Our Marketing Team at PopaDex

How to Build Emergency Fund Quickly & Secure Your Future

Let’s be real—life has a knack for throwing curveballs when you least expect them. Building an emergency fund isn’t just another box to check on your financial to-do list; it’s about creating a buffer that gives you genuine peace of mind. This is your financial safety net, plain and simple.

Think of it as the ultimate stress-reducer. This fund is what stands between you and a mountain of high-interest credit card debt when something goes wrong. It empowers you to handle the unexpected with confidence instead of panic.

Why You Absolutely Need to Start Today

So, what kind of trouble are we talking about? This isn’t theoretical stuff. It’s the real, messy, and often expensive business of life.

- Sudden Job Loss: Your main source of income vanishes overnight, but the rent, car payment, and grocery bills certainly don’t.

- Surprise Medical Bills: An ER visit or an unexpected diagnosis can leave you with costs that your insurance policy won’t touch.

- Urgent Home Repairs: That leaky roof or busted furnace won’t wait for your next paycheck. They demand cash, and they demand it now.

These aren’t just worst-case scenarios; they’re common events that can throw anyone’s financial world into a tailspin. And on a bigger scale, recent global events have shown just how quickly things can change. With disaster-related economic losses now topping $2.3 trillion annually worldwide, being personally prepared is no longer optional. You can dig into the data yourself and see the global economic impacts of disasters from the UNDRR.

An emergency fund is your permission slip to solve a problem without creating a bigger one. It’s what turns a potential catastrophe into a manageable inconvenience.

Calculating Your Personal Savings Target

Alright, let’s get down to the brass tacks: figuring out exactly how much you need to set aside. This is where the journey to building an emergency fund gets real.

You’ve probably heard the common advice to save three to six months of essential living expenses. This isn’t just a number pulled out of thin air; it’s a strategic buffer designed to see you through a major life disruption, like a sudden job loss or an unexpected medical bill.

But think of that rule as a starting point, not a strict prescription. Recent household economic findings from the Federal Reserve show that only 55% of American adults have enough savings to cover three months of expenses. That number plummets to just 36% for those aged 18-29. This gap highlights why personalizing your savings goal is so important.

Defining Your Essential Expenses

To find your unique savings number, you first need to get brutally honest about your needs versus your wants. The goal here is to calculate your “survival number”—the absolute bare-minimum cost to run your life for one month.

Strip it all back and focus only on the absolute necessities:

- Housing: Your rent or mortgage payment.

- Utilities: The non-negotiables like electricity, water, heat, and internet.

- Food: Your essential grocery budget, not your Friday night takeout habit.

- Transportation: Car payments, insurance, and the fuel needed to get around.

- Debt Payments: The minimum payments on any loans or credit cards.

Add these up to find your baseline monthly expense. Once you have this number, you can get a clearer picture by using an emergency fund calculator to build your safety net.

To make this easier, I’ve put together a simple table to help you sort your expenses and find your own survival number.

Essential vs. Non-Essential Monthly Expenses Calculator

Use this template to categorize your spending and calculate the bare-bones monthly total you need to cover.

| Expense Category | Is it Essential? | Monthly Cost |

|---|---|---|

| Rent/Mortgage | Yes | $ |

| Groceries | Yes | $ |

| Car Insurance | Yes | $ |

| Student Loan (min. payment) | Yes | $ |

| Netflix Subscription | No | $ |

| Gym Membership | No | $ |

| Dining Out | No | $ |

| Total Essential Expenses: | $ |

Once you’ve filled this out, you’ll have a clear, personalized number to aim for. That’s your one-month target. Now, multiply it by the number of months of security you want to build.

Your ideal savings target isn’t one-size-fits-all. A freelancer with unpredictable income might aim for nine months of expenses, while a dual-income household with stable jobs could feel secure with four.

The key is to create a target that reflects your personal risk level and life circumstances. By doing this, you’re not just saving money; you’re building a customized financial shield that truly works for you.

How to Find Extra Money in Your Budget

Once you have a clear target for your emergency fund, the next step can feel like the hardest: actually finding the cash. But here’s the good news—you probably have more money available than you think, hiding in plain sight within your daily spending.

This isn’t about making drastic, painful cuts. It’s more like being a financial detective, hunting down the small, consistent “money leaks” that quietly drain your budget. Think about that daily specialty coffee, the streaming service you forgot about, or the subscription box that just isn’t exciting anymore.

