Our Marketing Team at PopaDex

10 Powerful Investment Diversification Strategies for 2025

True financial resilience isn’t about avoiding risk; it’s about managing it intelligently. While the old adage about eggs and baskets is a familiar start, building a robust, modern portfolio requires a more sophisticated approach. This guide moves past the basics to deliver ten powerful investment diversification strategies, offering actionable frameworks to protect and grow your wealth in any market environment.

We will break down exactly how each method works, from classic asset class allocation and geographic diversification to advanced models like risk parity and factor-based investing. For each strategy, we’ll provide clear, practical steps for implementation. Furthermore, we’ll show you how a comprehensive tool like PopaDex can empower you to monitor these strategies in real-time, providing the clarity needed to navigate market volatility with confidence. This is more than theory; it’s a blueprint for action.

By understanding and implementing these techniques, you can build a portfolio designed not just to survive market fluctuations, but to potentially capitalize on them. The goal is to create a balanced structure that aligns with your financial objectives, whether you’re saving for retirement, building wealth as a young professional, or managing multi-currency assets. For a broader perspective on modern approaches, exploring other essential investment diversification strategies can provide valuable insights for 2025. Let’s dive into the specific strategies that will fortify your financial future.

Free template

Want to follow along?

Grab the free net worth tracker spreadsheet and apply these steps immediately.

1. Asset Class Diversification

Asset class diversification is the cornerstone of modern portfolio construction and a fundamental investment diversification strategy. The principle is simple yet powerful: spread your investments across different categories of assets, such as stocks, bonds, real estate, and commodities. Since these asset classes react differently to economic events, a downturn in one area is less likely to devastate your entire portfolio.

This strategy, rooted in Harry Markowitz’s Modern Portfolio Theory, aims to optimize returns for a given level of risk. When stocks are volatile, high-quality bonds often provide stability. When inflation rises, real estate and commodities may outperform. By holding a mix, you smooth out your returns over time, protecting your capital from the sharp swings of any single market. Legendary investors like David Swensen, who managed the Yale Endowment, famously used this approach to achieve remarkable long-term growth by allocating significantly to alternative assets alongside traditional stocks and bonds.

Implementing Asset Class Diversification

Getting started is more straightforward than it sounds. A classic benchmark for a balanced portfolio is the 60/40 allocation: 60% in stocks for growth and 40% in bonds for stability. However, this is just a starting point. Your ideal mix should reflect your personal financial situation, including your age, risk tolerance, and time horizon. Younger investors might lean more heavily into stocks (e.g., 80/20), while those nearing retirement might prefer a more conservative allocation.

