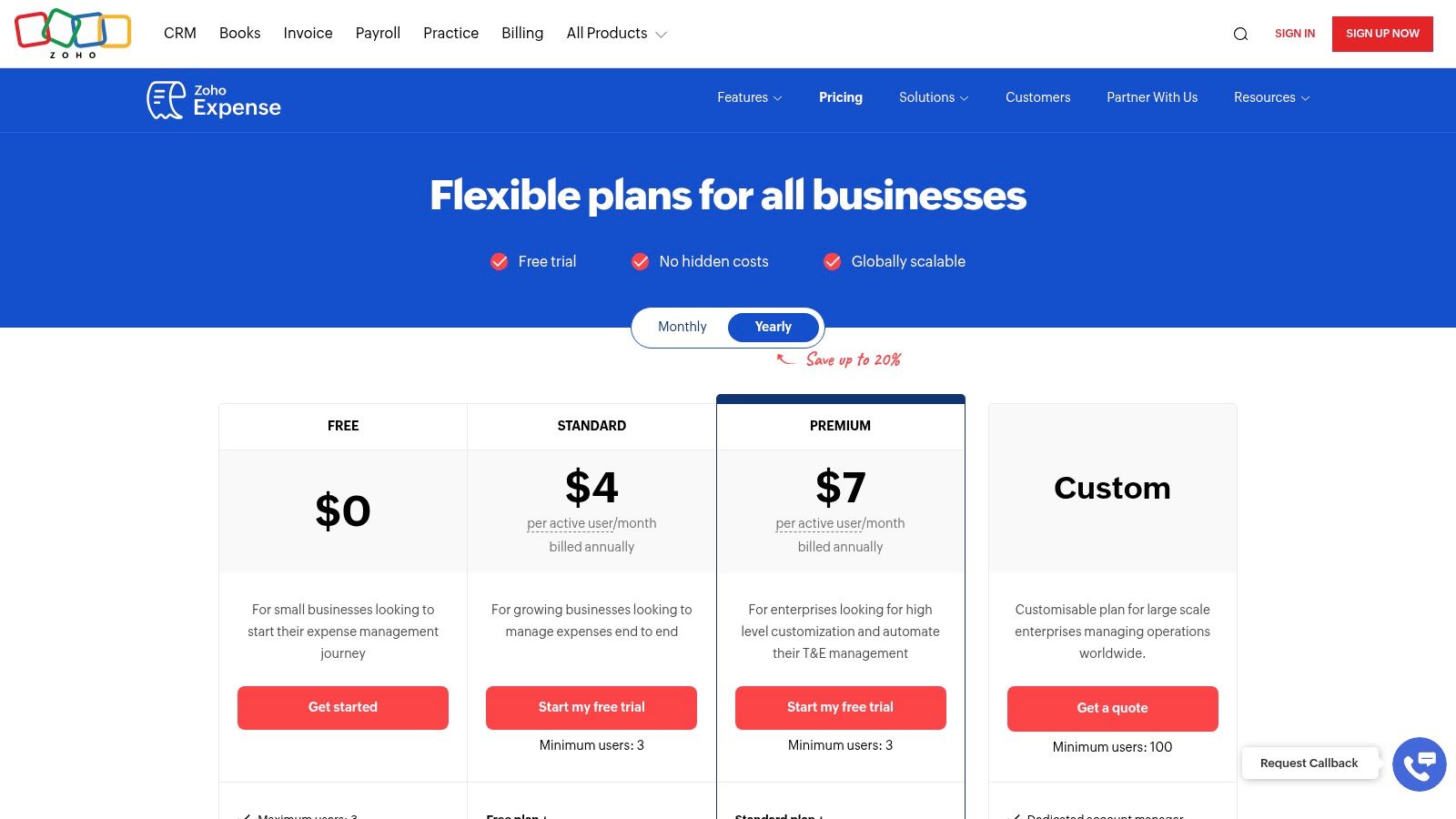

6. Zoho Expense

Part of a massive software ecosystem, Zoho Expense is a powerful, dedicated expense management tool that works as a standalone self employed expense tracker or integrates with other Zoho and third-party apps. While it can serve large teams with complex approval workflows, its free plan is a standout offering for solo professionals who need robust receipt scanning, mileage tracking, and basic reporting without a subscription fee. This focus makes it a strong contender for those who prioritize a purpose-built expense tool over a full accounting suite.

