Our Marketing Team at PopaDex

Cross Border Financial Planning: Master Your Global Wealth

Understanding Cross-Border Financial Planning From the Ground Up

Imagine conducting an orchestra where each musician speaks a different language and follows a different score. That’s kind of what cross-border financial planning feels like. It’s about coordinating your financial strategy across multiple countries, each with its own set of rules and rhythms.

This goes beyond moving money between nations. It’s about understanding how different financial systems interact. Think of a tech executive moving from Silicon Valley to Singapore – their entire wealth strategy needs to adapt. Or consider a retiree in Florida managing income streams from properties across three continents.

Both situations demand a deep understanding of global finance. Currency fluctuations, for example, can significantly impact your portfolio – either boosting your returns or eroding them. Knowing how to manage these fluctuations is key.

Free to start

Ready to track your net worth?

Connect your accounts and see your complete financial picture in under 2 minutes.

This screenshot from Investopedia shows how interconnected global markets are. What happens in one market can ripple through others, highlighting the need for a global perspective when planning your finances.

The increasing globalization of financial markets adds another layer of complexity. Resources like the Cross-Border Financial Market Monitor, using data from sources like Morningstar and Envestnet Tamarac, provide crucial insights for cross-border investment decisions. Staying informed is essential. You can learn more about these market dynamics here.

Why Cross-Border Planning Matters, Even For You

Cross-border planning is no longer just for the wealthy. Even middle-class families can benefit. Think about the growing trend of international real estate investment, foreign pensions from working abroad, or inheriting assets in another country. These situations are becoming more and more common.

This means understanding the basics of cross-border financial planning – like tax implications and currency exchange – is becoming crucial for a wider range of people. For instance, a family owning property in Spain needs to understand different tax laws and exchange rates when managing rental income or selling the property.

Taking the First Step

Cross-border planning may seem complicated, but breaking it down into smaller steps makes it manageable.

-

Identify your needs: Are you moving abroad? Investing in foreign markets? Managing inherited assets? Clearly defining your objectives is the first step.

-

Research: Once you know your needs, research the regulations, tax implications, and investment strategies that apply to your specific situation.

Taking a proactive approach will empower you to make informed decisions and confidently navigate the complexities of cross-border finance.

Why Cross Border Wealth Planning Became Essential Overnight

Remember the days of phoning your broker to buy international stocks? That old-school approach to “global” investing feels almost quaint now. Today’s wealth flows freely across borders. Families operate more and more like multinational corporations, with income streams, investments, and even debts scattered around the world. This fundamental shift demands a new approach: cross border financial planning.

The Rise of Global Citizens

This is no longer just a concern for the super-rich. Thanks to remote work, international business ventures, and increasingly globalized lifestyles, even middle-class families grapple with managing multiple currencies. Think of a freelancer earning dollars while living in Bali, or a retiree splitting time between Paris and Florida. Effectively managing finances across borders is no longer a luxury—it’s a necessity. Resources like this guide to Living In France can be invaluable for those considering a move abroad.

This growing complexity is mirrored in a recent shift within the family office world. A survey conducted between November 2024 and March 2025 by AlTi Tiedemann Global, partnering with Campden Wealth, illuminated this trend. Gathering data from 146 family offices across North America, Europe, and Asia Pacific, the report revealed a surge in demand for strategies to manage complex financial operations across various regions. You can explore these insights further here.

To illustrate the increasing globalization of wealth management, let’s look at some regional data:

The following table shows the regional breakdown of family office expansion and cross-border wealth management adoption rates.

| Region | Family Offices Surveyed | Cross-Border Activities | Growth Rate |

|---|---|---|---|

| North America | 55 | Increased diversification into emerging markets, focus on tax optimization strategies | 12% |

| Europe | 48 | Emphasis on ESG investing across borders, navigating complex regulatory changes | 8% |

| Asia Pacific | 43 | Significant growth in cross-border real estate investments, succession planning for global assets | 15% |

As you can see, each region presents its own set of opportunities and challenges in the cross-border wealth management landscape. The overall trend, however, points towards a significant increase in activity and the need for specialized planning.

Operational Excellence: The New Competitive Edge

Simply possessing wealth isn’t enough in today’s interconnected world. The families who truly prosper are those who embrace operational excellence in their financial planning. They’re not just reacting to global shifts; they’re proactively positioning themselves to benefit.

