Our Marketing Team at PopaDex

A Guide to Smarter Expat Banking

If you’ve ever felt the sting of a surprise wire transfer fee or the headache of trying to pay rent in one currency while your salary lands in another, you already know the limitations of a standard bank account. Life abroad is complicated enough without your finances adding to the stress.

This is where the concept of expat banking comes into play. Think of it less like a specific type of account and more like a financial toolkit, built from the ground up for people who live, work, and spend across borders.

What Is Expat Banking and Why Does It Matter?

At its core, expat banking is designed to solve the unique financial puzzles that pop up when you’re no longer living in your home country. Your bank back home is great for local stuff, but it wasn’t built for a global lifestyle. The moment you need to handle multiple currencies, you’ll find that a domestic account quickly becomes a bottleneck of high fees and frustrating delays.

Specialized expat banking services step in to bridge that gap. They exist to make the financial systems of different countries talk to each other smoothly, making your money just as mobile as you are.

Domestic vs. Expat Banking At a Glance

To see the difference clearly, let’s break down how a typical bank compares to one designed for expats. The contrast is pretty stark once you see it side-by-side.

| Feature | Domestic Banking | Expat Banking |

|---|---|---|

| Primary Focus | Local transactions in one country | Cross-border, multi-currency finance |

| Currency Management | Single-currency accounts | Multi-currency accounts (hold, send, receive) |

| International Transfers | Often slow and expensive | Typically faster with lower, more transparent fees |

| Credit History | Contained within one country | Offers solutions for building credit in a new country |

| Account Opening | Requires local address and documentation | Often allows remote account opening with international ID |

As you can see, while your home bank serves its purpose, it’s simply not equipped for the demands of an international life.

Core Features of Expat Banking

The main goal here is to make your financial life simpler and cheaper. These services usually pack in a few key features that make all the difference:

- Multi-Currency Accounts: This is the big one. Holding euros, dollars, and pounds in a single place without converting them every time is a game-changer.

- Low-Fee International Transfers: Sending money home or paying bills abroad shouldn’t cost a fortune. Expat-focused services dramatically cut down on the steep fees traditional banks charge.

- Credit Portability: Trying to get a credit card or a loan in a new country without a local credit history is a classic expat problem. These services can help you get started.

