Our Marketing Team at PopaDex

Master Your Car Loan With an Auto Loan Amortization Calculator

An auto loan amortization calculator is a financial tool that pulls back the curtain on the true cost of your car. It does this by breaking down every single payment you make into its two core parts: principal and interest.

This simple breakdown shows you exactly how much you’ll pay in total over the life of the loan and, just as importantly, how quickly (or slowly) you’re actually building equity in your vehicle. It’s the key to making smarter financing decisions from day one.

The Hidden Costs in Your Auto Loan and How a Calculator Reveals Them

When you’re signing the paperwork for a car, the monthly payment is always the star of the show. It’s the number that makes the car feel affordable and “fit” into your budget. But that single number hides a much more complicated financial story—one that an auto loan amortization calculator is designed to tell.

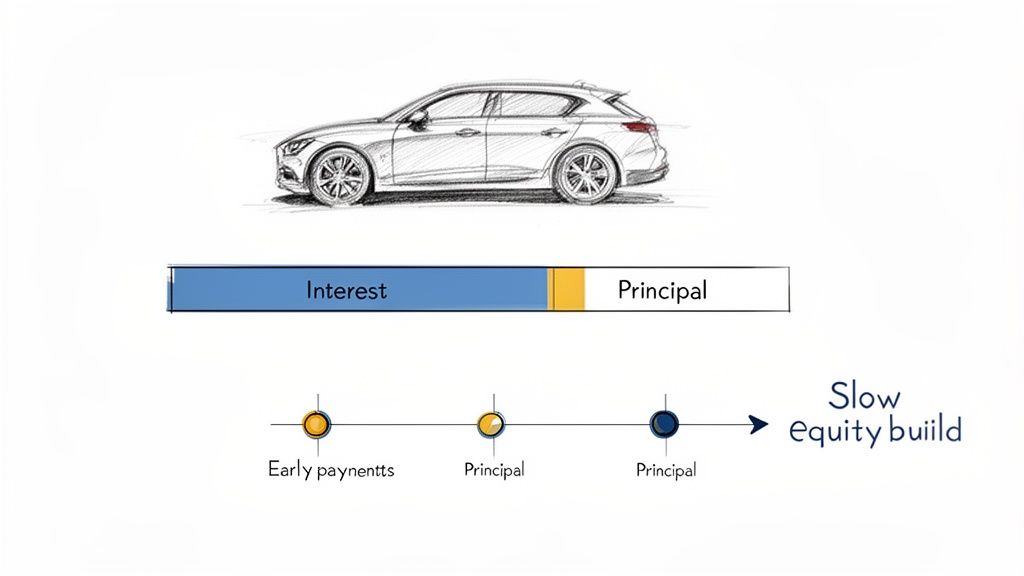

Every loan payment you make is split into two buckets: principal (the part that actually pays down what you owe) and interest (the lender’s profit). Amortization is just the fancy term for paying off that debt over time, but the split between those two buckets is rarely even.

Lenders structure loans to be front-loaded with interest. In plain English, this means a shockingly large chunk of your payments in the early years goes straight to the bank, not towards the car itself.

Why Early Payments Barely Make a Dent

Let’s put some real numbers on this. Say you take out a $30,000 loan for a new car with a 6.5% interest rate over 72 months. Your first payment is around $504. You feel good sending it in, but the calculator shows you the harsh reality.

Of that $504, about $162 is pure interest. Only $342 actually goes toward reducing your debt. This is why you build equity at a snail’s pace in the first year or two.

This front-loaded structure is a huge reason why so many people find themselves “upside-down,” owing more on their loan than the car is actually worth. It’s also why it’s so important to check for outstanding car finance before buying a used vehicle, as it directly impacts the true cost.

The calculator’s main job is to expose this front-loaded interest. It turns abstract numbers into a clear, month-by-month schedule, revealing the total interest you’ll pay—often thousands of dollars—that was hidden behind that “manageable” monthly payment.