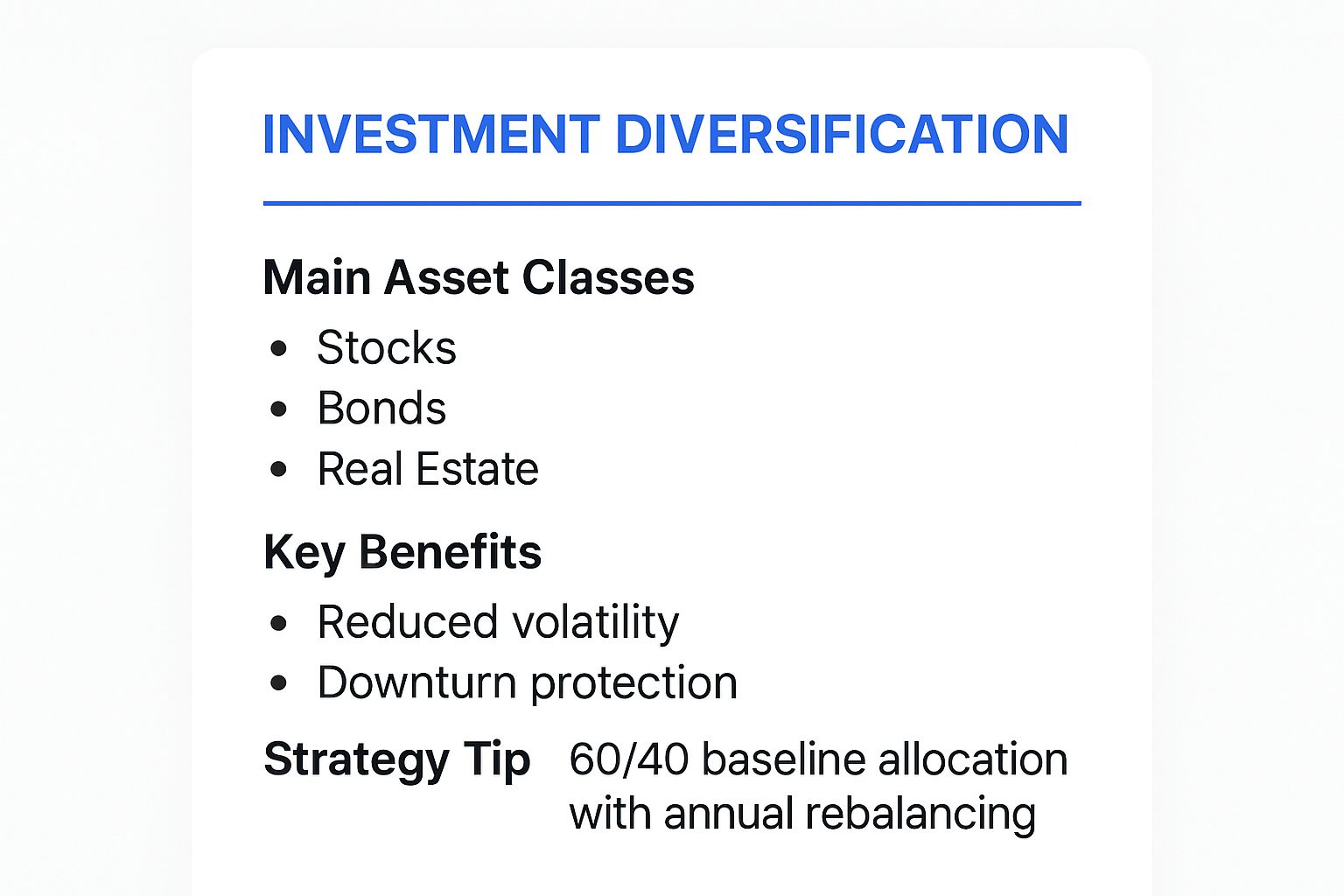

The infographic below summarizes the core components of this essential strategy.

As the key takeaways illustrate, a well-balanced portfolio built on major asset classes and maintained through disciplined rebalancing is your first line of defense against market volatility.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Establish Your Baseline: Use the 60/40 rule as an initial guide, then adjust based on your personal risk profile using a risk tolerance questionnaire.

- Incorporate International Exposure: Don’t limit your stocks and bonds to just your home country. Including international assets provides another layer of diversification against localized economic downturns.

- Rebalance Regularly: At least once a year, review your portfolio. If your stock allocation has grown to 70% due to market performance, sell some stocks and buy bonds to return to your 60/40 target. This enforces a “buy low, sell high” discipline.

2. Geographic Diversification

Geographic diversification is a critical investment diversification strategy that involves spreading investments across different countries and regions. The core principle is to reduce your portfolio’s vulnerability to the economic, political, and market risks of a single nation. Since different global economies do not move in perfect sync, a downturn in your home country might be offset by growth elsewhere, protecting your capital and potentially unlocking higher returns.

Legendary investors like Sir John Templeton built their careers on this global perspective, recognizing that the best opportunities are not always found at home. By looking beyond domestic borders, you tap into diverse growth engines, from established developed markets in Europe to dynamic emerging economies in Asia and Latin America. This strategy mitigates concentration risk and provides exposure to different currencies, industries, and consumer markets, creating a more resilient and globally balanced portfolio.