Zoho Expense excels with its mobile-first design, making on-the-go tracking simple. The app’s autoscan feature for receipts is highly accurate, and its GPS-based mileage tracker is a huge time-saver for anyone who drives for business. Unlike all-in-one accounting software, every feature in Zoho Expense is tailored specifically for capturing, categorizing, and reporting business expenses efficiently.

Key Features & Considerations

Zoho’s generous free tier offers core functionality that competitors often charge for, making it an excellent starting point. However, users needing advanced features on paid plans will find they are designed for teams, often with a minimum user requirement.

- Best For: Solopreneurs and freelancers who want a top-tier, dedicated expense and mileage tracker and can operate comfortably within the generous limits of a free plan.

- Standout Feature: The free plan is remarkably feature-rich, providing unlimited receipt scans, GPS mileage tracking, and bank feed connections for up to three users at no cost.

- Pricing: A comprehensive Free plan is available. Paid plans with advanced features like policy enforcement and corporate card reconciliation start with a 3-user minimum.

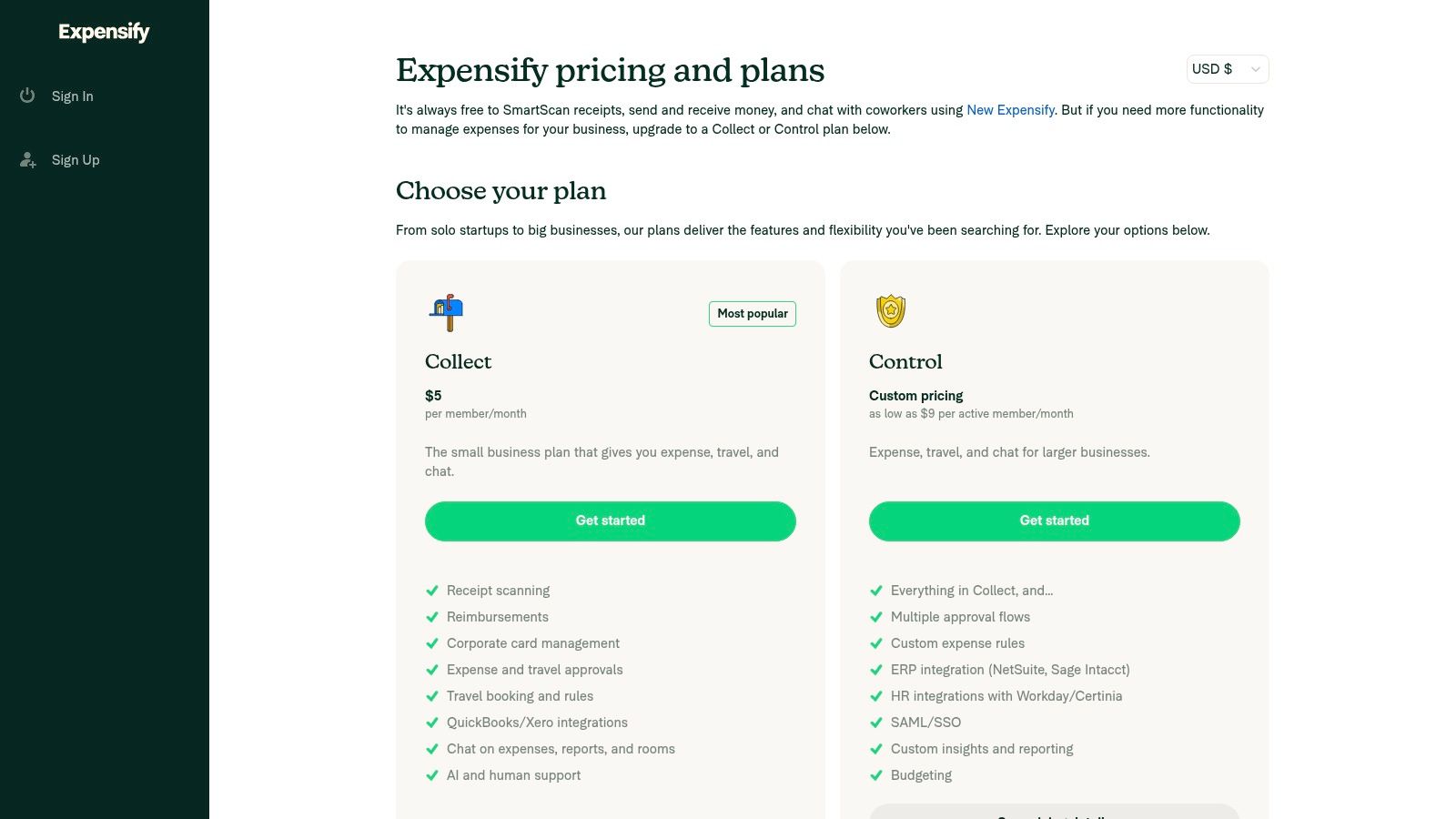

7. Expensify

Expensify is a long-standing leader in expense management, renowned for its powerful receipt scanning technology. While it has a strong focus on corporate teams, its simplified plans and robust features make it a compelling self employed expense tracker for freelancers who value automation. The platform is designed to eliminate manual data entry, allowing users to simply snap a photo of a receipt and let the SmartScan technology do the rest, from reading the merchant and date to the total amount.

This all-in-one approach combines expense tracking with invoicing, bill pay, and even travel booking. Its automated system is excellent for creating expense reports and categorizing transactions, helping you organize your finances effectively. For a deeper understanding of how to structure your spending, you can explore the 7 essential expense tracking categories to maximize your deductions. Expensify’s integrations with QuickBooks and Xero ensure your data flows seamlessly into your primary accounting software.

Key Features & Considerations

Expensify simplifies its offering with flat-rate plans that provide core features without complex tiers, though legacy customers may be on different pricing structures. The platform’s strength lies in making the expense submission process as fast and frictionless as possible.

- Best For: Solopreneurs and freelancers who prioritize best-in-class receipt scanning and automation to save time on administrative tasks.

- Standout Feature: The unlimited SmartScan receipt capture is a major advantage, allowing you to digitize and process an unlimited number of receipts without extra fees on its core plans.

- Pricing: The Collect plan is a flat $5 per active user per month, offering unlimited scans, invoicing, and bill pay.

