Our Marketing Team at PopaDex

Your Guide to After Tax Contribution to 401k

Ever feel like you’ve hit a wall with your retirement savings? You’ve maxed out your regular 401(k) contributions for the year, but you have more you want to put away. This is where the after-tax 401(k) contribution comes in—it’s a powerful, and often missed, opportunity for super-savers.

Think of it as a secret passage in your retirement plan. It lets you stash away a lot more money after your standard pre-tax or Roth 401(k) contributions are maxed out. These extra funds grow tax-deferred and are the linchpin for advanced strategies like the Mega Backdoor Roth.

Unlocking a New Level of Retirement Savings

When you hear “401(k),” you’re probably thinking of the two main flavors: traditional pre-tax contributions that shrink your current tax bill, or Roth contributions that give you tax-free money in retirement.

An after-tax contribution to a 401(k) is something else entirely. It’s a third option. You don’t get a tax deduction now, but it lets you contribute well beyond the usual employee limits set by the IRS each year.

Here’s the catch: not every company 401(k) plan allows for this. The very first step is to dig into your plan documents or just ask your plan administrator if it’s an option. If the answer is yes, you’ve just unlocked a strategy that savvy investors use to seriously accelerate their savings.

The core idea is simple: once you’ve hit the regular contribution ceiling, the after-tax option opens a new door. It lets you keep saving within your 401(k) wrapper, up to a much higher overall limit that includes your contributions, your employer’s match, and these extra after-tax funds.

Comparing 401k Contribution Types

To really get why after-tax contributions are so unique, it helps to see how they stack up against the others. A solid savings strategy is the bedrock of good personal finance, and these distinctions are crucial. You can see how this all fits into the bigger picture with a complete retirement planning checklist.

Let’s lay it all out. The main difference between these contribution types comes down to one thing: taxes. Specifically, when you pay them.

Here’s a simple breakdown of how the three main 401(k) contribution types work.

Comparing 401k Contribution Types

| Contribution Type | Tax Treatment on Contribution | Tax Treatment on Growth | Tax Treatment on Withdrawal |

|---|---|---|---|

| Traditional (Pre-Tax) | Tax-deductible; lowers your current taxable income. | Tax-deferred; you pay no taxes as it grows. | Taxed as ordinary income. |

| Roth 401(k) | Made with after-tax dollars; no immediate tax deduction. | Grows completely tax-free. | Completely tax-free in retirement. |

| After-Tax (Non-Roth) | Made with after-tax dollars; no immediate tax deduction. | Tax-deferred; you pay no taxes as it grows. | Contributions are tax-free; earnings are taxed. |

As you can see, the after-tax option is a hybrid. Your original contributions come back to you tax-free, but the earnings are taxable—unless, of course, you use a strategy like the Mega Backdoor Roth to convert them. And that’s where things get really interesting.

Understanding the Core Concepts of After Tax Contributions

To really get the hang of after-tax 401(k) contributions, it helps to picture your retirement savings as a set of buckets you need to fill. The first bucket is your standard 401(k). You fill this one up with your regular pre-tax or Roth contributions, right up to the annual employee limit. For most people, that’s where the saving stops.

But for high earners, there’s another, much larger bucket available if your plan allows it: the after-tax bucket. You can only start pouring money into this second bucket once the first one is completely full. This is a totally separate stash of money that lets you blast past the usual contribution limits.

Roth 401k vs After Tax 401k Contributions

Here’s where things can get a little confusing. People often mix up Roth 401(k) contributions and non-Roth after-tax 401(k) contributions. Yes, both are funded with money you’ve already paid taxes on, but they behave very differently once they’re inside your retirement plan.

Let’s use a gardening analogy.

- Roth 401(k) Contributions: Think of these as “magic” seeds. You plant them (make a contribution), and absolutely everything that grows from them—the stem, the leaves, the fruit—is 100% tax-free when you harvest it in retirement.

