Our Marketing Team at PopaDex

Increase Net Worth Today: Proven Strategies for Financial Growth

To get a handle on growing your net worth, you first need to know exactly where you stand today. The journey starts by figuring out your financial baseline with a simple formula: Assets minus Liabilities. This one number gives you the clarity to set real, achievable goals and, just as importantly, to see if you’re actually making progress.

Calculating Your Net Worth to Set a Clear Baseline

Before you can build a skyscraper, you need a solid foundation. In personal finance, that foundation is a clear, honest look at your current net worth. This isn’t just some number for bragging rights; it’s the single most important metric you have—a snapshot of your financial life at this very moment. Nailing this down is the first real step toward taking control of your financial destiny.

The math itself is pretty simple. Your assets are everything you own that has monetary value. Your liabilities are everything you owe. The difference is your net worth.

Identifying Your Assets

Assets are the “plus” side of your financial scoreboard. It’s crucial to get a full and accurate inventory to see the true picture of what you have.

- Cash and Equivalents: This is the easy stuff. Think checking accounts, high-yield savings, and any money market funds you have.

- Investments: Tally up the current market value of your stocks, bonds, mutual funds, and retirement accounts like your 401(k) or IRA.

- Real Estate: Use a recent appraisal or a realistic market estimate (like from Zillow or Redfin) for your home or any other properties you own.

- Personal Property: Be honest and conservative here. Include valuable items like your car, jewelry, or collectibles based on their realistic resale value, not what you paid for them.

Tallying Your Liabilities

Liabilities are the “minus” side of the equation—all your financial obligations. Being just as thorough here is non-negotiable.

Your liabilities are direct claims against your assets. Paying them down offers a guaranteed return on your money by freeing up capital you can then use to buy more income-producing assets.

Common liabilities to hunt down include:

- Mortgages and home equity loans

- Auto loans

- Student loan balances

- Credit card debt

- Personal loans

To make this easier, we’ve put together a simple worksheet you can use to map everything out.

Your Personal Net Worth Calculation Worksheet

Use this simple worksheet to calculate your current net worth by listing and totaling your assets and liabilities.

| Category | Item | Value ($) |

|---|---|---|

| ASSETS | (What you own) | |

| Checking Accounts | ||

| Savings Accounts | ||

| 401(k) / 403(b) | ||

| IRA (Roth/Traditional) | ||

| Brokerage Accounts | ||

| Home Value (Estimate) | ||

| Vehicle Value (Estimate) | ||

| Other Valuables | ||

| Total Assets | $ | |

| LIABILITIES | (What you owe) | |

| Mortgage Balance | ||

| Auto Loan Balance | ||

| Student Loan Balance | ||

| Credit Card Debt | ||

| Personal Loans | ||

| Total Liabilities | $ | |

| YOUR NET WORTH | $ | |

| (Total Assets - Total Liabilities) |

Once you’ve filled that out, you have your number. Whether it’s positive or negative, that’s your starting line. This figure empowers you to make smarter decisions and measure the real impact of your hard work. Tracking this over time is where the magic happens, and a good tool makes all the difference. You can explore how PopaDex helps you to track your net worth in one clean dashboard.

And this process isn’t just for the super-rich. In fact, the ranks of “Everyday Millionaires”—those with a net worth between $1 million and $5 million—have swelled to over 55 million people globally, according to a recent UBS report. This explosive growth proves that building substantial wealth is an achievable goal for many, and it all starts with this one foundational calculation.

Expanding Your Income Beyond a Paycheck

While cutting expenses and crushing debt are smart moves, the real game-changer for your net worth is boosting your income. Relying on a single paycheck is like trying to fill a bucket with a leaky faucet—it limits how fast you can grow. The goal here is to build several sturdy income streams that pump up your asset column without burning you out.

Think of it this way: your 9-to-5 covers your lifestyle. Every extra dollar you earn beyond that can be funneled directly into investments, dramatically shortening your path to financial freedom. This isn’t about grinding 80-hour weeks. It’s about working smarter by turning the skills and passions you already possess into cash.

Monetize What You Already Know

The quickest path to extra cash is often right under your nose. You have valuable skills from your career or hobbies that people will gladly pay for.