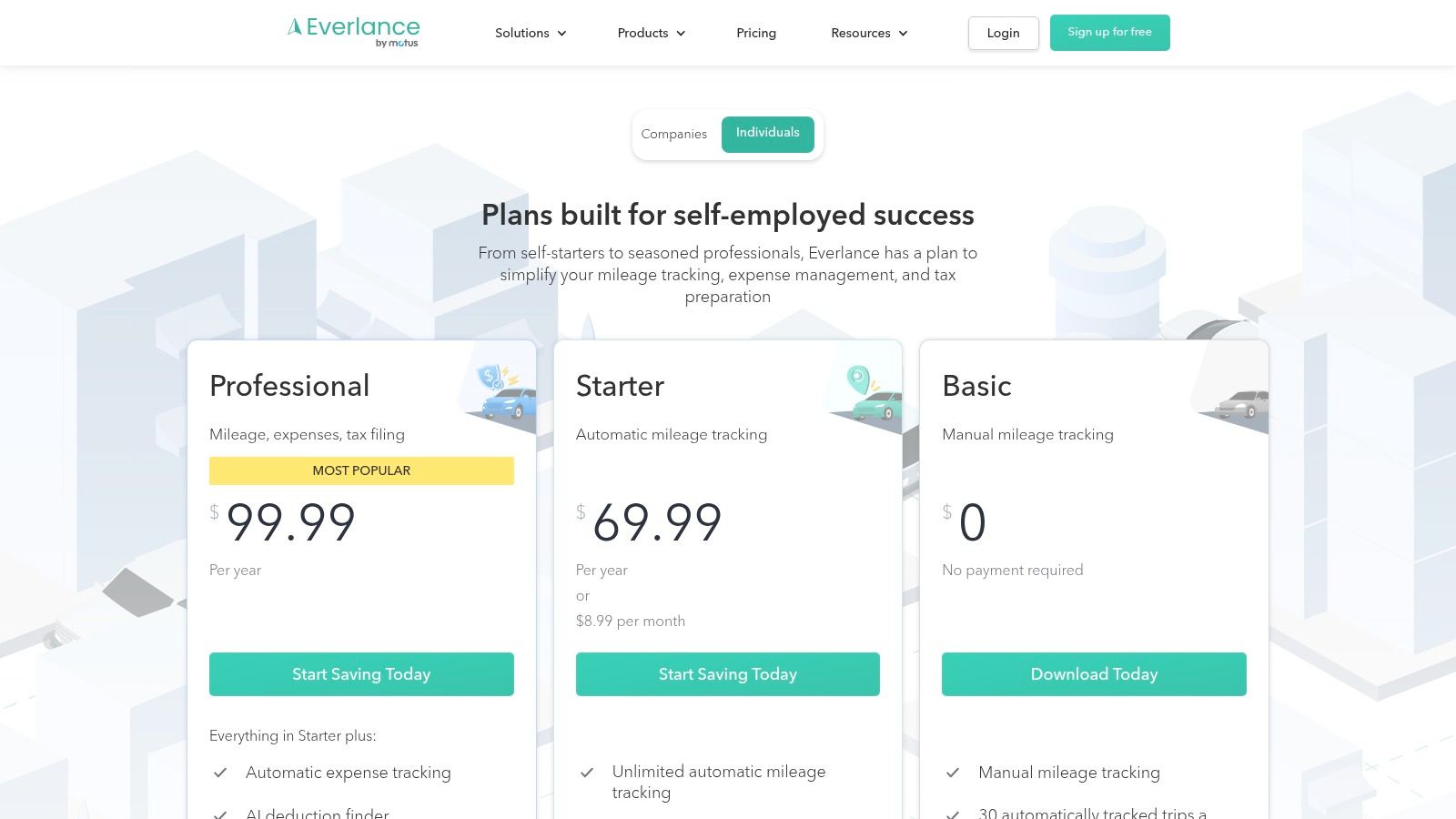

8. Everlance

Everlance is a highly specialized self employed expense tracker built from the ground up for freelancers, gig workers, and 1099 professionals whose business heavily involves driving. It excels at automatically tracking mileage using your phone’s GPS, providing a set-it-and-forget-it solution to maximize vehicle deductions. The platform then ties this mileage data directly into its expense management and tax reporting tools, creating a unified, mobile-first workflow for on-the-go professionals.

While its bank sync and receipt scanning are solid, the standout feature is the intelligent drive detection, which logs trips automatically and allows for quick classification as business or personal with a simple swipe. This focus makes it a superior choice for rideshare drivers, delivery couriers, real estate agents, and mobile consultants who need ironclad, IRS-compliant mileage and expense reports without the complexity of a full accounting suite.

Key Features & Considerations

Everlance offers a clear value proposition: simplify the most tedious parts of freelance bookkeeping. Higher-tier plans bundle tax services, including 1099 filing and audit defense, making it an all-in-one tax compliance tool for many independent workers.

- Best For: Mobile professionals and gig economy workers who prioritize accurate, automatic mileage tracking above all else.

- Standout Feature: The seamless and reliable automatic drive detection and classification system is best-in-class for capturing every deductible mile.

- Pricing: A free plan with limited automatic trips is available. Premium plans start at $10/month (billed annually) and include unlimited tracking.