- After-Tax (Non-Roth) Contributions: These are more like regular seeds. When harvest time comes, you get your original seed back tax-free (your principal contribution). But all the fruit that grew from it (the earnings) is taxable.

This difference is absolutely critical. The main reason savvy savers use the after-tax option is to eventually turn those “regular seeds” into “magic seeds” through a Roth conversion. It’s a powerful strategy we’ll break down in just a bit.

An after-tax contribution is not the same as a Roth contribution. While you can withdraw your initial after-tax contribution tax-free, its earnings are only tax-deferred. That means you’ll owe taxes on the growth when you withdraw it, unless you convert it first.

How After Tax Funds Are Handled

When you choose to make after-tax contributions, the process from your end is pretty straightforward. Your employer will deduct the amount from your paycheck after taxes are taken out, the same way they would for a Roth 401(k) contribution.

What happens behind the curtain is where the real work is. Your 401(k) plan administrator has to keep meticulous records, tracking your after-tax funds in a separate sub-account from your pre-tax and Roth money. This isn’t optional; it’s required by law because the tax treatment for each type of money is completely different.

This careful bookkeeping ensures that when it’s time to take a distribution or perform a conversion, the plan knows exactly:

- How much of your balance is pre-tax money (and fully taxable).

- How much is Roth money (and fully tax-free).

- How much is from after-tax contributions (where the principal is tax-free, but the earnings are taxable).

Understanding how the money is categorized and tracked is the first step. Once you nail this, you’re on your way to mastering this advanced savings tool.

Navigating the Complex World of 401(k) Contribution Limits

To really get why after-tax 401(k) contributions are such a big deal, you first have to understand the lay of the land when it comes to IRS limits. Think of them as a series of gates. Most savers know about the first one and stop there. But the real opportunity is knowing that a second, much larger gate even exists.

The first gate is the one everyone talks about: the employee deferral limit. This is the absolute maximum you can personally funnel from your paycheck into your traditional pre-tax or Roth 401(k). For most people, this is the only number they ever think about.

The Overall Contribution Limit: The Real Ceiling

But there’s a much higher ceiling called the overall contribution limit. This limit, dictated by Section 415(c) of the tax code, represents the total amount that can be dumped into your 401(k) from all sources combined in a single year.

This all-encompassing limit includes:

- Your own pre-tax and Roth 401(k) contributions

- Every penny your employer puts in (like matching funds or profit sharing)

- And—this is the key—any after-tax contributions you decide to make.

It’s the gap between your contributions, your employer’s match, and this massive overall limit that creates the opening for after-tax savings. This is your chance to “top up” your account and save way more than most people realize is even possible.

Putting the Numbers into Perspective

Let’s make this real. For 2025, the IRS bumped the 401(k) employee contribution limit to $23,500. That’s the first gate. The second, larger gate—the total annual contributions limit—is a whopping $70,000 for anyone under 50. You can see just how much space an after-tax contribution can potentially fill. For a deeper dive into these figures, FTI Consulting’s website offers some valuable insights.

Example in Action: Meet Sarah. She’s 40 and earns $150,000. She’s a great saver and maxes out her 401(k) at $23,500. Her company is generous, kicking in an $8,000 match. So far, her total contributions are $31,500. She’s still miles away from the $70,000 overall limit for 2025. That leaves $38,500 of room she could fill with after-tax contributions, assuming her plan allows it.

Don’t Forget About Catch-Up Contributions

The IRS also gives savers closer to retirement a way to turbocharge their savings. These are called catch-up contributions, and they let people aged 50 and over go past the standard employee deferral limit.

For savers aged 50-59, the 2025 catch-up is an extra $7,500, bringing their personal contribution total to $31,000. The SECURE 2.0 Act created an even bigger boost for those aged 60-63, allowing an $11,250 catch-up for a total of $34,750.

Just remember, these catch-up amounts don’t raise the overall $70,000 ceiling; they just help older workers fill that space faster with their own money. For anyone feeling behind, our guide on how to catch up on retirement savings lays out some great strategies.