The Bigger Financial Picture

This isn’t just a minor detail; it’s a massive slice of household debt. A recent LendingTree report on auto debt statistics showed Americans shouldering a staggering $1.655 trillion in auto loan debt in Q3 2025. With new car loans now averaging over $42,000, understanding where every dollar goes has never been more critical.

Using a calculator, and tracking the loan in a tool like PopaDex, helps you see how this liability impacts your complete financial health. It turns a simple car loan into a transparent piece of your overall net worth puzzle.

Getting Started With Your Amortization Calculator and Schedule

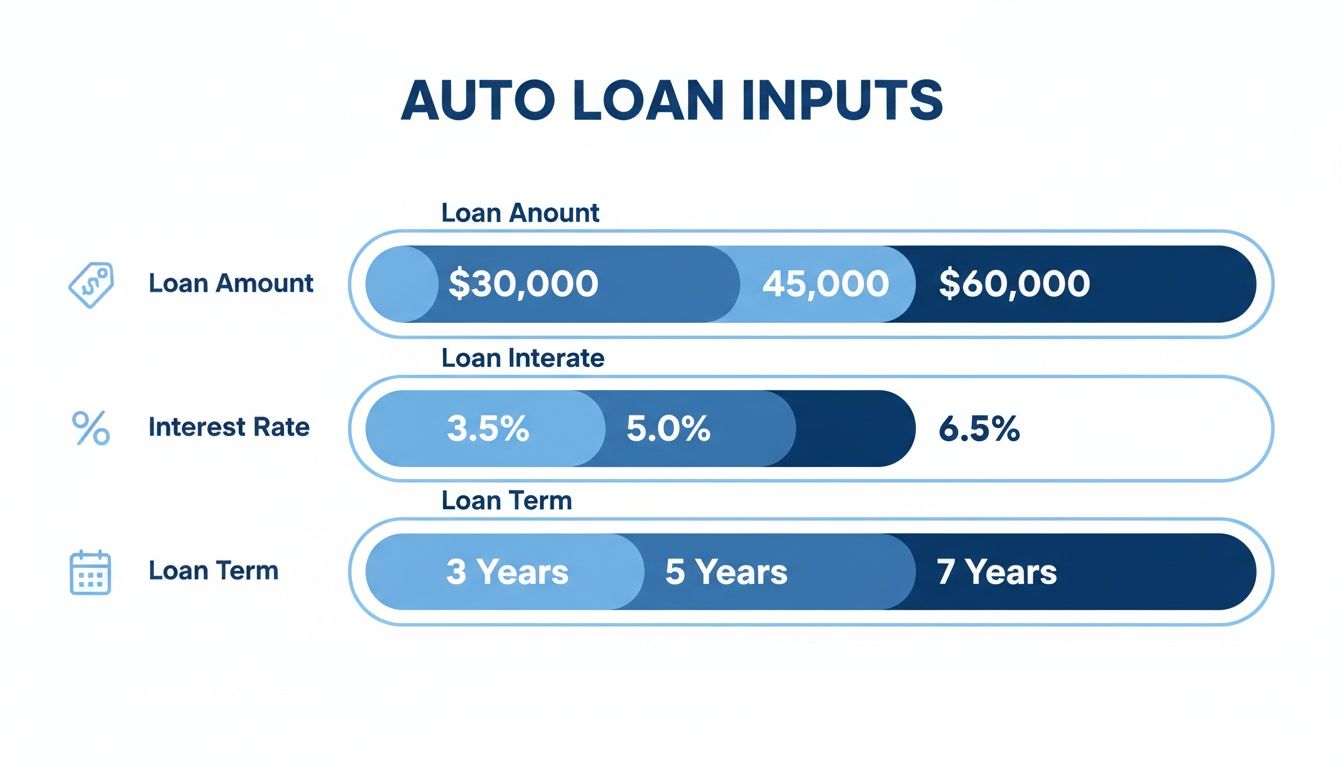

Using an auto loan amortization calculator is the first real step toward getting a handle on your car debt. The process itself is simple, but its power comes from being precise. To get a truly clear picture, you’ll need to grab three key pieces of information straight from your loan agreement.

