Our Marketing Team at PopaDex

Top 7 Best High Yield Savings Accounts for 2025

Ready to make your money work harder for you? Moving your cash from a traditional savings account, where interest rates often hover near zero, to one of the best high yield savings accounts can significantly accelerate your wealth-building journey. With today’s competitive rates, you could be earning 10, 20, or even more times the national average on your deposits, all without taking on market risk. This guide cuts through the noise to provide a direct comparison of the top options, helping you secure a much higher return on your cash reserves.

We go beyond just the advertised Annual Percentage Yield (APY). For each account, we break down the crucial details you need to know: minimum deposit requirements, monthly maintenance fees, mobile banking features, and the overall customer experience. This article provides a comprehensive review of leading online banks like Marcus, Ally, and Discover, innovative fintech platforms such as SoFi, and powerful comparison tools including NerdWallet and Bankrate. Each entry is designed for clarity, featuring screenshots and direct links to help you take action immediately.

Whether you’re building an emergency fund, saving for a down payment, or simply want a secure place for your cash to grow, finding the right account is key. As you explore top APYs, it’s also helpful to understand what a good average rate of return is on investments to see how a high-yield account fits into your broader financial strategy. By the end of this guide, you will have a clear, actionable roadmap to selecting a high-yield savings account that aligns perfectly with your financial goals, helping you reach them faster.

1. NerdWallet: Your Go-To Comparison Hub

NerdWallet isn’t a bank, but it’s an indispensable first stop for anyone searching for the best high yield savings accounts. It operates as a comprehensive financial comparison hub, consolidating offers from a wide array of online banks, traditional banks, and credit unions into a single, user-friendly interface. Its primary function is to provide a bird’s-eye view of the market, allowing you to quickly compare top contenders based on current rates and features.

The platform excels at distilling complex information into digestible formats. Its leaderboards are frequently updated with the latest Annual Percentage Yields (APYs), ensuring the data is as current as possible. This makes it an ideal tool for tech-savvy users and young professionals who want to efficiently research their options without visiting dozens of individual bank websites.

Why It Stands Out

What makes NerdWallet a powerful resource is its meticulous focus on qualification requirements. Many of the highest APYs come with specific conditions, such as maintaining a minimum balance or setting up recurring direct deposits. NerdWallet clearly outlines these hurdles for each account, preventing unwelcome surprises after you’ve signed up.

The user experience is clean and intuitive. You can filter and sort accounts based on your priorities, view side-by-side snapshots of key details, and read in-depth reviews from their editorial team. This approach empowers you to make a well-informed decision rather than simply choosing the account with the highest advertised rate.

Practical Tip: Use NerdWallet’s filters to narrow down your search. If you know you can’t meet a $5,000 minimum balance, filter those accounts out immediately to focus only on options that align with your financial situation.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| Curated “Best Of” Lists | Presents top-tier savings accounts with constantly updated APYs and clear eligibility rules. |

| Direct Application Links | Simplifies the sign-up process by providing direct links to each financial institution’s application page. |

| Editorial Reviews & Methodology | Offers detailed reviews and transparent scoring, so you understand why an account made the list. |

| Broad Market Coverage | Includes a mix of large national banks, agile online-only banks, and member-focused credit unions. |

Pros:

- Time-Stamped Rates: APYs are regularly updated (e.g., showing rates up to 4.50% as of September 2025) for timely comparisons.

- Convenience: Direct links to bank applications streamline the process from research to opening an account.

- Clarity on Hurdles: Clearly breaks down the specific actions required to earn the highest promotional APYs.

Cons:

- Partner-Focused: The lists may prioritize financial institutions that are partners, so not every available account is featured.

- Potential for Lag: While frequently updated, the fast-changing nature of APYs means rates could shift before the site reflects the change.

Website: https://www.nerdwallet.com/best/banking/high-yield-online-savings-accounts

2. Bankrate: The Daily Rate Tracker

Bankrate is a must-bookmark resource for anyone hunting for the absolute best high yield savings accounts with up-to-the-minute accuracy. Unlike platforms that update periodically, Bankrate prides itself on providing daily snapshots of the market, making it an essential tool for savers who want to capitalize on rate changes as they happen. It functions as a financial news and comparison engine, presenting its findings in clear, easy-to-scan tables.

