Our Marketing Team at PopaDex

How to Use a Home Equity Loan Payment Calculator

A home equity loan payment calculator is an online tool that cuts through the financial fog, giving you a clear estimate of your fixed monthly payment. It takes the big, abstract numbers—loan amount, interest rate, and term—and boils them down to a single, predictable expense you can plan your budget around. No more guesswork.

Tapping Into Your Home’s Value with a Payment Calculator

Think of your home’s equity as a savings account you’ve been funding for years. Every mortgage payment you make and every bump in your property’s value adds to this account. A home equity loan is simply a way to withdraw some of that cash for big-ticket items—think a new kitchen, college tuition, or clearing out high-interest credit card debt.

But before you open the tap, you need to know exactly what that withdrawal will cost you each month. This is where a home equity loan payment calculator becomes your best friend. It takes the mystery out of the borrowing process by giving you an instant, concrete number: your future monthly payment.

Why This Clarity Matters

This one number empowers you to make smarter financial choices. You can play around with different loan amounts and repayment timelines to see the trade-offs in real-time. Want a lower monthly bill? A longer term might work, but you’ll pay more in interest over the life of the loan. The calculator lets you find the sweet spot that works for your budget and your long-term goals.

To get a better handle on the asset you’re working with, it helps to understand what is real estate equity and how it’s calculated.

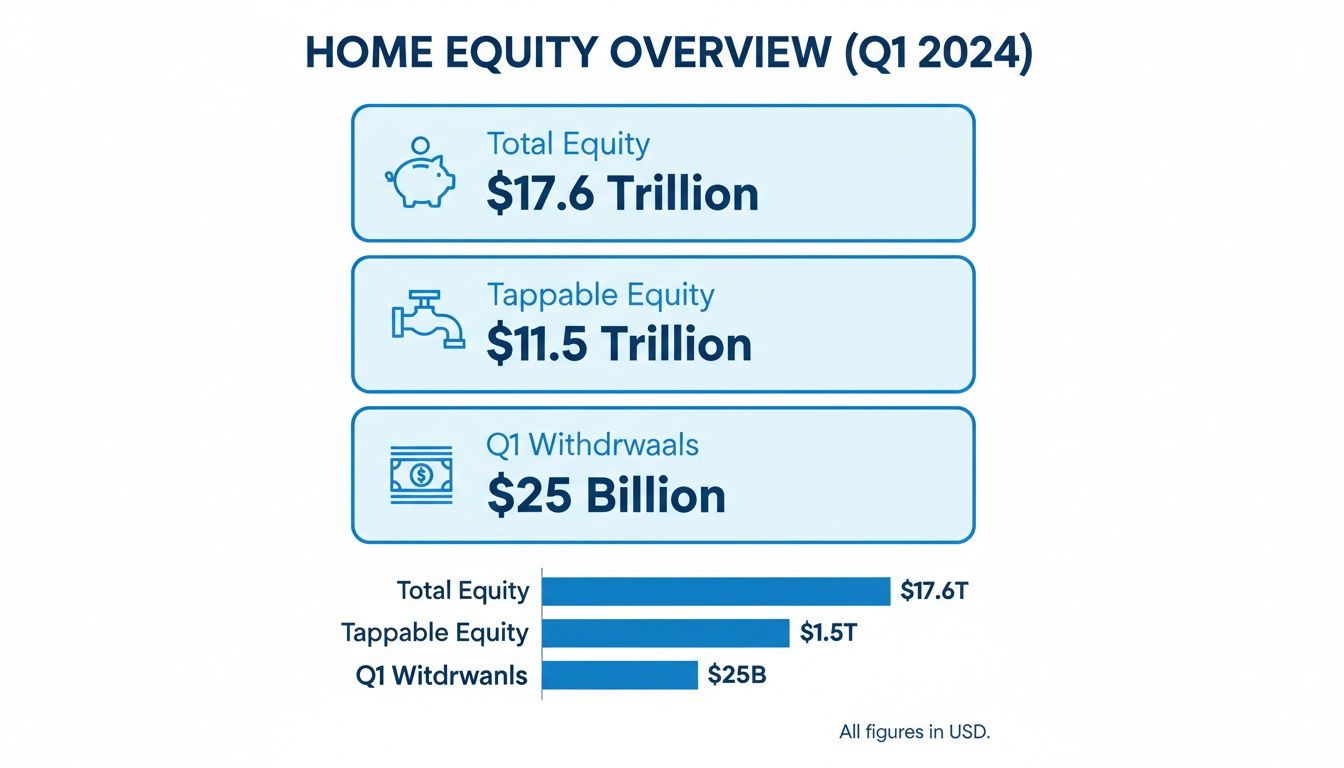

More and more homeowners are putting this value to work. In early 2025, U.S. homeowners were sitting on a staggering $17.6 trillion in home equity, and more than $11 trillion of that was considered “tappable.” This fueled a 22% year-over-year jump in homeowners taking out second-lien equity loans, a clear sign that people are using their home’s value to finance their goals.

