Our Marketing Team at PopaDex

401k Savings by Age A Realistic Guide

Are you on track for retirement? It’s the million-dollar question, literally. A common rule of thumb says you should have one times your salary saved by age 30, three times by 40, and six times by 50. Think of these as quick gut-checks on your path to financial freedom.

How Do Your 401k Savings Compare?

Think of your retirement journey as a marathon, not a sprint. The numbers showing average 401(k) savings by age aren’t a strict scorecard—they’re more like mile markers along the route. They help you gauge your pace and adjust your strategy to make sure you cross the finish line comfortably. It’s less about having a perfect start and more about consistent, forward progress.

Whether you’re ahead of the pack or feel like you’re just getting started, the key is to know where you are now so you can plan where you’re going. These benchmarks give you valuable context to set realistic goals for the future.

Average vs. Median: What’s the Real Story?

When you look at savings data, you’ll see two key figures: average and median. The average can be a bit misleading because it’s skewed by a few mega-savers with enormous balances. The median, on the other hand, is the true midpoint—half of the accounts have more, half have less. For most of us, the median gives a much more realistic picture.

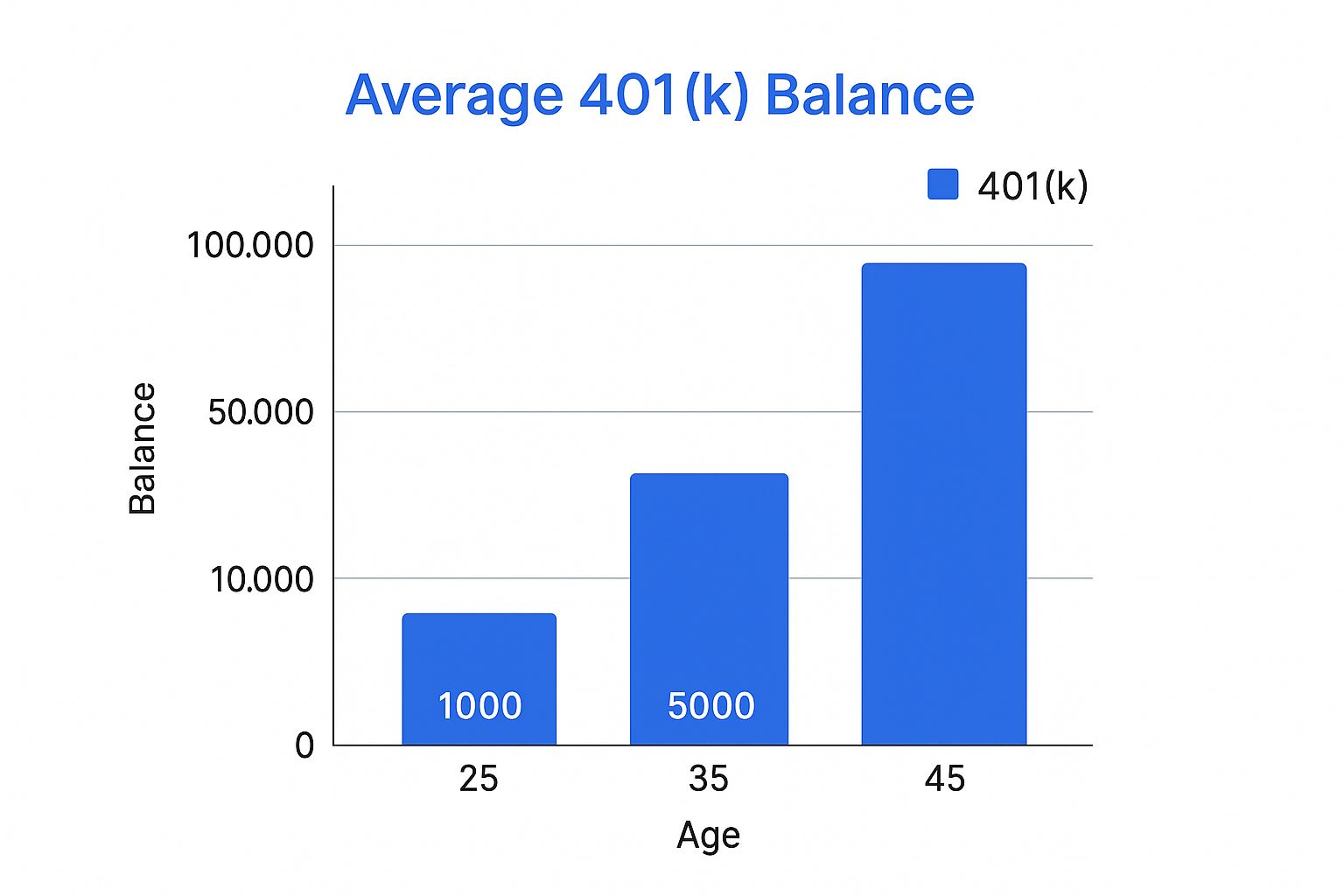

To see how powerful decades of saving can be, just look at the numbers. While the median 401(k) for someone in their 20s is around $34,225, it jumps to a median of $154,212 for those in their 40s. That’s the magic of consistent contributions and compound growth at work.

This chart gives you a quick look at 401(k) balances to help you gauge your savings progress compared to others in your decade.

| Age Group | Average 401(k) Balance | Median 401(k) Balance |

|---|---|---|

| 20s | $34,225 | $10,480 |

| 30s | $88,432 | $30,227 |

| 40s | $154,212 | $55,901 |

| 50s | $232,379 | $78,867 |

| 60s | $255,151 | $87,725 |

Source: Vanguard’s “How America Saves 2023” report.

As you can see, the gap between average and median widens with age, highlighting how a few high earners pull the average up. The median often tells a more relatable story.

The visual below really drives home how savings can accelerate once you get going.

It’s pretty clear: the growth is more than steady, it picks up steam. The balance at age 45 is a whopping ten times greater than at age 25.

What These Numbers Mean for You

Seeing these figures can spark a range of emotions, from “I’m doing great!” to “Oh no, I’m behind.” The important thing is to use them constructively. If your balance is lower than the median, don’t panic. Just see it as a signal to take action.

Your current 401(k) balance is simply a snapshot in time. What matters most are the steps you take from this point forward to build momentum for your future.

