Our Marketing Team at PopaDex

A Guide to Digital Wealth Management Platforms

Digital wealth management platforms are sophisticated software tools designed to bring your entire financial world into one place. Think of them as your personal financial command center, replacing that clunky old system of juggling spreadsheets, bank logins, and investment statements with one intuitive dashboard showing your total net worth.

From Financial Chaos to Digital Clarity

Imagine trying to drive across the country using a dozen different paper maps. One shows the highways, another has the local roads, and a third points out gas stations. That’s how most people still manage their finances—scattered across different accounts, institutions, and asset classes. It’s confusing, incredibly time-consuming, and makes seeing the big picture almost impossible.

This is the exact problem digital wealth management platforms were built to solve. They act as a central hub, pulling all your disconnected financial data into one secure spot. Instead of logging into five different apps and three websites, you get a real-time, consolidated view of everything you own and everything you owe.

Your Personal Financial Co-Pilot

The best way to think about these platforms is as your financial co-pilot. You’re still in the driver’s seat making the decisions, but the platform is handling all the complex navigational tasks, feeding you critical data and insights right when you need them.

A good co-pilot manages the complex systems so the pilot can focus on flying. In the same way, a wealth platform:

- Automates Data Collection: It syncs automatically with your bank accounts, investment portfolios, and even pulls in property value estimates, so you can finally ditch the manual data entry.

- Provides Real-Time Insights: It shows your net worth, asset allocation, and performance in real-time. You always know exactly where you stand, down to the last dollar.

- Simplifies Complex Analysis: It turns raw financial data into easy-to-read charts and reports. This helps you spot trends and opportunities without needing a degree in finance.

By taking over these tedious tasks, these tools free you up to focus on what actually matters—making smart decisions to grow your wealth.

A digital wealth management platform replaces financial fragmentation with a single, clear dashboard. It makes sophisticated financial strategies accessible to everyone, not just large institutions, by solving the fundamental problems of complexity and a lack of clarity.

This move from manual tracking to automated aggregation is a huge leap forward in personal finance. The main goal is to give you unprecedented clarity and control, turning what was once an overwhelming chore into a manageable, even empowering, experience. For anyone serious about building and managing their wealth, these platforms are no longer a nice-to-have; they’re a modern necessity.

The Rise of Modern WealthTech Solutions

The move to digital wealth management platforms is more than some passing fad; it’s a deep-rooted shift in how we handle our money. Think about how streaming services made DVD collections obsolete or how online shopping changed retail forever. WealthTech is simply the financial world’s response to this new reality. The days of waiting for quarterly paper statements and scheduling stuffy in-person meetings are numbered.

This whole transformation is being driven by a generation of investors who grew up expecting slick, seamless digital experiences in every part of their lives. Why should their finances be any different? They want to check their portfolio on their phone while waiting for a coffee, not wait for a scheduled call back from an advisor.

A New Generation of Investors Demands More

Today’s investors, especially millennials and Gen X, have a completely different playbook for managing their wealth. They’ve seen massive market swings and the rise of digital-first giants, so they naturally value control, data, and instant access. Opaque fee structures and taking a passive role in their own financial story just doesn’t fly anymore.

This demand for a digital-first relationship is forcing the entire industry to adapt. It’s no longer good enough for a financial firm to just have a website. To stay in the game, they have to offer a powerful, interactive, and genuinely useful digital wealth management platform.

The numbers tell the same story. The global wealth management platform market is on track to hit USD 11.68 billion by 2030—that’s a huge jump from its 2025 estimate of USD 6.06 billion. This growth is a direct result of investors wanting seamless access to their finances, whether they’re on a phone, tablet, or laptop. You can dig into more insights from a comprehensive market analysis about the future of wealth platforms.

This explosive growth goes beyond what people want; it’s also about what’s now possible. The technology to deliver these sophisticated experiences is more accessible and powerful than ever, lighting a fire under innovation across the industry.

The Unstoppable Push for Greater Efficiency

It’s not just about keeping clients happy. There’s also a massive internal push within the financial industry to get more efficient. Traditional wealth management is famously clunky and labor-intensive, bogged down by manual data entry, tedious compliance checks, and reports that take forever to generate. These old-school processes are not only expensive but are a breeding ground for human error.

