Our Marketing Team at PopaDex

How to Catch Up on Retirement Savings: Essential Tips

That sinking feeling when you look at your retirement balance is far more common than you might think. We’ve all been there. But getting back on track really boils down to three things you can control right now: figuring out where you truly stand, making every dollar you save count, and tweaking your investment strategy for growth. It is absolutely possible to close the gap with a clear, actionable plan.

Why It’s Never Too Late to Start Saving

So many people think that a late start means the game is already lost. Honestly, that mindset is the single biggest obstacle you’ll face. The power of compound interest is a beautiful thing, and it works its magic over any time period. Starting now is always, always better than waiting another year.

The key is to shift from anxiety about the past to a forward-looking, actionable strategy. This guide is built to move you past the worry. Forget the panic; building a secure future is about consistency and smart decisions, not perfection.

The Power of a Deliberate Plan

Feeling behind usually comes from a lack of clarity. When you don’t know your exact numbers—what you have now, what you’re aiming for, and what you can realistically save each month—the problem feels massive and overwhelming. A structured approach turns that vague fear into a concrete set of tasks you can actually tackle.

Here’s what a real plan helps you do:

- Define Your Target: It transforms “I need way more money” into “I need to save an additional $750 per month.” See the difference?

- Build Momentum: Small, consistent wins create a powerful snowball effect. Just increasing your 401(k) contribution by 1% is a huge victory that builds positive momentum.

- Give You Control: A plan puts you back in the driver’s seat of your financial future. That control reduces stress and empowers you to make confident choices.

The most effective way to address a retirement savings gap isn’t some single, dramatic action. It’s a series of small, intentional adjustments that compound over time, turning a daunting challenge into a manageable journey.

Understanding Your Timeline and Tools

Your age and timeline are critical here. The tools available to someone in their 50s look very different from those for someone in their 30s.

For instance, the IRS allows for catch-up contributions, which are a huge advantage. These let people aged 50 and over contribute thousands more to their 401(k) and IRA accounts every year. And starting in 2025, new rules might even permit “super-catch-up contributions” for those aged 60 to 63, offering an even bigger opportunity to accelerate savings.

To get a handle on the fundamentals that guide any successful strategy, it’s worth reviewing these retirement planning basics. Having that foundation makes the whole process feel achievable, helping you take ownership one step at a time.

Conducting Your Personal Retirement Audit

Before you can chart a course forward, you need to know exactly where you’re starting. This first step isn’t about passing some intimidating financial exam; it’s about gathering the coordinates for your personal financial map.

The goal here is clarity, not anxiety. By turning vague worries into hard numbers, you give yourself the power to build a smart, targeted plan to catch up on your retirement savings.

Tallying Up Your Current Assets

First things first: you need a complete inventory of everything you have saved for retirement. It’s time to track down every account you’ve ever opened, even the ones you’ve long forgotten about.

- Old 401(k)s: Do you have accounts left behind at previous jobs? It’s surprisingly common to lose track of these, but they are critical pieces of your financial puzzle.

- Individual Retirement Accounts (IRAs): Pull together any Traditional, Roth, SEP, or SIMPLE IRAs you might have.

- Other Accounts: Don’t overlook things like a Health Savings Account (HSA) or brokerage accounts that you’ve earmarked for long-term growth.

This is where a tool like PopaDex can be a game-changer. Instead of trying to wrangle a dozen different logins and paper statements, you can link your accounts and see your entire retirement war chest in one clean, real-time dashboard.

Defining Your Retirement Goal

Once you have a clear picture of what you have, the next question is what you’ll need. This is where a good retirement calculator becomes your best friend, helping you translate fuzzy ideas about the future into a specific number—your target nest egg.

A solid calculator will take into account your current age, when you want to retire, the lifestyle you envision, and reasonable assumptions about inflation and investment returns.