For example, a marketing manager can easily offer freelance social media help to local businesses on the weekends. A software developer could pick up small coding gigs. Even someone who is just really good at staying organized can offer virtual assistant services for a few hours a week. It’s all about spotting a skill you have and finding the people who need it.

Your existing knowledge is a valuable, untapped asset. Packaging it into a service or product is one of the most direct paths to boosting your income and, consequently, your ability to increase net worth.

This approach has almost zero startup cost and plays to your strengths, which means less risk and more immediate cash flow.

Launch a Side Hustle Aligned with Your Passions

Beyond your professional life, your hobbies can be a goldmine. When you turn a passion into a side project, it rarely feels like work, making it far more sustainable for the long haul.

Just look at these real-world examples:

- The Weekend Woodworker: Someone who loves woodworking can start selling custom cutting boards or small furniture on Etsy or at local craft fairs.

- The Fitness Enthusiast: A person passionate about yoga could get certified and teach a couple of classes a week at a nearby studio or online.

- The Talented Baker: A home baker could specialize in custom cakes for birthdays and local events, using Instagram to show off their work.

The best part about a passion-based side hustle is the built-in motivation. When you genuinely enjoy what you’re doing, it becomes a rewarding way to build wealth, not just another chore. For those aiming for a significant income jump, exploring the highest paying remote jobs can also be a fantastic strategy to land a high-earning primary or secondary role.

Building Your Passive Income Engine

The ultimate goal for most of us is to create income that flows in with minimal daily effort. Welcome to the world of passive income, where your assets do the heavy lifting for you. While setting it up might take a lot of upfront work or capital, the long-term payoff can be incredible.

Here are a few popular ways to build a passive or semi-passive income stream:

| Income Type | Upfront Effort | Potential for Passivity | Example |

|---|---|---|---|

| Dividend Stocks | Low (Financial) | High | Buying shares in established companies that pay regular dividends. |

| Digital Products | High (Time/Skill) | High | Creating an e-book, online course, or photo pack once and selling it infinitely. |

| Real Estate | High (Financial/Time) | Medium to High | Owning a rental property managed by a property management company. |

| Affiliate Marketing | Medium (Time) | Medium | Building a niche blog or social media following and earning commissions from product recommendations. |

Each new income stream you add is another pillar supporting your financial future. By diversifying how you earn, you not only speed up your net worth growth but also build a much more resilient financial life that isn’t tied to a single employer.

Optimizing Your Spending Without Strict Budgets

Growing your wealth isn’t just about what you earn; it’s about what you keep. When people hear “manage expenses,” they often picture soul-crushing spreadsheets and joyless budgets that track every last penny. And while that might work for a select few, for most of us, it’s a surefire path to burnout.

There’s a much more sustainable—and effective—way to go about it: conscious spending.

This isn’t about depriving yourself. It’s about alignment. It’s making sure your money actually flows toward the things that bring you value and get you closer to your big-picture goals. Think of it as the difference between mindlessly tapping your card for a daily coffee and deliberately saving that money for a vacation you’ll remember for years.

When you become more intentional with your spending, you start to spot the wealth leaks. These are those sneaky, often recurring expenses that quietly drain your bank account without you even noticing—like that free trial that morphed into a monthly charge or the premium cable package you haven’t touched in months.

Pinpointing and Plugging Your Wealth Leaks

You can’t fix a leak you can’t see. The first step is simply getting a clear view of where your money is going. This is where a tool like PopaDex is a game-changer. Once you link your accounts, it automatically sorts your spending, creating a simple, visual map of your monthly cash flow.

Instead of drowning in a sea of receipts, you can just look at the summary and ask a few powerful questions:

- “Does this expense still bring me joy or value?” That gym membership you haven’t used in six months is a perfect place to start.

- “Is there a cheaper, smarter way to get this?” A quick call to your insurance provider or cell phone company could reveal a better plan you qualify for.

- “Am I paying for convenience I don’t truly need?” Daily food delivery can easily swallow hundreds of dollars a month—money that could be fueling your investments instead.

This isn’t about beating yourself up over past choices. It’s about making smarter, more informed decisions for your future self. That $50 you save by canceling an unused subscription isn’t just $50. It’s fresh capital you can put to work, letting it grow and compound over time.