This platform is particularly useful for freelancers, gig workers, and anyone with a lump sum ready to deposit who wants to ensure they are getting the most competitive APY available today. Its frequently updated lists often feature lesser-known or regional banks that may be offering chart-topping rates to attract new customers, providing options you might not find on other major comparison sites.

Why It Stands Out

What sets Bankrate apart is its laser focus on timeliness and transparency. Each list is clearly timestamped, giving users confidence that the APYs shown are fresh. The platform excels at highlighting the most critical data point alongside the rate: the minimum deposit required. This immediate clarity helps users quickly disqualify accounts that don’t fit their financial profile.

Bankrate’s editorial reviews dig deeper than just the numbers, covering crucial aspects like account access, fee structures, and the overall customer experience. This combination of real-time data and qualitative insight empowers savers to find an account that not only offers a high yield but also aligns with their practical banking needs. The interface is straightforward, designed for quick checks rather than deep, prolonged research sessions.

Practical Tip: Check Bankrate in the morning. Since rates can fluctuate, a quick daily check can help you spot a new top-tier APY from a bank you hadn’t considered, allowing you to act fast before the offer changes.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| Daily Updated Tables | Provides daily lists of the highest available APYs, often including a “rate update” timestamp. |

| Editorial Bank Reviews | In-depth reviews that cover fees, mobile app usability, customer service, and overall accessibility. |

| Inclusion of Niche Banks | Often features smaller, online-only, or regional banks and credit unions that offer highly competitive rates. |

| Clear Minimum Deposit Info | Highlights the minimum opening deposit next to the APY for fast, at-a-glance comparison. |

| Direct Application Links | Offers convenient links that take you directly to the bank’s website to begin the application process. |

Pros:

- Timeliness: Daily updates make it one of the most current resources for tracking APY fluctuations.

- Practical Layout: Easy-to-scan tables are perfect for quick comparisons of rates and minimums.

- Comprehensive Coverage: Reviews go beyond rates to cover crucial details like fees and fund access.

Cons:

- Rate Volatility: The daily snapshot model means a top rate today might not be there tomorrow.

- High Minimums Featured: Some of the highest advertised rates are tied to banks with steep minimum deposits ($5,000+).

