Our Marketing Team at PopaDex

Mastering the International Salary Calculator

An international salary calculator is a financial tool that shows you what a salary is actually worth in another country, once you factor in things like taxes and the local cost of living. It goes way beyond a simple currency conversion to show you your true purchasing power.

This makes it an absolute must-have for anyone even thinking about a global career move.

What an International Salary Calculator Actually Shows You

Think of it as a financial travel guide for your career. A quick currency exchange tells you what your salary looks like on paper, but an international salary calculator tells you what that money can actually buy. It answers the most critical question: “Will my new salary support the lifestyle I want in my new home?”

This tool paints a realistic picture by looking at crucial local factors that a direct conversion completely misses. These calculators are built on a concept called Purchasing Power Parity (PPP), which adjusts for the huge differences in the cost of everyday goods and services between countries.

For example, a €50,000 net salary in Portugal can feel like $101,259 in U.S. spending power. On the other hand, 400,000 Danish krone might only feel like $69,106. You can see these differences for yourself and learn more about how to run a salary comparison by country.

To get this right, these tools have to account for a few key elements:

- Local Income Taxes: Tax rates can vary wildly from one place to another, taking a big bite out of your take-home pay.

- Social Security Contributions: Mandatory deductions for things like pensions or healthcare are different all over the world.

- Cost of Living: The calculator adjusts for everyday expenses like rent, groceries, and transportation.

By translating a nominal salary into real-world purchasing power, an international salary calculator helps you make informed decisions, negotiate effectively, and avoid costly financial surprises when moving abroad.

