Our Marketing Team at PopaDex

Financial Reporting Automation: Boost Accuracy & Efficiency

Ever feel like you’re trying to navigate a new city with a folded, hand-drawn map while everyone else is using a live GPS? That’s the difference between old-school manual reporting and modern financial reporting automation.

This technology takes over the tedious work of collecting, combining, and sharing financial data. It turns slow, error-prone tasks into a process that’s fast, accurate, and completely seamless.

The End of Manual Reporting As We Know It

For decades, finance departments have been buried under a mountain of manual work. The frantic cycle of closing the books, cranking out reports, and double-checking compliance has always been a high-pressure scramble. It left teams with virtually no time for the important stuff—like actual strategic analysis.

That old way of working just isn’t cutting it anymore.

Today’s business world moves at lightning speed, demanding precision and forward-thinking insights. Stakeholders don’t just want historical data; they need real-time information to make smart, agile decisions. This pressure has put a spotlight on the deep flaws of manual reporting, where one tiny spreadsheet mistake can spiral into a major problem.

The Wake-Up Call for Finance Teams

Shifting to digital tools in finance is no longer a “nice-to-have.” It’s a matter of survival. But you’d be surprised how many organizations are still stuck in the past.

A recent survey of finance leaders revealed that a shocking 49% of finance departments still operate with zero automation. They’re leaning heavily on manual inputs in Excel and even paper-based systems. This old-fashioned approach is a massive drag on operations, holding back growth and exposing the business to risks that are entirely avoidable.

But here’s the good news: financial reporting automation provides a clear path out of the chaos.

By embracing automation, finance teams can finally evolve. They can go from being historical record-keepers to proactive strategic partners who actively guide the business toward its goals. It’s about freeing up your most skilled people to do what they do best: analyze, strategize, and lead.

To give you a clearer picture, let’s break down the core differences between the old way and the new way.

Manual vs Automated Financial Reporting At a Glance

This table offers a quick comparison, highlighting just how stark the contrast is between traditional manual processes and modern automated financial reporting.

| Aspect | Manual Reporting | Automated Reporting |

|---|---|---|

| Speed | Slow, labor-intensive process taking days or weeks. | Near real-time data processing and report generation. |

| Accuracy | High risk of human error from manual data entry. | Minimal errors due to automated data validation. |

| Efficiency | Drains significant team resources and time. | Frees up finance professionals for strategic analysis. |

| Insights | Primarily provides historical, backward-looking data. | Delivers forward-looking, actionable insights. |

| Scalability | Difficult to scale with business growth. | Easily scales to handle increasing data volume. |

As you can see, the shift isn’t just about doing the same things faster—it’s about fundamentally changing what’s possible for a finance team.

Your Guide to Modern Finance

This guide is your complete roadmap to leaving those outdated, error-prone processes in the dust. We’ll walk you through everything you need to know, from the basic concepts to hands-on implementation.

To dig even deeper into this transformation, check out excellent resources on Unlocking Financial Reporting Automation to see how it’s being applied in different business contexts.

Here’s what we’ll cover:

- How Automation Works: A simple breakdown of the technology and processes that make it all happen.

- Key Benefits: The real-world advantages of better accuracy, efficiency, and strategic empowerment.

- Implementation Steps: A practical game plan for bringing automation into your own operations.

- Future Trends: A sneak peek at what’s coming next for the world of finance.

How Does Financial Automation Actually Work?

To really get what financial reporting automation can do, it helps to peek under the hood. The whole setup works like an expert chef in a high-tech kitchen, but for your financial data. It takes all your raw, sometimes messy, ingredients and turns them into perfectly prepared insights—all without anyone lifting a finger.

Think of your different data sources—your ERP, CRM, spreadsheets, and bank accounts—as separate pantries and refrigerators. Instead of a finance professional having to manually run to each one to grab what they need, the automation system does it instantly. It plugs directly into these sources and pulls the raw data automatically, making sure nothing gets left behind.

Once the “ingredients” are gathered, the system gets to the prep work. This is the all-important data cleansing and validation stage. It methodically flags and fixes inconsistencies, fills in gaps, and standardizes formats across the board. This automated scrubbing is what prevents the classic “garbage in, garbage out” problem that so often trips up manual reporting, ensuring the data is clean and reliable.

