Our Marketing Team at PopaDex

Smart Budgeting for Young Adults: Boost Your Finances Today

Why Traditional Budgeting For Young Adults Falls Short Today

Ever get financial advice from an older relative that feels… a little out of touch? They mean well, but the classic playbook—save 20%, land a stable job, and buy a house by 30—was written for a completely different economic game. Trying to follow that old advice today can feel like showing up to a soccer match with a basketball. The rules have changed, and so has the field. A solid budgeting plan for young adults in today’s world needs a new strategy, one that acknowledges your real-world challenges instead of ignoring them.

The financial world your parents navigated looks nothing like ours. They weren’t dealing with the same gap between wage growth and inflation, nor did they face a housing market where prices seem to defy gravity. Today, many of us are juggling student loan payments that feel like a second mortgage, piecing together income from side hustles, and watching rent eat up a huge slice of our paycheck. It’s no wonder the old formulas just don’t add up.

The New Rules of Financial Success

So, how are financially smart young adults adapting? They’re rewriting what success looks like. Instead of chasing outdated milestones that feel out of reach, they’re focused on building wealth and stability in ways that actually fit their lives. This isn’t about giving up; it’s about getting creative and realistic. This shift is more than just a feeling—it’s backed by data.

A 2025 study found a strong connection between physical fitness and financial planning for those aged 18-24. It revealed that an impressive 92% of fitness-conscious young adults also stick to a financial plan. The study also highlighted that due to pressures like the cost-of-living crisis, half of Gen Z feels traditional goals like homeownership are unattainable. Because of this, 46% are putting their money toward short-term goals that bring immediate joy, like travel and new experiences. You can dive deeper into these evolving financial priorities at Experian.com.

Building a Budget for Your Reality

This modern approach to budgeting for young adults means letting go of the guilt. You’re not failing if you can’t save 20% of your income when half of it goes straight to rent. You’re not behind if your main financial goal is building an emergency fund for an unexpected car repair, not saving for a down payment.

Here’s what this new mindset looks like in practice:

- Prioritizing debt management: Making a plan to tackle high-interest student loans or credit card debt often takes center stage.

- Embracing flexible income: Your budget needs to work with the unpredictable nature of freelance or gig work, not against it.

- Focusing on lifestyle goals: Saving for a trip that enriches your life is just as valid as saving for a future you’re not even sure you want.

- Rethinking “investment”: Pouring money into new skills, a side business, or your own mental well-being is a legitimate way to build long-term wealth.

This isn’t about lowering your expectations. It’s about setting smarter, more relevant ones that empower you to build a secure and fulfilling financial life—one that makes sense for the world you actually live in.

Treating Money Management Like Self-Care

Let’s be honest: the word “budgeting” doesn’t exactly spark joy. For most of us, budgeting for young adults sounds like a chore filled with sacrifice and saying “no” to things we love. But what if we started treating our finances with the same care we give to a good workout or a quiet moment of meditation? The most financially secure people I know have figured this out—they see managing their money not as a punishment, but as a fundamental part of their self-care.

This isn’t about wishful thinking; it’s a real shift in how you see your money. When you view your budget as a tool for your well-being, it becomes less intimidating. Instead, it’s a way to make sure your spending actually aligns with what brings you peace and happiness. A purchase is no longer just a transaction; it’s a choice that either contributes to your wellness or adds a little bit of stress to your life. This simple change can turn a dreaded task into a habit that actually feels good.

From Restriction to Empowerment

Shifting from a mindset of restriction to one of financial wellness helps you build habits that stick. Why? Because it’s driven by self-respect, not just sheer willpower. This isn’t just a personal feeling; it’s a growing trend. A recent consumer survey found that 58% of young adults aged 18-35 now consider financial management part of their wellness routine. For these individuals, getting a handle on their money is an act that genuinely reduces stress, with 44% reporting better well-being since making this change. You can dive deeper into this cultural shift and its impact on personal finance at Intuit.com.

So, what does this look like in practice?

- Mindful Money Check-Ins: Forget the guilt-ridden scroll through your bank statement. Instead, set aside time for a weekly “money date.” Put on your favorite playlist, make a coffee, and calmly review where your money went. Ask yourself, “Did this spending align with my goals and make me happy?”

- Celebrate the Small Wins: Did you stick to your grocery budget this week? Or maybe you managed to put an extra $20 toward your savings goal. Acknowledge it! This positive reinforcement builds momentum and makes the entire process more enjoyable.