Here’s how to frame this information in a positive way:

- Motivation: Let the benchmarks inspire you. Could you increase your contribution rate, even by just 1%? Every little bit helps.

- Planning: Use these numbers as a reference point. To get a much clearer picture of your own specific goals, plug your numbers into a retirement nest egg calculator.

- Perspective: Remember, everyone’s journey is unique. Your income, debt, and major life events all play a role. Comparison is only useful if it motivates you to make a positive change.

Building Your Foundation in Your 20s and 30s

Your 20s and 30s are, without a doubt, the most important decades for your financial future. Think of it like laying the foundation for a skyscraper—the deeper and stronger you build now, the higher your wealth can soar later on. Your single greatest advantage isn’t how much you earn; it’s time. And time is the secret ingredient that makes retirement savings work.

This is where the magic of compound interest kicks in. Picture your savings as a tiny snowball at the top of a very long, snowy hill. Every dollar you invest gives that snowball a little nudge. As it rolls, it picks up more snow (your investment returns), growing bigger and moving faster all on its own. The earlier you start that push, the longer the hill, and the more massive that snowball gets by the time it reaches the bottom.

The Unbeatable Power of an Early Start

Kicking off your savings in your 20s, even with just a little bit of money, puts you on a completely different path than someone who waits until their 40s. The growth is more than steady; it’s exponential. A dollar invested at age 25 has a full decade longer to work for you than a dollar invested at 35. This “snowball effect” is why making consistent, early contributions is the absolute key to building impressive 401k savings by age.

Let’s break it down with a quick example. If you start saving just $200 a month at age 25, you could have over $600,000 by age 65, assuming an average 7% annual return. But if you wait until 35 to start saving that exact same amount, you’d only end up with around $300,000. That ten-year delay literally cuts your final nest egg in half.

Actionable Strategies for Your Early Career

Juggling finances in your 20s and 30s is tough. Student loans, rent, and life expenses are all fighting for every dollar. But you don’t need a six-figure salary to make a huge impact. The real goal is to build smart, automatic habits that do the heavy lifting for you.

Here are the most effective moves you can make right now:

-

Capture Your Full Employer Match: This is the closest thing to free money you will ever find. If your company offers to match your contributions (like matching 100% of the first 3% you save), you absolutely must contribute enough to get every last cent. Not doing so is like turning down a guaranteed 100% return on your money.

