Our Marketing Team at PopaDex

Top Net Worth Tracker App Picks for 2025

Unlocking Your Financial Potential: A Guide to the Best Net Worth Trackers

Knowing your net worth is crucial for effective financial planning. A net worth tracker app simplifies this process, providing a clear snapshot of your financial health. This listicle explores the top 12 net worth tracker apps available, offering practical insights gleaned from real-world usage. Whether you’re a seasoned investor or just starting, this guide will help you find the perfect app to reach your financial goals.

This in-depth review covers:

-

Feature breakdowns: We go beyond generic descriptions, exploring how each feature works in practice.

-

Pricing: Understand the different pricing models and find the best value for your needs.

-

Pros and Cons: Honest assessments of each app’s strengths and weaknesses.

-

Use-case recommendations: Discover which app best suits your specific financial situation, whether you’re managing multiple currencies, tracking irregular income, or seeking advanced analytics.

Choosing the right net worth tracker app can significantly impact your financial journey. This guide will help you find the perfect tool, offering insights into 12 leading options including PopaDex, Empower Personal Dashboard™, Monarch Money, You Need a Budget (YNAB), and more. Let’s dive in and unlock your financial potential!

1. PopaDex

PopaDex stands out as a robust net worth tracker app, ideal for users seeking a global perspective on their finances. Its broad support for over 15,000 banks across 30+ countries, coupled with multi-currency handling, caters particularly well to expats or anyone with international investments. The platform consolidates all your assets, liabilities, and investments, providing a truly holistic financial snapshot. PopaDex empowers you to track progress, plan budgets, and set realistic financial goals.

While the free version offers manual account aggregation and community support, the premium tier (€5/month) unlocks powerful features. These include automated bank integrations, advanced analytics, and personalized customer support. A forthcoming AI co-pilot promises to further streamline financial decision-making.

Pros and Cons

Pros:

-

Extensive bank coverage (15,000+ banks in 30+ countries)

-

Multi-currency support

-

Free plan available

-

Affordable premium plan (€5/month)

-

Interactive dashboards and visualizations

Cons:

-

Automated integrations require the premium plan

-

Can have a learning curve for new users

Practical Application and Implementation

PopaDex excels at simplifying complex financial situations. Its multi-currency support and broad bank connectivity make it a lifesaver for expats. Young professionals will find the budgeting and goal-setting tools invaluable. Even experienced investors can benefit from the clear, consolidated overview of their entire portfolio.

Setting up PopaDex is straightforward. The free plan is quick to implement, although manual account updates are required. Upgrading to premium automates this process, though it requires linking your bank accounts. The platform offers helpful resources like Google Sheets and Excel templates for further customization.

2. Empower Personal Dashboard™

Empower Personal Dashboard™ (formerly Personal Capital) offers a comprehensive view of your net worth by consolidating all your financial accounts. Its robust investment tracking and retirement planning tools make it ideal for users focused on long-term financial goals. The platform aggregates bank accounts, credit cards, loans, and investments, providing a holistic picture of your financial health. Empower empowers you to analyze cash flow, create budgets, and track your net worth in real-time.

The core features are free to use, including net worth tracking, budgeting, and basic investment analysis. However, their portfolio management services require a minimum balance of $100,000. This makes the premium advisory services more suitable for high-net-worth individuals. The platform stands out for its detailed reporting and user-friendly interface, though customization options within the interface are somewhat limited.

Pros and Cons

Pros:

-

Comprehensive suite of financial tools

-

Free core features (net worth tracking, budgeting)

-

User-friendly interface and detailed reporting

Cons:

-

Portfolio management requires a $100,000 minimum

-

Limited interface customization

Practical Application and Implementation

Empower Personal Dashboard™ excels at providing a 360-degree view of your finances. It’s particularly useful for individuals actively planning for retirement or other long-term goals. The investment checkup and fee analyzer tools provide valuable insights for optimizing your portfolio. Young professionals will appreciate the budgeting and cash flow analysis features.

