Our Marketing Team at PopaDex

Your Guide to a Calculator Future Value

A future value calculator does one simple, powerful thing: it shows you what your money could be worth down the road. By factoring in growth from interest or investment returns, it turns vague financial goals into real, concrete numbers. It’s the tool that builds a clear roadmap for your savings and investments.

Why Future Value Unlocks Your Financial Goals

Ever find yourself wondering what your savings might look like in 10, 20, or even 30 years? Guessing is one thing, but knowing is where the power lies. This is exactly where the concept of future value (FV) becomes one of your most important financial allies.

It’s all built on a foundational idea: the time value of money.

Put simply, a dollar today is worth more than a dollar you get in the future. Why? Because the dollar in your hand right now can be invested to earn returns, growing into a bigger pile of cash over time. A future value calculator is the tool that puts a number to that growth, giving you a clear projection of what’s possible.

The Tale of Two Savers

Let’s see how this plays out in the real world. Imagine two friends, Alex and Ben, who both want to save $20,000 for a house down payment.

- Alex starts early. He invests a lump sum of $12,000 today in an account that earns an average of 7% annually.

- Ben waits. He puts the same goal off for five years before realizing he needs to get serious about catching up.

Using a future value calculator, Alex can see his $12,000 will likely grow to over $20,800 in 8 years. He hits his goal without adding another dime. Ben, on the other hand, has less time for his money to grow and will have to contribute a lot more out of his own pocket to hit that same $20,000 target.

The only difference was time.

This simple story highlights the core lesson of financial planning: time is your most powerful asset. The earlier you start, the less money you need to contribute personally because compounding does the heavy lifting for you.

From Abstract Dreams to Concrete Plans

This principle goes beyond down payments; it applies to any long-term goal you can think of. Whether you’re planning for retirement, saving for a child’s education, or building an emergency fund, understanding future value is what shifts you from wishful thinking to strategic action. It lets you confidently answer the big questions.

Even in our high-tech world, the demand for straightforward financial tools is stronger than ever. The global calculator market, valued at USD 2.09 billion in 2025, is projected to hit USD 3.07 billion by 2032. This trend shows a persistent need for these fundamental devices in both finance and education. You can dive deeper into these market trends and their implications for financial tools.

A calculator future value is more than about crunching numbers; it’s about building a tangible roadmap. It helps you set realistic targets, see the real impact of your saving habits, and make smart decisions that line up with your biggest goals. By getting a glimpse of your financial future, you gain the clarity you need to actually build it.

Decoding the Formulas Behind Future Value

Every future value calculator, whether it’s a simple online tool or part of sophisticated financial software, runs on a handful of core mathematical principles. Once you understand these formulas, the calculator stops being a magic box and becomes a logical tool you can actually trust.

This isn’t about becoming a mathematician. It’s about grasping the “why” behind the numbers, so you can make smarter decisions with your money.

At the heart of it all are two primary formulas built for two very different situations: investing a single lump sum versus making consistent contributions over time.

The Engine of Growth: The Single Sum Formula

Imagine you get a $10,000 inheritance or a nice work bonus. You decide to invest it and let it grow without touching it for a decade. To figure out what it could be worth down the line, you’d use the future value formula for a single lump sum.

The formula is surprisingly simple: FV = PV (1 + i)ⁿ

But what do those letters actually mean for your money? Let’s take a quick look.

Future Value Formula Components Explained

Here’s a quick-reference guide to the variables you’ll see in future value calculations.

| Variable | What It Means | Example |

|---|---|---|

| FV | Future Value | The final amount your investment will grow to. This is the number you’re trying to find. |

| PV | Present Value | Your starting amount or initial investment. For our bonus, this is $10,000. |

| i | Interest Rate | The expected rate of return per period, written as a decimal. A 6% annual return is 0.06. |

| n | Number of Periods | The total number of compounding periods. For 10 years of annual growth, ‘n’ is 10. |

| PMT | Periodic Payment | The amount of each regular contribution (used in the annuity formula). For example, $500 per month. |

Plugging our numbers into the single sum formula—$10,000 (1 + 0.06)¹⁰—shows a future value of about $17,908. Your initial investment almost doubles without you adding another dime. That’s the power of compounding in action.