From Raw Data to Polished Reports

After the data is collected and cleaned up, the system moves to the final stage: “cooking” and “plating” it. This is where the magic of report generation happens.

Using rules and templates you’ve already defined, the software assembles the clean data into structured financial statements, dashboards, and charts. This could be anything from a standard income statement and balance sheet to a more complex cash flow analysis or a custom KPI dashboard for the C-suite. The system handles every calculation, format, and presentation detail on its own.

To fully appreciate the mechanics, it helps to understand the broader concept of Intelligent Process Automation (IPA). This technology blends standard automation with a dose of machine learning and AI, which allows the system to not just follow rules but also learn and adapt over time.

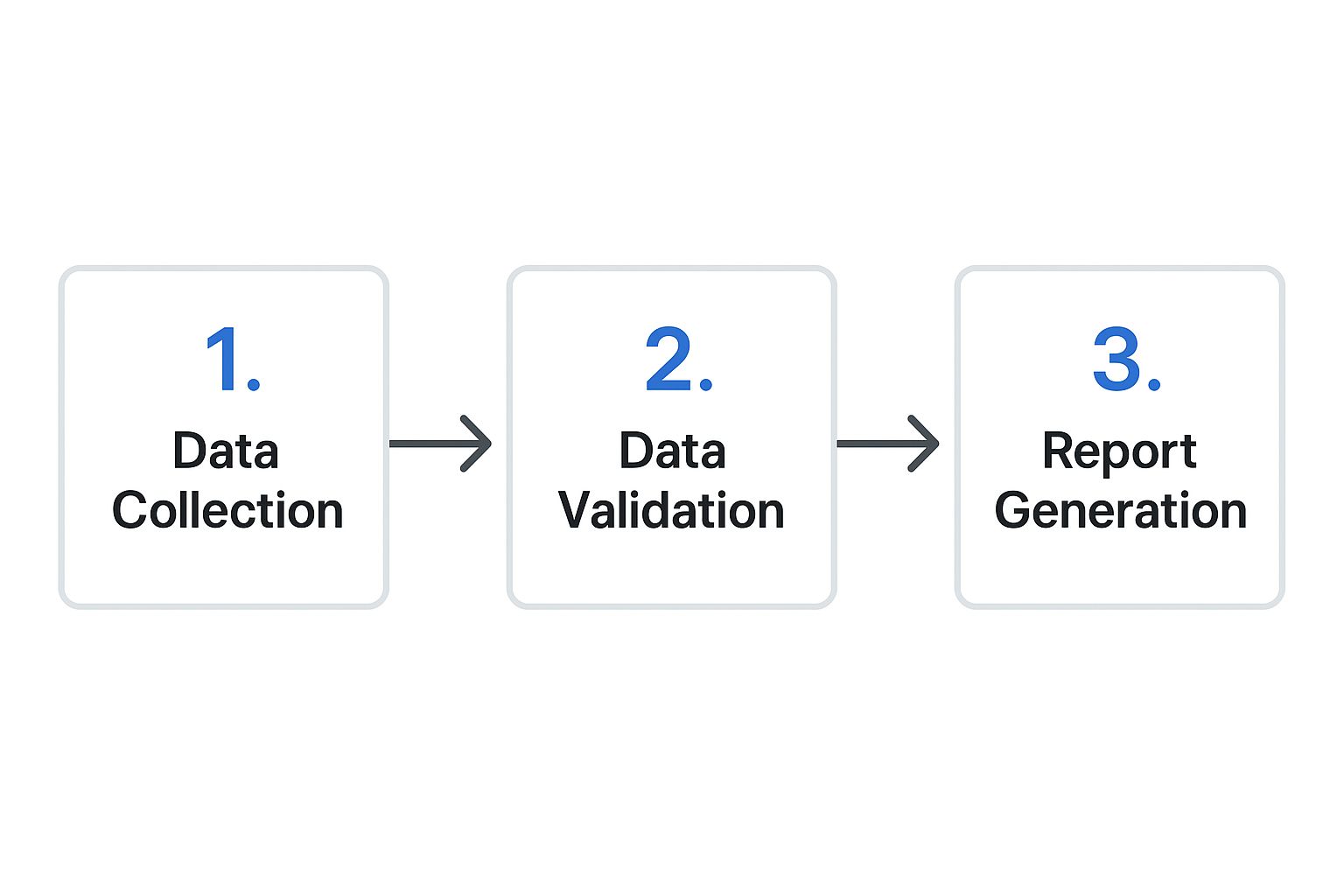

This three-step journey is the heart of how financial automation operates.