Understanding the Key Calculation Components

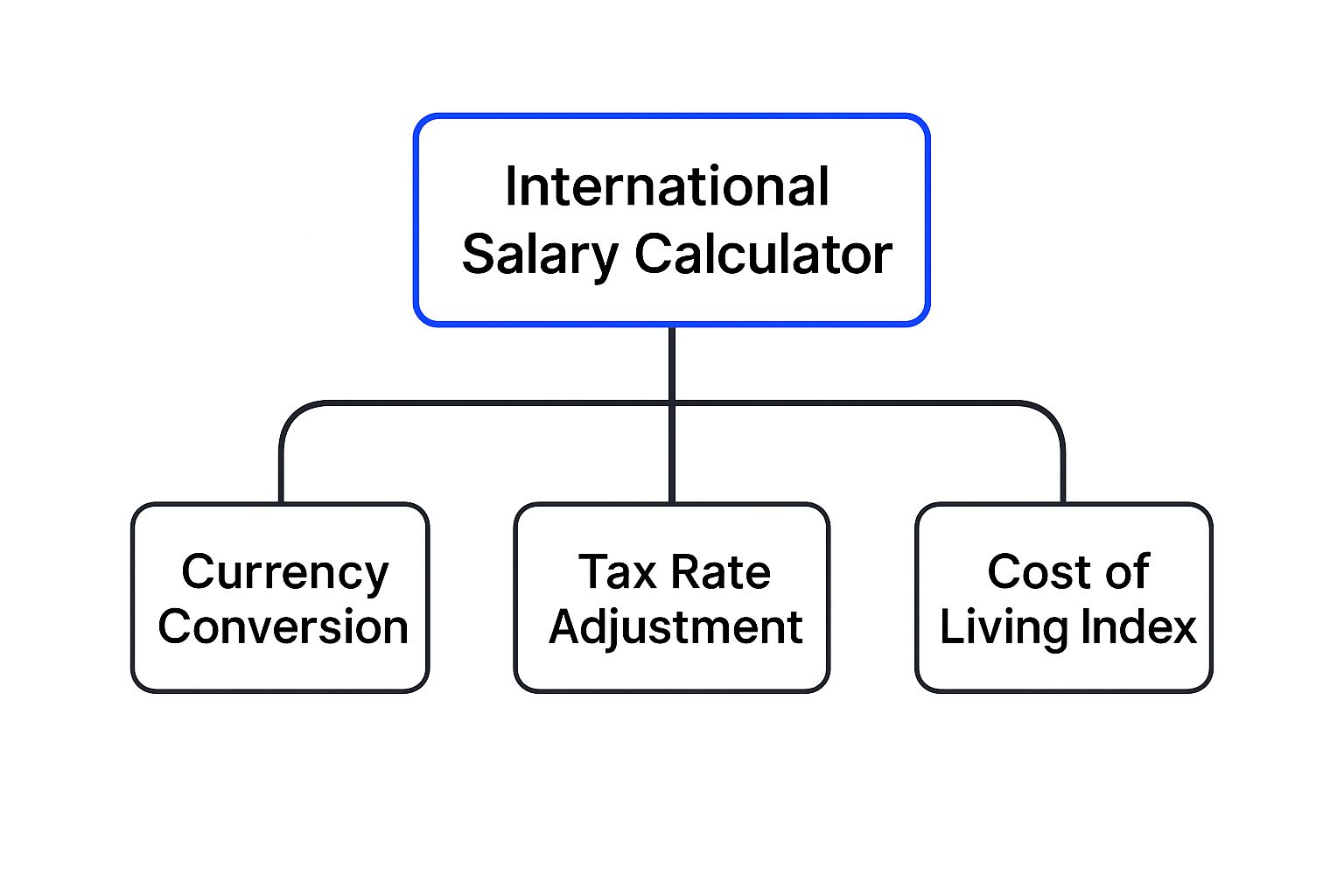

To really get what an international salary calculator does, you have to look past simple currency exchange. These tools are built on three core pillars that work together, turning a number on a page into a real-world picture of your lifestyle in a new country.

The first, most basic piece is Gross Salary and Currency Conversion. This is just the starting line—taking the salary you’re offered in one currency and swapping it for another. But stopping here is a big mistake. Exchange rates are always moving, and those shifts can seriously change what your paycheck is worth. It’s why you’ll often hear finance pros talk about learning how to hedge currency risk when you’re dealing with money across borders.

This next image really breaks down how a good calculator builds an accurate financial picture, layer by layer.

As you can see, it’s not just about the currency. A genuine international salary tool adds taxes and cost of living on top to show you what’s really going on with your money.

Cost of Living Adjustments

This is where the calculator starts getting clever. A Cost of Living Adjustment is all about comparing the buying power of your salary in two different places. It answers the one question that really matters: “How far will my money actually go here?” This concept is often called Purchasing Power Parity (PPP).

Think about it: a one-bedroom apartment in Tokyo is going to hit your wallet a lot harder than a similar one in Toronto. A monthly metro pass in London has a totally different price tag than one in Lisbon. A quality calculator digs into thousands of data points—housing, groceries, transport, entertainment—to figure out if your new salary will get you a similar, better, or worse standard of living.

This adjustment is the secret sauce that separates a basic converter from a true international salary calculator. It gives you the context you need to understand your financial reality, not just a meaningless number.

Taxes and Social Contributions

Finally, we get to the most important—and often most painful—part: Taxes and Social Contributions. Tax systems are wildly different from one country to the next. A $90,000 salary in a place with a 15% effective tax rate leaves you with way more cash in hand than the same salary in a country where the tax man takes 40%.

A solid calculator has to factor in all of it:

- National and local income taxes, which can get complicated fast.

- Mandatory social security, pension, or healthcare payments that come right off the top.

- Region-specific compensation rules, which are also critical. For instance, some jobs and locations have unique pay structures, making it important to understand details like understanding how to compute overtime in the UAE for accurate financial planning.

By subtracting all these mandatory costs, the calculator finally reveals your net disposable income—the money you actually have left to spend or save each month.

Why Global Salaries Differ So Much

Ever scroll through job listings and wonder how the same software developer role can pay three times more in Zurich than it does in Lisbon? The answer goes beyond a simple currency conversion. It’s a messy, fascinating mix of national economics, fierce industry demand, and local labor laws. This is exactly the kind of complexity an international salary calculator is designed to unravel.