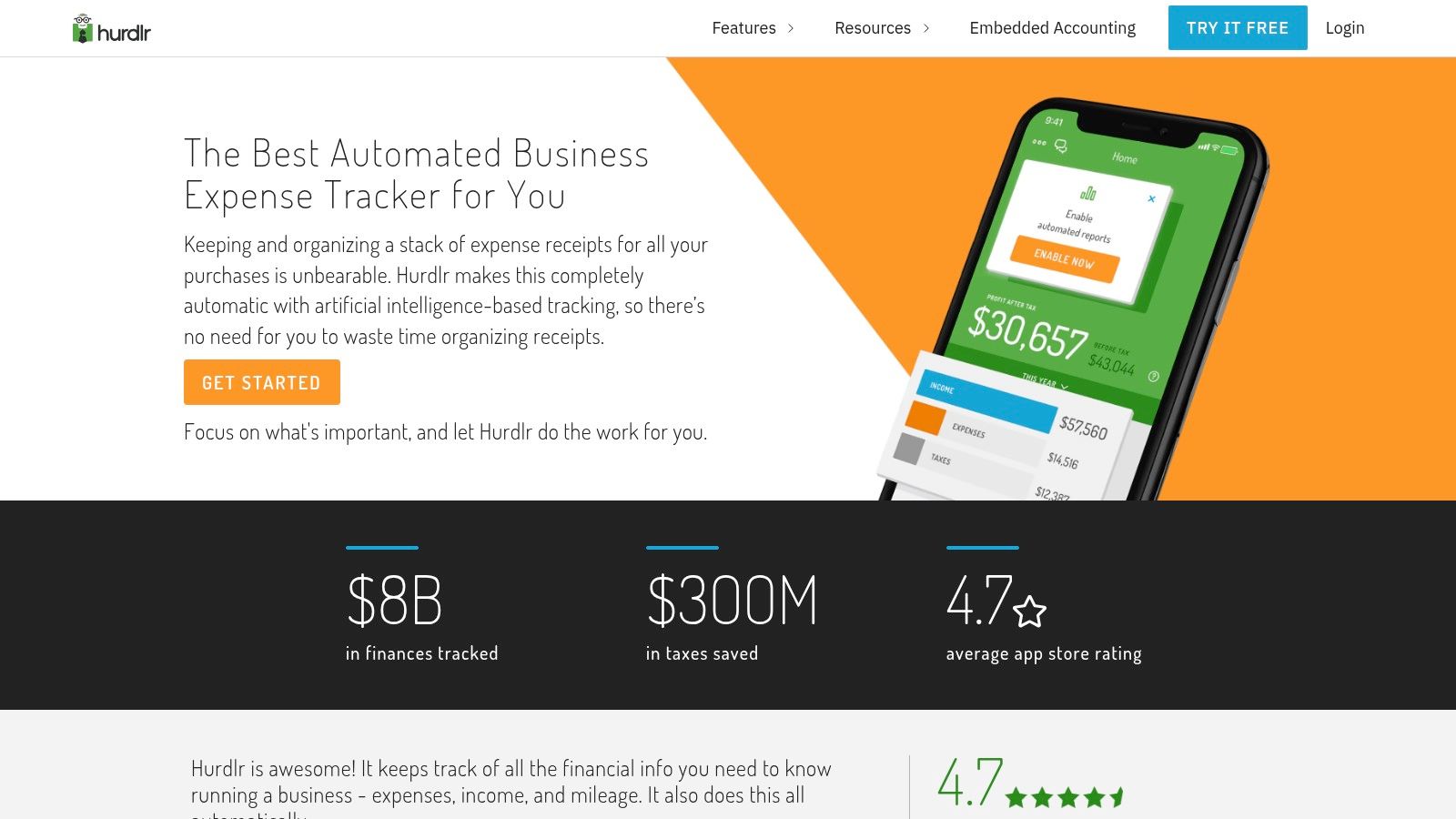

9. Hurdlr

Hurdlr is built from the ground up for the modern freelancer and gig economy worker. It offers a streamlined self employed expense tracker that excels at automating the core financial tasks of a solopreneur: tracking income, managing expenses, and logging mileage. Its key differentiator is the powerful, real-time tax calculation engine that shows you estimated tax liabilities throughout the year, helping you avoid surprises and manage cash flow effectively. This makes it an invaluable tool for rideshare drivers, delivery workers, and other independent contractors.

The platform connects directly to your bank accounts, credit cards, and even gig work platforms like Stripe, Square, and Upwork to automatically import financial data. Its automatic mileage tracker runs quietly in the background on your phone, capturing every business trip without manual input. While its interface is simpler than a full accounting suite, this focus is precisely what makes it so efficient for its target audience.

Key Features & Considerations

Hurdlr offers a clear and simple upgrade path from its free version to paid tiers that add more powerful features, including invoicing and integrated tax filing. It is designed for speed and simplicity, letting users categorize transactions and trips with just a few taps.

- Best For: Gig workers, freelancers, and solopreneurs who need effortless tracking and a constant, clear view of their real-time tax obligations.

- Standout Feature: The live tax calculations and direct integrations with gig platforms provide a highly specialized and automated financial overview for independent contractors.

- Pricing: Offers a free version for basic tracking. Premium plans with more advanced features start at $10/month.

10. Stride (Stride Tax app)

Stride offers a completely free self employed expense tracker primarily aimed at gig economy workers and freelancers who need simple, effective mileage and expense logging. Originally built for drivers on platforms like Uber and DoorDash, its functionality is perfectly suited for any solopreneur whose business involves significant travel. The app focuses on the essentials: capturing deductions without the complexity of a full accounting suite, making it an excellent entry point for those new to tracking business finances.

The platform’s strength lies in its simplicity and accessibility. Its automatic GPS mileage tracker is a standout feature, running in the background to capture every deductible mile. Users can also link a bank account to automatically import and categorize transactions, snap photos of receipts, and get helpful guidance on what counts as a legitimate IRS deduction. This educational component is invaluable for newcomers to self-employment.