This means:

- Understanding the intricacies of international tax treaties

- Optimizing cash flow across different currencies

- Successfully navigating complex regulatory environments

Imagine a family with businesses in both the US and the UK. Smart cross border financial planning could allow them to leverage tax treaties, minimizing their overall tax burden and freeing up capital for reinvestment.

Next-Generation Demands

Next-generation wealth holders are also driving significant change. Digitally native and globally mobile, they demand more sophisticated financial approaches. They’re not content with outdated, domestically-focused strategies. They require dynamic solutions that reflect their globalized lives.

This demand is pushing the financial industry forward, spurring innovation in areas like digital payment systems, multi-currency investment platforms, and automated portfolio management tools.

All of this underscores a crucial shift: cross border financial planning isn’t a niche concern anymore. It’s the new reality for anyone with international connections, financial interests, or global ambitions. And for families aiming to build lasting wealth, it’s no longer optional – it’s absolutely essential.

Cracking the Code on International Tax Treaties and Compliance

Imagine international tax regulations as a giant, constantly shifting jigsaw puzzle. This isn’t about memorizing every piece, but understanding how the pieces fit together to create a clear financial picture. For example, a London-based American entrepreneur, by understanding the US-UK tax treaty, was able to strategically optimize their investments, saving over $50,000 each year in unnecessary taxes. This demonstrates the potential of smart cross-border financial planning.

Navigating Tax Treaties and Double Taxation

Think of international tax treaties as agreements between countries to avoid taxing the same income twice. It’s like establishing a common set of rules about how each country will tax income earned by residents of the other country. This prevents you, as the taxpayer, from being hit with double taxation. These treaties can offer great benefits, like lower withholding tax rates on things like dividends or interest. The key is understanding the fine print of each specific treaty.

Understanding FATCA and CRS Reporting

Beyond tax treaties, there’s also the world of reporting requirements, primarily FATCA (Foreign Account Tax Compliance Act) and CRS (Common Reporting Standard). Imagine these as global initiatives designed to shine a light on tax evasion and promote transparency. They essentially require financial institutions around the world to report information about accounts held by foreign citizens to the appropriate tax authorities. While they might seem complex, understanding these rules helps you steer clear of penalties and maintain financial transparency.

This screenshot from the OECD website illustrates the global reach of automatic information exchange under CRS. It really highlights how interconnected tax authorities are worldwide, and why compliance is so vital in cross-border financial planning.

Knowing how financial information flows between countries empowers you to manage your reporting obligations proactively and avoid any compliance headaches. For instance, dealing with immigration cases within cross-border planning often involves mountains of paperwork, sometimes requiring specialized immigration case management software.

Avoiding Common Compliance Pitfalls

Even seasoned investors can stumble over common compliance pitfalls. These can include anything from neglecting to report foreign accounts to misinterpreting tax treaties. This is where meticulous documentation becomes your best friend. Keeping thorough records of your international financial activities isn’t just about ticking the compliance box; it’s about putting yourself in a position to seize opportunities that others might miss.

Key International Tax Treaties and Reporting Requirements

To help visualize the complexities involved, let’s take a look at a comparison of a few key tax treaties and their associated reporting requirements. This table highlights the differences and similarities across several jurisdictions.

| Countries | Tax Treaty Benefits | Reporting Requirements | Key Deadlines |

|---|---|---|---|

| US - UK | Reduced withholding tax on dividends and interest; avoidance of double taxation on certain types of income | FATCA, CRS | Varies depending on income type; typically April 15 for US taxes |

| US - Canada | Similar benefits to US-UK treaty, including reduced withholding tax and double taxation avoidance | FATCA, CRS | Varies depending on income type; typically April 30 for Canadian taxes |

| France - Germany | Avoidance of double taxation on various income streams; specific provisions for cross-border workers | CRS, EU Savings Directive (prior to CRS) | Varies depending on income type; generally May 31 for French taxes and July 31 for German taxes |

As this table shows, while there are overarching similarities like the implementation of CRS, the specifics of each treaty and reporting deadlines vary considerably. Therefore, careful research and planning are essential for successful cross-border financial management.