A country’s overall economic health, often measured by its Gross Domestic Product (GDP), really sets the foundation. Wealthier nations with high productivity can simply afford to support higher wages across the board. It’s like a bustling local market—when more money is flowing, sellers can charge more, and workers are in a position to demand better pay.

The Role of Industry and Talent

Beyond the big picture of a national economy, what’s happening in specific industries plays a massive role. If a city is a major hub for financial technology, for instance, the competition for skilled engineers becomes incredibly intense. That demand naturally drives salaries for those roles sky-high. On the flip side, a job in an industry that isn’t a local powerhouse won’t feel that same upward pressure.

The local talent pool is the other side of that coin. If a country has a huge surplus of qualified professionals in a certain field, companies don’t have to offer top-tier salaries to attract great people. This classic economic tug-of-war between supply and demand is one of the biggest reasons you see such dramatic wage differences from one country to the next.

And the results of this tug-of-war can be shocking. Take a look at the massive differences in average monthly net salaries (after tax) around the world.

Average Monthly Net Salary Comparison

| Country | Average Monthly Net Salary (USD) |

|---|---|

| Switzerland | $8,218 |

| United States | $6,562 |

| Germany | $3,875 |

| Japan | $2,782 |

| Brazil | $580 |

| Nigeria | $385 |

Source: Data compiled from various global economic reports and platforms like Caprelo.com.

This table throws the global wage gap into sharp relief. A professional in Switzerland takes home more than 21 times what their counterpart in Nigeria might earn. You can dig deeper into these numbers with this global employee experience report from Caprelo.com.

Understanding these dynamics changes your perspective completely. The goal goes beyond chasing the biggest number. It’s about finding the right balance where your salary, the local cost of living, and your desired quality of life all click into place. After all, a bigger salary in a wildly expensive city might actually leave you with less cash in your pocket than a more modest one somewhere else.

How to Actually Use an International Salary Calculator

Okay, so you get the theory. But how do these calculators work in the real world? Let’s walk through a common scenario to see exactly how this tool turns a foreign job offer into a clear financial picture.

Meet Alex, a graphic designer based in Chicago, currently earning a solid $85,000 a year. A dream job offer just landed in Alex’s inbox—a chance to move to Amsterdam. The salary looks good on paper, but before packing any bags, Alex needs to know what that number really means.

This is where a good international salary calculator comes in. Alex would start by plugging in the core details:

- Current Location: Chicago, USA

- Target Location: Amsterdam, Netherlands

- Current Salary: $85,000 USD

- Job Role: Graphic Designer

That last point—the job role—is more important than you might think. Modern calculators don’t just convert currency; they use your role to benchmark the offer against local industry standards, giving you a much sharper analysis.

What the Results Actually Tell You

Once the data is in, the calculator doesn’t just spit out a single number. Instead, it delivers a complete financial breakdown.

You’ll usually see an interface like the one below, designed to let you input your current role and location to compare it against a new opportunity.

This kind of granular control is what separates a vague guess from a genuinely useful insight.

For Alex, the results page would likely show a few key figures:

- Equivalent Gross Salary: First, the calculator converts the $85,000 into euros based on current exchange rates.

- Estimated Net Income: Next, it deducts estimated Dutch income taxes and social security. This is Alex’s projected take-home pay.

- ‘Real Feel’ Salary: Finally, it adjusts that net figure for Amsterdam’s cost of living, showing the true purchasing power compared to Chicago.

This ‘real feel’ number is the holy grail. It moves the conversation beyond currency and taxes to answer the most important question: “Will I be better or worse off?” It tells Alex if the new salary supports a comparable, better, or worse lifestyle than the one back home.

Today’s best global salary calculators are incredibly powerful, often providing wage benchmarks for over 150 countries. They can break down data into low, average, and high salary bands for specific roles. For instance, a software engineer in the United States might earn an average of $120,000, while the same job in India averages around $25,000. You can explore more about these global salary differences and find benchmarks for your own career.

