Our Marketing Team at PopaDex

Expat Financial Planning Tips for Success Abroad

Building Your International Banking Foundation That Won’t Let You Down

Let’s be honest, finding the right banking setup as an expat can be a minefield. Those glossy brochures promising seamless international finance? They rarely tell the whole story. I’ve chatted with countless expats who’ve been hit with unexpected fees and terrible exchange rates. So, let’s skip the generic stuff and dive into what really works.

Some expats love digital-only banks like Wise for their low fees and easy international transfers. Others prefer the stability and in-person support of traditional banks. The best choice depends entirely on your specific needs. For instance, if you’re bouncing between countries, a digital bank with a solid mobile app and multi-currency accounts might be perfect.

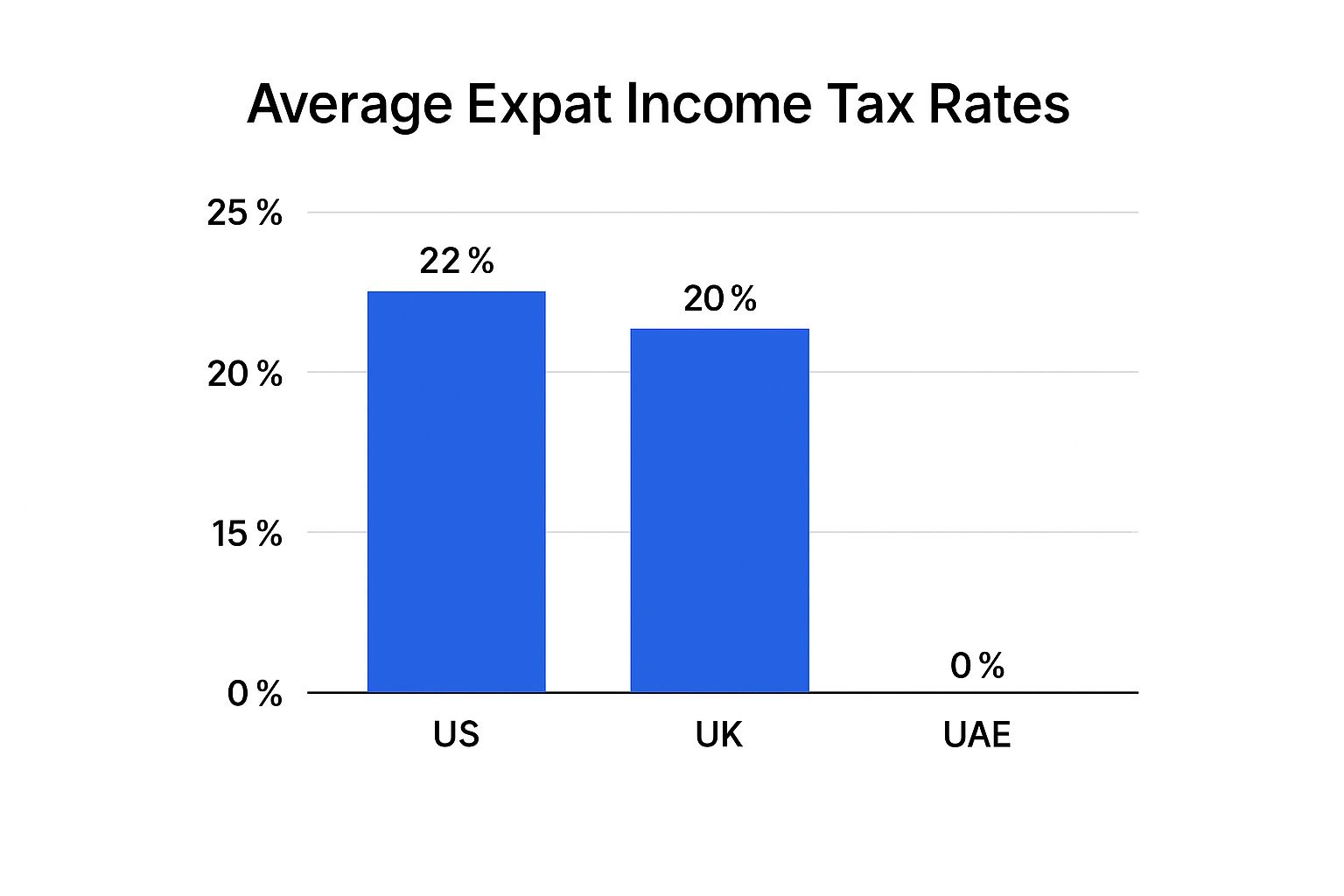

This Wise screenshot shows how you can manage different currencies in one account. This simplifies daily spending and can help minimize exchange rate losses.

But, if you’re putting down roots somewhere and need services like mortgage advice or local investment options, a traditional bank with a strong local presence could be a better fit. This is where doing your homework and learning from others’ experiences becomes crucial.

Evaluating Your Banking Options

Choosing a bank as an expat involves several important factors. International transfer fees can quickly drain your funds. Look for banks with clear, competitive rates, particularly if you’ll be sending money across borders regularly. Exchange rates are also crucial. Even small differences can add up over time.

Don’t forget about your bank accounts back home. Which ones are still useful, and which are just costing you money with monthly fees or inactivity charges? It’s a surprisingly common oversight. Also, think about your long-term financial goals. Are you planning to buy property abroad? Invest in local markets? These will influence the banking services you’ll need.