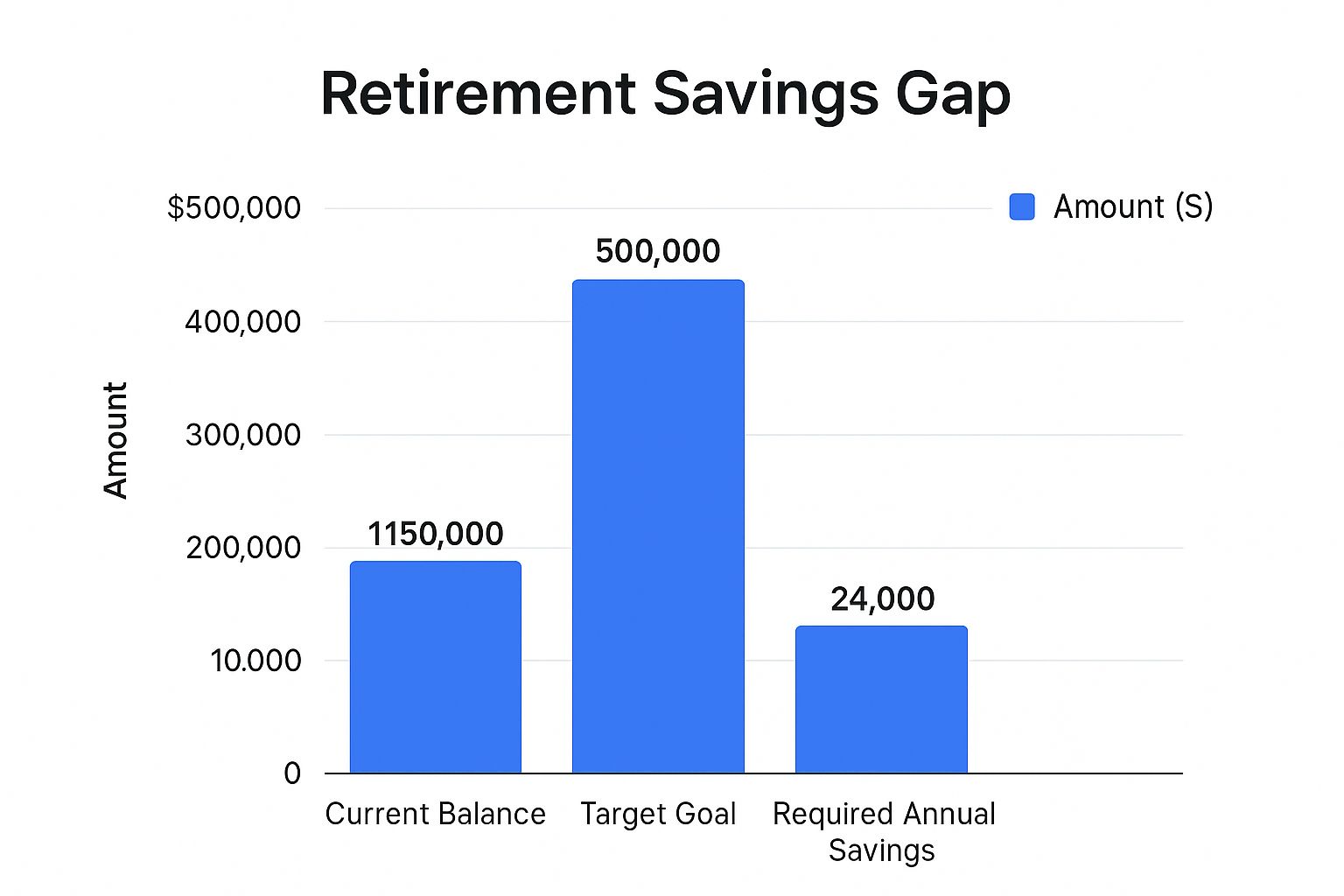

Let’s imagine Sarah, a 45-year-old who feels behind. After plugging her numbers into a calculator, she discovers she needs $1.5 million to retire comfortably at 67. With $300,000 already saved, she now knows her shortfall is $1.2 million. That vague, stressful feeling of “I’m not saving enough” is suddenly replaced by a concrete goal she can build a plan around.