Modern digital wealth management platforms tackle these headaches head-on with automation. By using technologies like artificial intelligence (AI) and machine learning, firms can put a huge range of tasks on autopilot.

Here’s where that automation is really making a difference:

- Automated Client Onboarding: Forget taking days to set up an account. AI-powered tools can verify identities and process documents in minutes, making for a great first impression.

- Intelligent Portfolio Analysis: Machine learning algorithms can chew through mountains of market data, spotting risks and opportunities much faster than any human analyst ever could.

- Streamlined Reporting: These platforms can whip up customized, in-depth financial reports automatically. This frees up advisors to spend less time on paperwork and more time on high-level strategy with their clients.

This drive for efficiency is a classic win-win. Financial firms cut their operational costs and can help more clients, better. Meanwhile, clients get faster service, deeper insights, and a more responsive, data-backed approach to managing their money. It’s this powerful combo of changing client demands and new technology that has made these platforms absolutely essential.

What Makes a Great Wealth Platform Tick?

It’s one thing to understand why you need a digital wealth platform, but it’s another to know what it should actually do. The best ones are far more than just pretty dashboards; they’re powerful engines built on a foundation of non-negotiable features. These are the core capabilities that separate a simple financial app from a true wealth management command center.

At the heart of any great platform is the ability to see everything in one place. This goes beyond convenience—it’s about making smart decisions based on the complete picture of your financial health, not just isolated snapshots.

Below, we break down these essential features and why they matter to you, whether you’re an individual investor trying to get organized or a family office managing complex, global assets.

Essential Platform Features and Their User Benefits

This table outlines the must-have features of any modern wealth management platform and explains the real-world value each one delivers.

| Feature | Description | Primary Benefit |

|---|---|---|

| Asset Aggregation | Automatically pulls data from all your financial accounts—banks, investments, property—into one view. | Get a real-time, accurate snapshot of your total net worth without manual updates or spreadsheets. |

| Third-Party Integrations | Connects seamlessly with other tools you use, like banking apps, brokerage firms, or CRM software. | Eliminates data silos, automates updates, and ensures consistency across your entire financial toolkit. |

| Advanced Analytics | Transforms raw data into clear charts, reports, and actionable insights on performance and allocation. | Understand the story behind your numbers, spot trends, and make informed decisions instead of guessing. |

| Multi-Currency Support | Automatically converts assets held in different currencies into a single, consolidated base currency. | Provides a true picture of your global net worth, essential for expats and international investors. |

| Enterprise-Grade Security | Employs multi-layered security like bank-level encryption, MFA, and read-only access to protect data. | Gives you peace of mind that your sensitive financial information is safe from unauthorized access. |

These features aren’t just bells and whistles; they are the fundamental building blocks of a platform that can genuinely simplify and empower your financial life.

1. Comprehensive Asset Aggregation

This is the big one. Think of comprehensive asset aggregation as the platform’s central nervous system. It connects all your separate financial accounts—checking, savings, investment portfolios, retirement funds, even property value estimates—and pulls all that data into a single, unified view.

Without this, you’re stuck manually updating spreadsheets, which is the exact headache these platforms are meant to solve. Solid aggregation gives you an accurate, real-time snapshot of your net worth, the true starting point for smart wealth management. You can dive deeper into how this works in our guide to https://popadex.com/financial-data-aggregation/.

2. Seamless Third-Party Integrations

Hand-in-hand with aggregation is the ability to connect with a whole ecosystem of other tools. Modern financial life is complicated, and your wealth platform needs to play well with others. This means having reliable connections to:

- Banking Institutions: Direct links to thousands of banks for automatic transaction and balance updates.

- Brokerage Firms: Syncing with investment accounts to track performance, holdings, and trades in real time.

- CRM Software: For financial advisors, this is crucial for piping client financial data directly into their relationship management systems.

- Planning Tools: Connections to budgeting apps or tax software to keep data consistent everywhere.

These integrations are the bridges that let data flow freely and automatically, wiping out data silos and ensuring you’re always working with the latest information.

