Our Marketing Team at PopaDex

The Real Cost of Living in Italy an Expat's Guide

So, what does it really cost to live in Italy? Let’s start with the magic number.

For a single person, you’re looking at an average cost of roughly €880-€900 per month, and that’s before you even think about rent. This figure is your essential starting point, whether you’re a student prepping for a semester abroad or a professional mapping out a move.

What Is the True Cost of Living in Italy

Figuring out the cost of living in Italy is a bit like learning the unwritten rules of a new game. Once you get the basics down, you can start playing strategically and really enjoy the experience without nasty financial surprises.

Free template

Want to follow along?

Grab the free net worth tracker spreadsheet and apply these steps immediately.

That initial €880-€900 estimate for daily expenses is the foundation you’ll build your personal budget on. Think of it as the price of your daily espresso, groceries, and bus pass all rolled into one predictable monthly sum.

This average isn’t just pulled out of thin air; it reflects real consumer prices for everyday goods and services across the country. For instance, recent data from Numbeo pins a single person’s monthly costs at around €881.70 excluding rent.

Interestingly, that makes living in Italy about 9.0% cheaper than in the U.S. on average, which is a big reason it’s such an attractive option for expats.

Breaking Down the Monthly Basics

To make that average feel a bit more real, let’s break it down into core spending categories. This gives you a clear picture of where your money will go each month before you even factor in housing. It’s a crucial first step in your financial planning, helping you see how your current spending habits might translate to life in Italy.

If you’re curious how these costs stack up against your potential earnings, you might want to check out our guide on salary equivalents by country.

A well-planned budget transforms the dream of la dolce vita into an achievable reality. By understanding these foundational costs, you empower yourself to make informed decisions about where to live and how to manage your finances effectively from day one.

To give you a practical starting point, here’s a quick overview of what a single person’s average monthly expenses look like.

Average Monthly Expenses in Italy for a Single Person (Excluding Rent)

This table provides a quick overview of the estimated monthly budget for an individual living in Italy, broken down by major spending categories.

| Expense Category | Estimated Monthly Cost (€) |

|---|---|

| Groceries & Food | €300 – €450 |

| Basic Utilities (Electricity, Heating, Water) | €150 – €250 |

| Public Transportation | €35 – €50 |

| Mobile Phone & Internet | €30 – €50 |

| Health & Personal Care | €40 – €60 |

| Entertainment & Dining Out | €150 – €250 |

These figures give you an immediate and actionable baseline for your budget. They set the stage for our deeper dive into how costs can shift dramatically from the bustling north to the serene south, allowing you to start crafting a budget that truly fits your lifestyle.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert.

How Italy’s Economy Shapes Your Budget

Sure, you need to know the day-to-day costs, but to really get smart about your money in Italy, you have to zoom out. Think of it this way: knowing the price of a single tomato is useful, but understanding the entire agricultural system helps you see the bigger picture—why prices fluctuate, when to expect the best deals, and how to plan ahead. The same logic applies to Italy’s national economy.