Before you start crunching numbers, it’s a good idea to get a handle on the various ways to get a loan for a new home, as many of the principles overlap.

A home equity loan payment calculator bridges the gap between your financial goals and your current reality, showing you exactly how borrowing against your home fits into your monthly budget.

Once you have a potential payment figured out, the final step is to see how this new liability fits into your overall financial picture. Using a platform like PopaDex, you can track the new loan alongside all your other assets, so you always have a clear, up-to-date view of your total net worth.

Deconstructing Your Monthly Loan Payment

Ever wonder what’s actually happening behind the scenes when you make a loan payment? A home equity loan payment calculator isn’t running on some complex financial wizardry. It’s all based on a simple, powerful concept called amortization.

Think of it like a perfectly balanced seesaw. On one side, you have the principal—the cash you actually borrowed. On the other, you have the interest, which is the lender’s fee for giving you that cash. Every single payment you make is split between these two, ensuring your loan balance shrinks methodically until it hits zero.

The Seesaw Effect of Loan Payments

At the start of your loan, the seesaw is heavily tilted toward the lender. The vast majority of your payment goes straight to covering interest, with only a tiny fraction chipping away at your principal. Honestly, it can feel like you’re spinning your wheels and not making much of a dent in the actual debt.

But stick with it, because the magic happens over time. With every payment, the seesaw begins to shift. As your principal balance gets smaller, the amount of interest charged on it also drops. This frees up more and more of your fixed monthly payment to attack the principal directly. By the final years of your loan, the seesaw has tipped completely—your payments are almost entirely principal.

This chart really puts into perspective the massive pool of home equity that homeowners are sitting on, which is what makes these loans possible in the first place.

The numbers are staggering. While total equity is a massive $17.6 trillion, a huge chunk of that—$11.5 trillion—is actually accessible. That’s what fuels borrowing activity like the $25 billion withdrawn in just one quarter.

The Math Behind the Monthly Payment

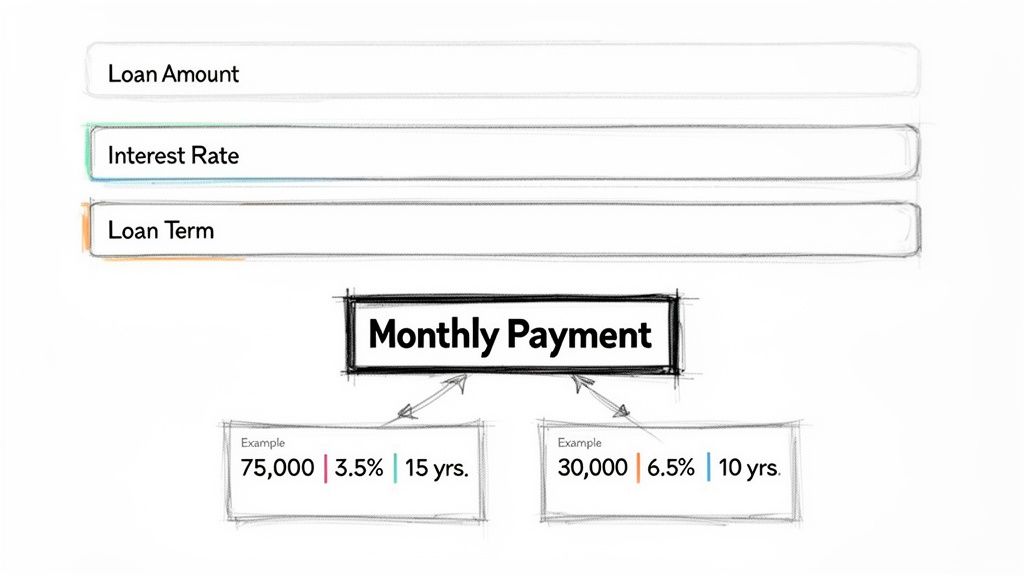

While a good calculator handles the heavy lifting, knowing the inputs gives you the power to play with the numbers and find what works for you. The formula boils down to three key variables to figure out that steady monthly payment.