This image shows exactly what that looks like—the gap between her current savings and her goal, and what she needs to contribute annually to close it.

The visual makes it clear. That huge number becomes a much more manageable annual savings target.

This step is where so many people stumble. Global surveys show that while retirement is a top reason for investing, only 46% of investors feel they have a well-developed plan. Many also seriously underestimate their needs; younger investors often think they’ll only need 55% of their current income, but for those over 50, that figure realistically jumps to 65%. You can explore more about these global retirement trends to see just how critical proper planning is.

Turning a vague worry into a concrete number is the single most powerful step you can take. It shifts your mindset from passive concern to active problem-solving, giving you a clear finish line to aim for.

From Goal to Actionable Plan

With your target number locked in, the final piece of the audit is to break it down into a monthly savings goal. This is where the rubber meets the road. Knowing you need to save an extra $1,500 a month is infinitely more actionable than staring at a seven-figure shortfall.

This monthly target becomes the bedrock for everything that follows. It will inform your budget, show you how aggressively you need to max out your contributions, and help shape your investment strategy.

With this number in hand, you’re no longer just hoping for the best. You’re executing a calculated plan.

Here’s a quick look at how a shortfall can play out at different ages, just as an example.

Retirement Savings Gap Snapshot

| Current Age | Target Nest Egg (Example) | Current Savings | Estimated Shortfall |

|---|---|---|---|

| 35 | $1,800,000 | $150,000 | $1,650,000 |

| 45 | $1,500,000 | $300,000 | $1,200,000 |

| 55 | $1,200,000 | $500,000 | $700,000 |

This table isn’t meant to be a precise calculation, but it illustrates how the gap changes over time. The earlier you identify it, the more years you have to close it. This initial audit gives you the essential clarity you need to start making real progress.

Finding and Maximizing Your Contributions

Alright, you’ve figured out your retirement target. Now for the hard part: where does the money to hit that target actually come from? This is where generic advice like “just stop buying lattes” completely misses the mark. If you’re serious about catching up, you need a real strategy to free up cash and make sure every single dollar is pulling its weight.

The most powerful mental shift you can make is to pay yourself first. Stop thinking of savings as what’s left over at the end of the month. Instead, treat your retirement contribution like your most important bill—the one that gets paid before anything else. This simple change in perspective is what fuels a successful catch-up plan.

Build a “Catch-Up” Budget

A regular budget helps you manage spending. A “catch-up budget” is different; its sole purpose is to aggressively find and redirect money into your retirement accounts. This isn’t about counting pennies—it’s about making big, impactful changes.

First, you need an honest look at where your money is going. Track every dollar for a month. Once you have that raw data, you can start making strategic cuts.

- Pinpoint the ‘Nice-to-Haves’: Go line by line. Do you really use all those streaming subscriptions? How much are you actually spending on takeout and happy hours? Be ruthless.

- Redirect Every Dollar Saved: This is key. The money you free up can’t just sit in your checking account. Every dollar you cut from a non-essential category needs to be immediately moved to your IRA or investment account.

- Automate Everything: Don’t leave this to willpower. Set up automatic transfers for the day after you get paid. Hike up your 401(k) contribution percentage right in the portal. Get the money working for your future self before you even have a chance to miss it.

This isn’t about living a life of deprivation. It’s about being intentional and making sure your daily spending aligns with your most important long-term goal.

Automate Your Raises and Bonuses

Here’s one of the most effective and painless ways to ramp up your savings: commit a slice of every future pay increase directly to retirement. This strategy, often called contribution rate escalation, lets you save more without ever feeling a dip in your take-home pay.

It’s surprisingly simple. Let’s say you get a 3% raise next year. Before that extra cash even lands in your bank account, log into your 401(k) and bump your contribution by 1% or 2%. You never got used to having that money, so you won’t feel the pinch.

This works wonders for unpredictable income, too. Create a personal rule for things like bonuses, tax refunds, or sales commissions. For instance: 50% of any windfall immediately goes to retirement. A $5,000 bonus is tempting to spend, but investing $2,500 of it can make a monumental difference over the next decade.