Another big challenge for expats is maintaining credit histories across different countries. This can be a real pain, especially for big purchases like a house or car. I knew one expat with a great credit score in the U.S. who found it meant nothing when he tried to get a mortgage in Spain. He had to start building his credit history all over again, delaying his home purchase by months.

The Hidden Costs of Expat Banking

Watch out for premium accounts with perks you don’t really need. They often come with high fees that outweigh any benefits. Prioritize functionality and value over fancy account names. A basic setup with a checking account, a savings account, and maybe a multi-currency account can often handle most of your international banking needs.

Good advice and real-world experience can make all the difference here. The right banking setup can save you time, money, and a lot of hassle. It’s interesting that many expats struggle to trust financial advisors. Studies show that only 9% of expats seek professional help, often because of hidden fees and unclear commissions, which can be steep – sometimes 7-8% on lump-sum investments. Discover more insights. Building a solid banking foundation is the first step to taking control of your expat finances and avoiding unnecessary expenses.

Currency Management Strategies That Save You Thousands

Let’s be honest, constantly refreshing currency exchange apps isn’t exactly a recipe for riches. It’s more likely to raise your stress levels than your bank balance. Experienced expats know this. They’ve figured out ways to manage their money across borders without needing to be glued to the market 24/7. I’ve chatted with expats everywhere, from bustling Singapore to cool Stockholm, picking their brains about the currency strategies that actually make a difference.

One American expat living in Germany told me how he shaves off €3,000 in costs every year. His secret? Smart timing. He avoids making lots of small currency transfers, which just bleed you dry with fees. Instead, he bundles larger sums together and converts them less frequently. This minimizes the sting of fluctuating exchange rates, too. It’s not about trying to beat the market; it’s about being efficient.