Key Features & Considerations

While Stride is powerful for what it does, it is not a comprehensive accounting system. It excels at gathering the data needed for tax time but lacks invoicing, payment processing, or advanced financial reporting features found in paid accounting software. It is a dedicated deduction-finding tool.

- Best For: Gig workers, delivery drivers, and freelancers who primarily need a free and simple way to track mileage and basic business expenses for tax purposes.

- Standout Feature: The combination of being 100% free with a reliable, automatic GPS mileage tracker makes it an unbeatable value proposition for mileage-heavy work.

- Pricing: Completely free to use. Stride generates revenue through health, dental, and life insurance offerings, not its tax app.

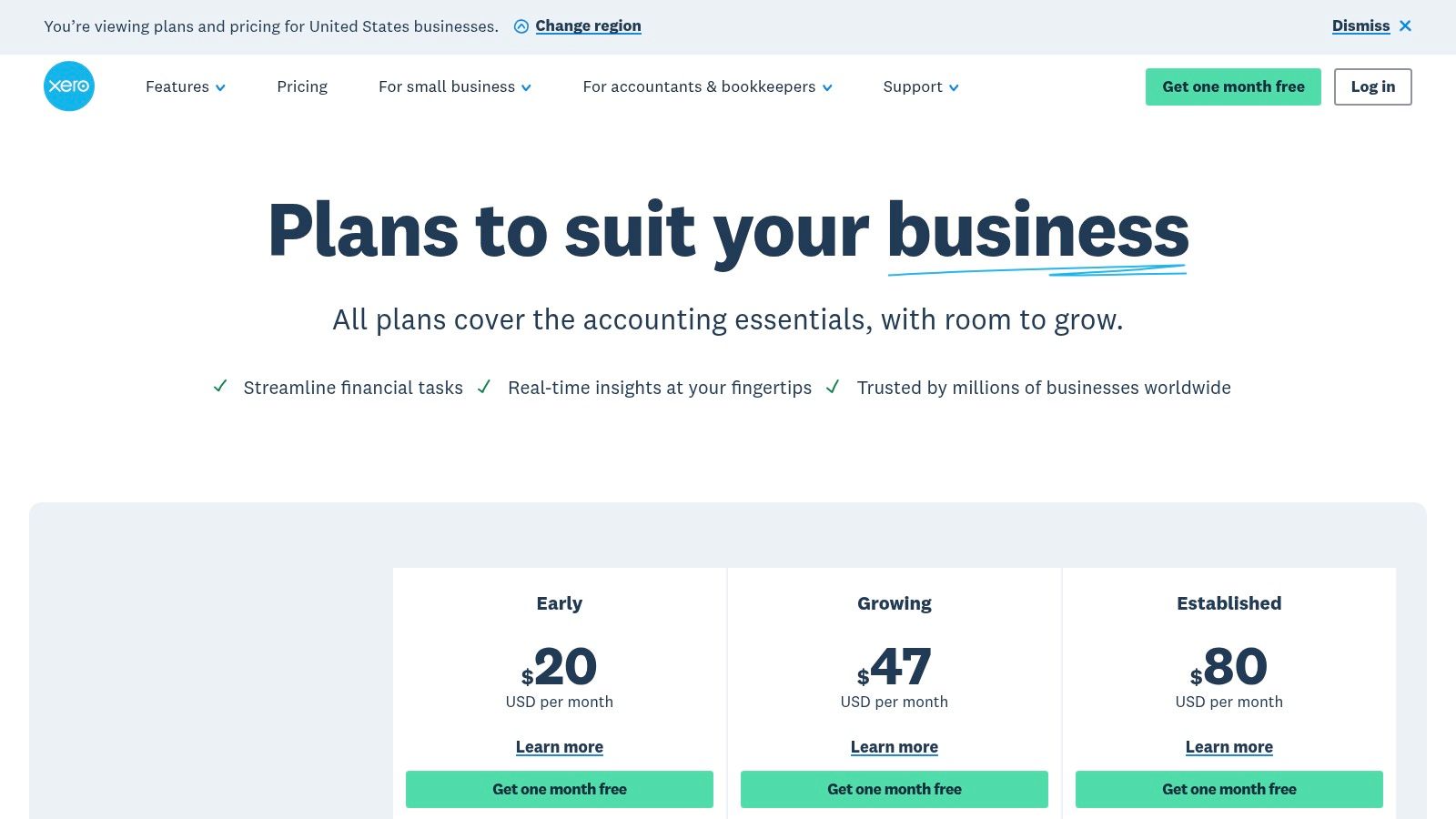

11. Xero (US)

Xero is a formidable cloud-based accounting platform often seen as a primary alternative to QuickBooks. For freelancers and sole proprietors, it offers a powerful self employed expense tracker within a beautifully designed, user-friendly interface. Rather than being just a standalone tool, Xero’s expense management is deeply woven into its invoicing, bank reconciliation, and reporting functions, providing a holistic view of your business finances. Its strong emphasis on collaboration makes it an excellent choice for those who work closely with an accountant or bookkeeper.

The platform’s automated bank feeds are reliable, pulling in transactions that you can easily categorize. A significant advantage is the inclusion of Hubdoc, its receipt and bill capture tool, which helps digitize paperwork and extract data, reducing manual entry. For US-based freelancers, Xero also supports the necessary W-9 and 1099 form management, simplifying contractor payments and year-end tax compliance.

Key Features & Considerations

Xero’s plan structure is built to scale with your business, but some features are reserved for higher-tier plans. While the interface is clean, new users may need some time to learn its unique workflow.

- Best For: Self-employed individuals who value a clean user interface and plan to collaborate with an accountant or bookkeeper.

- Standout Feature: The integration of Hubdoc for receipt and document capture at no extra cost provides significant value for organizing financial paperwork.

- Pricing: Xero’s “Early” plan starts at $15/month. Plans are subject to price changes and often feature introductory discounts.

12. Amazon (Physical mileage/expense logbooks)