Website: https://www.bankrate.com/banking/savings/

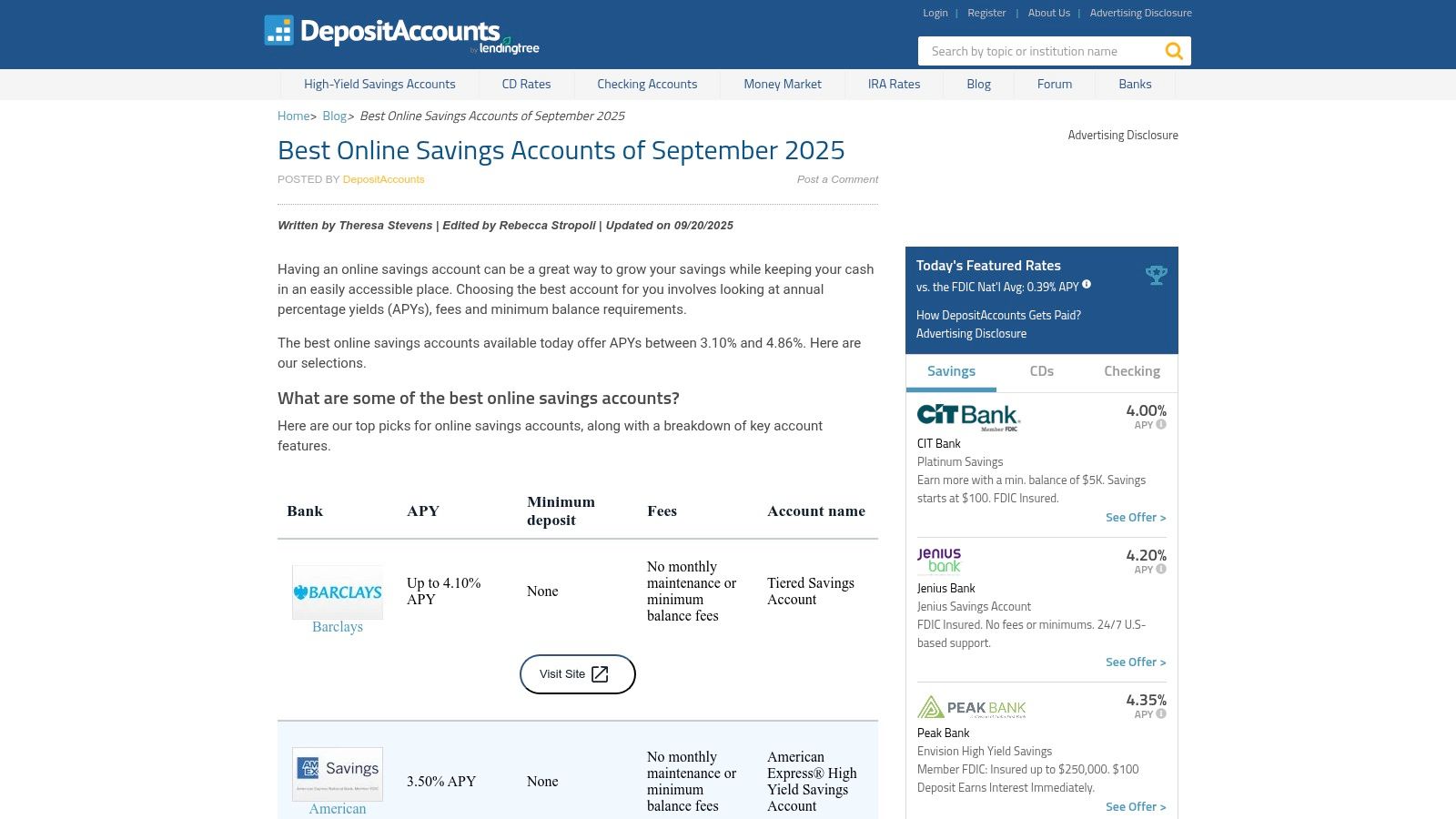

3. DepositAccounts (by LendingTree): The Rate Tracker’s Bible

DepositAccounts, a subsidiary of LendingTree, is the granular, data-driven counterpart to broader financial hubs. While other sites give you a snapshot, DepositAccounts provides a full-length documentary on the best high yield savings accounts. It specializes in meticulously tracking deposit rates across thousands of U.S. banks and credit unions, making it a haven for rate-chasers and anyone who wants to verify the very latest APY changes.

Its primary strength lies in its community-driven intelligence and historical data. Rather than just listing current rates, the platform maintains active community forums and rate-change logs, offering real-world, ground-level insights into how and when banks adjust their yields. This makes it an essential tool for savers who want to stay one step ahead of market fluctuations.

Why It Stands Out

What sets DepositAccounts apart is its depth and timeliness. The site’s “best online savings” lists are not just curated; they are supported by a community of engaged users who often report rate changes before they are widely publicized. This creates a powerful feedback loop where editorial content is constantly being cross-referenced with real-time consumer experiences, giving you a more complete picture of an account’s true value.

The platform is also exceptional at uncovering hidden gems. By tracking a vast number of institutions, including smaller, lesser-known online banks and credit unions, DepositAccounts often highlights competitive accounts that might not appear on larger, partner-focused comparison sites. This comprehensive approach ensures you are seeing a wider spectrum of the market, empowering you to find truly optimal rates.