-

Automate Your Savings: Set up your 401(k) contributions to come directly out of your paycheck. This “pay yourself first” approach ensures you save consistently before you even have a chance to miss the money. You can’t spend what never hits your checking account.

-

Embrace Target-Date Funds: Not sure what to invest in? A target-date fund is a fantastic, hands-off solution. You just pick the fund with the year closest to when you think you’ll retire (e.g., “Target 2060”). The fund handles the rest, automatically adjusting its investments to become more conservative as you get older. It’s the definition of a set-it-and-forget-it strategy.

Overcoming Financial Hurdles

It’s easy to feel like you can’t afford to save when you’re dealing with debt and day-to-day bills. But small, consistent actions make a much bigger difference than you think, and they don’t have to feel like a huge sacrifice.

The most important number isn’t how much you save in a single year; it’s the habit of saving that you build. Consistency beats volume every single time in the long run.

Start small. Contribute just 1% or 2% of your salary, especially if that’s enough to snag at least part of an employer match. Then, make a promise to yourself: every time you get a raise or at the start of each new year, bump up your contribution by another 1%. This gradual increase, sometimes called “auto-escalation,” lets you ramp up your savings rate painlessly over time. It’s a slow-and-steady strategy that will powerfully boost your 401k savings by age without blowing up your budget.

Accelerating Your Savings in Your 40s and 50s

Welcome to your peak earning years. For most people, the 40s and 50s finally bring some financial breathing room—salaries are higher, careers are more stable, and some of the big expenses of your 20s and 30s are behind you. If your early career was about laying the foundation, now’s the time to build the rest of the skyscraper. Fast.

Think of it like a long road trip. Your 20s and 30s were spent navigating city streets with endless stop-and-go traffic. Now, you’ve finally hit the open highway. It’s time to press the accelerator and really start covering some ground.

This is exactly when your 401(k) savings by age should see a major jump. On average, people between 45 and 54 have a 401(k) balance of around $188,643. The good news? You have some powerful tools at your disposal to leave that average in the dust.

Supercharge Your Nest Egg with Catch-Up Contributions

Once you hit 50, the IRS hands you a fantastic gift: catch-up contributions. This is, without a doubt, one of the most effective ways to turbocharge your savings just when the finish line is coming into view. It lets you sock away thousands of dollars above the standard annual limit.

For 2024, the normal 401(k) contribution limit is $23,000. But if you’re 50 or older, you can add an extra $7,500 on top of that. That brings your total potential savings for the year to a massive $30,500.

Think of catch-up contributions as your personal express lane to retirement. It’s a special provision designed to help you make up for lost time or simply take advantage of your higher income to secure your future faster.

This isn’t just a small bump; it’s a game-changer. Maxing out that catch-up contribution from age 50 to 60 means putting an extra $75,000 into your account—and that’s before a single dime of compound growth. If you feel like you’re behind, this is your number one strategy. For more ideas, you can find a great guide that explains how to catch up on retirement savings.

The government actively encourages this aggressive saving as you get closer to retirement. The key is to take them up on the offer.

Fight Lifestyle Creep with Purpose

One of the biggest financial traps during your peak earning years is lifestyle creep. It’s that subtle, almost invisible tendency to let your spending expand right along with your income. A bigger salary leads to a nicer car, a larger house, or more expensive vacations. Before you know it, you’re earning more but saving the same amount.

Beating lifestyle creep requires a conscious plan. Here’s how to do it:

- Automate Your Raise: The moment you get a salary increase, log into your 401(k) account and bump up your contribution percentage. Do it before you even see the bigger paycheck.

- Split the Difference: A popular rule of thumb is the 50/50 split. Commit half of any new income (from a raise or bonus) to savings and investments. Use the other half to enjoy your hard-earned success.

- Focus on the Goal: Keep your retirement vision front and center. That extra $200 a month you save today could mean thousands more in security and freedom down the road.

This proactive approach turns your higher income into a powerful wealth-building tool instead of just fuel for higher spending.

Rebalance Your Portfolio to Protect Your Gains

As you get closer to retirement, your investment strategy needs to mature. Growth is still important, but protecting the nest egg you’ve worked so hard to build becomes the top priority. The main tool for this is portfolio rebalancing.

Imagine your portfolio is a garden. In your 20s, you planted aggressive, fast-growing seeds (stocks). By your 40s and 50s, many of those have shot up into large trees. Rebalancing is like trimming back those overgrown trees and planting some steadier, more resilient shrubs (bonds) to protect the whole garden from a storm.