Building Wealth Over Time: The Annuity Formula

Now for a more familiar scenario: saving for retirement. Most of us aren’t starting with a giant pile of cash. Instead, we contribute a set amount from each paycheck. This series of regular payments is called an annuity, and it requires a slightly different formula.

The formula for the future value of an ordinary annuity is: FV = PMT [((1 + i)ⁿ - 1) / i]

The new player here is PMT, which is just the amount of each payment. Let’s say you invest $500 a month into an account that earns an average annual return of 7%.

Pro Tip: When you’re dealing with monthly contributions, you have to make sure your interest rate (‘i’) and number of periods (‘n’) match. An annual rate of 7% becomes a monthly rate of 0.0583% (0.07 / 12). A 30-year investment timeline becomes 360 months (30 * 12).

Getting these adjustments right is critical for an accurate calculation. It’s what allows the formula to account for the compounding that happens every single month, not just once a year. If you want to dive deeper into how this works, our guide to understanding compound interest breaks it all down.

Using the annuity formula, your $500 monthly contributions over 30 years could snowball into an incredible $608,823. You would have only put in $180,000 of your own money. That means over $428,000 of that final amount is pure growth.

It’s a powerful illustration of how consistent, even small, contributions can build substantial wealth when you give them enough time.

How to Calculate Future Value in Practice

Alright, let’s move past the theory. Knowing the formulas is one thing, but actually putting them to work is where you start building your financial future. We’ll walk through some real-world examples to show you how to use a future value calculator to map out tangible goals, from handling an inheritance to planning your retirement.

The goal here goes beyond getting an answer, but to understand the thinking behind the numbers. That way, you can take these methods and apply them to your own unique situation, whether you’re starting with a lump sum or making steady contributions over time.

No matter the scenario, the core ingredients are always the same: where you start (Present Value), how fast your money grows (Interest Rate), and how long you let it work its magic (Time).

This simple flow shows how these three pieces come together to determine what your money could be worth down the road.

Scenario 1: Projecting an Inheritance

Let’s say you receive an unexpected inheritance of $10,000. Instead of spending it, you decide to invest it for the long haul. Your goal is to let it grow for 20 years for a major purchase later on. You pick a simple index fund that has historically returned an average of 8% per year.

Here’s how we’d plug that into a calculator:

- Present Value (PV): $10,000

- Interest Rate (i): 8% (annually)

- Number of Periods (n): 20 (years)

- Periodic Payment (PMT): $0 (since you’re not adding anything to it)

Run those numbers, and you’ll find the future value is roughly $46,610. Your initial $10,000 more than quadrupled, without you lifting another finger. That’s the power of compounding in action over two decades.

This is a classic example of how powerful a single lump-sum investment can be when given enough time. It’s also why understanding how to calculate return on investment is just as important—it helps you gauge how effectively your money is working for you.

Scenario 2: Mapping Out a Retirement Plan

Now for a more common goal: saving for retirement. Let’s imagine you’re starting from zero but commit to contributing $500 every single month to your retirement account. Your timeline is 30 years, and you anticipate an average annual return of 7% from your investments.

This one is a bit different because we’re dealing with recurring contributions.

- Present Value (PV): $0

- Periodic Payment (PMT): $500 (per month)

- Interest Rate (i): 0.583% (that’s the 7% annual rate divided by 12 months)

- Number of Periods (n): 360 (which is 30 years multiplied by 12 months)

The result? A projected future value of a staggering $608,823. Over those 30 years, your total contribution was $180,000. The other $428,823 is pure investment growth. If you want to run your own numbers, our dedicated retirement nest egg calculator can give you a more personalized look.

This is a powerful demonstration of consistency. It proves you don’t need a massive windfall to build serious wealth. Regular, disciplined contributions are often the secret ingredient to life-changing results.

