Our Marketing Team at PopaDex

How to Calculate Disposable Income in 4 Easy Steps

Figuring out your disposable income is pretty straightforward. You just take your total earnings before any deductions—your gross income—and subtract all the mandatory taxes. The formula is simply Gross Income – Taxes. What’s left is the actual cash you have to work with for spending, saving, and investing after the government has taken its cut.

What Disposable Income Really Tells You

Before we get into the nitty-gritty of the math, it’s worth taking a moment to appreciate why this number is so important. Disposable income isn’t just some abstract figure for a spreadsheet; it’s the most honest measure of your financial horsepower and flexibility. It’s what determines your ability to cover your day-to-day bills, save for big goals like a down payment on a house, and build real, long-term wealth.

Think of it as the starting line for your entire financial life. Without knowing this number, you’re basically flying blind, just guessing at what you can truly afford.

Your disposable income is the true starting point for every financial decision you make. It tells you if your budget is realistic, if your savings goals are a pipe dream or a real possibility, and if your spending habits are sustainable.

Why This Simple Calculation is a Game-Changer

Getting a handle on your disposable income brings instant clarity. It slices through all the noise of gross pay, take-home pay, and other financial jargon to give you one clean, powerful number to work with. This clarity is a huge help in a few key areas:

- Building a Realistic Budget: It serves as the bedrock for any budget that actually works, since you’re planning with money you genuinely have.

- Setting Smarter Goals: You can set concrete goals for saving, investing, or crushing debt because you know exactly what your capacity is.

- Making Wiser Spending Choices: When you know your limit, you’re far less likely to overspend and rack up unnecessary debt.

To give you a better overview, here’s a quick breakdown of the main parts of the disposable income calculation.

Quick Guide to Disposable Income Components

| Component | Description | Example |

|---|---|---|

| Gross Income | Your total earnings before any taxes or other deductions are taken out. | A salary of $60,000 per year. |

| Mandatory Taxes | Federal, state, and local income taxes, plus other required deductions like FICA. | Federal income tax withholding, state tax. |

| Disposable Income | The money left over after all mandatory taxes have been paid. | The amount you can use for rent, groceries, savings, etc. |

Understanding these pieces makes the whole process much clearer and helps you see exactly where your money is going before it even hits your bank account.

This figure is also a big deal on a larger scale. In the United States, for instance, economists track disposable personal income (DPI) as a major indicator of the country’s economic health. The Bureau of Economic Analysis recently reported that DPI jumped by $194.3 billion in a single month, mostly due to changes in wages and government policies. This shows just how much things like tax law can directly affect the money in your pocket.

If you’re ready to find your own number, our detailed guide on how to calculate disposable income will walk you through it step-by-step. Nailing this figure is the first, most crucial move you can make toward building a rock-solid financial future.

Tracking Down Every Dollar You Earn

Before you can figure out your disposable income, you need a crystal-clear picture of your gross income. This is the starting line—the total amount of money you earn before a single dollar is taken out for taxes or other deductions. It’s easy to just plug in your main salary and call it a day, but if you do, you’re likely working with incomplete numbers and getting a skewed result.

Think about it: most people have more going on financially than just a 9-to-5. Did you pick up a freelance project last month? Earn a little interest from a savings account? These all add up. To get this right, you have to identify every single income stream. And if you’re looking to grow that list, you can discover ways to make extra money.

Finding All Your Income Sources

Go beyond your regular W-2 wages. Your true gross income is the sum of every dollar that comes your way. It’s time to gather your documents—pay stubs, bank statements, and any investment reports—to make sure nothing slips through the cracks.

Here are the most common sources of income you should be looking for:

- Salaries and Wages: This is your base pay from your primary job, but don’t forget to include any overtime or bonuses you received.

- Freelance or Gig Work: Any money from side hustles, consulting gigs, or other independent work (think 1099-MISC or 1099-NEC) is a crucial part of the equation.

- Investment Earnings: This covers a lot of ground, including dividends from stocks, interest from savings accounts or bonds, and any capital gains you made from selling assets.