- Principal (P): This is the total loan amount. If you’re borrowing $50,000 for that dream kitchen remodel, your principal is $50,000.

- Interest Rate (r): This is the annual rate your lender charges, which gets converted into a monthly figure for the calculation. A 6% annual rate becomes 0.5% per month (6% / 12).

- Loan Term (n): This is just the total number of payments you’ll make. A 15-year loan means 180 monthly payments (15 years x 12 months).

The calculator simply plugs these numbers into the standard amortization formula. The result is that fixed monthly payment you can count on, which is a huge advantage of a home equity loan. It makes budgeting predictable, unlike the rollercoaster payments you can get with variable-rate products.

By understanding amortization, you’re no longer just sending a check into the void. You’re watching a strategic process unfold where every dollar you pay has a specific job: first to cover the cost of borrowing, then to conquer the debt itself.

Once you grasp this, the calculator transforms from a simple estimation tool into a powerful strategic planner. You can see exactly how a slightly lower interest rate or a shorter term can slash the total interest you’ll pay over the life of the loan. It gives you the confidence to structure a loan that not only solves an immediate need but also fits perfectly with your long-term financial health.

Using a Home Equity Loan Payment Calculator Step by Step

Alright, you’ve got the theory down on how amortization works. Now, let’s get practical. This is where the rubber meets the road—where you turn those abstract loan concepts into a real number that fits into your monthly budget. Using a home equity loan payment calculator is surprisingly straightforward, and it’s the single best way to get the clarity you need to move forward with confidence.

Think of it like this: there are three main levers you can pull to see how a loan will impact your finances. Let’s walk through what they are and how to use them.

Gathering Your Key Inputs

Before you can get a meaningful result, the calculator needs three core pieces of information. Each one plays a huge role in shaping your final payment.

- Loan Amount: This is the total amount of cash you want to borrow. It’s the starting point for everything.

- Interest Rate: This is the lender’s annual percentage rate (APR). Don’t underestimate this number—even a tiny change here can have a massive impact on both your monthly payment and the total interest you’ll pay over the life of the loan.

- Loan Term: This is simply how long you have to pay the loan back, usually measured in years. For home equity loans, you’ll typically see terms ranging from five to 20 years.

Once you punch these three numbers in, the calculator does the heavy lifting, running the amortization formula in an instant to give you a precise monthly payment.

Real-World Scenario 1: The Kitchen Remodel

Let’s put this into practice. Imagine a family is finally ready to tackle that big kitchen renovation they’ve been dreaming of. After getting quotes, they figure they need to borrow $75,000. They shop around and lock in a fixed interest rate of 7.5% on a 15-year loan, which feels like a comfortable repayment timeline.

Here’s what they’d plug into the calculator:

- Loan Amount: $75,000

- Interest Rate: 7.5%

- Loan Term: 15 years (or 180 months)

The Result: The calculator instantly shows a fixed monthly payment of about $782. Over the full 15 years, they’d pay a total of $65,745 in interest.

That one number—$782—is incredibly powerful. The family can now see exactly how that renovation fits into their monthly cash flow. They can plan with total certainty, knowing that payment won’t ever change. And seeing the total interest gives them a clear-eyed view of the true cost of their new kitchen.

Real-World Scenario 2: Consolidating Debt

Now, let’s look at another common use case. Someone is struggling with $30,000 in high-interest credit card debt, with an average rate of over 20%. A home equity loan looks like a much smarter way to pay it off. They find a lender offering a 10-year loan with a fixed rate of 8.0%.

Their calculator inputs would be:

- Loan Amount: $30,000

- Interest Rate: 8.0%

- Loan Term: 10 years (or 120 months)

The Result: Their new monthly payment comes out to just $364. The total interest paid over that decade would be $13,688.

This is a game-changer. The calculator shows them a clear path out of crushing, high-cost debt with a single, predictable payment. That $364 is almost certainly far less than the combined minimum payments on their credit cards, and it highlights the massive savings they’ll achieve by ditching revolving credit.

These examples prove that a home equity loan payment calculator is so much more than a math tool—it’s a strategic planning partner. By running a few different scenarios, you can visualize the real-world financial impact of your choices before you sign on the dotted line.