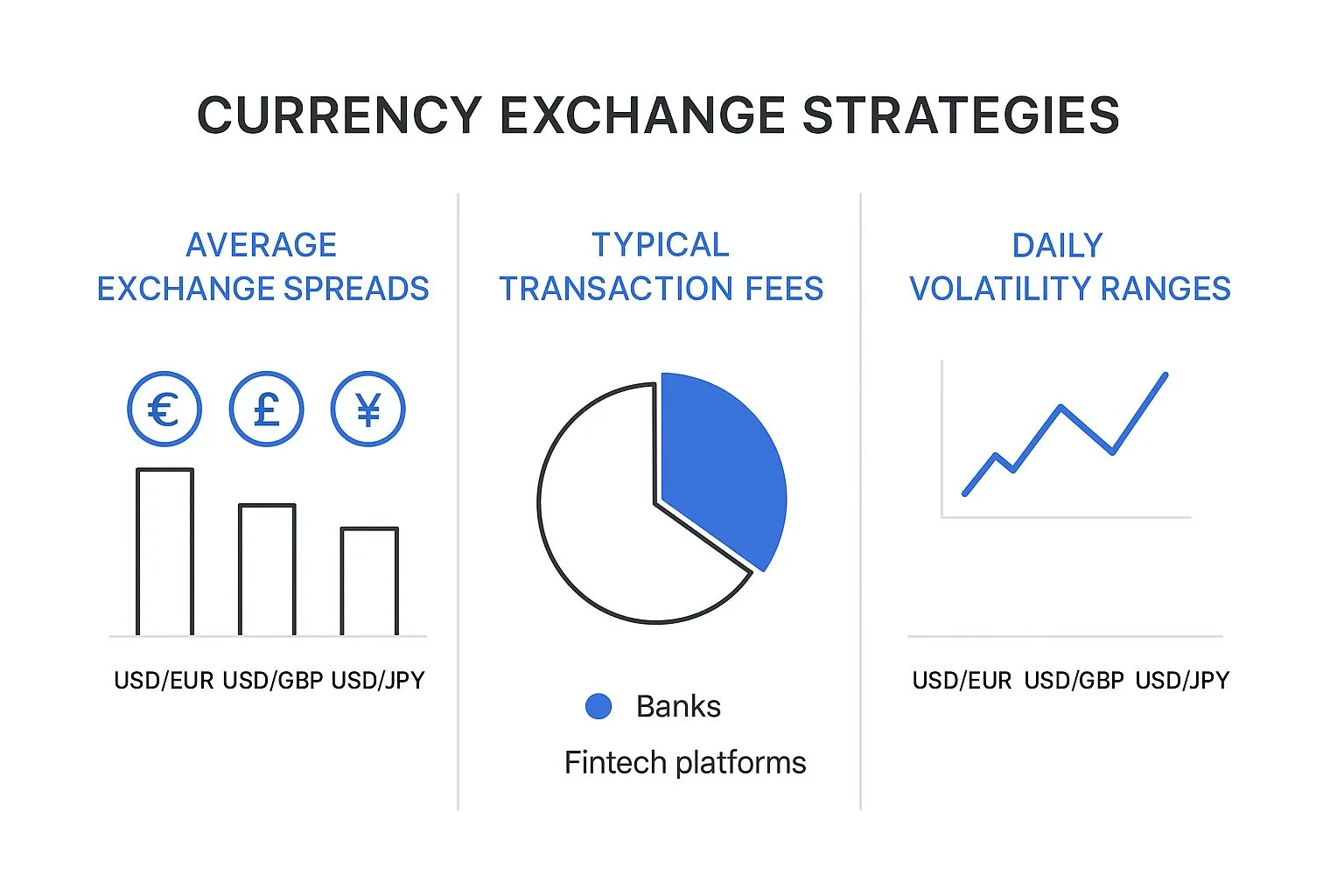

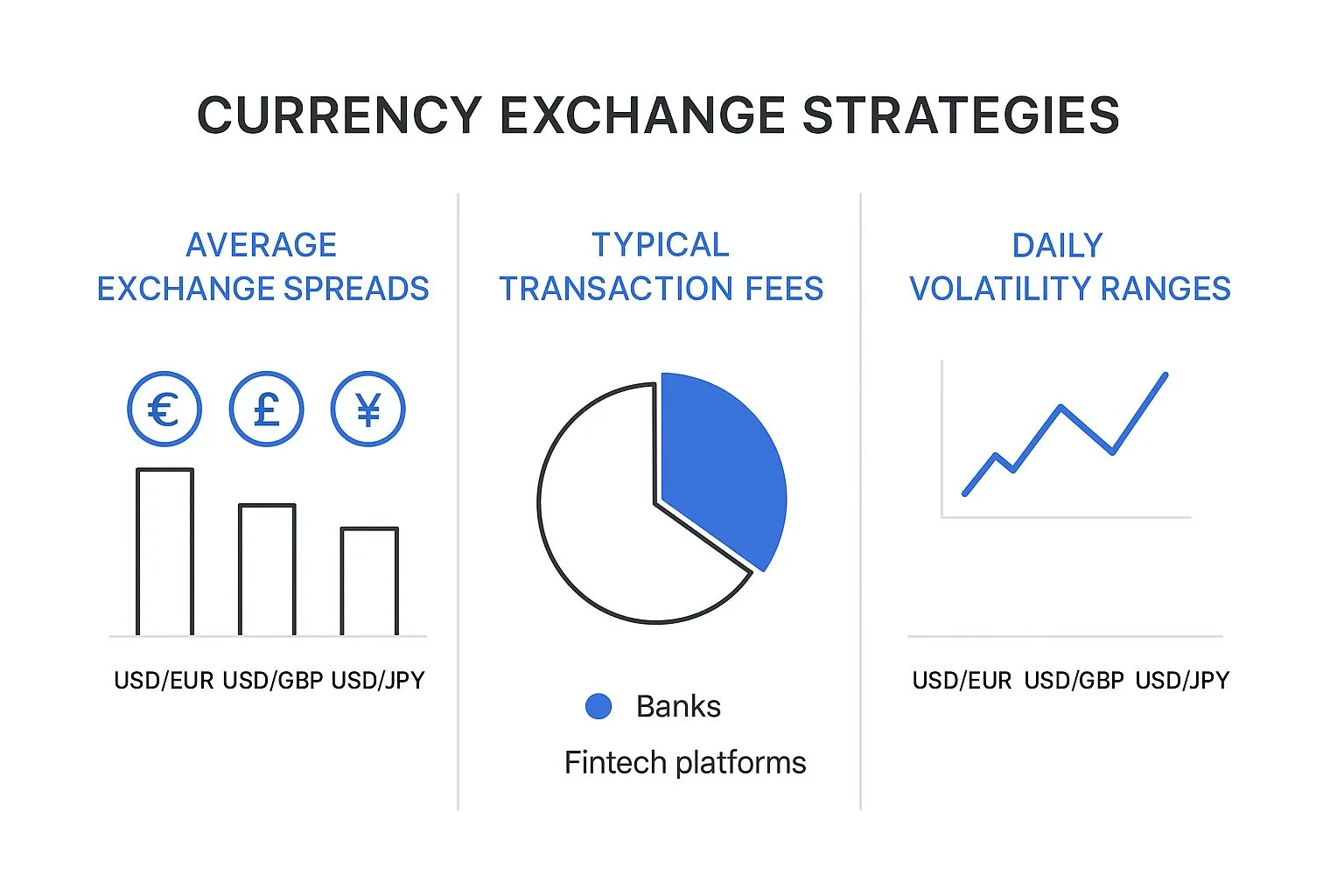

This infographic visualizes some key data related to currency exchange strategies. It shows things like average spreads (USD/EUR, USD/GBP, USD/JPY), transaction fees (banks vs. fintechs), and daily volatility ranges.

As the infographic demonstrates, choosing the right currency and platform can significantly affect your transaction costs and potential returns. Fintech platforms frequently offer lower fees and tighter spreads than traditional banks, highlighting the importance of exploring all your options. For those interested in forecasting and financial planning, Popadex offers helpful tools and information. You might find it helpful to read more about scenario forecasting and financial planning.

Building a Robust Compliance Strategy

A winning cross-border financial plan hinges on a robust compliance strategy. This involves understanding the relevant tax treaties, meeting all reporting requirements, and keeping meticulous records. By tackling these elements head-on, you not only minimize risk, but also set the stage for growth and financial success in the international arena. This proactive approach will lay the groundwork for effectively managing multi-currency strategies, which we’ll cover next.

Mastering Multi-Currency Strategies Like a Pro

This screenshot from XE.com shows a real-time currency converter. These tools provide up-to-the-minute exchange rates, crucial for smart decisions when moving money across borders. Staying informed about these changes can significantly impact your cross-border financial planning.

Managing multiple currencies can sometimes feel overwhelming, like juggling many balls at once. But with the right approach, this complexity becomes a major advantage. Instead of a headache, it becomes a powerful tool in your financial arsenal.

Natural Hedging: A Built-In Shock Absorber

Think of natural hedging like this: imagine a business owner earning income in Euros and paying expenses in US dollars. If the Euro weakens, their income in dollars decreases, but so do their dollar-denominated expenses. It’s a built-in balance, a natural buffer against currency swings.