- Rental Property Income: If you’re a landlord, the gross rent you collect is absolutely part of your income.

- Other Miscellaneous Income: Don’t overlook other potential sources like alimony, royalties from creative work, or pension payments.

The whole point here is a full accounting. Every dollar you miss at this stage will throw off your final calculation. Precision now means a much more reliable and genuinely useful disposable income figure later on.

Once you’ve carefully tallied up every one of these streams, you’ll have an accurate gross income total. This is the essential first number you need before you can move on to subtracting your tax obligations.

Uncovering Your Total Tax Obligations

When you’re trying to figure out your disposable income, taxes are the single biggest piece of the puzzle. It’s not just about what you might owe the IRS in April. The real story is told in the steady stream of deductions taken from every single paycheck, which ultimately determines what you actually take home.

The best place to start this investigation is right on your pay stub. Look for the line items that detail your federal, state, and local income tax withholdings. While these are usually the largest chunks, they’re not the only mandatory deductions. You also have FICA taxes—for Social Security and Medicare—which are non-negotiable subtractions from your gross pay.

How Location Impacts Your Bottom Line

Where you live can have a massive impact on your finances. Someone earning $70,000 a year in a high-tax state like California will have a dramatically different disposable income than a person with the same salary in a state with no income tax, like Texas or Florida. It’s a huge variable.

This is exactly why those generic online calculators can be so misleading. For a truly accurate number, you have to account for your specific state and even local tax laws. For instance, if that $70,000 earner in a high-tax state has an effective state and local rate of 8%, that’s $5,600 less in their pocket each year compared to their friend in a no-tax state. That’s a significant difference.

Understanding the full scope of your tax burden is critical. It transforms your disposable income from a rough estimate into a precise tool for financial planning.

Don’t forget to factor in any deductions you might be eligible for, as these can significantly lower what you owe. For those who own rental properties, for example, getting familiar with common short-term rental tax deductions can make a real financial difference.

Finally, keep in mind that the bigger economic picture plays a role, too. For example, U.S. disposable income got a 5.9% boost in 2020 from government stimulus measures, but that figure then dropped by 6.1% in 2022 as those policies shifted. It’s a good reminder that external factors can directly influence your personal financial capacity.

Bringing It All Together to Find Your Number

Alright, you’ve done the legwork of tracking down your gross income and your total tax bill. Now it’s time to put those numbers together with a simple but incredibly powerful formula. This is the moment where we turn abstract figures into the single most important number for your day-to-day financial life.

The calculation itself is refreshingly simple: Gross Income – Total Taxes = Disposable Income.

Let’s see how this plays out in the real world with a couple of different scenarios.

The Salaried Employee

Meet Maria, a marketing manager pulling in an annual salary of $85,000. She’s looked over her pay stubs and added everything up. Her total annual tax hit—including federal, state, and FICA—comes out to $21,250.

- Gross Income: $85,000

- Total Taxes: $21,250

- Calculation: $85,000 - $21,250 = $63,750

Maria’s annual disposable income is $63,750. When you break that down, it gives her about $5,312 per month. This is the real money she has to cover her rent, groceries, savings, and everything else life throws at her.

The Freelance Graphic Designer

Now let’s look at Alex, a freelance graphic designer. His income isn’t as predictable. Last month, he invoiced $6,000. Since he’s self-employed, he has to be his own payroll department and set aside money for taxes. He plays it safe and estimates his tax obligation for that income at 30%, which is $1,800.

- Gross Income: $6,000

- Estimated Taxes: $1,800

- Calculation: $6,000 - $1,800 = $4,200

For that month, Alex’s disposable income is $4,200. If you’re a gig worker or freelancer, running this calculation monthly is absolutely vital. It’s the key to managing that inconsistent cash flow without the stress.

Remember, the whole point of this exercise is to get an honest, unvarnished look at the actual cash you have to live on. The more precise you are with your income and tax numbers, the more reliable your final disposable income figure will be for budgeting and planning.