For those who prefer a tangible, low-tech solution or want a physical backup for their digital records, Amazon offers a vast marketplace for physical expense and mileage logbooks. This approach provides a simple, non-electronic self employed expense tracker that can be kept in a vehicle or office for immediate access. These IRS-friendly journals are specifically designed for manual record-keeping, with columns for dates, descriptions, amounts, and mileage, eliminating the need for apps, subscriptions, or battery life.

The primary advantage of sourcing these from Amazon is the sheer variety and competitive pricing, coupled with extensive user reviews to guide your purchase. You can find everything from simple pocket-sized mileage logs to comprehensive ledger books and receipt organizers. While this method requires manual data entry and lacks automated reporting, it offers a straightforward, audit-ready paper trail that some freelancers find more reliable and less distracting than digital alternatives.

Key Features & Considerations

A physical logbook is an excellent tool for capturing expenses on the go, especially in areas with poor connectivity. However, it requires discipline to maintain and lacks the powerful search and analysis capabilities of software.

- Best For: Freelancers who want a simple, non-digital method for tracking expenses, need a physical backup for digital records, or prefer a glove-box solution for mileage.

- Standout Feature: The immense selection allows users to find a logbook with the exact layout, size, and durability they need, often with fast Prime shipping.

- Pricing: Varies widely, with most simple logbooks available for between $5 and $15.

Top 12 Self-Employed Expense Tracker Comparison

| Product / Tool | Core Features / Highlights | User Experience & Quality | Value & Pricing | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| Irregular Income Budget Template (PopaDex) | Tailored for irregular income; manual tracking | ★★★★☆ Easy to use, offline | 💰 Free download | Freelancers, gig workers, self-employed | ✨ Tax allocation, expense & personal finance integration |

| Intuit QuickBooks (Solopreneur & Online) | Bank feeds, expense import, invoicing, reports | ★★★★☆ Popular, accountant-friendly | 💰 Moderate to high | Solo business owners & growing small biz | 🏆 Extensive integrations, upgrade path |

| FreshBooks | Expense capture, invoicing, mileage tracking | ★★★★☆ Simple, mobile-friendly | 💰 Mid-tier, free trial | Freelancers, small biz owners | ✨ User-friendly UI, good mobile apps |

| Wave | Free starter plan, bank feeds, receipt capture | ★★★★☆ Modern, simple | 💰 Free starter, low-cost Pro | Solo entrepreneurs, startups | 💰 True free tier, easy onboarding |

| Zoho Books | Expense tracking, invoicing, inventory (high tiers) | ★★★★☆ Comprehensive & scalable | 💰 Competitive, free tier | Small businesses | ✨ Broad Zoho integration, add-ons |