The image below gives you a simple, clear visual of this core process, from the initial data pull all the way to the final report.

As you can see, each step builds logically on the one before it, creating a repeatable and dependable system for producing top-notch financial intelligence.

The Automation Ecosystem

This entire workflow is managed through a central platform that acts as the command center. This is where your team sets the rules, schedules when reports should run, and defines who gets what.

Here are the key pieces working together behind the scenes:

- Data Connectors: These are the APIs and integrations that act as bridges, linking the automation software to all your different financial systems.

- Workflow Engine: This is the brain of the operation. It executes the predefined steps for collecting data, validating it, and building the reports.

- Reporting Module: This is what generates the final reports and dashboards, and it’s where you can customize the look and feel of everything.

- Audit Trail: Every single action the system takes is logged, creating a clear and unchangeable record for compliance and internal reviews.

This integrated approach is precisely what makes modern financial automation so powerful. If you’re looking to dive deeper into putting these workflows into practice, PopaDex has a complete guide on how to automate your financial reporting with today’s best tools.

Ultimately, financial reporting automation creates a self-sustaining ecosystem. It continuously pulls, refines, and presents data, ensuring that decision-makers always have timely and accurate financial information without the manual bottlenecks getting in the way.

The Real-World Benefits of Automated Reporting

Let’s move past the buzzwords and talk about what financial reporting automation actually does for your business. It’s the difference between your team pulling an all-nighter to find one typo in a board report and closing the books in a fraction of the time, ready to figure out what the numbers really mean.

These aren’t just minor improvements. They’re a fundamental upgrade to what your finance function can achieve. Here’s a look at the concrete benefits you can expect to see day-to-day.

Achieve Near-Perfect Accuracy

Let’s be honest: manual data entry is a minefield. A simple copy-paste error, a misplaced decimal, or an old spreadsheet formula can derail decisions and lead to expensive corrections. Automation takes that human error out of the equation.

By connecting directly to your source systems and applying consistent, pre-set rules, automated tools deliver a level of precision that’s impossible to match by hand. This means every report is built on a foundation of clean, trustworthy data, building confidence with stakeholders, investors, and regulators who rely on it.

Gain Massive Time Savings

Imagine getting hundreds of hours back every year. That’s the reality when you automate the grunt work. The time finance pros spend chasing down data, stitching together spreadsheets, and formatting reports is staggering.

A recent analysis showed just how big the impact can be. Studies reveal financial automation can make processes up to 85 times faster than manual workflows, while also cutting reporting errors by a massive 90%. You can explore more data on these efficiency gains to get the full picture.

This isn’t just about saving time; it’s about reallocating your most valuable asset—your team’s brainpower—to work that actually drives the business forward.

Empower Your Team as Strategic Advisors

When your sharpest financial minds are freed from the drudgery of manual reporting, their roles transform. They stop being historical scorekeepers and become forward-looking strategic partners.

With more time and better data, your team can finally:

- Perform Deeper Analysis: They can dive into the “why” behind the numbers, spot emerging trends, and flag potential risks before they spiral into real problems.

- Improve Financial Forecasting: Armed with real-time, accurate data, they can build more reliable financial models, giving leadership a much clearer view of what’s ahead.

- Provide Proactive Insights: Instead of just reporting what happened last quarter, they can offer sharp, proactive advice to boost profitability and guide critical business decisions.

This shift turns your finance department into a true strategic asset, one that directly contributes to growth and a stronger competitive edge.

Strengthen Compliance and Audit Trails

Prepping for an audit or meeting regulatory deadlines can be incredibly stressful. Manual reporting often means digging through a messy trail of files and trying to piece together what happened, when. It’s an auditor’s—and your team’s—worst nightmare.

Financial reporting automation cleans this up by creating an unchangeable, built-in audit trail. Every single action, from data pull to report generation, is automatically logged and time-stamped.