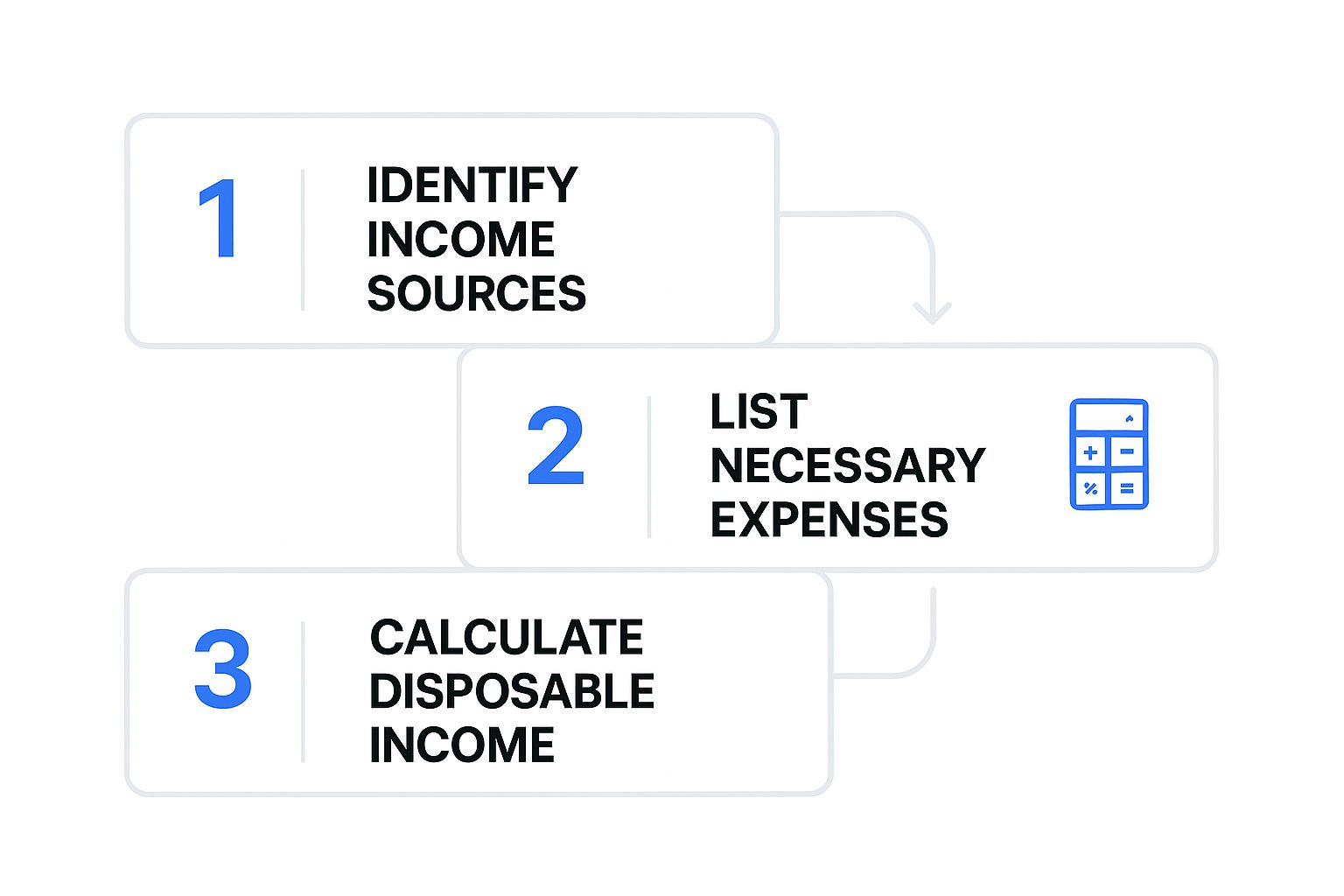

This infographic breaks the process down into its three essential parts.

Think of it as a roadmap. You start by gathering your earnings, figure out what you owe in taxes, and then make the final subtraction. Each step builds on the last, ultimately giving you a crystal-clear picture of your finances.