Think of these numbers as the foundation of your financial snapshot. If one of them is off, the whole picture will be blurry.

Gathering Your Essential Loan Details

Before you can crunch any numbers, you need the right numbers. Don’t guess here—pull out your original loan documents or log into your lender’s online portal to find these specific figures:

- Loan Amount: This is the total amount you financed. It’s not just the sticker price of the car; it includes all the extras like taxes, title, and dealership fees, minus whatever you put down as a down payment or got for your trade-in.

- Interest Rate (APR): Look for the Annual Percentage Rate (APR). This is the number you want because it includes not just the interest but also any lender fees baked in, giving you the true cost of borrowing money.

- Loan Term: This is simply how long you have to pay back the loan, usually shown in months. You’ll typically see terms like 48, 60, or 72 months.

Once you have these three numbers jotted down, you’re ready to plug them into the calculator.

Here’s an example of what a standard auto loan amortization calculator interface looks like.

This clean layout asks for the exact inputs we just talked about, making it super simple to get started and see your results in seconds.

Reading Your Amortization Schedule

After you enter your loan details, the calculator will generate an amortization schedule. This is just a detailed, payment-by-payment breakdown of your entire loan. It can look like a lot of data at first, but it’s actually pretty easy to understand once you know what the columns mean.

Your amortization schedule is your loan’s biography. It tells you where every dollar has gone and where every future dollar is going. It’s the ultimate tool for financial transparency.

Typically, you’ll see these key columns:

- Payment Number: Keeps track of where you are in the loan (e.g., payment 1 of 72).

- Payment Amount: Your fixed monthly payment that never changes.

- Principal Paid: The part of your payment that actually chips away at your loan balance.

- Interest Paid: The part of your payment that goes straight to the lender as their profit.

- Remaining Balance: The amount you still owe after your payment is applied.

Let’s look at a quick example for a $30,000 loan with a 6.5% APR over 72 months. The monthly payment would be $495.73. Here’s how the first six months break down.

Example Amortization Schedule Breakdown (First 6 Months)

| Payment # | Payment Amount | Interest Paid | Principal Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $495.73 | $162.50 | $333.23 | $29,666.77 |

| 2 | $495.73 | $160.69 | $335.04 | $29,331.73 |

| 3 | $495.73 | $158.87 | $336.86 | $28,994.87 |

| 4 | $495.73 | $157.05 | $338.68 | $28,656.19 |

| 5 | $495.73 | $155.22 | $340.51 | $28,315.68 |

| 6 | $495.73 | $153.38 | $342.35 | $27,973.33 |

Notice how in the beginning, more of your payment goes toward interest. As you scroll through the full schedule, you can see exactly when the balance tips and more of your money starts hitting the principal. For instance, in month one, $162.50 goes to interest. By month 36, that could drop to around $80.

Seeing this is powerful because it shows how much faster you build equity in the car during the second half of the loan. Learning how to read this is a fundamental skill, and you can dive deeper into the structure of an amortization schedule calculator to master the details.

The schedule also reveals the total interest paid over the life of the loan—a number that’s often buried in the fine print of your original agreement. Seeing that figure in black and white is often all the motivation someone needs to start looking for ways to pay the loan off faster.

Proven Strategies to Pay Off Your Car Loan Faster

Once you understand your amortization schedule, you’ve basically got the playbook for your loan. Now, it’s time to figure out how to win the game. The real magic of an auto loan amortization calculator isn’t just seeing the road ahead—it’s charting new, faster, and cheaper routes to the finish line.

Even small tweaks to your payment plan can completely change your loan’s story.

The goal is simple: attack the principal balance as hard as your budget allows. Every extra dollar you throw at the principal is a dollar that can no longer earn interest for the lender. When you do this early and often, the savings start to snowball in a big way.

This is what you’ll be working with in the calculator to map out these payoff scenarios.

Getting a handle on these three variables—your loan amount, interest rate, and term—is how you build a smarter payoff strategy.

