Our Marketing Team at PopaDex

How Often Rebalance Portfolio: Expert Tips for Optimal Timing

How often should you rebalance your portfolio? For most people, the sweet spot is either annually or whenever an asset class drifts more than 5% from its target. It’s a simple, disciplined check-in that keeps your well-thought-out strategy from accidentally becoming too risky over time.

The Rebalancing Dilemma: When and Why It Matters

Let’s be clear: rebalancing isn’t about chasing higher returns. It’s all about managing risk.

Here’s a common scenario: a strong bull market could quietly turn your balanced 60% stock and 40% bond portfolio into a much more aggressive 80/20 mix. You wouldn’t have done a thing, but the market’s momentum would have shifted your strategy for you.

This “portfolio drift” is sneaky. It exposes you to far more volatility than you originally signed up for. If the market takes a nosedive, that over-weighted portfolio is going to suffer a much bigger loss than your target allocation ever intended. Rebalancing is your unemotional, systematic course correction.

Think of rebalancing as your built-in mechanism to “sell high and buy low.” It forces you to systematically sell assets that have shot up in value (and are now overweight) and reinvest that cash into assets that have lagged (and are now underweight).

This process is critical for long-term success. It keeps your investment plan tethered to your actual financial goals and risk tolerance, preventing you from making emotional decisions when the market gets choppy. For a deeper look at the nuts and bolts of this, check out these expert tips for rebalancing your portfolio.

The Impact on Performance

This isn’t just theory—it has a real impact, especially when markets get volatile. Research from Morningstar consistently shows that the frequency of rebalancing can significantly affect investor outcomes.

In one analysis, portfolios that were rebalanced lost roughly 1 percentage point less than buy-and-hold strategies during major downturns like the COVID-19 bear market. By simply keeping their allocations in check, investors managed their risk and limited their losses.

Finding Your Rebalancing Cadence

Ultimately, finding the right frequency is a balancing act between a few key factors:

- Risk Control: Making sure your portfolio doesn’t get too aggressive or too conservative for your comfort level.

- Cost Minimization: Avoiding excessive trading fees and potential taxes that can come from rebalancing too often.

- Goal Alignment: Sticking to the plan you designed to get you where you want to go financially.

To help you decide, here’s a quick breakdown of the most common rebalancing strategies.

Quick Guide to Rebalancing Strategies

This table summarizes the main approaches, how often they’re typically applied, and who they’re best suited for.

| Strategy | Typical Frequency | Best For |

|---|---|---|

| Calendar-Based | Annually, semi-annually, or quarterly. | The hands-off investor who prefers a simple, scheduled routine. |

| Threshold-Based | When any asset class drifts by a set percentage (e.g., 5%). | The diligent investor who wants to act only when necessary to minimize trades. |

| Hybrid Approach | A combination of calendar and threshold checks (e.g., check quarterly, rebalance only if a 5% threshold is breached). | The strategic investor who wants the best of both worlds—discipline with efficiency. |

Choosing the right strategy depends on your personality and how hands-on you want to be. The most important thing is to pick one and stick with it.

Calendar Rebalancing: A Disciplined Approach

Calendar-based rebalancing is the classic “set-it-and-forget-it” method for keeping your portfolio in line. It’s a beautifully simple, disciplined approach where you review your asset allocation on a fixed schedule—think quarterly, semi-annually, or annually—no matter what the market is shouting about that day.

This strategy strips the emotion and guesswork right out of the equation. It forces a consistent routine, which is exactly what long-term investing needs.

For most passive investors, an annual check-up is just about perfect. It’s easy to remember by tying it to tax season or the New Year. This hands-off approach naturally minimizes trading, which means lower transaction costs and fewer tax headaches. You’re letting your investments breathe and allowing market cycles to do their thing without constant meddling.

But what if you’re a bit more hands-on? Some investors prefer a quarterly review. Checking in every three months allows for smaller, more frequent tweaks. This can be appealing if you want to keep your portfolio hugged tightly to its targets, especially when the market is on a rollercoaster.

Quarterly vs. Annual: A Real-World Scenario

Let’s walk through a year of wild market swings to see how this plays out. Imagine an investor, Alex, who starts the year with a $100,000 portfolio. The goal is a classic 60% stock and 40% bond split.