This gives you a few powerful advantages:

- Effortless Audits: When auditors come knocking, you can pull a complete, transparent record in just a few clicks. No more frantic searching.

- Consistent Compliance: Automation ensures reports are always generated using standardized templates that meet regulations like GAAP or IFRS.

- Reduced Risk: A clean, automated trail drastically cuts the risk of compliance failures and the costly penalties that come with them.

In the end, automation does more than just make reporting faster and more accurate. It fundamentally changes the role of your finance function, unlocking its true strategic power.

The Tech Behind Modern Finance

The engine driving today’s finance revolution isn’t one magic bullet. Instead, it’s a powerful mix of several key technologies working in concert. Getting a handle on what they are and how they fit together is key to making smart moves for your business.

Think of these technologies as a specialized team, where each member plays a unique role in making financial reporting automation a reality.

Robotic Process Automation: The Digital Assistant

At the ground level, you have Robotic Process Automation (RPA). The best way to think about RPA is to imagine a digital assistant who never gets tired, never makes a typo, and follows your instructions to the letter, 24/7. That’s RPA in a nutshell.

These software “bots” are built to copy the exact, rule-based, repetitive tasks a human would do. This includes things like logging into systems, pulling data from one app and pasting it into another, or filling out forms. In financial reporting, RPA is the tireless workhorse handling the most predictable, high-volume tasks with perfect accuracy.

For example, an RPA bot can be set up to:

- Log into your company’s bank portal first thing in the morning.

- Download the daily transaction statement.

- Enter that data right into your accounting software.

This simple but powerful automation wipes out hours of manual grind, freeing your team to focus on work that actually requires a human brain.

Artificial Intelligence: The Seasoned Analyst

While RPA is great at following strict rules, Artificial Intelligence (AI)—and its offshoot, machine learning—is designed to think and learn. If RPA is the digital assistant, AI is the seasoned analyst who spots patterns and red flags that a person might easily overlook.

AI elevates financial reporting by adding a layer of intelligence. It can sift through massive datasets to identify trends, forecast future results, and flag weird transactions that could signal an error or, worse, fraud.

This is where it gets interesting. Instead of just churning out reports on past data, AI-powered systems can give you predictive insights. They help you answer not just “what happened?” but “what’s likely to happen next?”

For instance, an AI algorithm could analyze years of sales data against market trends to create a much sharper revenue forecast. It can also learn what “normal” financial activity looks like for your business and automatically alert you when something’s off.

Cloud Platforms: The Central Hub

The final piece of this puzzle is the cloud. Cloud computing platforms serve as the central hub where all this action happens. They provide the flexible, scalable infrastructure needed to store huge amounts of data and run powerful automation software without breaking a sweat.

Without the cloud, putting these tools in place would mean a huge upfront investment in physical servers and IT maintenance. Cloud platforms offer a far more flexible and cost-effective way forward.

This accessibility is critical. A central cloud system is essential for effective financial data aggregation, pulling information from different, disconnected sources into one clean, unified location. For a deeper dive into the strategies behind this shift, check out this complete strategic guide to cloud accounting solutions. Ultimately, moving to the cloud means your team can securely access critical financial data and reports from anywhere, at any time.

Your Step-By-Step Implementation Roadmap

Successfully bringing financial reporting automation into your business is much more than just buying a new piece of software. It’s a full-on business transformation that demands a smart plan to get the results you’re after. This roadmap breaks that big journey down into four manageable steps, guiding you from where you are now to a successful rollout.

Think of it like building a house. You wouldn’t just show up with a pile of lumber and start nailing boards together without a blueprint. A solid implementation plan is your blueprint for success, making sure every move you make helps build a strong, valuable system.

Phase 1: Assess Your Current Workflows

Before you can fix your processes, you have to know exactly where they’re broken. The first step is to take a deep, honest look at your current financial reporting cycle. Map out every single step, from the moment data comes in the door to when the final report lands on someone’s desk.

Get your finance team in the room for this. They’re on the front lines every day and know precisely where the biggest bottlenecks, most mind-numbing tasks, and highest risks for error are hiding. Document every pain point—this list will become the core of your business case for automation.

This initial deep-dive is non-negotiable. It helps you zero in on the exact tasks that are sucking up the most time and money, giving you a clear target for your automation efforts.