Beyond Web Calculators: Using Excel or Google Sheets

Online calculators are great for quick checks, but sometimes you need to build these calculations into a bigger financial plan, like a personal budget spreadsheet. Thankfully, both Microsoft Excel and Google Sheets have a handy built-in formula for this: the =FV function.

The syntax is pretty straightforward: =FV(rate, nper, pmt, [pv], [type])

Let’s plug our retirement scenario into that formula. In any blank cell, you’d type:

=FV(7%/12, 30*12, -500, 0, 0)

Let’s break that down:

- rate:

7%/12converts the annual rate to a monthly one. - nper:

30*12gives us the total number of monthly payments. - pmt:

-500is your monthly contribution. It’s negative because it’s cash leaving your pocket. - [pv]:

0because we started with nothing. - [type]:

0tells the formula that payments are made at the end of each period, which is standard.

Hit enter, and you’ll get the same $608,823 result, now perfectly integrated into your spreadsheet. This is a game-changer because you can create dynamic models. Tweak your monthly contribution or expected return, and you’ll instantly see how it impacts your long-term goals.

Mastering both quick online tools and more robust spreadsheet functions gives you the flexibility to calculate future value in any context, turning abstract financial goals into clear, actionable plans.

Advanced Factors That Influence Your Growth

While a standard future value calculation gives you a powerful glimpse into your potential wealth, the real world is rarely that clean. To get a projection that’s genuinely realistic, you have to account for the subtle forces that can either supercharge your growth or quietly eat away at it.

These are the details that separate a back-of-the-napkin guess from a sophisticated financial strategy. Understanding things like inflation, compounding frequency, and even currency risk is what ensures the wealth you build on paper actually translates to real-world spending power down the road.

Real vs. Nominal Returns: The Inflation Effect

Ever look at old family photos and marvel at how cheap a new car or a gallon of milk used to be? That’s inflation in action. It’s the silent thief that steadily chips away at the purchasing power of your money. A $100,000 nest egg today will buy a lot less in 20 years.

This brings us to a critical distinction every investor needs to understand:

- Nominal Return: This is the headline number. If your investment account grew by 8% this year, that’s its nominal return. Simple enough.

- Real Return: This is what really matters. It’s your nominal return minus the rate of inflation. So, if your portfolio grew by 8% but inflation was 3%, your real return—the actual increase in your buying power—is only 5%.

Ignoring inflation is one of the easiest and most common traps in financial planning. It creates a false sense of security, making you think you’re on track when, in reality, your future nest egg might not even cover your future expenses.

Pro Tip: To get a more grounded future value, run your calculations using an expected real rate of return. If you anticipate an average return of 7% and average inflation of 3%, use 4% in the calculator. This simple adjustment shows you the future value in today’s dollars, making it far easier to visualize what your lifestyle will actually look like.

Why Compounding Frequency Matters

Most of the time, we talk about returns compounding annually. But in the real world, it often happens much more frequently. Your high-yield savings account might compound daily, and stock dividends are typically reinvested quarterly. This might seem like a tiny detail, but over decades, it adds up.

Think of it like rolling a snowball down a hill. The more often you stop to pack on a bit more snow (compound the interest), the faster that snowball grows.

Let’s look at a quick example. You invest $10,000 for 10 years at a 6% annual rate.

- Compounded Annually: Your future value is $17,908.

- Compounded Monthly: Your future value is $18,194.

- Compounded Daily: Your future value is $18,220.

The difference isn’t life-altering here, but it proves the point: more frequent compounding juices your returns. When you’re using a calculator, always try to match the compounding frequency to your actual investment for the most accurate projection. To see how this works in more detail, check out our guide on how to calculate rate of return.

Multi-Currency Considerations for Global Citizens

For anyone managing international investments or planning to live abroad, there’s another layer of complexity: currency exchange rates. If you’re saving in US dollars but dream of retiring on the coast of Spain, the future value of your nest egg is at the mercy of the USD-to-EUR exchange rate when you finally cash out.

This introduces what’s known as exchange rate risk. Even if your investments do fantastically, a strengthening dollar could mean your savings convert to fewer euros, shrinking your purchasing power overseas.