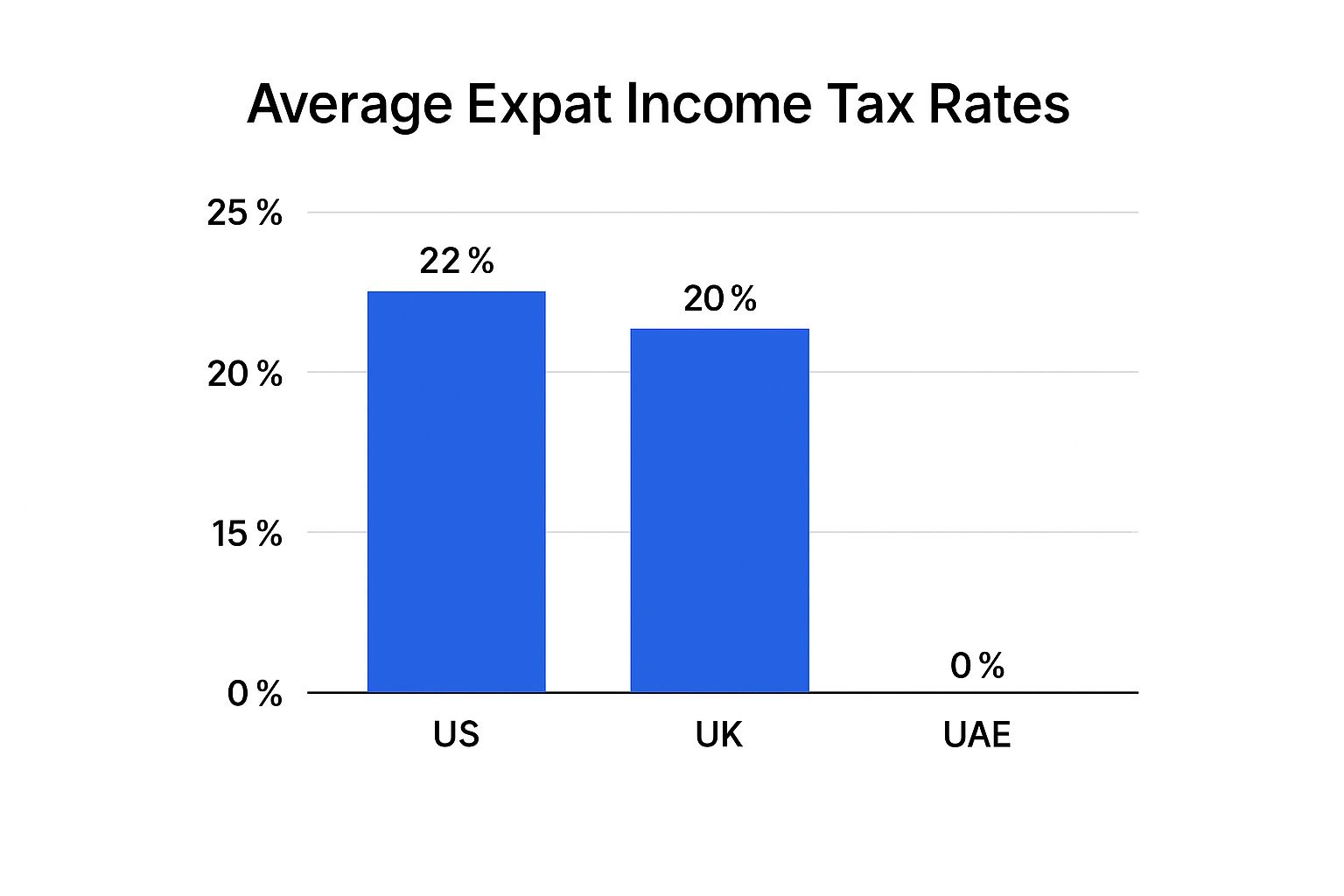

This chart really brings home how much taxes can change depending on where you live. The UAE’s 0% income tax is a stark contrast to the US (22%) and UK (20%). Knowing the tax landscape of your new home is essential for sound financial planning.

Tools and Techniques for Simplified Currency Management

The right tools can be game-changers. Some apps are overly complicated, but others truly simplify managing money in multiple currencies. PopaDex is a great example. It lets you see all your finances in one place, regardless of the currency, giving you a clear overview of your entire financial picture.

While a quick check on XE.com is handy, relying solely on real-time rates can be deceptive. Those numbers jump around constantly!