The secret to aggressive saving isn’t making huge, painful cuts all at once. It’s building small, automatic habits that consistently increase your savings rate over time, especially when your income grows.

Harnessing the Power of Catch-Up Contributions

The IRS gives savers over 50 a fantastic tool to accelerate their savings: catch-up contributions. These allow you to put away thousands more each year, far beyond the standard limits.

For 2024, the numbers are significant:

- 401(k)s, 403(b)s, and TSP: You can contribute an extra $7,500. That’s on top of the standard $23,000 limit, bringing your potential total to $30,500.

- IRAs (Traditional and Roth): You get an extra $1,000 on top of the regular $7,000 limit, for a total of $8,000.

These aren’t chump change. Maxing out these limits can dramatically shorten your timeline to retirement readiness. If you’re self-employed, knowing how these apply to a SEP IRA or Solo 401(k) is vital. You can find more on that in our guide to retirement for independent contractors.

Looking Ahead to “Super Catch-Up” Contributions

And it’s about to get even better. Starting in 2025, the SECURE 2.0 Act rolls out a new provision for savers aged 60 through 63: “super catch-up contributions.” It’s designed to give those closest to the finish line one last, powerful savings boost.

While plan administrators are still working out the final details, here’s what the framework looks like:

| Age Range | Catch-Up Limit Type | Expected 2025 Contribution Limit (Above Standard Limit) |

|---|---|---|

| 50-59 | Regular Catch-Up | $7,500 (indexed for inflation) |

| 60-63 | Super Catch-Up | Greater of $10,000 or 150% of the regular limit |

| 64+ | Regular Catch-Up | $7,500 (indexed for inflation) |

For a 62-year-old in 2025, this could mean stashing away at least $10,000 more than the standard 401(k) limit. It’s a massive opportunity for anyone who can swing it during that four-year window.

When you combine a disciplined budget with these powerful contribution tools, you turn small, consistent actions into serious wealth. The formula is simple: find the money, automate the process, and take full advantage of every tool the government gives you.

Adjusting Your Investment Strategy for Growth

Ramping up your savings rate is a huge step, but it’s only half the equation. If you’re serious about closing a retirement gap, you have to make sure every dollar is pulling its weight. That means taking an honest look at your investment strategy and making some smart, deliberate shifts to kickstart real growth.

This isn’t about chasing risky, speculative bets. Far from it. Catching up is about making calculated adjustments that align with your shorter timeline. It’s about being more intentional with where your money is, hunting down those sneaky fees that eat away at your returns, and using every tax-advantaged tool you can get your hands on.

Re-evaluating Your Asset Allocation

When you’ve got fewer years on the clock, a portfolio loaded with conservative assets like bonds probably won’t deliver the growth you need. This is where a more growth-oriented approach comes in, which usually means a higher allocation to stocks. That doesn’t mean you should start day-trading or piling into volatile single stocks.

Instead, think about these practical moves:

- Bump Up Your Stock Exposure: If you’re sitting on a classic 60/40 mix of stocks and bonds, it might be time to consider shifting to 70/30 or even 80/20. The right mix really depends on your personal comfort with risk and how much time you have.

- Diversify with Low-Cost Funds: You can get broad exposure to the entire market using index funds or ETFs. This gives you the growth potential of stocks without the nail-biting risk of putting all your eggs in one company’s basket.

- Keep Your Timeline in Mind: A 50-year-old with 15 years until retirement can stomach more market volatility than a 62-year-old who plans to hang it up in three years. Your strategy has to reflect your ability to recover from a downturn.

It’s a balancing act, for sure. You’re aiming for higher potential returns, but you have to stay within a risk level that lets you sleep at night.

The goal isn’t to chase quick wins. It’s to strategically position your portfolio for better long-term growth, giving your bigger contributions the best possible runway to compound.

The Hidden Drag of Investment Fees

High investment fees are one of the quietest killers of retirement dreams. A 1% fee sounds tiny, right? But over 15 or 20 years, that small percentage can siphon off tens of thousands of dollars from your nest egg in lost growth.