- Automate for Peace of Mind: Setting up automatic transfers to your savings is the financial equivalent of meal prepping. You do a little work upfront, and it buys you so much mental freedom later. If you want to make this even smoother, check out our guide on how to optimize your finances with smart strategies.

By treating your financial health as a key part of your overall well-being, you build a positive and sustainable relationship with your money. This approach makes budgeting for young adults feel less like a strict diet and more like creating a nourishing plan for your future.

Setting Financial Goals That Actually Excite You

Let’s be honest: traditional financial advice can feel a bit like a lecture. Saving for retirement or a house down payment are, of course, important. But when you’re in your twenties, those distant goals can feel abstract and completely disconnected from your day-to-day life. Real-world budgeting for young adults isn’t about forcing yourself to care about someone else’s idea of success; it’s about figuring out what you genuinely want your money to achieve for you, both today and down the road.

This means you have permission to prioritize goals that bring you happiness right now. Maybe your biggest dream isn’t a white picket fence but a three-week backpacking trip through Southeast Asia. Or perhaps it’s finally buying that pro-level camera to launch your freelance photography business. These aren’t just impulse buys; they’re life experiences and investments in your skills. The trick is to strike a healthy balance between living for today and planning for tomorrow.

To get a handle on this, it’s useful to compare the kinds of goals you might be juggling. The table below breaks down short-term, “live-in-the-moment” goals versus more traditional long-term objectives.

| Goal Type | Examples | Time Frame | Motivation Level | Success Rate |

|---|---|---|---|---|

| Short-Term (Enjoyment & Growth) | Backpacking trip, festival tickets, new laptop for a side hustle, weekend getaway | 1-12 months | High | High (quick wins) |

| Long-Term (Security & Future Self) | House down payment, retirement savings, paying off student loans, starting an investment portfolio | 5-30+ years | Low to Medium | Varies (requires sustained effort) |

As you can see, the excitement of a short-term goal often makes it easier to stick with, while long-term goals require more discipline. The key isn’t to pick one over the other but to build a financial plan that actively funds both, ensuring you’re not sacrificing your present happiness for a future you can’t yet picture.

Balancing Now vs. Later

A practical way to manage this is to create a hierarchy for your goals. Picture it as your personal financial pyramid. The bottom layer represents your essential security needs, while the very top holds those exciting “would love to have” dreams.

-

Foundation (Security): This is your non-negotiable financial safety net. It starts with building an emergency fund—first aim for $1,000, then gradually increase it to cover 3-6 months of essential living expenses. It also includes having a solid plan to tackle high-interest debt. These goals might not be glamorous, but checking them off gives you the peace of mind to chase bigger dreams without stress.

-

Mid-Term (Growth & Fun): This middle layer is where you blend practical needs with things that truly excite you. Your goals here could be saving for a reliable used car, funding a professional certification to advance your career, or planning that big international trip you’ve been dreaming of. These objectives usually have a 1-5 year timeline.

-

Long-Term (Future Self): This is where ambitions like retirement and major investments reside. You don’t need to max out your contributions from your very first paycheck. The power of compound interest is immense, so even starting small makes a huge difference. Putting just $50 a month into a retirement account gets the ball rolling and sets a powerful habit.

When you structure your goals this way, you can allocate your savings with purpose. You’re no longer stuck choosing between a fun weekend away and your 401(k). Instead, you’re consciously funding all the different parts of a full and balanced life, turning your budget from a list of restrictions into a roadmap for the life you actually want.

Expense Tracking That Fits Your Real Life

Let’s be honest for a moment: a lot of advice on tracking expenses feels like it was written for someone with way too much free time. The thought of manually logging every single $4 coffee or late-night takeout order is enough to make anyone quit before they even start. Meaningful budgeting for young adults isn’t about giving yourself a part-time data entry job; it’s about finding a sustainable way to see where your money goes without it causing a panic attack.

The reality is, perfect tracking is a fantasy. The real goal isn’t to chase down every last cent but to get a solid grasp of your main spending habits. You need a system that actually fits your lifestyle, not one you have to fight to keep up with.

Finding Your Tracking Style

The best method is simply the one you’ll actually stick with. Not everyone is built for a complex spreadsheet, and that’s completely okay. Think about what works for your personality and how you earn and spend.

- For the Hands-Off Person: If you’d rather not get bogged down in details, let technology do the work. Apps like PopaDex or your own bank’s tools can automatically sort most of your transactions. All you need to do is pop in once a week, look at the big picture, and see if anything seems out of place. No tedious manual entry is needed.