Beyond simple conversions, there are more strategic moves you can make, like currency hedging. Don’t worry, it’s not as complicated as it sounds. There are simple ways to reduce your exposure to fluctuating rates. If you’re earning in one currency and spending heavily in another, hedging part of your income can create some much-needed stability.

How currency swings affect you also depends on your income. Someone with a fixed salary in their home currency experiences these changes differently than a freelancer billing in multiple currencies. Figure out where you’re most vulnerable, and you can start putting safeguards in place. Ignoring currency fluctuations is a common expat mistake. Hoping things will magically “even out” is rarely a good strategy. It can really cost you, particularly during periods of volatility. Luckily, fintech solutions are making international money management much easier and more transparent. These tools give expats more control than ever before.

To help you navigate the world of multi-currency management, here’s a comparison of some popular platforms:

Multi-Currency Management Tools Comparison: Comparison of popular currency management platforms showing fees, features, and ease of use for expats

| Platform | Transfer Fees | Exchange Rate Markup | Multi-Currency Account | Best For |

|---|---|---|---|---|

| Wise | Low, transparent fees | Minimal markup, often the mid-market rate | Yes | Frequent international transfers, holding multiple currencies |

| Revolut | Varies depending on plan | Markup on weekends and for larger amounts | Yes | Travelers, those needing multiple currency cards |

| Payoneer | Varies depending on method | Can be higher than Wise | Yes | Freelancers, businesses receiving international payments |

This table summarizes some key features and who might find each platform useful. Remember to do your own research to find the best fit for your specific needs. The ideal platform will depend on how often you transfer money, the currencies you use, and the types of features you value most.

Budgeting Across Borders Without Losing Your Mind

Managing your finances while living abroad can feel like a juggling act. Multiple currencies, changing income, expenses scattered across the globe… it’s a lot! But don’t worry, it’s absolutely manageable. I’ve picked up some tricks from fellow expats – from a freelancer in Bali dealing with payments in Euros, USD, and Indonesian Rupiah, to a family with homes in both London and Singapore. They’ve taught me that traditional budgeting advice often falls short for expats, and I’m happy to share what works much better.

Ditch the Percentages, Embrace the Priorities

Typical budgeting advice often revolves around percentages (like spending 30% on housing). But this can be impractical when living abroad, where costs can vary drastically. Imagine budgeting 30% for rent, then moving somewhere twice as expensive! Your whole budget is thrown off. Instead, prioritize essential expenses first – think housing, visas, healthcare – and then allocate funds to other categories based on your location and lifestyle.

Housing is a big one. Expats typically spend 30-40% of their income on rent and utilities. This percentage can skyrocket in cities like London or New York, compared to places like Chiang Mai or Medellín. Discover more insights. Doing your homework on living costs before you move is crucial.

Managing Unique Expat Expenses

Expat life has its own set of unique costs. Visa renewals, flights back home, even maintaining bank accounts in your home country – these all add up. A smart strategy is to create a separate “Expat Expenses” fund. Regular contributions to this fund prevent those costs from blindsiding you. Think of it as your “hidden costs” cushion.

For instance, if your visa renewal is $500 every two years, set aside $250 annually. Planning a yearly trip home? Factor in the flight and any extra travel expenses.

Handling Currency Fluctuations in Your Budget

Exchange rates can really mess with your budget. A good approach is to budget in your primary spending currency. This gives you a clear view of your daily expenses. If you’re paid in a different currency, use a realistic exchange rate (maybe slightly worse than the current one) when budgeting. This provides a buffer against fluctuations. Check out PopaDex for more budgeting tips.

Building Your Emergency Fund Across Borders

Your emergency fund is your financial safety net. Aim for 3-6 months of essential living expenses. Accessibility is key. You need to be able to get to your money quickly, wherever you are. Consider a mix of accounts – maybe a high-yield savings account at home, a local account in your new country, and perhaps a multi-currency account for flexibility. This can help avoid those painful international transfer fees in a crisis.