A basic future value calculator can’t solve this for you, but it’s a vital factor to keep in mind. PopaDex users, who can track assets in over 30 countries, know how crucial it is to consider how currency swings might affect their global net worth.

The demand for smarter financial tools that can navigate these issues is only growing. The North American calculator market alone is projected to hit USD 124.14 million by 2025, a testament to a universal need for better planning tools. You can dig into the full research on global calculator market dynamics to learn more.

By layering these advanced considerations onto your basic future value calculations, you move beyond simple projections. You start building a financial plan that is resilient, realistic, and truly aligned with your long-term life goals.

Putting Future Value Insights to Work for You

Running the numbers is just the start. The real magic happens when you use the insights from a calculator future value to make smarter, more confident decisions with your money every day. It shifts your financial strategy from reactive to proactive, letting you weigh your options based on their actual long-term potential.

This is where you can start comparing different paths. For example, maybe you’re wondering whether to funnel extra cash into a high-yield savings account or an S&P 500 index fund. The future value projections for each, based on their wildly different expected returns, lay out the trade-off between safety and growth in black and white.

Making Big Decisions with Confidence

These calculations also drag the true cost of debt out into the open. Seeing how much a car loan will actually cost you in total interest over five years completely reframes the decision. It’s no longer just about the monthly payment.

The same logic transforms how you set retirement goals. Instead of plucking a big, round number out of thin air, you can work backward to figure out exactly how much you need to save each month to hit your target.

For really complex financial situations, professionals often use dedicated financial planning software for advisors to get even deeper analysis. But for your personal planning, the core principle is the same: good data leads to better decisions.

The most profound lesson from future value calculations is that small, consistent changes have a massive long-term impact. The choices that seem minor today are the ones that define your financial reality decades from now.

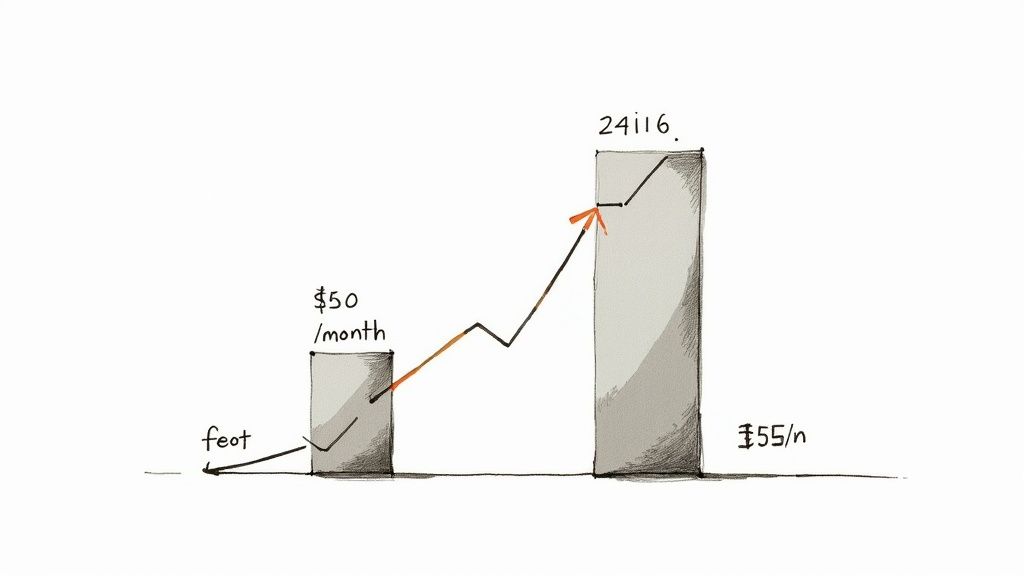

The Power of Small Adjustments

It’s incredible to see how tiny tweaks can lead to dramatically different outcomes. This is more than theory; it’s a mathematical certainty. Let’s look at how a few small changes can compound into huge sums over time.