Phase 2: Set Clear Goals and KPIs

Once you have a crystal-clear picture of your challenges, you need to define what “success” actually looks like. Vague goals like “making things more efficient” won’t cut it. You need specific, measurable Key Performance Indicators (KPIs) to track your progress and justify the investment.

Your goals should directly attack the pain points you just uncovered. For example:

- Slash the Month-End Close: Aim to cut the closing cycle from a grueling ten business days down to just three.

- Eliminate Reporting Errors: Target a 95% drop in manual data entry mistakes within the first six months.

- Free Up Your Team: Reclaim 20 hours per team member each month, shifting their focus from manual data entry to high-value strategic analysis.

Setting these concrete benchmarks gives you a clear finish line. This not only keeps the project on track but also makes it way easier to show a real, tangible return on investment to leadership later on.

Phase 3: Choose the Right Automation Tools

Let’s be clear: not all automation tools are built the same. The right one for your company depends entirely on your specific needs, the systems you already use, and your long-term vision. As you start looking at different options, focus on platforms that offer flexibility and can grow alongside your business.

A huge piece of this puzzle is figuring out how different systems will talk to each other. To get a better handle on this, you can explore the principles of financial workflow automation, which is all about weaving separate tasks into a single, cohesive process. This mindset helps ensure your shiny new tool will actually play nice with your existing tech stack.

When you’re vetting potential software, be sure to grill vendors with these questions:

- Integration Capabilities: How easily does your platform plug into our current ERP, accounting software, and other data sources?

- Scalability: Can your tool handle our data volume as it grows and manage more complexity as our business expands?

- Security and Compliance: What security measures do you have to protect our sensitive financial data? How does the platform help us stay compliant with standards like GAAP or IFRS?

- User Experience: Is the interface actually intuitive for finance pros who aren’t necessarily tech wizards?

- Support and Training: What kind of training and ongoing customer support do you offer to make sure our team can actually use the platform effectively?

Phase 4: Implement a Phased Rollout

Finally, whatever you do, avoid the “big bang” implementation where you try to automate everything at once. That approach is a recipe for overwhelming your team and creating a ton of unnecessary risk. Instead, go for a phased rollout that focuses on chalking up some quick wins.

Start with one or two of the most painful, high-impact processes you pinpointed back in Phase 1. This lets your team get comfortable with the new system, see the benefits for themselves, and build some positive momentum. As you nail the automation in one area, you can take what you’ve learned and apply it to the next phase of the project. This methodical approach leads to a much smoother transition and gets everyone on board.

Here is the rewritten section, crafted to meet all the specified requirements for a human-like, expert tone and style.

What’s Next? The Future of Finance and Global Trends

Looking beyond today’s efficiencies, financial reporting automation is setting the stage for a total reinvention of the finance function. The conversation is no longer just about closing the books faster. It’s about creating a system of continuous, real-time intelligence that completely changes what reports contain and how they’re used to steer the business.

Imagine a financial dashboard that doesn’t just show you last quarter’s results but actively predicts next quarter’s cash flow using live market data. That’s exactly where the industry is heading—away from reactive, historical analysis and toward proactive, predictive guidance. It’s about turning financial data into a tool for forecasting what’s coming, not just recording what already happened.

The Rise of Predictive Analytics

The next frontier is predictive analytics. By weaving artificial intelligence and machine learning into the fabric of finance, future systems will sift through massive volumes of data to spot subtle patterns and forecast future events with stunning accuracy.

This isn’t just an upgrade; it’s a complete role reversal. Finance shifts from being a backward-looking scorekeeper to a forward-looking strategist. Instead of just reporting what happened, teams can start answering the big, strategic questions:

- How will a hiccup in our supply chain affect profit margins six months from now?

- Which of our customer segments are poised for growth, and which are likely to shrink next year?

- What’s our projected cash position at the end of the next two quarters?

Answering these questions with data-backed confidence gives leaders the foresight to navigate uncertainty and jump on opportunities before they even fully appear. This is the real game-changer that advanced automation brings to the table.

Integrating ESG and Non-Financial Metrics

Another massive shift is the growing demand for Environmental, Social, and Governance (ESG) reporting. Stakeholders, from investors to customers, now expect businesses to report on their non-financial performance with the same rigor as their financial results.