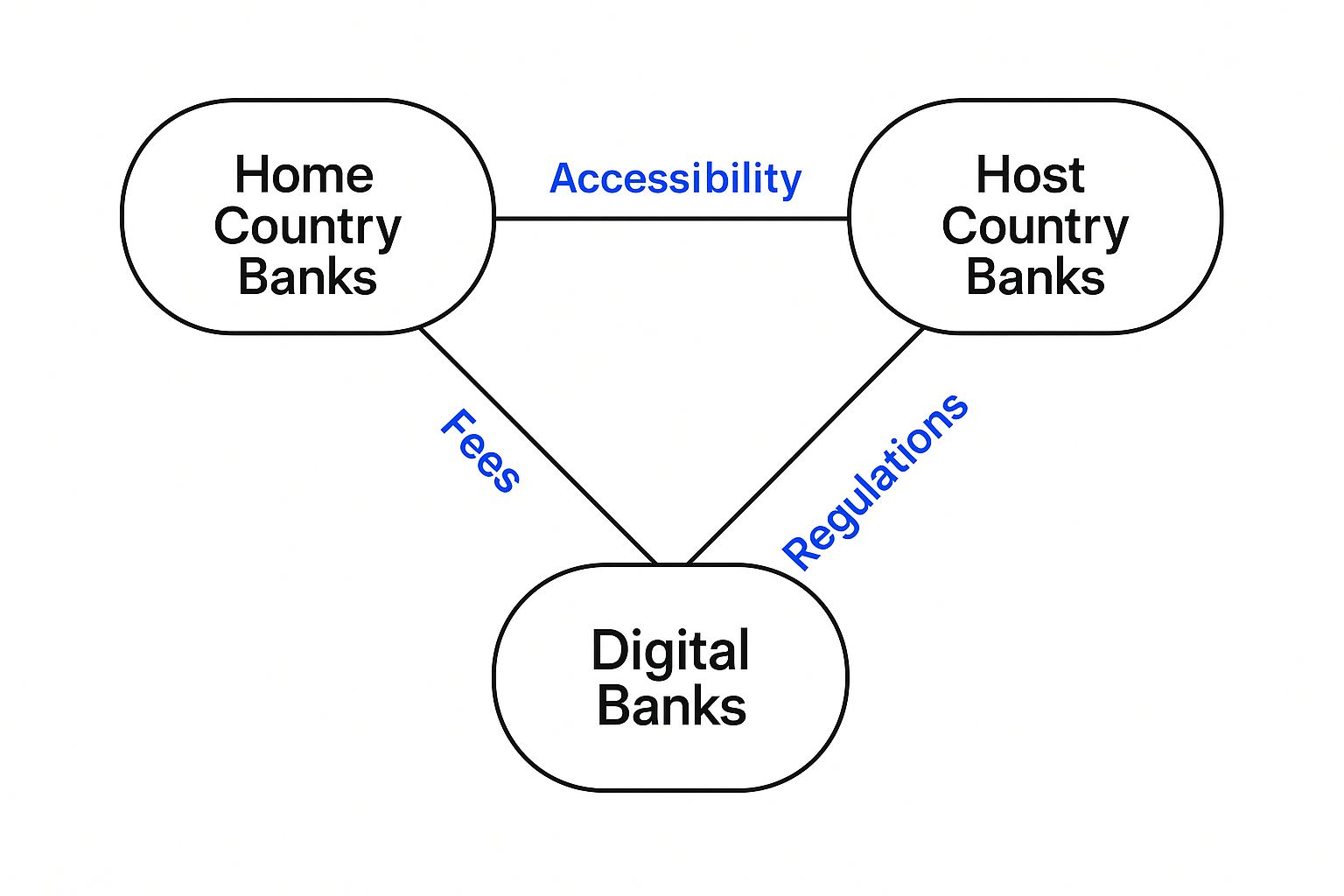

This infographic really drives home how different banking options stack up when you look at things like fees, accessibility, and the regulatory hoops they have to jump through.

You can see that traditional banks are walled off by their own borders, while digital and expat-focused banks are built to navigate that complex international web.

The real value of expat banking lies in its ability to centralize your global financial life. It transforms a scattered collection of accounts into a cohesive, manageable portfolio, giving you clarity and control no matter where you are.

Getting your financial setup right is a cornerstone of a successful life abroad. Understanding these basic concepts is the first step toward smart financial planning for expats and helps you sidestep the common traps that catch so many people out.

Why Your Old Bank Account Is Holding You Back

When you move abroad, clinging to your old bank account feels like a smart move. It’s familiar. It’s safe. But that feeling of security can vanish the first time you try to use it for your new international life. Before you know it, that account starts causing more problems than it solves.

Let’s imagine an expat, Alex, who just moved for a fantastic new job. Alex thought everything was sorted, with a healthy savings account back home. The first red flag popped up when it was time to pay the security deposit on a new apartment. The international wire transfer didn’t just take days; it came with a jaw-dropping fee and a terrible exchange rate that ended up costing hundreds of dollars more than planned.

The Hidden Costs and Roadblocks

That initial sting was just the beginning. Soon after, Alex’s home bank, unaccustomed to foreign transactions, started flagging everyday purchases. A simple trip to the grocery store turned into a declined debit card and a long, expensive international call to customer service just to get it unblocked. The bank’s fraud system, built for a domestic lifestyle, saw Alex’s new life as one giant security threat.

The hard truth is that traditional banks are built for people who stay in one country. Their systems, fees, and security rules are designed for a domestic customer, making them a terrible fit for a global citizen.

This friction goes beyond annoying fees or blocked cards. It digs deeper, creating real financial headaches that can threaten your stability abroad.

Common Financial Hurdles for Expats

Alex’s story is all too common. When you try to make a domestic bank work for an international life, you’ll almost certainly hit these frustrating and costly walls:

- Exorbitant Transfer Fees: Sending money home or receiving it from abroad through a traditional bank can skim 3% to 7% off the top when you account for terrible exchange rates and hidden fees.

- Blocked Access and Transactions: Banks frequently freeze accounts for “suspicious” foreign activity, leaving you high and dry without access to your money right when you need it most.

- A Broken Credit History: That great credit score you spent years building? It means absolutely nothing in your new country. Without a local credit history, simple things like getting a credit card, a phone plan, or a small loan can feel impossible.

These problems reveal a massive gap in the market. Your old bank just wasn’t designed for this journey. It’s like trying to navigate London with a map of New York—you’re going to get lost. This is exactly why specialized expat banking was created: to give you a financial map that actually works for your new, borderless life and turn these roadblocks into open roads.

Key Features of a Great Expat Bank Account

After seeing how your old bank can quickly turn into a financial anchor, it’s time to shift from problems to solutions. The right expat banking provider isn’t just a place to park your money; it’s a specialized toolkit for your global life, with each feature designed to dismantle a specific international headache. These aren’t just “nice-to-haves”—they’re absolute essentials for anyone living and working across borders.

Think of the following as your practical checklist. When you’re weighing your options between different banks or fintech services, measure them against these standards. Your goal is to find a partner that doesn’t just tolerate your international lifestyle but actively supports and simplifies it, saving you a ton of money and stress along the way.