- For the Visual Learner: If you’re a more hands-on person, a modern twist on the envelope system could be for you. Instead of using physical cash, you can set up separate checking or savings accounts for different spending categories, like “Groceries,” “Fun Money,” and “Bills.” Once an account is empty, you know spending in that area is done for the month.

- For the In-Betweener: Give the “Big Rocks” method a shot. Don’t sweat the small stuff—just track spending in your top 3-4 problem areas. If you know dining out and impulse online shopping are your weak spots, focus on logging only those purchases. It’s far less overwhelming and still gives you the most crucial data.

What to Do When You Fall Off

It’s going to happen. You’ll have a chaotic week or a month where you don’t track a single purchase. The important thing is to not panic or give up. You can get back on track without feeling guilty or needing to start from zero.

Just pick up where you left off. Glance over your bank statement for the time you missed, get a general sense of where the money went, and just move forward. If you need more ideas to get back in the groove, you can learn more about how to organize your finances with our guide. Remember, consistency over perfection is what builds financial habits that actually last.

Harnessing Your Generation’s Economic Influence

It might feel like your personal budget is just a tiny piece of a massive economic puzzle, but that couldn’t be further from the truth. As a generation, young adults wield incredible economic power, and grasping this concept can completely change how you approach your finances. Your collective tastes aren’t just background noise; they actively dictate what companies produce, how they market, and even the kinds of financial services that get created. Successful budgeting for young adults isn’t about suppressing your natural inclinations—it’s about understanding and directing your own influence.

This influence is not just big; it’s rapidly expanding. By 2025, Gen Z in the U.S. will control around $360 billion in direct spending power. That number is projected to soar to an astounding $12 trillion globally by 2030. These figures are driven by unique spending patterns that are actively reshaping the market. For instance, 55.1% of your peers use “buy now, pay later” services, and 64% are happy to spend more to support brands they feel a personal connection with. Social media is also a major driver, with 58% purchasing products they discovered on these platforms. You can dive deeper into these powerful Gen Z spending trends at ExplodingTopics.com. This economic clout means your financial choices have weight, and you can learn to make them work for you, not against you.

Turning Your Habits into Advantages

Instead of viewing your generation’s spending habits as roadblocks, reframe them as assets. Your tendencies—like valuing authenticity, expecting mobile-first convenience, and backing ethical companies—can be the building blocks of a budget that feels genuinely you.

Here’s how to make that happen:

- Values-Based Spending: If you’re passionate about sustainability or social justice, weave it directly into your budget. Set aside specific funds for brands that reflect your beliefs. This transforms spending from a thoughtless action into an intentional statement, making you feel better about where your money goes and less prone to impulse buys you’ll regret later.

- Strategic Brand Loyalty: You’re already willing to pay a bit more for brands you trust, so let’s flip that into a financial benefit. Actively join loyalty programs, download brand-specific apps for exclusive discounts, and follow your favorite companies on social media for special offers. Your loyalty can become a real money-saving strategy.

- Mindful Digital Consumption: Since social media is a primary source for discovering new products, approach it with a plan. Instead of instantly clicking “buy,” create “wish lists” or save posts for later. Unfollow accounts that only push products and follow financial influencers who share smart, actionable advice. This helps you cut through the marketing noise and make deliberate choices that serve your financial goals.

To better understand how these habits play out, let’s look at some common Gen Z spending behaviors and how they connect to budgeting. The table below breaks down these trends and offers strategies to manage them effectively.

| Spending Behavior | Percentage | Budgeting Strategy | Potential Risk | How to Manage |

|---|---|---|---|---|

| Supporting value-aligned brands | 64% | Allocate a “Values” category in your budget. | Overspending on premium or niche products. | Set a firm limit for this category; research and compare brands to find affordable options that still align with your values. |

| Buying products seen on social media | 58% | Implement a 24-hour waiting period before purchasing items discovered on social media. | Impulse buying and falling for influencer marketing hype. | Create a “Wish List” and review it monthly. Unfollow accounts that trigger overspending. |

| Using “Buy Now, Pay Later” (BNPL) | 55.1% | Treat BNPL payments as fixed expenses in your monthly budget. | Accumulating multiple small debts that become unmanageable. | Limit yourself to one or two BNPL purchases at a time and track payment due dates diligently in a calendar or budgeting app. |

This data shows that your generation’s spending habits, while powerful, come with unique risks. By proactively creating strategies to manage them, you can enjoy the benefits without falling into common financial traps.