When you’re playing catch-up, cutting costs is a must. Take a hard look at the expense ratios on every mutual fund and ETF you own. If you’re paying more than 0.50% for any given fund, chances are you can find a cheaper alternative that does the exact same thing. Switching from a fund with a 1.2% expense ratio to one charging 0.1% is like giving yourself an instant, guaranteed 1.1% return boost, year after year.

Unlocking the Power of a Health Savings Account

Here’s a tool that’s criminally underused for retirement: the Health Savings Account (HSA). Too many people see it as just a way to pay for today’s medical bills, but its unique triple-tax advantage makes it an absolute powerhouse for your future self.

Here’s the magic:

- Tax-Deductible Contributions: The money you put in lowers your taxable income for the year. Simple as that.

- Tax-Free Growth: Your investments inside the HSA grow completely tax-free.

- Tax-Free Withdrawals: You can pull money out tax-free at any time for qualified medical expenses.

But here’s the real kicker for retirement: after you turn 65, you can withdraw money from your HSA for any reason. If it’s not for a medical cost, you’ll pay ordinary income tax on it—just like a traditional 401(k) or IRA. This turns the HSA into a fantastic secondary retirement account, especially for covering those inevitable healthcare costs in your later years.

Getting a handle on these tax implications is central to building a truly efficient plan. As you look at the long game, it’s crucial to understand how taxes will affect your retirement savings both while you’re saving and when you start drawing down your accounts.

This financial reality is critical when considering national savings trends. While the average 401(k) balance in the U.S. is $134,128, there are wide disparities. For instance, a persistent gender gap means women have median savings of just $31,291 compared to $45,106 for men, highlighting the need for everyone to optimize their strategy. Find out more by reviewing these essential retirement statistics for 2025. Making smart, tax-efficient adjustments is a key lever for closing these gaps.

Creative Strategies to Bridge a Major Gap

When maximizing your contributions and tweaking your investments just isn’t enough to close a significant shortfall, it’s time to pull out the bigger levers. These aren’t minor adjustments; they’re powerful, game-changing moves that can fundamentally redirect your path to retirement.

If you need to make up serious ground, thinking outside the box is non-negotiable. These strategies demand more commitment, but the payoff is a much bigger impact—the kind of horsepower needed to close a daunting gap. They’re all about re-examining major life and career decisions through the lens of your financial future.

Redefining Your Retirement Timeline

One of the most powerful moves you can make is simply to work a little longer. This isn’t about giving up on your retirement dreams; it’s about strategically extending your earning years to build a much more comfortable and secure future.

The financial benefits of this approach are threefold and incredibly potent:

- More Time for Compounding: Every extra year your money stays invested is another year it can work its magic through compound growth. An additional three to five years can add a truly substantial amount to your final nest egg.

- Continued Contributions: You get to keep adding to your 401(k) and IRA, padding your accounts instead of starting to draw them down.

- Higher Social Security Benefits: Delaying when you claim Social Security can significantly boost your monthly payments for life. Waiting from age 67 to 70, for instance, can increase your benefit by as much as 24%.

Launching a Retirement-Focused Side Hustle

Another high-impact strategy is to create a new stream of income dedicated solely to your retirement. A side business, freelance work, or a consulting gig can supercharge your savings rate far beyond what your primary salary allows.

The trick here is discipline. 100% of the net profit from this new venture needs to go directly into your retirement accounts. This isn’t extra spending money; think of it as a targeted capital injection for your future self.

For example, a marketing consultant who brings in an extra $1,000 a month after taxes can sock away an additional $12,000 a year. Over five years, that’s $60,000 in principal alone—which could easily grow to over $85,000 with modest market returns. If you’re hitting income limits, exploring a backdoor Roth IRA conversion can be a smart way to get this extra cash into a tax-advantaged account.

Making a Strategic Lifestyle Shift

Finally, it’s time to consider major lifestyle changes that can free up significant capital. These are big decisions, but their financial impact can be permanent, allowing you to catch up on retirement savings much, much faster.