3. Advanced Analytics and Reporting

Raw data is just noise. Actionable insights are what drive progress. Top-tier platforms are brilliant at turning complex financial data into clear, intuitive charts and reports. They don’t just show you account balances; they help you understand the story behind the numbers.

A huge part of wealth management is portfolio analysis. To get a feel for what’s possible, you can learn about various portfolio analysis tools and the different capabilities out there.

Good analytics let you dissect your asset allocation, track performance against benchmarks, and spot trends in your spending or saving. It’s the difference between having a box of ingredients and having a recipe—analytics give you the instructions to make smart financial moves.

4. Multi-Currency Support

If you’re an expat, a global investor, or anyone holding assets in different countries, multi-currency support is an absolute must. A platform that can’t handle different currencies will give you a dangerously incomplete and inaccurate view of your true net worth.

The best systems automatically convert your foreign assets into your home currency, giving you a consolidated total that reflects your actual global financial position. This feature is vital for navigating the complexities of international finance and making decisions that account for exchange rate swings.

5. Enterprise-Grade Security

Let’s be clear: none of these other features matter if your data isn’t locked down tight. Given the incredibly sensitive nature of this information, enterprise-grade security is non-negotiable. This goes way beyond a simple password.

Leading platforms use a multi-layered security strategy, including:

- Bank-Level Encryption: Using protocols like AES-256 to scramble your data, both when it’s moving and when it’s stored.

- Multi-Factor Authentication (MFA): Requiring a second proof of identity to make sure it’s really you logging in.

- Read-Only Access: When linking accounts, the platform should only get permission to view your data, never to move money or make changes.

- Regular Security Audits: Constant testing by outside experts to find and fix any potential weak spots.

The demand for these secure, all-in-one tools is exploding. The global wealth management platform market was valued at around USD 5.5 billion in 2024 and is projected to hit USD 14.0 billion by 2033—a compound annual growth rate of 10.88%. This isn’t a fad; it’s a fundamental shift in how people manage their wealth.

Exploring the Different Flavors of Wealth Platforms

Stepping into the world of digital wealth management can feel a lot like walking into a massive car dealership. You’ve got your zippy two-seaters, your rugged off-roaders, and those big, comfortable family sedans. They all get you from A to B, sure, but they’re built for entirely different journeys. It’s the same with wealth platforms—they aren’t one-size-fits-all. Each is engineered for a specific kind of investor and a unique set of financial goals.

The market is blowing up to meet this demand. The global wealth management platform space is expected to rocket from USD 6.72 billion in 2025 to USD 17.88 billion by 2032, driven by a massive shift toward digital-first financial tools. This is more than a fleeting trend; it’s a clear signal that people want specialized platforms that give them more control and efficiency over their money.

Getting a handle on the main categories is the first step to finding the right fit for your financial life. Let’s break down the three primary types you’ll come across.

Robo-Advisors: The Automated Investor

Think of a Robo-Advisor as the self-driving car of the investment world. You plug in your destination—your financial goals and how much risk you’re comfortable with—and it uses algorithms to build and manage a diversified portfolio for you. The whole process is completely hands-off.

These platforms are a dream for passive investors who want a low-cost, set-it-and-forget-it approach. They generally use a mix of exchange-traded funds (ETFs) and automatically handle things like rebalancing your portfolio to keep it on track with your goals.

- Ideal User: Beginners, passive investors, or anyone who wants a simple, automated investment solution without the high fees.

- Common Use Case: Building a retirement fund or saving for a long-term goal with minimal day-to-day fuss.

- Pricing Model: Usually a small percentage of your assets under management (AUM), often somewhere between 0.25% and 0.50% per year.

Hybrid Platforms: Blending Tech with a Human Touch

Hybrid platforms are all about giving you the best of both worlds. They fuse the slick automation of a robo-advisor with access to actual human financial advisors. It’s like having a top-of-the-line GPS that also comes with a live expert you can call when you hit a tricky intersection.

This model is perfect for investors who are comfortable with technology but still want the option to talk to a professional for big life decisions, like planning an estate or figuring out what to do during a crazy market downturn. That human element adds a layer of personalized advice that an algorithm just can’t replicate.