Trying to collect, validate, and report on ESG metrics manually is a nightmare of spreadsheets and frantic data chases. Automation is the clear solution, integrating non-financial data sources directly into the reporting workflow. This ensures ESG data is consistent, verifiable, and woven seamlessly into the company’s overall performance story, turning sustainability reporting into a standard, auditable process instead of an annual fire drill.

Global Market Growth and Professional Evolution

The momentum behind this change is impossible to ignore, and the market numbers tell a compelling story. This rapid adoption is reshaping the role of the finance professional right before our eyes.

Here’s a snapshot of the global financial automation market, which underscores just how fast this transformation is happening. The growth is widespread, driven by the universal need for smarter, more agile financial operations.

Global Financial Automation Market Snapshot

| Region/Segment | Projected Value/Growth Rate | Key Driver |

|---|---|---|

| Global Market | $18.4 billion by 2030 | Widespread need for operational efficiency and data-driven insights. |

| Global Growth Rate | 14.6% CAGR | Increasing adoption of AI and machine learning in finance functions. |

| North America (2025) | Approx. $40.64 billion | Intense focus on adopting AI-driven tools for a competitive edge. |

| Asia-Pacific | High Growth Potential | Rapid digitalization and a growing focus on corporate governance. |

This data paints a clear picture: businesses everywhere are investing heavily in automation. You can discover more insights on financial automation’s global impact to see the full scope of this trend.

Ultimately, as routine tasks become automated, the finance professional of tomorrow looks very different. The demand for strategic thinkers, data storytellers, and true business partners is set to skyrocket. Future finance experts will spend less time buried in spreadsheets and more time interpreting complex data, advising leadership, and shaping business strategy. This evolution elevates the entire profession, making it more dynamic and valuable than ever.

Investing in financial reporting automation today isn’t just about efficiency—it’s an investment in this more strategic, forward-thinking future.

Frequently Asked Questions

When you start exploring financial reporting automation, it’s natural for a few practical questions to pop up. Let’s tackle some of the most common ones we hear from finance leaders, so you can move forward with a clear head.

What Is the Initial Cost of Automation?

The honest answer? It varies. A lot. The price tag really depends on your company’s size, how tangled your current processes are, and which software you ultimately choose.

For smaller businesses, you might be looking at a simple, out-of-the-box solution with a low monthly subscription. For a large enterprise, a full-scale implementation is obviously a more significant line item. But it’s a mistake to view this as just another expense. Think of it as an investment.

When you sit down to do the cost-benefit analysis, don’t forget the “soft costs” of doing things manually—the countless hours your team burns on repetitive tasks or the very real financial risk of a single human error. You’d be surprised how quickly the ROI from time savings and greater accuracy can make the system pay for itself.

How Does It Integrate with Our Existing Systems?

This is a make-or-break question, and the good news is that modern automation tools are built to play nicely with others. Most quality platforms come with pre-built connectors or powerful APIs that let them pull data from all the usual suspects.

We’re talking about systems like:

- ERPs: SAP, Oracle, and NetSuite

- Accounting software: QuickBooks and Xero

- CRMs: Salesforce

- Spreadsheets: Excel and Google Sheets

A huge part of picking the right tool is making sure it can plug into your current tech stack without a major headache. The goal is to create one unified stream of data.

The point of financial reporting automation isn’t to rip and replace what you already have. It’s designed to be an intelligent layer that sits on top of your existing systems, orchestrating data flow to cut out manual work and lock in consistency.

How Much IT Support Is Really Needed?

This is a huge source of anxiety for many finance teams, but the reality is usually much less demanding than you’d think. Today’s cloud-based automation platforms are designed for finance pros, not IT wizards. The vendor handles all the heavy lifting—server maintenance, security updates, and all that backend infrastructure stuff.

Your IT team will definitely have a role to play during the initial setup, mainly to help with integrations and to make sure all the data security boxes are ticked. But once it’s up and running? The day-to-day work—building report templates, scheduling runs, and tweaking workflows—is almost always handled directly by the finance team with very little need to call for IT backup.

Ready to take control of your complete financial picture? PopaDex provides the intuitive tools you need to track your entire portfolio, from bank accounts and investments to property and liabilities, all in one place. Gain the clarity you need to achieve your goals. Start your journey with PopaDex today.