If you want to dive even deeper into the payment schedules these calculators create, check out our guide on using an amortization calculator for mortgages, which runs on the exact same principles.

Home Equity Loan vs. HELOC Payments

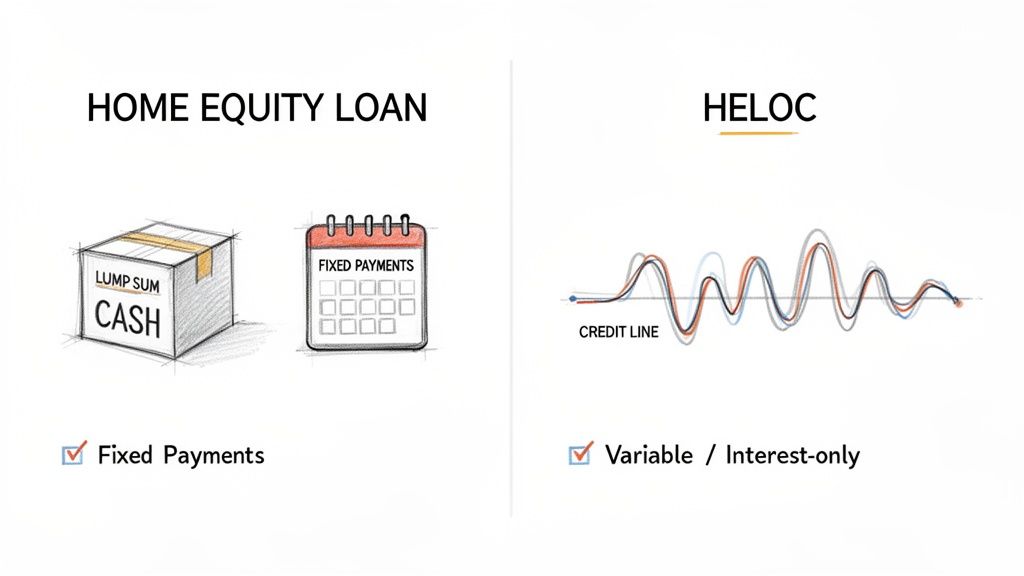

When you’re ready to tap into your home’s equity, you’ll quickly run into two main players: the home equity loan and its more flexible cousin, the Home Equity Line of Credit (HELOC). While both let you borrow against your property’s value, the way you repay them couldn’t be more different. Getting this distinction right from the start is crucial.

Think of a home equity loan as the definition of predictable. It’s a straightforward installment loan where you get a lump sum of cash upfront and pay it back with fixed monthly payments over a set term. This is where a home equity loan payment calculator becomes your best friend, giving you a rock-solid number you can build your budget around.

A HELOC, on the other hand, acts more like a credit card that’s secured by your house. You’re given a credit limit and can draw money as you need it, pay it back, and draw again. That flexibility is fantastic, but it comes with a major trade-off: your payments are anything but predictable.

The Key Differences in Payment Structure

The biggest split between these two loans comes down to interest rates and how your monthly payments are calculated. Home equity loans almost always have a fixed interest rate, which means your payment—covering both principal and interest—will be the exact same from day one until the loan is paid off. You’ll know in year one what your very last payment will look like 15 years down the road.

HELOCs, however, typically carry a variable interest rate that’s tied to a benchmark like the prime rate. When that rate goes up or down, so does your payment. Even more importantly, HELOCs are structured in two distinct phases that completely change what you owe each month.

- The Draw Period: This is the first phase, usually lasting 5-10 years, where you can access your line of credit. During this time, your required payments are often interest-only, which keeps them quite low.

- The Repayment Period: Once the draw period is over, the tap is turned off. You can’t borrow any more money, and you must start repaying both the principal you borrowed and the interest. This phase usually lasts 10-20 years, and it’s when payments can jump significantly.

The switch from low, interest-only payments to a fully amortized schedule can cause serious “payment shock” for homeowners who aren’t prepared. That initial low payment on a HELOC can be dangerously misleading if you haven’t budgeted for the much larger payments to come.