Hybrid solutions neatly bridge the gap between pure automation and traditional advisory services. They offer a balanced approach for investors who value both tech-driven convenience and expert human insight.

This blended approach is gaining a lot of traction, especially among people who need more than just basic portfolio management.

All-in-One Solutions: Your Financial Command Center

Finally, you have the All-in-One Solutions. These are the most comprehensive platforms out there, built to be a complete command center for your entire financial life. They go way beyond just managing investments.

These platforms are designed for high-net-worth individuals (HNWIs), family offices, or anyone with a complicated financial picture that includes multiple asset classes, global investments, and complex ownership structures. They pull everything together—from public stocks and private equity to real estate and crypto—into a single, holistic dashboard.

- Ideal User: High-net-worth individuals, family offices, and investors with complex, multi-asset portfolios.

- Common Use Case: Getting a consolidated, real-time view of your total net worth to make strategic moves across every part of your financial life.

- Pricing Model: Often a flat monthly or annual subscription fee, since their value comes from providing a complete financial overview, not just managing assets.

As you explore these platforms, you’ll also find specialized tools designed for very specific jobs. For instance, a stablecoin yield aggregator is a niche platform built to squeeze the best possible returns out of stablecoin holdings—a great example of a tool for a very particular strategy.

If you’re looking for a wider view of the top players, check out our guide on the best wealth management apps available today. Ultimately, picking the right type of platform comes down to how complex your finances are and just how hands-on you want to be.

How to Choose the Right Platform for Your Needs

Picking the right digital wealth management platform isn’t about finding the “best” one on the market. It’s about finding the best one for you. The decision comes down to your personal financial goals, how complex your assets are, and frankly, how hands-on you want to be.

Rushing this choice often leads to paying for features you’ll never touch or, worse, ending up with a tool that you quickly outgrow.

Think of it like buying a car. A zippy sports car is a thrill, but it’s completely impractical for a family of five. An SUV might be overkill if you just need to get around the city. In the same way, your unique financial situation dictates which platform will actually serve you best. The key is to get crystal clear on your own needs before you even glance at a feature list.