Model Extra Monthly Payments

This is the most straightforward tactic, and honestly, one of the most effective. Let’s go back to our example: a $30,000 loan at 6.5% for 72 months. Your scheduled payment is $495.73, and you’re on the hook for $5,692.56 in total interest.

But what if you just round up that payment to $550 every month? That’s an extra $54.27—about the cost of a few fancy coffees.

Plug that into the calculator, and you’ll see a pretty awesome result. You’d pay off the loan 8 months early and keep about $730 in interest from ever leaving your pocket. It’s a perfect example of how a small, consistent effort pays off big time. You can play around with different amounts yourself using a dedicated amortization calculator with extra payments.

The Power of Bi-Weekly Payments

Here’s another popular trick: switch to bi-weekly payments. Instead of 12 monthly payments, you make 26 half-payments over the year. The clever part? You end up sneaking in one extra full payment each year without really feeling the pinch in your budget.

Let’s see how that works for our loan:

- Monthly Payment: $495.73

- Bi-Weekly Payment: $247.87 (exactly half)

By making this simple switch, you could pay off the loan roughly 11 months ahead of schedule and save over $1,000 in interest. One quick heads-up: before you start, call your lender. You need to confirm they’ll apply the extra funds directly to your principal and that they don’t hit you with any fees for this payment plan.

Applying Lump-Sum Payments

Got a bonus from work, a tax refund, or a cash gift? Don’t just let it sit in your checking account. Firing a one-time lump sum directly at your loan’s principal can have a huge impact, especially if you do it early on when interest is gobbling up most of your payment.

On a $30,000 loan, dropping a single $2,000 extra payment in the first year could knock 5-6 months off your term and save you hundreds in interest. A good calculator lets you model the exact month of the payment so you can see the precise benefit.

These strategies become even more crucial with longer loans. By the first quarter of 2025, the most common auto loan terms in the U.S. stretched between 61 and 72 months. While longer terms make the monthly payment look smaller and more attractive, they dramatically inflate the total interest you pay. If you’re serious about getting out of debt, looking into debt snowball calculator tools can also give you a structured plan for tackling multiple debts at once.

Using the Calculator to Evaluate Refinancing Offers

Refinancing offers show up in your inbox with a tempting hook: a lower monthly payment. While the promise of more cash in your pocket each month is hard to ignore, it’s never the whole picture.

An auto loan amortization calculator is the perfect tool for cutting through the marketing noise. It helps you see if a refinance offer actually saves you money or just ends up costing you more in interest over the long haul.

The trick is to run a simple side-by-side comparison. First, you’ll need to generate the amortization schedule for your current loan. This shows you exactly what your remaining principal balance is and how much interest you still have left to pay. Then, you model the new refinance offer, using that remaining balance as your new loan amount.

Modeling a Refinance Scenario

Let’s walk through a real-world example. Imagine you’re two years into a $30,000, 72-month car loan with a 7% APR. Your current payment is $495.73, and your remaining balance is about $20,850.

Suddenly, a great refinance offer lands: a new 60-month loan at 5.5% APR.

Here’s how you’d plug this into the calculator:

- New Loan Amount: $20,850

- New Interest Rate: 5.5%

- New Loan Term: 60 months

The calculator instantly shows your new monthly payment would be around $397. That’s a saving of nearly $100 a month. Seems like a no-brainer, right?

But here’s the thing: the monthly payment is just one piece of the puzzle. The real goal is to compare the total interest paid from this day forward for both loans. A good calculator makes this comparison crystal clear.

The Hidden Trap of Longer Terms

This is where you have to be careful. In our example, the new loan is a winner. But what if the offer was for a 72-month term instead of 60?

Sure, your payment would drop even lower—maybe to around $340—but you’d be adding two full years of payments back onto your timeline. By extending the term, even with a lower rate, you’re giving interest more time to pile up.

Let’s break down the total cost of interest for all three options:

- Scenario 1 (Keep Original Loan): You have 48 months left. The total remaining interest you’ll pay is roughly $3,145.