These little expenses add up faster than you’d think. For instance, canceling a couple of streaming services you barely watch could easily free up $30 a month. That doesn’t sound like much, but over a year, it adds up to $360 straight into your emergency fund without any real sacrifice.

Uncovering Hidden Savings

To get started, pull up your last few months of bank and credit card statements. Go through them line by line, looking for patterns and asking tough questions about each expense. The goal here is to spot costs that no longer align with your priorities or provide real value.

You can often find some quick wins in these common areas:

- Subscriptions and Memberships: Do a full audit of every recurring payment. Are you really using that gym membership? Do you even read that magazine anymore? Be honest.

- Food Spending: Take a hard look at what you spend on takeout, lunches out, and coffee runs. Packing a lunch just twice a week can genuinely save you hundreds over the year.

- Recurring Bills: Your cable, internet, and cell phone bills aren’t set in stone. A quick call to customer service to ask for a better rate often works wonders.

While you’re reviewing everything, don’t forget your insurance bills. So many people overpay without even knowing it. Finding ways to trim these costs can be a goldmine for your savings goal. If you’re looking for where to start, you can find some valuable expert tips to lower insurance premiums and save money that can be put directly toward your emergency fund.

Finding extra money isn’t about deprivation—it’s about conscious spending. Every dollar you redirect is a deliberate choice to invest in your own financial security.

This process is more important than ever. Recent data shows that only 46% of U.S. adults have enough savings to cover three months of expenses. Worse, a staggering 73% report saving less because of rising prices. You can learn more about emergency savings trends from Bankrate’s report.

Choosing the Right Home for Your Savings

Where you park your emergency fund is almost as important as having one in the first place. Stash it in the wrong account, and you might find it’s too tempting to raid for non-emergencies or, even worse, too hard to get to when you actually need it. The real goal is finding that sweet spot: safe, accessible, and maybe earning a little something.

Your everyday checking account is definitely not the place for this money. It’s the account you use for coffee runs and bills, making it far too easy to “borrow” from your emergency savings for a weekend trip. This fund needs to be separate—out of sight, but not out of reach.

Finding the Right Balance

On the flip side, throwing your emergency savings into the stock market is a huge gamble. Market volatility means your $10,000 fund could easily shrink to $7,000 right when your car’s transmission decides to give up. This money’s primary job isn’t to chase high returns; its job is to be there, stable and ready, when disaster strikes.