Practical Tip: Before settling on an account, check the corresponding forum thread on DepositAccounts. Users often share tips about the application process, customer service experiences, and how quickly funds become available, providing valuable insights you won’t find on a bank’s official website.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| Community Rate Tracking | User-powered forums provide crowd-sourced updates on APY changes for major online banks. |

| Historical Rate Data | Documents past rate movements, offering context on how a bank adjusts its APY over time. |

| User Reviews & Nuances | Provides firsthand accounts of customer service, platform usability, and unique bank features. |

| Broad Institutional Coverage | Includes data from thousands of banks and credit unions, beyond just the most well-known names. |

Pros:

- Granular and Timely: Often one of the first places to reflect breaking rate changes due to its active community.

- User-Sourced Intelligence: Incorporates real-world feedback, highlighting both the pros and cons of each bank’s service.

- Extensive Database: Covers a massive number of financial institutions, increasing the odds of finding a top-tier account.

Cons:

- Data-Dense Interface: The sheer amount of information, including forum posts and tables, can feel overwhelming for new users.

- Community Lag Possible: While fast, crowd-sourced information may occasionally lag behind a bank’s official, instantaneous rate update.

Website: https://www.depositaccounts.com/blog/best-online-savings-accounts.html

4. Marcus by Goldman Sachs

Backed by one of the most recognized names in finance, Marcus by Goldman Sachs offers a streamlined and dependable online high-yield savings account. It appeals to savers who value brand reputation and a straightforward banking experience without the complexities of tiered rates or strict deposit requirements. The platform is designed for simplicity, focusing on delivering a competitive APY with no fees or minimum balance hurdles.

This no-fuss approach makes it an excellent choice for young professionals building an emergency fund or established savers who want a reliable place to park their cash. The digital interface is clean and user-friendly, ensuring that managing your savings, setting up transfers, and tracking your interest earnings is an effortless process. Marcus has solidified its place among the best high yield savings accounts by consistently offering solid rates combined with robust customer support.

Why It Stands Out

What sets Marcus apart is its commitment to transparency and accessibility. There are no monthly maintenance fees, no minimum deposit to open an account, and no ongoing balance requirements to earn the advertised APY. This removes common barriers to entry, making high-yield savings accessible to everyone. The platform also offers high transfer limits, allowing same-day transfers of up to $100,000 to or from linked external bank accounts.

Furthermore, Marcus provides 24/7 customer support, a feature not always available with online-only banks. This combination of a prestigious financial backing, a user-centric design, and powerful features creates a compelling and trustworthy option for savers who prioritize both security and performance.

Practical Tip: Use Marcus’s same-day transfer feature strategically for large transactions. If you are moving a down payment for a house or making a significant investment, the ability to transfer up to $100,000 in a single business day provides valuable liquidity and speed.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| No Fees or Minimums | Zero monthly maintenance fees, no minimum deposit to open, and no minimum balance to earn the stated APY. |

| Same-Day Transfers | Initiate transfers up to $100,000 to linked bank accounts for same-day processing if done by 12 PM ET. |

| 24/7 Customer Support | Access to live customer service representatives via phone around the clock, seven days a week. |

| FDIC Insured | Deposits are insured by the FDIC up to the maximum allowable limit, backed by Goldman Sachs. |

| Additional Savings Products | Offers a range of Certificate of Deposit (CD) options, including traditional and no-penalty CDs. |

Pros:

- Simplicity and Transparency: A straightforward account with no hidden fees or complex requirements to earn interest.

- Strong Brand Reputation: Backed by Goldman Sachs, offering a high level of trust and security.

- High Transfer Limits: Excellent flexibility for moving large sums of money quickly and efficiently.

Cons:

- APY Can Be Lower: The APY is competitive but often slightly lower than promotional rates from smaller, newer online banks.

- No Physical Branches: As an online-only bank, there is no in-person support or branch access.

Website: https://www.marcus.com/us/en/savings/high-yield-savings

5. Ally Bank: The Automation Powerhouse

Ally Bank is a leading name in the online banking space, renowned for offering one of the best high yield savings accounts for users who value both competitive rates and powerful digital tools. While it doesn’t always boast the chart-topping APY, its strength lies in a user-centric platform designed to make saving effortless and intuitive. It’s a full-service digital bank that goes beyond a simple savings account, providing a robust suite of products for a holistic financial experience.