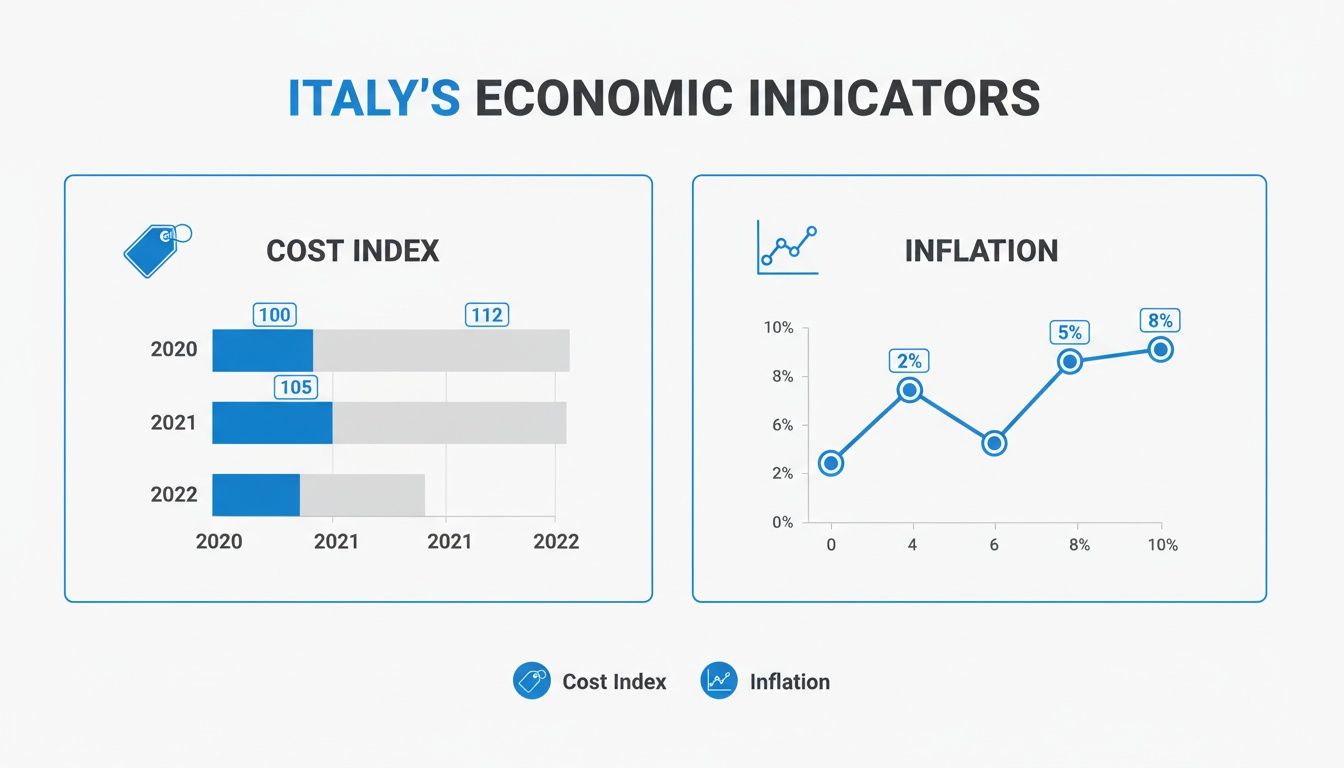

Two key numbers act as your financial weather forecast: the Cost of Living Index and the national inflation rate. These aren’t just abstract stats for economists to debate; they’re practical tools that tell the real story of the country’s affordability and stability. Getting a handle on these will help you understand why things cost what they do and let you plan your new life with a lot more confidence.

Decoding the Cost of Living Index

The Cost of Living Index is basically Italy’s price tag compared to the rest of the world. It’s a handy benchmark that rolls up the costs of goods, services, and getting around into a single score. The global average is set at 100, so a score above that means a country is more expensive, while a score below means it’s more affordable.

This index is a fantastic starting point. Before you dive into the nitty-gritty of your own budget, it gives you a quick, high-level snapshot of how Italy’s costs might stack up against what you’re used to back home.

For instance, Italy’s cost of living index was 122.59 in 2021, which pegs it as about 23% pricier than the global average. But here’s the interesting part: that number is actually down from 124.24 back in 2017. It’s a small shift, but it shows Italy has become slightly more accessible over the last few years. You can dig into more of this data by checking out the global economic trends on TheGlobalEconomy.com.

Why Inflation Matters for Your Monthly Plan

If the Cost of Living Index is the current price tag, inflation tells you how quickly that price is changing. It’s the rate at which prices for everything are rising, which, in turn, affects how far your money actually goes.

A low, stable inflation rate is a sign of a healthy, predictable economy. It means the price of your morning cappuccino or your monthly bus pass isn’t going to suddenly jump overnight. For anyone on a fixed budget—whether you’re a retiree or just starting your career—that kind of predictability is pure gold.

A stable inflation rate is your best friend when budgeting for a new life abroad. It minimizes financial surprises, allowing for more accurate long-term planning and giving you peace of mind as you manage your expenses in a new country.