Here’s why it’s so critical now:

- Lock in Gains: After years of market growth, your stock allocation is probably much higher than your original target, leaving you exposed to a downturn.

- Reduce Volatility: Shifting some money from stocks to bonds can act as a cushion, softening the blow during sharp market swings.

- Align with Your Timeline: With fewer years until you need the money, you have less time to recover from a major loss. A big dip at age 58 is much scarier than one at age 28.

Make a point to review your 401(k) at least once a year. Make sure your asset allocation still fits your timeline and comfort level with risk. Your 40s and 50s are all about striking that perfect balance between smart growth and prudent protection.

Navigating Retirement Transitions in Your 60s

As you hit your 60s, your entire financial mindset does a 180. For decades, the name of the game was accumulation—socking away as much as you could. Now, the focus pivots to preservation and smart distribution. Think of it like this: you’ve spent years piloting a plane, steadily climbing to cruising altitude. Now it’s time to plan for a smooth, controlled landing into retirement.

This is the decade of precision. You’ve worked hard to build that nest egg, and the choices you make now will decide how long it lasts and how well it supports your lifestyle. It’s no longer about chasing aggressive growth; it’s about protecting what you’ve built while making sure it generates a steady income for life. Let’s walk through the critical moves for this all-important transition.

From Accumulation to Preservation

The first major shift is dialing down the risk in your portfolio. You still need some growth to keep ahead of inflation, of course, but the top priority is shielding your savings from a major market nosedive. A huge loss right before you retire—or just after—can be devastating because you simply don’t have the time to recover.

This means gradually moving assets from stocks into more stable investments like bonds and cash. The goal is to build a portfolio that can handle market turbulence without forcing you to sell your investments at a loss just to pay the bills. It’s a delicate balancing act between safety and growth.

Your 60s are about shifting from a wealth-builder to a wealth-manager. The goal goes beyond growing your assets anymore; it’s making them last for the next 20, 30, or even 40 years.

Here’s how to start making that shift:

- Review Your Asset Allocation: Take a hard look at your mix of stocks and bonds. Does it still fit your new, lower-risk reality?

- Build a Cash Cushion: Aim to have at least one to two years of living expenses in a liquid, safe account (like a high-yield savings account). This is your buffer so you never have to sell investments in a down market.

- Plan for Healthcare: Retirement goes beyond income. It’s also about managing expenses. Get a handle on your future health costs by researching Over 65 Health Insurance options.

Understanding Your Withdrawal Strategy

So, you’ve retired. How much can you safely pull from your 401(k) each year without the well running dry? Answering this question is one of the most important things you’ll do. A solid withdrawal strategy is the foundation of a secure retirement.

A common starting point is the 4% rule. It suggests you withdraw 4% of your total nest egg in your first year of retirement, then adjust that dollar amount for inflation each year after. For example, if you retire with $1 million, your first year’s withdrawal would be $40,000. It’s a useful guideline, but it’s not foolproof—you’ll want to adjust it based on your personal situation, health, and market performance.

Decoding RMDs and Rollovers

Two technical terms you’ll hear a lot are Required Minimum Distributions (RMDs) and rollovers. Getting a grip on them is essential for managing your money and minimizing your tax bill.

Required Minimum Distributions (RMDs): Uncle Sam doesn’t let you keep money in tax-deferred accounts like a traditional 401(k) forever. Starting at age 73, the IRS requires you to start taking out a certain amount each year. The penalties for messing this up are steep, so it’s critical to plan for these withdrawals.

401(k) to IRA Rollover: Many retirees decide to roll their 401(k) into an Individual Retirement Account (IRA). This can be a really smart move for a few reasons:

- More Investment Choices: IRAs typically offer a much wider universe of investment options than the limited menu in most 401(k) plans.

- Consolidation: You can combine multiple old 401(k)s from previous jobs into a single IRA, which makes everything much easier to manage.

- Flexible Withdrawal Rules: Some IRAs offer more flexibility for withdrawals than company-sponsored 401(k)s.

Making these decisions thoughtfully is how your 401k savings by age finally translate into a comfortable, worry-free retirement.

To help you visualize these changing priorities, here is a quick summary of the key decisions you’ll face at different life stages.