Synthetic Hedging: Locking in Rates

Beyond natural hedges, we have synthetic hedging using financial instruments. These aren’t as complicated as they sound. For example, with a forward contract, you lock in an exchange rate for a future transaction. This offers certainty, especially for large payments or international business deals.

Timing is Key: Riding the Currency Waves

The timing of your currency conversions matters too. Understanding costs like those associated with work visas is crucial. For instance, check out the: UK Work Visa Cost. Converting currencies at the right moment can significantly impact your bottom line. This might involve keeping an eye on economic news and anticipating market shifts – like catching a wave at the perfect moment.

Diversification: Spreading the Risk

Diversifying your money across currencies isn’t about adding risk. Think of it like diversifying your investments. Holding assets in various currencies acts as a cushion. If one currency falters, others might stay strong or even gain value, offsetting potential losses.

Managing Your Everyday Multi-Currency Flow

Practical steps are just as important. Choosing the right international bank accounts is key. Some banks specialize in multi-currency transactions, offering lower fees and better exchange rates. Optimizing the timing and cost of wire transfers is also vital. Even small differences in fees accumulate, especially with frequent transfers.

Paying attention to these details, from hedging strategies to managing your daily cash flow, allows you to truly master multi-currency management. By understanding these principles, you transform currency complexity from a challenge into a powerful tool for financial success.

How Technology Is Revolutionizing Cross-Border Payments

Remember the days of sending international mail? Weeks of waiting, hefty fees… Cross-border payments used to feel much the same. But just as email replaced snail mail, technology is transforming how money moves across borders. Transactions that once took ages and cost a fortune now happen in minutes, for much less. This is having a huge impact on how we plan our finances internationally.

The Rise of Digital Payment Systems

Digital payment systems are making international finance accessible to everyone. Sending money abroad used to be a complicated dance involving banks and paperwork. Now, countless platforms offer near-instant transfers. This easy movement of money has big implications for people and businesses involved in cross-border financial planning.

This shift is reflected in the market’s booming growth. The global cross-border payments market was worth USD 190.2 billion in 2023. It’s expected to reach $392.01 billion by 2033, growing at a 7.5% compound annual growth rate (CAGR). This surge is driven by the rise of digital currencies and expanding global trade. Learn more about this impressive growth here.

Central Bank Digital Currencies (CBDCs) and Blockchain

One of the most significant changes is the arrival of Central Bank Digital Currencies (CBDCs). Imagine governments settling transactions directly with each other using digital versions of their currencies – that’s the promise of CBDCs. This could simplify government-to-government payments and potentially reduce the need for middlemen, reshaping the core of international finance.

Blockchain technology is also slashing costs and processing times. Since blockchain transactions are verified by a network, not a central authority, they’re faster and more secure. This increased efficiency is a game-changer for cross-border financial planning, creating new ways to manage international transactions.

Fintech and AI: Disrupting The Status Quo

Fintech solutions are challenging traditional banks, offering fresh approaches to cross-border transactions. These platforms often have lower fees, faster processing, and more transparency. This competition spurs innovation, ultimately benefiting consumers dealing with international finance. You might find PopaDex’s financial data aggregation capabilities interesting.

Artificial intelligence (AI) is further optimizing currency exchange and predicting market trends. AI algorithms analyze huge amounts of data to find the best exchange rates and anticipate currency swings, helping investors make smarter choices. This enhances cross-border financial planning strategies.

This goes beyond speedier payments. It’s a fundamental shift in how we manage money across borders. These technological advances open up new doors for individuals and businesses navigating the complex world of global finance. This isn’t a small upgrade; it’s a complete transformation, making international finance more efficient and accessible than ever before.

Building Your Cross Border Financial Dream Team

Imagine building your dream house. You have a fantastic blueprint, but without the right builders, it stays just a drawing. Cross-border financial planning is similar. A solid plan is essential, but you need the right team and tools to bring it to life. This section focuses on assembling the right professionals and resources to make your international financial vision a reality.

The Power of Platforms and Integration

Managing finances across borders can feel like juggling multiple currencies and regulations. Technology, especially platforms like PopaDex, provides a central hub to simplify this complexity. Think of it as your global financial command center. These platforms integrate with traditional financial services, streamlining tasks like managing multi-currency portfolios and keeping track of international tax obligations.