When inflation is steady, the budget you create today will still make sense next month and the month after. You won’t find yourself constantly scrambling to adjust for rising costs. It’s one of those subtle but incredibly important factors that connects the huge, complex national economy directly to the balance in your bank account, making the whole process of settling into Italian life that much smoother.

Comparing Living Costs Across Italian Cities

The national average for living costs in Italy gives you a decent bird’s-eye view, but it’s like looking at a map of the whole country from 30,000 feet. To really get a feel for what you’ll spend, you have to zoom in. Italy’s financial landscape is anything but uniform—it’s a vibrant patchwork of regional economies where your budget can either stretch for miles or shrink in a heartbeat, all depending on your address.

Your choice of city is the single biggest lever you can pull to control your expenses. The classic Italian divide isn’t just about culture; it’s deeply economic. You have the industrial, fast-paced north, which generally comes with higher price tags and better salaries. Then there’s the historic, sun-drenched south, offering a more relaxed way of life and a much lower cost of living.

Think of this section as your city-by-city playbook. We’ll break down the real numbers to help you find the perfect Italian home that fits both your lifestyle and your bank account.

The North-South Economic Divide

Picture Italy as having two totally different economic personalities. Up north, cities like Milan and Bologna are the country’s powerhouses. They’re hubs for finance, tech, and fashion, which means stronger job markets and higher average incomes. But that prosperity doesn’t come cheap—rent, dining out, and even a bus pass will set you back quite a bit more. Milan, as the financial capital, often feels more like living in London or Paris when it comes to costs.

Now, head south, and the entire story changes. Cities like Palermo in Sicily or Bari in Puglia offer a lifestyle that’s far more affordable. The pace is slower and the job market isn’t as dynamic, but the trade-off is a cost of living that can be 30-50% lower than what you’d find up north. This makes the south a magnet for retirees, remote workers, or anyone whose income isn’t tied to a specific location.

The choice between north and south is a fundamental trade-off. It’s a balance between higher earning potential in the industrious north and greater purchasing power in the more affordable south. Aligning your location with your career and budget is the first step to financial success in Italy.

The graphic below shows some of the key indicators that shape these regional economic differences.

This data helps visualize how big-picture factors like the cost index and inflation rates directly squeeze or expand your personal budget from region to region.

City Showdown: Milan vs. Rome vs. Palermo

To make this comparison more than just an abstract idea, let’s put three major cities in a head-to-head matchup. We’ll look at Milan (representing the wealthy north), Rome (the sprawling central capital), and Palermo (a gem of the affordable south). This side-by-side view gives you concrete numbers for things like rent, groceries, and daily life.

To dive even deeper, you can always use a reliable cost of living comparison tool for granular details tailored to your specific needs. But for now, the table below gives a fantastic snapshot of what you can expect.

Cost of Living Comparison: Milan vs. Rome vs. Palermo

This table offers a clear, side-by-side look at key monthly expenses in Italy’s major northern, central, and southern cities. It’s designed to help you see exactly how far your money will go and choose a location that truly fits your budget.

| Expense Category | Milan (€) | Rome (€) | Palermo (€) |

|---|---|---|---|

| 1-Bedroom Apt (City Center) | €1,200 - €2,000 | €900 - €1,500 | €450 - €700 |

| Basic Utilities (85m² Apt) | €220 | €200 | €160 |

| Monthly Transport Pass | €39 | €35 | €30 |

| Meal at Inexpensive Restaurant | €20 | €15 | €12 |

| Cappuccino | €1.80 | €1.50 | €1.30 |

| Estimated Monthly Total (Single) | €2,200 - €3,000 | €1,800 - €2,500 | €1,100 - €1,600 |

The numbers don’t lie—your chosen city will absolutely dictate your budget. A professional earning a Milan-level salary could live like royalty in Palermo. On the other hand, someone with a remote work contract might find Milan a serious financial stretch.

Ultimately, getting a handle on these urban differences is the key to building a realistic and successful financial plan for your new life in Italy.