- The Market: Stocks soar in the first half of the year, pushing Alex’s stock allocation up to 70%. Then, the market corrects sharply in the second half, and stocks take a tumble.

How would different calendar approaches handle this?

The Annual Rebalancer

An investor on an annual schedule would sit tight and do nothing until the end of the year. They’d log in, see their stock allocation is now way overweight, and make a single move: sell some stocks, buy some bonds, and get back to the 60/40 target. One transaction. Simple, clean, and cost-effective.

The Quarterly Rebalancer

Now, the quarterly investor. They’d rebalance four times. After that big stock run-up in the first quarter, they would have trimmed some of their winning stocks to buy more bonds. They’d repeat this process every three months, making smaller adjustments each time. While this keeps the portfolio much closer to its target allocation throughout the year, it also means more trades and potentially higher fees.

The key takeaway here is that neither approach is inherently “better.” They just serve different goals. The annual method is all about simplicity and cost efficiency, while the quarterly schedule prioritizes tighter risk control.

Choosing Your Calendar Cadence

So, how often should you rebalance? It really boils down to your personal investing style and priorities. There’s no magic number, but here are the key factors to weigh.

- Your Engagement Level: If you want a low-maintenance strategy that lets you get on with your life, annual is your friend. If you’re someone who actively monitors your finances anyway, a quarterly check-in might feel more natural.

- Transaction Costs: Every trade can have a price tag. If your brokerage charges fees, rebalancing less often is the more cost-effective route. Simple as that.

- Tax Implications: In taxable accounts, every sale can trigger capital gains taxes. An annual schedule means fewer taxable events. Remember, rebalancing is just one piece of the puzzle; exploring broader investment diversification strategies can help optimize your portfolio’s overall structure, too.

- Your Peace of Mind: This is the big one. Choose the frequency that lets you sleep at night. The absolute best plan is the one you can actually stick with, year after year, without stressing out.

Threshold Rebalancing: A Market-Driven Strategy

What if you could let the market itself tell you exactly when to rebalance? That’s the big idea behind threshold rebalancing. Forget circling dates on a calendar; this is a dynamic strategy where you only act when an asset class drifts from its target allocation by a specific amount.

This approach ensures you’re not just rebalancing for the sake of it. Instead, you’re making moves because market performance has genuinely shifted your portfolio’s risk profile. The trigger isn’t a random Tuesday in June—it’s a meaningful deviation that you defined ahead of time.

Setting Your Smart Thresholds

The magic of this strategy lies in choosing the right threshold, often called a “band.” This is simply the percentage of drift you’re willing to tolerate before you step in to make a change. A common starting point is 5%, but the ideal number really depends on your goals and what you’re holding.

A tight threshold, say 3%, keeps your portfolio almost perfectly aligned with your target risk level. The tradeoff? You’ll likely trade more often, which can rack up transaction costs and create more taxable events. On the flip side, a wider 10% band means less trading, but it also lets your portfolio stray further from its intended path, potentially exposing you to more risk than you bargained for.

The goal is to find a threshold that keeps you in control without reacting to every minor market blip. It’s a balance between precision and practicality, ensuring you act on significant shifts, not just daily noise.

Tailoring Thresholds to Your Assets

A one-size-fits-all approach just doesn’t cut it here. A much smarter play is to set different thresholds for different asset classes based on how volatile they tend to be.

- High-Volatility Assets: For the wilder rides like emerging market stocks or small-cap equities, a tighter band (maybe 3-5%) makes a lot of sense. Their prices can swing dramatically, and a smaller threshold prevents them from quickly dominating your portfolio and throwing your risk level out of whack.

- Low-Volatility Assets: For your steadier investments like government bonds or large-cap value stocks, a wider band (like 8-10%) is usually fine. These assets don’t typically see huge price swings, so they need less frequent course correction.

This tailored approach makes your rebalancing strategy far more efficient and responsive. To get a feel for the kind of market movements that can trigger these thresholds, it’s worth checking out an August 2025 market update.

Research backs this up. A comprehensive study looking at data from 1973 to 2022 found that deviation-based strategies strike an effective balance. For a typical 60/40 portfolio, this method was more efficient than monthly rebalancing (which had the highest costs) and a hands-off approach (which had the most risk drift). Threshold rebalancing offers a strategic middle ground, letting real market data drive your decisions.