Sometimes the fastest way to increase your savings isn’t by earning more, but by strategically and permanently reducing your single biggest expense.

Here are a couple of big ideas:

- Downsizing Your Home: Selling a large family home after the kids have moved out can unlock hundreds of thousands of dollars in equity. Investing that windfall can instantly close a massive portion of your savings gap.

- Relocating to a Lower-Cost Area: Moving from a high-cost-of-living city to a more affordable one can slash your monthly expenses—housing, taxes, and daily costs—freeing up thousands per year for savings.

These aren’t easy moves, but their financial impact is undeniable. You can use our https://popadex.com/retirement-nest-egg-calculator/ to model how a large, lump-sum investment from downsizing could dramatically accelerate your journey to financial independence.

Got Questions About Catching Up? We’ve Got Answers.

Even the best-laid plans can hit a few snags. When you’re laser-focused on catching up with your retirement savings, it’s natural for questions and “what-if” scenarios to pop into your head. Don’t worry, that’s completely normal.

Let’s tackle some of the most common hurdles people face. Think of this as the final piece of your strategy, giving you the clarity and confidence to move forward.

Should I Pay Off Debt or Save for Retirement First?

Ah, the classic financial tug-of-war. The answer almost always boils down to a simple math problem: interest rates.

High-interest debt, like a credit card screaming at you with a 22% APR, isn’t just a nuisance—it’s a financial emergency. The interest you’re paying is almost certainly demolishing any investment returns you could realistically hope for. That debt needs to be your top priority.

However, there’s one massive exception. Never, ever stop contributing enough to your 401(k) to get the full employer match. That’s a 100% return on your money, right out of the gate. Turning that down is like lighting free money on fire.

Here’s a straightforward game plan:

- Step 1: Contribute just enough to get your full 401(k) match. No excuses.

- Step 2: Throw every spare dollar at high-interest debt (think anything over 8-10%).

- Step 3: Once that toxic debt is gone for good, redirect all that cash flow toward maxing out your retirement accounts.

How Much More Aggressive Should My Investments Be?

Let’s be clear: “more aggressive” doesn’t mean you should start day-trading or betting the farm on speculative meme stocks. It’s about making a calculated, strategic shift in your asset allocation based on your timeline and how well you sleep at night when the market gets choppy.

For most people playing catch-up, this simply means tilting their portfolio a bit more towards stocks. For instance, you might move from a classic 60/40 stock-to-bond mix to a more growth-oriented 75/25 split. This is easily done with low-cost, diversified index funds or ETFs that track major indexes like the S&P 500. You don’t need to overcomplicate it.

A good financial advisor can be your secret weapon here. They’ll help you find that sweet spot that aligns with your specific goals without pushing you into a risk level you’re not comfortable with.

What if I Can’t Max Out the Catch-Up Contributions?

Don’t let perfect be the enemy of good. Seriously. The goal isn’t to hit the absolute maximum contribution limit on day one—it’s simply to save more than you were before. Progress over perfection.

Start with an amount that feels manageable, even if it seems small at first. An extra $100 a month is still $1,200 more per year that’s compounding and working for your future self. The real magic is in building the habit and automating it. Once that extra contribution is just part of your routine, you can look for ways to nudge it higher over time.

Can I Just Rely on Social Security?

In a word: no. Please don’t make this mistake.

Social Security was never designed to be a full-service retirement plan. It was created as a safety net. On average, it replaces only about 40% of a person’s pre-retirement income. That’s a huge gap to fill if you want to maintain your current lifestyle.

Think of Social Security as the solid foundation of your retirement house. It’s essential, but your personal savings and investments are the walls, roof, and everything else that makes it a comfortable home. That nest egg you’re building is what will truly fund the retirement you’ve worked so hard to achieve.

Ready to stop guessing and start seeing your progress in real-time? With PopaDex, you can link all your accounts, watch your net worth grow, and get the crystal-clear picture you need to crush your retirement goals. Take control of your financial future today.