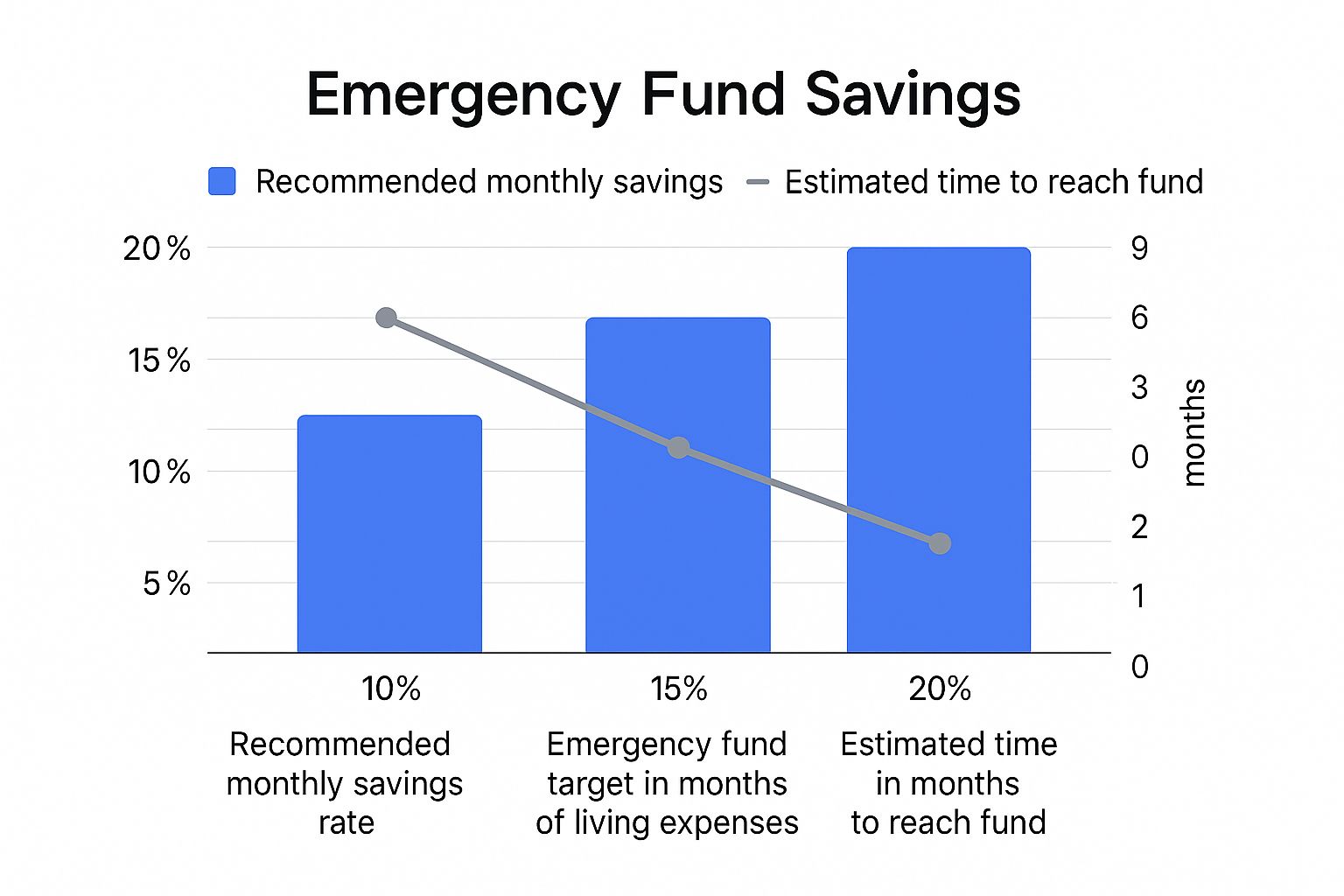

As you can see below, how quickly you can save up really depends on how much you can put away each month.

This just goes to show that even a small bump in your savings rate can dramatically shorten your timeline to financial security.

So, where’s the best place to keep this crucial cash? There are a couple of top contenders designed for exactly this purpose.

- High-Yield Savings Accounts (HYSAs): These are usually online accounts that pay way more interest than your typical brick-and-mortar bank. They’re FDIC-insured up to $250,000, totally liquid, and the modest return helps your money keep up with inflation.

- Money Market Accounts (MMAs): Similar to HYSAs, these offer competitive interest rates and FDIC insurance. They often come with a debit card or check-writing abilities, which adds a bit of convenience, though they sometimes require a higher minimum balance to get started.

Your emergency fund’s location should create just enough friction to prevent impulsive spending, but not so much that it delays access during a genuine crisis.

For most people, a high-yield savings account is the perfect fit. To get started, you can check out some of the best high-yield savings accounts available right now to find one that works for you.

Comparing Emergency Fund Account Options

Choosing the right account type is about balancing your need for quick access against the desire to earn a little interest and avoid temptation. Here’s a quick rundown of your main options.

| Account Type | Best For | Accessibility | Typical APY |

|---|---|---|---|

| High-Yield Savings Account | Stashing cash you don’t need to touch often but want to earn interest on. | High (typically 1-3 business days for transfers). | 4.00% - 5.00%+ |

| Money Market Account | Those who want slightly easier access with check-writing or debit card features. | Very High (debit card, checks, or transfers). | 3.50% - 5.00% |

| Regular Savings Account | People who prefer having all their accounts at a single brick-and-mortar bank. | High (instant access at a branch or ATM). | 0.01% - 0.50% |

| Checking Account | Not recommended for emergency funds due to the high risk of accidental spending. | Instant (this is your daily spending account). | 0.00% - 0.05% |

As the table shows, a High-Yield Savings Account (HYSA) usually offers the best combination of safety, growth, and accessibility for an emergency fund. It keeps the money separate and working for you, which is exactly what you want.

Automate Your Savings and Build Momentum

Let’s be honest, the real secret to growing an emergency fund isn’t about having iron willpower. It’s about making saving so ridiculously easy that you don’t even notice you’re doing it. This is where automation becomes your financial superpower, helping you sidestep decision fatigue and stay on course without any daily effort.