This screenshot from PopaDex shows a multi-currency dashboard. Imagine seeing all your accounts, no matter the currency or location, displayed in one clear view. This consolidated perspective simplifies managing a complex, global portfolio. Interested in learning more about asset optimization tools? Check out this resource: Learning More About Optimizing Your Assets.

Digital Tools vs. Human Expertise: Finding the Right Balance

While automated tools like robo-advisors excel at tasks like rebalancing multi-currency portfolios, they can’t replace expert human advice. Think of it like using a GPS – it gets you there, but a local guide can reveal hidden gems you’d otherwise miss. Similarly, a financial advisor specializing in cross-border planning offers personalized strategies and guidance tailored to your specific situation.

Assembling Your Advisory A-Team

Your cross-border financial dream team should include professionals with genuine global expertise. This includes:

- Specialized CPAs: Look for CPAs deeply familiar with international tax treaties and reporting requirements.

- International Estate Planning Attorneys: Ensure your estate plan considers the laws of every country where you hold assets or reside.

- Investment Advisors with Global Expertise: Choose an advisor with a proven track record in managing multi-currency portfolios and navigating international markets.

Don’t be swayed by marketing hype. Ask for concrete examples of their cross-border experience and client success stories.

Red Flags and Checklists: Avoiding Costly Mistakes

Learning from others’ missteps can save you time and money. Here are some red flags to watch out for:

- “Experts” in Everything: True expertise lies in specialization. Be wary of anyone claiming to handle all aspects of cross-border planning alone.

- Lack of Transparency: Clear communication is crucial. Your advisor should explain complex topics clearly, not hide behind jargon.

- Overreliance on Automation: While technology is helpful, it should support, not replace, human expertise.

- Ignoring Individual Needs: Your financial plan should be tailored to your unique goals and circumstances, not a generic solution.

By carefully selecting your team, using the right technology, and being aware of potential pitfalls, you can transform cross-border financial planning from a daunting challenge into a manageable and rewarding journey toward achieving your global financial goals.

Real Success Stories: Learning From Cross-Border Champions

Sometimes, the best way to grasp a new concept is by looking at real-world examples. Let’s dive into some stories of people who’ve successfully navigated the complexities of cross-border financial planning. These aren’t just made-up scenarios; these are real people who’ve tackled real challenges and found clever solutions.

From Mumbai to Toronto: A Tech Founder’s Journey

Imagine a tech startup founder moving their entire financial life from Mumbai to Toronto. This wasn’t simply transferring money; it was like rebuilding their financial world in a new country. They had to think about everything from opening new bank accounts and setting up investment structures to understanding different tax laws and regulations. Through careful planning and expert guidance, they optimized their tax efficiency, kept their business running smoothly, and ensured a seamless transition for their family. This story shows how vital a proactive and strategic approach is to cross-border financial planning, especially during major life changes.

Global Retirement: An Executive Couple’s Story

Now, picture a retired executive couple who created sustainable income streams across three countries: the US, Portugal, and Thailand. They essentially turned their international lifestyle into a financial asset. By strategically diversifying their assets and income across multiple locations, they minimized their tax burden and capitalized on investment opportunities in each country. Their story demonstrates how smart cross-border planning can help you achieve financial freedom and enjoy a global lifestyle without sacrificing security. Think of it as building a diversified investment portfolio, but on a global scale.

The Digital Nomad: A Portfolio Without Borders

Consider the experience of a digital nomad with a truly global investment portfolio. They managed to stay perfectly tax compliant across six different countries, proving that global mobility doesn’t have to equal tax nightmares. This individual used technology and expert advice to stay organized and compliant, even while constantly traveling. This highlights the importance of digital tools and specialized knowledge when dealing with international tax laws. It shows that even a highly mobile lifestyle can be compatible with sound financial planning.

Cautionary Tales: Learning From Mistakes

Of course, not every story is a success. It’s crucial to also learn from those who’ve stumbled. Think about the investor who didn’t properly report foreign accounts, leading to hefty penalties. Or the entrepreneur who misunderstood the tax implications of a cross-border business deal and ended up with unexpected costs. These stories emphasize the importance of expert advice and thorough planning. They underscore the fact that even small mistakes in cross-border finance can have significant consequences. Learning from these errors can help you avoid similar pitfalls.

By studying both the successes and the mistakes of others, we gain invaluable insights into the practical strategies that can shape our own financial success. Each story offers a unique perspective and practical lessons you can adapt to your own situation. This real-world application of cross-border financial planning principles is what truly empowers you to achieve your global financial goals.

Ready to take charge of your global finances? Start your journey with PopaDex today!