Home Equity Loan vs. HELOC Payment Structures

To make this crystal clear, let’s put them side-by-side. This table really highlights why one might be a perfect fit for a specific goal while the other is better suited for a different kind of financial need.

| Feature | Home Equity Loan | HELOC (Home Equity Line of Credit) |

|---|---|---|

| Fund Distribution | You get the entire loan amount in one lump sum at closing. | You can draw funds as you need them, up to a set credit limit. |

| Interest Rate | Almost always a fixed interest rate for the entire loan term. | Typically a variable interest rate that can change over time. |

| Monthly Payment | A predictable, fixed monthly payment of principal and interest. | Payments fluctuate. Often interest-only in the draw period, then principal plus interest. |

| Best Use Case | Perfect for big, one-time projects with a known cost, like a kitchen remodel. | Ideal for ongoing projects, unexpected expenses, or when the final cost is uncertain. |

Seeing the differences laid out like this makes it easier to align your borrowing strategy with your actual financial goals.

Choosing Based on Your Needs

So, which one is right for you? It all comes down to your specific situation.

If you need a set amount, say $50,000, for a single project and you absolutely value budget stability, the home equity loan is the clear winner. You can use a home equity loan payment calculator to lock in your exact monthly cost and plan with total confidence.

But if you see yourself needing funds at different times—maybe for a renovation you’re doing in phases, ongoing college tuition, or just a powerful emergency fund—then the flexibility of a HELOC might be the better fit. Just make sure you’re ready for the variable payments and that eventual leap into the full repayment period.

How to Score a Lower Monthly Loan Payment

Figuring out what a home equity loan payment calculator will spit out is step one. Step two is learning how to nudge that number in your favor. Getting a lower monthly payment isn’t about some secret trick; it’s all about smart preparation and even smarter shopping. If you focus on a few key areas before you even start applying, you can seriously trim your borrowing costs.

The single biggest factor you can influence is your credit score. Lenders see that number as a direct report card on how reliable you are with debt. A higher score tells them you’re a lower risk, and they’ll often reward you with a better interest rate. Even a tiny dip in your interest rate can add up to thousands of dollars in savings over the loan’s lifetime.

Before you start filling out applications, take some time to comb through your credit report for mistakes, chip away at high-balance credit cards, and make sure your payment history is spotless.

The Power of Comparison Shopping

Whatever you do, don’t just take the first loan offer that lands in your inbox. You’d be surprised how much rates and terms can vary between lenders, even for the exact same person. It’s absolutely essential to get quotes from multiple places—think national banks, your local credit union, and even online lenders. Each one has its own appetite for risk and internal lending rules, which means their offers can be wildly different.

You can even use these offers as leverage. Mentioning a competitor’s better offer can sometimes spark a little competition, pushing a lender to match or beat the terms you’ve found elsewhere. To really get a handle on this, it helps to understand how bigger economic shifts, like Bank Rate changes, can ripple down to the rates lenders are willing to offer.

When lenders compete, you win. Getting at least three different loan estimates gives you the negotiating power and market insight needed to secure the most favorable terms available to you.

Playing with Your Loan Term

Another straightforward way to shrink your monthly payment is to stretch out the loan term. This is where a home equity loan payment calculator really shines, making the trade-off perfectly clear. Spreading the same loan amount over 20 years instead of 15, for example, will definitely result in a smaller, more manageable monthly bill.

But, there’s a catch. A longer term means you’re paying interest for more years, which bumps up the total amount of interest you’ll pay over the life of the loan.

Here’s a simple way to think about it:

- Go for a longer term if: Your main goal is to keep your monthly payment as low as possible to free up cash for other things.

- Pick a shorter term if: You can comfortably handle a higher payment and want to save the most money on interest in the long run.

Ultimately, the best way to decide is to use a calculator to play out these different scenarios. It lets you stop being a passive borrower and become an active participant, structuring a loan that fits both your immediate budget and your long-term financial goals.

Integrating Your Loan Into Your Financial Big Picture

A new loan is so much more than a monthly payment—it’s a brand-new liability that reshapes your entire financial world. A home equity loan payment calculator is great for figuring out that monthly number, but its true power comes alive when you see that figure in the context of everything else you own and owe. To really be in control, you have to move beyond the calculator.

Think of it this way: the loan isn’t an isolated event, but a new piece of a much larger puzzle. You need a way to see how this new debt stacks up against your assets, like your savings, investments, and the value of your property. Seeing that relationship clearly is the key to understanding its immediate hit on your net worth and making smarter moves from here on out.