Comparing Rebalancing Strategies Head to Head

Theory is one thing, but seeing how these strategies actually perform in the wild is what really counts. Let’s put them to the test.

Imagine a $100,000 portfolio navigating a volatile decade. We’ll compare what happens if you do nothing versus rebalancing annually, quarterly, or using a 5% deviation rule. We’re zeroing in on what matters most to investors: the final portfolio value, how bumpy the ride was (volatility), and the hit from transaction costs and taxes.

Spoiler alert: there’s no single “best” strategy. The goal here is to shine a light on the trade-offs so you can pick the one that fits you.

Dissecting the Performance Data

When we run the numbers, some clear patterns jump out.

The “do nothing” approach often ends up with the highest final dollar amount, especially during a long bull run. But—and it’s a big but—it also comes with the most volatility. Why? Because the stock portion of the portfolio just keeps growing, leaving you far more exposed to risk than you originally intended.

On the flip side, more frequent rebalancing, like the quarterly method, is great at taming volatility. It provides a much smoother experience by consistently taking profits and buying low, keeping your portfolio right on its target. That discipline isn’t free, though. More trades can mean higher fees and a bigger tax bill.

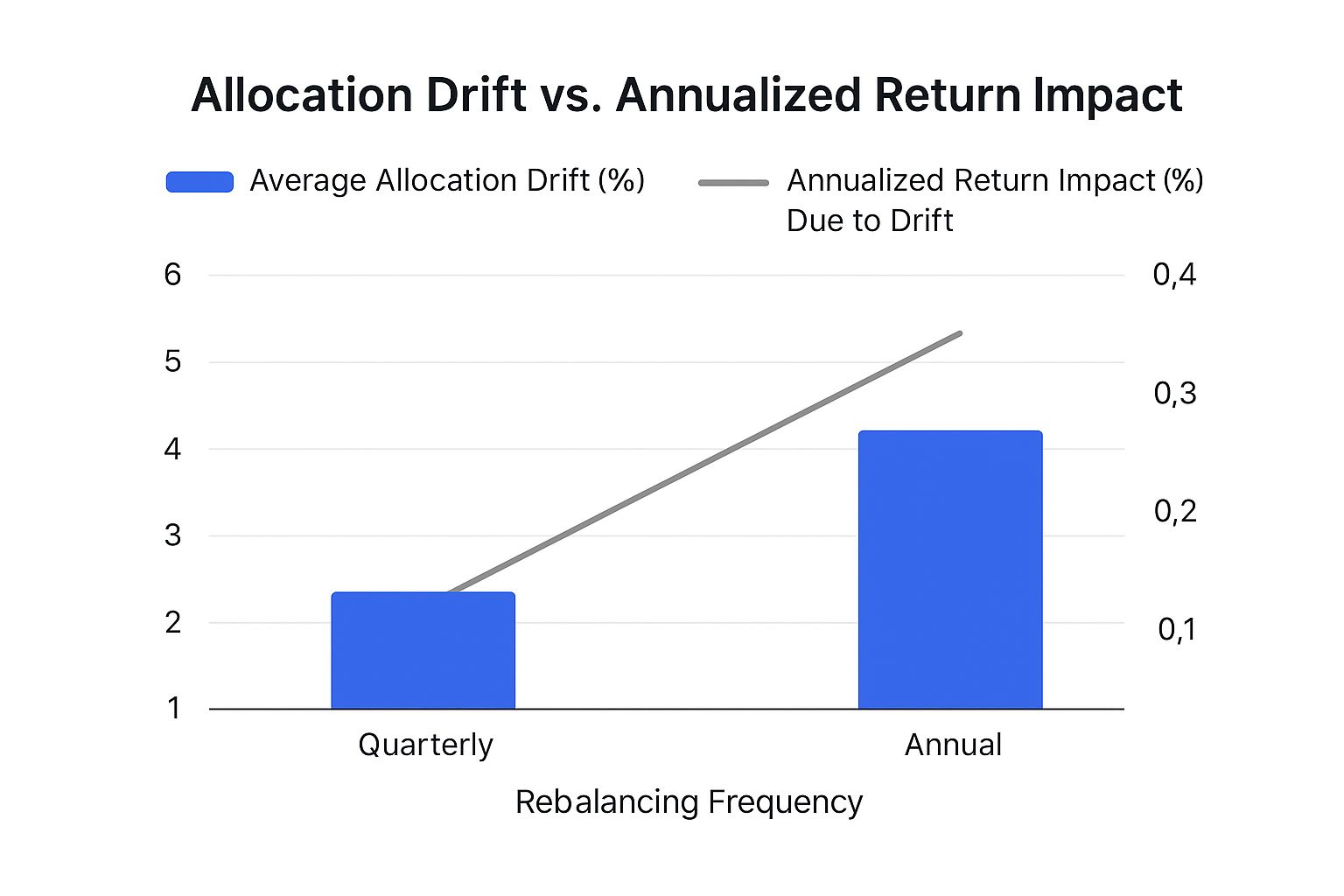

This chart shows exactly how rebalancing frequency (or lack thereof) impacts your portfolio’s drift and potential returns.

As you can see, letting things slide leads to major portfolio drift, which can quietly upend your risk and return expectations over time.

A Data-Driven Look at Different Approaches

Let’s break down how a 60/40 portfolio might have fared over a 10-year period marked by both ups and downs. This hypothetical data illustrates the real-world trade-offs between different rebalancing cadences.

Rebalancing Strategy Performance Comparison (Hypothetical 10-Year Period)

| Rebalancing Strategy | Ending Value | Portfolio Volatility | Estimated Costs & Taxes | | :— | :— | :— | :— | | No Rebalancing | $265,330 | 12.5% | Low | | Annual Rebalancing | $258,950 | 10.2% | Moderate | | Quarterly Rebalancing | $255,100 | 9.8% | High | | 5% Threshold | $261,500 | 10.0% | Moderate-High |

The table makes the trade-offs crystal clear. Doing nothing might have yielded the highest raw return in this scenario, but it came with significantly more risk. The quarterly approach offered the smoothest ride but at the cost of both returns and higher fees. The annual and threshold strategies found a compelling middle ground.

Interpreting the Results

The data tells a story about the constant tug-of-war between risk and return.