Key 401k Decisions by Life Stage

| Age Group | Primary Goal | Recommended Actions | Key Considerations |

|---|---|---|---|

| 20s-30s | Accumulation | Start early, contribute consistently, be aggressive with stock allocation. | Time is your biggest asset; focus on growth, not market timing. |

| 40s-50s | Acceleration | Max out contributions, use catch-up provisions, rebalance regularly. | Monitor progress against goals, avoid lifestyle inflation. |

| 60s+ | Preservation & Distribution | De-risk portfolio, plan withdrawal strategy, manage RMDs. | Healthcare costs, longevity risk, tax efficiency. |

As the table shows, your strategy needs to evolve as you move closer to and into retirement. What worked in your 30s is not what you need in your 60s. The key is to be proactive, adjusting your plan to fit your new reality.

Common Mistakes That Sabotage Retirement

Hitting your 401(k) savings by age benchmarks is a fantastic goal, but even the most disciplined saver can see their progress torpedoed by a few common blunders. These mistakes often feel minor in the moment, yet they can silently drain the nest egg you’ve worked so hard to grow.

Think of your retirement plan as a ship on a long voyage. These errors are the small, slow leaks below the waterline—easy to ignore at first, but over time, they can seriously threaten your entire journey. Knowing what these financial traps are is the key to patching the holes before they do real damage.

The Temptation of Cashing Out Your 401(k)

When you switch jobs, that old 401(k) balance can look like a surprise windfall. It’s incredibly tempting to cash it out for a down payment or to clear some debt, but this is one of the most destructive financial moves you can make. Right off the bat, you’ll get hit with a 10% early withdrawal penalty if you’re under 59½, and the entire amount gets taxed as regular income.

That double-whammy can vaporize a huge chunk of your savings instantly. Worse, you lose all the future compound growth that money would have generated. The best move is almost always to do a direct rollover into an IRA or your new company’s 401(k).

Ignoring the Hidden Drain of High Fees

Fees are the silent killer of investment growth. Even a fee that looks tiny can devour a shocking amount of your returns over the decades. For instance, a 1% difference in annual fees might not sound like much, but on a $100,000 portfolio, it can cost you almost $140,000 in lost gains over 30 years.

Many 401(k) plans stick you in default investment options with higher-than-average expense ratios. It pays to be a detective. Dig into your plan’s documents and look for low-cost index funds or target-date funds that give you broad market exposure without eating away at your returns.

Your retirement is a long-term project, and seemingly minor details like fees have a massive compounding effect over time. A small adjustment today can result in tens of thousands of extra dollars in your pocket down the road.

Playing It Too Safe Too Early

While it’s smart to dial back risk as you approach retirement, being overly conservative in your 20s and 30s is a massive misstep. When you have decades of time on your side, your portfolio needs exposure to stocks to outrun inflation and build serious wealth. Sticking to “safe” bets like cash or bonds means your money will barely grow at all.

Here are a few other common pitfalls to watch out for:

- Neglecting the Employer Match: Not contributing enough to get your company’s full match is literally turning down free money—often a 100% return on your investment.

- Failing to Increase Contributions: Get into the habit of bumping your savings rate by 1% each year, or every time you get a raise. It’s a small change you’ll barely notice.

- Letting Debt Derail Savings: High-interest debt can feel like an anchor, dragging down your ability to save. Building a solid financial picture requires managing both sides of the balance sheet; explore various debt consolidation strategies to clear these hurdles and free up cash for your 401(k).

Steering clear of these common mistakes is just as vital as actively saving. By sidestepping these traps, you’re protecting your hard-earned money and keeping your financial ship sailing smoothly toward a comfortable retirement.

Building Your Complete Retirement Picture

Hitting your 401(k) savings by age goals is a huge win, but your 401(k) can’t be the only player on your team. Think of it as your star quarterback—absolutely essential, but it needs a full roster to guarantee a championship. True financial freedom is built on a strategy where multiple accounts work together in harmony.

This big-picture view is critical because there’s often a startling gap between what people have saved and what they’ll actually need. While many Americans believe they need around $1.26 million to retire comfortably, the reality on the ground is starkly different. The median savings for those aged 55 to 64 is just $185,000, a gap you can read more about on kiplinger.com.

That sobering number is exactly why relying only on a 401(k) is a risky bet. To build a truly resilient plan, you have to bring other powerful savings vehicles into the mix.