Setting up Empower is straightforward. Simply link your various financial accounts to the platform. The dashboard automatically aggregates your data and provides a real-time overview. While the free version offers robust functionality, consider the premium advisory services if you meet the minimum balance requirement and seek personalized portfolio management.

Visit Empower Personal Dashboard™

3. Monarch Money

Monarch Money shines as a user-friendly net worth tracker app, simplifying financial management for individuals and families. Its seamless synchronization with a vast network of financial institutions (covering 99.8%) offers a truly comprehensive view of your net worth. Customizable dashboards and robust collaborative tools further enhance its appeal. Monarch empowers users to track their financial progress, plan budgets, and achieve their financial goals.

While Monarch Money offers a free trial, its full potential is unlocked with the premium subscription. The cost is relatively high compared to other net worth tracker apps. However, the premium version provides unlimited budget creation, advanced net worth forecasting, and priority customer support.

Pros and Cons

Pros:

-

Wide compatibility with financial institutions

-

Intuitive and customizable interface

-

Collaborative tools for shared finances

-

Real-time net worth tracking

Cons:

-

Premium version is expensive

-

Investment tracking could be more robust

Practical Application and Implementation

Monarch Money is ideal for families and individuals seeking a streamlined approach to managing their finances. The collaborative features make it particularly useful for shared financial planning. Its intuitive interface simplifies complex financial data, making it accessible for users of all levels. The setup process is quick and straightforward, requiring users to link their financial accounts.

4. You Need A Budget (YNAB)

You Need A Budget (YNAB) distinguishes itself as a net worth tracker app by prioritizing proactive budgeting. Instead of simply reflecting your current financial state, YNAB encourages you to assign every dollar a purpose, fostering mindful spending and saving habits. This budgeting-first approach helps users gain control of their finances and work towards their financial goals more effectively. It offers a comprehensive platform for tracking net worth alongside robust budgeting features.

YNAB provides easy-to-read graphs for net worth tracking, integrates with various financial accounts, and offers goal-setting features. The platform also boasts extensive educational resources to bolster users’ financial literacy. While YNAB offers a free trial, it operates on a paid subscription model ($14.99/month or $99/year). For further insights into YNAB and other net worth tracking tools, learn more about effective wealth management.

Pros and Cons

Pros:

-

Encourages proactive financial management

-

Comprehensive educational resources

-

User-friendly interface

Cons:

-

Monthly fee may be a barrier for some

-

Can have a learning curve for new users

Practical Application and Implementation

YNAB is ideal for individuals committed to taking control of their finances. Young professionals and those struggling with budgeting will benefit significantly from its structured approach. The app’s educational content provides valuable guidance for improving financial literacy.

Implementing YNAB requires linking your financial accounts and dedicating time to learn its methodology. While the initial setup might take some effort, the long-term benefits in terms of improved financial habits and increased net worth make it a worthwhile investment.