Both the annual and 5% threshold strategies often hit a sweet spot. They manage to capture most of the market’s gains while putting guardrails in place to prevent the portfolio from getting dangerously top-heavy with stocks. They offer a practical middle ground between the high-risk “set it and forget it” method and the higher-cost diligence of quarterly tweaks.

Ultimately, the best strategy is the one that aligns with your personal risk tolerance, time horizon, and how much you value a stress-free journey over squeezing out every last dollar of return.

Making this decision becomes even more powerful when you have a complete view of your finances. Understanding the benefits of holistic portfolio consolidation can give you that clarity, making whichever rebalancing strategy you choose that much more effective.

A brilliant strategy on paper means nothing without smart, consistent execution. Figuring out how often to rebalance your portfolio is only half the battle. The other half is actually doing it without sabotaging your own returns.

This means being smart about taxes, using new cash strategically, and—most importantly—steering clear of common behavioral traps that trip up even seasoned investors.

Think of this as your practical checklist for building a rebalancing plan that’s both effective and sustainable for the long haul.

Rebalance in a Tax-Efficient Way

One of the biggest (and most expensive) mistakes I see investors make is completely ignoring the tax implications of rebalancing.

Every time you sell an appreciated asset in a standard brokerage account, you could trigger a capital gains tax bill. That bill directly eats into your returns. It’s a classic own goal.

To avoid this, always prioritize rebalancing inside your tax-advantaged accounts first.

- Your 401(k) and IRA are Your Playground: Inside these accounts, you can buy and sell assets as much as you need to without creating a taxable event. Make them your go-to for any rebalancing trades.

- Use New Cash Strategically: Instead of selling your winners, use new contributions—like your monthly savings or dividends—to buy more of your underperforming, underweight assets. This nudges your portfolio back into alignment without a single taxable sale.

This simple “buy-only” rebalancing method is a surprisingly powerful way to maintain your targets while keeping your tax bill to a minimum.

Avoid These Common Rebalancing Errors

Even professional fund managers are constantly tweaking their rebalancing approach. Research on thousands of international equity funds shows that managers actively rebalance to control risk, with the intensity changing based on how volatile the market is. We can learn a lot from that kind of discipline. For a deeper dive, check out this detailed study on active rebalancing behavior among global managers.