Your Financial Toolkit Beyond the 401(k)

Your 401(k) is just the starting point. To build a genuinely solid financial future, you need to add a few more specialized tools to your kit. Each account plays a unique role, creating a more flexible and tax-efficient portfolio for the long haul.

Here are the key accounts that should work alongside your 401(k):

-

Individual Retirement Accounts (IRAs): Both Traditional and Roth IRAs are fantastic supplements. They often give you far more investment choices than a standard 401(k) and are the perfect place to roll over old 401(k) funds from previous jobs. This keeps your money consolidated and much easier to manage.

-

Health Savings Accounts (HSAs): Often called the “secret weapon” of retirement, an HSA offers a rare triple tax advantage. Your contributions are tax-deductible, the money grows tax-free, and any withdrawals for qualified medical expenses are also completely tax-free.

-

Brokerage Accounts: These taxable investment accounts offer ultimate flexibility. While they don’t have the same tax perks, there are no contribution limits or withdrawal restrictions, making them ideal for goals that might pop up before retirement.

Creating a Cohesive Financial Strategy

A well-rounded strategy isn’t just about having these accounts; it’s about making them work in concert. For example, you might prioritize contributing to your 401(k) just enough to get the full employer match, then shift gears to max out a Roth IRA for its tax-free growth, and finally, funnel any extra savings into an HSA to cover future health costs.

Your financial plan should be a living document, not something you set up once and forget. It’s about orchestrating different accounts to cover all your bases—from short-term flexibility to long-term tax advantages and healthcare security.

By looking beyond a single account, you can build a more complete and secure financial life. Understanding how these different pieces fit together is a core concept we cover in our guide to retirement planning basics. A diversified approach doesn’t just grow your wealth—it builds invaluable peace of mind.

Answering Your Top 401k Savings Questions

When it comes to retirement savings, a lot of questions pop up. Whether you’re just kicking off your career or you’re on the home stretch, getting straight answers is the key to feeling confident about your financial plan. We’ve tackled some of the most common questions about 401(k)s right here.

Think of this as your go-to guide for those nagging “what if” scenarios and a quick refresher on the most important lessons.

How Much Should I Actually Be Putting Into My 401k?

The absolute bare minimum? Contribute enough to get your full employer match. No exceptions. This is a guaranteed return on your money you simply can’t get anywhere else. Not taking it is like leaving a pile of free cash on the table.

Once you’ve secured the match, a solid goal for most people is to save 15% of your pre-tax income. If that number makes you sweat, don’t panic. Start where you are, and then challenge yourself to bump it up by 1% every year. That tiny, gradual increase will make a shockingly big difference over the long haul.

I’m Changing Jobs—What Do I Do with My Old 401k?

You’ve got a few choices, but one of them is a definite no-go: cashing it out. Doing that means getting hit with brutal taxes and penalties, which will instantly wipe out a huge chunk of your savings and kill off all its future growth potential.

For most people, the smartest play is a direct rollover into an IRA. This move opens up a much wider world of investment options, gives you total control, and neatly consolidates your retirement funds in one place. You can also sometimes leave it with your old plan or roll it into your new company’s 401(k), if they allow it.

What’s the Real Difference Between a Traditional and Roth 401k?

It all boils down to one simple question: When do you want to pay taxes? You can either pay them now or pay them later.

- Traditional 401(k): You contribute with pre-tax dollars. This is great because it lowers your taxable income today. Your money then grows tax-deferred, but you’ll pay income tax on your withdrawals when you retire.

- Roth 401(k): You contribute with after-tax dollars, meaning you pay the taxes upfront. The massive payoff comes in retirement, when all your qualified withdrawals are completely tax-free.

If I’m Hitting the Average for My Age, Am I Saving Enough?

Hitting the average 401k savings by age is a fantastic sign that you’re on the right path, but it’s just a benchmark—not your personalized finish line. The definition of “enough” is entirely personal, depending on your own life and dreams.

Averages give you context, but your personal retirement goal is the only number that truly matters. It should be built around your desired lifestyle, income, and where you see yourself living.

Use those age-based averages as a reality check to see how you stack up. But your ultimate goal should be a number crafted specifically for you. For many people, aiming well above the average is what it will take to live comfortably in retirement.

Ready to see your complete financial picture in one place? PopaDex is an intuitive net worth tracker that helps you monitor your 401(k), investments, and all other assets to ensure you stay on track. Start making confident financial decisions today at https://popadex.com.