Sketching Out Your Personal Italian Budget

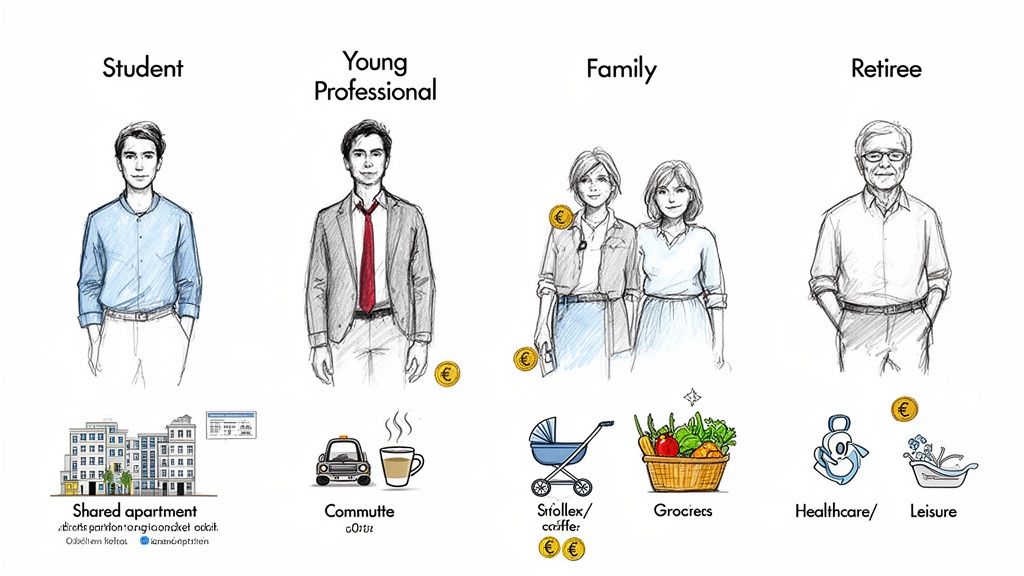

The national averages and city-by-city breakdowns give you a great starting point, but let’s be honest—the real cost of living in Italy boils down to your lifestyle. Numbers on a spreadsheet can feel a bit abstract, so we’re going to bring them to life with four different scenarios for people starting their own Italian adventure.

Think of these as templates you can borrow from. Each person—a student, a young professional, a family, and a retiree—has completely different priorities and spending habits. By seeing how their choices shape their monthly expenses, you can start building a practical plan that fits your own move.

The Student Surviving (and Thriving) in Bologna

First up is Sofia, a 21-year-old American student doing a year abroad in Bologna. Her budget is tight, and her main goal is to soak up Italian culture without racking up debt. Every euro has a job to do.

Sofia’s biggest win is her housing. She splits a three-bedroom apartment with two other students just outside the city walls, keeping her rent at a very manageable €450 a month. They split utilities three ways, which adds another €80 to her costs.

To keep her food bill down, she’s a regular at the local markets and discount grocers like Lidl, budgeting about €250 per month. Eating out is rare; she prefers the classic Italian aperitivo, where a €10 drink often comes with enough snacks to count as dinner. For getting around, she relies on a €27 monthly student bus pass and her own two feet.

- Total Monthly Budget: Roughly €950

- Top Priorities: Cheap rent, public transport, and home cooking.

- The Trade-Off: She gives up personal space and restaurant meals in exchange for weekend trips and cultural experiences.

The Young Professional Hustling in Milan

Now, meet Liam. He’s a 28-year-old software developer who just moved to Milan for a great tech job. He’s focused on balancing a demanding career with a pretty active social life, and his budget reflects both a higher salary and the premium you pay to live in Italy’s financial capital.

Liam rents a sleek one-bedroom apartment near his office for €1,300 a month. His utilities, including the all-important high-speed internet, come to about €200. He values convenience, so he spends more on groceries from nicer markets and eats out with colleagues a few times a week, putting his total food budget around €600.

He gets around on Milan’s efficient metro with a €39 monthly pass. Liam also budgets for a €50 gym membership and puts aside €300 for entertainment—that covers everything from concerts to weekend escapes to Lake Como.