To help illustrate how budgeting might shift based on location costs, take a look at this table:

Expat Budget Allocation by Location Type Breakdown of typical monthly expense categories for expats in high-cost vs. low-cost destinations

| Expense Category | High-Cost Cities (%) | Mid-Cost Cities (%) | Low-Cost Destinations (%) |

|---|---|---|---|

| Housing | 40 | 30 | 20 |

| Groceries | 15 | 12 | 10 |

| Transportation | 10 | 8 | 5 |

| Healthcare | 10 | 8 | 5 |

| Entertainment | 10 | 12 | 15 |

| Travel | 5 | 7 | 10 |

| Savings & Investments | 5 | 8 | 10 |

| Other/Expat Specific | 5 | 5 | 5 |

As you can see, housing costs take a much larger chunk out of your budget in expensive cities, leaving less room for things like entertainment and travel. In contrast, living in a less expensive location frees up more funds for other categories.

Building a solid financial foundation as an expat requires some effort, but it’s totally doable. Prioritize your spending, account for those unique expat costs, manage currency fluctuations smartly, and build a strong emergency fund. You’ll be able to fully embrace the adventure of living abroad with more financial peace of mind.

Tax Planning That Protects Your Wealth (Without the Headaches)

This screenshot shows the IRS page about the Foreign Earned Income Exclusion. This exclusion can be a real game-changer for expats, potentially shielding a big chunk of your foreign earnings from U.S. taxes. Knowing if you qualify is essential for minimizing your tax bill.

Expat taxes can feel overwhelmingly complicated. But trust me, it doesn’t have to be a constant struggle. I’ve picked up a few things from fellow expats – some who’ve absolutely nailed the tax game, and others who, well, learned some pricey lessons. Here’s what I’ve gathered to help you keep more of your money.

I once met a tech consultant who, unbelievably, had overpaid taxes for three years! He’d completely missed some expat-specific deductions. After some digging and a chat with a tax advisor, he received a substantial refund. This just goes to show how important it is to understand the tax rules for your situation.

Also, remember tax laws change. The global economy is constantly shifting, creating both headaches and opportunities for expat finances. Expected economic instability and geopolitical events are likely to trigger major exchange rate swings, which can really impact your savings and the money you send home. Plus, tax policies are always evolving. Keeping up with double taxation treaties and local tax rules is key to avoiding unexpected tax bills. Discover more insights.

Tax Software and Professional Help

Tax software can be incredibly helpful, but not all programs are designed for expat life. Some are perfect for basic domestic taxes but get totally confused by foreign income, exclusions, and tax treaties. Look for software specifically made for expats, or consider talking to a tax professional. Knowing when to DIY and when to bring in an expert can save you time, money, and a lot of stress. For complex situations—like owning property in multiple countries or juggling income from various sources—professional help is worth its weight in gold.

Record-Keeping for Stress-Free Tax Season

Good record-keeping is your secret weapon for a smooth tax season. It doesn’t have to be fancy. A simple system, even spreadsheets, will do. Categorize your income and expenses by country and currency. Store digital copies of important documents (tax forms, bank statements, etc.) securely in the cloud. This makes finding everything a breeze come tax time. You might also find this helpful: Cross-border financial planning.

Common Tax Traps and How to Avoid Them

Many expats unknowingly miss out on deductions they are entitled to. This could include things like foreign housing exclusions, moving expenses, or even deductions tied to your home country’s tax obligations. Understanding these details can save you a significant amount of money.

There are also red flags that might suggest you need professional help. Feeling overwhelmed? Unsure about which forms to file? Is your tax situation especially complicated? Seeking expert advice is the smart move.

Don’t let tax planning stress you out. By understanding the basics, using the right tools, and knowing when to call in the pros, you can handle expat taxes effectively and efficiently. A solid tax strategy is a cornerstone of your overall expat financial plan, protecting your wealth and giving you peace of mind to truly enjoy your international adventure.