Implementing Geographic Diversification

A common guideline is to allocate between 20% and 40% of your equity portfolio to international markets. This provides meaningful exposure without over-complicating your holdings. You can achieve this easily through broad-based international index funds or ETFs, such as those tracking the MSCI World Index or total world stock market indices. These funds offer instant diversification across dozens of countries in a single, low-cost investment.

The infographic below highlights the key components of a globally diversified portfolio.

As you can see, blending domestic and international investments is key to navigating the complexities of the global economy. This is particularly relevant for expats and international users who can benefit from a detailed guide on cross-border financial planning.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Start with Broad Index Funds: For simplicity and broad exposure, use international ETFs like the Vanguard Total International Stock Index Fund (VXUS) or iShares MSCI ACWI ex U.S. ETF (ACWX).

- Balance Developed and Emerging Markets: Don’t just focus on established economies. Including a smaller allocation to emerging market funds can add a powerful growth component to your portfolio, though with higher risk.

- Monitor Currency Risk: Fluctuations in exchange rates can impact your returns. While some funds hedge currency risk, most do not. Be aware that a strong home currency can reduce gains from foreign investments, and vice versa.

3. Sector Diversification

Going a layer deeper than asset classes, sector diversification is one of the most effective investment diversification strategies for managing risk within your equity allocation. This approach involves spreading your stock investments across different economic sectors, such as technology, healthcare, financials, energy, and consumer staples. The core idea is that different sectors thrive in different phases of the economic cycle, preventing your portfolio from being overly exposed to a downturn in a single industry.

This strategy protects investors from the inherent cyclicality of the market. For instance, when economic growth is strong, cyclical sectors like technology and consumer discretionary tend to perform well. Conversely, during a recession, defensive sectors like utilities and consumer staples often hold their value better. Legendary investor Peter Lynch was a master of this concept, using a sector rotation strategy to shift capital toward industries poised for growth. By not putting all your eggs in one industry basket, you can achieve a more stable and resilient growth trajectory over the long term.

Implementing Sector Diversification

The easiest way to start is by investing in broad market index funds, like those tracking the S&P 500, which automatically provide exposure to all major economic sectors. However, for more hands-on investors, sector-specific ETFs (like the SPDR Select Sector funds) or mutual funds allow for more targeted allocations. Your goal is to build a balanced portfolio that isn’t heavily concentrated in one or two trendy areas.

The infographic below highlights how different sectors can be categorized and used to balance a portfolio effectively.

As shown, a thoughtful mix of cyclical and defensive sectors creates a portfolio better equipped to handle changing economic tides, smoothing out returns and reducing overall volatility.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Analyze Your Current Holdings: Use a portfolio analysis tool to see your current sector breakdown. You might be surprised to find you are heavily overweight in a single sector, like technology, if you hold many popular large-cap stocks.

- Avoid Over-Concentration: Be wary of chasing performance in “hot” sectors. While it’s tempting to pile into a booming industry, this increases risk. Aim for a balanced allocation that you are comfortable with.

- Consider Defensive Tilts: During periods of economic uncertainty, increasing your allocation to defensive sectors like healthcare, utilities, and consumer staples can help protect your portfolio’s value.

- Rebalance Sector Weights: Periodically review your sector allocations. If one sector has a great run and now makes up a disproportionately large part of your portfolio, trim it back to your target weight to lock in gains and manage risk.

4. Time Diversification (Dollar-Cost Averaging)

Time diversification is a powerful investment diversification strategy that mitigates the risk of entering the market at a single, inopportune moment. Its most common application is Dollar-Cost Averaging, a method that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach removes emotion from the investment process and smooths out the purchase price over time.

This strategy was championed by legendary investors like Benjamin Graham and John Bogle, who understood the futility of trying to perfectly “time the market.” By investing consistently, you automatically buy more shares when prices are low and fewer when they are high. This discipline averages out your cost basis and can reduce the impact of volatility on your portfolio. A prime example is the automatic payroll deduction for a 401(k), which forces investors to buy into the market consistently, rain or shine.