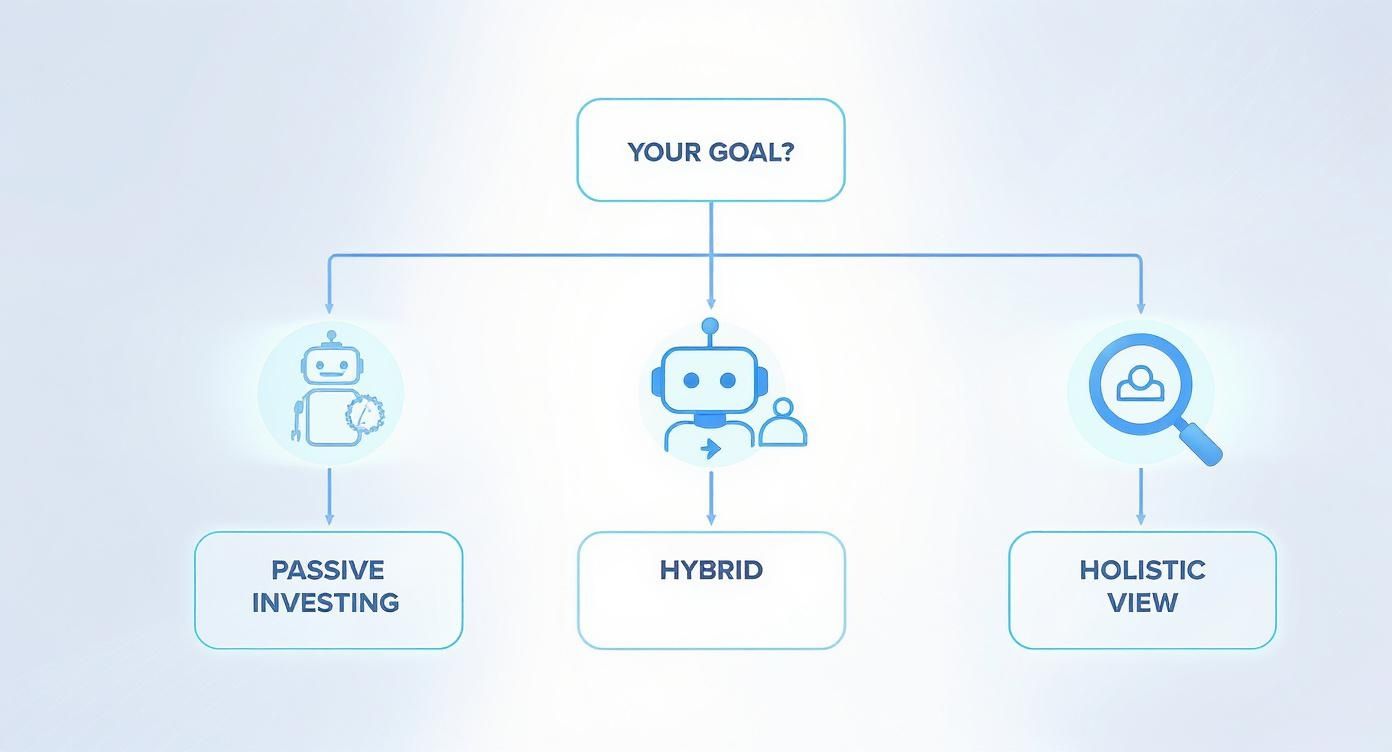

This decision tree can give you a quick visual on which path might be a good starting point, based on what you’re trying to achieve.

As you can see, your primary goal—whether it’s passive investing, getting a bit of expert advice, or seeing the complete picture of your wealth—points you toward a specific type of platform.

Create Your Personal Selection Checklist

To make a choice you feel good about, you need a simple set of criteria. It’s easy to get distracted by flashy marketing, so focus on the core fundamentals that will shape your experience and long-term success. A methodical approach ensures you cover all your bases and can compare different options on an even playing field.

Here are the essential factors to put on your checklist:

- Breadth of Integrations: Can the platform connect to all of your accounts? We’re talking international banks, brokerage firms, crypto wallets, and retirement plans. A tool with limited connections will always leave you with an incomplete, and therefore inaccurate, picture.

- Fee Structure Transparency: Is the pricing model dead simple to understand? Look for platforms that are upfront about their costs, whether it’s a flat subscription or a percentage of your assets. Hidden fees are notorious for quietly eating away at your returns.

- Security Protocols: Does it have the essentials like bank-level encryption, multi-factor authentication (MFA), and read-only access for linked accounts? Your financial data is incredibly sensitive, so non-negotiable, enterprise-grade security is an absolute must.

- User Experience (UX): Is the interface actually pleasant to use? A clunky, confusing dashboard just creates more work. You want a clean design that makes complex information feel simple and actionable.

- Customer Support Quality: What happens when you hit a snag? See if you can get access to a responsive human via email, chat, or phone—not just a generic FAQ page that leaves you hanging.

The Critical Shift to a Net-Worth-First Approach

This might be the single most important factor to consider: what is the platform’s core philosophy? For decades, wealth management has been stuck in an “investment-first” mindset. This old-school approach focuses almost entirely on your investment portfolio, treating everything else—your cash, your house, your debts—as an afterthought. It’s like a doctor only checking your blood pressure while ignoring the rest of your health.

A modern, net-worth-first approach provides a more complete and accurate picture of your financial health. It helps you make decisions based on your total wealth, not just one piece of it.

This shift in perspective is a game-changer. A net-worth-first platform gets that a decision in one area of your life creates ripple effects everywhere else. For instance, deciding to sell some stock (an investment move) is often directly tied to needing cash for a down payment on a house (an asset and liability decision).

Platforms built on this philosophy give you the holistic view required for real strategic planning. By seeing all your assets and liabilities in one place, you can spot opportunities and risks you’d otherwise miss entirely. This complete view empowers you to manage your entire financial world with clarity and confidence, moving far beyond the narrow focus on just one part of the puzzle.

Getting Started with Your New Platform

You’ve picked your platform. That’s a huge step, but the real journey starts now. The true power of a digital wealth management tool goes beyond owning it—it’s weaving it into the fabric of your financial life until it becomes your command center.