- Total Monthly Budget: Around €2,489

- Top Priorities: A comfortable, well-located apartment, a buzzing social life, and personal wellness.

- The Trade-Off: He pays a premium for the convenience and excitement of living in a major city.

Seeing how these costs eat into your salary is key. Once you have an idea of your fixed expenses, you can figure out what you’ll actually have left over to save or spend. If you want to get a head start on planning your own move, you can learn how to calculate disposable income to get a much clearer financial picture.

The Family of Four Settling into Florence

Let’s check in with the Thompsons: Mark, Jessica, and their two kids, ages 6 and 9. They moved to a quiet neighborhood just outside Florence to find a better work-life balance. Their budget is bigger and way more complex, built entirely around family needs.

They rent a three-bedroom apartment for €1,500 a month to make sure everyone has enough space. With a larger home and four people, their utility bills average €300. Groceries are a huge line item at €800 a month, since they cook nearly all their meals at home.

Education is a major priority. While the kids are in the public school system, the Thompsons budget €400 for extracurriculars like soccer practice and art classes. They own a used car for school runs and family day trips, which costs them about €350 a month in fuel, insurance, and maintenance.

- Total Monthly Budget: Approximately €3,350

- Top Priorities: A spacious home, kids’ education and activities, and a reliable family car.

- The Trade-Off: Higher household costs mean less room for spontaneous spending and a much bigger need for careful long-term planning.

The Retiree Enjoying the Slow Life in Puglia

Finally, there’s David, a 67-year-old retiree who picked a charming small town in Puglia for its relaxed vibe and incredibly low cost of living. His budget is funded by his pension and savings, and his whole focus is on a comfortable, peaceful retirement.

David bought a small two-bedroom house, so he’s rent-free. He does, however, budget €200 a month for property taxes, home insurance, and general upkeep. His utility costs are low, hovering around €150. He loves cooking with fresh local produce, keeping his grocery bill to about €350.

While Italy’s national healthcare system covers his needs, he pays €150 a month for private insurance for extra peace of mind. David spends his days gardening, meeting friends at the local piazza, and taking short trips, setting aside €300 for leisure. And remember, relocation has its own set of one-time expenses—if you’re bringing a pet, for example, you’ll need to research specific pet transportation costs.

- Total Monthly Budget: Around €1,150

- Top Priorities: Health, hobbies, and home maintenance.

- The Trade-Off: He lives in a more rural, less-connected area, but in return, his daily expenses are drastically lower.

Managing Your Finances as an Expat in Italy

Moving to Italy is about more than just finding the best pasta spot and mastering the art of the aperitivo. It requires a real, practical game plan for your money. Getting the financial nuts and bolts sorted out early is the secret to a smooth landing, letting you focus on enjoying la dolce vita instead of stressing over bank accounts and bills.

Think of it as laying the groundwork for your new life. You’ll need to tackle a few key tasks head-on, from opening an Italian bank account to getting your head around the local tax system. We’ll walk through the essentials to help you sidestep the common financial traps expats fall into and settle in with total confidence.

Setting Up Your Financial Foundation

One of your first big money moves will be opening an Italian bank account, known locally as a conto corrente. This is non-negotiable for getting paid, paying rent and utilities, and just making daily life a whole lot easier. Big names like Intesa Sanpaolo and UniCredit are everywhere, but don’t overlook online banks—they’re gaining ground with lower fees and solid English-language support.

To get an account opened, you’ll generally need a few key documents:

- Your passport or another valid ID.

- Your Italian tax code, the codice fiscale. This is a unique ID number you’ll need for practically everything, from signing a lease to getting a phone plan.

- Proof of your address, which can be a bit of a catch-22 for newcomers. A signed rental contract usually does the trick.

Once your account is up and running, you have to get money into it. This is where navigating currency exchange becomes a critical skill. Whatever you do, avoid exchanging big piles of cash at the airport—the rates are famously terrible. A much smarter move is to use a specialized currency transfer service that offers far better exchange rates and lower fees than your old bank back home. That one decision can literally save you hundreds of euros right off the bat.

The image below, from the PopaDex homepage, shows how a modern financial tool can give you a unified view of your assets, even when they’re spread across different countries and currencies.