From Monthly Payment to Net Worth Impact

The first, most crucial step is to log this new liability in a central dashboard. When you add your home equity loan to a tracker like PopaDex, you immediately see the needle on your net worth shift. It’s a moment of truth, grounding the abstract idea of a loan in the hard reality of your personal balance sheet.

This big-picture view helps you avoid financial tunnel vision. Instead of just stressing about making the next payment, you can manage your finances strategically. You get to watch how paying down this new debt actively builds your net worth back up over time, which is incredibly motivating.

For young professionals or gig workers juggling an irregular income, a payment calculator can make different scenarios concrete. Borrowing $50,000 at 7% over 10 years might be a ~$660 monthly payment, but stretching it to 15 years could drop it to a more manageable $450. This is where platforms like PopaDex really shine. They can pull in bank links from 30+ countries, property values, and all your liabilities into one clean view. For a small fee, auto-syncs show you exactly how a new loan warps your dashboard visuals and disposable income.

A loan isn’t just an expense to be managed; it’s a dynamic variable in your net worth equation. Tracking it properly transforms it from a source of stress into a measurable component of your financial strategy.

Managing Your Loan in a Multi-Currency World

For expats, digital nomads, and anyone living a global life, this big-picture view is non-negotiable. Juggling a home equity loan in one currency while your income and assets are in others adds a layer of complexity that simple calculators just can’t handle.

This is where a multi-currency net worth tracker becomes an essential tool. It lets you:

- View All Finances in a Base Currency: See your USD loan, EUR savings, and GBP investments all converted into a single currency for a clear, apples-to-apples comparison.

- Track Exchange Rate Fluctuations: Understand how currency swings are affecting both the real value of your debt and the strength of your assets.

- Adjust Your Financial Strategy: Make informed decisions about where to put your money based on a global view of your finances, not just a local one.

By plugging your new home equity loan into a platform that gets your global financial life, you gain instant clarity and control. You can finally see how this liability fits with every other part of your portfolio, ensuring your new debt helps you reach your goals without wrecking your overall financial health. If you want to understand how this new payment impacts your spending power, check out our guide on how to calculate disposable income.

Frequently Asked Questions

When you’re tapping into your home’s equity, a lot of questions can pop up. Let’s tackle some of the most common ones that come to mind when using a home equity loan calculator, giving you clear, straightforward answers.

Does This Calculator Include Taxes and Insurance?

Nope. A good home equity loan payment calculator keeps things clean and simple. It focuses on one thing only: the principal and interest (P&I) payment for the new loan you’re considering.

This new payment is completely separate from your main mortgage payment, which often bundles in property taxes and homeowners insurance into an escrow account. Think of the calculator’s result as the pure, direct cost of this specific loan, letting you see exactly what you’ll owe each month for the borrowed money.

A home equity loan payment calculator gives you a precise figure for the loan itself. This helps you analyze the new payment on its own before you factor it into your bigger monthly budget.

How Accurate Are Online Loan Payment Calculators?

For planning and comparing your options, they’re incredibly accurate. These calculators all use the same time-tested amortization formula that banks do, so the math itself is rock-solid. You can absolutely rely on the numbers when you’re building a budget or weighing different loan terms.

That said, the final payment on your official loan documents might be a hair different. Why? The lender might approve you for a slightly different interest rate after your credit check, or they might roll small origination fees into the total loan amount.

- Use the calculator for: Budgeting, comparing loan scenarios, and strategic what-if planning.

- Rely on the lender’s Loan Estimate for: The final, official payment you’ll be making.

Think of the calculator as your trusty guide for the journey and the lender’s paperwork as the final, detailed map.

Can I Make Extra Payments on My Home Equity Loan?

Absolutely—and it’s one of the smartest ways to save a ton of money over time. Nearly all lenders will let you make extra payments that go straight toward your loan’s principal balance.

When you chip away at the principal, you reduce the balance that interest gets calculated on. This creates a powerful snowball effect: you pay off the loan faster and can slash the total amount of interest you pay over the life of the loan.

Before you start sending extra cash, just check two quick things with your lender:

- Confirm there are no prepayment penalties for paying off the loan ahead of schedule.

- Make sure any extra money is applied directly to the principal, not just credited toward a future payment.

Taking that simple step ensures every extra dollar you send is working as hard as possible to get you debt-free sooner.

Ready to see how this new loan fits into your complete financial picture? With PopaDex, you can track your home equity loan right alongside all your other assets and liabilities, giving you a clear, real-time view of your net worth. Start tracking for free today!