Redirecting just a few hundred dollars a month from mindless spending to intentional investing can add tens or even hundreds of thousands of dollars to your net worth over the long run. It’s the small, consistent actions that build significant wealth.

Smart Tactics for Immediate Savings

Once you’ve identified the leaks, it’s time to take action. The goal here is to cut your costs without sacrificing your quality of life.

- Negotiate Your Bills: Many service providers, from your internet company to your car insurance agent, have more wiggle room than you think. A single phone call asking for a better rate or any new promotions can often lead to instant savings.

- Conduct a Subscription Audit: Pull up your bank statements and make a list of every recurring charge. Be ruthless. Cancel anything you no longer use or value. For the keepers, see if there’s a cheaper plan or an annual payment option that offers a discount.

- Implement a 24-Hour Rule: For any non-essential purchase over a set amount (say, $100), force yourself to wait 24 hours before buying. This simple pause is incredibly effective at separating an impulse buy from a genuine want, preventing buyer’s remorse and keeping cash in your account.

By optimizing your spending this way, you free up a surprising amount of capital that can be used to demolish debt or build your investment portfolio—the two main engines that increase net worth. This whole process is a fundamental part of building a solid financial foundation. For more on this, check out our guide on creating a financial plan that truly reflects your goals.

Creating a Strategic Debt Reduction Plan

Debt is a direct anchor on your financial progress. Think about it: every dollar you send to a lender for interest is a dollar that isn’t working for you, growing your assets, or buying back your time. Paying down what you owe, especially the high-interest stuff, is more than just getting out of the red. It’s about locking in a guaranteed, risk-free return on your money and freeing up powerful cash flow to increase your net worth.

A solid plan starts with a crystal-clear picture of what you owe. Before you can attack your debt, you need to know exactly what you’re up against. A great first step is learning how to get all three of your credit reports for free for a detailed list of every account. Once you have that intel, you can pick a payoff strategy that clicks with both your finances and your personality.

The Avalanche Method: Financial Efficiency

If you’re a numbers person, the debt Avalanche method is your best friend. From a purely mathematical standpoint, it’s the most efficient way to get out of debt. The game plan is simple: you make the minimum payments on all your debts, but you channel every spare cent toward the one with the highest interest rate. Once that one is gone, you take its entire payment and roll it over to the next-highest-interest debt.

This method saves you the most money over time because you’re surgically targeting the most expensive debt first. It’s the go-to choice for anyone driven by optimization and the desire to pay as little interest as humanly possible.

The Snowball Method: Motivational Wins

On the other hand, maybe you’re someone who thrives on momentum. That’s where the debt Snowball method shines. It’s all about behavior and psychology. Like the Avalanche, you make minimum payments on everything. But the extra cash? You throw it all at your smallest debt balance, completely ignoring the interest rate.

The moment you wipe that first small debt off the books, you get a quick, powerful win. It feels incredible. You then take that freed-up payment and “snowball” it onto the next-smallest balance. This approach builds serious momentum and can be the key to staying motivated for the long haul, even if it means paying a bit more in interest along the way.

Choosing between Avalanche and Snowball isn’t about right or wrong; it’s about what works for you. The best plan is the one you will actually stick with until you’re debt-free.

Comparing Debt Payoff Strategies

Your personality and financial discipline will be the biggest factors in deciding which method is the better fit. Let’s break down the core differences.

| Feature | Debt Avalanche | Debt Snowball |

|---|---|---|

| Primary Focus | Highest Interest Rate | Smallest Balance |

| Key Benefit | Pays the least amount of interest over time | Provides quick motivational wins |

| Best For | Individuals who are disciplined and motivated by financial efficiency. | Individuals who need positive reinforcement to stay on track. |

| Potential Drawback | Can feel slow at the start if the highest-interest debt is large. | May cost more in total interest paid over the life of the loans. |

Practical Steps For Debt Elimination

Picking a method is just the start. The real magic happens when you take practical action to supercharge the process. One of the most effective moves you can make is to increase your income specifically to accelerate your debt repayment.