- Scenario 2 (Refinance to 60 Months): You’ll pay about $3,000 in interest on the new loan. This is a modest saving, but a saving nonetheless.

- Scenario 3 (Refinance to 72 Months): Your total interest on this new loan would be closer to $3,620. You’d have a much lower payment, but you’d ultimately pay $475 more in the end.

Using an auto loan amortization calculator for these comparisons turns a confusing decision into a simple math problem. It helps you look past the shiny monthly payment and figure out if a refinancing deal actually aligns with your goal: paying less interest and getting out of debt faster.

How Your Auto Loan Fits into Your Financial Big Picture

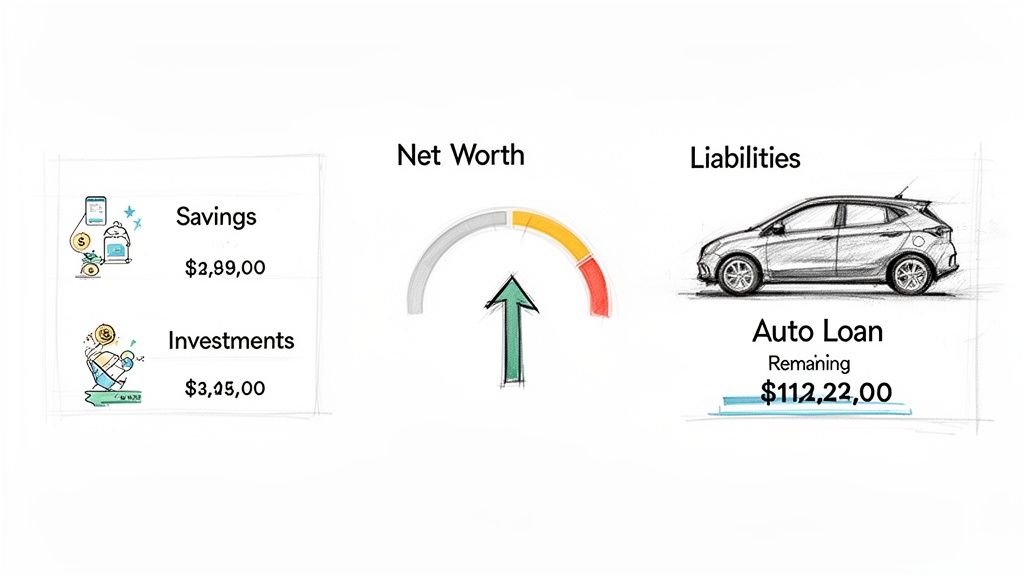

It’s easy to see your car payment as just another monthly bill that vanishes from your bank account. But that payment is doing more than you think—it’s actively shaping your financial health. Your auto loan is a major player on your personal balance sheet, and understanding its role is key to building real wealth.

True financial clarity comes when you stop treating debts as isolated expenses and start seeing them as part of your total net worth.

The amortization calculator is your secret weapon here. The schedule it spits out isn’t just a list of dates and numbers; it’s a precise roadmap showing your remaining loan balance after every single payment. That balance is your liability.

Connect Your Debt to Your Net Worth

Once you have that number, you can plug it into a financial dashboard like PopaDex. Seeing your auto loan liability sitting right next to your assets—like your savings, investments, and home equity—changes everything. It gives you a live, dynamic view of your wealth.

Now, each car payment you make becomes a strategic move. It’s not just money out the door; it’s a direct reduction of a liability, which in turn gives your net worth a little nudge upward.

From Paying Bills to Building Wealth

Framing it this way completely shifts your mindset. You’re no longer just “paying the car bill.” You’re actively managing a liability to build wealth. It’s a powerful perspective that leads to smarter financial choices.

Think about it: when you use the calculator to model an extra payment, you’re not just seeing the interest you’ll save. If you’re tracking it in a tool like PopaDex, you’d also see an immediate, tangible increase in your net worth as that liability shrinks ahead of schedule. That visual feedback is incredibly motivating. You can see this relationship up close by playing around with a dedicated net worth calculator and watching how the numbers interact.