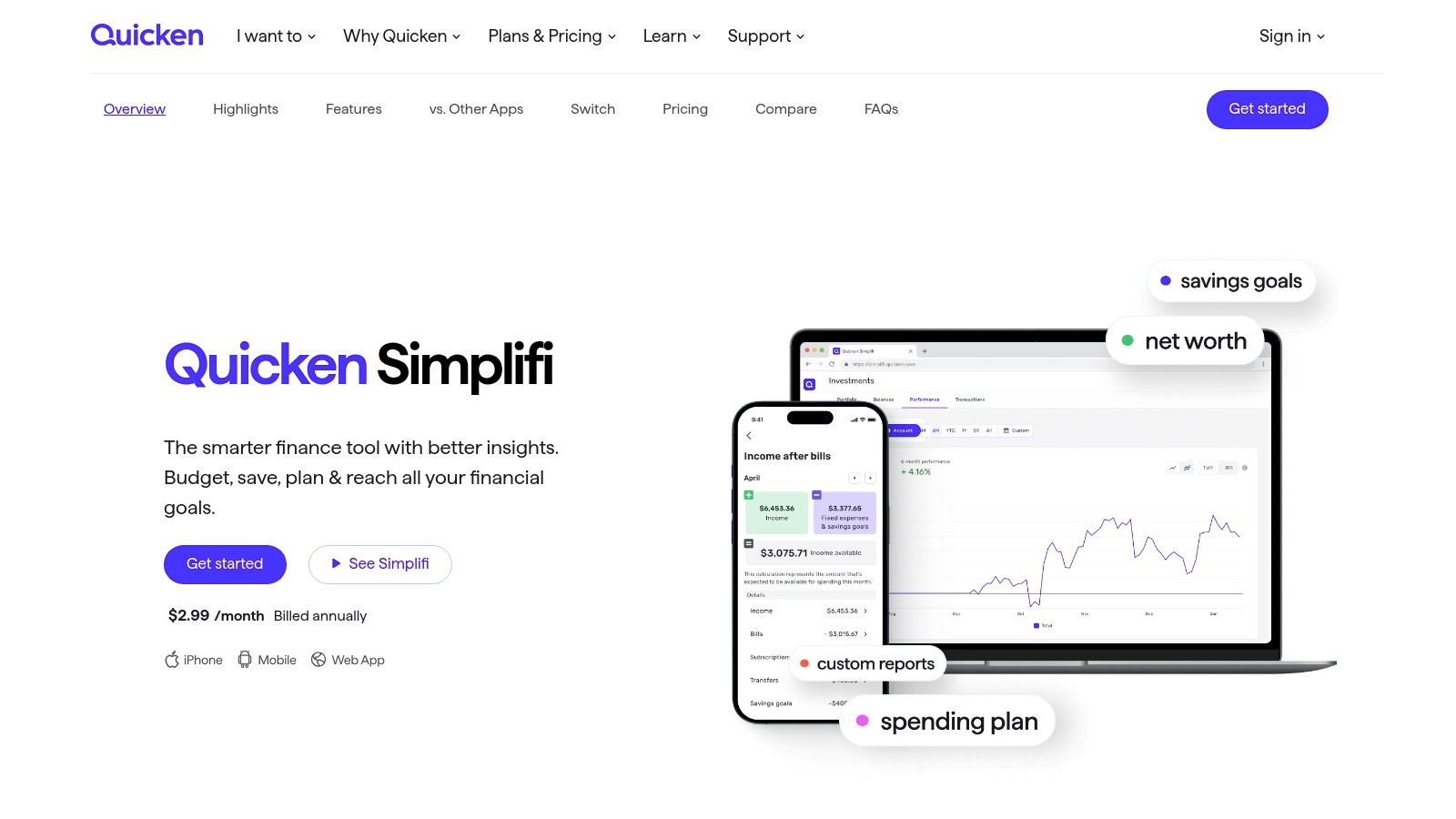

5. Simplifi by Quicken

Simplifi by Quicken is a streamlined financial management app ideal for users who want a straightforward approach to managing their net worth. It offers real-time net worth tracking and budgeting tools, perfect for those seeking a clear and concise financial overview. The app helps you understand your spending patterns and make informed decisions to achieve your financial goals. Simplifi consolidates all your accounts, providing a real-time snapshot of your financial health.

While Simplifi excels in budgeting and cash flow management, its investment tracking features are less comprehensive than some dedicated net worth tracker apps. The basic plan starts at $3.99/month, offering core features like account aggregation and budgeting tools. The $5.99/month plan adds bill pay reminders and spending plan customization.

Pros and Cons

Pros:

-

User-friendly and intuitive interface

-

Affordable pricing

-

Comprehensive budgeting and cash flow insights

Cons:

-

Limited investment tracking features

-

Some users may prefer more advanced analytical tools

Practical Application and Implementation

Simplifi shines for users new to budgeting and net worth tracking. Its clean interface and easy setup make it simple to get started. Young professionals will appreciate the straightforward budgeting tools and spending insights. While seasoned investors might find the investment tracking lacking, those primarily focused on cash flow management will find Simplifi highly effective.