The Mega Backdoor Roth: A Powerful Conversion Strategy

Making an after-tax contribution to a 401(k) is just the starting point. The real power play is converting that money into a Roth account—a strategy widely known as the “Mega Backdoor Roth.” This move turns your after-tax contributions into a powerhouse of tax-free growth.

Think of it like this: your after-tax 401(k) contributions are a VIP ticket. This ticket gets you past the velvet ropes of both standard contribution limits and the income restrictions that lock many people out of Roth IRAs. It’s your exclusive pass to move a huge chunk of money into one of the best tax-advantaged retirement accounts out there.

How The Conversion Process Works

The Mega Backdoor Roth is basically a straightforward, two-step dance. The trick is to act quickly to lock in the biggest tax advantage possible.

- Fund Your After-Tax Account: First, you make contributions to your 401(k)’s after-tax bucket. You’ll typically do this after you’ve already maxed out your standard pre-tax or Roth 401(k) contributions for the year.

- Execute the Conversion: As soon as you can, you move those after-tax funds into a Roth account. Depending on what your plan allows, this could be an in-plan conversion to a Roth 401(k) or a rollover to an external Roth IRA.

Speed is your best friend here. Your after-tax contributions can start generating earnings right away. If you let that money sit too long before converting, any earnings will be taxable when you finally make the move. By converting quickly, you can minimize—or even completely avoid—any taxable gains, making sure the entire amount gets that sweet tax-free Roth treatment.