Implementing Time Diversification

The key to this strategy is automation and consistency. By setting up recurring investments, you remove the temptation to make impulsive decisions based on market headlines. Your ideal schedule and amount should align with your income flow and financial goals, making it a sustainable, long-term habit.

Many investors use this method without even realizing it through workplace retirement plans or automated contributions to a mutual fund. The goal is to build wealth steadily by leveraging time as your greatest ally. By regularly tracking your contributions and growth, you can see the tangible results of your discipline, which is easy to do when you use tools to monitor your net worth and investment progress.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Automate Your Investments: Set up automatic, recurring transfers from your bank account to your brokerage account. This is the cornerstone of a successful DCA strategy.

- Choose Low-Cost Vehicles: This method works best with low-cost index funds or ETFs, as frequent purchases of high-fee investments can erode your returns over time.

- Stay the Course: The greatest challenge is sticking to the plan during market downturns. Resist the urge to pause your contributions; these are the times when your dollars buy more and future returns are potentially greatest.

5. Style Diversification (Growth vs Value)

Beyond diversifying across asset classes and geographies, savvy investors add another layer of protection by diversifying across investment styles. Style diversification, one of the more nuanced investment diversification strategies, involves balancing your portfolio between “growth” and “value” stocks. These two styles behave differently in various market environments, and holding both can smooth out your portfolio’s performance over time.

This strategy is heavily influenced by the groundbreaking Fama-French three-factor model, which identified value and size as key drivers of stock returns beyond overall market risk. Growth stocks are shares in companies expected to grow faster than the market average, often reinvesting earnings rather than paying dividends. Value stocks, in contrast, are companies that appear to trade for less than their intrinsic worth and are often established, dividend-paying businesses. By combining them, you can capture upside during growth-led rallies while potentially cushioning your portfolio during value-driven market cycles.

Implementing Style Diversification

A common approach is to aim for a relatively even split between growth and value funds within your equity allocation. For example, if your portfolio is 60% stocks, you could allocate 30% to growth-focused funds and 30% to value-focused funds. This balance helps prevent your portfolio from being overly dependent on a single market sentiment or economic phase, as leadership between growth and value often rotates.

Your ideal mix will depend on your market outlook and risk tolerance, but a balanced starting point provides robust diversification. Many fund providers offer specific growth and value ETFs, such as the Vanguard Growth ETF (VUG) and Vanguard Value ETF (VTV), making implementation straightforward.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Maintain a Balanced Split: Start by allocating roughly equal portions of your equity holdings to growth and value styles to capture benefits from both sides of the market cycle.

- Incorporate Company Size: Apply style diversification across different market capitalizations. Hold a mix of large-cap value, large-cap growth, small-cap value, and small-cap growth to further enhance portfolio resilience.

- Use Style-Pure Funds: For cleaner exposure, opt for index funds or ETFs specifically designed to track style indices, like the Russell 1000 Growth or Russell 1000 Value.

- Rebalance Style Tilts: Review your style allocations annually. If a strong growth market has pushed your growth allocation significantly higher, rebalance back to your target to lock in gains and buy undervalued assets.

6. Alternative Investment Diversification

Alternative investment diversification involves allocating a portion of your portfolio to non-traditional assets that operate outside of public stock and bond markets. This strategy adds another powerful layer of protection by including assets like real estate investment trusts (REITs), commodities, private equity, hedge funds, and even collectibles. These investments often have a low correlation to traditional markets, meaning they may perform well when stocks and bonds are struggling.

This approach was famously championed by managers of large institutional funds, like David Swensen at the Yale Endowment, who achieved remarkable returns by venturing beyond conventional assets. Similarly, Ray Dalio’s “All Weather” strategy at Bridgewater Associates heavily incorporates assets like commodities to hedge against inflation and economic shifts. By including alternatives, investors can enhance returns, reduce overall volatility, and gain exposure to different drivers of economic growth.