Tracking your auto loan as part of your net worth connects your daily financial actions to your long-term goals. It turns a simple calculator into a strategic tool for accelerating your journey to financial freedom.

The Risk of Not Seeing the Whole Picture

Ignoring how your auto debt fits into your finances can have serious ripple effects. It’s not just a hypothetical problem. Delinquency rates on auto loans have been climbing, with 6.65% of subprime borrowers falling behind on payments in late 2025—a level not seen since the 1990s. As Marketplace.org reports, this trend is a direct result of high car prices and massive loans putting a strain on household budgets.

This is where your amortization calculator becomes a defensive tool. It clearly lays out how longer loan terms (now often stretching 61-72 months) mean you build equity at a snail’s pace, dramatically increasing the risk of being “underwater”—owing more than the car is worth.

By keeping a close eye on your loan balance versus your car’s depreciating value and your total net worth, you stay in the driver’s seat. You get ahead of the risks and avoid becoming just another statistic.

Common Questions About Auto Loan Amortization

Even with a great auto loan amortization calculator in your corner, questions are bound to pop up. It’s totally normal. Getting a handle on the finer points of how these loans work is key to making smarter money moves.

Let’s tackle some of the most common questions people have. Think of this as your go-to guide for a quick dose of clarity.

How Accurate Is an Online Auto Loan Amortization Calculator?

For a standard, fixed-rate car loan, they’re dead-on accurate. The math behind amortization is a universal formula, so a good calculator isn’t guessing—it’s just running the numbers.

The real question is about the accuracy of the numbers you put in. The output is only as good as the input. To get a schedule that mirrors your lender’s, you need the precise figures from your loan agreement:

- The exact loan amount you financed.

- Your official Annual Percentage Rate (APR), not just the interest rate.

- The loan term in the correct number of months (e.g., 60, not 5 years).

Nail those three details, and the calculator’s amortization schedule will be a near-perfect match to what your lender sees on their end.

What Is the Difference Between Amortization and Depreciation?

This is a big one, and it’s a concept every car owner should understand. They’re two completely different forces acting on your vehicle’s finances, and they’re always in a race against each other.

Amortization is a financial process. It’s the simple act of paying down your loan balance over time with scheduled payments.

Depreciation, however, is a market reality. It’s the unavoidable drop in your car’s resale value from things like age, mileage, and general wear and tear.

Your goal is for your loan amortization (paying it down) to happen faster than your car’s depreciation (losing its value). When you pull that off, you build equity. But if depreciation wins the race, you end up “upside-down,” owing more on the loan than the car is actually worth.

Can I Use an Amortization Calculator for a Car Lease?

Nope, you can’t. An amortization calculator is the wrong tool for the job because leases and loans are fundamentally different beasts.

A loan is straightforward: you’re paying off a principal balance until it hits zero, and then you own the car. A lease payment is calculated in a completely different way. It’s mostly based on the car’s expected depreciation during your lease term, plus a financing fee (often called a “money factor”). It’s more like a long-term rental where you’re just paying for the value the car loses while you’re driving it.

Why Is So Much of My Early Payment Going to Interest?

Welcome to the world of amortization! This is how these loans are designed to work. Your interest charge is calculated each month based on your current outstanding loan balance.

Naturally, at the very beginning of the loan, your balance is at its absolute highest. That means the amount of interest you’re charged is also at its peak.

As you keep making payments, your principal balance slowly chips away. With each payment, a little less money is needed to cover that month’s interest charge, which means a little more of your fixed payment can go toward the principal. It’s a slow-moving seesaw, but eventually, the balance tips heavily in favor of your principal. This is exactly why making extra payments early in the loan has such a powerful, outsized impact on the total interest you’ll pay over the life of the loan.

Ready to see how your auto loan fits into your complete financial picture? With PopaDex, you can track your car loan as a liability right alongside your investments and savings. Get a clear, real-time view of your net worth and make smarter decisions to accelerate your financial goals. Start tracking your finances for free today.