Investment Strategies That Work From Anywhere

This screenshot from Interactive Brokers shows their international trading platform. It highlights their global market access, a huge plus for expats looking to diversify. That kind of broad reach is a real game-changer when you’re building a portfolio across different countries.

Expat investing can be exciting and, let’s be honest, a little daunting. You’ve got more opportunities, but also unique hurdles. I’ve chatted with expats who’ve built amazing international portfolios, and I’ve learned about their successes and, importantly, their expensive missteps.

For example, a British expat in Australia built a smart portfolio across three markets, using the strengths of each. He picked platforms with low fees and wide-ranging assets. This spread his risk and opened doors to specific growth areas.

On the flip side, I met an American entrepreneur in Thailand who had to overhaul his investments after hitting unexpected regulatory roadblocks. He assumed his domestic strategy would work overseas. It didn’t. This really highlights why expat financial planning needs a fresh perspective and often, a whole new approach.

Navigating the Challenges of International Investing

One big challenge? Investment vehicles that shine in your home country might not be right for you as an expat. Some tax-advantaged accounts, for instance, can lose their benefits or even become tax liabilities abroad. This is why understanding how your tax residency affects your investments is so important. For US expats, this often means filing specific forms like Form 1040.

Local regulations can also limit your investment choices. Some countries restrict or even ban foreign residents from investing locally, while others impose hefty taxes on foreign investments. Researching your new country’s rules is crucial.

Platforms and Strategies for Global Investors

So, what does work for international investors? Platforms designed for expats are a solid start. They often offer multi-currency accounts, global market access, and tax-reporting tools that make managing cross-border investments easier. A financial advisor specializing in expat investing is also a smart move, particularly if your finances are complex.

A good expat investment strategy usually involves diversifying across asset classes, currencies, and locations. This can reduce risks tied to currency swings, political instability, and market dips in specific regions. Think international ETFs, global mutual funds, or even real estate in different markets.

Managing Investments Across Time Zones and Tax Jurisdictions

Different time zones can make managing investments a logistical nightmare. Trying to call your broker during market hours when they’re eight hours ahead? Not fun. Platforms with 24/7 online access and good mobile apps become essential.

Taxes also add complexity. You might have to file in both your home country and your country of residence. Understanding tax treaties and using the right investment structures can minimize your tax burden. Detailed records of your investments and transactions make tax reporting much less painful.

Balancing Growth and Complexity

International investing offers amazing growth potential, but it’s definitely more complex. Finding the sweet spot between chasing returns and managing the administrative side of cross-border investing is key. Don’t let the challenges scare you away from exploring the potential of international investments. With careful planning and the right resources, you can build a portfolio that fits your expat life and supports your long-term financial goals.

Digital Tools That Actually Simplify Your Expat Money Management

Managing your finances as an expat can feel overwhelming. Juggling different currencies, navigating international transfers, and understanding varying tax rules – it’s a lot! But don’t worry, the right digital tools can make a huge difference, turning this financial maze into a well-oiled machine. I’ve tried tons of apps and platforms with expats all over the world, so I can share what really works and what’s just hype.

Automating Your Expat Finances

Smart expats use technology to automate their finances, from tracking daily expenses to managing investments. I have a friend living in Spain who uses a few different apps to automatically categorize his spending, convert currencies, and even update his budget. This gives him a clear picture of where his money goes, across different currencies and accounts, without manually tracking every transaction.