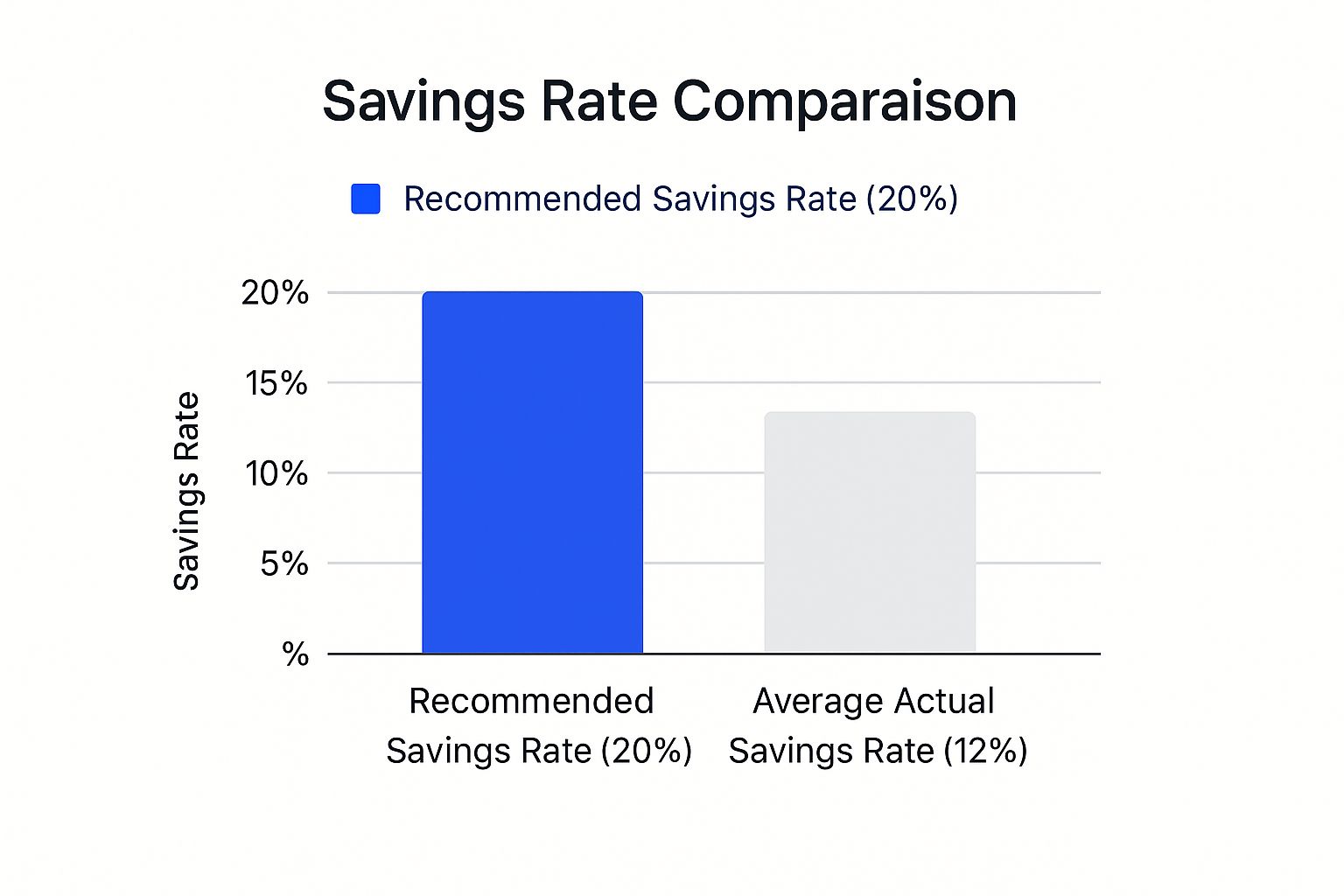

This infographic highlights the gap between the recommended savings rate and what many young adults actually manage to save.

The main takeaway here is clear: while the ideal savings rate is 20%, many people fall short. However, this gap isn’t impossible to close. By consciously aligning your powerful spending habits with your financial goals, you can take charge, turning your generation’s economic influence into a personal financial win.