The platform is particularly well-suited for tech-savvy savers and young professionals who want to automate their financial goals. Ally’s approach is less about chasing the highest possible rate and more about providing a stable, feature-rich environment where your money can grow consistently with minimal hands-on effort. Its seamless mobile app and 24/7 customer support make managing your money straightforward and accessible at any time.

Why It Stands Out

What truly sets Ally Bank apart are its built-in savings automation tools. Features like “buckets” allow you to digitally earmark funds for specific goals, such as an emergency fund, a vacation, or a down payment, all within a single savings account. This digital envelope system is a game-changer for anyone looking to bring structure to their savings plan without the complexity of opening multiple accounts.

Furthermore, Ally’s “Round Ups” and “Surprise Savings” features actively help you save more. Round Ups automatically transfer the spare change from your Ally checking account purchases to your savings, while Surprise Savings analyzes your linked checking account for “safe-to-save” money and moves it over for you. These smart tools help build your savings incrementally, reinforcing good financial habits.

Practical Tip: Activate the “buckets” feature immediately after opening your account. Assigning every dollar to a specific goal (e.g., “$2,000 for Car Repairs,” “$5,000 for Vacation”) provides a clear visual roadmap and makes you less likely to withdraw funds for impulse purchases.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| Savings Buckets | Organize your savings into up to 10 digital envelopes for different goals within one account. |

| Automation Tools | Includes “Round Ups” and “Surprise Savings” to automatically find and transfer extra cash to savings. |

| No Fees or Minimums | Earn the full APY with no monthly maintenance fees or minimum balance requirements to worry about. |

| 24/7 Customer Support | Access to human support via phone or online chat around the clock for any account-related questions. |

| Full Product Suite | Offers a wide range of products including checking, Money Market Accounts, CDs, and investment services. |

Pros:

- Excellent User Experience: The mobile app and website are consistently praised for being intuitive and easy to navigate.

- Powerful Savings Tools: Automated features and goal-setting buckets actively help you save more effectively. Learning how to organize finances is much easier with these tools.

- Consistently Competitive Rates: While not always the highest, Ally’s APY remains competitive and stable over time.

Cons:

- APY Can Be Beaten: Other online banks frequently offer higher APYs, sometimes by a significant margin.

- Online-Only: As a digital-first bank, it has no physical branches for in-person banking services.

Website: https://www.ally.com/bank/online-savings-account/

6. Discover Bank: A Trusted Name in Online Savings

Discover Bank is a household name, and its online high-yield savings account brings that brand recognition into the modern banking era. It offers a straightforward, fee-free savings experience, making it a compelling choice for those who value simplicity and trust. While it may not always boast the absolute highest APY on the market, it provides a competitive rate combined with excellent customer service and a user-friendly digital platform.

The platform is designed for ease of use, appealing to everyone from young professionals opening their first savings account to seasoned savers looking for a reliable place to park their cash. Discover’s commitment to a no-fee structure is a major draw; there are no monthly maintenance fees, no minimum opening deposit, and no fees for insufficient funds on savings, which provides significant peace of mind.

Why It Stands Out

What sets Discover Bank apart is its combination of a strong, recognized brand with a genuinely customer-centric online banking model. While many of the best high yield savings accounts come from newer, fintech-focused companies, Discover offers the stability and customer support infrastructure of a large financial institution. Its 24/7 U.S.-based customer service is a significant differentiator for users who want to know they can speak to a real person whenever an issue arises.

Furthermore, Discover frequently runs promotional offers for new account holders, providing a cash bonus for meeting certain deposit requirements within a specified timeframe. This can give your initial savings a substantial boost, effectively increasing your return in the first year. The mobile app and website are consistently praised for their clean design and intuitive navigation, making it easy to manage your money on the go.