Setting up Simplifi is quick and easy. You can link your various financial accounts to enable automatic updates. The app also offers customizable budgeting categories and spending alerts to help you stay on track. While it lacks complex investment analysis tools, Simplifi’s simplicity is its greatest strength.

6. PocketSmith

PocketSmith shines as a comprehensive financial planning platform, going beyond basic net worth tracking. It’s ideal for users who want to visualize their financial future, thanks to its impressive forecasting capabilities of up to 30 years. The platform seamlessly integrates with over 12,000 financial institutions, simplifying account aggregation for a clear picture of your financial health. PocketSmith empowers you to not only track your net worth but also project its growth based on current trends and planned adjustments.

While the free version provides basic net worth tracking and budgeting, the premium tiers (starting at $9.95/month) unlock powerful features like long-term forecasting, multiple budget creation, and advanced reporting. Its multi-currency support and customizable dashboards are valuable assets for users managing complex financial situations.

Pros and Cons

Pros:

-

Comprehensive financial forecasting (up to 30 years)

-

Supports multiple income streams

-

Customizable and flexible interface

-

Multi-currency support

Cons:

-

Premium version can be expensive

-

Free version has limited features

Practical Application and Implementation

PocketSmith excels at helping users plan for long-term financial goals, such as retirement or major purchases. Its forecasting feature allows users to model different scenarios and adjust their savings strategies accordingly. The platform’s support for multiple income streams makes it a great choice for freelancers or those with side hustles.

Setting up PocketSmith is straightforward. Connecting your financial accounts is simple, though the level of automation depends on your chosen subscription tier. The platform’s calendar-based interface offers a unique and intuitive way to visualize your cash flow and project future balances.

7. Kubera

Kubera shines as a modern net worth tracker app, seamlessly integrating both traditional and crypto assets. This provides a truly comprehensive view of your financial portfolio. It’s designed specifically for users with diverse investments, simplifying the often complex task of managing a varied portfolio. Kubera consolidates all your holdings, from bank accounts and stocks to Bitcoin and Ethereum, offering a holistic snapshot of your financial standing.

While Kubera doesn’t offer a free version, its annual subscription ($150/year) unlocks a powerful suite of features. These include automated portfolio tracking, manual adjustments for personalized accuracy, and support for a wide array of asset types. This includes real estate, vehicles, and even precious metals. Kubera also provides valuable insights into asset allocation, helping you make informed investment decisions.

Pros and Cons

Pros:

-

Comprehensive asset tracking (traditional and crypto)

-

User-friendly interface

-

Supports a wide range of assets (real estate, vehicles, etc.)

Cons:

-

No free version available

-

Limited budgeting tools

Practical Application and Implementation

Kubera excels at simplifying complex portfolios for users with diverse investments. Its ability to track both traditional and crypto assets makes it an ideal net worth tracker app for those invested in the evolving digital landscape. Tech-savvy investors will appreciate the automated integrations and clean interface. The manual adjustment feature allows for personalized accuracy, ensuring your net worth reflects the true value of your holdings.

Setting up Kubera is straightforward. The platform guides you through linking your various accounts and assets. While the initial setup might require some time, the automated tracking quickly takes over, minimizing manual input. Kubera provides a clear dashboard that displays your net worth, asset allocation, and historical performance.

8. Rocket Money (formerly Truebill)

Rocket Money distinguishes itself as a net worth tracker app by integrating subscription management. This all-in-one approach helps users gain a clearer picture of their finances. It consolidates assets, liabilities, and recurring expenses into a single dashboard. This provides a holistic view of spending and saving habits. Rocket Money empowers users to track progress, optimize budgets, and achieve their financial goals.