The main takeaway here is clear: while the ideal savings rate is 20%, many people fall short. However, this gap isn’t impossible to close. By consciously aligning your powerful spending habits with your financial goals, you can take charge, turning your generation’s economic influence into a personal financial win.

Finding Your Perfect Budgeting Method

After tracking your spending, you have the raw data—a clear, honest look at where your money actually goes. Now it’s time to give that data a purpose with a system to manage your money moving forward. The secret to a successful budget isn’t about finding the most restrictive, iron-clad plan. It’s about finding a method that genuinely fits your lifestyle and financial habits.

Think of it like finding the right workout routine. If you despise running, a marathon training plan is doomed from the start. The same principle applies here. The “best” budget is the one you’ll actually stick with because it supports your goals without making you miserable. What works for your best friend might feel completely impractical for you, and that’s perfectly okay.

Choosing a Framework That Fits You

Your income patterns and spending habits are your best guides for picking the right approach. Are you someone who needs clear rules and thrives on structure, or do you prefer more of a flexible guideline? Let’s walk through a few popular methods with some real-world examples.

-

The 50/30/20 Rule: This is an amazing starting point, especially if you have a pretty consistent paycheck. The idea is to divide your after-tax income into three buckets: 50% goes to Needs (rent, car payment, groceries), 30% to Wants (concert tickets, eating out, that new video game), and the final 20% to Savings & Debt Repayment. It’s popular because it’s simple and provides a great sense of balance without needing to track every single penny.

-

The Envelope System (Digital Edition): Are you a visual person who finds it easy to overspend with a debit card? This classic method has a powerful modern update. Instead of using physical cash, you create digital “envelopes” by opening multiple savings accounts and nicknaming them for specific categories like “Weekend Fun,” “Groceries,” or “Vacation Fund.” Once an “envelope” is empty, that’s your cue to stop spending in that area for the month. It creates a very real, tangible limit that’s hard to ignore.

-

Zero-Based Budgeting: This approach is a game-changer for freelancers, gig workers, or anyone with an income that changes from month to month. The core idea is simple: your income minus your expenses should equal zero. Every dollar you earn gets assigned a specific job at the beginning of the month—whether it’s paying a bill, going into savings, or being allocated for spending. It’s definitely more hands-on, but it gives you incredible control and ensures no money slips through the cracks. For anyone serious about their financial journey, mastering budgeting is a crucial step toward financial freedom.

You might even find that a hybrid approach is your sweet spot. Perhaps you use the 50/30/20 rule as your general guide but apply zero-based budgeting to your side hustle income. The most important part is to experiment without any pressure. Try one method for a full month. If it feels like a chore or just isn’t working, don’t hesitate to switch things up. Your budget is a personal tool that should grow and change right along with you.

Smart Technology for Effortless Money Management

Using technology can completely change how you handle your money, turning budgeting from a dreaded task into something you just do. The right tools can automate the boring stuff, like tracking every single purchase, so you can focus on what really matters: making smart choices with your money. But remember, a tool is only as good as the person using it. The aim isn’t to find an app that runs your life for you, but one that keeps you in the loop and in control, without making things more complicated.

A common pitfall is relying too heavily on an app and developing a false sense of security. Real financial command comes from fitting a tool into your daily habits, not twisting your lifestyle to fit a rigid app. You need a platform that gives you clear insights while also fiercely protecting your personal information. When you’re picking an app, always put data privacy first and look for platforms with a solid, trustworthy reputation.

Making Technology Work for You

A fantastic tool gives you a single, clear view of your financial world without drowning you in numbers. Platforms with interactive dashboards can make understanding your net worth feel surprisingly simple and even motivating.

For example, a dashboard like this one gives you a clean, visual summary of your entire financial picture. Seeing all your assets and liabilities in one spot helps you quickly see what’s going on and track how you’re doing with your goals. It’s this kind of clarity that takes budgeting from a guessing game to a well-thought-out plan.

To get the most out of these tools, try this:

- Set up regular check-ins: Just 15 minutes a week to look over your dashboard is enough. This simple habit keeps you connected to your finances without feeling like a chore.

- Put your savings on autopilot: Use the insights from your tool to figure out a comfortable amount to save, then set up automatic transfers. This is one of the most effective ways to build wealth without thinking about it all the time.

- Always be the one in charge: Think of an app as your co-pilot, not the pilot. Use its data to guide your choices, but you always have the final say on your financial strategy.

Ready to get a handle on your finances with a tool that simplifies everything? Get a complete view of your net worth and start making smarter decisions today with PopaDex.