| Zoho Expense | Expense management, GPS mileage, receipt scan | ★★★★☆ Strong mobile focus | 💰 Flexible, per-user | Teams, mid-size businesses | ✨ Corporate cards, approval workflows |

| Expensify | SmartScan unlimited receipts, mileage, reimbursements | ★★★★☆ Fast, all-in-one expense | 💰 $5/member/month flat | Small teams, expense-focused users | 🏆 Unlimited scans, chat & travel features |

| Everlance | Auto mileage detection, IRS reports, tax filing | ★★★★☆ Tax-focused, mobile apps | 💰 Good annual value | Self-employed, mileage-heavy workers | ✨ IRS-compliant reports, audit defense |

| Hurdlr | Auto mileage & finance, real-time tax estimates | ★★★★☆ Freelancer-oriented | 💰 Affordable premium/pro | Gig workers, solo service providers | ✨ Real-time tax, payment platform integrations |

| Stride (Stride Tax) | Free mileage tracker, receipt capture, IRS guidance | ★★★☆☆ Simple, free | 💰 Completely free | Gig workers, self-employed individuals | ✨ IRS deduction education, multi-job support |

| Xero (US) | Bank feeds, receipt capture (Hubdoc), invoicing | ★★★★☆ Scalable, accountant favored | 💰 Mid to high, discounts | Small businesses, accountants | 🏆 Strong reporting, 1099/W9 support |

| Amazon (Mileage/Expense Logbooks) | IRS-friendly physical journals & organizers | ★★★☆☆ Manual, low-tech | 💰 Varies by product | Users preferring paper records | ✨ Manual audit-ready logs, prime shipping |

Making Your Final Choice: Which Tracker is Right for You?

Navigating the landscape of financial tools can feel overwhelming, but selecting the right self employed expense tracker is a foundational step toward financial clarity and business growth. As we’ve explored, the “best” tool is not a one-size-fits-all solution; it’s the one that seamlessly integrates into your unique workflow, addresses your specific pain points, and scales with your ambitions. Your choice ultimately hinges on your business model, your current stage of growth, and your personal preferences for managing finances.

The key takeaway from our detailed comparison is that functionality should align with necessity. For instance, a rideshare driver or a traveling sales consultant will find the automatic, GPS-powered mileage tracking in apps like Everlance or Hurdlr indispensable. In contrast, a freelance designer or writer whose primary need is managing client projects and billing will gravitate towards the robust invoicing and time-tracking capabilities of FreshBooks or Zoho Books. The most powerful software is useless if it doesn’t solve your immediate problems.

Key Factors to Guide Your Decision

Before you commit, take a moment to evaluate your needs based on these critical factors:

- Business Complexity: Are you a solopreneur with a single income stream, or are you managing multiple projects, clients, and potential subcontractors? All-in-one accounting software like QuickBooks or Xero is built for complexity, while a simple app like Stride is perfect for straightforward gig work.

- Budget: Your financial resources play a significant role. Free tools like Wave or our Irregular Income Budget Template provide an excellent starting point with zero financial risk. As your revenue grows, investing in a paid subscription often pays for itself through time saved and deductions maximized.

- Automation Needs: How much time do you want to spend on bookkeeping? If your goal is to “set it and forget it,” look for a self employed expense tracker with strong bank integrations, automatic receipt scanning, and smart categorization rules, features prominent in platforms like Zoho Expense and Expensify.

- Scalability: Consider where you want your business to be in one, three, or five years. Choosing a platform that can grow with you, perhaps by adding payroll, inventory management, or multi-currency support, will save you the headache of migrating your financial data later on.

Your Actionable Next Steps

The most crucial step is to simply begin. Procrastination in financial tracking leads to lost deductions, inaccurate profit analysis, and immense stress during tax season. Start today by choosing one tool from this list that best fits your current situation, even if it’s a basic spreadsheet or a physical logbook. The habit of consistent tracking is far more valuable than finding the “perfect” software from day one. By taking control of your financial data, you are not just organizing numbers; you are empowering yourself to make strategic decisions, identify growth opportunities, and build a more resilient, profitable, and sustainable business.

Ready to build a strong financial foundation without the complexity of accounting software? The PopaDex Irregular Income Budget Template is the perfect first step for any self-employed professional. It’s designed specifically to help you manage fluctuating income and gain control over your expenses, making it an ideal companion to any automated self employed expense tracker. Start organizing your finances with clarity and confidence today at PopaDex.