While the free version offers basic net worth tracking and some expense categorization, the premium version ($3-$12/month) unlocks additional power. These features include enhanced subscription cancellation support, bill negotiation services, and personalized financial insights. The user-friendly interface makes navigating the app straightforward, even for those new to personal finance tools.

Pros and Cons

Pros:

-

Identifies and cancels unwanted subscriptions

-

User-friendly interface

-

Affordable premium version

-

Budgeting and expense tracking tools

Cons:

-

Free version has limited features

-

Some features require manual input

Practical Application and Implementation

Rocket Money shines in its ability to help users regain control of their subscriptions. It excels at uncovering recurring charges that might otherwise be overlooked. Young professionals can leverage the budgeting and goal-setting tools to build a strong financial foundation. Those looking to optimize their spending will find the subscription management features particularly valuable.

Setting up Rocket Money is simple. The free version allows for quick account linking, though some features require manual input. Upgrading to premium unlocks the full suite of tools. The platform’s intuitive design makes it easy to navigate and understand your financial situation.

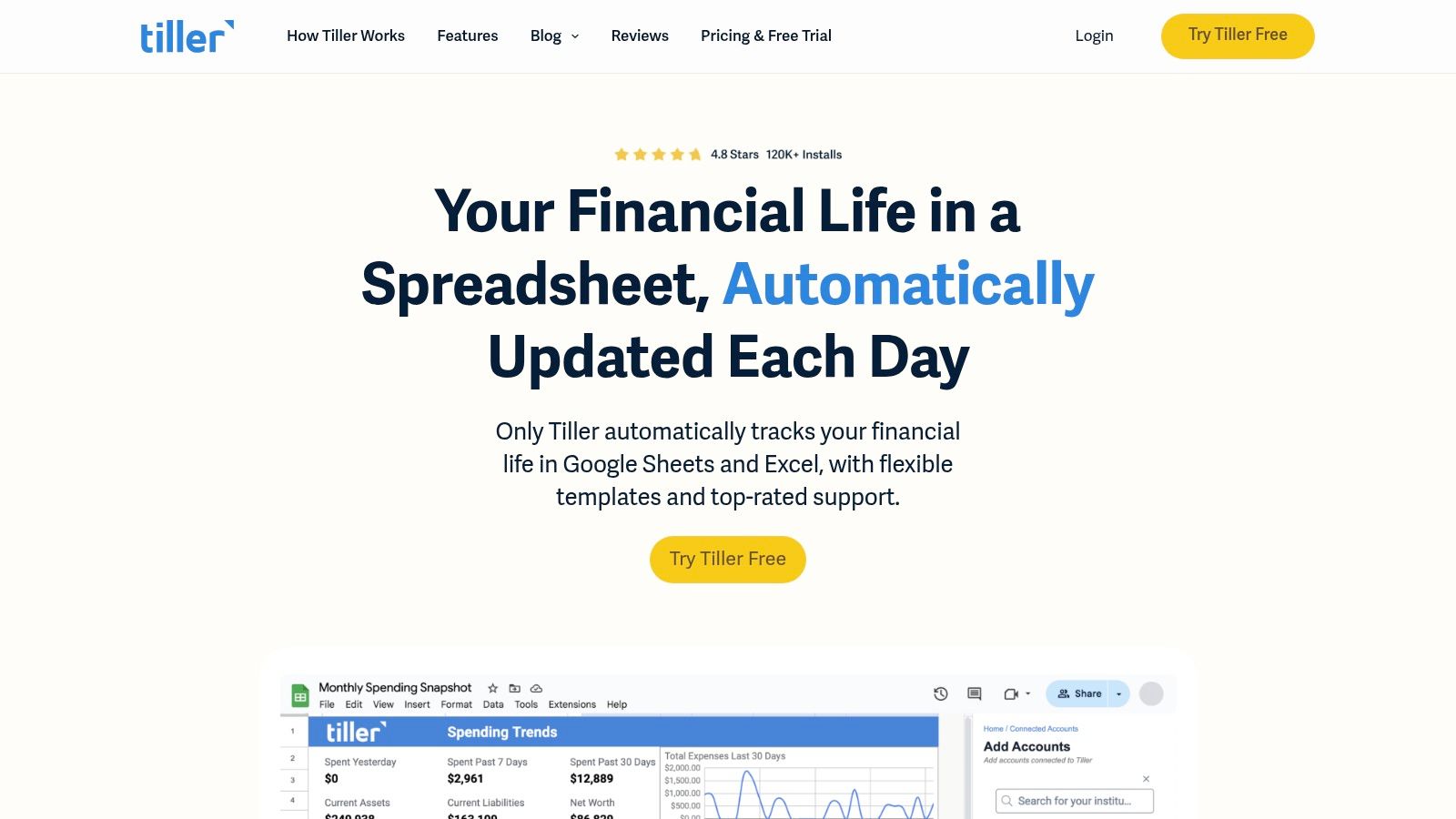

9. Tiller Money

Tiller Money distinguishes itself as a net worth tracker app specifically designed for spreadsheet enthusiasts. It automates the flow of your financial data directly into Google Sheets or Microsoft Excel, providing a powerful, customizable platform for managing your finances. This makes it an excellent choice for users comfortable with spreadsheets and who prefer a hands-on approach to budgeting and net worth tracking. Tiller empowers you to build personalized dashboards, visualize your financial progress, and gain deeper insights into your spending habits.

While Tiller offers a 30-day free trial, the subscription costs $79 per year. This unlocks features such as automatic data feeds, pre-built templates for budgeting and net worth tracking, daily email updates, and customizable transaction categories. For those interested in comparing Tiller with other spreadsheet-based solutions, you can learn more about Tiller Money and its comparison to other tools like Google Sheets and even Elon Musk’s net worth tracker.

Pros and Cons

Pros:

-

Highly customizable and flexible

-

Seamless integration with Google Sheets and Excel

-

Automated data feeds for supported accounts