When you put your savings plan on autopilot, you’re making a powerful mental shift. You guarantee that your financial security gets top priority, long before the temptation to spend on other things even crops up.

The easiest and most effective way to start is by setting up an automatic transfer from your checking account to your dedicated savings account. The trick is to time this transfer for the very day you get paid. This is the classic “pay yourself first” method in action, and it works because it treats your savings contribution just like any other bill that has to be paid. No excuses.

Set-It-and-Forget-It Strategies

Once that main transfer is humming along, you can get creative and layer in a few other automated tricks to pick up the pace. These little tactics work quietly in the background, building momentum without you feeling the pinch.

- Round-Up Features: Most modern banking apps have a feature that rounds up your debit card purchases to the nearest dollar, then squirrels away the spare change into your savings. That $3.50 coffee suddenly becomes a 50-cent deposit. It sounds small, but it adds up shockingly fast.

- Scheduled “Sweeps”: Don’t stop at just one transfer. Set up a smaller, recurring transfer to happen mid-month. Even an extra $25 every other week adds another $650 to your emergency fund over a year.

By making saving your default setting instead of a daily choice, you eliminate the biggest hurdle to success: yourself. This hands-off approach seamlessly weaves saving into the fabric of your financial life. If you want to take this principle even further, you can learn how to automate finances to reach your goals faster.

Automating your savings is the closest thing you’ll find to a “magic bullet” in personal finance. It transforms good intentions into consistent, tangible progress.

Common Emergency Fund Questions Answered

As you start putting your emergency fund plan into action, you’re bound to run into some tricky questions. Knowing the “how-to” is one thing, but figuring out the gray areas is where things get real. Let’s tackle some of the most common hurdles people face.

Getting these details right can be the difference between a plan that actually works and one that fizzles out. So, let’s get into the specifics to make sure you’re confident every step of the way.

Should I Pay Off Debt or Build My Emergency Fund First?

Ah, the classic financial tug-of-war. The good news is you don’t have to pick just one. The smartest move here is a balanced one.

First things first: build a “starter” emergency fund of $1,000 to $2,000. Think of this as your financial firewall. It creates a critical buffer so that a surprise car repair or an unexpected medical bill doesn’t immediately send you deeper into high-interest debt.

Once that small cushion is in place, you can pivot and attack your high-interest debt (looking at you, credit cards) with everything you’ve got. After that debt is gone or at least under control, you can shift your focus back to growing your emergency fund to that full three-to-six-month goal. This strategy protects you from life’s little disasters while you make real progress on your debt.

What Actually Counts as an Emergency?

This is a big one. If you don’t define what an “emergency” is, your fund can quickly turn into a slush fund for impulse buys. A true emergency is usually something that is unexpected, urgent, and necessary.

Here are a few real-world examples of what qualifies:

- A sudden job loss that cuts off your main source of income.

- A major medical or dental bill that your insurance won’t cover.

- An essential car repair needed to get you to work.

- An urgent home disaster, like a burst pipe or a broken furnace in the middle of winter.

A simple gut check is to ask yourself: “If I don’t pay for this right now, will it have serious and immediate negative consequences for my health, safety, or ability to earn a living?” If the answer is a clear “yes,” it’s probably a real emergency.

Planned expenses—like holidays, a new gadget, or even a down payment on a car—are not emergencies. Your fund’s job is to be your safety net for genuine crises, not planned spending.

How Can I Build a Fund with an Irregular Income?

Building an emergency fund on a variable income isn’t just possible; it’s essential. The strategy just needs a slight tweak. Instead of saving a fixed dollar amount each month, think in percentages.

When you have a great income month, commit to saving a larger slice, maybe 20-30%. During those leaner months, save a smaller but still consistent percentage, like 5-10%. The most important thing is to keep the savings habit going, no matter how much the amount changes.

For freelancers and gig workers, it’s also wise to aim for a bigger fund—more like six to nine months of expenses. This provides extra security for those inevitable slow periods. Your overall savings goal should be based on your average monthly income from the past year to smooth out those peaks and valleys.

Trying to keep track of savings goals, debt-paydown progress, and a fluctuating income can feel like a juggling act. The PopaDex net worth tracker simplifies everything by giving you a clear, consolidated view of your entire financial picture. It empowers you to make smarter decisions and build your emergency fund with confidence. Get started today and take control of your financial future at https://popadex.com.