Having a tool like this gives you a clear, consolidated picture of your financial health, which is a lifesaver when you’re juggling money in both your home currency and Euros.

Understanding Taxes and Healthcare

The Italian tax system can look intimidating from the outside, but the core idea is pretty simple. Personal income tax, called IRPEF (Imposta sul reddito delle persone fisiche), works on a progressive scale. In short, the more you earn, the higher the tax rate you pay. Those rates generally run from 23% up to 43%.

Don’t let the paperwork spook you. Getting a handle on IRPEF and the SSN isn’t just about staying compliant; it’s about unlocking the benefits of the Italian system and making sure your financial life here is stable and secure.

Next up is healthcare. Italy has a public healthcare system, the Servizio Sanitario Nazionale (SSN), that provides low-cost or even free care to residents. If you’re a legal resident, you’ll typically be required to register. While the public system is surprisingly comprehensive, many expats also opt for private health insurance. It can mean faster access to specialists and the peace of mind that comes with having English-speaking services readily available.

For a much deeper dive into the specifics, check out our guide on financial planning for expats, which is packed with more detailed strategies.

Everyday Money-Saving Tips from Locals

The easiest way to adjust to the local cost of living is to start thinking like a local. Italians are masters of smart spending, and you can be, too.

Start at the supermarket. Sign up for a tessera fedeltà (loyalty card) at stores like Coop or Esselunga. They offer some serious discounts and rack up points you can cash in for free groceries. You should also hunt for the best mobile phone plans from providers like Iliad or Ho Mobile. They offer huge data packages for as little as €7-€10 a month, a fraction of what you might be used to paying.

Got More Questions About Living in Italy?

Even with the best budget in hand, a few lingering questions always pop up when you’re planning a move abroad. It’s totally normal. Think of this section as our final sit-down, where we tackle the common “what ifs” that might be on your mind.

Let’s get you those last few answers so you can finalize your financial plans with confidence.

How Much Money Do You Need to Live Comfortably in Italy?

This is the golden question, isn’t it? While “comfortable” means different things to different people, a solid benchmark for a single person is somewhere between €1,700 and €2,500 per month, and that includes rent. That’s the range where you’re not just scraping by, but actually enjoying the good life.

Of course, your address is the biggest variable. In a major city like Milan or Rome, you’ll definitely be leaning toward the higher end of that scale. But head to a smaller city or down south, and you could live very well on the lower end, with plenty left over for regular dinners out and weekend getaways.

Can I Live in Italy on $1000 a Month?

Let’s be direct: living on $1,000 (which is roughly €920) a month is not realistic for most people. It’s incredibly tight, especially once you factor in rent and utilities. While you might just barely survive in a tiny, remote village in the south by living an extremely frugal life, it would be a constant struggle, not a comfortable existence.

A budget that small leaves zero room for error. No unexpected expenses, no healthcare costs, no travel, and certainly no entertainment. It falls far short of what you’d need to cover the essentials in almost any part of the country.

Which Part of Italy Is the Cheapest to Live In?

For the best value, look south. The southern regions of Italy, known as the Mezzogiorno, are hands-down the most affordable places to live. We’re talking about places like Sicily, Calabria, Basilicata, and Puglia, where the cost of living is significantly lower than in the north and central regions.

Cities like Palermo, Bari, and Catania are great examples. You’ll find that housing costs, in particular, can be up to 50% cheaper than in a powerhouse like Milan. This makes the south a fantastic option for retirees, remote workers, or anyone who wants to make their money go further.

On a broader note, Italy has managed its inflation well, keeping prices relatively stable. As of late 2025, the country’s inflation was a gentle 1.2%, well under the European Central Bank’s target. This financial predictability is a huge plus for anyone planning a move. You can dig into more of the data on Italian economic trends on Trading Economics.

Ready to get a crystal-clear picture of your financial life, no matter where you are? PopaDex helps you track your entire net worth—from Italian bank accounts to investments back home—all in one simple dashboard. Start managing your money with confidence by visiting https://popadex.com to sign up for free.