Implementing Alternative Investment Diversification

While direct investment in private equity or hedge funds can be complex, accessing alternatives has become easier for individual investors. The key is to start small and focus on liquid, accessible options before exploring more sophisticated vehicles. Your allocation to this category should be deliberate, often capped to manage its unique risks.

A common starting point is to allocate 10-20% of your portfolio to a mix of alternatives. This could include publicly traded REITs for real estate exposure, commodity ETFs that track gold or oil, or interval funds that provide access to private markets. For those exploring tangible assets beyond traditional markets, considering investing in coins as an alternative asset can also contribute to portfolio diversification.

Actionable Tips

To effectively integrate this advanced investment diversification strategy, consider the following steps:

- Start with Liquid Alternatives: Begin with publicly traded vehicles like REIT ETFs and commodity ETFs. They offer the diversification benefits of alternatives with the liquidity of traditional stocks.

- Limit Your Allocation: As a general rule, keep your total allocation to alternative investments between 10% and 20% of your overall portfolio to manage risk effectively.

- Understand the Specifics: Before investing, thoroughly research the fee structures, liquidity constraints, and specific risks associated with each alternative asset. For example, MLPs have unique tax implications, and private market funds have lock-up periods.

7. Risk Parity Diversification

Risk parity diversification is an advanced strategy that shifts the focus from dollar-based allocation to risk-based allocation. The core principle is to construct a portfolio where each asset class contributes equally to the overall portfolio risk, rather than being weighted by its market value. This often means allocating more capital to traditionally lower-volatility assets like bonds and using leverage to bring their expected return in line with higher-risk assets like equities.

Pioneered by figures like Ray Dalio of Bridgewater Associates with his famous All Weather Fund, this approach aims to create a truly balanced portfolio that can perform well across different economic environments. By equalizing risk contributions, the strategy seeks to deliver more consistent returns and better downside protection compared to traditional 60/40 portfolios, which often derive the vast majority of their risk from the equity portion. The goal is to build a robust portfolio that is not overly dependent on any single economic outcome.

Implementing Risk Parity Diversification

While building a bespoke risk parity portfolio with leverage can be complex for individual investors, accessing the strategy has become much easier. The most direct route is through ETFs and mutual funds designed specifically around this concept, such as those offered by firms like AQR or Invesco. These funds handle the complex risk calculations and leverage management internally, providing a one-stop solution.

Your goal is to achieve a balance of risk, not just capital. For a more hands-on approach, you can use advanced analytical tools to measure the risk contribution of each asset in your portfolio and adjust allocations accordingly. Using sophisticated portfolio analysis tools available on PopaDex can help you visualize and manage these risk contributions more effectively.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Start with Dedicated Funds: For most investors, the easiest entry point is through a risk parity mutual fund or ETF. This removes the complexity of managing leverage and calculating risk contributions yourself.

- Understand the Role of Leverage: Be aware that many risk parity strategies use leverage on lower-risk assets (like bonds) to achieve their return targets. This can enhance gains but also amplify losses if not managed correctly.

- Monitor Risk Contributions: If building your own risk-weighted portfolio, use financial tools to regularly review how much risk each asset class is contributing. The goal is to keep these contributions relatively equal through periodic rebalancing.

- Adopt a Long-Term View: This strategy is designed for patient, long-term capital. Its benefits are most apparent over full economic cycles, as it aims to minimize drawdowns during periods of market stress.

8. Core-Satellite Diversification

The core-satellite approach offers a blended investment diversification strategy, merging the stability of passive indexing with the targeted growth potential of active management. This method involves dedicating the majority of your portfolio, the ‘core’ (typically 70-80%), to low-cost, broad-market index funds or ETFs. This core provides a solid foundation of diversified market returns. The remaining portion, the ‘satellites’ (20-30%), is allocated to more specialized or higher-risk investments aimed at outperforming the broader market.