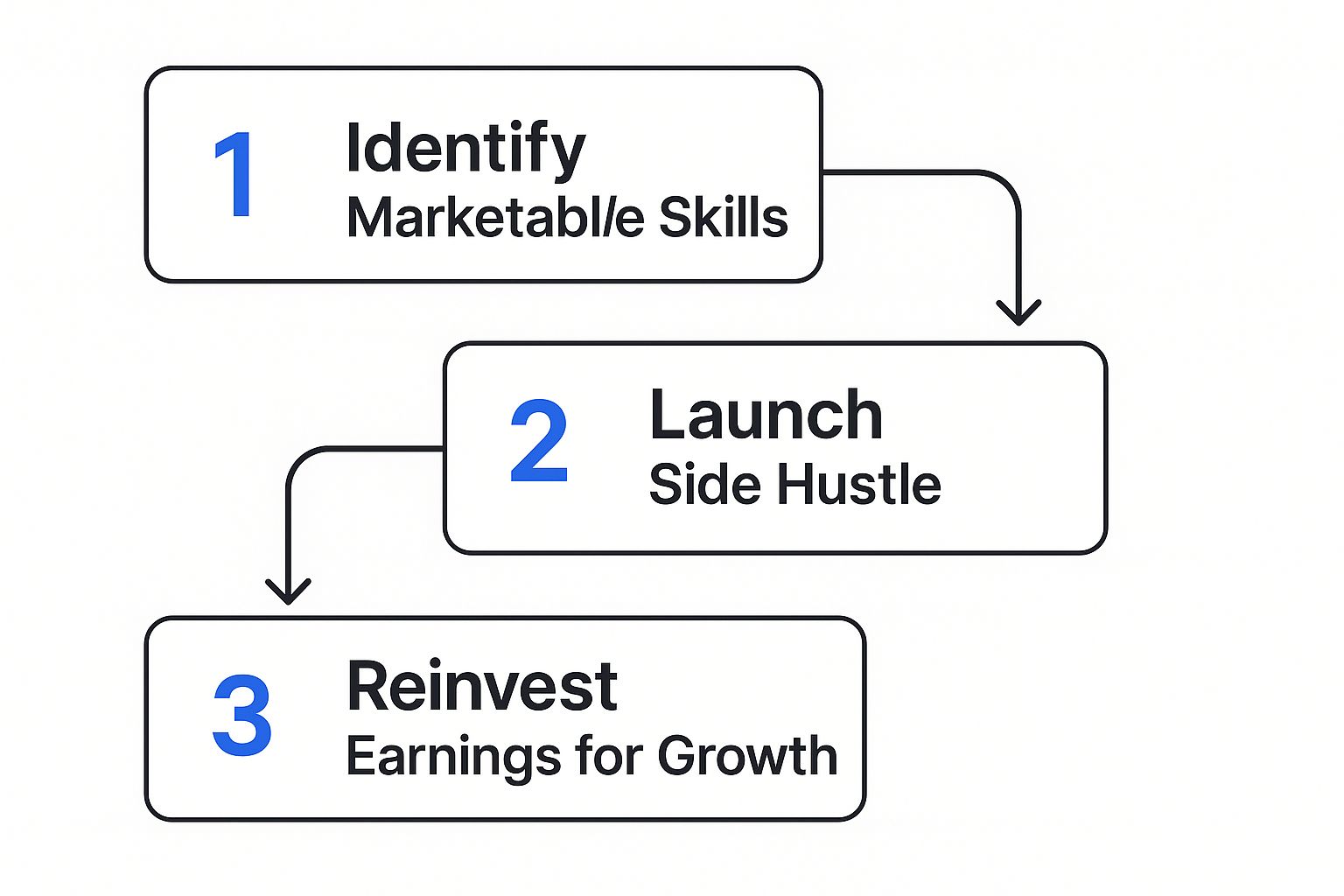

This flowchart maps out a simple but incredibly powerful process: learn a new skill, use that skill to bring in extra income, and then strategically deploy those earnings to crush your debt.

The key insight here is creating a dedicated income stream with one job: destroying your liabilities. Whether you start freelancing, consulting, or running a weekend business, earmarking that new money for debt turns your side hustle into a high-powered wealth-building engine. This targeted approach transforms your debt reduction from a slow crawl into a sprint, freeing up your primary income for saving and investing much, much sooner.

Investing Intelligently for Long-Term Wealth

Once you’ve started making more money and have a solid handle on your spending, it’s time to put your cash to work. This is where you really start to see your net worth take off. Investing is the engine that turns your savings from idle money into a powerful force for wealth creation, building a future where your money works even harder than you do.