Practical Tip: Keep an eye out for Discover’s new account promotions. Timing your application to coincide with a cash bonus offer (e.g., $150 for depositing $15,000) can maximize your initial earnings, making its competitive APY even more attractive.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| No Fees or Minimums | Requires no minimum deposit to open and charges no monthly maintenance fees on its savings account. |

| Occasional Signup Bonuses | Periodically offers cash bonuses, such as $150 or $200, for new customers who meet deposit thresholds. |

| Strong Digital Experience | Provides a highly-rated mobile app and an intuitive website for easy account management and transfers. |

| 24/7 Customer Support | Offers round-the-clock access to U.S.-based customer service representatives via phone. |

Pros:

- Simple, Transparent Pricing: No hidden fees for maintenance, overdrafts, or insufficient funds on your savings account.

- Trusted National Brand: High customer satisfaction scores and the backing of a well-established financial company.

- Valuable Promotional Offers: New account bonuses provide a significant upfront boost to your savings.

Cons:

- APY Can Be Mid-Tier: Its interest rate is competitive but often trails the highest rates offered by some online-only competitors.

- Limited Physical Presence: As an online-focused bank, it lacks an extensive branch network for in-person banking.

Website: https://www.discover.com/online-banking/savings-account/

7. SoFi Checking & Savings: The All-in-One Powerhouse

SoFi blurs the line between traditional banking and modern savings by offering a hybrid Checking & Savings account. This integrated approach is designed for users who want the convenience of managing their daily finances and long-term savings from a single app. SoFi’s primary draw is its competitive high-yield APY on savings balances, which is unlocked for customers who meet specific direct deposit or qualifying deposit requirements.

This platform is particularly well-suited for tech-savvy individuals and young professionals looking to streamline their financial life. It goes beyond a simple savings account by integrating features like early paycheck access, savings “Vaults” for goal-setting, and an extensive fee-free ATM network. This makes it one of the best high yield savings accounts for those who value an all-in-one ecosystem over a standalone savings product.

Why It Stands Out

What sets SoFi apart is its powerful combination of a high APY with a full suite of banking tools. While many online banks offer high rates, few match SoFi’s robust checking features and frequent promotional cash bonuses for new members. This makes the initial setup particularly rewarding and encourages users to fully commit to the platform for both their spending and saving needs.

The user experience is a major selling point. The mobile app is sleek, intuitive, and centralizes everything from tracking spending to monitoring savings goals. The terms for earning the top-tier APY are clearly stated, ensuring users understand exactly what is needed, such as setting up direct deposits totaling a certain amount each month. By linking your primary banking to your savings, you can easily automate your finances and ensure consistent growth.

Practical Tip: To maximize your earnings, ensure your direct deposits meet the minimum threshold required to unlock the highest APY. Set up recurring transfers from your checking to your savings “Vaults” on payday to make saving for specific goals effortless.

Features, Pros, and Cons

| Feature | Description |

|---|---|

| Hybrid Account Model | Combines checking and savings functionalities in a single account with one app interface. |

| APY Boost with Deposits | Offers a competitive high-yield APY on savings balances for members who set up qualifying deposits. |

| Promotional Bonuses | Frequently provides cash bonuses for new members who meet specific direct deposit milestones. |

| Savings “Vaults” | Allows users to create sub-accounts to save for specific goals, like a vacation or a down payment. |

| No-Fee Overdraft Coverage | Provides fee-free overdraft protection for eligible members, adding a layer of financial security. |

Pros:

- All-in-One Convenience: Manages spending, saving, and financial goals from a single, user-friendly platform.

- Competitive Rates: The boosted APY is highly competitive, provided you meet the direct deposit criteria.

- Valuable Bonuses: New member promotions offer a significant cash incentive to switch your banking.

Cons:

- APY is Conditional: Failing to meet the direct deposit or qualifying deposit requirements results in a much lower, standard APY.

- Not a Pure HYSA: Users who prefer to keep their savings entirely separate from their daily banking may find the hybrid model less appealing.

- Variable Terms: Promotional offers and APY requirements can change, so it’s important to review the terms carefully.