This strategy was popularized by thinkers like John Bogle, whose advocacy for low-cost indexing forms the philosophical basis for the ‘core’ component. Financial advisors often use this structure to give clients a reliable market foundation while still allowing for tactical bets on specific sectors, themes, or geographic regions. The goal is to capture market returns with the core while adding potential alpha, or excess returns, through carefully selected satellites, creating a balanced and cost-effective portfolio.

Implementing Core-Satellite Diversification

Building a core-satellite portfolio involves two distinct stages: establishing your stable base and then selecting your targeted growth opportunities. For your core, you might choose a total stock market index fund (like VTI) or a target-date fund that aligns with your retirement goals. This part of your portfolio is designed for long-term, steady growth with minimal management.

For the satellites, you can explore niche areas. For example, if you believe the technology or clean energy sectors will outperform, you could add specific sector ETFs as satellites. Other satellite examples include individual stocks you’ve researched, emerging market funds, or alternative assets like REITs. This structure provides discipline while allowing you to act on specific investment theses without jeopardizing your entire portfolio.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Maintain Your Ratios: Strictly adhere to your predetermined allocation, keeping the core at 70-80% of your total portfolio to ensure stability remains the primary focus.

- Keep the Core Low-Cost: Use broad-market index funds or ETFs with very low expense ratios for your core holdings. The goal of the core is to cheaply and efficiently track the market.

- Limit Your Satellites: Avoid “diworsification” by limiting your satellite positions to a manageable number (e.g., 3-5). This ensures each position is meaningful and makes monitoring easier.

- Evaluate Satellite Performance: Regularly review your satellite investments against their benchmarks. If a satellite consistently underperforms, don’t hesitate to cut it and reallocate the capital.

9. Factor-Based Diversification

Factor-based diversification, often called “smart beta,” is a sophisticated investment diversification strategy that moves beyond traditional market capitalization. The principle involves building a portfolio around specific “factors,” or broad, persistent drivers of returns that have been identified through academic research. Key factors include value, momentum, quality, low volatility, and size.

This approach, pioneered by researchers like Eugene Fama and Kenneth French, aims to capture potential excess returns by systematically tilting a portfolio toward these historically rewarded characteristics. Instead of just buying a market-cap-weighted index, you intentionally overweight stocks exhibiting traits like low price-to-book ratios (value) or strong recent performance (momentum). By diversifying across these different return drivers, you can build a more resilient portfolio that is less dependent on overall market movements alone.

Implementing Factor-Based Diversification

Implementing this strategy often involves using specialized ETFs or mutual funds designed to target specific factors. For instance, an investor might combine a value factor ETF with a momentum factor ETF to capture returns from two distinct and often uncorrelated market drivers. The goal is to create a portfolio where the underperformance of one factor might be offset by the outperformance of another.

This method requires a deeper understanding of what drives each factor’s performance. For example, value strategies tend to do well during economic recoveries, while low-volatility strategies may provide protection during downturns. A multi-factor approach, which combines several factors into a single product like the Vanguard Multifactor ETF (VFMF), can simplify implementation for many investors.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Diversify Across Factors: Avoid concentrating on a single factor. Combine several, such as value, momentum, and quality, to reduce the risk of any one factor underperforming for an extended period.

- Understand the Rationale: Before investing, learn the economic logic behind each factor. Know why a particular characteristic, like high profitability (quality), is expected to generate returns over the long term.

- Maintain a Long-Term View: Factors can and do experience long periods of underperformance. This strategy requires patience and discipline, as chasing the “hot” factor often leads to poor results.

- Check for Correlations: When combining factors, consider how they interact. For example, value and momentum often have a low or negative correlation, making them effective diversifiers for each other.

10. Lifecycle/Target-Date Diversification

Lifecycle or target-date diversification offers a “set it and forget it” approach to investing, making it one of the most accessible investment diversification strategies for long-term goals like retirement. The core principle is an automated adjustment of your asset mix over time. These funds start with a more aggressive, growth-oriented allocation (heavy on stocks) when you are young and far from retirement, then gradually and automatically shift to a more conservative allocation (heavy on bonds) as your target date approaches.