Once you’ve started making more money and have a solid handle on your spending, it’s time to put your cash to work. This is where you really start to see your net worth take off. Investing is the engine that turns your savings from idle money into a powerful force for wealth creation, building a future where your money works even harder than you do.

The magic behind all of it is compounding. Think of it like a snowball rolling downhill. Your money earns a return, and then that return starts earning its own return. Over time, this effect can lead to explosive growth. This isn’t about chasing risky stocks or trying to perfectly time the market; it’s about a consistent, patient strategy that uses time as its greatest advantage.

The Bedrock Principles of Smart Investing

Before you jump into specific investments, there are a few foundational ideas you absolutely need to grasp. These principles are your North Star, guiding you to build a portfolio that can handle market bumps and bruises while steadily growing your wealth.

First up, diversification. It’s your best friend when it comes to managing risk. The old saying, “Don’t put all your eggs in one basket,” is the absolute cornerstone of smart investing. By spreading your money across different asset types—like stocks, bonds, and real estate—you soften the blow if one area takes a hit.

Next is asset allocation, which is just putting diversification into practice. It’s about deciding what percentage of your portfolio goes into which asset class, based on your own comfort with risk and how long you have to invest. If you’re in your 20s, you might lean more heavily into stocks for their growth potential. If you’re nearing retirement, you’ll likely want more stability from bonds.

The real power of investing isn’t in finding that one “perfect” stock. It’s in consistently adding to a diversified portfolio and letting the magic of compounding do the heavy lifting over many years.

This long-term mindset is everything. The goal isn’t to get rich quick. It’s about building real, sustainable wealth through patience and discipline, making regular contributions whether the market is soaring or slumping—a strategy known as dollar-cost averaging.

Your Toolkit for Building Wealth

With those principles in mind, let’s look at some of the most effective and accessible ways to build long-term wealth.

- Low-Cost Index Funds and ETFs: Think of these as pre-packaged baskets of stocks or bonds that track a market index, like the S&P 500. They give you instant diversification for a tiny fee, making them a fantastic starting point for almost everyone.

- Retirement Accounts (401(k)s and IRAs): These are your secret weapons, packed with powerful tax advantages. Contributions to a traditional 401(k) or IRA can often lower your taxable income now, while a Roth IRA gives you tax-free growth and withdrawals in retirement.

- Real Estate: This one requires more cash and hands-on effort, but owning property can be a fantastic way to build equity and generate a steady stream of rental income.

As you build out your portfolio, a common question is how much to put where. It can be helpful to explore guidance on how much of your net worth to allocate to specific assets like gold and silver to see how alternative assets can fit into your overall plan.

Putting Your Capital to Work in the Real World

The importance of owning assets simply can’t be overstated. Get this: between 2000 and 2020, global net worth shot up from $160 trillion to a mind-boggling $510 trillion. And a massive 77% of that growth came not from people saving more, but from the rising prices of assets like real estate and stocks.

This is proof positive that just holding appreciating assets was one of the biggest drivers of wealth creation. This is why making the leap from saving to investing is so critical. Every dollar you invest becomes a piece of an asset with the potential to grow in value. Your mission is to systematically turn the income you earn into a portfolio of assets that works for you 24/7, pulling you closer to your financial goals.

How to Track and Optimize Your Financial Progress

All the hard work you put into earning more, spending less, and investing smartly can fall flat without one critical habit: consistent tracking. It’s an old saying, but it holds true: what gets measured gets managed. This final piece of the puzzle transforms your scattered financial efforts into a focused, data-driven strategy to increase your net worth.

It’s the difference between just hoping you’re making progress and actually steering your financial ship with purpose. Without a clear view, it’s easy to lose steam. But seeing your net worth tick upward, even by a little each month, is the tangible proof that your smart decisions are paying off.

From Clunky Spreadsheets to a Live Dashboard

Not long ago, tracking meant wrestling with a clunky spreadsheet every month. While that manual grind can teach you a few things, modern tools have made it incredibly simple to get a real-time, all-in-one view of your entire financial world.

A dedicated tool like PopaDex’s net worth tracker acts as your personal financial command center. You securely connect your accounts—savings, investments, mortgage, loans—and it automatically pulls all that data together. What you get is a live, at-a-glance overview of your total assets, liabilities, and that all-important net worth figure.