Multi-Currency Capabilities

The absolute cornerstone of any worthwhile expat account is the ability to handle multiple currencies. This means you can hold, send, and receive different currencies—like USD, EUR, and GBP—all from a single, unified account.

This feature is a complete game-changer. It lets you get paid in one currency and pay bills in another without being forced into a conversion every single time. By sidestepping those constant conversions, you dodge the terrible exchange rates and hidden fees that slowly but surely bleed your funds dry.

A true multi-currency account hands the control back to you. You get to decide when and how to exchange your money, empowering you to move funds when the rates are in your favor, not just when a bill happens to be due.

The big, established international banks were some of the first to get this right. Players like HSBC, founded way back in 1865, literally built their reputation on serving global citizens. With a presence in dozens of countries, they pioneered multi-currency accounts that are still a critical tool for expats today. You can read more about how these large banks have shaped the industry and check out other international banking options.

Low-Cost and Transparent International Transfers

Sending money across borders shouldn’t feel like you’re being punished for it. A top-tier expat account makes international transfers affordable and dead simple. This means clear, upfront fee structures and exchange rates that hug the mid-market rate—the real rate banks use with each other behind the scenes.

Here’s what to look for:

- Minimal Transfer Fees: Low, flat fees are infinitely better than percentage-based charges that penalize you for sending larger amounts.

- Competitive Exchange Rates: The bank needs to be honest about its exchange rate markup. Some of the more modern providers even offer transfers with no markup at all.

- Global ATM Access: You need to be able to pull out cash abroad without getting hit with crippling fees from both your bank and the local ATM operator.

Building Your Financial Footprint

Finally, a truly valuable expat banking solution helps you do something most people forget about: establish a financial presence in your new country. Your credit history doesn’t pack its bags and move with you, and that’s a massive hurdle to overcome.

The best providers offer clear pathways to build credit, which is absolutely essential for things like securing loans, getting a mortgage, or even signing up for a new phone contract. This might look like offering a secured credit card to get you started or using your global banking relationship to vouch for you. It’s a feature that turns a major expat frustration into a totally manageable process, helping you truly settle into your new home.

Choosing the Right Expat Banking Provider

Picking the right bank as an expat can feel a lot like trying to find the best stall in a massive, overwhelming marketplace. You’ve got a ton of options, and they generally fall into three buckets. The best one for you really boils down to your own situation—what’s your job, how often are you on the move, and how comfortable are you with doing everything through an app?

The number of choices has exploded because the expat community itself is huge and growing. Just look at the numbers: the United States is home to roughly 50 to 51 million expats. In the United Arab Emirates, an incredible 88% of the population are expats. This isn’t a niche group anymore; it’s a massive global community that needs banking that actually works for them. You can dig into even more expat population statistics to see just how big this movement has become.

Traditional International Banks

First up are the big, established players like HSBC or Citibank. You’ve seen their names everywhere. Their major selling point is their global footprint; having physical branches you can walk into can be incredibly reassuring when you’re navigating a new country. They’ve been handling cross-border finance for decades and usually offer a full suite of services, from mortgages to serious wealth management.

But that size comes with a downside. They can be slow, clunky, and bureaucratic. You’ll likely run into higher fees and digital apps that feel a decade old compared to the new kids on the block. They’re a solid, reliable choice if you’re a corporate exec or have a complex financial life and value that face-to-face service.

Digital-First Neobanks

On the complete opposite end, you have the slick, modern neobanks. These are the app-first providers that have taken the banking world by storm. They’re famous for their clean user interfaces, rock-bottom fees, and getting an account set up in minutes, not weeks. They are masters of the daily expat grind: holding multiple currencies and sending money across borders quickly and cheaply.

The main appeal of neobanks is their relentless focus on user experience and cost. They cut through the old-school banking complexity, giving digital nomads and frequent travelers a streamlined tool that just works.

The trade-off? Their product list is pretty slim. You’re not going to get a mortgage or sophisticated investment options from them. And if something goes wrong, customer service is almost always a digital chat or email, which isn’t for everyone.

Specialized Fintech Solutions

The third category isn’t really “banks” but specialized fintech companies. These guys pick one piece of the expat finance puzzle—like currency exchange or international transfers—and do it exceptionally well. While you wouldn’t use them as your only bank, they can be a fantastic addition to your financial toolkit, often giving you the absolute best exchange rates you can find anywhere.

So, what’s the right move? Honestly, it’s probably a mix-and-match approach. Pairing a stable international bank for your core needs with a nimble neobank for daily spending can give you the best of both worlds. The key to making this work without pulling your hair out is having a single, clear view of all your accounts. That’s a cornerstone of any smart expat financial planning strategy.