To stay on the right track, you need to watch out for these common missteps:

- Abandoning the Plan in a Panic: The entire point of a rebalancing strategy is to have a dispassionate system in place before things get emotional. When the market is crashing, every fiber of your being will scream “sell everything!” Your plan, however, will calmly tell you to sell your now-overweight bonds and buy stocks while they’re on sale. Sticking to the plan is hardest when it matters most.

- Ignoring Transaction Fees: Sure, many brokers now offer commission-free trades on stocks and ETFs, but some mutual funds still carry fees. Rebalancing too often can let these small costs add up and quietly erode your performance. A solid financial plan means understanding all the costs involved, a core principle we cover in our guide to budgeting best practices.

- Making It Way Too Complicated: A rebalancing plan with dozens of intricate rules and tiny allocation targets is a plan that will never get followed. Simplicity is your friend here. A straightforward annual or 5% threshold strategy is far more effective than some complex masterpiece you end up ignoring.

Key Takeaway: The most brilliant rebalancing strategy is useless if it’s too complex to follow or too costly to implement. Focus on a simple, tax-aware plan you can actually stick with through bull and bear markets. Consistency beats complexity every single time.

Your Rebalancing Questions Answered

Even with a solid strategy mapped out, the real world always throws a few curveballs. Getting into the nitty-gritty of rebalancing helps build a plan that isn’t just effective on paper, but one you can actually stick with for the long haul.

Let’s tackle some of the common questions that pop up when it’s time to go from theory to practice, from juggling different account types to knowing when your strategy needs a tune-up.

Should I Rebalance My 401k and Brokerage Account Differently?

Yes, and this is a big one. You should treat them very differently.

Think of your 401(k) or IRA as your rebalancing playground. Inside these tax-advantaged accounts, you can sell assets that have shot up in value without triggering a capital gains tax bill. This freedom lets you rebalance back to your targets without worrying about the tax drag, making them the perfect place to make frequent tweaks.

Your taxable brokerage account, on the other hand, demands a much more delicate touch. Every time you sell a winner, you could be creating a tax event that shaves off a piece of your returns.

To handle this smartly, follow this pecking order:

- First, use new cash. When you add money to your brokerage account, funnel it directly to your underweight asset classes. This is the cleanest way to rebalance—no selling required.

- If you have to sell, be strategic. If possible, only sell assets you’ve held for more than a year. This ensures you qualify for the much friendlier long-term capital gains tax rates instead of the higher short-term rates.

Can I Automate My Portfolio Rebalancing?

Absolutely. For many investors, putting rebalancing on autopilot is the single best way to enforce discipline and take emotion out of the driver’s seat.

Most robo-advisors are built on this very principle. Their algorithms constantly watch your portfolio and make tiny, often tax-smart adjustments whenever your allocations drift. Target-date funds, a staple in many 401(k)s, do the same thing, automatically shifting to a more conservative mix as you get closer to retirement.

Even if you’re a DIY investor, you can create a simple form of automation. Just set up recurring investments that automatically buy more of your underweight funds. Over time, this does a lot of the rebalancing work for you.

Automation is your secret weapon for consistency. It ensures your plan gets followed even when you’re busy or when scary market headlines make it tempting to do nothing at all.

Does My Rebalancing Strategy Need to Change as I Near Retirement?

It’s not just a good idea—it’s critical. As you get closer to retirement, your financial goal shifts from accumulation to preservation. A big market drop right before you plan to start living off your investments can be devastating, and you simply have less time to recover.

This means you need to be much more diligent about keeping your risk in check. You can’t let a bull market push your stock allocation dangerously high right when you need stability the most.

Consider making these changes about five to ten years out from retirement:

- Increase the Frequency: If you rebalance annually, think about shifting to a semi-annual or even quarterly check-in.

- Tighten Your Thresholds: For those using a threshold strategy, it might be time to shrink your rebalancing bands from 10% down to a stricter 5%.

The whole point is to dial down the risk and make sure your portfolio is perfectly aligned with your need for a stable, reliable income stream when you finally hang it up.

Get a crystal-clear view of your entire financial picture with PopaDex. Track all your accounts in one place to make rebalancing simple and effective. Start managing your net worth with confidence at https://popadex.com.