The point of tracking isn’t to obsess over every daily market swing. It’s about spotting the long-term trends, confirming your strategy is actually working, and making smart adjustments when something’s off. This feedback loop is the real secret to sustainable growth.

This big-picture view is a game-changer. You can instantly see how a good day in the stock market boosts your assets or how an extra payment on your student loan shrinks your liabilities and nudges your net worth in the right direction.

Using Your Data to Make Smarter Moves

With a clear dashboard, you’re no longer a passenger—you’re the active manager of your own wealth. Are your investments doing what you expected? Is your debt-to-asset ratio getting better? Are there any sneaky expenses eating away at your progress? The answers are right there in front of you.

This kind of visibility empowers you to ask better questions and find better answers:

- Spotting Opportunities: You might see your cash savings are piling up, a clear signal it’s time to put that money to work in your investment accounts to speed things up.

- Catching Problems Early: A dip in net worth could reveal that a high-interest credit card is wiping out your investment gains, telling you to pivot and attack that debt.

- Staying Fired Up: Nothing beats the motivation of seeing your net worth chart climb steadily over six months. It’s a powerful psychological boost to keep you disciplined.

This proactive approach is more important than ever. In 2024, global financial wealth hit a record $305 trillion. But here’s the interesting part: over 80% of net new assets were managed by newly hired advisors, not existing ones. This suggests that people get huge benefits when they have the right tools to take control themselves. You can dive deeper into these global wealth trends on bcg.com.

By making a habit of reviewing your financial dashboard, you create a powerful cycle: plan, act, measure, and optimize. You replace emotion and guesswork with clarity and confidence, paving a much smoother road to building lasting wealth.

Of course. Here is the rewritten section, crafted to sound like an experienced human expert and match the provided examples.

Your Top Net Worth Questions, Answered

When you start getting serious about building wealth, a lot of questions pop up. It’s completely normal to wonder if you’re doing things right or if there’s some secret sauce you’re missing. Let’s cut through the noise and tackle some of the most common questions I hear.

One of the first things people ask is, “How fast should my net worth be growing?” The honest answer? It depends. In the beginning, your growth is almost entirely powered by how much you save. As your investments start to pile up, market swings will have a much bigger say. Stop comparing your progress to someone else’s highlight reel and focus on consistent, positive movement every single month.

Then there’s the question of risk: “Should I be aggressive to grow my wealth faster?” Your comfort with risk is deeply personal. If you’re young with decades until you’ll need the money, you can generally afford to take on more risk for a shot at higher returns. If you’re nearing retirement, protecting what you’ve built becomes the top priority. The goal is to match your investment strategy to your own timeline and stomach for volatility, not to copy someone else’s playbook.

How Much Is “Enough”?

This is the big one. Everyone wants to know, “What’s a good net worth to aim for?” There isn’t a single magic number that works for everyone. Forget fixating on a random figure like a million dollars. Instead, figure out your number by working backward from the life you want to live.

- Picture Your Ideal Future: How much income would you need each year to live comfortably without having to work?

- Lean on the 4% Rule: A reliable guideline is that you can safely withdraw 4% of your investment portfolio annually during retirement. To find your target, just multiply your desired yearly income by 25.

- For example: If living your best life costs $80,000 a year, your target net worth for financial independence is $2,000,000 ($80,000 x 25).

That number isn’t just a dream; it’s your personal North Star. It makes the entire wealth-building journey concrete and measurable.

The most powerful way to hit your target is to put your finances on autopilot. Set up automatic transfers to your savings and investment accounts the day you get paid. This “pay yourself first” approach builds wealth consistently, no willpower required.

Finally, people often worry, “Is it too late for me to start?” Absolutely not. Sure, starting early gives you a huge leg up thanks to the power of compounding, but starting today is infinitely better than putting it off. Every single dollar you invest has the potential to grow, no matter your age. The most important step you can take is the first one.

Ready to stop guessing and start tracking? Take control of your financial journey with PopaDex. Our intuitive dashboard brings all your assets and liabilities into one clear view, so you can see your progress in real-time and make smarter decisions to grow your wealth. Start tracking your net worth for free today at PopaDex.com.