-

Comprehensive financial tracking and reporting

Cons:

-

Requires familiarity with spreadsheets

-

No dedicated mobile application

-

Subscription-based pricing

Practical Application and Implementation

Tiller Money excels at providing granular control over your financial data. Its spreadsheet integration makes it ideal for users who enjoy building custom dashboards and reports. Small business owners and freelancers can benefit from its detailed tracking capabilities. Even tech-savvy individuals who prefer a more hands-on approach to net worth tracking will appreciate its flexibility. You might compare this approach with other methods before you fully commit. Learn more about…

Setting up Tiller Money involves connecting your financial accounts and selecting your preferred spreadsheet platform. The pre-built templates provide a solid starting point, but the real power comes from customizing them to your specific needs. Tiller’s extensive documentation and community forum offer valuable resources and support.

10. Betterment

Betterment distinguishes itself as a net worth tracker app deeply integrated with its robo-advisor platform. It’s ideal for users who want to track their net worth alongside automated investment management and financial planning. Betterment consolidates linked external accounts, providing a comprehensive financial overview that includes investment accounts, checking, savings, and even credit cards. This holistic view simplifies tracking progress toward financial goals.

Betterment offers two primary services: Betterment Digital (0.25% annual fee) and Betterment Premium (0.40% annual fee with a $100,000 minimum balance). Digital provides automated portfolio management and basic financial planning tools. Premium unlocks dedicated advisor access and more advanced planning features. The net worth tracking functionality is integral to both plans.

Pros and Cons

Pros:

-

User-friendly interface simplifies complex financial data

-

Low-cost investment management, combined with net worth tracking

-

Goal-based investing features enhance planning

Cons:

-

Limited investment customization options for advanced investors

-

No direct indexing available

Practical Application and Implementation

Betterment is best suited for beginners and hands-off investors. Young professionals will appreciate the streamlined interface and automated features. The goal-based planning tools make it easier to visualize and achieve financial milestones. More experienced investors might find the limited customization options restrictive.