Impact of Small Changes on Long-Term Growth

Here’s a quick comparison table showing the future value of a 30-year investment with minor adjustments. We’ll start with a baseline scenario: investing $300 per month for 30 years, earning an average annual return of 7%. This alone gets you to an impressive $362,492. But watch what happens next.

| Scenario | Monthly Contribution | Annual Return Rate | Future Value After 30 Years |

|---|---|---|---|

| Baseline | $300 | 7% | $362,492 |

| Extra Contribution | $350 | 7% | $422,907 |

| Higher Return | $300 | 8% | $451,515 |

| Combined Power | $350 | 8% | $526,768 |

The numbers don’t lie. Just adding an extra $50 per month—the cost of a few lattes and a streaming service—adds over $60,000 to your final nest egg. If you can find an investment that returns just 1% more annually, you’re looking at an extra $89,000.

But the real stunner is when you combine both. Saving a little more and finding a slightly better return gives you an extra $164,276. That kind of money wasn’t earned through a risky gamble or a sudden windfall. It was built from small, disciplined optimizations that were allowed to compound over time.

This is the actionable wisdom a future value calculator gives you. It empowers you to stop guessing and start actively steering your financial ship, proving that the small choices you make today truly build the wealth of tomorrow.

Got Questions About Future Value? We Have Answers

Even with the best calculator, it’s easy to get tangled up in the details. A few common questions pop up time and again when people start projecting their financial future. Getting these concepts straight will make your planning much more accurate and insightful.

Let’s clear up some of the most common sticking points.

Future Value vs. Present Value

This is a big one. Think of Future Value (FV) and Present Value (PV) as two sides of the same coin—they both measure the time value of money, just from opposite directions.

-

Future Value (FV) is all about looking forward. It answers the question, “If I invest $10,000 today, what will it be worth in 20 years?” This is your go-to for setting goals, like figuring out how much you’ll have for retirement or a down payment.

-

Present Value (PV) does the reverse; it looks backward from a future goal. It answers, “I need to have $500,000 in 20 years, so what’s that lump sum worth today?” PV is essential for understanding what a future payout, like from a pension, is actually worth in today’s dollars.

Bottom line: Use FV when you have the money now and want to see it grow. Use PV when you know the future number you need and want to find out its value today.

How Do I Pick a Realistic Interest Rate?

This is probably the single most important variable in your entire calculation. If you’re too optimistic, you’ll get a false sense of security. Too pessimistic, and you might feel like your goals are impossible.

There’s no magic number, but you can land on a smart, educated guess.

Start with historical averages for the assets you own. The S&P 500, for example, has returned roughly 10% per year over the long run. But for planning, it’s smarter to be more conservative. Most financial planners will dial that back to 6-7% to build in a cushion for inevitable market swings.

A good rule of thumb: always err on the side of caution. Using a slightly lower expected return builds a buffer into your plan. It makes it far more likely you’ll hit—or even beat—your target, no matter what the market does.

Don’t forget to factor in your own risk tolerance. If you’re mostly in lower-risk bonds, your expected return will naturally be much lower than someone who is all-in on stocks.

What About Taxes and Fees?

This is the detail that trips up almost everyone. Your standard online calculator doesn’t know about the taxes you’ll owe on gains or the fees your investment funds charge. Ignoring them means your final number could be way off—and not in a good way.

The pro move is to use an after-tax, after-fee return rate for your calculation.

Let’s say you expect a portfolio to return 8%. But your fund charges a 0.5% expense ratio and you’ll eventually pay a 15% tax on the gains. Suddenly, your real growth rate is closer to 6.3%.

That math can get complicated, but you can do a quick “back-of-the-napkin” adjustment. If your best guess for returns is 7%, just knock a point off and run the numbers at 6%. This one simple step gives you a much more grounded, realistic forecast of what you’ll actually get to keep.

Ready to stop guessing and start planning? The PopaDex net worth tracker consolidates all your accounts, giving you a crystal-clear view of your financial progress. See where you stand and map out your future with confidence. Start your free trial today at PopaDex.