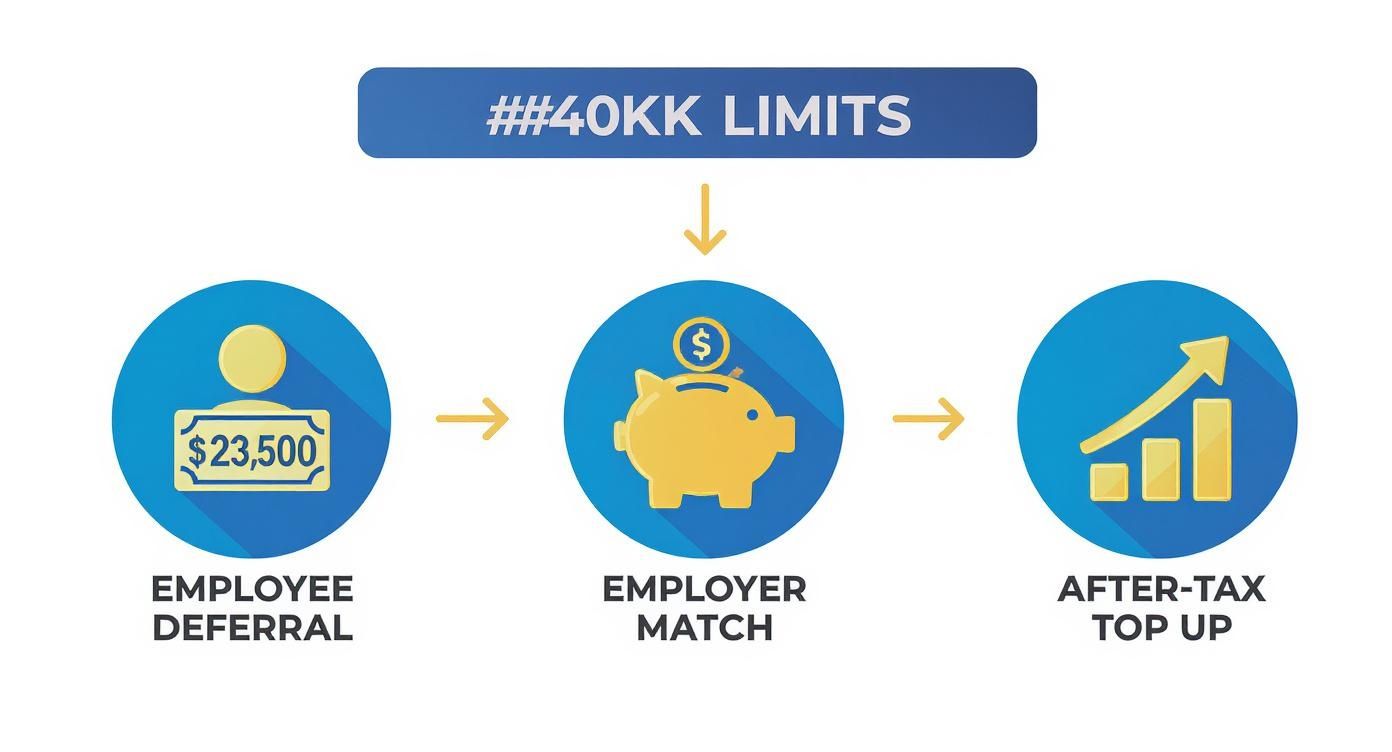

The infographic below really helps visualize how after-tax contributions fill the final gap in your retirement savings plan.

As you can see, once you’ve hit your personal deferral limit and factored in the employer match, the after-tax portion is what allows you to push your savings all the way to the absolute maximum allowed by the IRS.

Choosing Your Conversion Path

When you’re ready to pull the trigger, you generally have two places for your after-tax money to go. Your specific 401(k) plan rules will determine which of these options you have.

- In-Plan Roth Conversion: This is often the simplest path. It keeps your money right inside your current 401(k) plan, simply shifting it from the after-tax sub-account over to the Roth 401(k) sub-account.

- Rollover to a Roth IRA: This moves the money completely out of your 401(k) and into a separate Roth IRA you control. The big advantage here is that a Roth IRA can give you far more investment choices and flexibility than your company’s 401(k) plan might offer.

The real magic of the Mega Backdoor Roth strategy is locking in 100% tax-free growth on a potentially massive sum of money. This lets you build wealth far beyond what standard Roth IRA contribution limits could ever permit.

This strategy is a game-changer for high earners who are normally phased out of contributing directly to a Roth IRA. Because workplace 401(k) plans allow these conversions regardless of your income, it opens a critical door to building a tax-free retirement nest egg.

The Mega Backdoor Roth is just one piece of the puzzle, of course. For a more complete picture, it’s smart to explore other essential retirement tax planning strategies to really optimize your financial future.

Evaluating the Pros and Cons of This Strategy

So, is making an after-tax contribution to a 401(k) the right move for you? It’s a powerful strategy, no doubt, but it’s not a silver bullet. Let’s take a clear-eyed look at the powerful upsides and the very real hurdles you might face. While it can open the door to some serious wealth creation, it isn’t a one-size-fits-all solution and really demands a close look at your personal finances and your specific 401(k) plan.

This strategy really starts to shine for ambitious savers—the folks who are already hitting the max on their standard 401(k) and IRA contributions and are still looking for more ways to put money away. The headline benefit is simple: the ability to save far beyond the usual limits, creating a massive, tax-advantaged pool of funds for retirement.

When you pair this with a Roth conversion—the “Mega Backdoor Roth” maneuver—it gets even more compelling. The end game is to unlock tax-free withdrawals in retirement. This concept isn’t unique to the US system; you can see similar principles of tax-free retirement fund access in other retirement frameworks around the world.

A Balanced View of After-Tax 401(k) Contributions

Now for the reality check. The single biggest obstacle is simply whether your plan allows it. A 2021 survey found that only about half of 401(k) plans even permit after-tax contributions. Before you spend too much time dreaming about this, your first step is to confirm your employer’s plan actually offers this feature.

Another key piece of the puzzle is the admin work. To really make this work, you have to act fast and convert those after-tax funds into a Roth account to avoid getting hit with a tax bill on any investment gains. This means staying on top of your plan’s rules and executing those conversions promptly, which definitely adds a layer of complexity to managing your money.

Let’s break down the core advantages and disadvantages side-by-side.