This strategy operationalizes the concept of managing risk over an investor’s lifetime. The predetermined adjustment schedule, known as a “glide path,” aims to reduce portfolio volatility as you near the point when you’ll need to start withdrawing funds. Its popularity soared after being designated a Qualified Default Investment Alternative (QDIA) for 401(k) plans, with major providers like Vanguard and Fidelity managing trillions in these funds. This endorsement highlights its effectiveness for investors who prefer a hands-off, professionally managed approach to diversification.

Implementing Lifecycle/Target-Date Diversification

Getting started is as simple as choosing a fund with a year closest to your anticipated retirement date. For example, if you plan to retire around 2055, you would select a “Target-Date 2055” fund. This single fund provides instant diversification across a wide range of stocks and bonds, both domestic and international. The fund’s managers handle all the rebalancing and strategic shifts for you.

Your ideal fund choice should align with your retirement horizon and personal risk appetite. While the fund automates the process, it’s crucial to understand its underlying strategy to ensure it fits your financial plan.

Actionable Tips

To effectively implement this strategy, consider the following steps:

- Check the Expense Ratio: Target-date funds are not all created equal. Compare the fees, as lower expense ratios can significantly impact your long-term returns.

- Understand the Glide Path: Review the fund’s methodology. Some are more aggressive (“to” retirement) while others are more conservative (“through” retirement). Ensure its risk trajectory matches your comfort level.

- Avoid Redundancy: If you invest in a target-date fund, avoid holding other funds that overlap heavily with its assets. This can unintentionally skew your allocation and negate the fund’s built-in diversification.

Top 10 Investment Diversification Strategies Comparison

| Diversification Type | Implementation Complexity | Resource Requirements | Expected Outcomes | Ideal Use Cases | Key Advantages |

|---|---|---|---|---|---|

| Asset Class Diversification | Medium - needs allocation & rebalancing | Moderate - requires knowledge of asset classes | Reduces portfolio volatility and risk, long-term wealth preservation | Long-term investors seeking risk reduction across assets | Risk reduction, downturn protection, simplicity |

| Geographic Diversification | Medium - requires international market knowledge | Moderate to High - involves currency and tax considerations | Reduces country-specific risks, access to global growth potential | Investors wanting exposure beyond home country markets | Risk diversification, currency benefits, global exposure |

| Sector Diversification | Medium - must understand sector dynamics | Moderate - requires tracking multiple sectors | Smooths performance across economic cycles, offers tactical allocation | Investors seeking exposure to various industry sectors | Reduces sector risk, captures cyclical rotations |

| Time Diversification (Dollar-Cost Averaging) | Low - systematic investment plan setup | Low - automated or manual investments | Reduces timing risk, smooths cost basis, builds discipline | Investors with regular income investing over time | Reduces volatility impact, disciplined investing |

| Style Diversification (Growth vs Value) | Medium - understanding styles and rebalancing | Moderate - requires style-specific funds | Balances returns across market cycles, reduces style risk | Investors aiming to balance growth and value exposure | Consistent returns, reduces style concentration risk |

| Alternative Investment Diversification | High - complex asset types and knowledge | High - fees, minimums, and liquidity issues | Enhances diversification, potential inflation hedge | Sophisticated or institutional investors allocating alternatives | Inflation protection, unique returns, low traditional asset correlation |

| Risk Parity Diversification | High - advanced risk allocation & leverage | High - monitoring and rebalancing required | Balanced risk exposure, potentially stable risk-adjusted returns | Investors with long-term horizon seeking balanced risk | Equal risk contribution, systematic portfolio construction |

| Core-Satellite Diversification | Medium - combining passive and active parts | Moderate - managing core and satellites | Broad diversification with tactical flexibility | Investors wanting a blend of passive core and active themes | Cost efficiency, tactical opportunity, portfolio balance |