Best Practices for Managing Your Global Finances

Juggling money across different countries can feel chaotic, but it doesn’t have to be. With the right game plan, managing your global finances becomes a surprisingly straightforward process. The secret? Being proactive, staying organized, and using the right tools to keep you in the driver’s seat.

Think of this as your playbook for mastering the day-to-day financial life of an expat.

First things first: opening your new account. It’s often less of a headache than people imagine, but a little prep work goes a long way. Most international banks and modern digital providers will need the same core documents to verify who you are and why you’re there.

Gathering Your Documentation

To make the application process a breeze, get these documents together before you even start. Having everything on hand saves a ton of time and back-and-forth emails.

- Proof of Identity: Your passport is the gold standard here. A national ID card might also work, depending on the bank.

- Proof of Address: This is usually a recent utility bill or a bank statement. If you’re setting up an account ahead of your move, you may need proof of address for both your current home country and your new one.

- Proof of Your Expat Status: This could be your work visa, an employment letter from your new job, or proof that you’re enrolled at a university abroad.

Minimizing Fees and Maximizing Your Money

Once your account is up and running, the real game begins: using it wisely. Small fees are silent killers; they can nibble away at your funds until a significant chunk is gone. This is where smart management truly pays off. A key part of this is leveraging seamless cross-border payment solutions to sidestep unnecessary costs and headaches.

The biggest drain on an expat’s finances isn’t always a single large fee but the “death by a thousand cuts” from poor exchange rates and hidden charges on frequent, small transactions. Proactive management turns these losses into savings.

Plan your large money transfers. Don’t wait until a big bill is due. By watching exchange rates and moving your money when the rate is in your favor, you can save a surprising amount. Also, always look past the “zero fee” marketing claims. Often, the cost is just baked into a terrible exchange rate markup. For more strategies on keeping your financial house in order, check out our complete guide on how to organize your finances.

Staying Compliant with Tax Regulations

Finally, let’s talk about the serious stuff: staying on the right side of the tax authorities. Holding accounts in multiple countries means you likely have tax obligations in both your home and host nations. For U.S. citizens, for instance, regulations like the Foreign Account Tax Compliance Act (FATCA) require you to report all your foreign financial assets.

It’s absolutely critical to understand the tax treaties between your countries to avoid the nightmare of being taxed twice on the same income. This is a genuinely complex area where the rules can and do change. For this reason, consulting with a tax advisor who specializes in expat issues is strongly recommended. They’ll cut through the confusion and ensure you’re fully compliant, which is a peace of mind you can’t put a price on.

Common Questions About Expat Banking

Even after you’ve got a handle on the basics, a few questions always pop up. It’s completely normal. Let’s walk through some of the most common things people ask when they’re getting started with expat banking so you can move forward feeling confident.

Even after you’ve got a handle on the basics, a few questions always pop up. It’s completely normal. Let’s walk through some of the most common things people ask when they’re getting started with expat banking so you can move forward feeling confident.

Can I Open an Expat Bank Account Before I Move?

Yes, and honestly, you’d be wise to do so. A lot of international banks and the newer fintech companies are built for this exact situation. They let you start the application online right from your home country, well before you pack a single box.

This is a huge advantage. It lets you hit the ground running financially from the moment your plane touches down. To get it done, you’ll usually just need to show some proof of your move, like a signed employment contract or a valid work visa.

The ability to open an account remotely transforms your move from a financial scramble into a smooth transition. It means you can have a functioning bank account ready to receive salary payments and pay bills from day one.

What Is the Difference Between an Expat and a Local Account?

Think of a standard local bank account as being firmly planted in one country, speaking only one currency. It’s perfect for day-to-day domestic life, but the moment you try to do anything international, you’ll run into high fees and slow transfer times.

An expat account, on the other hand, is designed from the ground up for a life that crosses borders. It’s a financial hub, built to handle multiple currencies, offer better exchange rates, and make international transfers feel effortless. It’s the bridge connecting your old financial life with your new one—a job a simple local account just can’t do.

How Do I Handle Taxes with Accounts in Multiple Countries?

This is where things can get tricky. As an expat, you might owe taxes in both your home country and your new one. The key is to understand the specific tax treaties that exist between those countries to avoid getting taxed twice on the same income.

For example, U.S. citizens have to deal with regulations like FATCA, which requires them to report all their foreign financial assets. Because tax laws are so different everywhere and the consequences of getting it wrong are serious, we always recommend talking to a tax advisor who specializes in expat finances. It’s the best way to make sure you’re fully compliant.

Juggling accounts across different currencies and countries can feel chaotic. PopaDex cuts through the noise by giving you a single, clear view of your entire financial world. You can track your net worth and make smarter decisions, no matter where you are. See how it works at https://popadex.com.