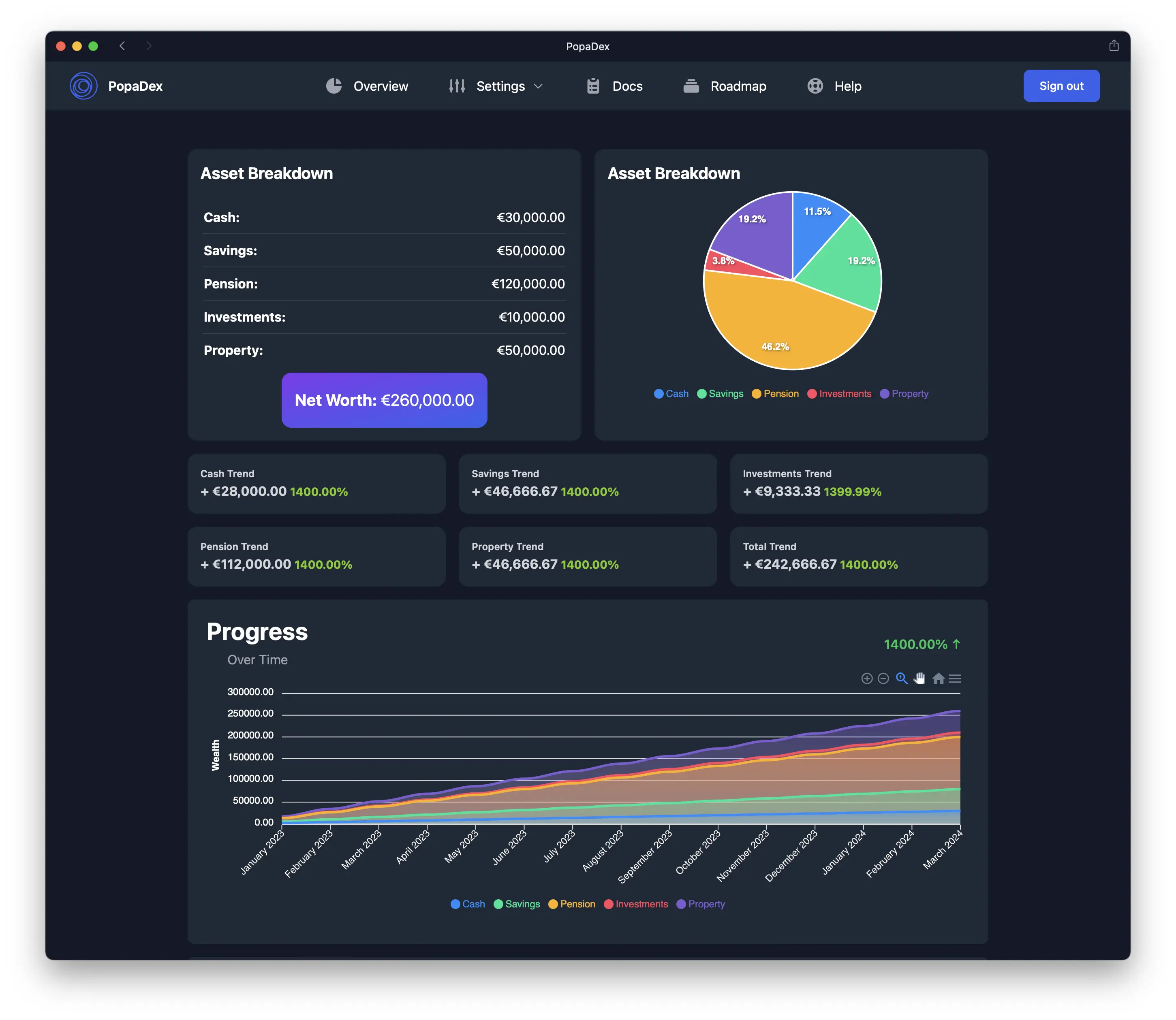

Solutions like PopaDex take this even further. PopaDex lets you track your financial progress across multiple currencies and countries, providing a consolidated view of your net worth. This is especially helpful for expats with assets in different places. Check out this snapshot of the PopaDex interface:

This image shows how PopaDex pulls all your accounts together, no matter the currency or location. This unified view is incredibly helpful for managing a complex international financial life. You can see the big picture and make informed decisions. Want to learn more? Check out PopaDex’s financial data aggregation features.