Setting up Betterment is straightforward. The process involves linking your external accounts and answering a few questions about your financial goals. The platform then generates personalized investment recommendations and provides ongoing monitoring. The integrated net worth tracker automatically updates as your accounts fluctuate.

11. Mint

Mint is a free, user-friendly net worth tracker app ideal for individuals new to personal finance management. It automatically aggregates financial accounts, providing a comprehensive overview of your spending, budgeting, and net worth. Mint simplifies complex financial data, presenting it in an easily digestible format. It empowers users to track progress, manage budgets, and gain control over their finances.

While Mint’s free tier offers robust budgeting, bill management, and even credit score monitoring, its investment tracking features are limited compared to dedicated investment platforms. The app also incorporates advertisements, which some users may find distracting. For a deeper comparison of Mint with other net worth tracking options, you can learn more about Mint in this comparative study.

Pros and Cons

Pros:

-

Free to use

-

Intuitive and user-friendly interface

-

Comprehensive financial overview

-

Budgeting and bill management tools

Cons:

-

Limited investment tracking

-

In-app advertisements

Practical Application and Implementation

Mint excels at providing a consolidated view of your finances. Its budgeting tools are particularly helpful for young professionals or anyone looking to gain better control of their spending. The automated account aggregation simplifies tracking net worth, eliminating manual entry.

Setting up Mint is straightforward, requiring you to link your financial accounts. While the free version offers significant value, the limitations in investment tracking might make it less suitable for experienced investors with complex portfolios. Mint is an excellent starting point for those beginning their journey in personal finance management.

12. TrackMyStack Net Worth Tracker

TrackMyStack is a privacy-focused net worth tracker app that allows for a blend of manual and automatic tracking. It’s ideal for users concerned about sharing financial data with third-party apps, as it requires no account creation. The app shines in its ability to handle multiple portfolios and diverse asset classes, from traditional stocks and ETFs to cryptocurrencies and real estate.

While TrackMyStack automatically updates investment portfolios with real-time market prices, manual entry is required for assets like bank accounts, credit cards, and mortgages. This combination offers flexibility and control over your data, but it may not suit users seeking fully automated aggregation. Features like dividend tracking, cost basis calculations, and automatic currency conversions add further value.

Pros and Cons

Pros:

-

Privacy-focused (no account required)

-

Supports multiple portfolios and diverse assets

-

Real-time intraday prices

-

Automatic currency conversions

Cons:

-

Manual data entry for some assets

-

Limited integrations with financial institutions

Practical Application and Implementation

TrackMyStack is perfect for the hands-on investor who prefers to maintain close control over their financial data. It’s also valuable for those with complex portfolios spanning multiple asset classes. The manual entry for some assets can be time-consuming, but it allows for precise tracking and personalized categorization.

Getting started is simple. Download the app and begin inputting your assets. For investment portfolios, you’ll need to provide the necessary details to enable automatic tracking. While the lack of automated bank integrations might be a drawback for some, it aligns with the app’s core focus on privacy.

Net Worth Tracker Apps Feature Comparison

Product | Core Features & Capabilities | User Experience & Quality ★ | Value & Pricing 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

PopaDex 🏆 | 15,000+ banks, multi-currency, multilingual, dashboards | Interactive visuals, secure, intuitive | Free plan; Premium €5/month | Global investors, FIRE enthusiasts, professionals | Privacy first, extensive international coverage, multicurrency |

Empower Personal Dashboard | Real-time net worth, investment & retirement planning | User-friendly, detailed reporting | Free | Long-term investors, wealth builders | Investment fee analyzer, retirement cost planner |

Monarch Money | Sync with 99.8% institutions, customizable dashboards | Intuitive, collaborative for families | Premium pricey | Families, individuals wanting collaboration | High financial institution compatibility |

You Need A Budget (YNAB) | Proactive budgeting, net worth graphs, education | User-friendly, strong educational content | Monthly subscription (higher fee) | Budget-focused users, beginners | Focus on budgeting, financial literacy resources |