Website: https://www.sofi.com/banking/checking-and-savings/

Top 7 High Yield Savings Accounts Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| NerdWallet | Moderate – curated lists & filters | Low – web platform | Up-to-date rate comparisons | Users wanting detailed qualifying criteria | Clear qualification info, direct links |

| Bankrate | Low – daily updated tables | Low – editorial and data updates | Quick snapshot of current top rates | Quick daily rate checks | Practical tables, detailed fees info |

| DepositAccounts | Moderate – combines data & community | Medium – user reviews & forums | Granular tracking with historical context | Users valuing user experiences & detailed data | Community insights, extensive coverage |

| Marcus by Goldman Sachs | Low – straightforward product | Low – single online product | Consistent, no-fee savings experience | Users seeking simple, reliable HYSA | No minimums, high transfer limits |

| Ally Bank | Moderate – added automation tools | Medium – tech development | Improved savings with goal tracking | Savers wanting automation & user-friendly app | Automation features, broad offerings |

| Discover Bank | Low – basic online savings setup | Low – online banking platform | Simple savings with occasional bonuses | Users preferring no fees & solid support | No fees, periodic signup bonuses |

| SoFi Checking & Savings | Moderate – hybrid account setup | Medium – app features & promos | Combined checking/saving with APY boost | Users wanting all-in-one banking/saving | All-in-one accounts, boosted APY offers |

From Choosing an Account to Tracking Your Growth

Navigating the landscape of financial tools and accounts can feel overwhelming, but by now, you have a clear roadmap to making a powerful choice. We’ve explored the detailed offerings from leading comparison platforms like NerdWallet, Bankrate, and DepositAccounts, which act as your research headquarters. We’ve also delved into the specific features of top-tier institutions like Marcus by Goldman Sachs, Ally Bank, Discover Bank, and SoFi, each presenting unique advantages for different types of savers.

The journey, however, doesn’t conclude once you’ve opened an account. Making the decision to move your cash from a traditional, low-yield account into one of the best high yield savings accounts is a pivotal moment in your financial strategy. It’s the act of putting your money to work, ensuring it doesn’t lose value to inflation but instead actively contributes to your wealth. This single move can generate hundreds, or even thousands, of extra dollars over time with virtually no additional effort.

Synthesizing Your Decision: A Practical Framework

Choosing the right account isn’t about finding a single “best” option, but rather the best fit for your specific financial life. To crystalize your decision, consider these final action-oriented steps:

- Define Your Primary Goal: Are you building an emergency fund that requires immediate, penalty-free access? Or are you saving for a down payment on a house in three years? Your timeline and purpose will dictate which features matter most. For instance, a tech-savvy user who values seamless digital integration might prefer Ally or SoFi, while someone prioritizing brand trust and straightforward savings might lean toward Marcus or Discover.

- Conduct a Final Rate Check: APYs are dynamic. Use the comparison tools we discussed, like Bankrate or DepositAccounts, one last time before you apply. A rate that was competitive last month might have been surpassed by another institution. A quick final check ensures you are capturing the highest possible return at the moment you commit.

- Review the Fine Print on Fees and Access: Re-confirm the details. Are there monthly maintenance fees if your balance dips? How easy is it to transfer money in and out? Check the number of free withdrawals allowed per month and the speed of ACH transfers. These logistical details can significantly impact your day-to-day experience with the account.

Beyond the Account: The Bigger Picture of Your Financial Health

Opening a high-yield savings account is a fantastic step, but its true power is realized when you see how it accelerates your overall financial growth. Your savings are just one component of your total financial picture. To truly track your financial progress and see how your savings contribute to your overall wealth, understanding how to calculate your net worth is essential. This calculation provides the ultimate scoreboard for your financial decisions.

By regularly monitoring your net worth, you move from simply saving money to strategically building wealth. You can see precisely how the interest earned in your HYSA, combined with your investment returns and debt reduction efforts, is increasing your financial security. This holistic view is what keeps you motivated and focused on your long-term goals, whether you’re planning for retirement, saving for a child’s education, or working toward financial independence. It transforms saving from a chore into a rewarding process where you can tangibly see the positive results of your discipline and smart choices.

Ready to see how your new high-yield savings account fits into your complete financial picture? PopaDex is the all-in-one net worth tracker that brings your assets and liabilities into a single, intuitive dashboard. Stop juggling multiple logins and start visualizing your wealth grow in real-time by signing up for PopaDex today.