Choosing the Right Tools for You

Not all financial tools are created equal. Some free tools offer great features, while some paid services offer valuable extras that justify their cost. The trick is finding the right combination for your needs. A simple budgeting app might be perfect for someone just starting out, while a more advanced platform with investment tracking and tax reporting might be better for someone with a more complex financial situation.

Building an Integrated System

The most effective approach is building an integrated system where your tools work together. Think of it as your personal financial command center. Your budgeting app feeds into your net worth tracker, which informs your investment decisions. This connected approach gives you a complete view of your finances and empowers you to make smart choices.

Speaking of investments, expats should also understand how to protect your retirement savings from IRS levies. This resource offers valuable information on safeguarding your assets.

Growing With Your International Journey

Your financial needs will change as your expat experience unfolds. The tools you choose should adapt with you. Look for platforms that offer scalability and flexibility so you don’t have to constantly switch tools as your situation evolves. For example, a platform that handles multiple currencies and investment accounts will be more helpful long-term than a basic budgeting app as your finances become more complex.

By using the right digital tools and building a system that works for you, you can simplify your expat finances, reduce stress, and have more time to enjoy living abroad. It’s about taking control of your money, not letting it control you.

Your Personal Roadmap to Expat Financial Confidence

Expat financial planning isn’t about perfect spreadsheets. It’s about building systems that fit your life, adapting as you go. Whether you’re dreaming of your first international move or already unpacking boxes abroad, this roadmap breaks down everything into manageable steps.

Prioritizing Your Financial Moves

Some moves have a bigger impact than others. At the beginning, focus on these key areas:

- Banking: Setting up the right accounts in your new country and simplifying your home country banking is essential. A good resource for streamlining your financial admin, especially as a remote worker, can be found in this guide to remote work tools.

- Budgeting: A realistic budget is your best friend. Factor in those fluctuating exchange rates and expat-specific costs (visas, trips back home, international school fees – it all adds up).

- Tax Planning: Get a handle on the basic tax rules in both your home country and your new one. This will save you headaches (and potentially a lot of money) down the road.

These core elements set you up for smooth day-to-day finances and help you avoid costly surprises.

Recognizing Warning Signs and Adjusting Your Strategy

Expat life isn’t always predictable. Be ready to adjust your plan when life throws a curveball:

- Unexpected Expenses: Job loss, a medical emergency, family issues – sometimes you need that emergency fund. Make sure you prioritize building it back up as soon as possible.

- Currency Swings: Big changes in exchange rates can impact your budget and investments. Be prepared to revisit your financial plan and make adjustments.

- Tax Law Changes: Tax laws can change, so staying informed about updates in both countries is key. Nobody wants unexpected tax penalties!

These aren’t failures – they’re chances to refine your approach and become even more financially savvy.

Celebrating Milestones and Staying Motivated

Don’t forget to acknowledge your wins! Every success, big or small, fuels your motivation:

- Conquering Your First Tax Season Abroad: That’s a major achievement – pat yourself on the back.

- Hitting a Savings Target: Whether it’s a down payment, a dream trip, or an investment milestone, celebrate it!

- Building a Solid Emergency Fund: Knowing you’ve got a financial safety net is a huge stress reliever.

Remember, expat finances are a marathon, not a sprint.

Building a Financial Future That Supports Your International Lifestyle

Your financial choices should support your current expat life and your long-term dreams. Want to buy property abroad? Retire early? Invest internationally? Thinking about these big-picture goals helps ensure your current actions are aligned with your future ambitions. This could involve:

- Diversifying your investments. Don’t put all your eggs in one basket – spread them across different countries and currencies.

- Looking into expat-specific retirement plans. There are often tailored options available.

- Sorting out estate planning. This is especially important when you have international assets and family members in different locations.

Don’t let expat finances feel overwhelming. By focusing on the essentials, staying adaptable, and celebrating your progress, you can build a financial future that supports your global adventures and gives you peace of mind. Simplify your financial journey today with PopaDex.