| Factor-Based Diversification | Medium to High - factor selection and combination | Moderate to High - factor research and fund selection | Potential for enhanced risk-adjusted returns, diversified drivers | Investors seeking smart beta and systematic factor exposure | Academic-backed returns, transparent methodology |

| Lifecycle/Target-Date Diversification | Low - automatic adjustment by fund managers | Low to Moderate - passive management | Age-appropriate asset allocation, reduces behavioral errors | Retirement-focused investors preferring hands-off approach | Automated rebalancing, ease of use, professional management |

Putting It All Together: From Strategy to Action

We’ve explored a comprehensive suite of ten powerful investment diversification strategies, moving far beyond the simple advice to “not put all your eggs in one basket.” From the foundational principles of asset class and geographic diversification to the more nuanced approaches of factor-based and risk parity investing, you now possess a robust framework for building a resilient, goal-oriented portfolio. The journey from financial theory to financial reality, however, is paved with disciplined action and consistent oversight.

The true power of these strategies is not in choosing just one, but in intelligently combining them. A young professional might blend Lifecycle Diversification with a strong emphasis on Time Diversification (dollar-cost averaging) to aggressively build their nest egg. A seasoned investor nearing retirement, conversely, might implement a Core-Satellite model, using a stable core of bonds and blue-chip stocks while exploring alternative investments for inflation hedging.

Key Insight: Diversification is not a passive, one-time event. It is an active, ongoing process of alignment. Your portfolio must evolve as your financial goals, risk tolerance, and the global economic landscape change over time.

From Knowledge to Confident Action

The primary barrier for many investors isn’t a lack of knowledge about what to do, but a lack of clarity on where they currently stand. You can’t effectively implement sector or style diversification if you don’t have a clear, real-time view of your current exposures across all your accounts. Are you accidentally over-concentrated in the technology sector because of overlapping holdings in your 401(k), IRA, and brokerage accounts? Is your international exposure truly global, or is it skewed heavily towards a single region?

This is where a unified financial dashboard becomes indispensable. Executing sophisticated investment diversification strategies requires a command center that provides a holistic view of your entire financial picture. Without it, you are essentially navigating a complex journey with a fragmented map, making it nearly impossible to make informed, strategic adjustments.

Your Blueprint for a Diversified Future

The ultimate goal is to construct a portfolio that is intentionally designed, not accidentally assembled. It should be a direct reflection of your personal financial plan. The strategies we’ve discussed are the architectural blueprints; your actions are the building materials.

Here are your immediate next steps to put this knowledge into practice:

- 1. Assess Your Current Allocation: Before making any changes, get a clear snapshot of your existing portfolio. Identify your current breakdown across asset classes, geographic regions, and sectors.

- 2. Define Your Target Strategy: Select a primary diversification model (like Core-Satellite or Lifecycle) and decide which other strategies you will layer on top. This selection should be based on your personal risk tolerance, time horizon, and financial objectives.

- 3. Identify and Close the Gaps: Compare your current allocation to your target strategy. Pinpoint areas of over-concentration and under-exposure. Create a clear plan to rebalance your portfolio by selling, buying, or adjusting future contributions.

- 4. Schedule Regular Reviews: Set a recurring calendar reminder (quarterly or semi-annually) to review your portfolio. This ensures your allocations remain aligned with your strategy and allows you to make adjustments based on life changes or market shifts.

Mastering these investment diversification strategies is more than just a box-checking exercise; it’s about taking control of your financial destiny. It’s the critical difference between being a passive passenger in your financial journey and being a confident pilot, capable of navigating market turbulence and staying on course toward your most important goals.

Ready to transform these complex strategies into simple, actionable steps? PopaDex provides a unified dashboard to track all your investments in one place, giving you the clarity needed to identify concentration risks and implement your diversification plan with confidence. Start your journey to a more resilient portfolio by signing up for PopaDex today.