Weighing the After-Tax 401(k) Strategy

To make a smart decision, you need to weigh both sides of the coin. Here’s a straightforward comparison of what you stand to gain versus the potential headaches involved.

| Advantages | Disadvantages |

|---|---|

| Massive Savings Potential: Funnel tens of thousands more per year into your retirement, blowing past standard 401(k) limits. | Limited Availability: Your employer has to offer this feature in their 401(k) plan, and many don’t. |

| Bypass Roth IRA Income Limits: High earners who are locked out of direct Roth IRA contributions have a powerful alternative to get huge sums into a Roth account. | Administrative Complexity: You have to stay on the ball and perform timely conversions to sidestep taxes on investment gains. |

| Unlock Tax-Free Growth: Once the money is converted to a Roth account, the entire balance grows completely tax-free for retirement. | Potential for Taxable Gains: If you delay a conversion, any earnings your after-tax money generates become taxable when you finally move it. |

Ultimately, for those lucky enough to have this option and willing to manage the moving parts, the benefits of building a substantial, tax-free nest egg often make the extra effort well worth it.

Important Rule Changes High Earners Should Know

If you’re a high-income earner, the retirement savings landscape is about to look a little different. A major change is on the horizon thanks to the SECURE 2.0 Act, and it’s going to directly impact how catch-up contributions work for those hitting a certain income level. This isn’t just some minor regulatory tweak—it’s a fundamental shift that will require a new tax strategy for many seasoned savers.

Until now, savers aged 50 and over have had the flexibility to make their extra catch-up contributions on either a pre-tax or Roth basis. It was a nice perk. That flexibility, however, is going away.

The Mandatory Roth Catch-Up Rule

Starting in 2026, a new rule kicks in that forces high earners to make all their 401(k) catch-up contributions on a Roth (after-tax) basis. This isn’t for everyone, though. The mandate specifically applies to individuals who had wages of $145,000 or more in the previous calendar year.

What does this mean in plain English? If you’re in this group, the option to get an immediate tax deduction on those extra catch-up dollars is off the table. Period. The funds will have to go in after you’ve already paid taxes on them, just like a standard Roth contribution.

For anyone affected, this policy change makes proactive tax planning more crucial than ever. It shines a spotlight on the importance of understanding the nuances of an after tax contribution to 401k and how to work it into your broader financial picture. It’s a clear signal that Roth strategies are becoming an even bigger part of modern retirement planning. You can learn more about the 2025 contribution limits to see how all these pieces fit together.

Your Top After-Tax 401(k) Questions, Answered

Even when you get the big picture, the little details of the after-tax 401(k) strategy can be tricky. Let’s walk through some of the most common questions that pop up.

First things first: how do you even know if your plan offers this? The answer is buried in your plan documents, specifically a document called the Summary Plan Description (SPD). If you hunt through it and spot phrases like “voluntary employee contributions” or “after-tax contributions,” you’re probably in business.

Of course, the fastest way to get a straight answer is just to call or email your plan administrator. They’ll tell you in two minutes.

Another huge question revolves around the earnings. What happens if you make these after-tax contributions but don’t convert them to a Roth account right away? In that scenario, the earnings on your contributions grow tax-deferred. When you eventually pull the money out in retirement, your original contributions come back to you tax-free, but you’ll owe ordinary income tax on every penny of the growth.

Navigating Eligibility and Income Limits

Here’s where this strategy really shines, especially for high earners.

Can you still make after-tax 401(k) contributions if your income is too high for a normal Roth IRA? Yes, absolutely. This is one of the biggest draws. After-tax 401(k) contributions have no income limits, which opens up a powerful backdoor for high earners to get a ton of money into a Roth account.

This gives you a path to Roth savings that would otherwise be completely shut off. It’s always a good idea to know how your savings compare to your peers, and you can see some helpful benchmarks in these breakdowns of 401(k) savings by age to get a better sense of where you stand.

Ready to see your entire financial picture in one place? PopaDex helps you track your net worth, monitor investments, and confidently plan for a secure retirement. Take control of your financial future today at https://popadex.com.