Getting set up might look like a big task, but it really boils down to feeding the system the right information. This is the crucial first move that allows the platform to give you that clean, consolidated view of your net worth you’ve been searching for. The sooner you get it done, the faster you can get to the good stuff.

Your Four-Step Onboarding Plan

Getting everything connected and running smoothly can be broken down into four simple steps. Think of it as a checklist to make sure you don’t miss anything and can start using the platform’s best features from day one.

- Gather Your Financial Docs: Before you even log in, get all your account details in one place. We’re talking logins for your bank accounts, brokerage platforms, retirement plans, and any mortgage or loan providers. Having this stack ready to go makes the whole process a breeze.

- Securely Link Your Accounts: This is where the magic happens. The platform will guide you to connect your various financial institutions using secure, encrypted links. Most tools today use trusted services like Plaid for this, which means your actual login details are never stored by the platform itself. If you’re curious about the tech behind it, seeing how Plaid is added to an app offers a great look under the hood at the security involved.

- Customize Your Dashboard: Once the data starts flowing, it’s time to make the dashboard your own. Drag and drop widgets, and set up your reports to put the numbers that matter most to you front and center. Maybe that’s your total net worth, your investment performance, or just your monthly cash flow.

- Set Up Alerts and Goals: Don’t just be a passive observer of your finances—make your data work for you. Create custom alerts that ping you about big balance changes, market shifts, or when you’re getting close to a savings goal. This turns the platform into a proactive partner, keeping you on track without you having to constantly check in.

From Setup to Lasting Control

Once you’re set up, the game changes from onboarding to habit-building. That first complete net worth report you generate is often a real eye-opener. It gives you a clear baseline, a starting point from which you can measure every bit of progress.

Onboarding isn’t just about plugging in numbers; it’s about starting a new habit of financial clarity. The goal is to get so comfortable that checking your financial picture feels as natural as checking your email.

By putting in a bit of effort at the beginning to get everything connected and personalized, you’re not just setting up software. You’re giving yourself a powerful tool for long-term financial control and confidence. That initial time investment pays off every single day with the real-time insights you need to navigate your financial world.

Frequently Asked Questions

When you start digging into the world of digital wealth management, a few big questions always pop up—usually about security, cost, and what these tools actually do. Getting straight answers is a must before you hand over access to your sensitive financial data.

Let’s tackle the most common ones so you can move forward with confidence.

Are Digital Wealth Management Platforms Secure?

This is the big one, and for good reason. Any platform worth its salt treats security like Fort Knox. They don’t just have one lock on the door; they use multiple, overlapping layers of protection to keep your information safe.

Here’s what that typically looks like in practice:

- Bank-Level Encryption: Your data is scrambled with heavy-duty protocols like AES-256, making it completely unreadable to anyone who shouldn’t have access.

- Read-Only Access: When you link your accounts, the platform gets a “look but don’t touch” permission. It can see your balances and transactions, but it has zero ability to move money or make trades on your behalf.

- Multi-Factor Authentication (MFA): This adds a crucial second step to logging in, like a code sent to your phone. It’s a simple but powerful way to ensure you’re the only one getting into your account.

The gold standard in the industry is to never store your actual bank login details on their servers. Instead, platforms use trusted services that create a secure, encrypted “token” for data access. It’s a critical extra layer of security that separates your credentials from the platform itself.

How Much Do These Platforms Cost?

The price tags on these platforms can vary quite a bit, so it’s smart to find a model that fits your needs and budget. You’ll generally run into two main approaches.

First, there’s the Assets Under Management (AUM) fee. This is common with robo-advisors. You pay a small percentage of the total assets they’re actively managing for you.

The other model is a simple flat subscription fee. You’ll see this with all-in-one net worth trackers that focus on giving you a complete picture of your finances, rather than managing investments directly. This is usually a fixed monthly or annual cost.

Ready to see your entire financial world in one place, with crystal clarity? PopaDex gives you a powerful, net-worth-first view of your wealth by bringing all your accounts into a single, intuitive dashboard. Start tracking your progress for free and take control of your financial future today.