Who Benefits From Salary Calculators?

You might think an international salary calculator is a niche tool, but it’s actually an essential resource for a whole range of people navigating today’s global economy. From individuals dreaming of a move abroad to the very companies looking to hire them, these calculators bring much-needed financial clarity.

Different people use these tools to solve very specific, high-stakes problems. The real value, though, is universal: turning an abstract salary figure into what it’s actually worth in the real world.

Job Seekers and Expats

If you’re even thinking about a move abroad, this tool is your new best friend. It helps you look past the raw salary number and see the kind of lifestyle that money can actually buy you in a new country. Getting a handle on financial planning for expats is a critical step that can make or break an international move.

An international salary calculator gives you the power to:

- Negotiate with confidence, because you’ll know exactly what a fair, livable wage looks like in your target city.

- Compare multiple offers from different countries by seeing their true purchasing power, side-by-side.

- Dodge nasty financial surprises by getting a clear estimate of your take-home pay after all the local taxes and deductions are factored in.

HR Managers and Global Companies

For companies hiring talent from around the world, these calculators are indispensable for crafting fair and competitive compensation packages. They arm HR teams with the data needed to attract top candidates without overspending or, worse, lowballing a great applicant.

By standardizing how they look at salaries across wildly different economic landscapes, businesses can build equitable, data-driven pay structures. This is a cornerstone of modern global mobility and talent acquisition—it’s all about creating a fair system that supports a diverse, global workforce.

Of course, a salary calculator is just one piece of the puzzle. Global mobility pros also have to navigate complex legal frameworks. For instance, a solid guide to U.S. business visa requirements is invaluable for any company or individual planning a move that involves the United States, making sure all the legal and financial boxes are ticked.

A Few Lingering Questions

Navigating global pay can feel a bit tricky, even with a great tool in hand. It’s smart to know what an international salary calculator can—and can’t—do. Let’s tackle some of the most common questions people have.

How Accurate Are These Calculators Anyway?

The million-dollar question! The short answer is: their accuracy hinges entirely on the quality of their data. The most trustworthy calculators are upfront about where they get their numbers and constantly update their data on cost of living, tax rules, and currency rates. If a tool pulls data from reputable sources like the OECD, that’s a great sign.

That said, no calculator can be 100% perfect. Think of it as a highly educated estimate. It’s your starting point, not the final word—giving you a solid, data-backed baseline for comparisons and negotiations.

What Factors Might a Calculator Miss?

While these tools are incredibly comprehensive, they can’t capture every single detail of a job offer. You’ll want to dig into these elements on your own to see the complete financial picture.

Key factors that are often left out include:

- Healthcare Costs: The difference between a country with robust public healthcare and one that relies on private insurance is massive and can seriously impact your budget.

- Retirement Benefits: Things like company pension contributions or 401(k)-style matching plans are almost never factored in.

- Stock Options and Bonuses: Any kind of variable pay is usually outside the scope of a standard salary calculation.

Think of the calculator’s result as your net salary baseline. From there, you can start adding the value of these other financial perks to get a real sense of the total offer.

How Do I Use This Data to Negotiate a Better Offer?

This is where the magic happens. When you walk into a negotiation armed with data, you change the entire conversation. It’s no longer just about a number; it’s about lifestyle and purchasing power. If a calculator shows that an offer in Lisbon doesn’t stack up to your current standard of living in Chicago, you have a concrete, impersonal reason to ask for more.

Frame your request around the data. You could say something like, “Based on my research into the local cost of living and tax rates, a salary of X would be necessary to maintain a comparable lifestyle to my current role.” It shows you’ve done your homework and makes your request far more compelling.

Ready to stop guessing and start knowing? With support for over 15,000 banks and multi-currency accounts, PopaDex gives you the clarity you need to manage your global finances. Get your complete financial picture today.