Putting Your Disposable Income to Work

Calculating your disposable income is a fantastic first step, but the number itself is just data. The real magic happens when you put that number to work. This figure is the foundation for turning vague financial wishes into a concrete action plan, giving you total control over where your money goes.

Knowing this number allows you to make informed decisions. It’s the starting line for building a budget that doesn’t feel restrictive, setting aggressive but reachable savings targets, and paying down debt faster. This is where you transform a simple calculation into meaningful progress.

Distinguishing Disposable from Discretionary Income

Before you start allocating funds, it’s vital to understand a key distinction: disposable income is not the same as discretionary income. I see people mix these up all the time, but the difference is critical for smart budgeting.

Think of it this way:

- Disposable Income: This is your total income after only taxes are subtracted. It’s the entire pot of money you have available for both your needs and wants.

- Discretionary Income: This is what’s left over from your disposable income after you’ve paid for all essential living expenses—things like your mortgage, utilities, groceries, and car payment. This is your “fun money.”

Separating these two gives you a much clearer picture of your actual cash flow. It shows you exactly how much you have for saving, investing, and spending on non-essentials after all your core obligations are met.

Your disposable income is your starting point for your budget. Your discretionary income is what you have left to enjoy after the essentials are handled. Understanding both gives you complete financial clarity.

Building Your Financial Plan

Once you know your disposable income, you can build a financial strategy with real purpose. A practical way to manage it is by learning how to create a family budget that aligns with your specific goals.

For younger folks just starting their financial journey, our guide to budgeting for young adults offers targeted advice for building a solid foundation from day one.

This number is also a huge economic indicator reflecting consumer purchasing power. For example, recent government data showed that real disposable income per capita in the U.S. actually saw a slight decrease when adjusted for inflation. This highlights how broader economic shifts can directly impact your personal bottom line, reinforcing why having your own plan is so important.

Common Questions About Calculating Your Income

Even with a straightforward formula, things can get a little fuzzy when you start digging into your own numbers. Let’s clear up some of the most common questions people have when figuring out their disposable income. Nailing these details is the key to creating a financial snapshot you can actually rely on.

One of the biggest hang-ups I see is the confusion between disposable and discretionary income. They sound similar, but they tell you two very different things about your money.

Disposable Income is your paycheck after only one thing is taken out: taxes. It’s the total amount you have to cover everything—needs like rent and food, plus all your wants. Discretionary Income, on the other hand, is what’s left of your disposable income after you’ve paid for all your essential living expenses. This is your “fun money” for things like hobbies, travel, or dining out.

Getting this distinction right is a massive step in learning how to budget your money effectively.

Should I Include 401(k) Contributions?

Nope. When you’re calculating your disposable income, you start with your gross salary—that’s your total pay before pre-tax deductions like a 401(k) or an HSA are touched. The formula keeps it simple: Gross Income – Taxes.

While it’s true that your 401(k) contributions lower your taxable income (which is great!), the contribution itself isn’t a tax. The goal here is to see the total cash you have available after the government takes its mandatory cut. That number gives you the truest sense of your power to spend and save.

How Often Should I Calculate It?

Honestly, you should recalculate your disposable income any time your financial world shifts. That could mean a pay raise, a new job, a change in your marital status, or even new tax laws that affect your paycheck.

At a minimum, doing it once a year is a fantastic check-in, maybe when you’re gathering your tax documents. But if you’re a freelancer or your income bounces around from month to month, you’ll get a much clearer, more useful picture by running the numbers quarterly or even monthly.

What About Bonuses or Overtime?

Yes, absolutely include them. Your disposable income should reflect your total gross earnings, and that means everything—your base salary plus any bonuses, commissions, overtime pay, or income from a side hustle.

Just don’t forget that this extra money is also taxed, and sometimes it’s withheld at a different rate. To get an accurate number, you have to account for the taxes paid on that extra income, too.

Ready to stop guessing and start tracking? With PopaDex, you can see your full financial picture, including how your disposable income fits into your net worth. Get started for free today and take control of your financial future.