Simplifi by Quicken | Cash flow tracking, net worth overview, budgeting | Intuitive, easy to use | Affordable subscription | Simplicity seekers, casual financial managers | Real-time spending insights |

PocketSmith | 30-year forecasts, multi-currency, customizable | Flexible interface, detailed projections | Premium can be expensive | Future planners, multi-income users | Long-term forecasting, cash flow projections |

Kubera | Traditional + crypto assets, asset allocation insights | User-friendly, broad asset support | No free version | Investors with diverse asset types | Crypto integration, manual adjustments |

Rocket Money | Subscription & expense tracking, bill negotiation | User-friendly | Affordable premium; limited free | Subscription-heavy users, budget-conscious | Bill negotiation, subscription management |

Tiller Money | Spreadsheet automation, templates, daily updates | Customizable but spreadsheet dependent | Subscription-based | Spreadsheet power users, budget planners | Google Sheets/Excel integration |

Betterment | Automated investing, tax-efficient, goal-based | User-friendly, low-cost investment tools | Paid investment management fees | Goal-oriented investors | Automated investing, tax strategies |

Mint | Aggregated accounts, budgeting, bill & credit score | Intuitive, ad-supported | Free | Entry-level users, casual trackers | Free, credit monitoring |

TrackMyStack Net Worth Tracker | Manual + automatic investment tracking, dividend tracking | Privacy-focused, supports multiple portfolios | Free | Privacy-conscious users | No account required, real-time intraday prices |

Final Thoughts

Choosing the right net worth tracker app can significantly impact your financial journey. This comprehensive guide has explored twelve leading platforms, each with its strengths and weaknesses. From manual spreadsheet integration with Tiller Money to the automated syncing of Mint, and the international capabilities of Kubera, the options cater to a diverse range of needs. Remember, the “best” net worth tracker app is ultimately the one that best aligns with your individual financial situation and goals.

Key Takeaways and Considerations

Several key factors emerged from our exploration of these net worth tracker apps. Security is paramount; ensure your chosen platform employs robust encryption and two-factor authentication. Consider the level of automation you prefer. Some apps offer hands-off tracking, while others require manual input, offering greater control and accuracy. Pricing structures vary significantly, from free versions with limited features to premium subscriptions with advanced analytics and personalized advice. Lastly, user experience is crucial. A cluttered or unintuitive interface can hinder your engagement, so choose an app that feels comfortable and easy to navigate.

Choosing the Right Net Worth Tracker App for You

For those new to tracking their net worth, user-friendly apps such as Mint or Simplifi by Quicken provide a solid starting point. Their intuitive interfaces and automated features simplify obtaining a quick overview of your finances. Investors with complex portfolios might favor Kubera or TrackMyStack for their strong investment tracking capabilities. Popadex offers advantages such as privacy and integrations with international institutions, making it a valuable choice for international financial management. Budget-conscious users can explore free versions of several apps or consider YNAB for its distinct budgeting approach connected to net worth. Ultimately, the right app depends on your specific needs and preferences.

Implementation and Beyond

Successfully implementing a net worth tracker app requires consistent updating and accurate data entry. Establish a regular routine, whether weekly or monthly, to ensure your information is up-to-date. Take advantage of features like automated account syncing to minimize manual effort. Remember, the true value of these tools lies not just in tracking your net worth, but in utilizing the insights gained to make informed financial decisions. Analyzing trends, identifying areas for improvement, and adjusting your financial strategies are essential steps toward achieving your long-term goals.

Embarking on your wealth-building journey can feel daunting, but with the right tools and a proactive approach, you can gain control of your finances and build a secure financial future. A net worth tracker app is a valuable tool in this journey, providing clarity and motivation along the way.

Ready to take control of your finances and start building lasting wealth? Check out PopaDex, a powerful platform designed to help you manage and optimize your investments, contributing to a more comprehensive understanding of your net worth. PopaDex offers advanced tools and insights to empower your financial journey.

Article created using Outrank